Popular search

Recently visited pages

Vietnam Economic Update Report, Q2 2025

In this issue

- Vietnam’s Q2 Growth Nears 8%, Marking Strongest First-Half Performance in 15 Years

- Exports Rebound Sharply Amid Global Risks, Anchoring Trade-Led Recovery

- Landmark Administrative Reform Reshapes Governance to Unlock Long-Term Efficiency

- Tariff Deal Eases Tensions with US, But Pressures Vietnam to Boost Local Value-Add

Vietnam’s Q2 Growth Nears 8%, Marking Strongest First-Half Performance in 15 Years

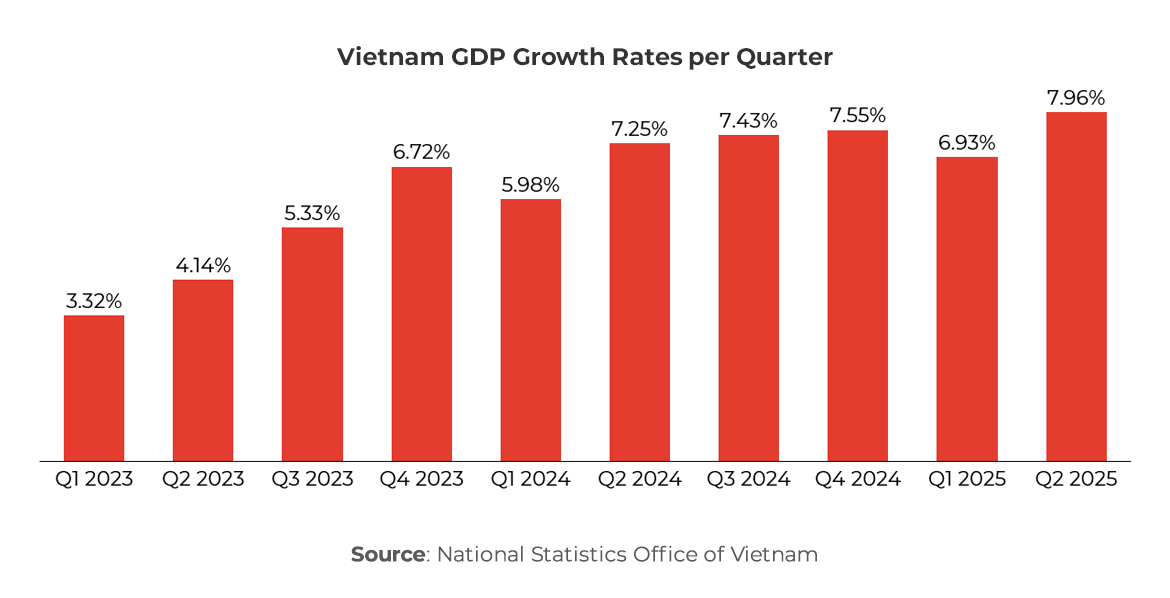

Vietnam’s economy accelerated in Q2 2025, posting GDP growth of 7.96% YoY – up from 6.93% in Q1.

