Download

Click here to download this article as a .pdf document.

Executive Summary

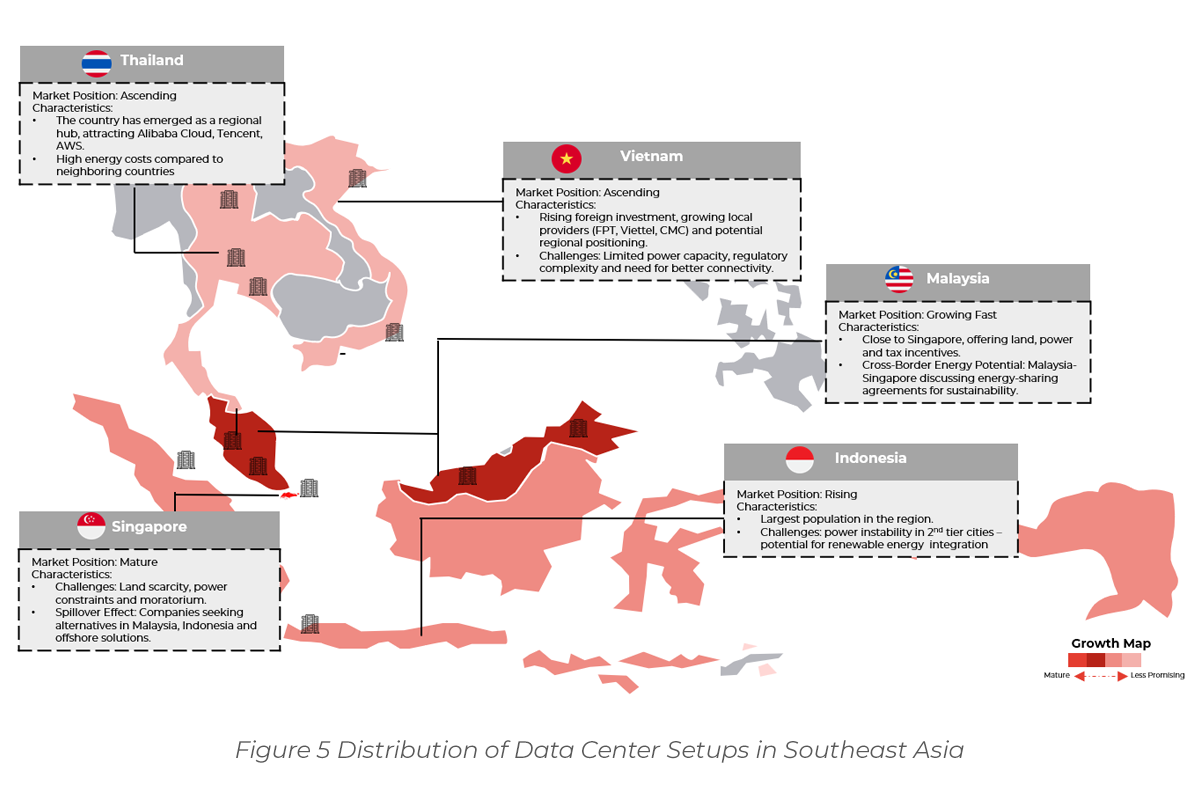

ASEAN is rapidly emerging as a global hotspot for data center investment. While traditional hubs like Singapore face constraints, Malaysia, Indonesia, Vietnam and Thailand are seeing unprecedented investment inflows from major cloud providers, hyperscalers and industrial investors.

Key Trends Shaping The Expansion of Data Centers in ASEAN

Shifting geopolitical dynamics, tightening regulatory frameworks and the rapid evolution of digital services are redefining the requirements for data infrastructure across ASEAN. These forces are pushing companies to rethink their data center strategies in the region, driving demand for more localised, scalable and resilient facilities.

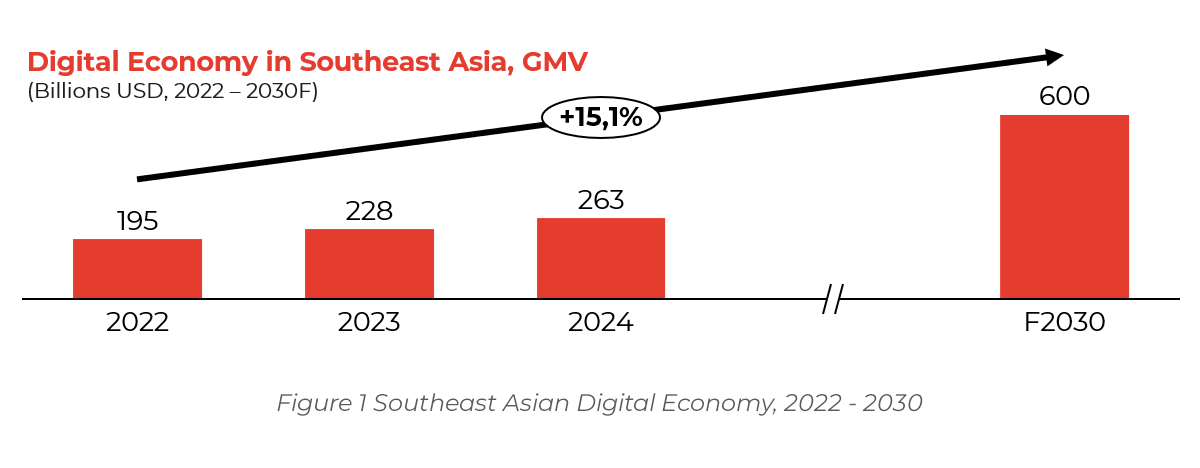

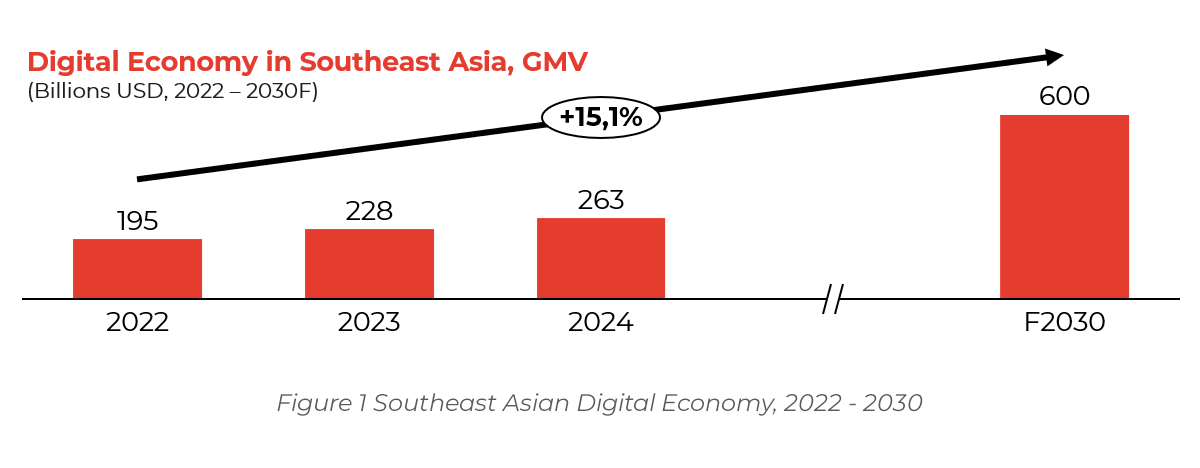

- Strong regional demand for digital infrastructure driven by ASEAN’s fast-growing digital economy, which is projected to reach USD 600 billion by 2030 – propelled by rapid cloud adoption, increasing AI workloads, and surging mobile data usage.

- Stricter data sovereignty laws require companies to store and process data locally, pushing hyperscalers and enterprises to invest in in-region infrastructure.

- Geopolitical shifts, including US-China tensions and Hong Kong’s declining role as a data hub, are making ASEAN a stable and attractive destination for global digital infrastructure.

- Singapore’s land and energy limitations are shifting investment to lower-cost, high-growth markets like Malaysia, Indonesia and Thailand, where strong infrastructure and incentives support expansion.

Key Opportunities in ASEAN’s Data Center Ecosystem

ASEAN’s evolving data center landscape is unlocking new business models, investment strategies and infrastructure innovations. Operators, equipment manufacturers and investors stand at the forefront to benefit from this growth trajectory fast growth of the market, which includes:

- Data center models are diversifying, with rising demand for hyperscale, edge and sustainable facilities creating new investment opportunities.

- Energy-intensive data centers are accelerating investment in renewable energy and ESG-aligned infrastructure, driving sustainability-focused growth.

- AI-driven automation, advanced cooling, and resilient infrastructure are becoming critical priorities for operators optimising performance.

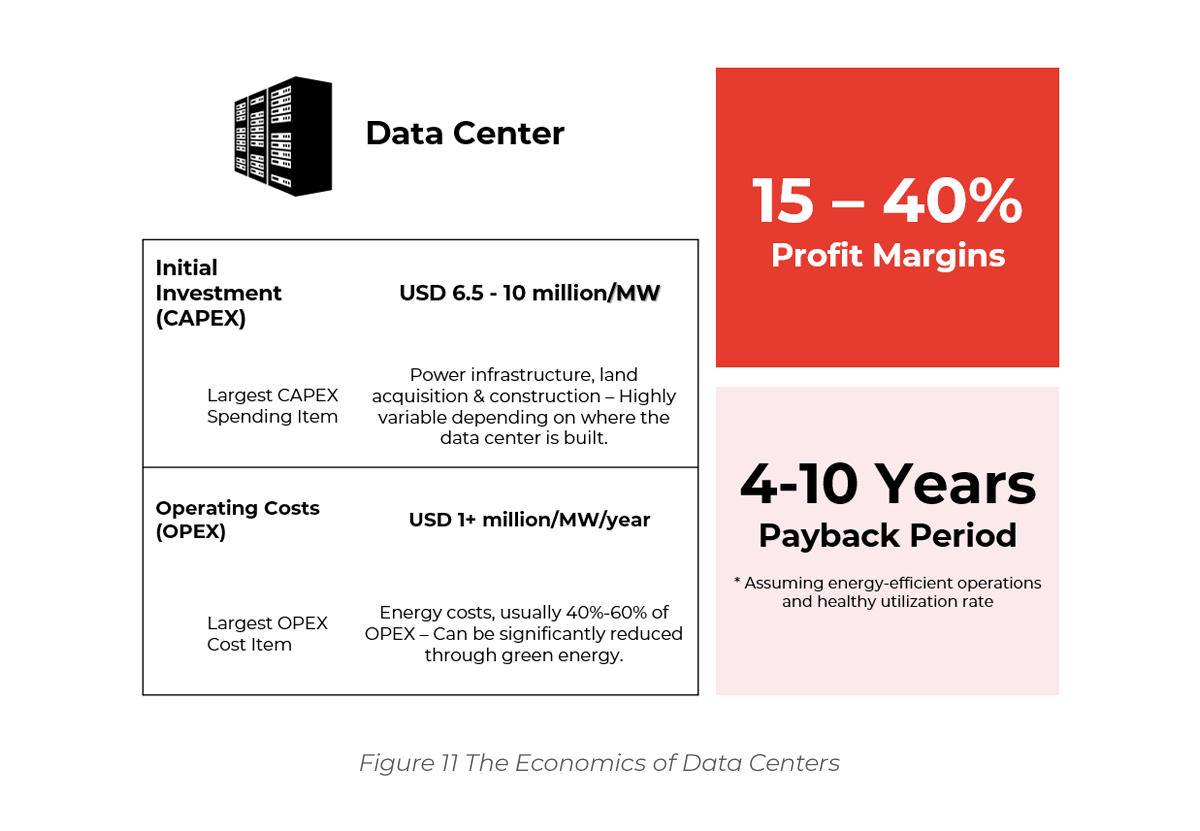

- ASEAN offers high ROI, with 15-40% profit margins and 4–10-year payback periods, making it one of the most lucrative data center markets.

