China’s Economy Maintained Moderate Growth in Q2 2025, but Underlying Fragilities Persist

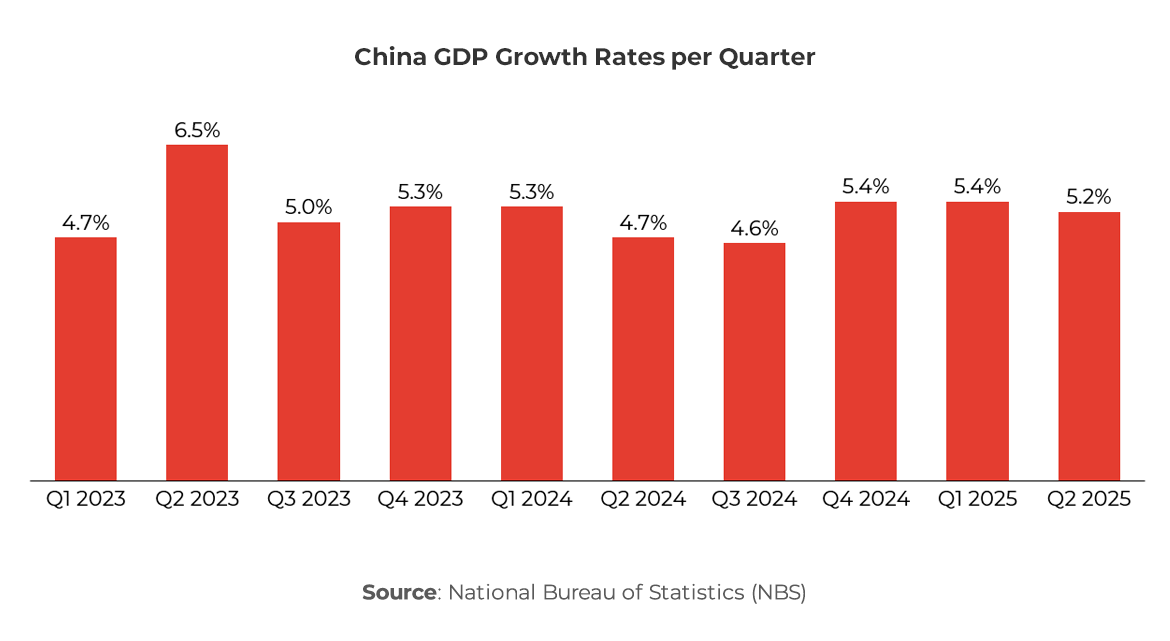

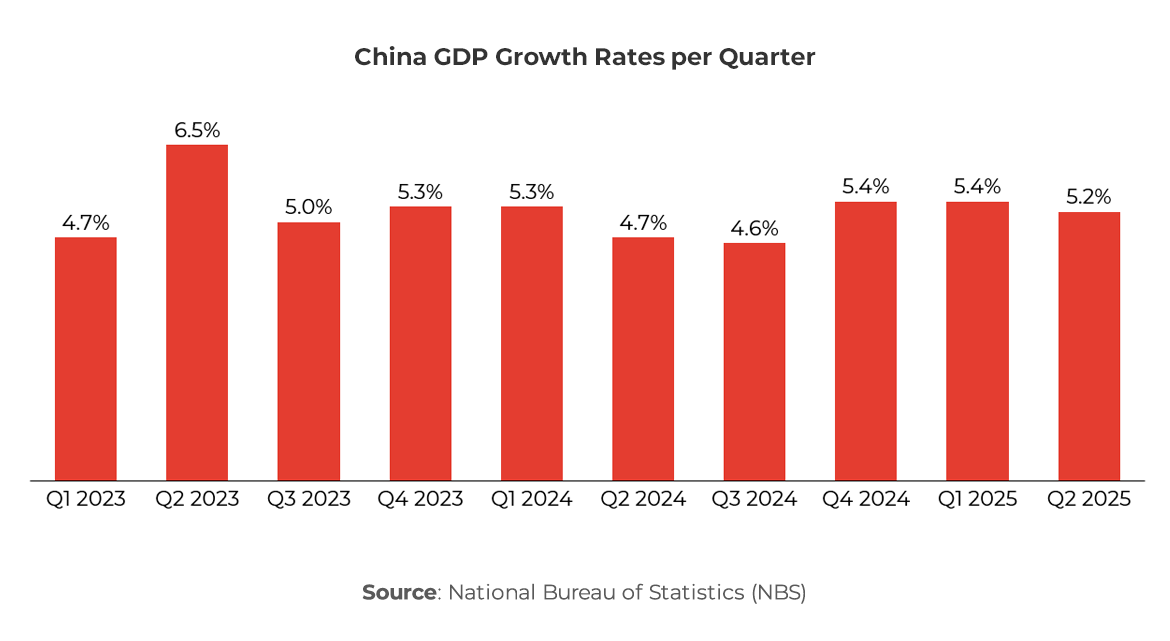

China’s economy maintained solid growth in Q2 2025, albeit with some loss of momentum compared to Q1.

GDP expanded 5.2% YoY in Q2 (down from 5.4% in Q1). On a quarter-on-quarter basis, growth was 1.1% in Q2 (versus 1.2% in Q1), indicating a slight slowdown. H1 2025 GDP growth averaged around 5.3%, comfortably above the official full-year target of around 5%. This resilience in H1 was supported by earlier reopening gains and policy measures, keeping China on track to meet its annual goal despite rising challenges.

Industrial activity showed mixed signals during the quarter. Factory output surprised to the upside in June, jumping 6.8% YoY (accelerating from May’s 5.8%), as manufacturers rushed to fill orders before potential US tariff hikes. However, consumer spending showed signs of fatigue. Retail sales growth cooled to 4.8% in June (down from 6.4% in May), reflecting cautious consumer sentiment. Consumer confidence remained fragile amid deflationary pressures (with prices barely rising) and a still-recovering job market. Big-ticket consumption rebounded in areas like cinema box office (H1 2025 revenue up ~23% YoY) as pandemic effects faded, but overall household spending did not yet fully regain pre-pandemic vigor.

Industrial activity showed mixed signals during the quarter. Factory output surprised to the upside in June, jumping 6.8% YoY (accelerating from May’s 5.8%), as manufacturers rushed to fill orders before potential US tariff hikes. However, consumer spending showed signs of fatigue. Retail sales growth cooled to 4.8% in June (down from 6.4% in May), reflecting cautious consumer sentiment. Consumer confidence remained fragile amid deflationary pressures (with prices barely rising) and a still-recovering job market. Big-ticket consumption rebounded in areas like cinema box office (H1 2025 revenue up ~23% YoY) as pandemic effects faded, but overall household spending did not yet fully regain pre-pandemic vigor.

