Popular search

Recently visited pages

Malaysia Economic Update Report, Q1 2025

In this issue

- Malaysia’s economy grew 4.4% in Q1 2025, driven by strong domestic demand, surging construction and investment, and steady manufacturing

- Malaysia’s Q1 2025 trade rose 3.6% YoY with a RM41 billion surplus, driven by record E&E exports and strong U.S. demand

- Amid rising U.S. trade tensions, Malaysia is deepening ties with China, reengaging with the EU and GCC

- The launch of the Johor - Singapore Special Economic Zone in January 2025 positions Johor as a key regional hub by offering tax incentives, streamlined trade, and cross-border connectivity

Malaysia’s economy grew 4.4% in Q1 2025, driven by strong domestic demand, surging construction and investment, and steady manufacturing—despite mining declines and global trade headwinds.

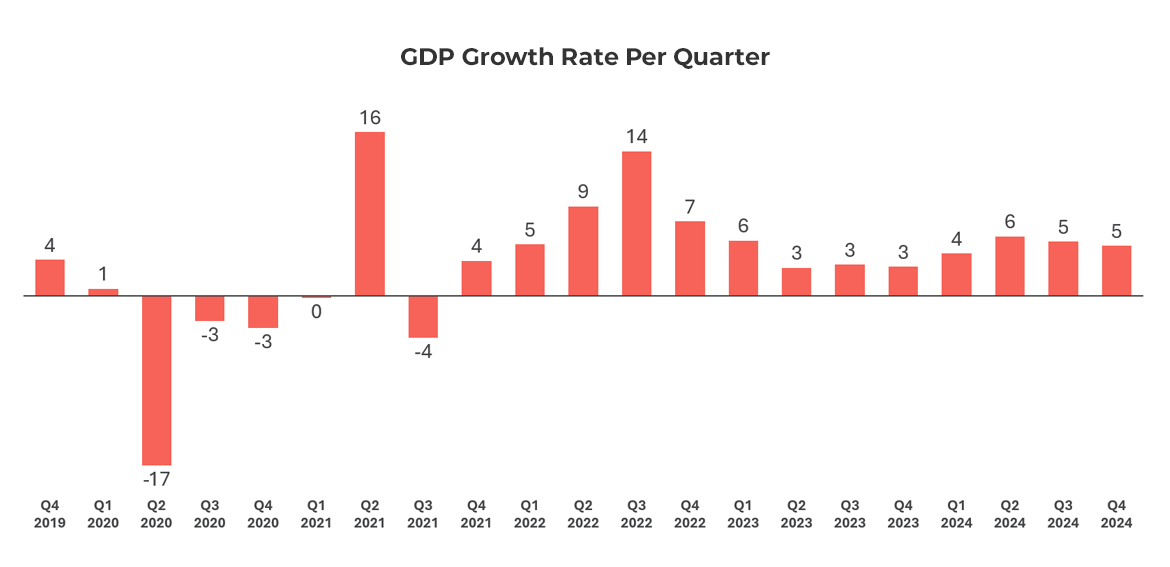

Malaysia recorded a solid economic performance in Q1 2025, with GDP growing 4.4% year-on-year, underpinned by resilient domestic demand and a broad-based sectoral expansion.

While the figure marked a slight moderation from 4.9% in Q4 2024, the economy showed notable resilience against a backdrop of softer global demand and volatile trade conditions. On a quarter-on-quarter seasonally adjusted basis, GDP rose 0.7%, rebounding from the contraction at the end of 2024.