- Investment is decentralising beyond tier-1 cities, with tier-2 hubs like Johor, Batam and Hanoi emerging as key digital infrastructure zones.

In the context of accelerating investment in digital infrastructure, this whitepaper helps stakeholders navigate the evolving landscape by providing insights into market dynamics and emerging opportunities.

1 | Domestic Strength & Geopolitics Drive Data Center Growth in ASEAN

Unprecedented Digital Growth Fueled by Data and Infrastructure Expansion

Southeast Asia is rapidly positioning itself as a global leader in digital adoption, with the digital economy significantly outpacing global growth rates. The region’s Gross Merchandise Value (GMV) is expected to reach USD 600 billion by 2030, growing at an annual rate of approximately 15%[1].

This momentum is driven by several key trends that are reshaping ASEAN’s data and technology landscape:

- Explosive Growth in Data Consumption: Monthly data usage per smartphone user in Southeast Asia is expected to rise 2.5x, from 17 GB/month in 2023 to 42 GB/month by 2029, highlighting a growing need for robust data storage and workload processing capabilities

- Surge in Cloud Computing Demand: Businesses in the region spent USD 4 Billion on cloud computing in 2020, with this spending anticipated to increase by 33% annually through 2026. This substantial growth reflects strong enterprise demand for scalable cloud solutions and underlying data center infrastructure

- Rapid Adoption of E-Governments: ASEAN governments are actively promoting digitalization, with 40% already implementing national cloud adoption strategies. This drives the need for secure, reliable local data centers to manage sensitive government data and citizen interactions.

Collectively, these trends are driving the region to undergo a rapid digital transformation, which has been fueled demand for data infrastructure in the region, thereby solidifying its role as a critical hub for technology, connectivity and data-driven growth.

ASEAN as The Emerging Growth Engine for The Global Data Center Market

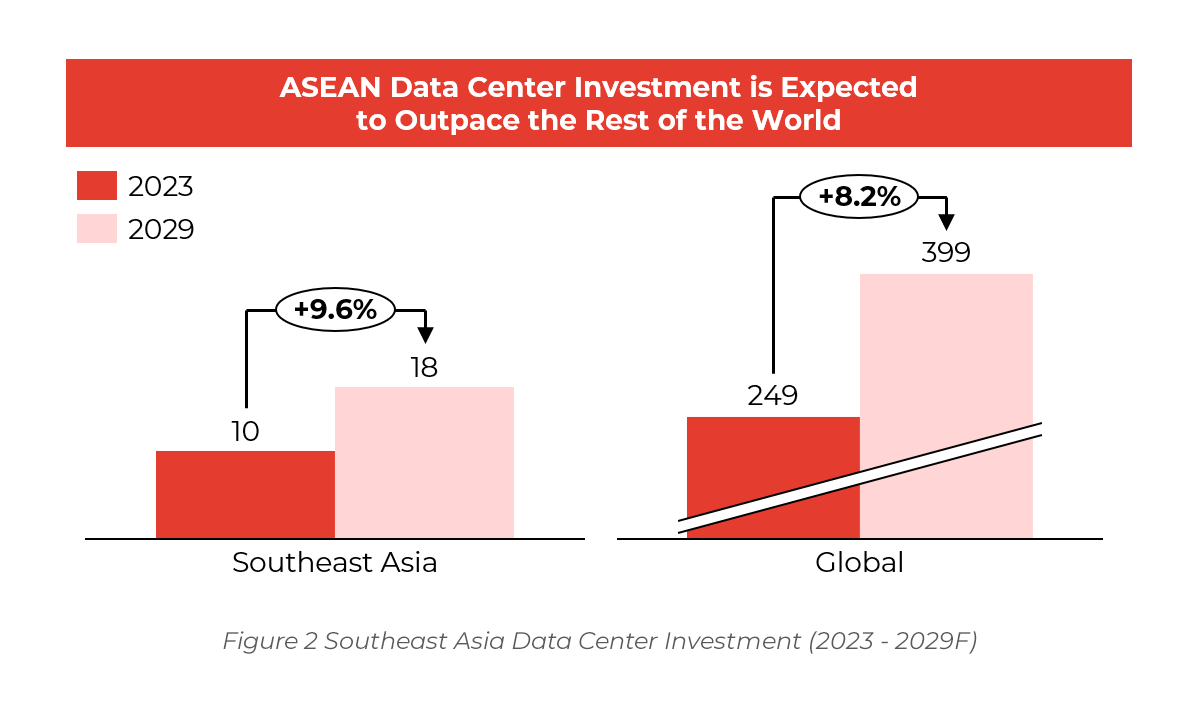

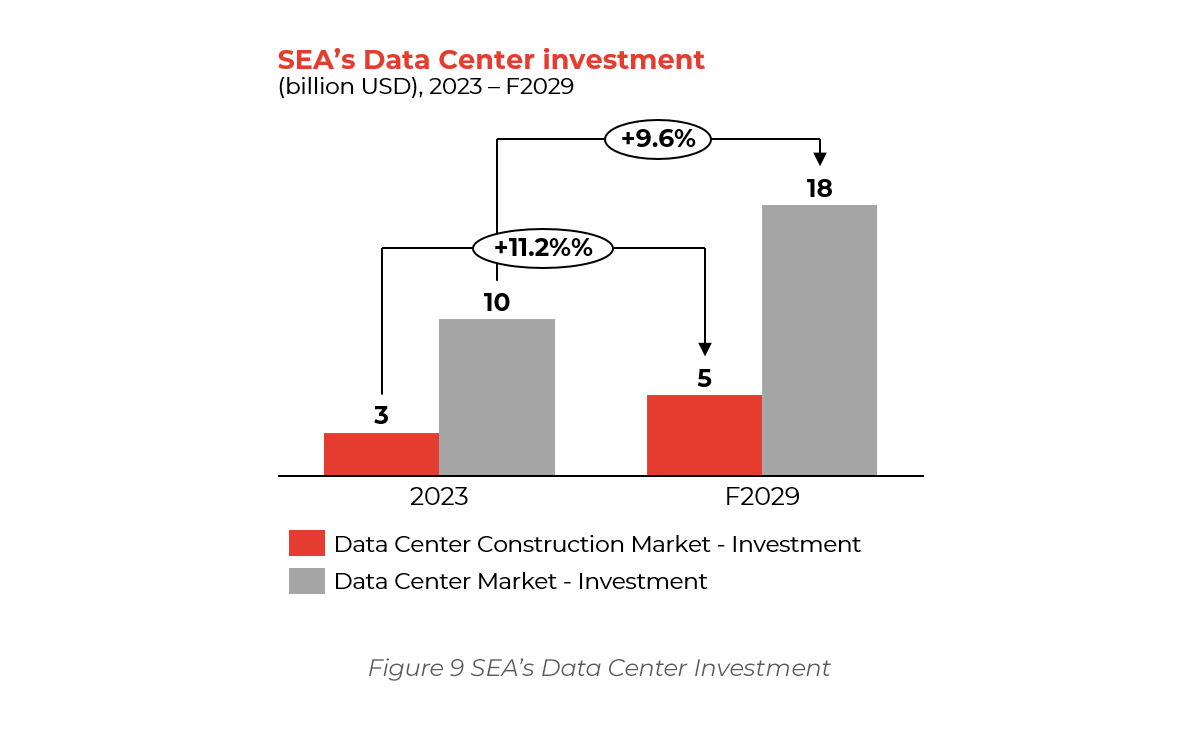

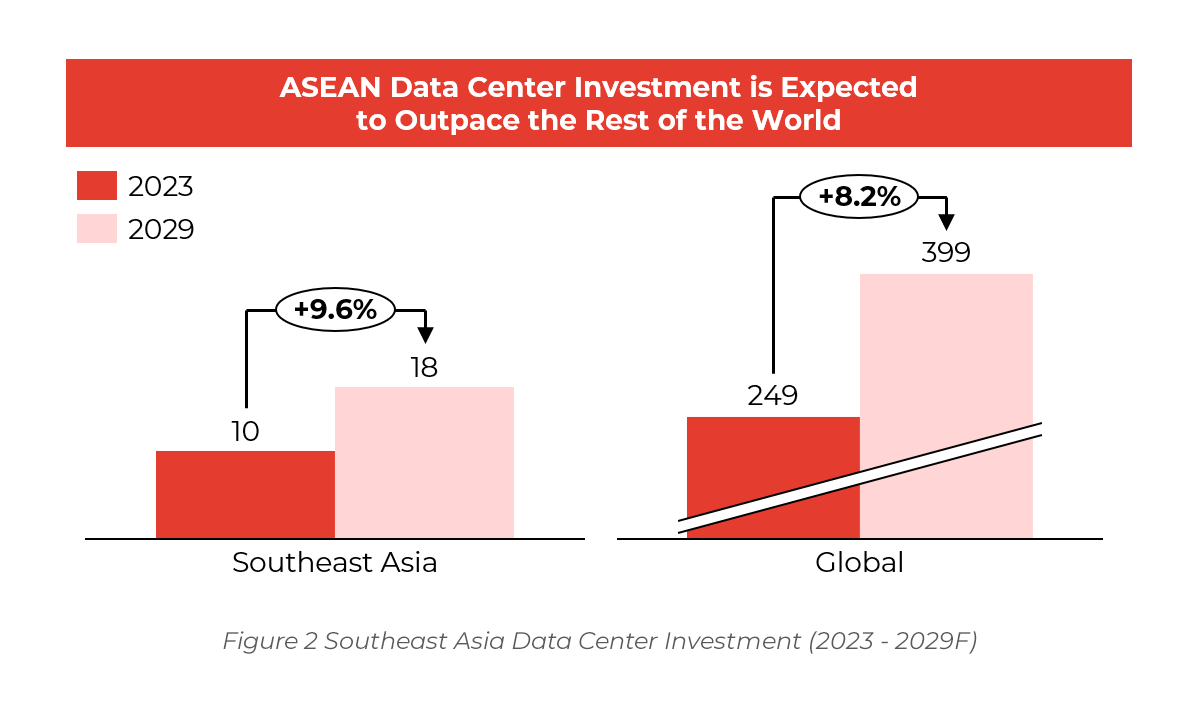

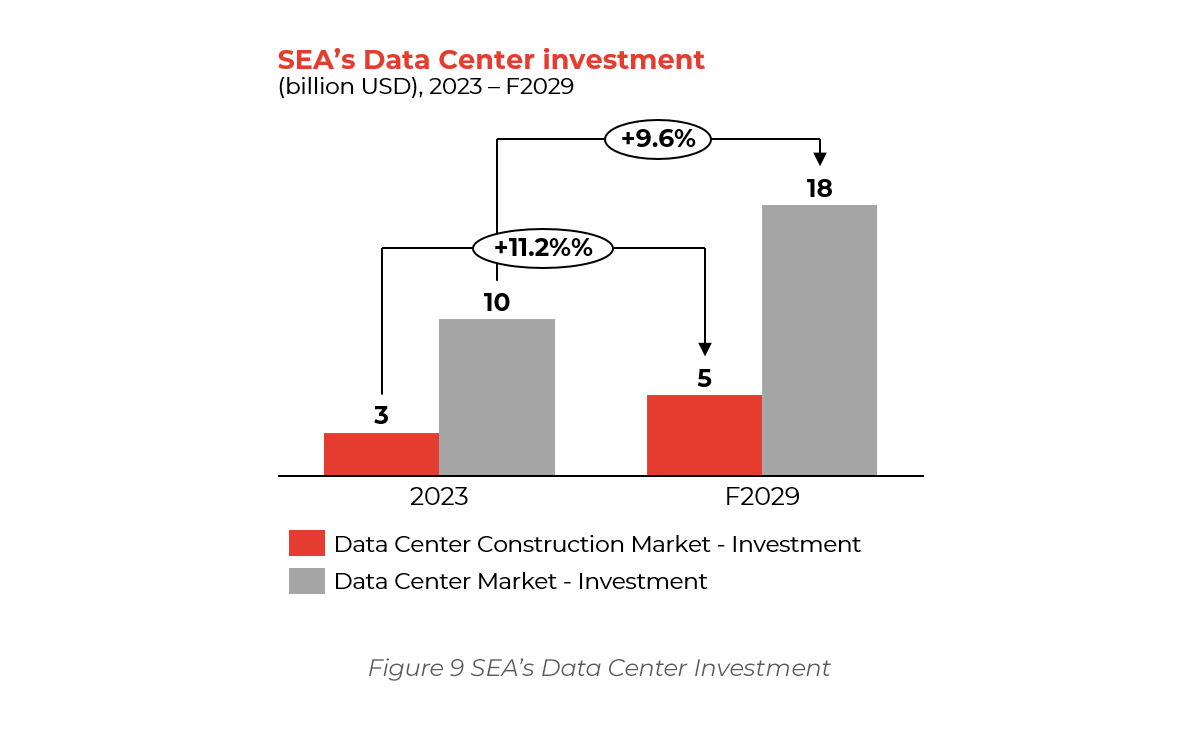

By 2029, data center investment in ASEAN is expected to grow at a CAGR of 9.6%, exceeding the global average of 8.2%, reflecting the region’s potential to become a key player in the global digital economy[2].

