Over the last few months, there has been a notable increase in transaction volume directly tied to cryptocurrency treasury strategies. What began as a niche movement among digital-native companies, has evolved into a widely popular approach among a large set of public issuers. Both crypto-native and traditional businesses are increasingly leveraging publicly listed vehicles to build reserves of digital assets such as Bitcoin, Ethereum, Solana, and other coins. This article explores strategic rationales behind crypto treasury strategies and how the evolving capital markets landscape supports the expansion.

Current Market Trends in Crypto Treasury Adoption

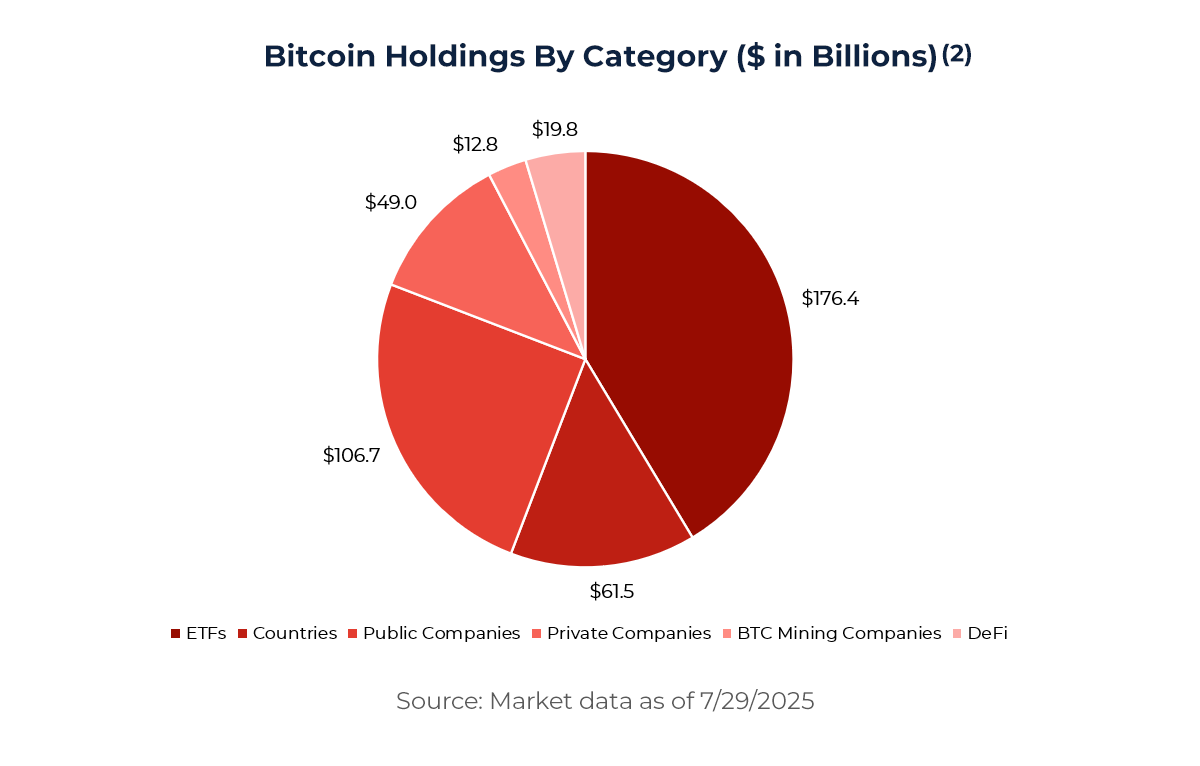

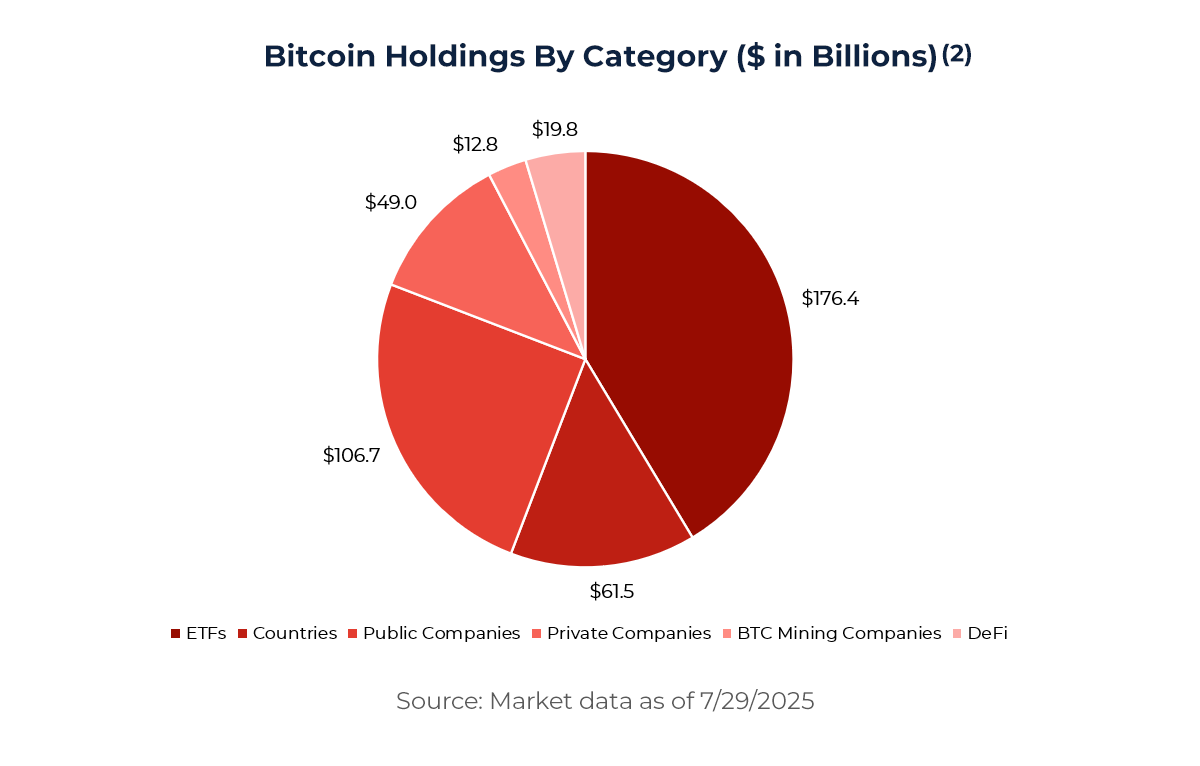

A growing number of firms are implementing structured strategies to create their own crypto treasuries. The number of public companies that hold Bitcoin has increased from 64 to 141 over the first half of 2025, a 120% increase in only six months.[1] As of July 29, 2025, public companies held approximately 900,000 BTC (~$100 billion in value at current price levels). Across all sectors (public, private, ETFs, nations), total corporate and institutional holdings have reached roughly 3.6 million BTC, ~17% of the 21 million maximum supply.[2]

Beyond Bitcoin, publicly listed Ethereum treasuries are close to $5 billion in value, with roughly 1.3 million ETH held by 14 public companies.[3] Notable Ethereum treasury participants include SharpLink Gaming (NASDAQ: SBET), Bitmine Immersion (NYSE American: BMNR), and Coinbase (NASDAQ: COIN). Following the GENIUS Act, which is a pro-stablecoin regulation signed by President Trump on July 18, 2025, Ethereum-linked equities experienced significant stock price appreciation. [4]

These data points indicate that digital assets, mainly Bitcoin and Ethereum, are increasingly seen as strategic reserve assets, while broader institutional interest is being validated through public markets and regulatory developments.

Strategic Rationales Behind Crypto Treasury Implementation

Companies are embracing crypto treasury strategies as part of a broader response to structural shifts in the global financial and technological landscape. Due to this shift, corporate treasuries are no longer limited to low‑yield instruments like cash, money‑market funds, or government bonds. Instead, firms now increasingly regard digital assets as a viable complement to traditional reserves, motivated by several aligning factors.

One of the main motivations is monetary diversification, an effort by companies to reduce exposure to fiat currency depreciations, geopolitical currency volatility, and the cyclical nature of centralized monetary policy. In a highly interconnected global economy, holding a portion of reserves in non-sovereign, supply-limited digital assets offers a hedge against inflation risk and foreign exchange instability, especially for multinational firms with significant dollar-denominated exposures. At the same time, firms seek portfolio diversification as crypto assets typically exhibit low correlation with cash and fixed income instruments, offering exposure to an emerging asset class that may display appreciation if broader adoption continues.

