Implications and Trends in the Capital Market – August 2025

Southeast Asia’s presence in the U.S. capital markets is gaining momentum as several companies listed on Nasdaq and NYSE deliver strong results, exceed growth expectations, and demonstrate resilience in a challenging macro environment. These successes reflect not just company-specific wins, but also a broader shift: global investors are increasingly viewing Southeast Asia as a sustainable growth engine and an attractive diversification play amidst global uncertainty.

A critical factor driving this momentum is the region’s commitment to regulatory reforms and enhanced transparency. Countries within the ASEAN bloc, including Malaysia, Indonesia, Thailand, and Singapore, are actively working to elevate corporate governance and disclosure standards. These efforts are vital in raising the investability of regional equities, making them more appealing to foreign investors who prioritize transparency and accountability in their investment decisions.

Furthermore, there is a notable trend towards greater regional capital integration. Initiatives such as the ASEAN Trading Link and pan-ASEAN Exchanges are fostering increased liquidity and facilitating cross-border investments among member exchanges. This coordinated approach not only enhances market accessibility but also allows investors to tap into a broader array of opportunities within the region, thereby boosting overall market confidence.

The structural growth potential of Southeast Asia is further strengthened by proactive policy reforms. Regulatory bodies, including Indonesia’s OJK, the Philippines’ SEC, and Malaysia’s Securities Commission, are undertaking significant reforms aimed at streamlining capital markets and attracting external capital. These regulatory enhancements are designed to create a more conducive environment for investment, thereby reinforcing Southeast Asia’s position as a key player in the global capital markets.

Additionally, the region is witnessing rapid growth in private credit and sustainable finance. The private credit market in Southeast Asia has surged to approximately $65 billion by mid-2022, reflecting a growing appetite for alternative financing solutions. Concurrently, initiatives such as green bond frameworks in Singapore are attracting considerable ESG (Environmental, Social, and Governance) capital, aligning with the global shift towards sustainability and responsible investing.

Together, these factors create a robust foundation for investor confidence and promote a global allocation towards Southeast Asia. As the region continues to evolve into a high-growth, digitally enabled market with improving regulatory frameworks, it stands poised to attract significant attention from global investors seeking not only returns but also sustainable investment opportunities.

Notable Performers

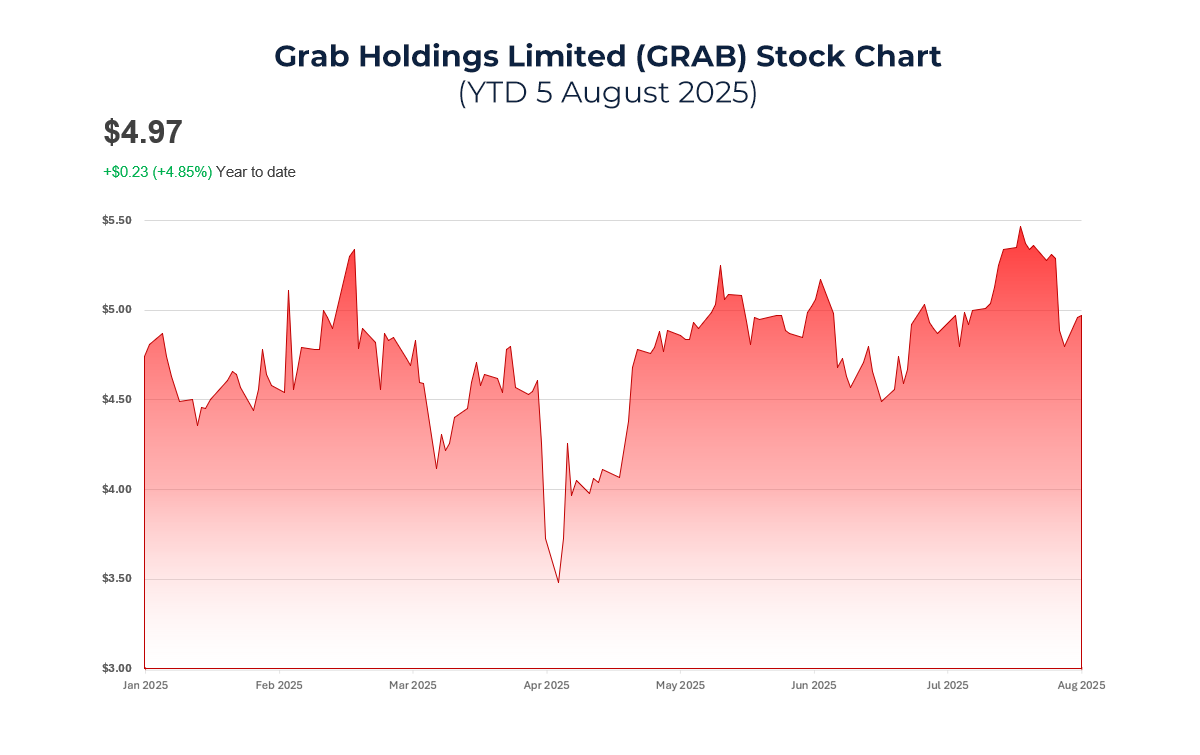

Grab Holdings Ltd. (NASDAQ: GRAB)

