As global tech players diversify away from single-market dependencies, Southeast Asia has emerged as a core pillar of digital infrastructure development. Among its dynamic economies, Malaysia, Indonesia, and Vietnam are rapidly asserting distinct roles in the next wave of data center expansion. The question for forward-looking businesses is no longer whether to enter the region, but how to allocate infrastructure investments to match strategic needs.

Malaysia: The Infrastructure Powerhouse

Malaysia is fast becoming Southeast Asia’s preferred destination for data center deployment, driven by a confluence of factors that support hyperscale scalability and operational efficiency.

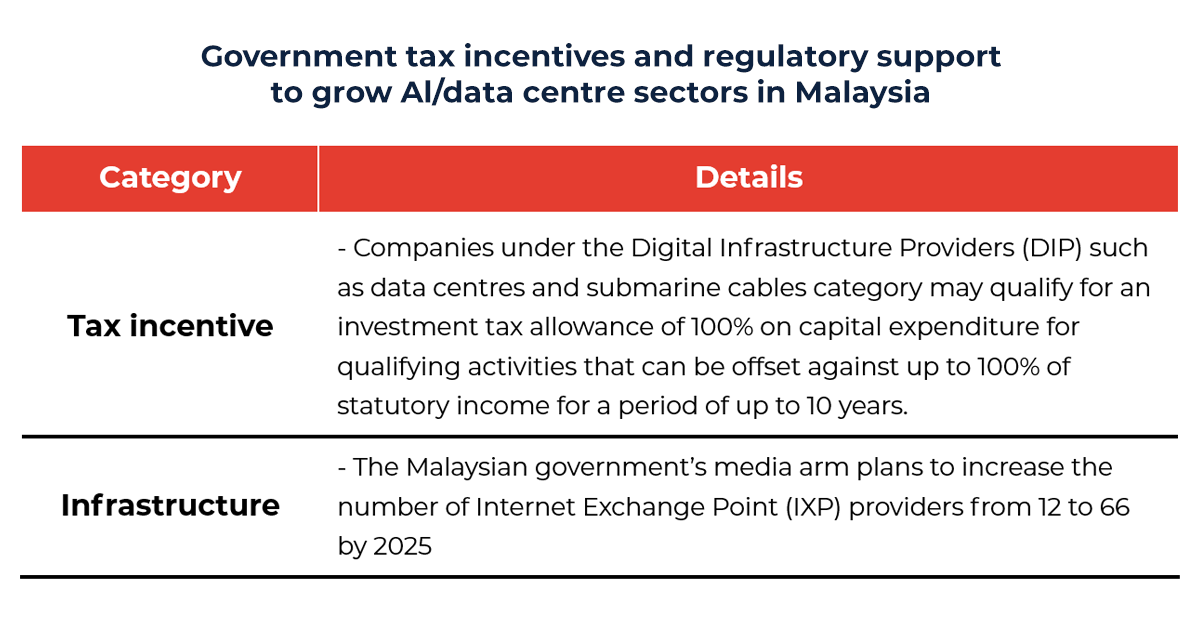

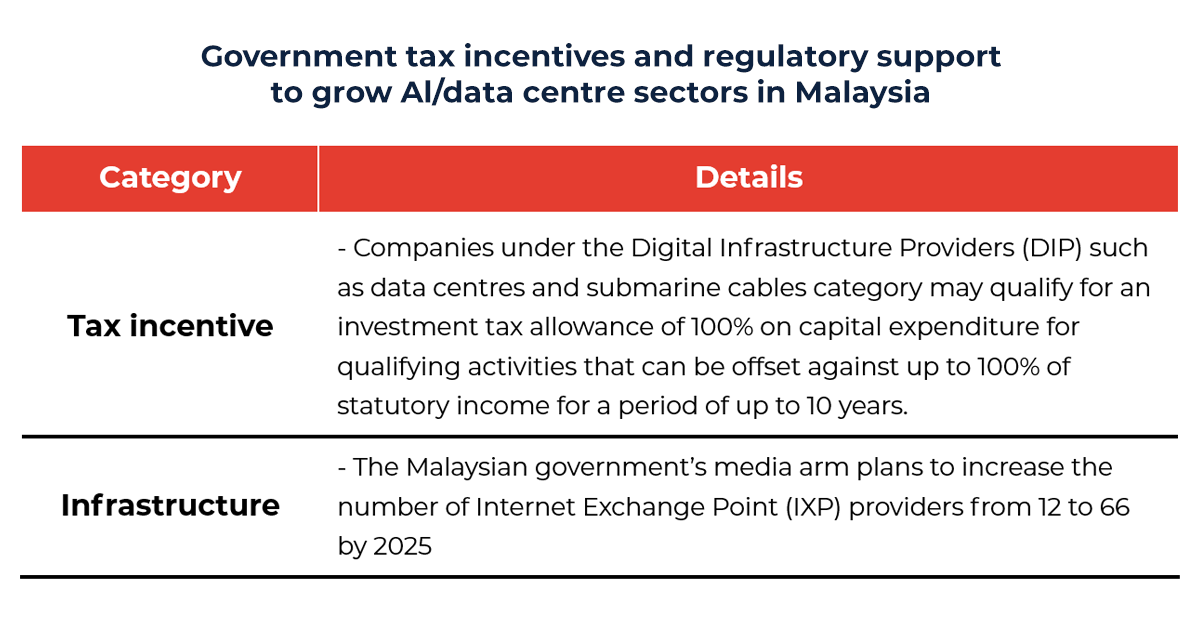

- Attractive Government Incentives

Government-backed initiatives such as NIMP 2030 and Malaysia Digital (DIO) provide fiscal incentives, streamlined approvals, and robust policy backing for tech infrastructure projects to foster the growth of data center in the country and achieve its goal in 2030.