Beyond serving as a financial hedge, crypto treasury strategies also enable companies to align themselves with the rapidly evolving digital asset ecosystem. As tokenized ecosystems grow across sectors like payments, gaming, social media, and enterprise infrastructure, treasury holdings in crypto assets allow companies to move from passive observers to active participants. For firms engaged in Web3 development, NFTs, digital identity, or decentralized platforms, holding digital assets can be viewed as a natural extension of the business model, effectively integrating themselves into the networks and ecosystems they interact with. Meanwhile, traditional industries are increasingly exploring crypto treasuries to gain operational exposure, signal innovation, and integrate with decentralized technologies.

In addition, certain firms are not only holding tokens but are also actively staking them to earn yield, effectively transforming digital assets from passive reserves into income-generating instruments. Staking allows companies to commit their crypto holdings to support blockchain network operations, such as transaction validation and governance, in exchange for rewards paid in the native token. This approach enables treasury teams to extract additional value from idle assets while maintaining exposure to the underlying cryptocurrency. It also reflects a broader shift in how corporates engage with digital assets, moving from passive allocation toward active on-chain participation. As staking frameworks mature and regulatory guidance evolves, more companies are likely to explore these mechanisms as part of a diversified treasury strategy.

Several companies have taken a more active approach to crypto treasury management by raising external capital specifically to acquire digital assets. Rather than reallocating existing cash reserves, these firms have executed financing transactions such as equity offerings, convertible bonds, and various debt instruments to build or expand their crypto positions. This reflects a deliberate strategy to use capital markets as a funding mechanism for digital asset exposure. In several cases, these financing announcements have been followed by increased trading volumes and rapid gains in equity valuation, suggesting that investors may interpret such moves as a sign of strategic alignment with the digital asset ecosystem.

Beyond capital formation, crypto treasuries also carry a strong signaling function. Corporate crypto holdings can attract a growing base of digital asset-oriented investors, including hedge funds, family offices, and retail shareholders, who view on-balance-sheet exposure as indicative of long-term innovation, governance maturity, and strategic planning. For small- and mid-cap public companies in particular, implementing a crypto treasury program can enhance market visibility, improve trading liquidity, and help differentiate the issuer in a competitive capital formation environment. Crypto accumulation can function both as a financial allocation and as a tool for investor engagement and brand positioning.

Notable Corporate Crypto Treasury Transactions

Several recent transactions reflect the growing institutionalization of crypto treasury strategies and highlight the range of financing structures being used by issuers across various sectors. Among the most notable Bitcoin-related deals, Trump Media & Technology Group (NASDAQ: DJT) raised approximately $2.3 billion in net proceeds through a combination of equity and convertible debt issuances. The company allocated roughly $2 billion to Bitcoin acquisitions, establishing one of the largest corporate holdings of the asset. An additional $300 million was earmarked for Bitcoin options strategies, indicating a structured approach to treasury management with both directional and derivative exposure. The transaction demonstrates how issuers are using capital markets to convert proceeds into strategic digital asset reserves on a large scale.[5]

In the Ethereum space, GameSquare Holdings (NASDAQ: GAME), the owner of gaming and media properties including FaZe Clan, announced a program to allocate up to $100 million toward Ethereum acquisitions. The company raised over $90 million in equity in two weeks. The management is now routing the tokens through Dialectic’s Medici platform to target risk‑adjusted on‑chain yields of 8–14%, with profits channeled for further ETH accumulation, growth initiatives, or shareholder buybacks. The announcement doubled GameSquare’s market capitalization overnight and underscored CEO Justin Kenna’s thesis that a consumer‑facing entertainment brand can treat Ethereum not as a speculative asset but as a yield‑generating operating asset at the core of its business model.[6]

The SPAC market has also been active in supporting crypto treasury strategies. On July 17, 2025, Bitcoin Standard Treasury Co. announced a merger with Cantor Equity Partners I Inc. (NASDAQ: CEPO). The transaction combines the SPAC’s $200 million trust (subject to redemptions) with a $1.5 billion PIPE, consisting of common equity, preferred equity, and convertible senior notes. Upon closing, the combined entity is expected to hold over 30,000 BTC, placing it among the largest publicly listed Bitcoin holders. The deal underscores the ability of SPACs to serve as capital formation vehicles for digital asset strategies, particularly for entities without traditional operating revenues.[7]