Grab, headquartered in Singapore, reported a remarkable turnaround in the first half of 2025. Its improved profitability, especially in its delivery and mobility arms, has proven the scalability of its “super app” model. Investors were particularly optimistic about Grab’s accelerated expansion into digital financial services, offering lending, insurance, and payments, which shows promise in underserved Southeast Asian markets. As a result, its shares have climbed over 20% this year, signalling renewed investor confidence in its long-term growth potential.

Sea Limited (NYSE: SE)

After a tough 2024 marked by layoffs and restructuring, Sea Limited rebounded sharply in 2025. Shopee, its e-commerce platform, implemented monetization strategies that helped increase take rates and reduce logistics costs. Meanwhile, Garena’s mobile game portfolio has seen a resurgence with new titles and revitalized user engagement. These developments, combined with disciplined cost control, have led to Sea’s stock price rising over 30% year-to-date, reinforcing its reputation as a leading digital conglomerate in the region.

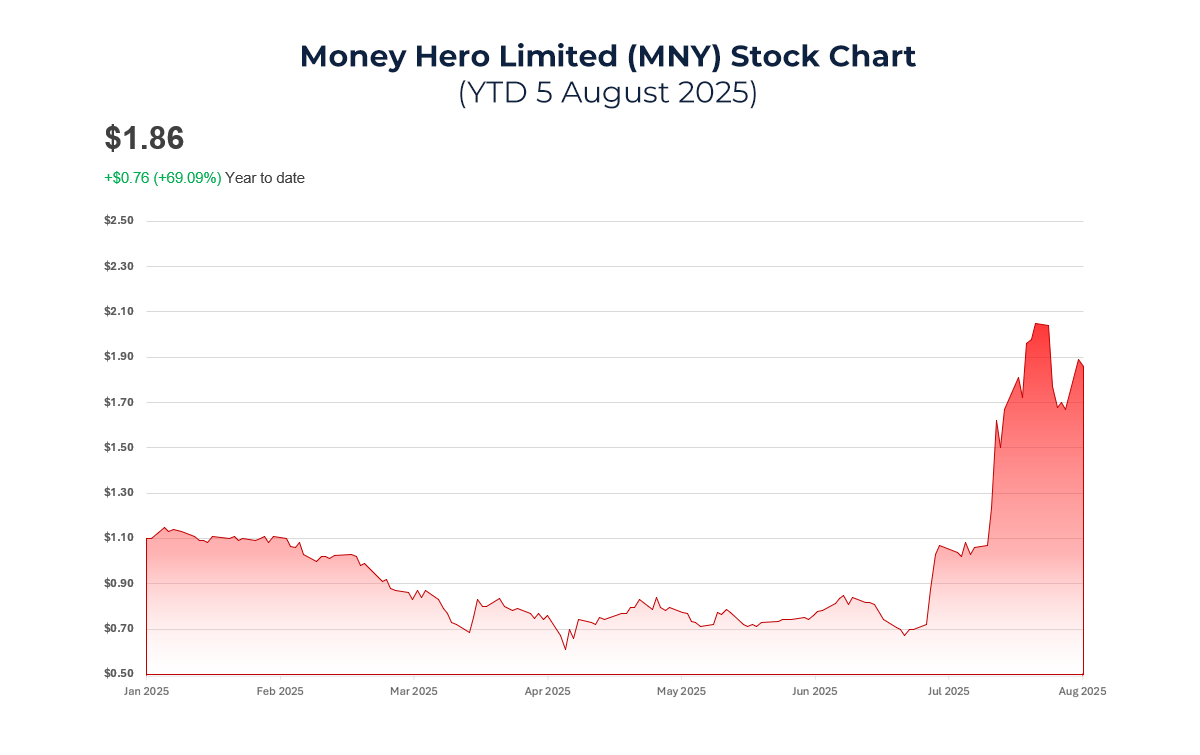

MoneyHero Group (NASDAQ: MNY)

Headquartered in Singapore and listed via a SPAC in 2024, MoneyHero operates comparison platforms for financial products across Hong Kong, Singapore, and the Philippines. In 2025, it added AI-powered tools for financial education and personalized product recommendations. Strong user engagement and rising digital ad revenue have made it one of the most exciting fintech plays from Southeast Asia.