This exponential growth highlights ASEAN’s increasing need for high-performance computing, energy-efficient infrastructure and strategic connectivity, making it a prime market for investors, cloud service providers and data center operators.

Key Growth Drivers Fueling ASEAN’s Data Center Expansion

The region’s emergence as a digital powerhouse is fueled by both demand-side and supply-side factors reshaping the investment landscape. Below are the five key growth drivers that are fueling the growth of the market.

1. Digital Acceleration Fuels Demand for Data Centers

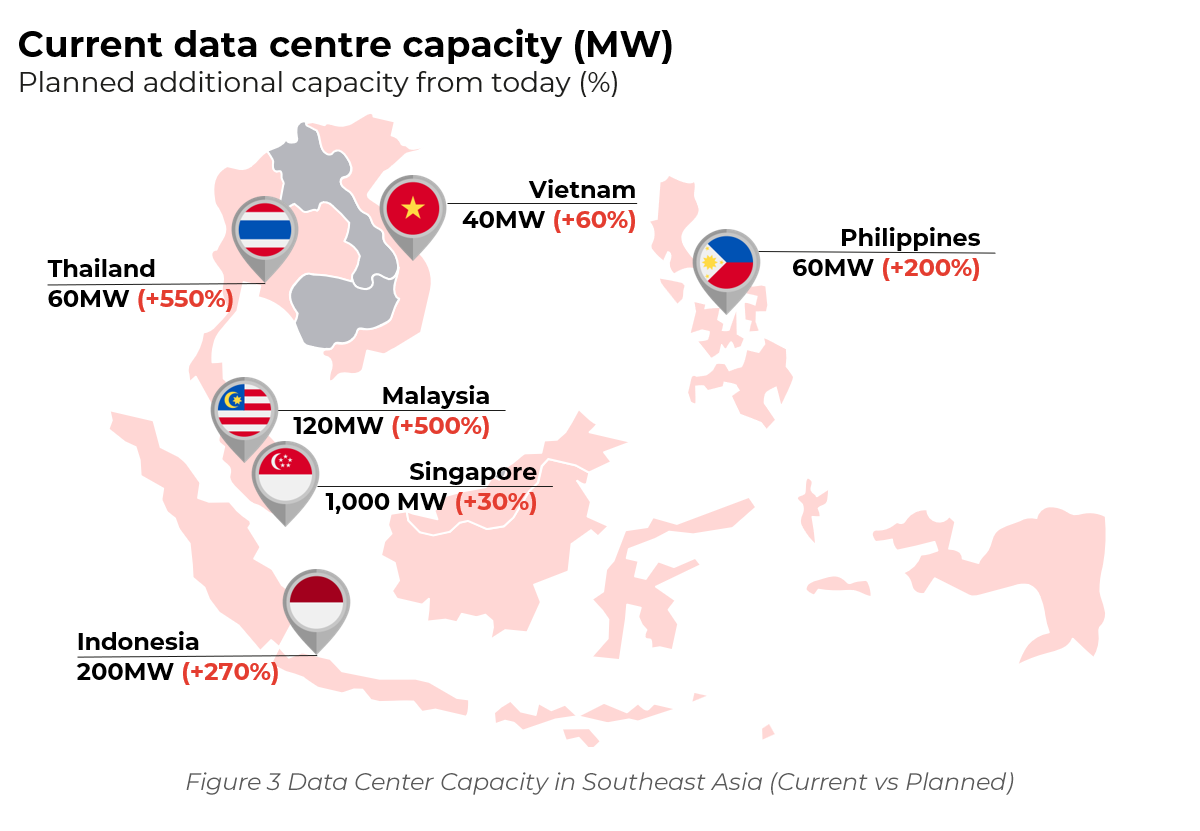

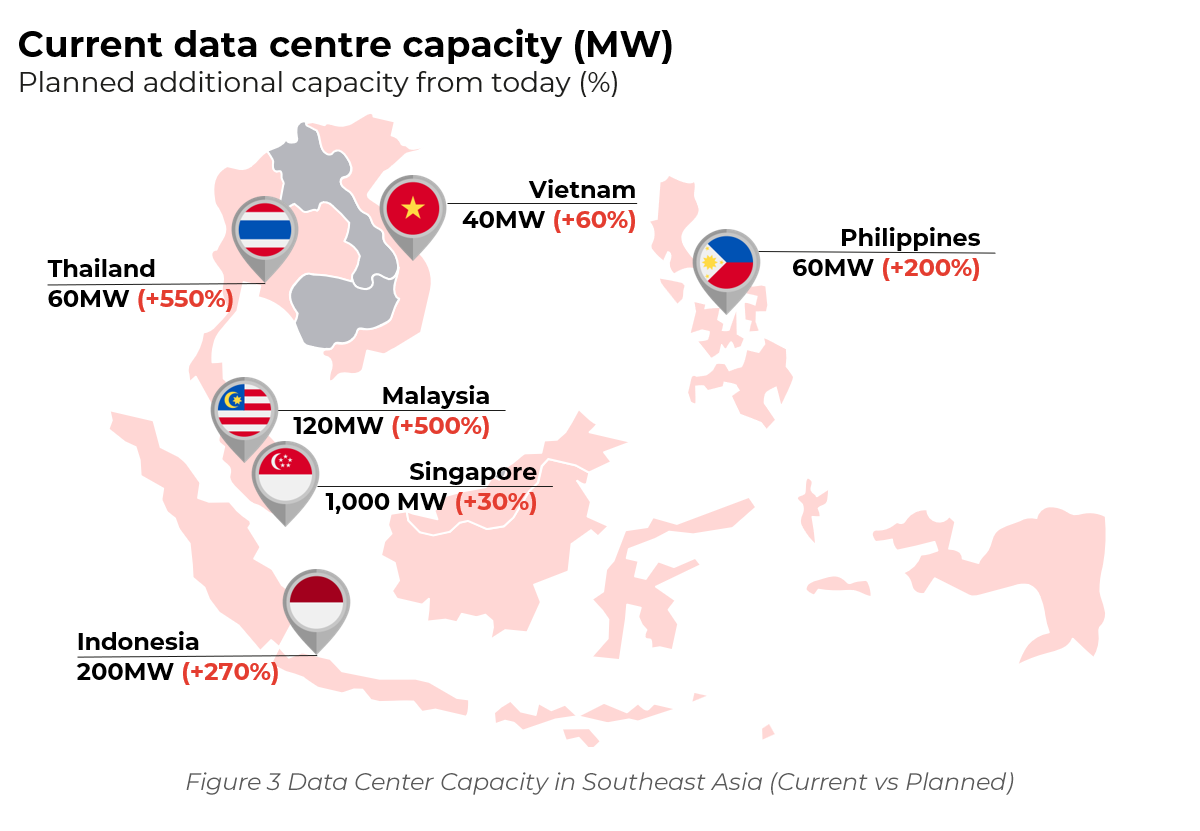

Population growth, rising incomes, and ASEAN’s role as a growing manufacturing and outsourcing hub are driving digital adoption at an unprecedented pace. Expanding middle-class consumption, e-commerce penetration, and cloud-based services are intensifying the need for scalable, high-performance data infrastructure. The surge in demand puts a high pressure on ASEAN’s digital infrastructure in data center capacity to keep pace. By 2024, the capacity of data centers in Southeast Asia is planned to increase by ~1.5X within SEA (vs 13% increase expected across APAC)[3] .

2. AI & High-Performance Computing (HPC) Drive Infrastructure Upgrades

The rise of AI, machine learning, and high-performance computing (HPC) is pushing demand for power-intensive, scalable data centers. ASEAN is emerging as a key market for hyperscale and edge data centers, supporting real-time processing needs for fintech, gaming, industrial automation, and smart city applications.

3. Governments Are Actively Supporting Data Center Expansion

Governments across ASEAN – especially Indonesia, Malaysia, and Vietnam – are actively incentivizing data center investment. They are offering tax breaks, investment-friendly policies, and regulatory clarity to attract global players.

- Thailand is offering corporate tax reductions and promoting its fast internet

- Vietnam is offering financial incentives in the research and development space, along with land rental exemptions and preferential credit.

- Singapore is framing itself as a start-up incubator hub, attracting top talent to the country’s tech ecosystem and tax reductions that encourage innovation.

- Malaysia also has its own raft of grants and incentives while Indonesia has focused on talent development in technology sectors.

4. ASEAN’s Digital Infrastructure Expands Beyond Singapore Amid Rising Localisation Trends

ASEAN’s geographic location provides seamless access to global submarine cable networks, making it a prime data center destination. Singapore remains a critical connectivity hub with 24 undersea cables, but land and power constraints are limiting further expansion. In response, regional hubs like Johor (Malaysia), Batam (Indonesia), and Bangkok (Thailand) are emerging as preferred alternatives, benefiting from lower land costs and increasing government support.

Furthermore, growing national confidence across ASEAN is driving regulation to demand more in-country positioning of digital infrastructure, such as data centers. This shift reflects a broader trend toward data sovereignty and localized digital infrastructure investment.

5. Data Localisation Mandates Are Reshaping Investment Strategies

With data sovereignty laws tightening in Thailand, Vietnam, Malaysia and Indonesia, companies are required to store and process data locally. This regulatory shift is forcing cloud providers, hyperscalers, and enterprises to invest in regional infrastructure, accelerating data center growth across ASEAN.