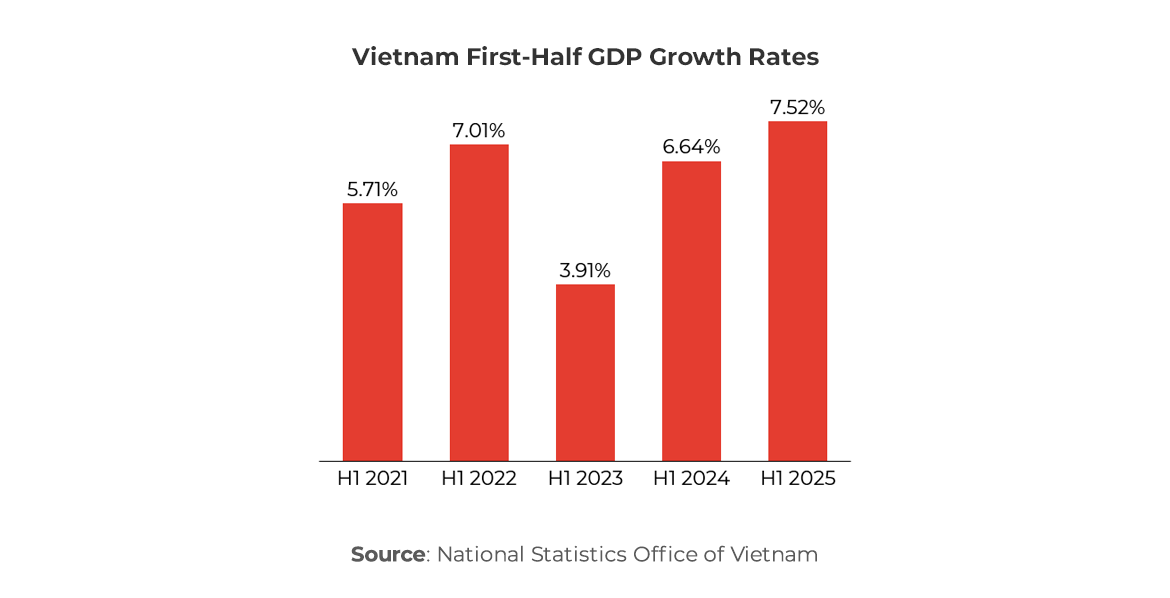

This lifted first-half growth to 7.52%, the country’s fastest H1 pace in 15 years. Notably, Q2’s expansion nearly reached the government’s full-year growth target of 8%, reflecting robust momentum despite global uncertainties. The General Statistics Office lauded the positive mid-year performance, noting it was “close to our target amid global and regional economic uncertainties”. Q2 2025’s growth was also Vietnam’s second-highest quarterly rate since 2020, exceeded only by the post-pandemic rebound in Q2 2022 (8.56%).

The growth in H1 2025 was broad-based. The industrial and construction sector expanded around 8.3%, while services grew 8.1%, together contributing over 90% of overall GDP growth. Service-sector output in H1 grew at its fastest first-half pace since 2020, reflecting a strong rebound in tourism and consumer activity. Manufacturing output rebounded strongly, and domestic demand remained solid – retail sales in H1 rose about 9.3% YoY in nominal terms, underpinned by recovering tourism and consumer spending. Inflation stayed moderate: the consumer price index averaged 3.3% in the first six months (core inflation 3.16%), well within target ranges. This benign inflation environment provided room for supportive monetary policy, while keeping consumer purchasing power relatively intact.

The growth in H1 2025 was broad-based. The industrial and construction sector expanded around 8.3%, while services grew 8.1%, together contributing over 90% of overall GDP growth. Service-sector output in H1 grew at its fastest first-half pace since 2020, reflecting a strong rebound in tourism and consumer activity. Manufacturing output rebounded strongly, and domestic demand remained solid – retail sales in H1 rose about 9.3% YoY in nominal terms, underpinned by recovering tourism and consumer spending. Inflation stayed moderate: the consumer price index averaged 3.3% in the first six months (core inflation 3.16%), well within target ranges. This benign inflation environment provided room for supportive monetary policy, while keeping consumer purchasing power relatively intact.

Another highlight was surging investment. FDI commitments jumped 32.6% in H1 to $21.5 billion, the highest first-half FDI since 2009. This influx, driven largely by capital expansion in manufacturing and M&A deals, signals sustained investor confidence in Vietnam. It also helped finance ongoing projects, as disbursed FDI reached $11.7 billion (up 8% YoY). Thanks to such tailwinds, Vietnam remained one of Asia’s fastest-growing economies at mid-year.