Fixed investment continued to weaken, dragged by the ongoing property downturn. In the first half, fixed asset investment rose only 2.8% YoY, undershooting forecasts, as private sector confidence lagged. Crucially, property development remained a major drag, with real estate investment plunging 11.2% in H1. Property prices kept falling: new home prices in June dropped 0.3% from May, the sharpest one-month fall in 8 months, and were down 3.2% YoY. The housing slump, now entering its fourth year, has erased a key growth engine and strained local government finances. The property sector once comprised roughly a quarter of China’s GDP, and its contraction remains a drag on economic growth, complicating efforts to hit the 5% GDP target amid weak demand. Authorities rolled out multiple support measures (easier mortgages, allowing developers to offload inventory to local governments, etc.), but housing demand stayed sluggish in Q2, necessitating ongoing policy attention.

Price pressures turned increasingly worrying in Q2. China flirted with deflation as overall prices barely rose – the consumer price index (CPI) was up just 0.1% YoY in June after several months of decline. Meanwhile, factory-gate prices plunged deeper: the producer price index (PPI) sank 3.6% in June (its steepest drop in nearly two years). This broad-based price weakness (reflected in a falling GDP deflator) underscores “subdued demand at home” and uncertainty from the trade war, piling pressure on policymakers. In essence, China’s post-COVID recovery has been hampered by soft domestic demand, a prolonged housing downturn, and external headwinds, leading to a “negative deflationary feedback loop”, as mentioned by analysts at Morgan Stanley, emerging by mid-year.

