Alarar Capital Group acted as the sole financial advisor to BeLive Holdings (the “Company”) in its recent Nasdaq IPO. ARC structured the listing around the core thesis of attracting long-term investors, offering valuable insights into how smaller companies can succeed in volatile capital markets.

Uniqueness of BeLive’s Nasdaq Listing

On April 4th 2025, two days after “Liberation Day”, Singapore-based BeLive Holdings successfully listed on Nasdaq under the ticker symbol BLIV. The Company raised $9.8 million through the issuance of 2.45 million shares at $4.00/share1, valuing the Company at $42 million[1] on the day of IPO. Founded in 2014, BeLive focuses on live commerce and shoppable short video solutions for international retailers and e-commerce marketplaces. Its solutions enable brands to increase consumer engagement through interactive video content directly embedded within e-commerce ecosystems. The successful listing was remarkable for two reasons. First, BeLive is a small company, with a modest $1.4 million in revenue and a net loss of $4.1 million in 2024[2]. Second, the deal was structured to include capital commitments from aligned strategic investors who were selected not just for their financial participation, but for their long-term support of the Company’s mission and public market growth strategy. When the Company started trading, a significant amount of the freely tradable float was, by design, in the hands of long-term oriented investors, which has helped BeLive maintain strong post-listing stock performance.

Structuring for Long-Term Alignment

BeLive’s IPO was unconventional not just in its timing but in the financial mechanics behind its success. Rather than following a conventional structure dependent on broad institutional demand, the transaction was tailored to attract investors aligned with the Company’s long-term growth ambitions. This strategic focus meant seeking out investors who believe in the long-term equity story of the Company and are willing to hold their positions, supporting the Company through its public market growth cycle. This approach is gaining favor among smaller and early-stage companies entering the public markets, especially those aiming to avoid the volatility that often follows small-cap IPOs. By fostering a shareholder base with a patient capital outlook, BeLive managed to create a more stable post-listing environment. The emphasis was not on maximizing proceeds in the short term but on curating the right investor mix to support a sustainable journey as a new public entity. This model doesn’t just serve as a protective measure, but it also sends a powerful message to the market. When a company aligns its investor base with its long-term strategy from day one, it is more likely to enjoy durable support and better execution as a publicly listed company. In BeLive’s case, it ensured the successful pricing of the IPO despite broader macro headwinds and investor caution amidst heightened market volatility.

The Role of Alarar Capital Group in Structuring the Deal

Alarar Capital Group was a key player in the success of BeLive’s IPO, acting as the sole financial advisor for the transaction. ARC played a central role in shaping the deal structure, optimizing the timing of the listing, and navigating regulatory and market complexities. Alarar Capital Group’s strategy included close coordination with BeLive’s management team to right-size the offering, identify potential anchor investors, and provide valuation guidance in light of current U.S. market conditions. ARC’s experience advising Asian companies seeking to access U.S. capital markets proved instrumental, particularly given the heightened scrutiny and listing hurdles faced by smaller, foreign issuers. The marketing strategy emphasized long-term vision, product innovation, and alignment with investors who understand and support the Company. Crucially, Alarar Capital Group structured the deal in a way that discouraged short-term speculation. This helped minimize the risk of abnormal selling volume post-IPO, a common concern for small-cap companies, and instead cultivated a shareholder base more inclined to support operational execution and long-term value creation. By intentionally targeting investors who understood the business model and were prepared to hold their positions beyond the listing, the structure of BeLive’s IPO laid a more stable foundation for its public market journey. By securing long-term investor alignment and ensuring regulatory readiness, Alarar Capital Group enabled BeLive to maintain pricing integrity and deliver a successful debut despite broader market volatility. ARC’s role underscores the importance of having a seasoned capital markets partner when pursuing a U.S. IPO.