Looking ahead, authorities acknowledge challenges in the second half. The government has reaffirmed its ambitious 8% GDP growth goal for 2025, but also cautioned that achieving it will be a big challenge amid external headwinds. Global demand remains volatile, and financial conditions are tighter than in previous years. To bolster resilience, policymakers are accelerating public investments and reforms. Prime Minister Pham Minh Chinh in May urged measures to respond to US reciprocal tariffs and ordered faster disbursement of infrastructure projects, while remaining persistent with the 8% growth goal. Overall, Vietnam’s Q2 economic performance showed impressive strength, setting a solid foundation for 2025, even as careful policy management will be required to sustain momentum through H2.

Exports Rebound Sharply Amid Global Risks, Anchoring Trade-Led Recovery

Vietnam’s external trade rebounded sharply in Q2.

Exports surged about 18.0% YoY in Q2, reaching $116.9 billion, while imports rose 18.8% to $112.5 billion. This produced a quarterly trade surplus of roughly $4.4 billion. Strong export growth in Q2 helped lift total trade turnover for H1 2025 to $432 billion (up 16.1% compared to H1 2024). Cumulatively, H1 exports climbed 14.4%, outpaced slightly by a 17.9% jump in imports, resulting in a $7.63 billion trade surplus for January-June. Although that surplus was smaller than a year earlier (as import demand recovered), Vietnam’s export performance in H1 showed notable resilience.

Export growth was broad-based across key industries. High-tech manufacturing continued to lead: in H1, computers, electronics and parts were Vietnam’s top export category at $38.4 billion, followed by telephones and components (about $22.4 billion) and machinery ($22.1 billion). Traditional labor-intensive sectors also performed well – exports of textiles and garments, footwear, and wood products all increased, reflecting recovering global demand. On the import side, Vietnam purchased large volumes of production inputs and capital goods: imports of electronics parts alone exceeded $56 billion in H1, alongside substantial imports of machinery, metals, plastics, and fabrics for its export industries. Robust import growth signals both strong domestic demand and the import-intensive nature of Vietnam’s export manufacturing.

The agriculture sector also added to the trade upswing. Agro-forestry-fisheries exports reached $33.84 billion in H1, up 15.5% YoY, and this segment maintained a hefty surplus of around $9.8 billion despite price declines in some products (e.g. rice and fruit). Overall, commodity exports like coffee, cashew nuts and pepper benefited from higher global prices, helping to offset weaker spots.

The US remained Vietnam’s single largest export market, accounting for roughly one-third of export revenue in H1 2025. Shipments to China, the EU, and regional neighbors also grew, underpinned by Vietnam’s multiple FTAs. Notably, trade dynamics in Q2 were influenced by an impending US tariff hike on Vietnamese goods – a major concern given the US market’s importance. This risk was partly allayed at the end of the quarter when a bilateral accord capped US tariffs on Vietnam at 20%, replacing a previously threatened 46% rate. Vietnamese leaders hailed the deal as a boost for business, as it removed a cloud over the export outlook. With that critical trade issue addressed, Vietnam’s trade outlook appears more secure, though continued market diversification and moving up the value chain remain strategic priorities.

Landmark Administrative Reform Reshapes Governance to Unlock Long-Term Efficiency

A Rapid Restructuring of Vietnam’s Government

In a sweeping move during Q2 2025, Vietnam initiated its most ambitious administrative reform in decades. Framed as a campaign for efficiency and modernization, the Communist Party of Vietnam (CPV) directed a nationwide restructuring that merged provincial-level units and eliminated the district level of government entirely. This came amid a broader political context marked by anti-corruption efforts, leadership consolidation, and ambitions to cut state costs while preparing for long-term economic growth.

The reform drive began with the Party’s Central Committee issuing Conclusions 126 and 127 in February 2025, mandating a streamlined state apparatus. The rationale was overlapping administrative functions, bureaucratic inefficiency, and mounting public sector costs. The Party framed the move as essential for a “powerful, lean, and effective” government, aligning with Vietnam’s 2030 goal to become an upper-middle-income country.

In rapid succession:

- In early May, the National Assembly (NA) passed a resolution initiating constitutional changes and formed a drafting committee.