Policymakers responded in Q2 with a mix of monetary and fiscal support, while pledging more if needed. The People’s Bank of China cut key interest rates in May and injected liquidity to prop up growth. Infrastructure spending was accelerated and consumer subsidies (such as appliance trade-in programs) were expanded to spur buying. These steps provided some cushion – for example, core inflation got a one-time boost from auto and electronics trade-in incentives. However, officials remain cautious about large-scale stimulus given high local debt and financial risks. Attention is now on the late-July Politburo meeting, where investors expect new measures to shore up H2 growth. Beijing faces a delicate balancing act: it has ramped up support through easier credit and government spending, yet China observers and analysts warn that “stimulus alone may not be enough” to overcome structural drags like weak confidence and overcapacity. In summary, China’s Q2 2025 economic performance was solid but slightly softer, with 5.2% growth keeping H1 on a stable track. Nevertheless, intensifying deflationary signs, a cooling property sector, and external pressures all signal that stronger policy responses may be needed to sustain momentum into the second half.

China’s Trade Remained Resilient in Q2 2025 Despite Slowing Global Demand and Softening Export Momentum

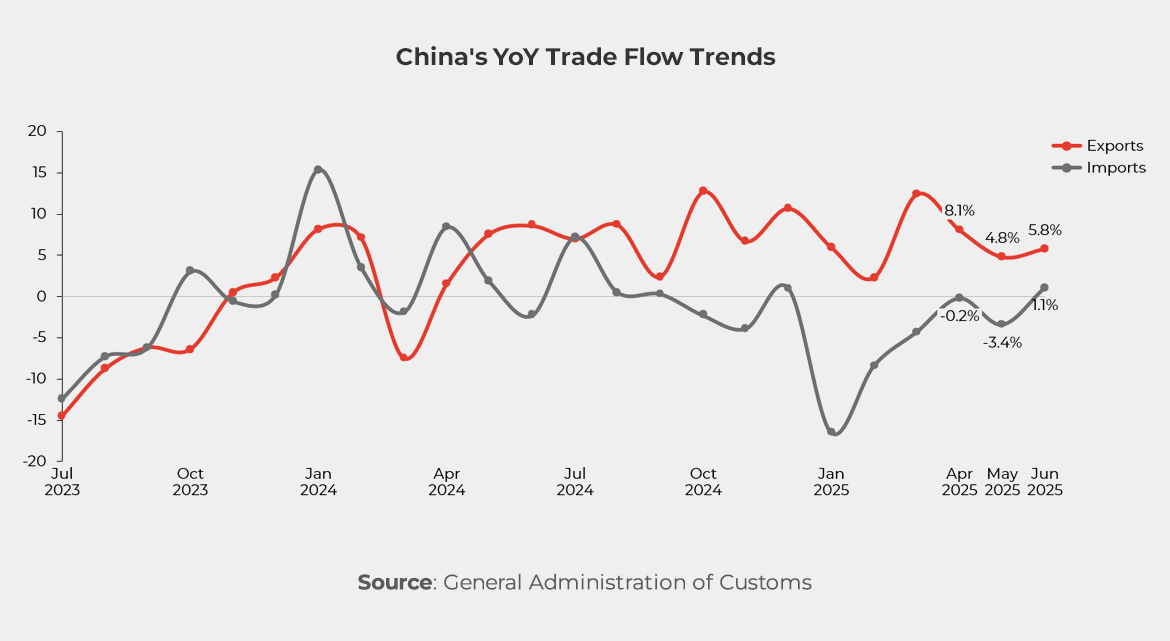

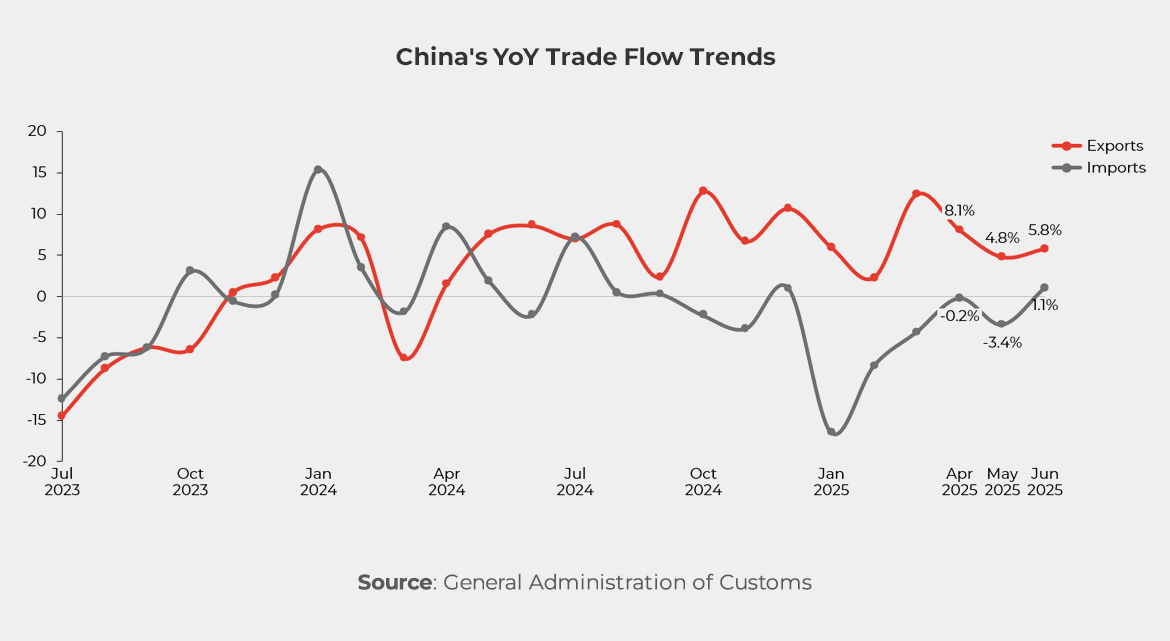

China’s trade sector regained some momentum in Q2, after a tepid start to the year.