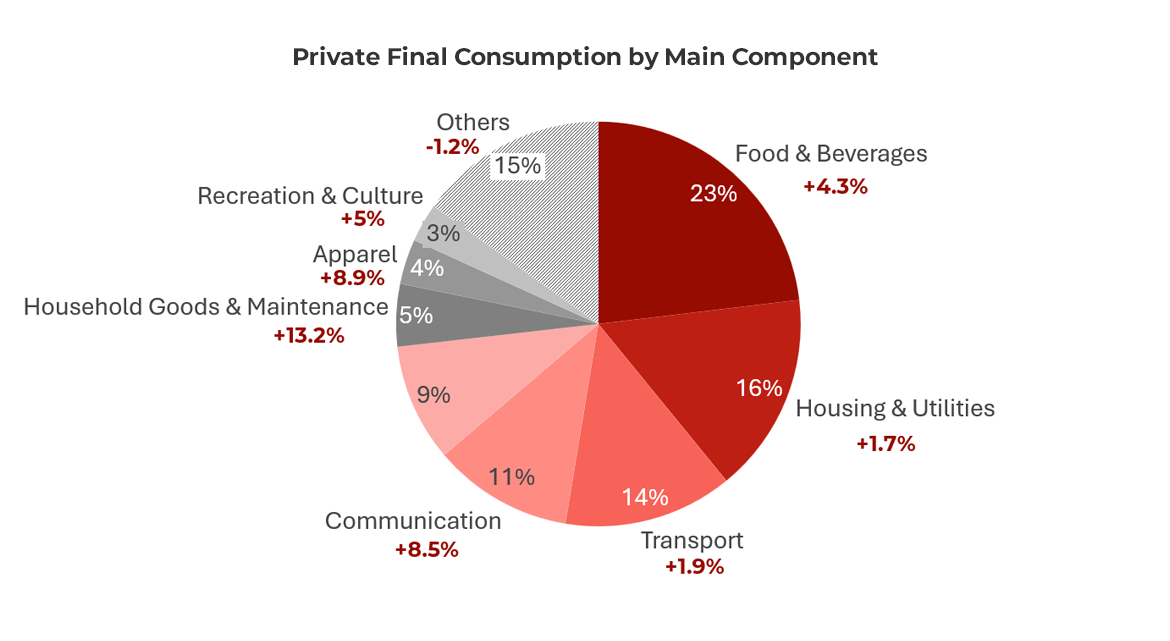

Private consumption, rising around 5%, was a key driver, supported by higher public-sector wages, festive spending, and targeted fiscal aid. Investment activity rose sharply, with gross fixed capital formation up 9.7% YoY, led by strong performance in construction and industrial real estate. The unemployment rate declined to 3.1%, a post-pandemic low, signaling strong labor market fundamentals.

Sectorally, the services sector expanded 5.0%, supported by strong performance in wholesale and retail trade (~5.3%), accommodation and food services (~7.4%), and transportation and storage services, which surged +9.5% due to recovery in air travel and logistics demand. Tourism-related services showed continued recovery, with international tourist arrivals in Q1 reaching nearly 90% of 2019 levels, reflecting strong inbound flows from regional markets. Finance, insurance, and real estate services also recorded modest but steady growth as interest rate stability and low inflation supported credit conditions.

Sectorally, the services sector expanded 5.0%, supported by strong performance in wholesale and retail trade (~5.3%), accommodation and food services (~7.4%), and transportation and storage services, which surged +9.5% due to recovery in air travel and logistics demand. Tourism-related services showed continued recovery, with international tourist arrivals in Q1 reaching nearly 90% of 2019 levels, reflecting strong inbound flows from regional markets. Finance, insurance, and real estate services also recorded modest but steady growth as interest rate stability and low inflation supported credit conditions.

Manufacturing posted 4.1% growth in Q1, largely anchored by sustained demand in the electrical and electronics (E&E) segment, which makes up over 40% of Malaysia’s exports. Notably, the S&P Global Malaysia Manufacturing PMI hovered around the 50 marks in March, signaling a stabilization in industrial output following contractionary readings earlier in the quarter. Output and new orders saw a modest recovery toward the end of Q1, especially among exporters serving the U.S. and EU. Sub-sectors such as chemicals and medical devices also showed improved capacity utilization rates. However, the sector remains vulnerable to downside risks, particularly from cyclical fluctuations in the global semiconductor market and uncertainties surrounding U.S. tariff measures that could dampen export momentum.

Construction surged 14.2%, its fifth consecutive quarter of double-digit growth, led by non-residential and civil engineering works. Major contributors included the ramp-up of data center facilities in Johor and Selangor, public infrastructure upgrades (especially rail and road projects), and commercial developments tied to industrial zones and logistics hubs. The sector’s recovery has been aided by improved labor availability, largely due to streamlined foreign worker approvals and relaxed hiring quotas, as well as the easing of raw material costs.

Agriculture grew a modest 0.6%, rebounding from negative growth in late 2024. The aquaculture and fisheries segments posted positive gains, while rubber and food crops saw minor upticks. However, palm oil production underperformed due to mixed weather conditions, offsetting broader sector gains.

In contrast, the mining and quarrying sector declined 2.7%, weighed down by a dip in crude oil and natural gas production. Several fields underwent scheduled maintenance, while natural field depletion continued to impact volumes. Despite this, the sector is expected to stabilize later in the year as new offshore projects come online.

Foreign direct investment remained robust, contributing to 2/3 of the investment. In Q1, Malaysia approved RM89.8 billion in investments across 1,556 projects, expected to create over 33,000 jobs. Notably, RM60.4 billion (67.3%) came from foreign sources. Actual FDI inflows were RM15.6 billion, the highest Q1 level in recent years, with strong contributions from Germany, Hong Kong, and Singapore. The majority of FDI targeted services (especially financial and ICT) and high-value manufacturing.

Malaysia’s Q1 2025 trade rose 3.6% YoY with a RM41 billion surplus, driven by record E&E exports and strong U.S. demand, though looming U.S. tariffs pose growing external risks.