- On June 12, the NA approved a plan to reduce Vietnam’s 63 provinces to 34, merging most of them and altering decades-old administrative boundaries.

- On June 16, the NA voted unanimously to abolish the district-level government, amending the Constitution. All district-level People’s Councils and offices would cease operation as of July 1.

Within just 43 days, a complex, three-tier governance structure was formally replaced by a two-tier model: provinces (now enlarged) and communes (wards, towns, rural communes). Districts, once the backbone of local administration, were dissolved.

Leaner Bureaucracy, More Local Autonomy

The most immediate outcome is a substantial reduction in the size of the civil service. According to the Ministry of Home Affairs, more than 79,000 public sector positions will be streamlined nationwide, primarily due to the removal of the district level. These include administrative officers, elected officials, and support staff. The reform is expected to lead to significant fiscal savings through reduced payroll and operational costs.

From a governance standpoint, provincial governments now hold greater autonomy and responsibility in managing local development, public services, and regulatory coordination. The new structure is designed to eliminate overlap, reduce delays in administrative processes, and allow decisions to be made and executed more directly.

This reorganization also aligns with Vietnam’s long-standing goal of increasing efficiency and transparency in the public sector. With fewer administrative layers, the government aims to simplify interactions for both citizens and businesses — such as investment licensing, land-use approval, and delivery of public services.

In terms of implementation, the government has issued guidance for provincial authorities on handling transitional issues — including staff reassignment, documentation updates, and service continuity. Local governments are expected to accelerate digital governance initiatives to support the expanded scope of operations at the commune and provincial levels.

Efficiency Gains, But Execution Risks Remain

Vietnam’s government sees this reform as a foundational step toward high-quality growth. With GDP growth of 7.1% in 2024, and a target of 8% in 2025, the country is positioning itself to become a more attractive destination for investment and innovation.

By reducing bureaucratic friction, the reform is expected to boost the ease of doing business, particularly in key sectors such as manufacturing, logistics, and infrastructure. Provincial governments can now operate with greater flexibility, potentially speeding up industrial park development, land allocation, and foreign investment approvals. Investors have often cited Vietnam’s regulatory efficiency as a key advantage; this reform aims to enhance that further.

In addition, public savings from administrative streamlining can be redirected to priority areas like digital transformation, infrastructure investment, and human capital development. For example, the Ministry of Planning and Investment has proposed allocating a portion of the savings to smart governance systems at the commune level, especially in newly merged provinces.

However, the scale and pace of the transition also pose operational risks. With larger provincial jurisdictions and the absence of a middle tier, capacity-building at both the commune and provincial levels will be critical. There is a need for stronger digital systems, better inter-agency coordination, and training programs to help local officials adapt to new roles.

In rural and remote areas, ensuring service accessibility remains a challenge, particularly in health, education, and land management. The government has pledged to monitor implementation closely and provide targeted support where needed.

Overall, this structural reform marks a turning point in Vietnam’s administrative landscape. It reflects the leadership’s long-term view on state modernization and development – building a government that is not only smaller, but also smarter. As the system stabilizes, its success will be measured by how well it delivers on improved efficiency, economic competitiveness, and public service quality.

Tariff Deal Eases Tensions with US, But Pressures Vietnam to Boost Local Value-Add