Total goods trade (exports + imports) grew 4.5% YoY in Q2 – a significant pickup from roughly 1.3% growth in Q1. This brought H1 2025 trade value to $3.04 trillion, up 2.9% from a year prior. The improvement was export-driven: in H1, exports climbed 7.2% YoY to ¥13 trillion while imports fell 2.7% amid still-soft domestic demand. By mid-year, China’s export engine was outperforming expectations, helping offset import weakness and resulting in a wider trade surplus. The data underscores China’s export resilience in the face of global headwinds – but also highlights its reliance on external markets at a time of uncertain demand.

A key storyline in Q2 was a short-term export surge linked to US tariff dynamics. June in particular saw Chinese exports jump 5.8% YoY, picking up from May’s 4.8% growth and beating forecasts. This strength was partly due to front-loading of shipments: Chinese firms rushed out orders to capitalize on a fragile tariff truce ahead of a looming August 12 deadline when US tariffs were set to ratchet up. With a 90-day reprieve in place, exporters hurried to send goods before any trade deal fallout. Notably, shipments to the US spiked over 30% month-on-month in June as reduced tariffs took effect, though YoY exports to the US were still down. Exports to Southeast Asia also surged – for example, sales to ASEAN jumped 16.8% in June – suggesting Chinese companies are diversifying toward regional hubs amid Western trade frictions. On the import side, China saw its first monthly import growth of the year in June (+1.1% YoY), a tentative sign of stabilizing domestic demand and restocking. Still, for H1 overall, imports remained below last year’s levels, reflecting weak internal demand and lower commodity prices. The Q2 rebound in exports, combined with sluggish imports, swelled China’s trade surplus – which hit $114.7 billion in June, up from $103 billion in May.