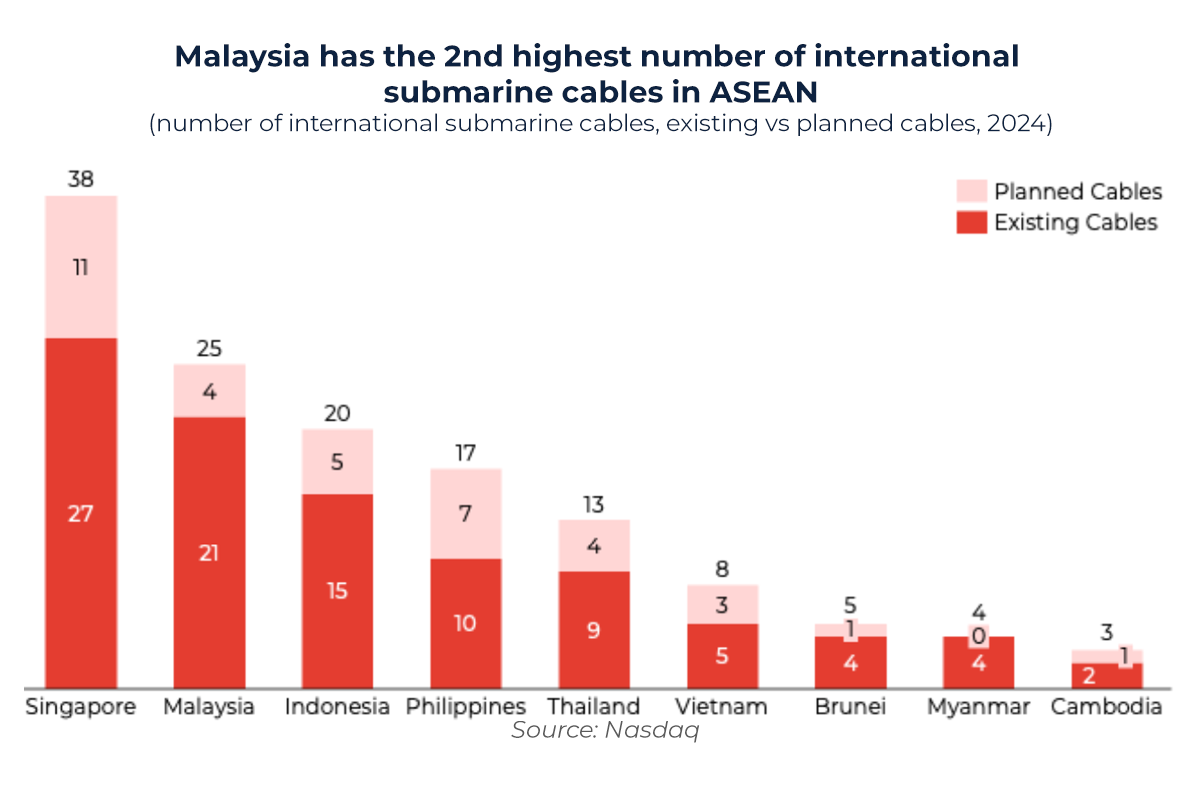

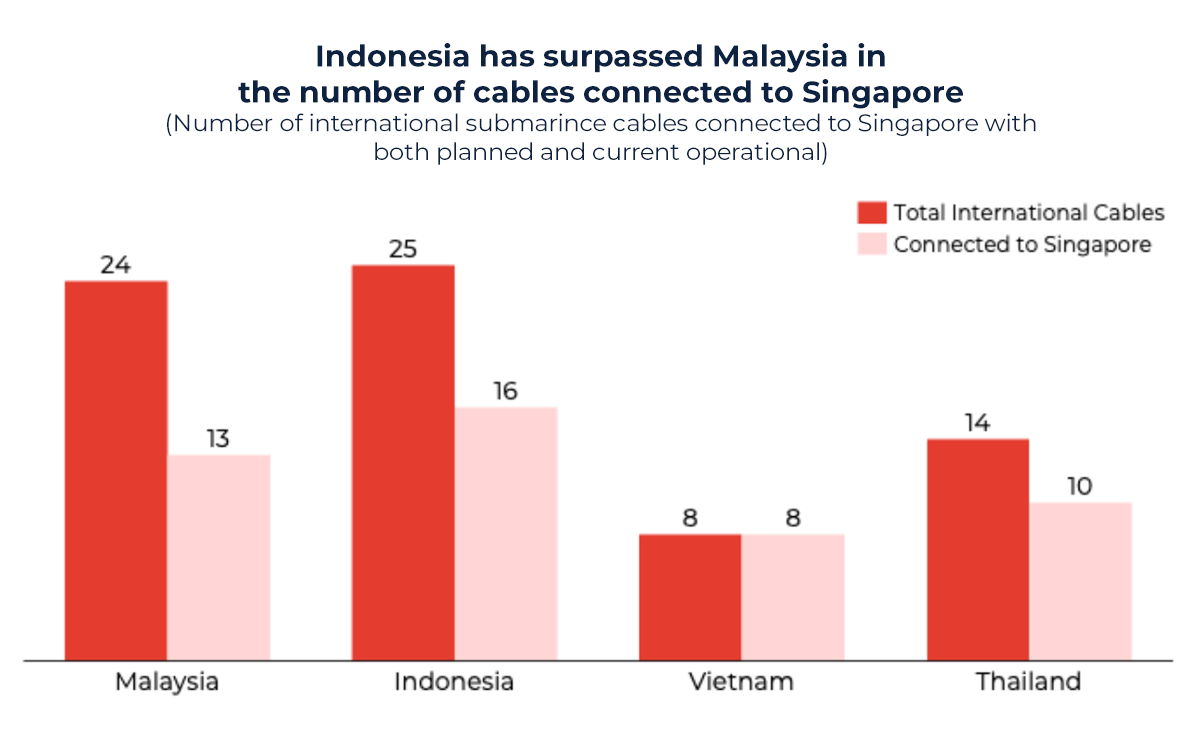

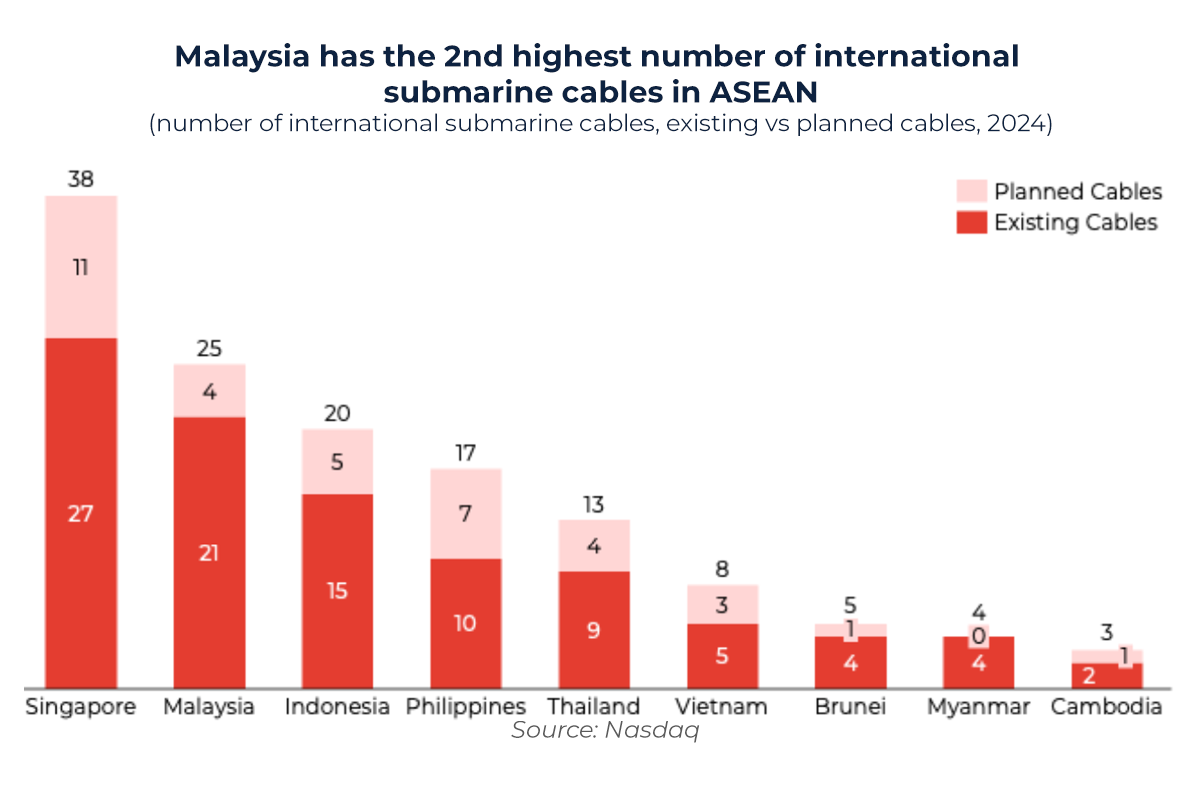

- World-Class Subsea Connectivity

With more than 20 international submarine cables landing on its shores, Malaysia offers high bandwidth, low-latency access to global networks, a critical asset for cloud, enterprise, and content delivery platforms.

