I. Executive Summary

Multinational firms are facing mounting pressure to diversify their supply chains in a time of growing geopolitical risks and ongoing global disruptions. Despite its economic benefits, the long-standing reliance on China’s manufacturing base has revealed serious weaknesses. Companies that start diversification strategies, however, face the sobering fact that alternative sourcing markets are too small and immature in terms of quality to handle a big and sudden change.

A significant risk highlighted by recent data is the scarcity of reliable, certified suppliers outside of China. Their capacity is quickly getting close to saturation as the demand for these suppliers increases. To ensure supply continuity and preserve long-term competitiveness, strategic action is now needed.

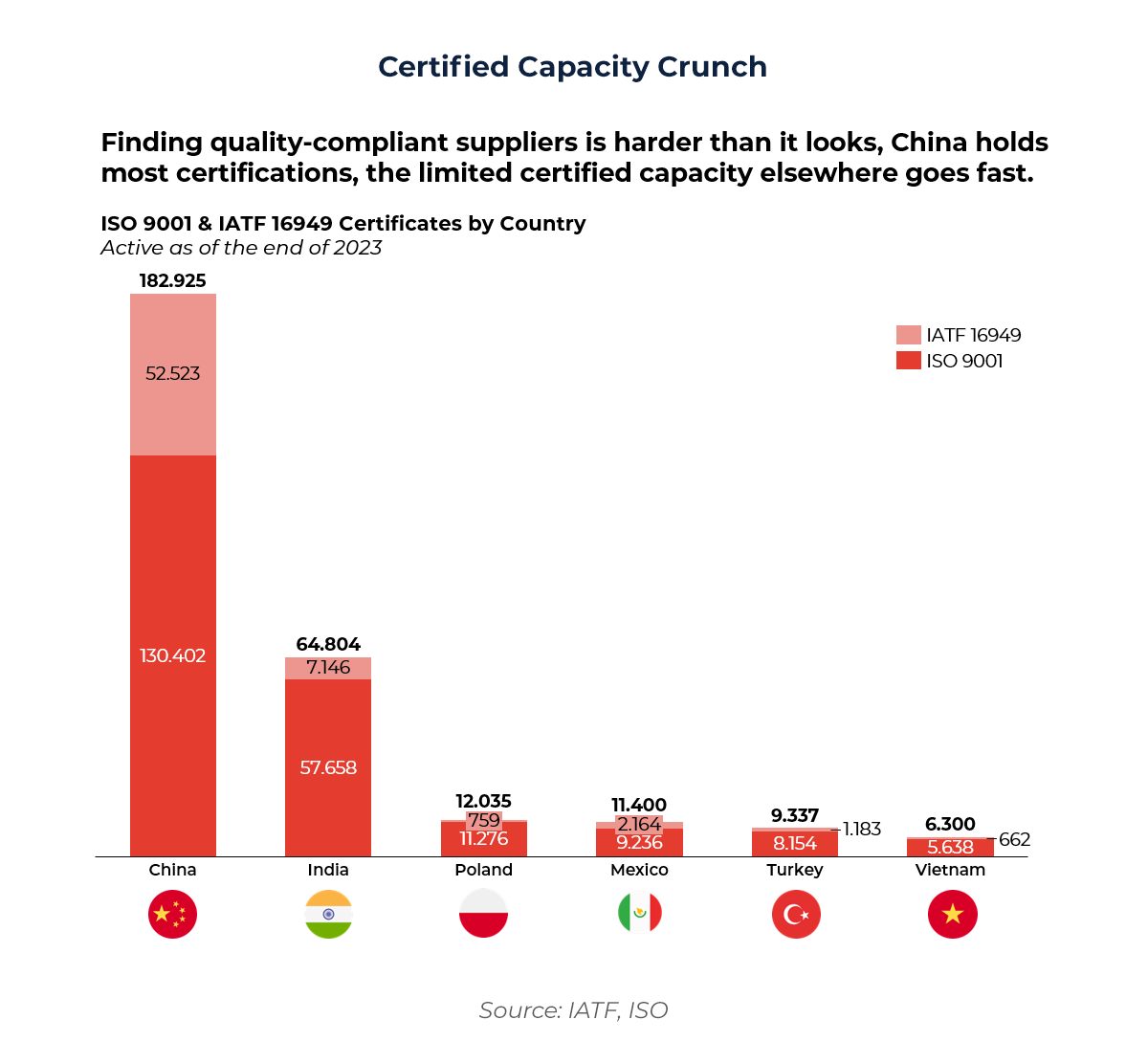