A key storyline in Q2 was a short-term export surge linked to US tariff dynamics. June in particular saw Chinese exports jump 5.8% YoY, picking up from May’s 4.8% growth and beating forecasts. This strength was partly due to front-loading of shipments: Chinese firms rushed out orders to capitalize on a fragile tariff truce ahead of a looming August 12 deadline when US tariffs were set to ratchet up. With a 90-day reprieve in place, exporters hurried to send goods before any trade deal fallout. Notably, shipments to the US spiked over 30% month-on-month in June as reduced tariffs took effect, though YoY exports to the US were still down. Exports to Southeast Asia also surged – for example, sales to ASEAN jumped 16.8% in June – suggesting Chinese companies are diversifying toward regional hubs amid Western trade frictions. On the import side, China saw its first monthly import growth of the year in June (+1.1% YoY), a tentative sign of stabilizing domestic demand and restocking. Still, for H1 overall, imports remained below last year’s levels, reflecting weak internal demand and lower commodity prices. The Q2 rebound in exports, combined with sluggish imports, swelled China’s trade surplus – which hit $114.7 billion in June, up from $103 billion in May.

China’s trade performance thus far in 2025 shows both resilience and realignment. Exports have held up better than many anticipated, aided by export diversification and an adaptive manufacturing sector. Trade with emerging markets is rising: in H1, trade with Belt and Road partner countries grew 4.7% (now over half of China’s trade) and exports to ASEAN climbed ~9.6%. These gains helped counteract sluggish trade with some developed markets, as geopolitical tensions persist. US-China trade tensions reignited external pressure – President Trump’s renewed tariffs and export controls cast a shadow over China’s export outlook. Analysts warn that the export uptick from tariff front-loading may be temporary, and that tariffs likely to remain high will weigh on export growth in coming quarters. Indeed, many expect China’s export growth to slow in H2 as the tariff truce expires and global demand softens. In addition, indirect effects of a broader trade offensive by the US (targeting third countries and supply chains) could create further headwinds. On the positive side, Chinese exporters are adapting by rerouting trade and focusing on high-growth regions, and the government has emphasized expanding trade agreements and supporting new export industries. Overall, through Q2 2025, China’s trade sector has demonstrated strong resilience despite external headwinds, delivering modest growth in the first half. However, with external demand uncertainty and a potential tariff escalation on the horizon, sustaining this trade momentum will be a central challenge in the remainder of the year.

Deflation Returns as a Central Challenge in China’s Policy Agenda

China is facing persistent deflationary pressures in 2025, diverging sharply from the inflationary environment in many other major economies.

Recent data show flat or falling prices, weak domestic demand, and industrial overcapacity, prompting growing concerns of a deflationary spiral. This trend has evolved into a central issue shaping economic policymaking, presenting Beijing with a difficult balancing act: how to revive confidence and price stability without reigniting financial risks.

Persistent Price Declines and Their Drivers

In June 2025, China’s Producer Price Index (PPI) fell 3.6% YoY – the sharpest drop in nearly two years and the ninth consecutive month of factory-gate deflation. Consumer prices also remain flat, with CPI rising just 0.1% YoY. Core inflation excluding food and energy remains below 1%, signaling persistent weakness in underlying demand.

These figures reflect more than just cyclical softness. Consumers remain cautious, delaying purchases amid economic uncertainty. Companies are discounting heavily to compete in oversupplied sectors like steel, chemicals, and electronics. A multi-year property downturn continues to suppress housing-related spending, while demographic pressures and high youth unemployment weigh on household sentiment. Structural mismatches in labor and capital allocation have also weakened the transmission of stimulus into real demand.

Measured Policy Response, but Structural Risks Remain

To stabilize the economy, Chinese authorities have adopted an incremental stimulus strategy. The People’s Bank of China lowered its benchmark Loan Prime Rate by 10 basis points and provided liquidity injections to reduce borrowing costs. Fiscal authorities have focused on targeted consumption incentives and infrastructure spending, such as appliance subsidies and support for small firms.

These interventions offered a short-term boost to confidence, particularly in early 2025. However, their impact on inflation and private-sector momentum has faded quickly. Analysts now argue that the nature of the problem is increasingly structural: excess capacity, weak credit demand, and fragile consumer confidence are not easily addressed through marginal rate cuts or isolated fiscal programs.

China’s cautious approach also reflects the risks of overreach. Large-scale stimulus could inflate new asset bubbles, particularly in the real estate sector, or exacerbate already-high debt burdens among local governments. Policymakers are also wary of weakening the renminbi and triggering capital flight – a key concern as US-China interest differentials remain wide.