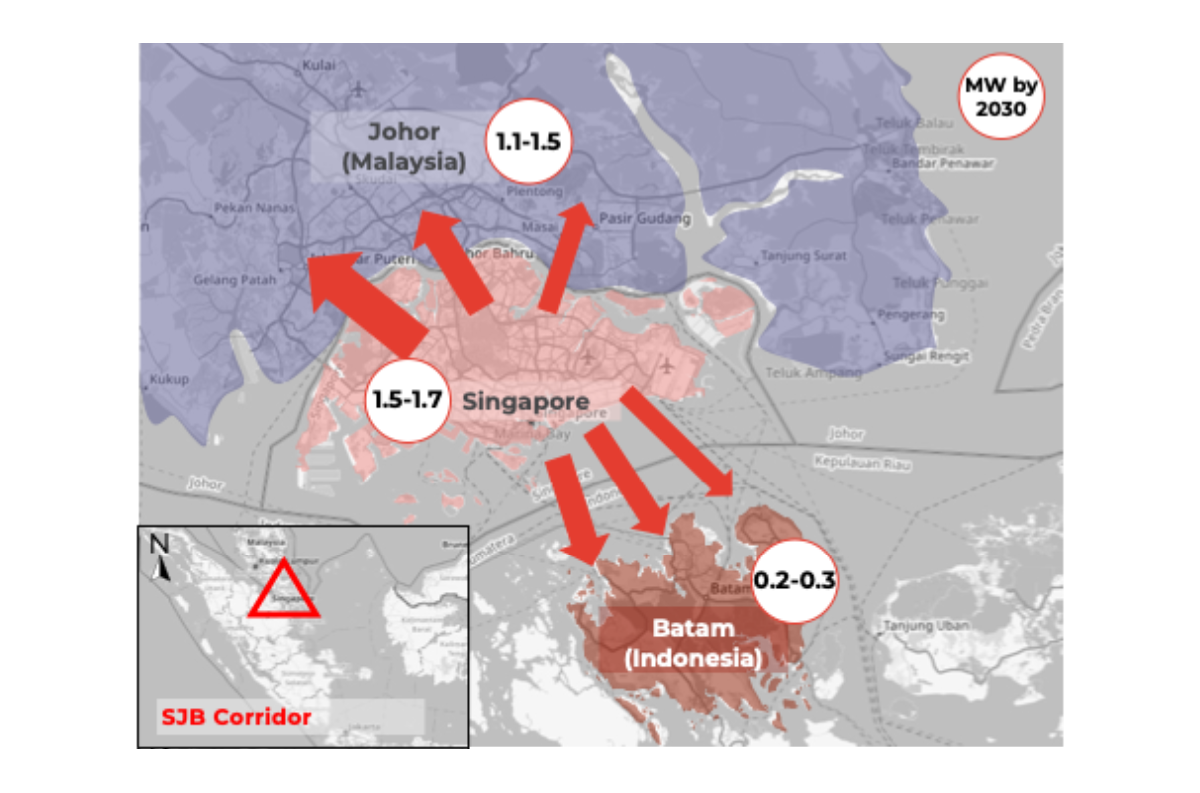

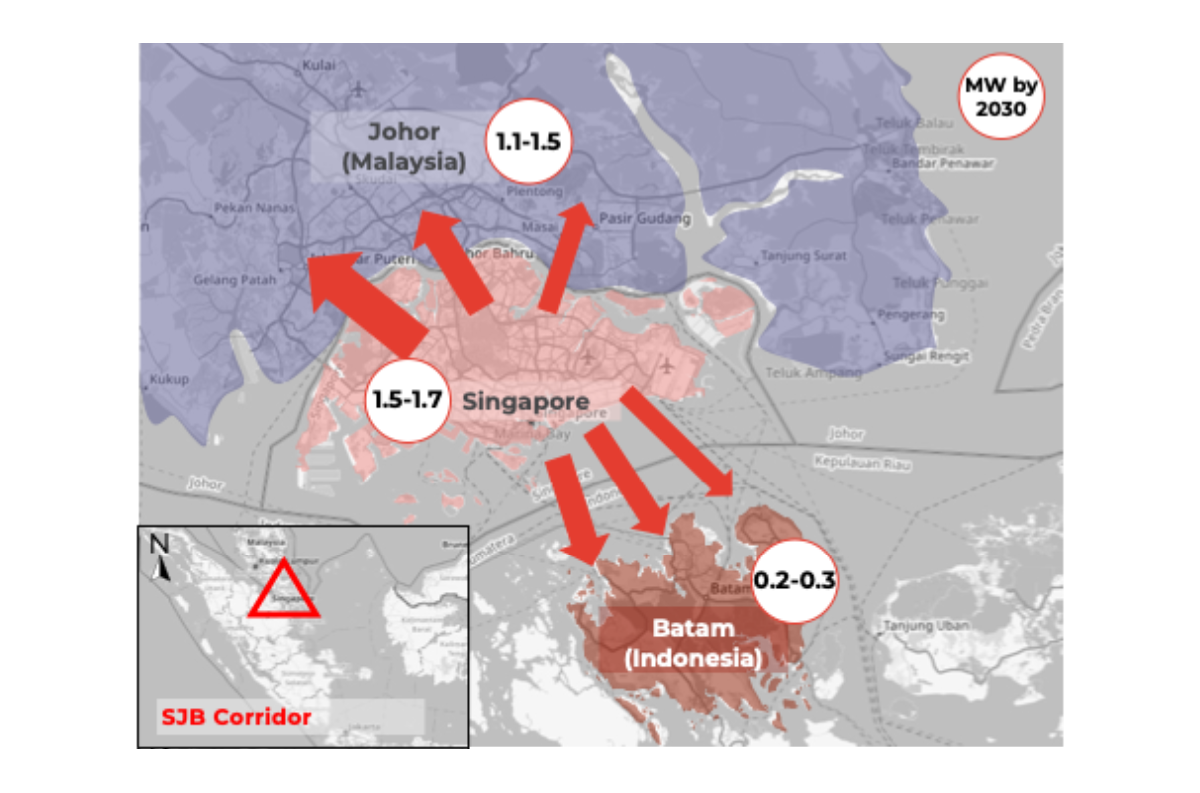

- Proximity to Singapore as the regional traditional hub of Data Center

Cyberjaya offer seamless spillover capacity for Singapore-based firms seeking cost-effective, high-availability infrastructure within close reach. This proximity has successfully attracted hyperscale’s as Google, Microsoft, etc. to setup their local data centers in Johor and Johor’s nearby areas.

Indonesia: The Domestic Demand Engine

Indonesia continues to attract strategic interest due to its scale and digital acceleration, offering a powerful platform for front-end services and market-facing infrastructure.