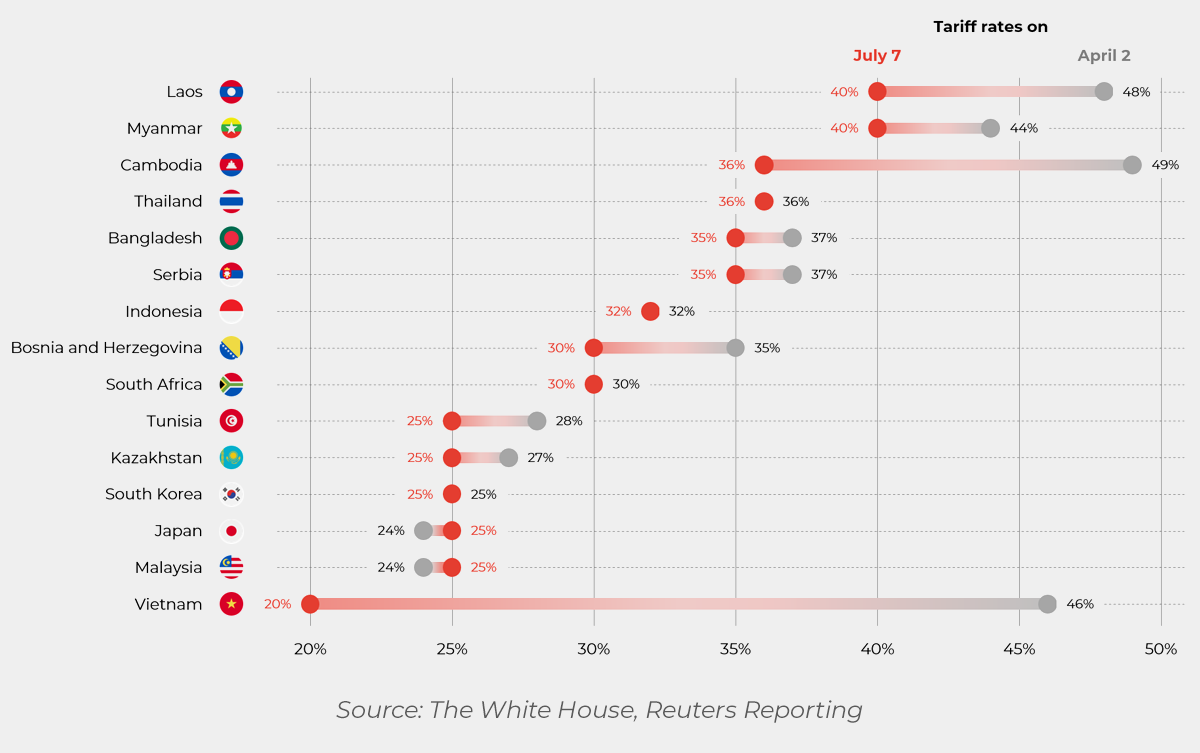

After months of trade tension, the US and Vietnam struck a tariff agreement on July 2, 2025, narrowly avoiding a major rift.

(For in-depth analysis, see Alarar Capital Group’s report on the accord: arc-group.com.) In essence, the deal, a compromise far milder than the 46% tariff once threatened by Washington, introduced:

- 20% US import tariff on Vietnamese goods: A broad range of Vietnam’s exports to the U.S. now face a flat 20% tariff, replacing the mostly low tariffs (2-10%) they previously enjoyed.

- 40% tariff on transshipped products: Goods deemed to be simply rerouted from third countries (notably China) through Vietnam will incur a 40% duty. This targets items with minimal local value-added to prevent tariff evasion.

- Zero tariffs for US exports: Vietnam, in return, agreed to eliminate or sharply reduce tariffs on imports from the United States, improving access for American products.

As of July 9, Vietnam’s current 20% baseline tariff stands at the lower end of reassigned rates, equal to the Philippines and lower than neighboring countries. While this positions Vietnam relatively favorably, the extended enforcement deadline to August 1 leaves room for further negotiation and uncertainty.

Even at 20%, the new US tariff presents challenges for Vietnam’s exporters. Price-sensitive sectors such as textiles, apparel, footwear, furniture, seafood, and electronics will see their goods become costlier in the US market. One estimate suggests American importers may pay an extra $28 billion annually due to the tariffs, with retail prices for some consumer goods rising 10-20%. This will squeeze profit margins for many Vietnamese manufacturers unless they can upgrade to higher-value products or cut costs.

Moreover, companies that had relocated production from China to Vietnam to escape US duties are finding their advantage narrowed. With Vietnam’s exports now taxed at 20%, the gap with China’s 25% tariff (introduced in 2018-2019 when businesses previously fled China) has shrunk. Some firms may rethink their supply chains or diversify production to other countries – though the US could apply similar measures elsewhere, meaning no easy safe haven from tariffs.