The Dilemma Ahead: Stability vs Stimulus

With GDP growth for Q2 at 5.2% and unemployment relatively contained, Beijing currently sees little need for a broad-based stimulus package. Instead, officials are targeting support to specific weak spots: tax relief for firms hiring young workers, support for unfinished housing projects, and credit access for small businesses.

But the risk is that this gradualist approach may fall short if deflationary expectations take hold. Households might further delay purchases, and businesses could reduce investment, trapping the economy in a low-growth, low-inflation cycle. Some economists warn of a Japan-style deflationary trap, where prolonged stagnation undermines productivity, earnings, and long-term competitiveness.

This scenario would be especially damaging as China attempts to pivot toward a more innovation- and consumption-driven growth model. If the deflation trend becomes embedded, it could stall that transition and erode confidence in China’s broader development strategy.

Implications for China and the World

China’s deflation challenge will not remain confined within its borders. Prolonged weakness in Chinese prices could depress global inflation, especially for manufactured goods, and intensify competitive pressures in global trade. At the same time, continued sluggishness in Chinese demand would weigh on global commodity prices and curtail export opportunities for emerging market economies that rely on China as a major buyer.

Domestically, China’s path forward will depend on its ability to revive household confidence, improve employment outcomes, and restructure underperforming sectors. Addressing youth unemployment, reducing overcapacity, and encouraging more efficient capital allocation will be critical to reinvigorating demand and escaping the current disinflationary path.

In sum, deflation has returned as a defining challenge for China’s economy in 2025. The government’s strategy of measured, targeted support reflects its desire to avoid destabilizing the financial system – but the longer price pressures persist, the more urgent the need for broader, confidence-building reforms. The next few months will test whether incrementalism can succeed, or whether stronger action becomes inevitable.

Youth Unemployment and Labor Mismatches are Emerging as Long-Term Structural Risks to China’s Growth Model

China’s labor market is under increasing strain as youth unemployment rises and skills mismatches persist. Despite broader economic stabilization in 2025, many young Chinese struggle to find meaningful employment, especially recent graduates and first-time job seekers. This disconnect between labor supply and market demand is becoming one of China’s most pressing socio-economic challenges – with implications for long-term productivity, household consumption, and social cohesion.

The issue first drew attention in 2023 when China’s National Bureau of Statistics (NBS) reported a record youth unemployment rate of over 21%. Though official reporting was suspended for several months, the NBS resumed publishing data in late 2024 using an adjusted methodology. As of mid-2025, the new youth unemployment rate stands at around 14.5%, still high compared to historical norms, and significantly above the national urban rate of roughly 5%.

The root causes are both cyclical and structural. Slower job creation in traditional sectors like real estate, construction, and export manufacturing has limited new opportunities for vocational and lower-skilled workers. Meanwhile, graduates face intense competition in the urban service economy and white-collar roles – often holding degrees that do not align with in-demand skills. Employers report shortages in fields like AI, engineering, and advanced manufacturing, even as hundreds of thousands of young workers remain underemployed.

Moreover, regional disparities exacerbate the problem. Youth in smaller cities and rural areas often lack access to high-quality education, digital tools, or job-matching platforms. Many migrate to larger cities, where oversaturation and high living costs add further barriers to entry. This deepens social divides and increases frustration among younger cohorts, particularly “lying flat” youth who disengage from the labor market altogether.

The Chinese government has introduced targeted initiatives, including employment subsidies for small firms, expanded vocational training programs, and tax incentives for companies that hire recent graduates. While these measures have had some localized success, a more comprehensive strategy is likely needed – one that links education reform, labor market transparency, and innovation policy.

If unaddressed, youth unemployment could become a drag on domestic consumption, deepen household pessimism, and weaken China’s longer-term growth trajectory. Rebuilding alignment between workforce readiness and economic transformation will be key to ensuring a productive and inclusive labor market in the years ahead.

About this report

This report was compiled with contributions from the team of business experts across Alarar Capital Group’s global offices.