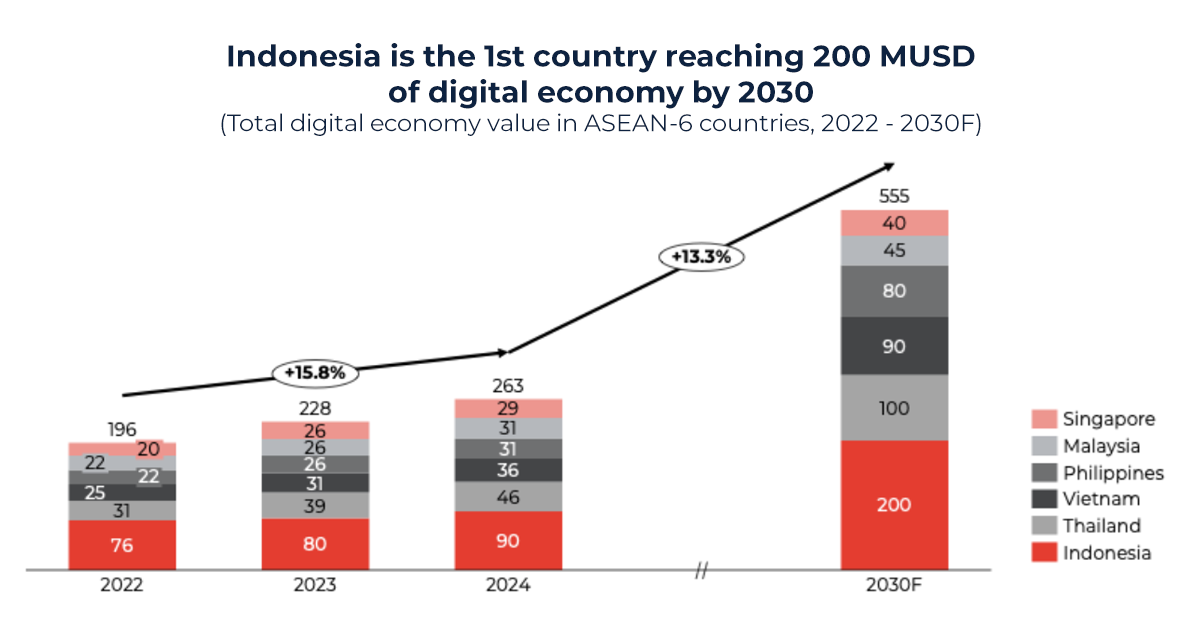

- Expansive Domestic Market

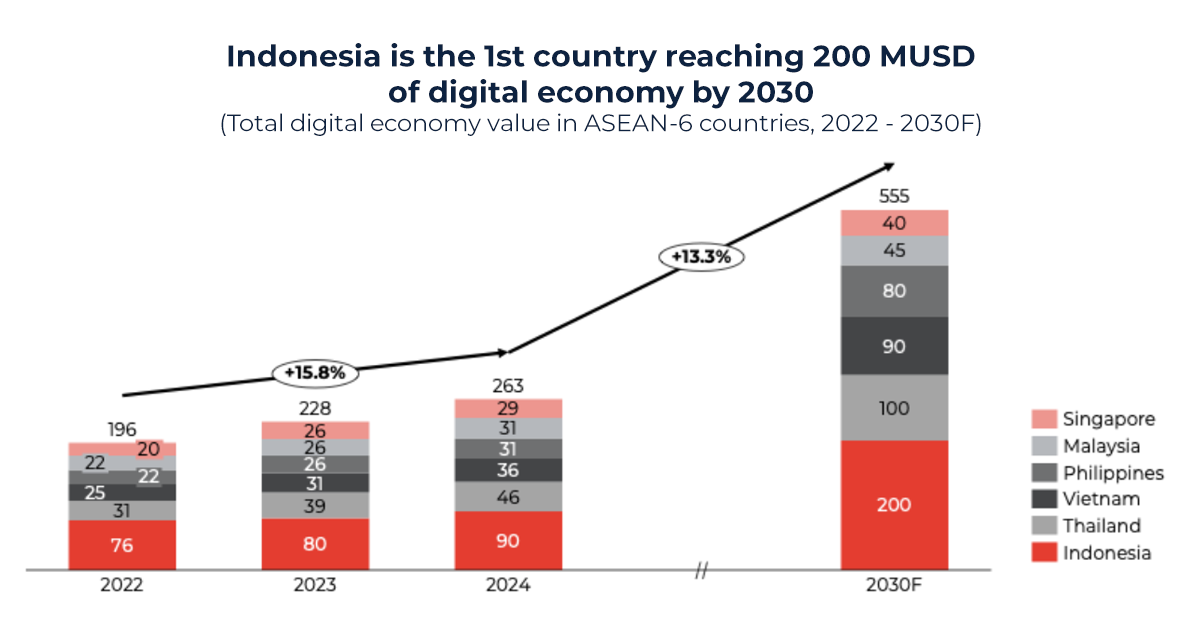

By 2030, Indonesia’s digital economy is projected to achieve 200 million USD, capturing approx. 40% of total market size of the ASEAN-6 countries.

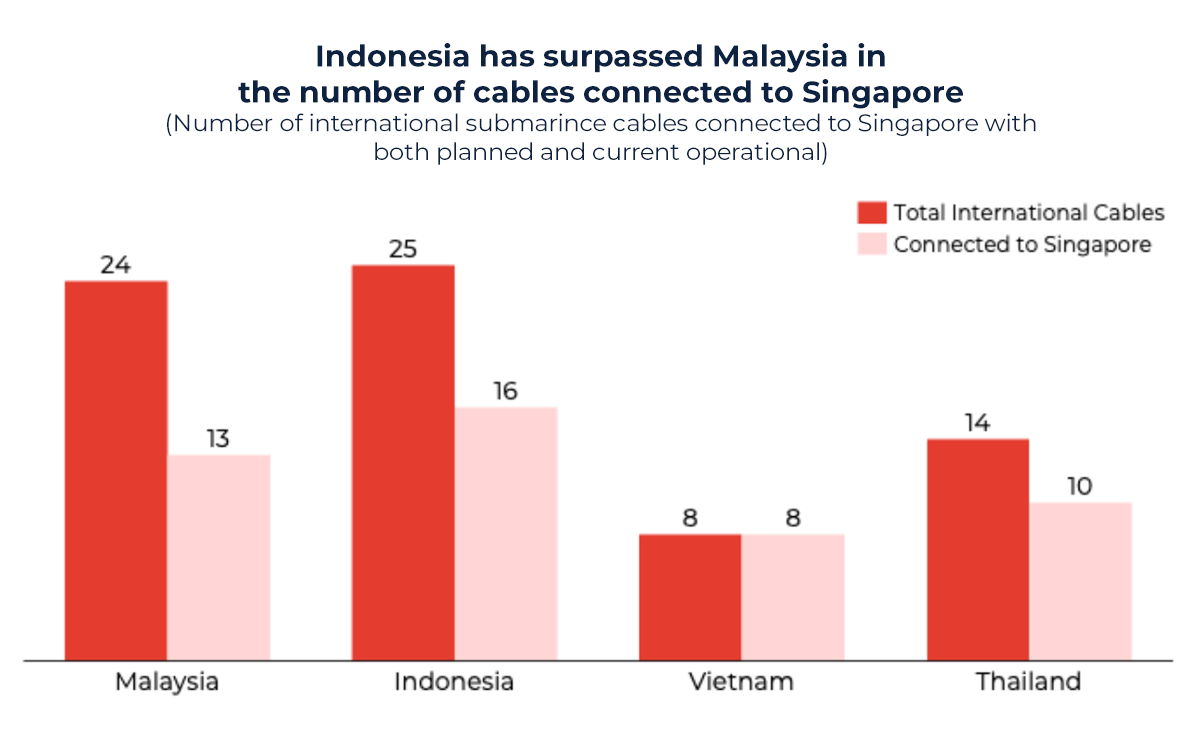

with approx. 2/3 of this country’s submarine cables are connected to Singapore, surpassing Malaysia.