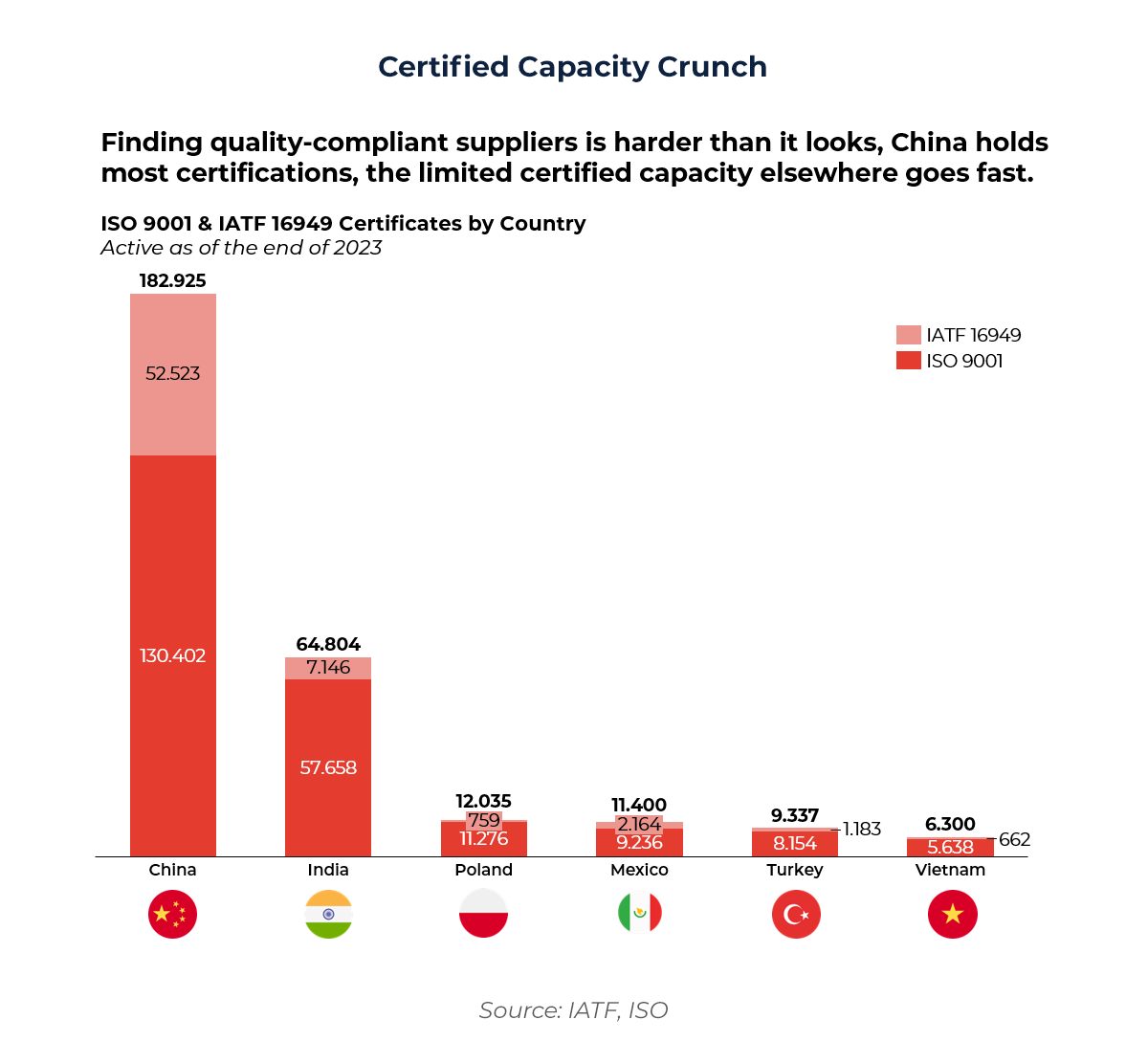

II. China’s Dominance in Certified Supply Infrastructure

China’s industrial scale and high-quality infrastructure continue to be unmatched. China currently has 182,925 active ISO 9001 and IATF 16949 certifications, of which 130,402 are ISO 9001 and 52,523 are IATF 16949. The next-largest source of certified suppliers, India, has only 64,804 certifications, while Poland, Mexico, Turkey, and Vietnam lag far behind.

China’s dominance in manufacturing volume and the quality systems that multinational corporations demand are both reflected in this data. Automotive and other high-precision industries require IATF 16949 certifications in particular, and their scarcity in emerging markets suggests a significant bottleneck for businesses looking for compliant suppliers outside of China.

