In Southeast Asia, third-party logistics (3PL) is evolving from a back-end support service into a core lever of industrial competitiveness. As governments promote local manufacturing (e.g., Thailand 4.0, Vietnam’s industrial parks), and global players diversify away from China, the region is emerging as a critical hub for industrial production and distribution.

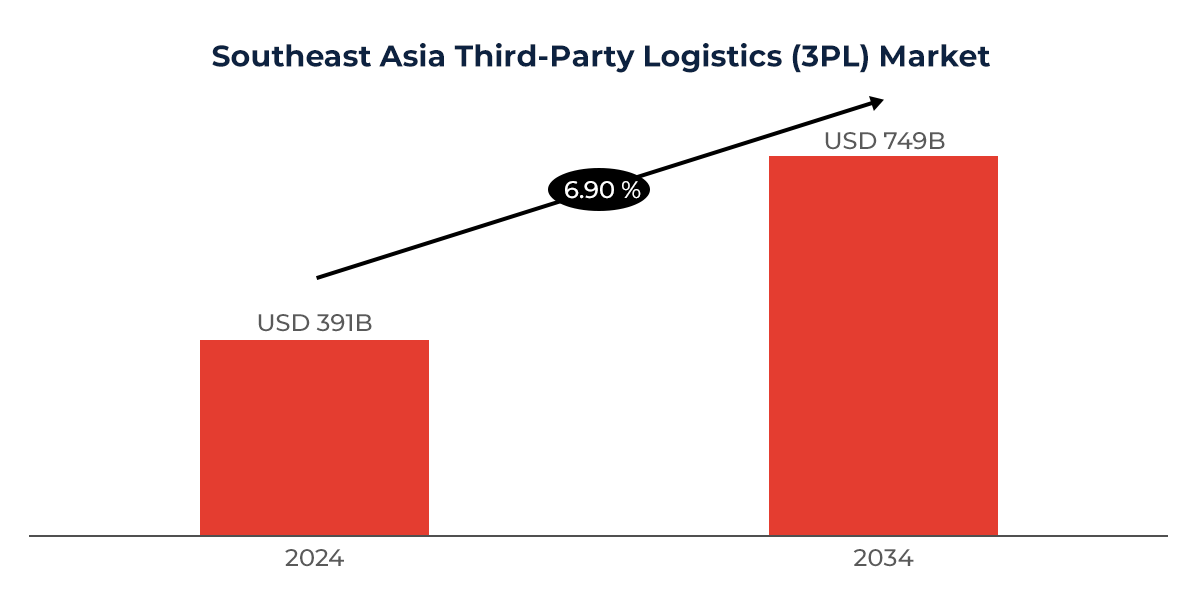

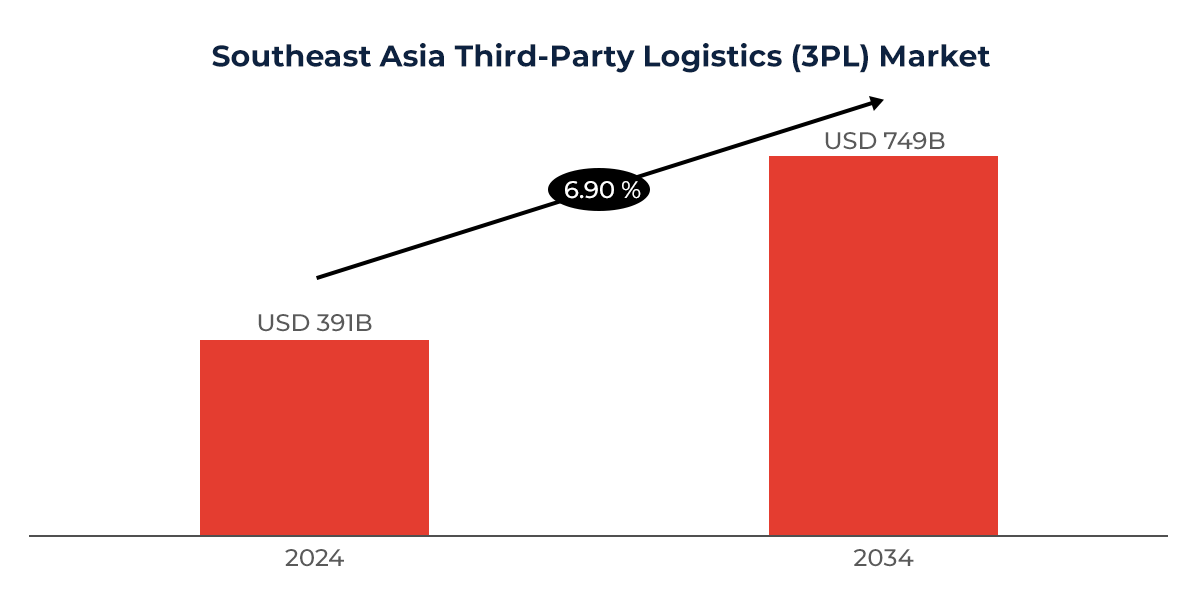

The 3PL market in Southeast Asia is projected to grow at a 5.2% CAGR through 2030, driven by:

- Expanding intra-ASEAN trade

- A shift toward multi-nodal manufacturing

- Increasing demand for digitally enabled and regulation-compliant logistics solutions

Yet many legacy logistics setups remain geared toward bulk transport or traditional B2B flows, and are not optimized for the flexibility, visibility, and specialization modern industrial clients require.

1. Multi-Nodal Manufacturing Demands Integrated Networks

Southeast Asia’s industrial economy is regionally distributed: a product may be molded in Vietnam, assembled in Thailand, and exported via Singapore. Managing these flows through disconnected 3PLs often leads to delays, excess inventory, and suboptimal cost structures.

The emerging solution? Integrated 3PL networks that connect:

- Country-level warehouses (Vietnam, Thailand, Indonesia)

- Bonded and free trade zones (e.g., Batam, Port Klang, Laem Chabang)

- Multimodal transport hubs with coordinated customs and visibility systems

These setups enable component-level visibility, real-time coordination, and lower landed costs for regional manufacturing ecosystems.

2. Digital Visibility is Now a Core Expectation

Industrial logistics has low tolerance for disruption. Downtime due to late parts delivery or lost cargo can halt entire production lines. As supply chains digitize, industrial clients now expect:

- Real-time dashboards with predictive ETAs and exception alerts

- IoT tracking for containers, assets, and temperature-sensitive goods

- Seamless integration with ERP, MES, and TMS platforms

Modern 3PLs are no longer just movers—they are data partners, helping clients maintain uptime, reduce manual reconciliation, and make agile decisions.

3. Scale and Specialization for Industrial Complexity

Industrial supply chains require 3PLs that can flex across a wide spectrum—from oversized capital goods to small, frequent spare parts shipments. Increasingly, clients seek:

- Dual-format warehouses that support both bulk and bin picking

- Pre-bonded spare parts inventory for maintenance/service speed

- Heavy-haul transport coordination for machinery, with route clearance and permit handling

3PLs must adapt to these needs with configurable infrastructure, VMI models, and multi-tier replenishment planning.

4. Compliance as a Differentiator

Industrial logistics is governed by complex compliance layers—ranging from hazardous materials (DG) handling to ESG reporting and cross-border documentation.

Leading 3PLs differentiate through:

- Expertise in customs classification, DG packaging, and local regulations

- ESG data support for Scope 3 emissions reporting

- Ability to navigate RCEP, AFTA, and bilateral FTAs for faster clearance and reduced tariffs

As enforcement tightens, compliance is shifting from a back-office function to a core service offering.

A Strategic Rethink for Industrial Brands

Logistics is no longer just about delivery—it’s about resilience, data control, and operational agility. For industrial players, now is the time to ask:

- Is our logistics strategy aligned with multi-country production and trade?

- Do we have end-to-end visibility from supplier to plant to customer?

- Are we using logistics to improve service levels, reduce cost, and manage compliance?

The answers to these questions will define competitiveness in Southeast Asia’s next wave of industrial growth.

How Alarar Capital Group Supports Industrial Supply Chains in Southeast Asia

Alarar Capital Group partners with industrial manufacturers and distributors across Southeast Asia to build logistics networks that are resilient, scalable, and regulation-ready. Our expertise spans manufacturing-driven fulfillment design, regional distribution modeling, and cross-border enablement, with a focus on the following areas:

- Multi-Nodal Network Design: Optimizing inventory placement and transport flows across industrial zones, bonded hubs, and SEZs to minimize lead times and reduce landed cost for multi-country production.

- Specialized Warehousing Solutions: Advising on warehouse selection and fit-out for heavy goods, temperature-sensitive materials, and parts inventory—including support for vendor-managed inventory (VMI) and reverse logistics.

- Digital Logistics Control Towers: Building centralized dashboards that connect TMS, WMS, and IoT trackers to give procurement and operations teams full visibility into asset movement, delays, and compliance alerts.

- Regulatory & Trade Compliance: Providing guidance on DG (dangerous goods) handling, customs documentation, and regional trade agreements to reduce cross-border risk and unlock faster clearances.

For industrial brands seeking to modernize their SEA logistics infrastructure, we bring the insight and operational muscle to support both strategic redesign and in-market execution.