Beyond Bitcoin and Ethereum, capital markets have also seen heightened activity around lesser-known digital assets. On July 28, 2025, Mill City Ventures III Ltd. (NASDAQ: MCVT), a Minnesota-based non-bank lender, announced a $450 million private placement intended to support the launch of a Sui-based crypto treasury strategy. The company will acquire and stake native SUI tokens as part of a broader effort to establish an active on-chain reserve system.[8] This initiative highlights that corporate crypto treasury programs are expanding beyond Bitcoin and Ethereum, with increasing interest in alternative layer-1 ecosystems and proof-of-stake networks. The transaction structure, which includes proceeds raised through preferred equity with institutional backing, illustrates how small-cap firms are leveraging targeted capital raises to fund blockchain-native treasury programs aligned with next-generation financial infrastructure.

Market Conditions Aligning for Strategic Entry

Overall, the surge in corporate crypto treasury adoption is being driven by a convergence of strategic, financial, and structural forces that are reshaping how companies manage capital. Digital assets are no longer viewed as speculative holdings, but as long-term, yield-generating instruments that can enhance overall treasury performance. With real yields expected to decrease and traditional cash instruments offering limited upside, token reserves, especially when staked or deployed in on-chain strategies, are increasingly being treated as productive balance sheet assets. At the same time, regulatory clarity, institutional-grade custody infrastructure, and expanded access to structured financing have removed many of the historical barriers to adoption. Companies that implement transparent crypto treasury strategies are already seeing benefits in the form of valuation uplifts and tighter deal pricing, reinforcing a cycle of capital access and reserve expansion.

This shift is reflected in the wide range of transactions executed in recent months, which shows that crypto treasuries are being integrated into broader corporate finance and capital markets planning. Issuers are using traditional equity and debt raises, PIPE transactions, and SPAC mergers to fund crypto reserve strategies, while asset allocation is also diversifying beyond Bitcoin and Ethereum to include other crypto tokens. For corporate issuers, both in tech-native and in traditional sectors, the ability to convert low-cost equity or convertible debt into high-performing digital assets has become a meaningful form of return enhancement. In 2025, companies with clearly articulated crypto treasury strategies consistently priced equity offerings at tighter discounts compared to peers, signaling growing investor confidence in the upside optionality embedded in digital asset reserves.

The appeal extends to financial sponsors as well. SPAC vehicles are increasingly being repurposed to take crypto-holding entities public, offering faster execution timelines and earlier mark-to-market value realization than traditional de-SPACs. Meanwhile, a combination of macroeconomic and technical factors continues to support near-term action. Bitcoin’s April 2024 halving has significantly reduced new supply, while Ethereum’s Dencun upgrade enhanced scalability and reduced Layer-2 transaction costs. At the same time, regulatory developments, most notably the passage of the GENIUS Act and the anticipated approval of spot ETH ETFs, have materially lowered headline risk for institutional participants. With front-end U.S. dollar yields projected to decline, equity-funded crypto purchases made today may lock in a positive carry that fades with time.

All signs point to one conclusion: the market is rewarding first movers. Companies that execute during this window are not only optimizing their balance sheets but also securing access to an increasingly crypto-aware investor base. For corporate boards, the question is no longer whether crypto belongs on the balance sheet, but how quickly can they move before the market fully prices in the opportunity.

References

[1] Flores (2025): 36 New Public Firms Eye Bitcoin in 6 Months; Is the Corporate Crypto Boom Just Starting?

[2] Bitbo (2025): Bitcoin Treasuries | 145 Companies Holding (Public/Priv)

[3] CoinGecko (2025): Companies with Ethereum Holdings – CoinGecko

[4] Chauhan (2025): Crypto-linked stocks advance after Trump signs stablecoin law | Reuters

[5] Breuninger (2025): Trump Media: DJT grows $2 billion bitcoin hoard

[6] Hulse (2025): GameSquare Emerges as Major Ethereum Holder with $100M On-Chain Strategy – Financial Tech Times

[7] Montgomery (2025): Bitcoin Standard Treasury To Go Public With 30,021 BTC In SPAC Merger

[8] Morningstar (2025): Mill City Ventures III, Ltd. Announces $450,000,000 Private Placement to Initiate Sui Treasury Strategy | Morningstar