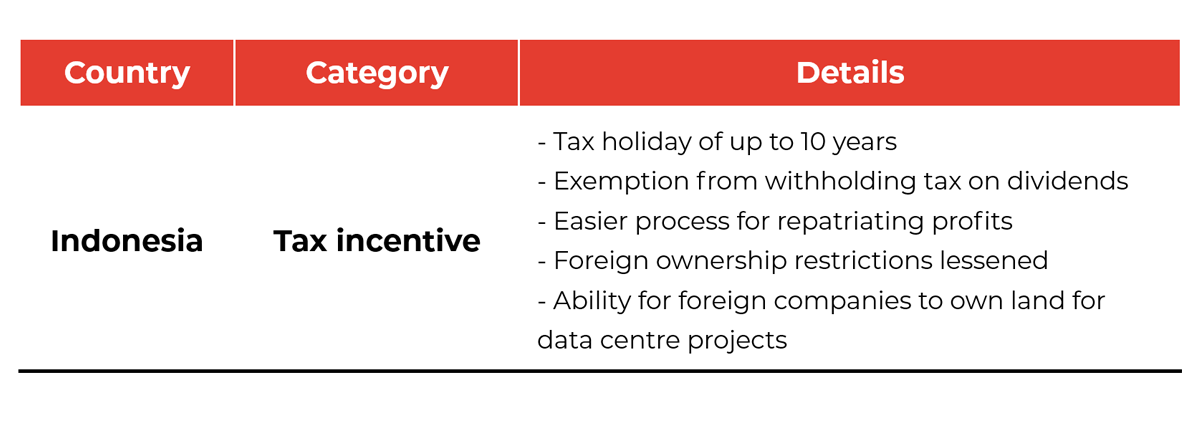

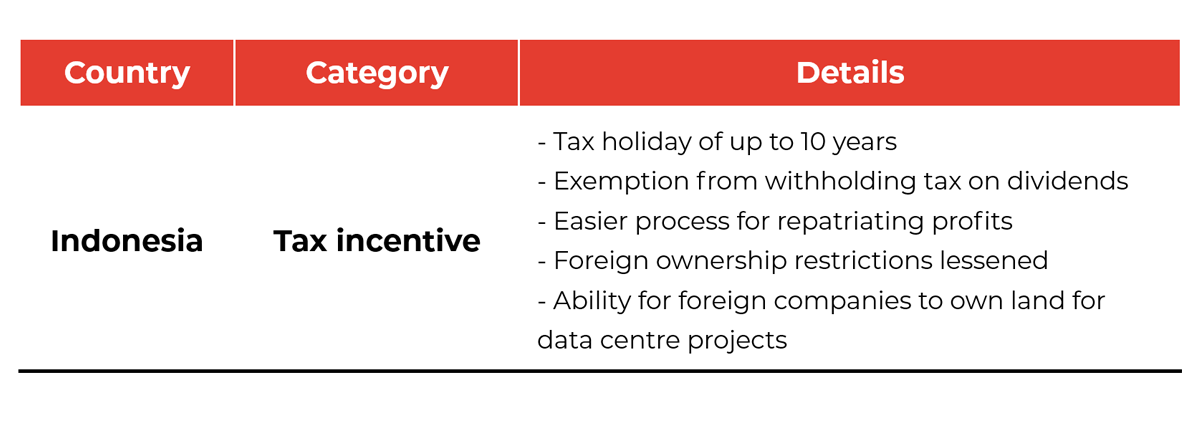

- Policy Support for Digital Infrastructure

While more limited incentives compared to Malaysia, Indonesia government also get on the pitch with its peers in the race to become the regional data center hub with fiscal incentives and the eased regulations.

Besides, the Indonesian government is also increasing support for digital infrastructure investment through public-private initiatives and special economic zones to expedite the digitalization of the country and strengthen its advantages of the extensive domestic market.

Vietnam: The Cost-Performance Advantage

Vietnam is emerging as a value leader for data center infrastructure, offering a blend of affordability, geographic advantages, and regulatory clarity.

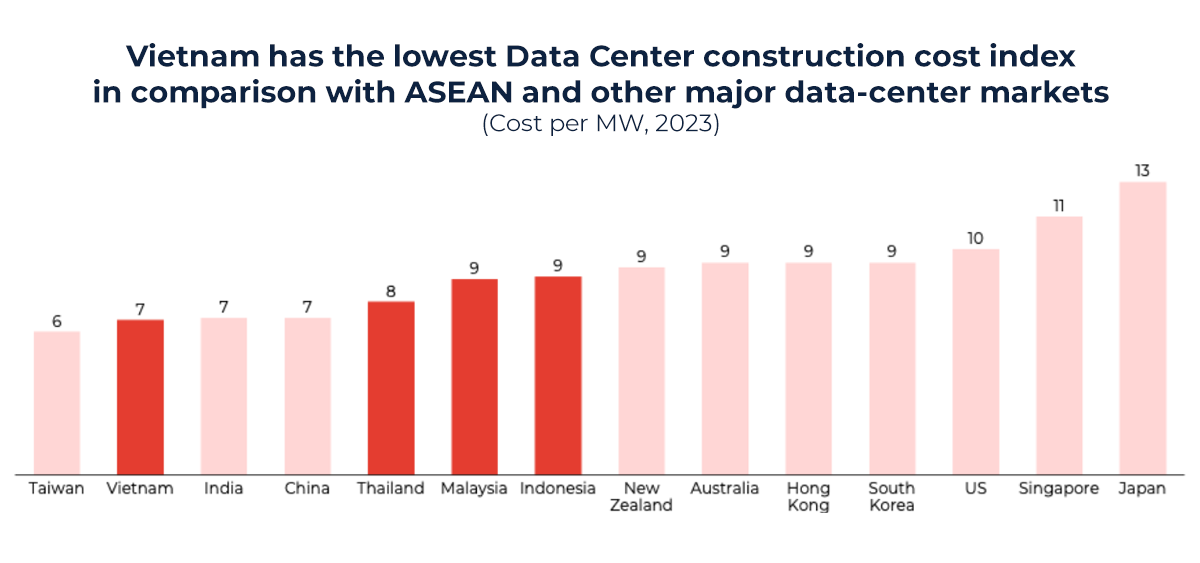

- Lowest Data Center Construction Costs in the Region

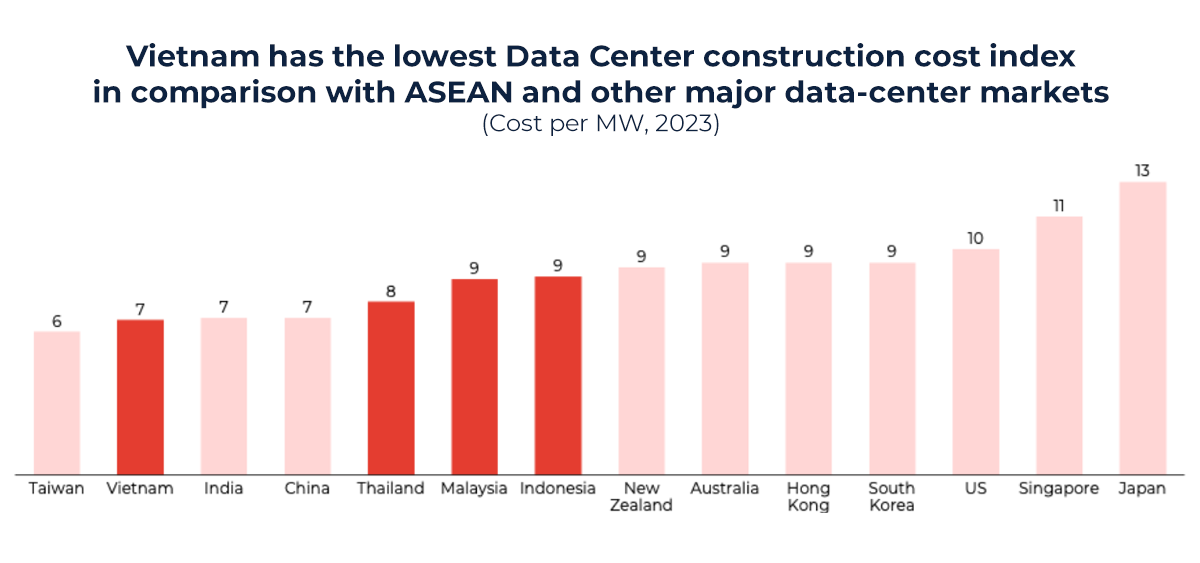

With build costs as low as USD $6 million per MW, compared with 8.5 million per MW in Malaysia and 8.6 million per MW in Indonesia. Vietnam presents compelling economics for both enterprise and hyperscale builds.