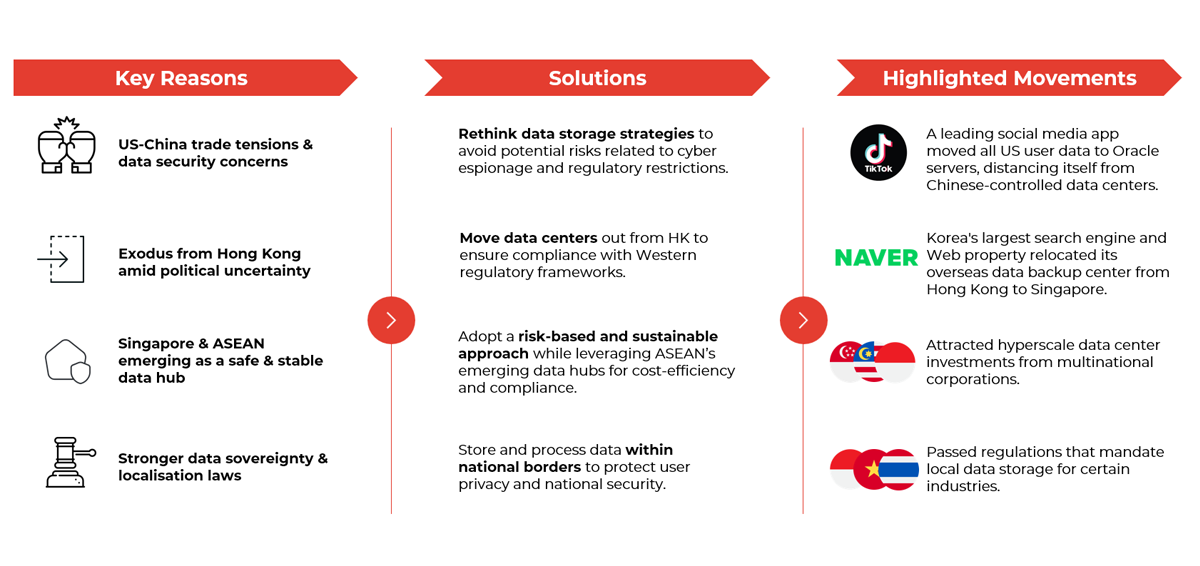

Global Uncertainty Accelerates Decentralisation

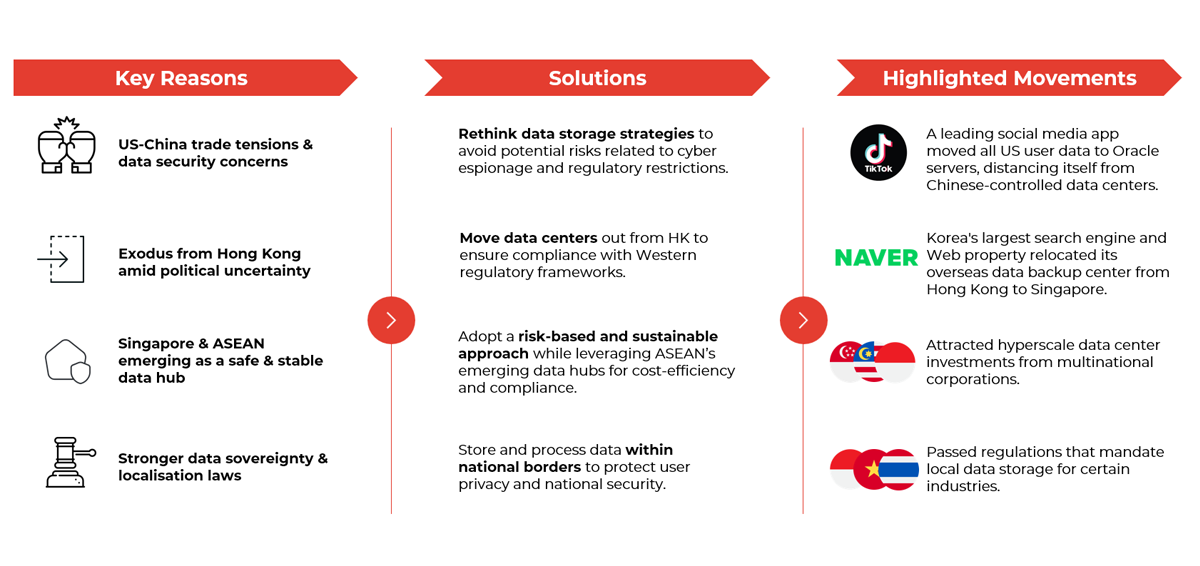

Shifting global geopolitical dynamics are accelerating data center investment in ASEAN, as businesses seek stable, compliant, and geopolitically neutral locations for digital infrastructure.

Rising US-China trade tensions and data security concerns have led multinational corporations to rethink their data storage strategies, prioritizing risk diversification and regulatory compliance. Many firms are relocating their regional data center operations from Hong Kong, following the shifting political climate, to ASEAN markets that offer stronger data sovereignty frameworks and reduced political risk.

Additionally, governments worldwide are tightening data localization laws, compelling companies to store and process data within national borders. This shift is driving hyperscalers and cloud providers to expand ASEAN-based infrastructure, leveraging the region’s growing network of compliant, cost-competitive data hubs.

Recent high-profile moves – such as TikTok migrating US user data to Oracle servers and Naver relocating backup data from Hong Kong to Singapore – highlight a broader trend: ASEAN is solidifying its position as a preferred destination for secure, scalable and geopolitically neutral data center investment.

2 | From Concentration to Distribution: ASEAN’s Evolving Data Center Landscape

Global Investment is Pouring into ASEAN

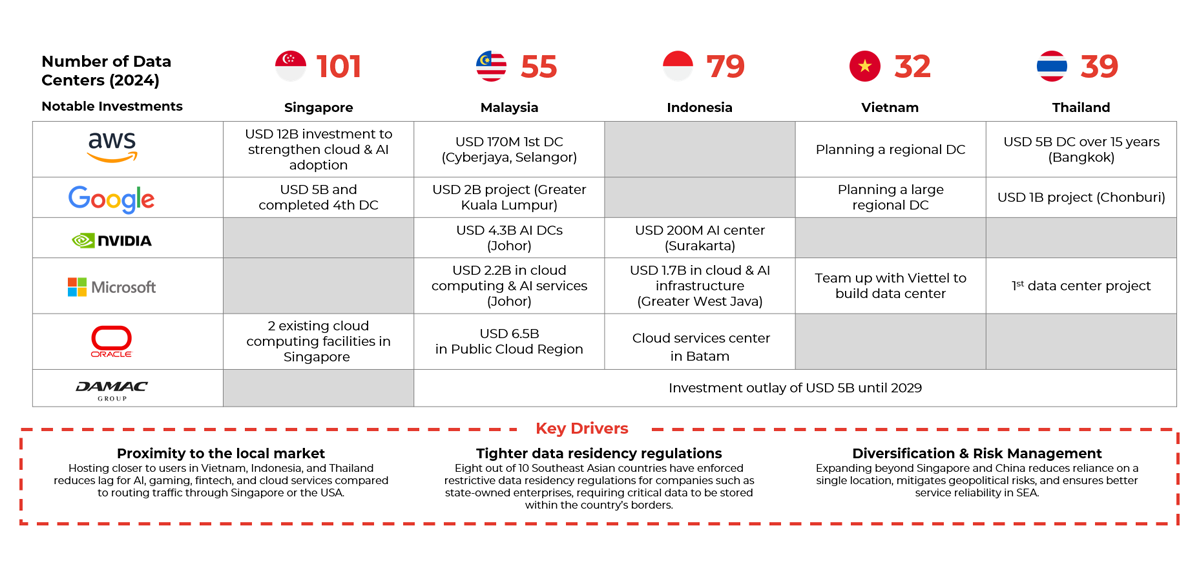

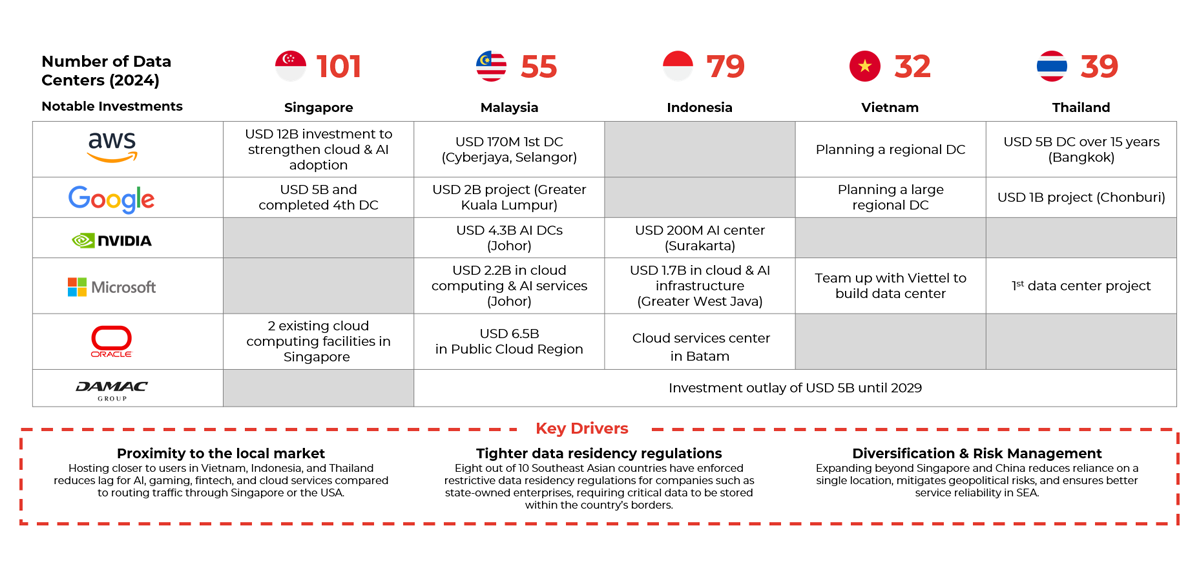

ASEAN’s digital economy is attracting unprecedented investment from global technology leaders, including the Magnificent 7 US-tech behemoths and global investors, e.g. from the Middle East, all racing to expand their regional data center footprint. These investments are not just accelerating but also decentralising, with companies increasingly diversifying beyond Singapore as the traditional hub to establish infrastructure across Malaysia, Indonesia, Thailand and Vietnam.

This shift is driven by three primary factors:

- Proximity to Fast-Growing Digital Markets: With Vietnam, Indonesia and the Philippines experiencing rapid digital adoption, hosting data centers closer to end-users significantly reduces latency – a critical factor for AI applications, gaming, fintech and cloud services.

- Evolving Regulatory Environment: ASEAN governments are tightening data sovereignty laws, requiring enterprises to store sensitive data locally. This has forced cloud providers and hyperscalers to invest in regional infrastructure rather than relying solely on Singapore.

- Diversification & Risk Management: Geopolitical and operational risks are prompting companies to decentralise their data center strategies. Expanding into multiple ASEAN locations ensures regulatory flexibility, resilience and scalability, securing long-term competitiveness in the region.

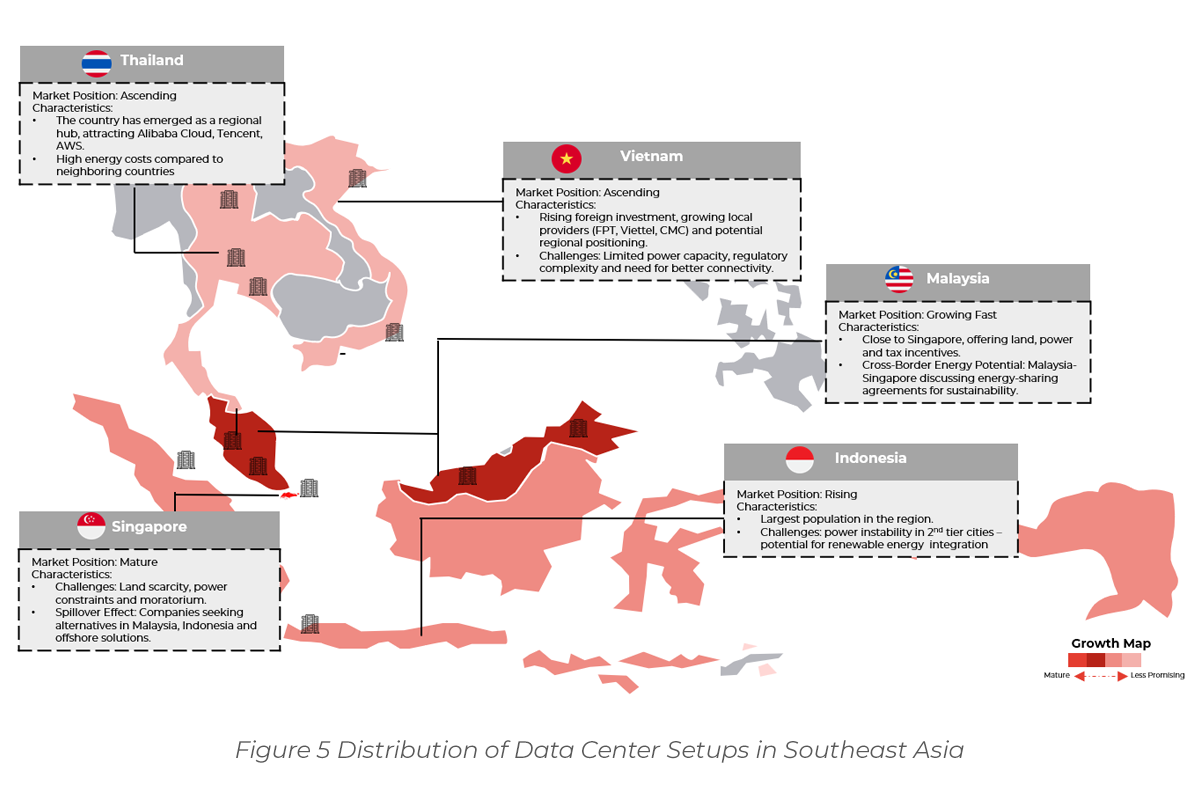

Singapore’s Position Shifts as ASEAN Data Centers Decentralise

Singapore has long been the dominant data center hub in ASEAN, leveraging its strategic geographic location, business-friendly policies and world-class connectivity. With over 600 MW of colocation capacity, the city-state has been the go-to destination for global cloud and enterprise infrastructure. However, new constraints are shifting investment flows toward emerging ASEAN markets.