What This Means for the Capital Market

The recent successes of these companies are reshaping how global investors view Southeast Asia, not just as a developing region, but as a high-potential, digitally enabled market with long-term relevance. These companies are proving they can compete at a global level, drive innovation, and sustain profitability while addressing large addressable markets.

U.S. investors, in particular, are showing a renewed appetite for Southeast Asian assets as they seek diversification beyond developed markets. These listings provide a channel for American capital to access high-growth sectors such as fintech, e-commerce, and proptech in a relatively de-risked manner. This increased participation also contributes to improved liquidity, valuation transparency, and better governance for listed companies.

Moreover, the continued success of these firms affirms that the U.S. stock exchanges remain attractive for Southeast Asian companies seeking scale, visibility, and credibility. Despite past concerns about foreign listings, U.S. markets continue to offer strong capital access and broader investor reach compared to regional exchanges.

Emerging Trends

- SPAC 2.0 Resurgence

While the SPAC (Special Purpose Acquisition Company) boom cooled after 2022, a new wave of “SPAC 2.0” listings is on the rise in 2025, supported by stronger regulatory standards and increased transparency. Several Southeast Asian startups, especially those in fintech and AI, are now exploring this route as a faster alternative to traditional IPOs. These vehicles offer flexible deal structures and strategic advisory from experienced sponsors, making them appealing to younger tech firms that want to list without enduring the prolonged IPO process.

- Sustainability and ESG-Driven Listings

Institutional investors in the U.S. are placing greater emphasis on Environmental, Social, and Governance (ESG) metrics. Southeast Asian companies are responding by embedding ESG narratives into their growth stories, whether it’s offering green loans, building sustainable infrastructure, or improving corporate governance. Companies with a clear ESG value proposition are enjoying premium valuations and increased institutional backing, setting a positive precedent for future listings.

- Dual Listings and Regional Pride

After debuting in the U.S., more Southeast Asian firms are planning or executing secondary listings in their home markets, such as on the Singapore Exchange (SGX) or Indonesia Stock Exchange (IDX). This dual-listing strategy enhances liquidity, brings the brand closer to regional investors, and serves as a hedge against currency and geopolitical risks. It also signals a long-term commitment to both global and domestic stakeholders.

What This Means for Southeast Asian Firms Eyeing U.S. Listings

For Southeast Asian startups and mid-sized firms contemplating U.S. listings, recent developments in the capital markets serve as encouraging signals. The success stories of companies like Grab and Sea provide a valuable blueprint for aspiring firms. These companies have demonstrated that strong unit economics, scalable technology infrastructure, and regional leadership are essential criteria for gaining investor trust in the competitive U.S. market.

Listing on a U.S. exchange not only enhances a company’s visibility but also opens doors to new partnerships and diversifies its investor base. Access to larger capital pools is a significant advantage, allowing firms to fund their growth ambitions more effectively. Additionally, companies listed on U.S. exchanges gain the credibility that comes with adhering to stringent U.S. regulatory compliance standards. This credibility often translates into increased confidence from customers and employees alike, fostering a stronger brand image in both local and international markets.

However, the path to a successful U.S. listing demands that firms be prepared to meet high standards of governance, financial disclosure, and investor relations. For many companies, this transition acts as a catalyst for strengthening internal processes and professionalizing operations. It underscores the notion that going public is not merely about raising capital; it’s about evolving into a mature global enterprise that can effectively compete on the world stage.

The performance of Southeast Asian firms listed in the U.S. reflects both micro-level execution and macro-level investor interest. This trend highlights the growing integration of Southeast Asian economies into the global capital market ecosystem. As more success stories emerge, a positive feedback loop is likely to develop—where strong performance fuels additional listings, which in turn attracts further attention and investment into the region.

For investors, analysts, and policymakers, the message is clear: Southeast Asia is not on the periphery of the global economy; it is moving towards the center. The region’s dynamic growth and increasing presence in U.S. markets signify its potential as a significant player in the global economic landscape.

In this context, the Alarar Capital Group emerges as a pivotal partner for Southeast Asian companies seeking to go public in U.S. markets. With its extensive experience and expertise, Alarar Capital Group excels in multiple areas that are critical for successful listings.