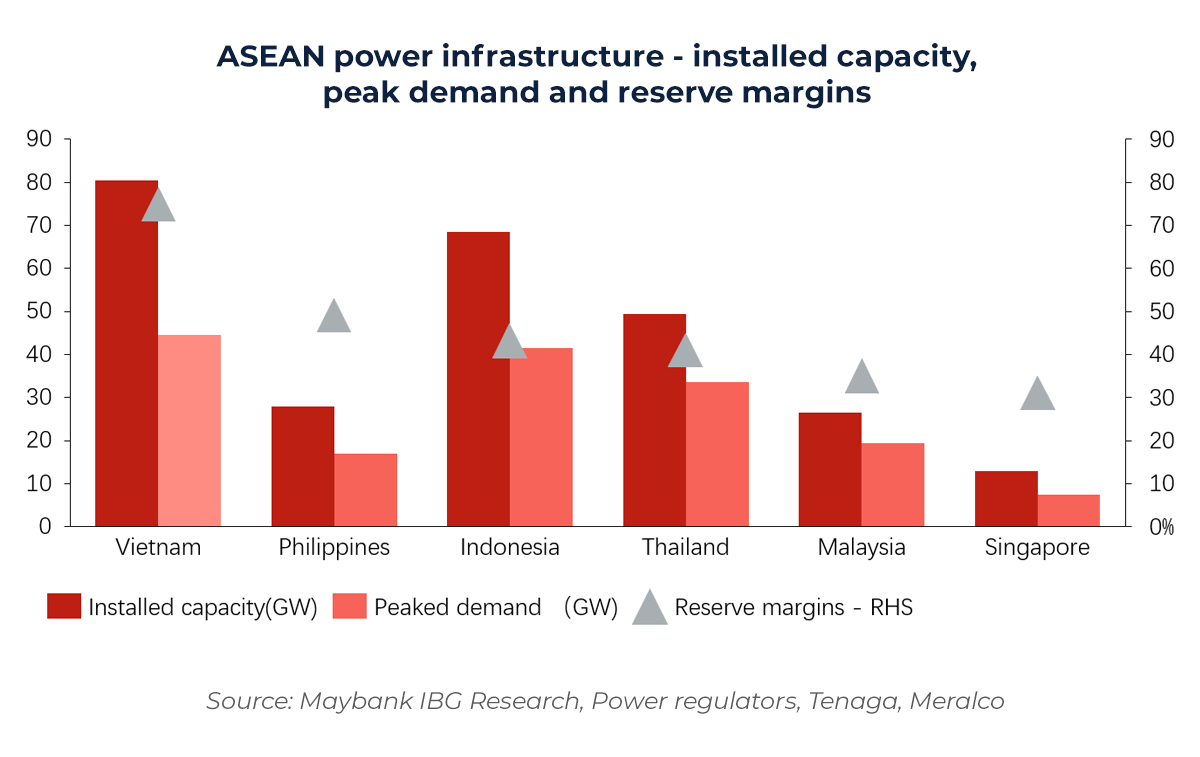

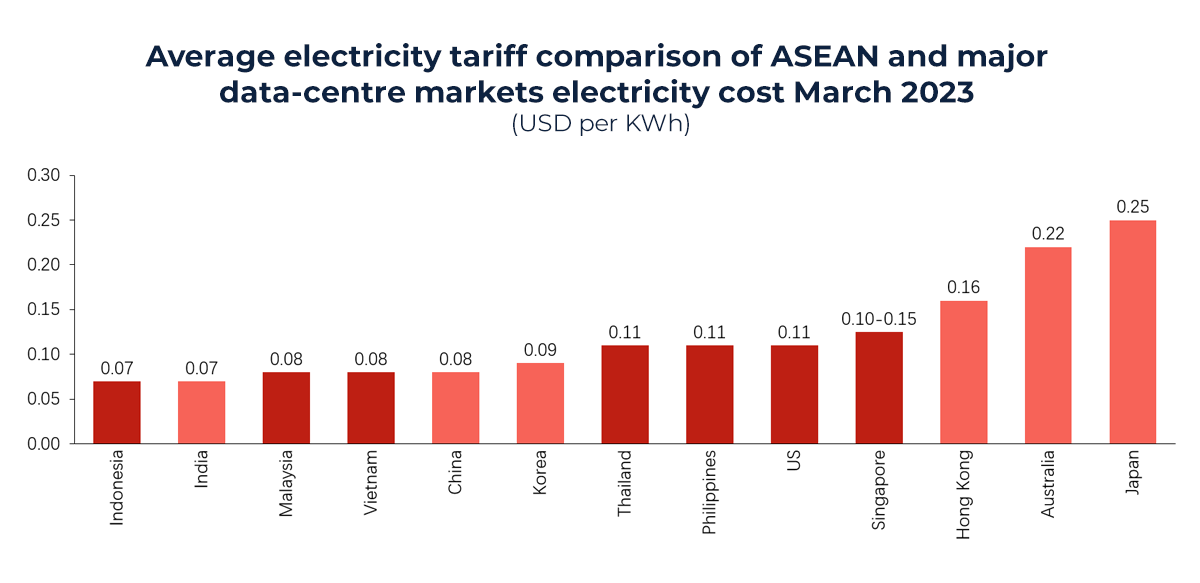

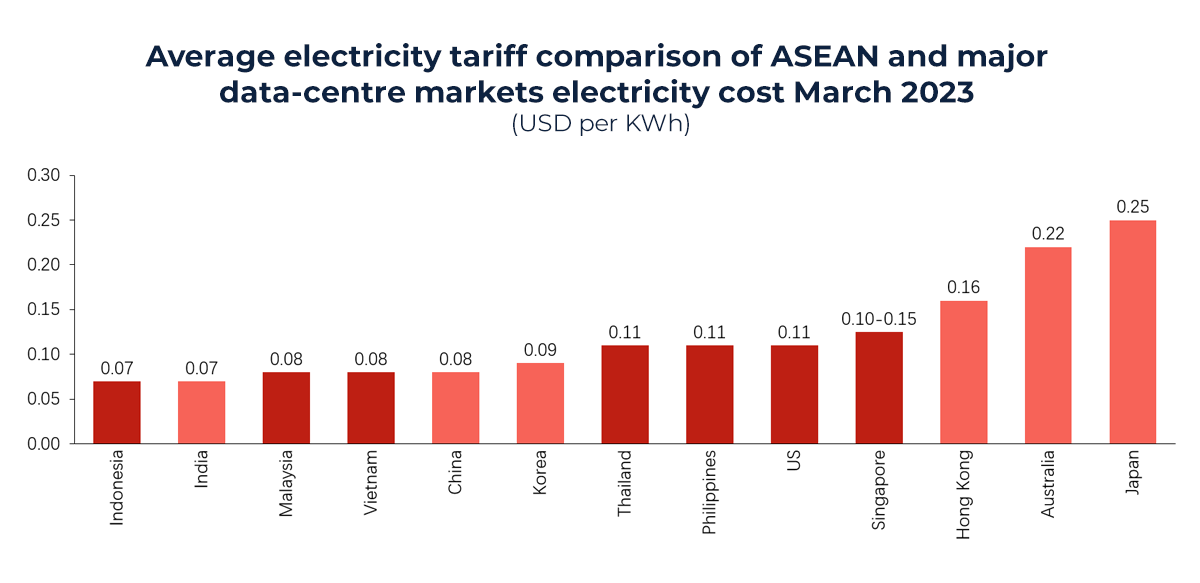

- Most Competitive Electricity Rates for Businesses

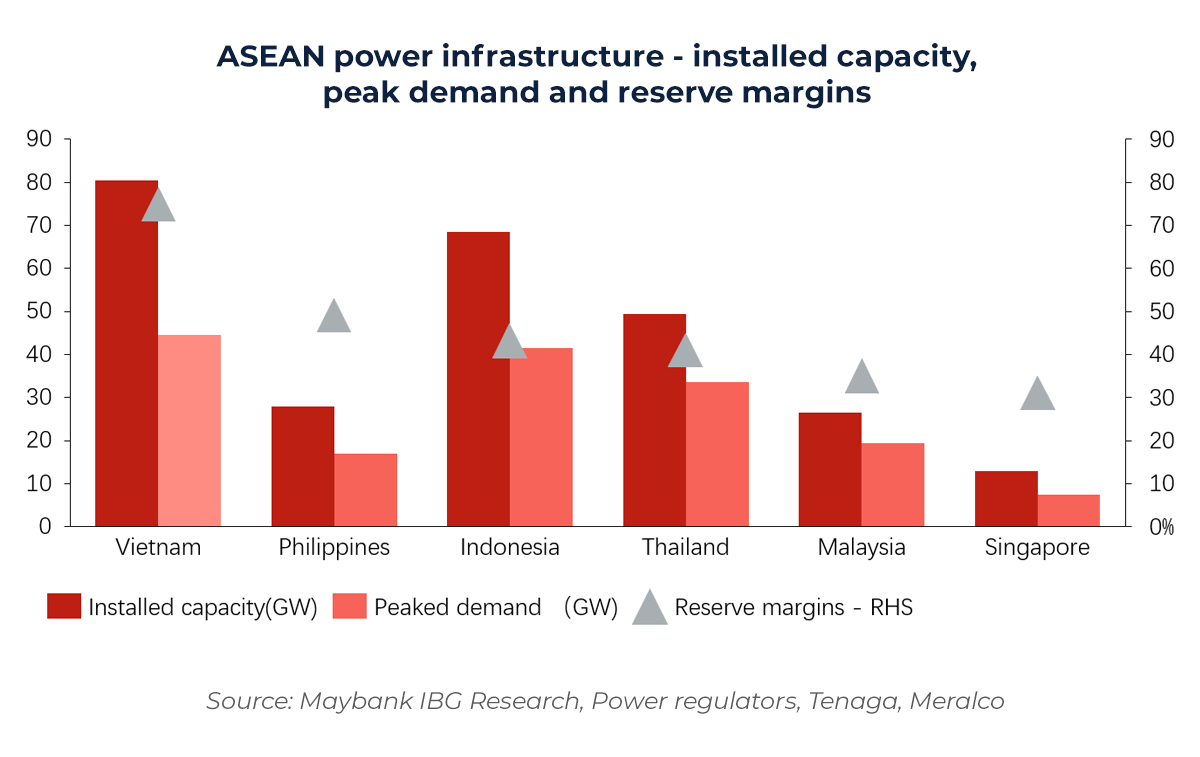

Besides offering low upfront cost, stable and low-cost electricity pricing, coupled with an increasing renewable mix gives Vietnam a strong long-term advantage in operational efficiency. By 2024, Vietnam led the region in the installed power capacity with approx. 80 GW, outshining its regional peers, which also reflected by the competitive electricity tariffs in the region.

From Alternative to Integrated: The New Regional Model

Rather than viewing Indonesia as fallback options, global companies are building multi-hub operating models across ASEAN. A typical distribution might look like:

- Malaysia: Regional data hosting, cloud infrastructure, and high-reliability services.

- Indonesia: Front-end operations, customer acquisition, digital services.

- Vietnam: Micro Data Centers to serve local rising demand and accommodate the international market once the in-progress submarine cables finish.

This modular approach reduces concentration risk and aligns each country’s strength with business function from capacity-building to demand fulfillment.

Strategic Implications for Global Leaders

To leverage Southeast Asia effectively, executives must adopt a function-first lens:

Build Location-Based Specialization

- Avoid one-size-fits-all setups. Define roles for each market based on capabilities, costs, and strategic fit.

Design ASEAN-Integrated Operations

- Link functions across borders: Malaysia-based cloud centers supporting Vietnamese hardware, with Indonesian user engagement.

Plan for Policy Divergence

- Regulations vary significantly. Agile compliance systems and cross-market scenario planning are essential for resilience.

The winners in Southeast Asia will not be those who rush to one hotspot, but those who orchestrate a regionally integrated, agile strategy.

How Our Management Consulting Division Can Help

We support clients in building Southeast Asia strategies that are resilient, scalable, and tailored to sector-specific priorities. Our offerings include:

- ASEAN Market Function Mapping: We help define where each country best fits into your operating model, from R&D to infrastructure and sales.

- Location Strategy & Cost Modeling: Through data-driven insights, we support site selection, investment prioritization, and incentive evaluation.

- Operational Integration Planning: We build executional blueprints for cross-border workflows, compliance, and talent deployment.

Whether entering Southeast Asia for the first time or recalibrating for growth, our experts can help craft a sustainable, function-aligned presence across the region’s most promising tech economies.