Key Factors Driving Decentralisation:

- Supply Constraints in Singapore: Land scarcity and strict energy policies are capping Singapore’s data center expansion. The government has limited new approvals, prompting investors to explore alternative ASEAN locations.

- Stronger Data Localisation Regulations: Governments in Indonesia, Vietnam, Malaysia and Thailand have tightened data sovereignty laws, requiring local data storage for industries such as finance and state-owned enterprises. This makes Singapore a less viable option for hosting regulated workloads.

- Government Incentives in ASEAN: Recognising the economic benefits of data centers, Malaysia, Indonesia and Vietnam are actively offering tax breaks, streamlined approvals and infrastructure incentives to attract hyperscalers and enterprise IT firms.

- Emerging Edge & 5G Use Cases: The growth of IoT, AI and edge computing demands localised data processing to ensure low latency. Distributed urbanisation across ASEAN supports new data center deployments in tier-1 and tier-2 cities, catering to autonomous systems, fintech and cloud gaming.

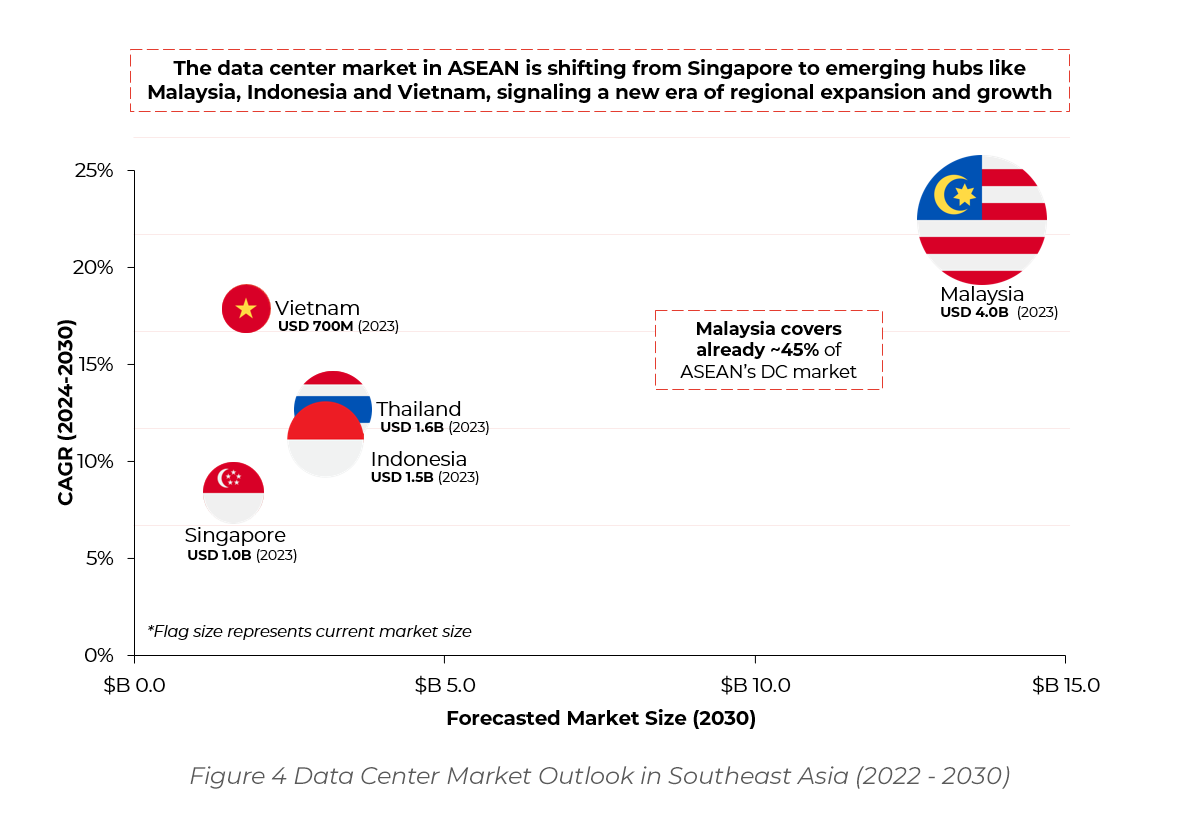

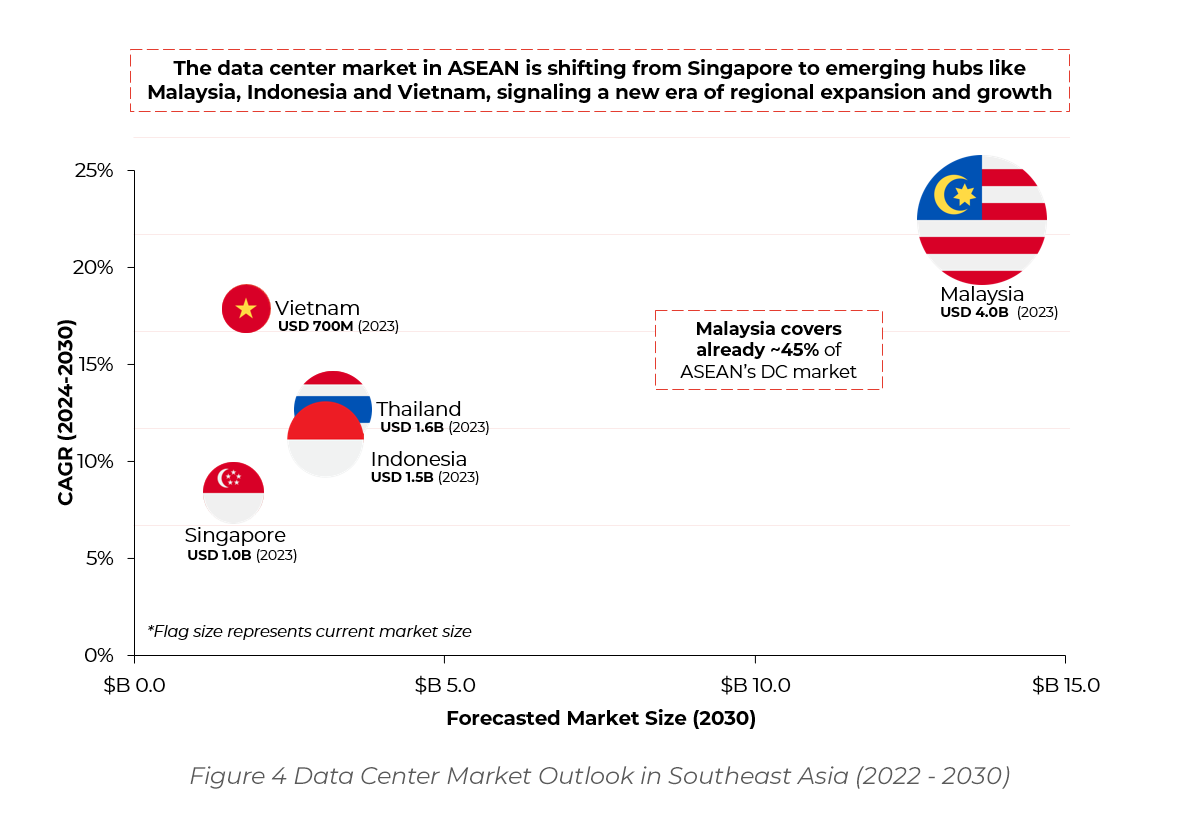

Malaysia Takes the Lead as ASEAN’s Data Center Hub

Among the emerging ASEAN data center markets, Malaysia has firmly established itself as the region’s new hub, attracting significant investments from major global tech firms, including the Magnificent 7. The country’s data center sector is projected to grow at a staggering 22% CAGR from 2023 to 2029, outpacing its regional peers[4] .

Malaysia’s strong value proposition for data center investors is underpinned by:

- Cost-competitiveness: Lower land and energy costs compared to Singapore allow for more scalable infrastructure deployment.

- Skilled workforce: Malaysia benefits from a well-educated talent pool, particularly in engineering, IT and data center operations.

- Robust digital ecosystem: The country has been investing in 5G networks, smart city initiatives and AI-driven data infrastructure, making it an attractive location for cloud and hyperscaler expansion.

Major US cloud giants and technology firms have already set up large-scale facilities, reinforcing Malaysia’s growing status as the preferred ASEAN alternative to Singapore for data center investments.

Meanwhile, significant movement is also observed in Thailand, where the Board of Investment (BOI) approved several data center and cloud service investment projects totaling USD 2.7 billion on 17 March 2025[5]. Three different operators are planning to provide 350 MW capacity, opening a possible pathway where Thailand may grow even faster than projected in the above graph. Indonesia, in fact, sees investment ongoing in a similar dimension as Thailand.

Expanding Beyond Tier 1 Cities – Data Centers Spread Across ASEAN

As data center demand surges, investments are no longer concentrated in capital cities or traditional hubs. Instead, a wave of decentralisation is unlocking opportunities in tier 1 and tier 2 cities. Key locations such as Johor (Malaysia), Batam (Indonesia), Hanoi (Vietnam) and Chonburi (Thailand) are seeing strong data center development driven by local demand, government incentives and improved infrastructure.

This geographic diversification supports the rise of new economic hubs, fosters technology transfer, job creation and regional development beyond primary metropolitan areas. By spreading infrastructure investments across multiple cities, ASEAN is ensuring a more balanced and resilient digital economy while reducing congestion and over-reliance on traditional data center markets.