Malaysia’s total trade reached RM715.7 billion in Q1 2025, up 3.6% YoY, with exports growing 4.4% to RM378.4 billion, and imports rising 2.8% to RM337.4 billion. This led to a healthy trade surplus of RM41.0 billion, reflecting continued strength in the external sector.

Export momentum was led by E&E products, which hit record highs in March and accounted for roughly 42% of total exports. Strong demand from the U.S. and EU, especially for semiconductors and consumer electronics, supported this growth. Exports of petroleum products, chemicals, and palm oil also contributed positively.

Notably, exports to the U.S. surged 50.8% YoY in March, attributed to front-loading by Malaysian exporters ahead of U.S. tariff measures scheduled for July. ASEAN remained Malaysia’s largest regional market (~29% share), followed by the U.S., China, and the EU.

Import growth remained moderate. Capital goods imports (e.g., machinery and tech equipment) rose notably, reflecting continued business investment. Consumer goods imports remained healthy, while intermediate goods showed mixed trends. The trade balance remained favorable, supported by steady demand and a competitive currency.

Despite solid fundamentals, trade risks are mounting. The U.S. has proposed broad 24% tariffs on Malaysian exports beginning July 2025. In response, Malaysian officials are engaging in negotiations while seeking to diversify market exposure.

Amid rising U.S. trade tensions, Malaysia is deepening ties with China, reengaging with the EU and GCC, advancing regional leadership, and implementing fiscal reforms to boost resilience, attract green investment, and diversify its global economic partnerships.

As trade uncertainty with the United States intensifies, Malaysia is actively recalibrating its international partnerships to enhance long-term economic resilience.

A central pillar of this effort is the strengthening of economic and strategic ties with China. In April 2025, shortly after the first quarter, President Xi Jinping paid a landmark state visit to Kuala Lumpur to commemorate the 50th anniversary of diplomatic relations between the two nations. The visit resulted in the signing of over 30 new cooperation agreements, signaling a deepened commitment to bilateral collaboration.

These agreements span critical sectors, including technology, green energy, manufacturing, and digital infrastructure. Among the highlights was Malaysia’s adoption of China’s BeiDou satellite navigation system, aimed at enhancing the country’s geospatial capabilities and reducing reliance on Western technologies. This move is also seen as a step toward greater technological self-reliance. Furthermore, the two countries announced the establishment of joint research and development centers focusing on artificial intelligence, health technology, and robotics—areas seen as key to Malaysia’s industrial upgrading and digital transformation.

Infrastructure development continues to be a focal point of the partnership. Agreements included ongoing support for the East Coast Rail Link, a major transport project that will improve connectivity between Malaysia’s east and west coasts. Additionally, the revival of the “Two Countries, Twin Parks” initiative, linking industrial zones in Kuantan (Malaysia) and Qinzhou (China), underscores efforts to create integrated industrial ecosystems that benefit from the strengths of both nations.

China remains Malaysia’s largest trading partner, with bilateral trade reaching a record US$212 billion in 2024. Foreign direct investment (FDI) inflows from China surged by 39% year-on-year, particularly in the manufacturing, logistics, and renewable energy sectors. Visa-free travel between the two countries has further facilitated tourism, business exchanges, and people-to-people connectivity. Importantly, Malaysia’s outreach to China is not a pivot away from the West, but rather a strategic diversification to mitigate risks tied to any single economic bloc. For foreign companies, this deepening integration into China’s supply chains and infrastructure networks opens new opportunities for investment, sourcing, and trade facilitation.

Simultaneously, Malaysia is expanding its global market footprint. In January 2025, it resumed negotiations with the European Union on a long-delayed Free Trade Agreement (FTA). The renewed talks focus on digital trade, sustainable development, and the circular economy, areas aligned with Malaysia’s policy priorities. In May, the country also launched FTA negotiations with the Gulf Cooperation Council (GCC), with ambitions to deepen cooperation in energy, halal exports, Islamic finance, and sovereign investments.

As the ASEAN Chair in 2025, Malaysia is also playing a more assertive regional role. It has prioritized digital connectivity, environmental sustainability, and supply chain resilience within the ASEAN agenda. These themes not only align with national interests but also enhance Malaysia’s image as a hub for inter-ASEAN trade, innovation, and collaboration. Its leadership has been instrumental in advancing regional frameworks on digital trade standards and green infrastructure financing.

Domestically, the Malaysian government has introduced several fiscal reforms to strengthen economic fundamentals. Key measures rolled out in Q1 include the rationalization of fuel subsidies and the expansion of the Sales and Services Tax (SST) base. These reforms are designed to improve fiscal discipline and reduce the national deficit to 3.8% of GDP by the end of 2025, thereby creating fiscal space for future public investments.