Alarar Capital Group is an advisory firm specialised in supporting western companies operating in Asia and beyond. Our mission is to bridge the gap between global business ecosystems and key markets worldwide. Through our Management Consulting division, we provide services within corporate strategy, business transformation, operations, sustainability, growth, sales & marketing, and digital & AI solutions. We work across a wide range of industries, including automotive & mobility, energy & environment, consumer goods & retail, food & beverage, technology, media & telecom, advanced industry & materials, financial services, and healthcare, medtech & biotech.

If you are interested in exploring how we can support your business, reach out through our contact page, or leave your email below for a representative to get in touch directly:

Industrial activity showed mixed signals during the quarter. Factory output surprised to the upside in June, jumping 6.8% YoY (accelerating from May’s 5.8%), as manufacturers rushed to fill orders before potential US tariff hikes. However, consumer spending showed signs of fatigue. Retail sales growth cooled to 4.8% in June (down from 6.4% in May), reflecting cautious consumer sentiment. Consumer confidence remained fragile amid deflationary pressures (with prices barely rising) and a still-recovering job market. Big-ticket consumption rebounded in areas like cinema box office (H1 2025 revenue up ~23% YoY) as pandemic effects faded, but overall household spending did not yet fully regain pre-pandemic vigor.

Industrial activity showed mixed signals during the quarter. Factory output surprised to the upside in June, jumping 6.8% YoY (accelerating from May’s 5.8%), as manufacturers rushed to fill orders before potential US tariff hikes. However, consumer spending showed signs of fatigue. Retail sales growth cooled to 4.8% in June (down from 6.4% in May), reflecting cautious consumer sentiment. Consumer confidence remained fragile amid deflationary pressures (with prices barely rising) and a still-recovering job market. Big-ticket consumption rebounded in areas like cinema box office (H1 2025 revenue up ~23% YoY) as pandemic effects faded, but overall household spending did not yet fully regain pre-pandemic vigor. A key storyline in Q2 was a short-term export surge linked to US tariff dynamics. June in particular saw Chinese exports jump 5.8% YoY, picking up from May’s 4.8% growth and beating forecasts. This strength was partly due to front-loading of shipments: Chinese firms rushed out orders to capitalize on a fragile tariff truce ahead of a looming August 12 deadline when US tariffs were set to ratchet up. With a 90-day reprieve in place, exporters hurried to send goods before any trade deal fallout. Notably, shipments to the US spiked over 30% month-on-month in June as reduced tariffs took effect, though YoY exports to the US were still down. Exports to Southeast Asia also surged – for example, sales to ASEAN jumped 16.8% in June – suggesting Chinese companies are diversifying toward regional hubs amid Western trade frictions. On the import side, China saw its first monthly import growth of the year in June (+1.1% YoY), a tentative sign of stabilizing domestic demand and restocking. Still, for H1 overall, imports remained below last year’s levels, reflecting weak internal demand and lower commodity prices. The Q2 rebound in exports, combined with sluggish imports, swelled China’s trade surplus – which hit $114.7 billion in June, up from $103 billion in May.

A key storyline in Q2 was a short-term export surge linked to US tariff dynamics. June in particular saw Chinese exports jump 5.8% YoY, picking up from May’s 4.8% growth and beating forecasts. This strength was partly due to front-loading of shipments: Chinese firms rushed out orders to capitalize on a fragile tariff truce ahead of a looming August 12 deadline when US tariffs were set to ratchet up. With a 90-day reprieve in place, exporters hurried to send goods before any trade deal fallout. Notably, shipments to the US spiked over 30% month-on-month in June as reduced tariffs took effect, though YoY exports to the US were still down. Exports to Southeast Asia also surged – for example, sales to ASEAN jumped 16.8% in June – suggesting Chinese companies are diversifying toward regional hubs amid Western trade frictions. On the import side, China saw its first monthly import growth of the year in June (+1.1% YoY), a tentative sign of stabilizing domestic demand and restocking. Still, for H1 overall, imports remained below last year’s levels, reflecting weak internal demand and lower commodity prices. The Q2 rebound in exports, combined with sluggish imports, swelled China’s trade surplus – which hit $114.7 billion in June, up from $103 billion in May.