3 | Expanding Ecosystem Creates Complexity & Unlocks Opportunities

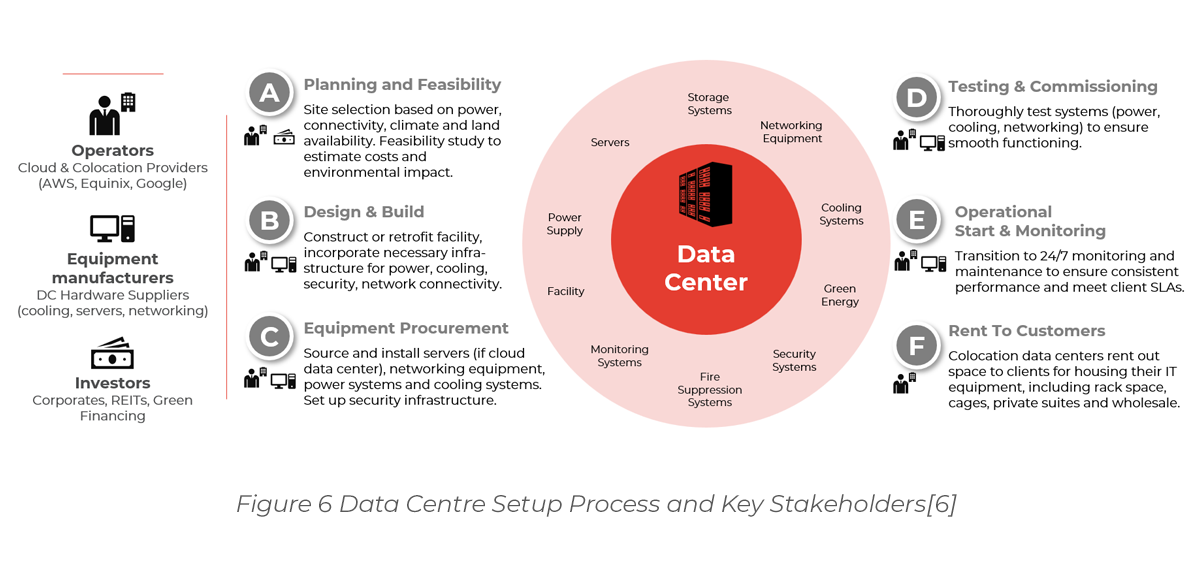

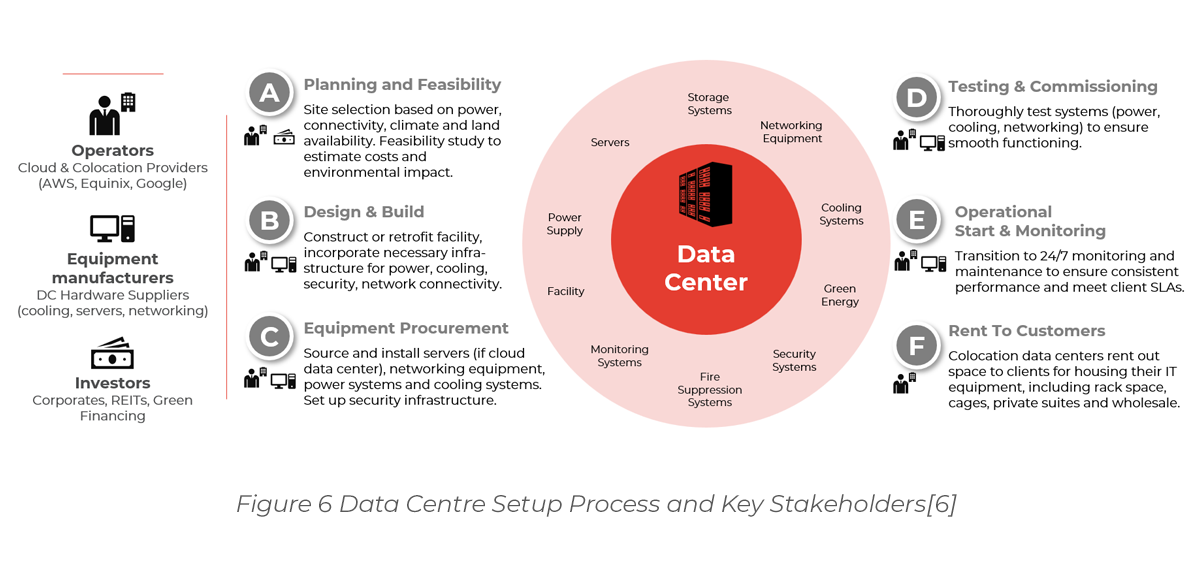

With the growing demand for advanced digital infrastructure across the region, data center operators are under increasing pressure to deliver reliable and sustainable solutions. Equipment manufacturers (EMs) hence collaborate much closer with operators in the data center setup process to create tailored solutions.

This section explores five key opportunities from the perspective of the following stakeholder groups:

- Operators: Cloud and colocation providers such as AWS, Equinix and Google, who manage and operate data centers and provide storage, computing and networking resources to businesses and consumers.

- Equipment Manufacturers: Data center hardware suppliers specialising in cooling systems, servers and networking equipment.

- Investors: Corporates, Real Estate Investment Trusts (REITs) and Green Financing Firms looking for high-ROI opportunities.

Rising technical requirements – driven by the need for higher-quality equipment and stricter sustainability demands from host locations – are prompting companies to clearly define their market positioning amid an expanding range of business models and operational strategies. Simultaneously, growing interest from major tech players is elevating investment ticket sizes, encouraging further specialisation across the data center ecosystem. Equipment manufacturers are also increasingly involved in data center setup.

Evolving Ecosystem Complexity Unlocks Opportunities

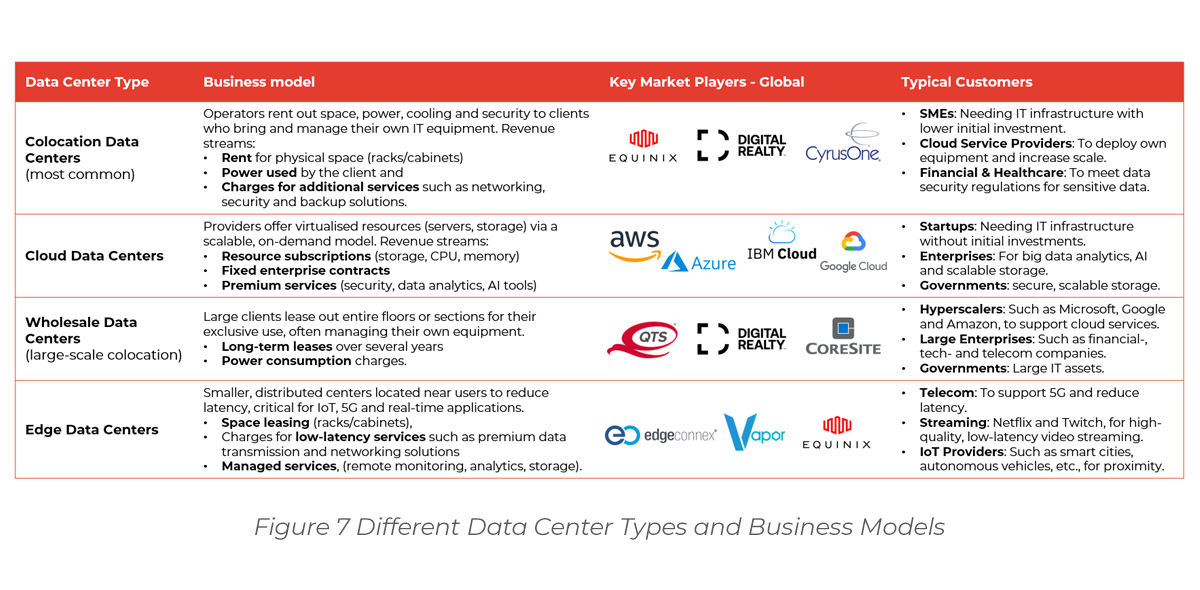

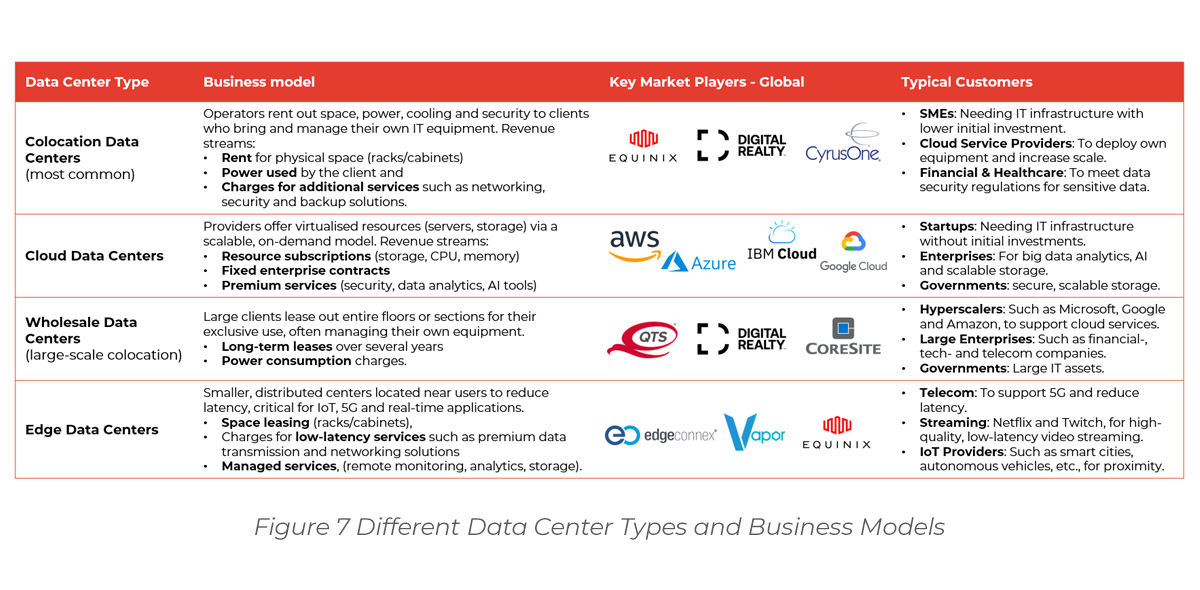

1. Evolving Business Models to Serve Diverse Customer Needs

ASEAN’s growing data center market is giving rise to new business models designed to address increasingly diverse customer requirements. To remain competitive, operators must differentiate themselves through factors such as hyperscale versus colocation models, energy efficiency, specialized services and distinct ownership structures. These decisions significantly influence the data centers’ architecture, operational scale, connectivity, security standards and service quality, ultimately determining their ability to attract long-term tenants and capture market share.