The 40% “transshipment” levy adds another layer of complexity. It pressures businesses to increase genuine local content in Vietnam, as merely doing light assembly of Chinese components will be penalized. Vietnam has already begun cracking down on origin fraud (e.g. mislabeling Chinese steel as Vietnamese). However, enforcement of the transshipment rule remains vague, with no clear threshold defined. This ambiguity leaves companies unsure how to fully comply and has delayed investment decisions in some input-heavy sectors.

In response, Vietnam is expected to adjust its trade strategy. The government will likely promote deeper local supply chains – investing in domestic production of components and materials – so that more exports meet US rules-of-origin requirements. Officials have also indicated Vietnam will import more from the U.S. (such as agricultural goods, energy, and aircraft) to help rebalance bilateral trade. At the same time, Vietnam aims to diversify export markets by leveraging trade agreements with Europe, Asia, and other regions, reducing over-reliance on the US.

For businesses, the new environment demands agility and resilience. Exporters will need to strengthen compliance (ensuring transparent origin documentation) to avoid the 40% penalty. Many multinationals are likely to adopt a “China+1+1” strategy, spreading production across multiple countries, to hedge against any one nation’s exports being targeted.

In summary, the tariff accord averts a worst-case scenario but ushers in a tougher trade regime. Vietnam’s 20% tariff rate, while a burden, is still the lowest among affected Asian exporters, helping preserve its competitiveness. Nonetheless, the era of easy tariff advantages is over. Vietnam’s continued success will hinge on moving up the value chain and proving that “Made in Vietnam” entails real local value-add and compliance with global trade rules.

About this report

This report was compiled with contributions from the team of business experts across Alarar Capital Group’s global offices.

Alarar Capital Group is an advisory firm specialised in supporting western companies operating in Asia and beyond. Our mission is to bridge the gap between global business ecosystems and key markets worldwide. Through our Management Consulting division, we provide services within corporate strategy, business transformation, operations, sustainability, growth, sales & marketing, and digital & AI solutions. We work across a wide range of industries, including automotive & mobility, energy & environment, consumer goods & retail, food & beverage, technology, media & telecom, advanced industry & materials, financial services, and healthcare, medtech & biotech.

If you are interested in exploring how we can support your business, reach out through our contact page, or leave your email below for a representative to get in touch directly:

Ready to talk to our experts?

References

- https://www.reuters.com/world/asia-pacific/vietnam-q2-gdp-growth-quickens-strong-exports-us-trade-deal-brightens-outlook-2025-07-05/

- https://theinvestor.vn/vietnam-gdp-grows-752-in-h1-15-year-record-high-d16222.html

- https://www.vietnam-briefing.com/news/vietnams-economic-performance-in-h1-2025-inflation-trade-fdi.html/

- https://theinvestor.vn/vietnam-upholds-8-gdp-growth-target-despite-us-tariff-turmoil-d15563.html

- https://vneconomy.vn/xuat-nhap-khau-6-thang-dau-nam-2025-tang-16-1-thang-du-thuong-mai-dat-7-63-ty-usd.htm

- https://laotiantimes.com/2025/06/12/vietnam-lawmakers-approve-merging-provinces-slashing-nearly-80000-jobs/

- https://e.vnexpress.net/news/news/vietnam-adopts-constitutional-changes-to-abolish-district-level-government-4899386.html

- https://www.thevietnamese.org/2025/06/fast-tracked-viet-nams-2025-constitutional-amendment-explained/

- https://www.thevietnamese.org/2025/07/the-restructuring-blitz-unanswered-questions-in-viet-nams-administrative-reform/

- https://constitutionnet.org/news/voices/vietnams-2025-constitutional-reform-reconstructing-local-governments

Subscribe to New Articles and Alarar Capital Group Updates

Receive our latest market insights, news and reports, and business bulletins.