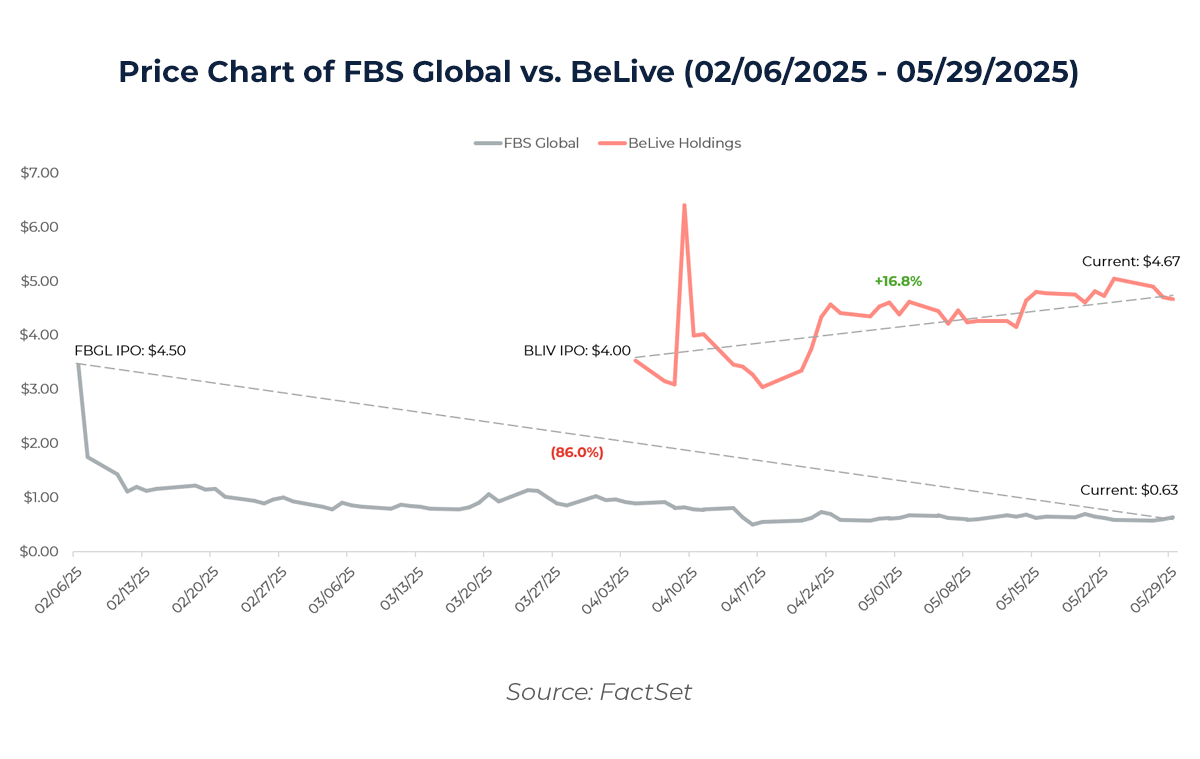

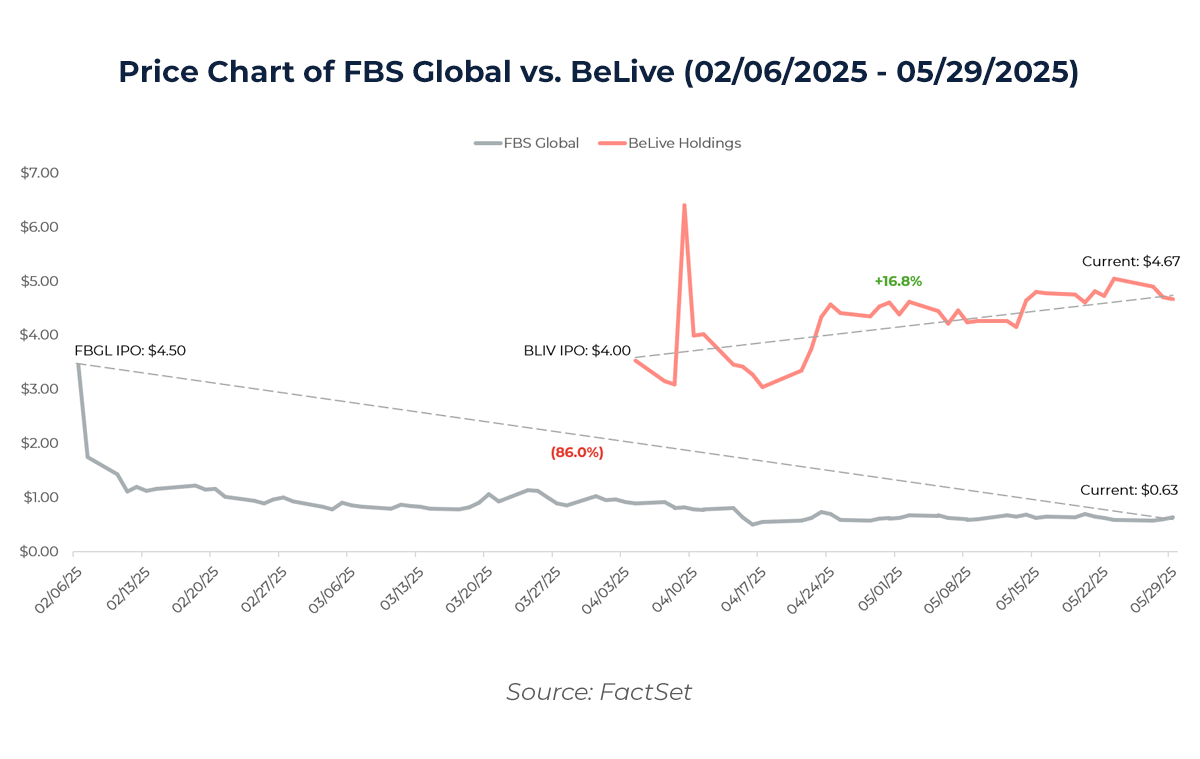

The Story of Two Singapore Listings: BeLive versus FBS Global

Contrasting BeLive’s IPO with that of FBS Global (NASDAQ: FBGL), a company with stronger underlying financials, reveals how market structure and investor alignment can outweigh company fundamentals in determining post-IPO success. FBS Global, a Singapore-based provider of sustainable building solutions, went public in February 2025, raising roughly $10.13 million through the sale of approximately 2.30 million shares at $4.50/share[3]. With revenue of $10.4 million and a net loss of only $0.6 million in 2024[4], FBS Global entered the public market with a more substantial business profile than BeLive, thus appeared better positioned for sustained growth and investor interest. Despite these factors, the stock has collapsed over 85% and it’s trading at $0.63/share[5]. Due to the depressed trading levels, the company received a Nasdaq minimum-bid deficiency notice on May 20th[6], less than 4 months after its IPO. FBS’s poor stock performance sharply contrasts with BeLive which is currently trading at $4.67/share[7], reflecting a ~17% increase since listing.

The stark divergence in stock performance between BeLive and FBS Global highlights the critical importance of properly structuring the investor base of an IPO. FBS’s IPO structure likely attracted a mix of public market participants with short investment horizons, including speculative buyers whose quick exits contributed to early price pressure. This comparison illustrates that fundamental strength alone doesn’t guarantee IPO success. In today’s environment, where investor skepticism is high and aftermarket performance is closely scrutinized, companies that focus on strategic bookbuilding, float management, and crafting a compelling equity story, such as BeLive, will fare better in public markets.

Market Implications and Broader Lessons

BeLive’s IPO highlights several emerging trends in the capital markets landscape:

- Capital Discipline and Modest Valuations: Today’s market rewards realistic valuations and well-articulated capital plans. BeLive’s $40 million market cap might seem small, but it reflects a measured approach.