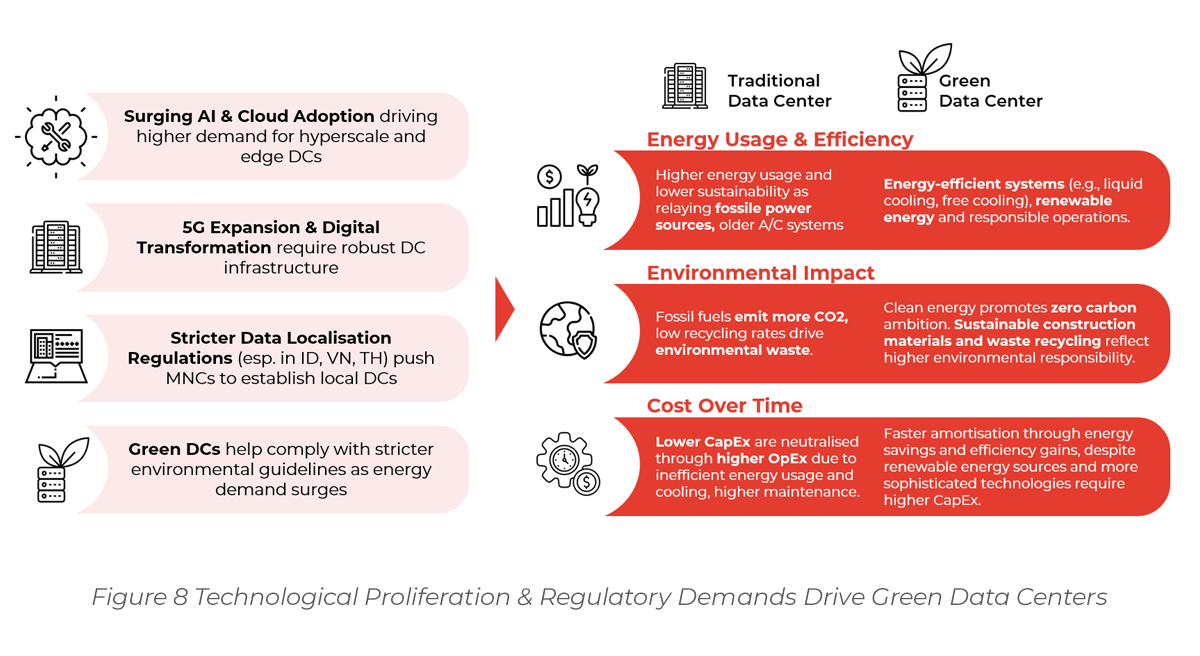

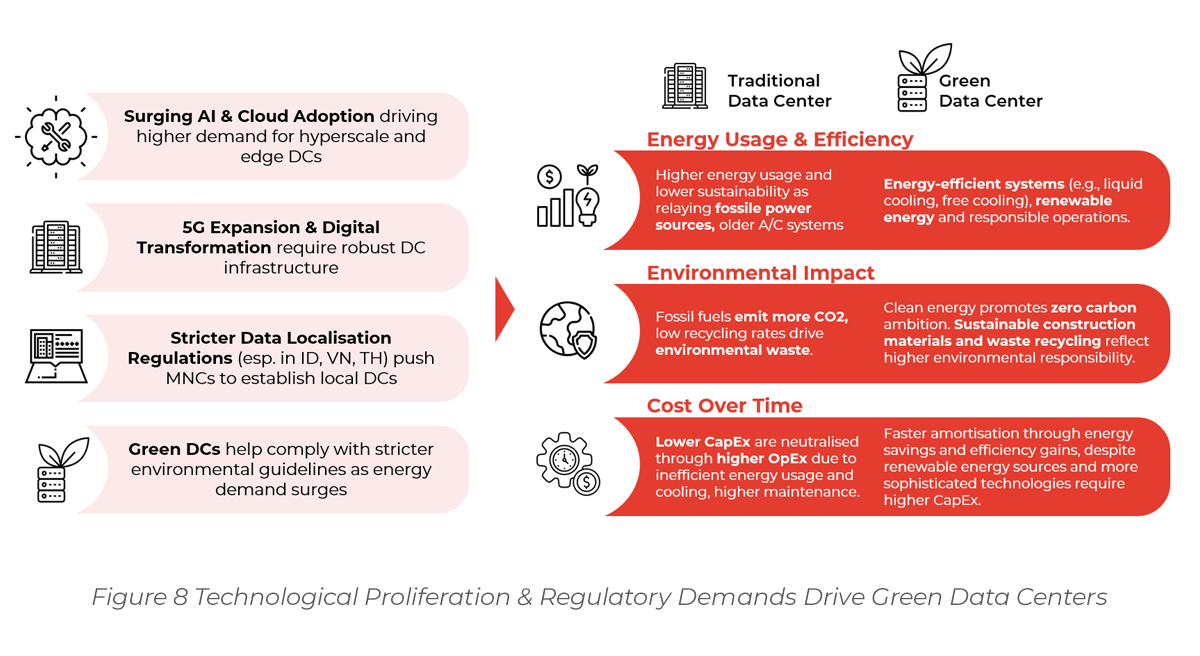

2. Sustainability Pressures & Rising Energy Demand Drive Green DCs

Exponential energy consumption is becoming a defining challenge for the industry. AI-powered applications, high-performance computing (HPC) and cloud workloads require significantly more electricity than previous generations of data centers. For example, according to the IEA, a ChatGPT query consumes about 2.9 watt-hours of power, almost. 10 times that of a traditional Google search, illustrating the mounting power requirements.

These challenges are accelerating the adoption of green data centers. Companies are investing in renewable energy sources, high-efficiency cooling and sustainability-linked financing to align with ESG mandates while controlling long-term operating expenses (OPEX).

3. Infrastructure & Equipment Innovation: Balancing Cost, Performance & Sustainability

The ASEAN data center market is set to grow at a CAGR of 9.6% through 2029[7] , with construction-related investments expanding at 11.2%. This growth is driving demand for high-performance equipment, particularly cooling systems, which are expected to reach USD 5.7 billion[8] by 2029 (10.1% CAGR).

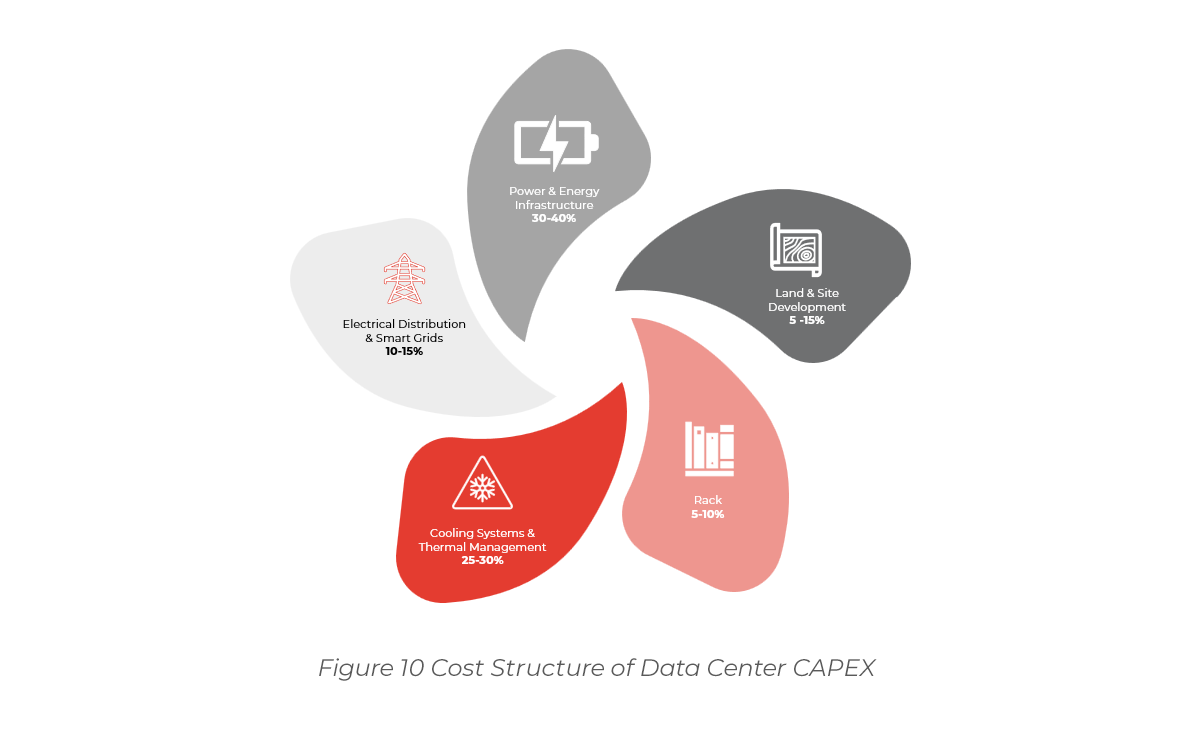

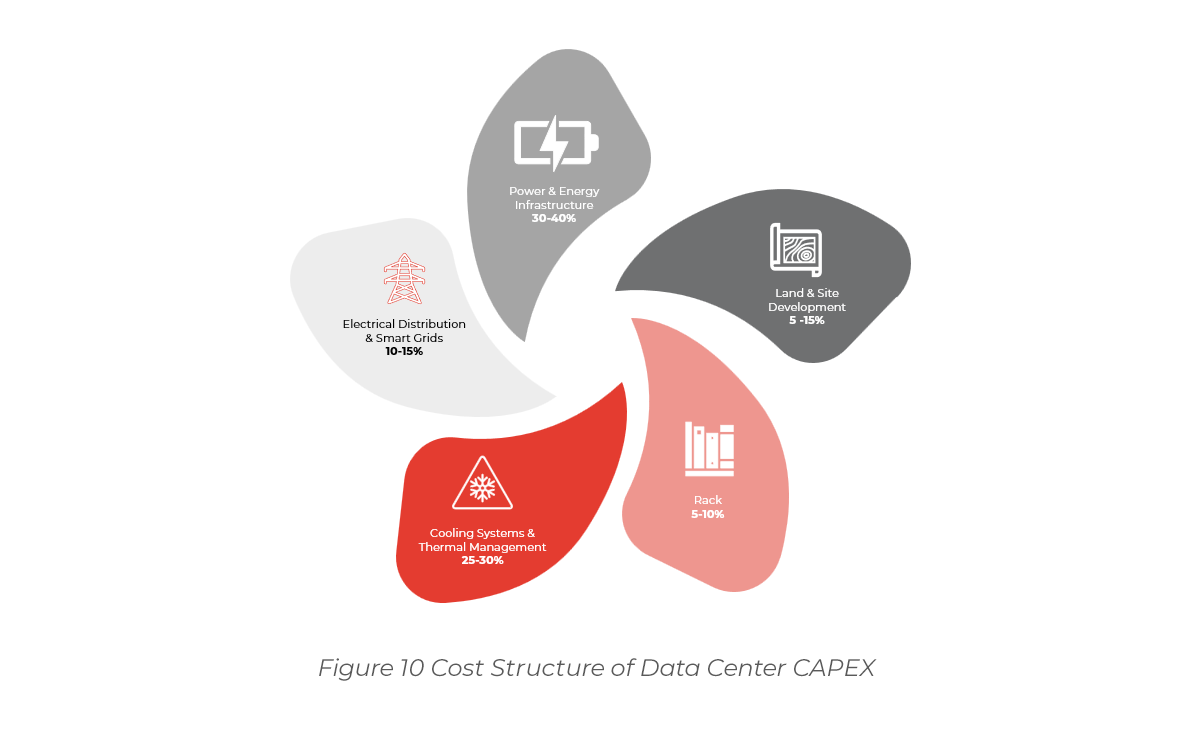

Balancing CAPEX and OPEX remains a critical challenge. Equipment accounts for 40-50% of total capital expenditure, forcing operators to balance upfront costs with long-term operational efficiency. While lower-cost equipment may reduce short-term expenses, inefficiencies often lead to higher lifetime costs. As a result, investors are prioritising performance-driven solutions in cooling, energy efficiency and power management to optimise long-term competitiveness and sustainability.