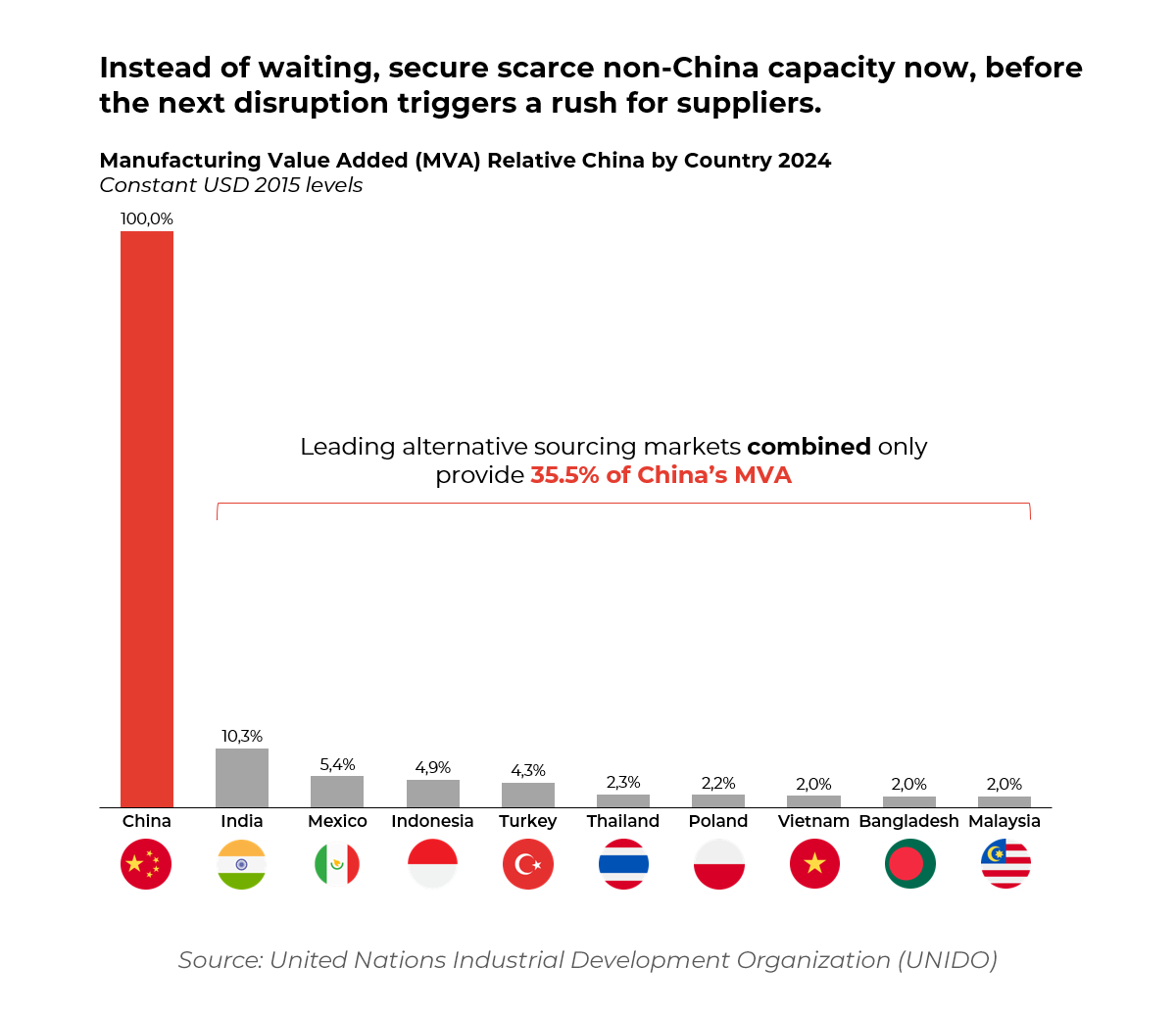

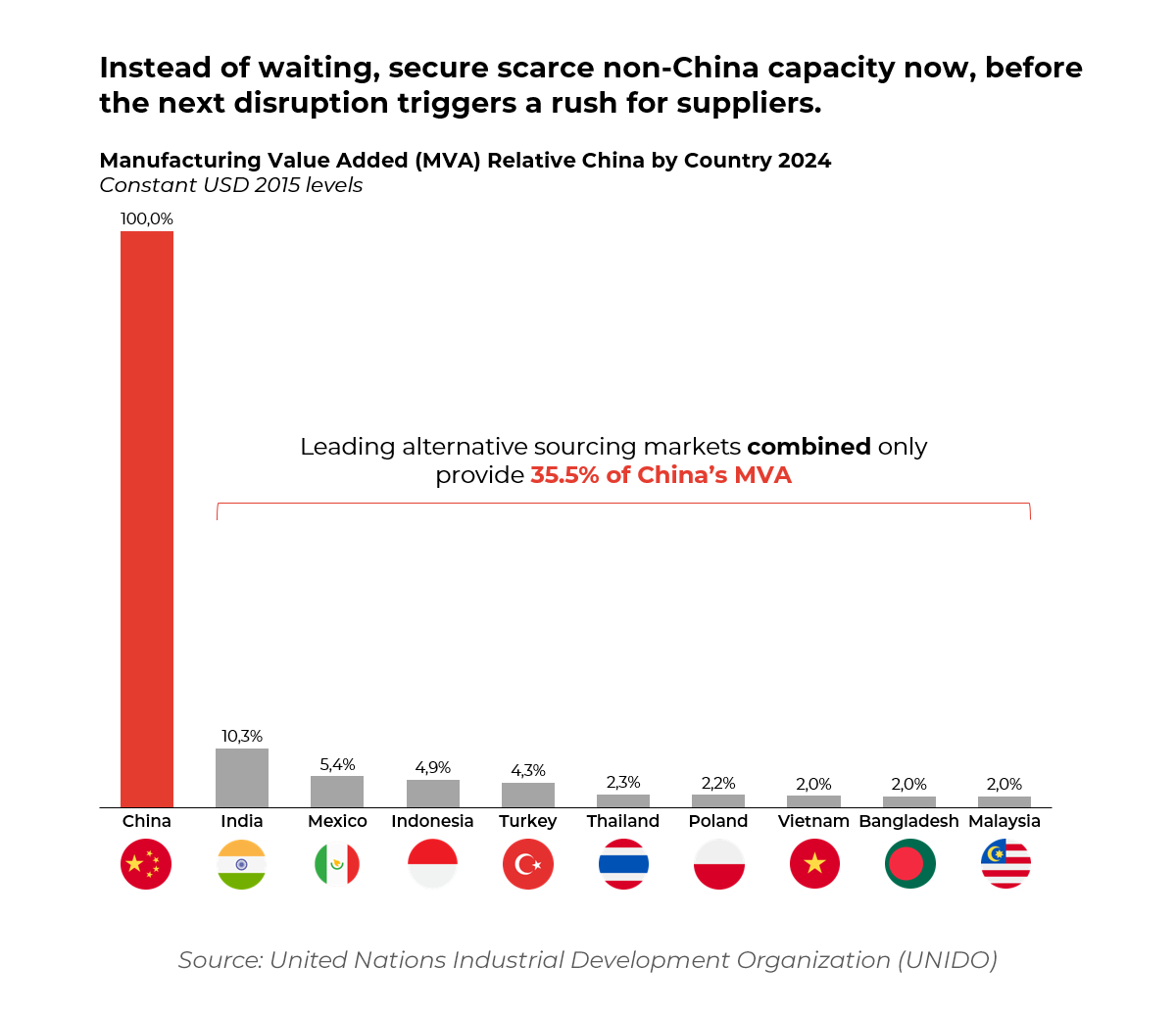

III. The Structural Constraint: Limited Manufacturing Capacity

Beyond certification, the broader industrial base outside China is comparatively underdeveloped. As illustrated by Manufacturing Value Added (MVA) metrics from the United Nations Industrial Development Organization (UNIDO), leading alternative sourcing markets combined represent only 35.5% of China’s manufacturing output (based on constant 2015 USD values).

This structural limitation represents a critical constraint on large-scale supply chain realignment. While alternative markets are attracting increased foreign direct investment, their ability to meet the volume, quality, and timeline expectations of multinational corporations remains a significant challenge.

IV. Strategic Risk: Capacity Saturation and Supply Imbalance

The growing demand for compliant, capable suppliers outside China is quickly overwhelming the available certified capacity. As leading multinational corporations pursue parallel diversification strategies, high-performing suppliers in emerging markets are reaching operational limits. This trend presents several risks:

- Extended onboarding and qualification timelines

- Upward cost pressure due to demand-driven scarcity

- Limited supplier selection leading to potential quality variability