Foreign investor interest remains strong. In Q1, Saudi Arabia’s ACWA Power signed a landmark US$10 billion agreement to develop 12.5 gigawatts of renewable energy and green hydrogen projects in Malaysia. The deal supports the country’s National Energy Transition Roadmap and affirms its position as a leading regional destination for sustainable, high-impact investments.

Taken together, these developments reflect Malaysia’s strategic realignment toward economic resilience, international diversification, and high-value sector development, trends that are expected to shape investor sentiment and policy direction in the quarters ahead.

The launch of the Johor – Singapore Special Economic Zone in January 2025 positions Johor as a key regional hub by offering tax incentives, streamlined trade, and cross-border connectivity, attracting high-tech investment and deepening Malaysia – Singapore economic integration.

The launch of the Johor-Singapore Special Economic Zone (JS-SEZ) in January 2025 marked a significant milestone in the deepening of economic ties between Malaysia and Singapore.

Backed by strong political commitment from both governments, the JS-SEZ is designed to become a new engine for cross-border growth, attracting high-value investments through enhanced trade facilitation, robust infrastructure, and investor-friendly policies.

The SEZ introduces a range of business-friendly features aimed at streamlining operations and encouraging long-term investment. These include faster customs clearance and improved transport connectivity between Johor and Singapore, enabling smoother movement of goods and talent across borders. Companies operating in the zone can also benefit from expedited regulatory approvals and corporate tax incentives, with rates as low as 5% for up to 15 years, making it one of the most competitive packages in the region.

The zone specifically targets sectors such as data centers, advanced electronics, renewable energy, and logistics. These industries are well-positioned to leverage Johor’s strengths in land availability, industrial infrastructure, and cost competitiveness, alongside Singapore’s deep capital pools, skilled workforce, and established tech ecosystem. The strategic pairing of Johor’s physical advantages with Singapore’s financial and innovation edge creates a compelling proposition for multinational companies looking to optimize regional supply chains.

In the first quarter of 2025, Johor emerged as Malaysia’s leading investment destination, accounting for more than RM30.1 billion in approved investments. This surge reflects growing investor confidence in Johor’s role as a regional industrial and logistics hub. Its proximity to Singapore, lower operating costs, and improving business climate have made it a natural choice for companies seeking to expand in Southeast Asia.

For foreign investors, the JS-SEZ represents a unique opportunity to tap into the strengths of both Malaysia and Singapore through a single, integrated platform. Access to high-quality infrastructure, a skilled and bilingual workforce, and political and regulatory stability further enhances the zone’s attractiveness.

Beyond immediate economic benefits, the JS-SEZ also reflects Malaysia’s forward-looking approach to regional integration and industrial upgrading. By embedding itself more deeply into global value chains and fostering high-tech investment, Malaysia is taking a strategic step toward long-term competitiveness. The JS-SEZ not only strengthens bilateral relations but also positions Johor, and by extension, Malaysia, as a rising node in the Southeast Asian economic landscape.

About this report

This report was compiled with contributions from the team of business experts across Alarar Capital Group’s global offices.

Alarar Capital Group is an advisory firm specialised in supporting western companies operating in Asia and beyond. Our mission is to bridge the gap between global business ecosystems and key markets worldwide. Through our Management Consulting division, we provide services within corporate strategy, business transformation, operations, sustainability, growth, sales & marketing, and digital & AI solutions. We work across a wide range of industries, including automotive & mobility, energy & environment, consumer goods & retail, food & beverage, technology, media & telecom, advanced industry & materials, financial services, and healthcare, medtech & biotech.

If you are interested in exploring how we can support your business, reach out through our contact page, or leave your email below for a representative to get in touch directly:

Ready to talk to our experts?

References

- Malaysia records 4.4% GDP growth in Q1 2025: DOSM | Human Resources Online

- 4.4% GDP Growth In First Quarter 2025 Fortifies Malaysia’s Fundamentals In The Face Of Global Uncertainties

- Mida: Malaysia secures RM89.8b approved investments in Q1 2025, up 3.7pc y-o-y | Malay Mail

- EU and Malaysia relaunch free trade agreement negotiations - EU Reporter

- Malaysia to widen tax net, raise minimum wages in 2025 as budget spending hits record | Reuters

- ACWA Power Forges Strategic Partnerships in Malaysia with Potential Investments of up to USD 10 Billion - IDRA | The Global Desalination and Water Reuse Community

- Malaysia Sets Trade Targets For 2025 With A Focus On BRICS, FTA Partners and Emerging Markets - Malaysia SME®

- TMP_KDNK Q1 2025_PP.pdf

Subscribe to New Articles and Alarar Capital Group Updates

Receive our latest market insights, news and reports, and business bulletins.