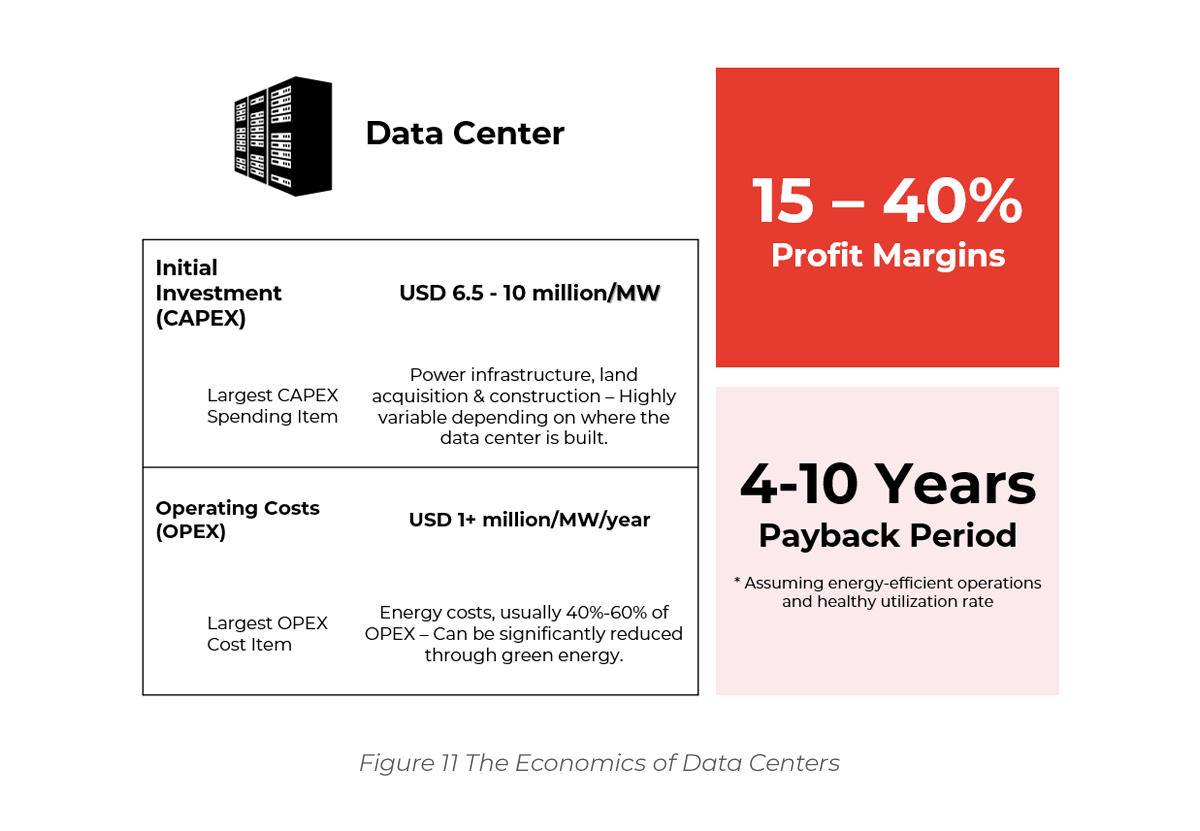

4. Attractive Investment Profile – High Margins, Low Cost, Fast ROI

ASEAN’s data center market offers one of the most attractive investment opportunities globally, with profit margins of 15-40%[9] and payback periods of 4 to 10 years[10]. This draws real estate developers, industrial estate operators and infrastructure investors seeking stable, long-term returns.

Data centers benefit from predictable, long-term contracts (typically three years or more), ensuring stable cash flow and MW-based billing models that generate recurring revenue. While green data centers require higher upfront CAPEX, they align with ESG mandates in Malaysia and Singapore, making them increasingly attractive to both regulators and sustainability-focused investors.

Among ASEAN markets, Indonesia is the largest revenue-generating country (USD 3.1 billion in 2023), followed by Thailand (USD 2.2 billion) and Vietnam (USD 2.0 billion)[11]. This underscores the region’s strong digitalisation trends, cost advantages and infrastructure expansion, reinforcing its investment appeal.

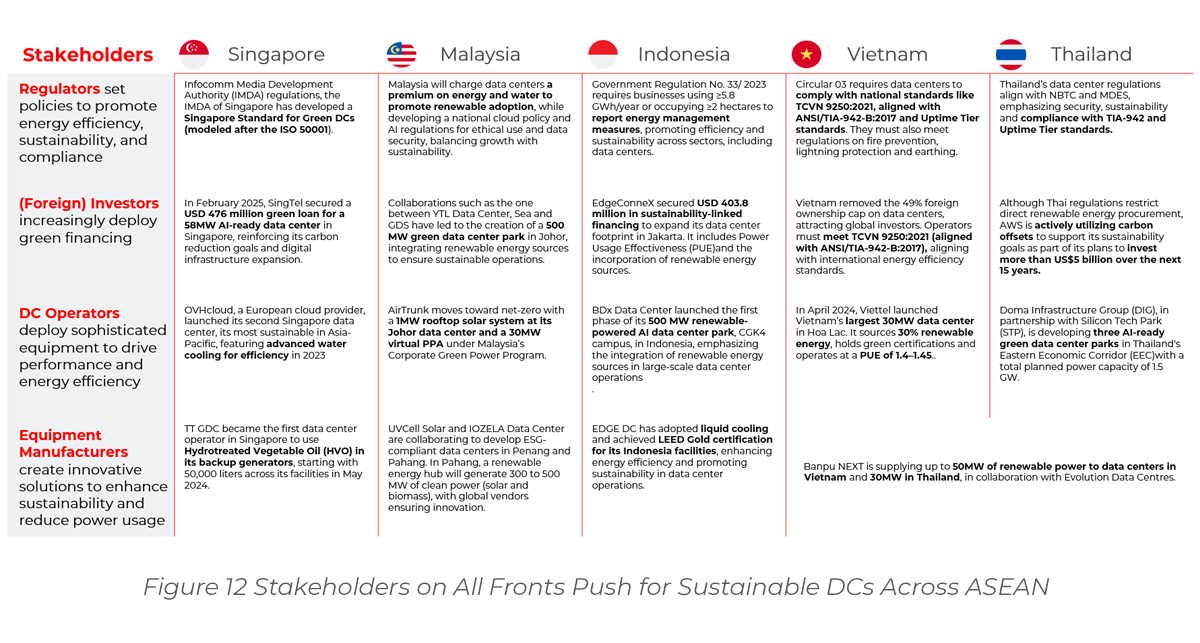

5. The Sustainability Imperative in ASEAN’s Data Center Growth

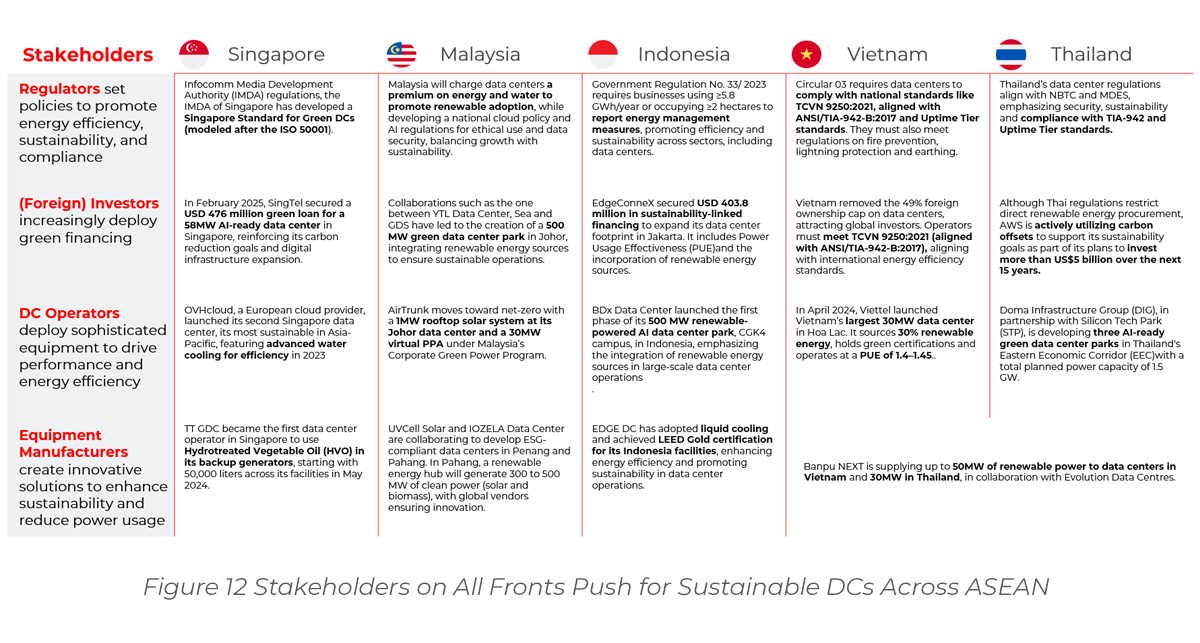

The transition to sustainable data centers in ASEAN is being driven by key stakeholders across regulatory bodies, investors, data center operators and equipment manufacturers, each playing a critical role in shaping the region’s infrastructure.

- Regulators are setting policies to ensure energy efficiency, sustainability and compliance. Singapore has introduced the Singapore Standard for Green DCs, modeled after ISO 50001, while Indonesia mandates energy management reporting for businesses consuming over 5.8 GWh annually. Similarly, Vietnam enforces national energy efficiency standards for data centers, aligning with global best practices.

- Investors are increasingly deploying green financing to support sustainable projects. A key example is SingTel’s USD 476 million green loan for a 58MW AI-ready data center in Singapore, reinforcing the trend of financial backing for low-carbon infrastructure. In Indonesia, EdgeConneX secured USD 403.8 million in sustainability-linked financing to expand its data center footprint, emphasizing the integration of renewable energy sources.

- Data Center Operators are advancing high-performance and energy-efficient solutions. Companies like OVHcloud in Singapore are pioneering advanced water cooling for efficiency, while Viettel in Vietnam launched a 30MW data center sourcing 30% renewable energy. AWS e.g. in Thailand utilises carbon offsets to align with sustainability targets[14].

- Equipment Manufacturers are playing an increasingly important role in delivering innovative solutions for energy-efficient data centers. Australian-based AirTrunk is integrating rooftop solar systems and virtual PPAs (Purchase Power Agreements) into their data center campus in Johor Bahru, while Indonesia’s EDGE DC has adopted liquid cooling and achieved LEED Gold certification, ensuring operational sustainability[15].

Together, these stakeholders are driving rapid advancements in sustainable data center infrastructure, reinforcing ASEAN’s position as a key hub for digital expansion and green technology adoption.

| Actionable Strategies

The rapid expansion of ASEAN’s data center market unlocks targeted opportunities across the value chain, particularly benefiting three core stakeholder groups crucial to the sector’s future growth: Operators, Equipment Manufacturers and Investors. These stakeholders can take decisive steps today to capitalize on Southeast Asia’s digital transformation

Operators:

Rapidly diversify footprint: Accelerate deployment in Vietnam, Indonesia and Thailand to meet rising demand driven by data sovereignty laws and latency requirements.

Invest in AI and renewable energy: Implement AI-driven optimization and renewable power sources to achieve competitive operational efficiency and sustainability benchmarks.

Build strategic grid partnerships: Collaborate proactively with local utilities for energy integration and advanced storage solutions, ensuring reliable uptime and reduced operational costs.

Equipment Manufacturers:

Develop specialized ASEAN-centric technologies: Create AI-enhanced, high-efficiency cooling and energy management solutions specifically tailored to tropical climates and local regulatory requirements.

Lead joint innovation initiatives: Establish co-development partnerships with data center operators to deliver integrated grid storage, innovative cooling and climate-adaptive infrastructure solutions.

Proactively align with regulatory standards: Ensure product development strategies anticipate and exceed evolving ASEAN regulatory frameworks around efficiency and environmental sustainability

Investors:

Fund integrated infrastructure platforms: Invest strategically in end-to-end data center ecosystems – covering real estate, power supply, and advanced connectivity – to leverage vertical integration opportunities.

Champion green and sustainability-linked finance: Deploy ESG-compliant funding mechanisms to attract sophisticated capital pools, achieving competitive differentiation and higher returns.

Drive market consolidation proactively: Identify and execute strategic M&A deals and partnerships to rapidly gain scale in high-growth markets, leveraging early-mover advantages in Indonesia, Malaysia, and Vietnam. EU-based companies are uniquely positioned to leverage their expertise and resources to secure significant roles within ASEAN’s rapidly expanding data center ecosystem. Contact us today to begin your successful expansion into this vibrant and strategically important market.

Download

Click here to download this article as a .pdf document.

References

[1] Bain, Google and Temasek Report 2024

[2] Arizton

[3] Google, Bain and Temasek Report 2024

[4] Globe Wire Research

[5] Thailand Board of Investment Updates

[6] The stakeholder icons beneath each process represent the key stakeholders involved at that particular stage.

[7] Alarar Capital Group’s Analysis

[8] Arizton

[9] Alarar Capital Group’s Analysis

[10] Expert interviews

[11] Maybank

[12] Channel News Asia, W.Media

[13] Dorna Singtel, Fintech News, EdgeConnex

[14] Channel News Asia, W.Media

[15] AirTrunk, EdgeConnex, W.Media