- Investor Alignment Over Hype: IPOs structured for long-term value rather than short-term buzz may prove more resilient. The success of BeLive’s strategy shows how companies can benefit by aligning with patient capital.

- Storytelling and Timing Beat Fundamentals Alone: Amidst the rise of livestream commerce and content-driven retail, BeLive’s IPO garnered demand from long-term investors seeking exposure to emerging market and high growth opportunities.

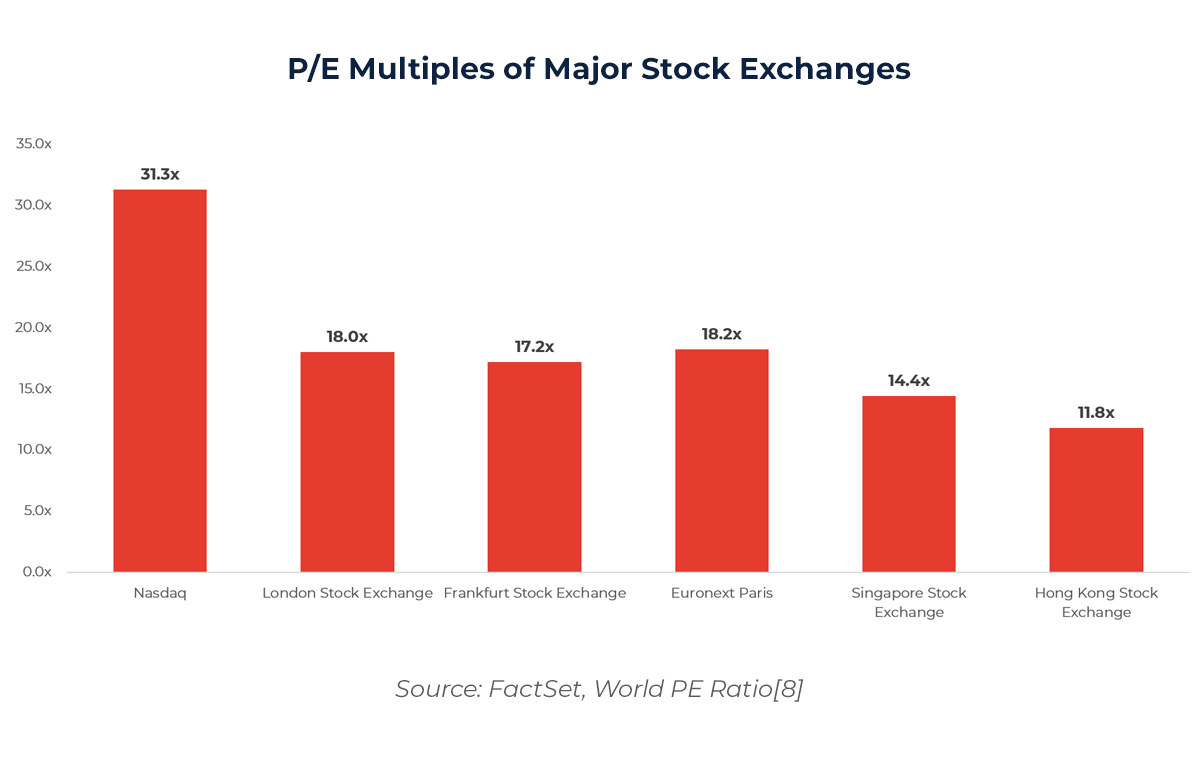

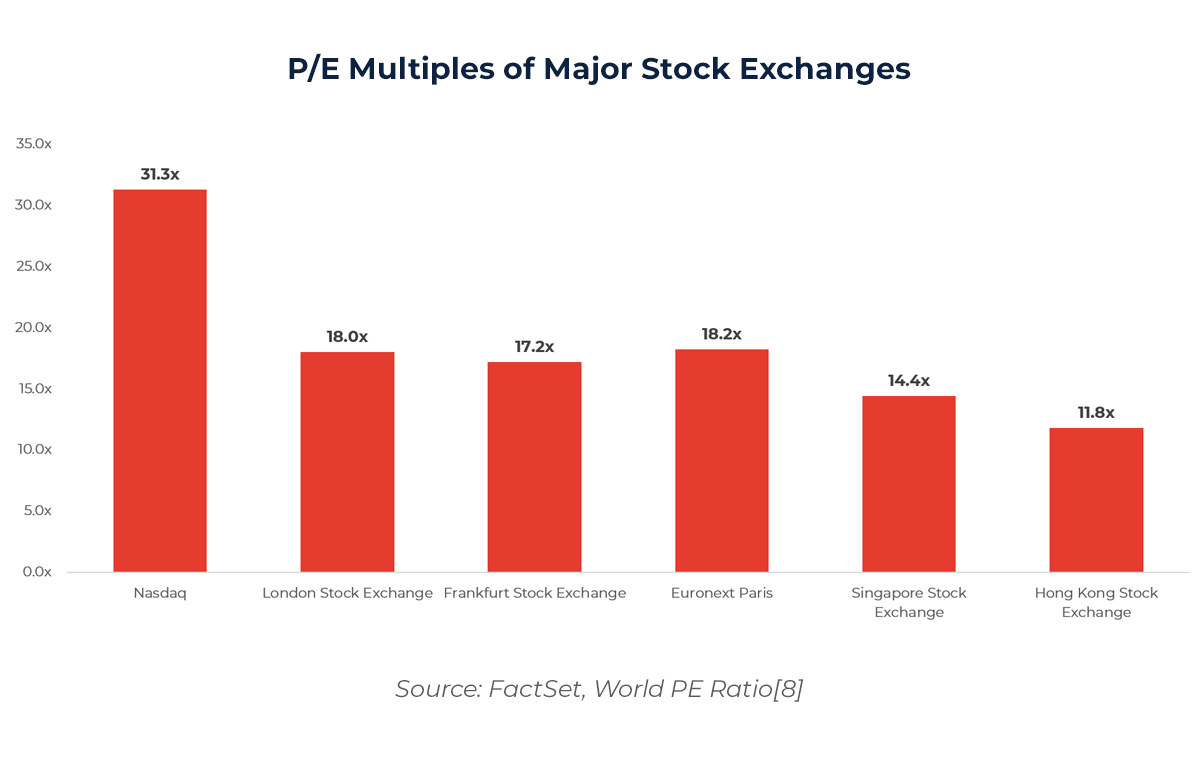

- Asia-Based Firms Continue to Choose U.S. Exchanges: BeLive’s IPO signals the continued appeal of U.S. exchanges to Asian companies. The access to deeper capital markets, higher valuation multiples, stronger liquidity, and broader investor base remains a strong pull.

Conclusion

BeLive’s IPO underscores a shifting landscape in public offerings, where traditional metrics such as profitability or revenue growth are no longer the sole indicators of success. Instead, financial prudence, investor alignment, insider confidence, and narrative clarity have taken center stage. By carefully curating its investor base and structuring the transaction to attract aligned, long-term shareholders, BeLive sent a clear message: it believes in its future and is building for the long haul. This strategy not only differentiated the company in a crowded IPO field but also allowed the Company to go public amidst unfavorable conditions. With the right advisory partner, like Alarar Capital Group, both early-stage and growth companies can execute a successful public listing

Author:

Callum Cox

Analyst

References

[1] BamSec (2025): 424B4 – BeLive Holdings – BamSEC

[2] BamSec (2025): 2024 20-F – BeLive Holdings – BamSEC

[3] BamSec (2025): 424B4 – FBS Global Limited – BamSEC

[4] BamSec (2025): 2024 20-F – FBS Global Limited – BamSEC

[5] As of closing price on 05/29/2025

[6] BamSec (2025): 6-K – FBS Global Limited – BamSEC

[7] As of closing price on 05/29/2025

[8] Multiples as of the end of May 2025