Late-stage entrants to alternative markets may face difficulty in securing adequate capacity or may be compelled to accept compromises on quality, delivery timelines, or pricing.

V. Development Trajectory: Progress With Constraints

While there is observable progress in key regions such as India, Mexico, and Vietnam, supplier development remains uneven. For example:

- India, with over 64,000 certifications, is emerging as a focal point for electronics and automotive assembly, evidenced by large-scale shifts such as Tata Electronics’ partnership with Apple.

- Vietnam continues to attract investment in textiles and consumer electronics, supported by its proximity to East Asia and favorable trade terms.

- Mexico offers proximity advantages for U.S.-based firms, benefiting from the USMCA and increasingly robust industrial clusters.

However, despite this progress, the speed of supplier development does not yet match the pace of global corporate demand. Investments in infrastructure, talent development, and quality systems are ongoing but require years to reach maturity levels seen in China.

VI. Strategic Recommendations for Multinational Corporations

To mitigate future risk and ensure continued operational resilience, it is imperative for global enterprises to adopt a proactive and phased approach to supply chain diversification:

- Phased Realignment:

Gradual relocation of specific product lines or geographies to alternative sourcing markets can minimize disruption while building internal expertise in new regions.

- Supplier Development Investment:

Co-investing in supplier capability building—through technical training, compliance support, and infrastructure financing—can accelerate readiness and secure long-term alignment.

- Capacity Lock-in Through Strategic Partnerships:

Engaging in long-term contractual agreements and joint ventures with top-tier suppliers can secure production bandwidth ahead of competitors.

- Technology-Enabled Visibility:

Leveraging digital tools to monitor supplier performance, track lead times, and manage risk exposure is essential in navigating emerging market complexity.

VII. Conclusion: A Narrowing Window of Opportunity

The global supply chain landscape is undergoing a significant transformation. China will continue to play a central role in manufacturing, but the concentration risk is no longer tenable. While the case for diversification is well understood, the data now provides urgency: certified capacity beyond China is finite, and it is being rapidly consumed.

Multinational corporations must act decisively. Securing access to high-quality alternative suppliers requires lead time, strategic commitment, and investment. Those who delay may find themselves outpaced, outbid, or unable to meet their own quality and resilience standards.

Author:

Chulisa Nguyen

Associate