Cross-Border Listing Strategy

Alarar Capital Group offers a comprehensive cross-border listing strategy, leveraging deep bi-continental experience to align Asian issuers with Western capital markets. The firm specializes in managing IPOs, dual listings, and SPAC (Special Purpose Acquisition Company) or RTO (Reverse Takeover) processes, ensuring that companies navigate the complexities of different jurisdictions smoothly. This expertise not only simplifies the listing process but also enhances the likelihood of successful outcomes.

SPAC Advisory & Execution

Alarar Capital Group is recognized as a global leader in SPAC advisory and execution. The firm has advised on billions of dollars in transactions, showcasing its ability to craft innovative solutions tailored to the unique needs of each client. By launching new SPAC vehicles in collaboration with prominent partners like D. Boral Capital, starting in 2025, Alarar Capital Group positions itself at the forefront of this evolving market. Their deep understanding of SPAC structures and processes equips clients with the insights needed to leverage this financing avenue effectively.

Capital Markets and M&A Capability

ARC’s full-spectrum capital markets services extend beyond traditional listings. The firm offers a robust suite of services, including private placements, structured financings, and M&A advisory. This capability empowers firms to scale their funding strategies and optimize their capital structures, ensuring they are well-equipped to seize growth opportunities in a competitive landscape. By integrating M&A advisory into their offerings, Alarar Capital Group also helps clients identify strategic acquisition targets, further enhancing their market positioning.

Reputation and Client-Centric Approach

Alarar Capital Group’s reputation in the industry is built on a foundation of trust, integrity, and a client-centric approach. The firm prioritizes building long-term relationships with its clients, understanding their unique challenges, and providing tailored solutions that align with their strategic goals. This dedication to client success has earned ARC a stellar reputation among investors and issuers alike, making it a sought-after partner for companies looking to expand into U.S. markets.

By partnering with Alarar Capital Group, Southeast Asian firms can navigate the complexities of U.S. listings and capitalize on the burgeoning opportunities in the global capital markets. With ARC’s support, companies not only raise capital but also mature into influential players on the international stage, solidifying their positions within the global economy.

References

-

- Grab stock rallies as financial services growth boosts earnings. Bloomberg. 2025. https://www.bloomberg.com/news/articles/2025-07-15/grab-stock-rallies-as-financial-services-growth-boosts-earnings

- Sea’s e-commerce arm sees strong Q2 performance. Reuters. 2025. https://www.reuters.com/technology/seas-ecommerce-arm-sees-strong-q2-performance-2025-07-22/

- SPAC market rebounds on stronger disclosures and new rules. TechCrunch. 2025. https://techcrunch.com/2025/06/12/spac-market-rebounds-on-stronger-disclosures-and-new-rules/

- Southeast Asia firms eye U.S. IPOs as growth outlook brightens. Wall Street Journal. 2025. https://www.wsj.com/finance/investing/southeast-asia-firms-eye-us-ipos-as-growth-outlook-brightens-2025-06-29

- MoneyHero raises guidance, expands in Southeast Asia. Forbes. 2025. https://www.forbes.com/sites/digital-assets/2025/07/05/moneyhero-raises-guidance-expands-in-southeast-asia/

- Grab Holdings Limited current share price $4.97 USD as of August 5, 2025.

https://www.investing.com/equities/grab-holdings-historical-data

- Sea Limited stock price $151.44 USD as of August 5, 2025.

https://www.investing.com/equities/sea-limited

- MoneyHero Group (NASDAQ: MNY) Current stock price $1.86 USD as of August 6, 2025.

https://stockanalysis.com/stocks/mny/

- Southeast Asia Equities: Unlocking Growth in a Dynamic Region. 2025.

https://aquis-capital.com/news/southeast-asia-equities-unlocking-growth-in-a-dynamic-region

- OECD Asia Capital Markets Report 2025.

https://www.oecd.org/en/publications/asia-capital-markets-report-2025_02172cdc-en/full-report/equity-markets_21fa56c1.html

- Financial Services Authority (Indonesia). 2025.

https://en.wikipedia.org/wiki/Financial_Services_Authority_%28Indonesia%29

- Southeast Asia’s Untapped Potential for Private Credit. 2024.

https://www.admcapital.com/southeast-asias-untapped-potential-for-private-credit/

- PWC Unlocking the potential of sustainable finance in Southeast Asia. 2024.

https://www.pwc.com/gx/en/issues/esg/southeast-asia-sustainable-finance-potential.html

- Time News The Rise of Green Wall Street. 2025.

https://time.com/7307275/green-wall-street-london-sustainable-finance/

- ARC Services. 2025.

https://arc-group.com/service/capital-markets/