Global capital markets in 2025 reflects a complex environment. While inflationary pressures have eased and sentiment in the public markets is gradually improving, issuers face a materially different regulatory backdrop. For those preparing to access the public markets, adapting to new listing frameworks and evolving investor expectations has become a critical part of the capital formation process.

Among the most consequential developments: Nasdaq’s newly approved listing requirements, effective April 11, 2025. These changes reshape the path to becoming a public company, especially for small to mid-sized issuers and those seeking to uplist from OTC exchanges.

At Alarar Capital Group, we support our clients in navigating regulatory developments with clarity and precision. Our team works closely with each company to structure capital strategies that align with evolving market standards, support long-term growth, and ensure readiness for successful market entry.

A Market Reawakening — With New Conditions

After a restrained period in 2023 and 2024, equity capital markets are showing signs of renewed momentum. Stabilizing macroeconomic indicators and growing investor confidence are contributing to a more favorable environment for capital raising in the second half of 2025.

At the same time, many companies that postponed IPO plans in recent years are now preparing to reengage with the market, pointing to a buildup of delayed activity.

This re-entry, however, is taking place within a changed regulatory landscape — particularly for those seeking to list on Nasdaq.

What Changed: Nasdaq’s New Listing Requirements (Effective April 11, 2025)

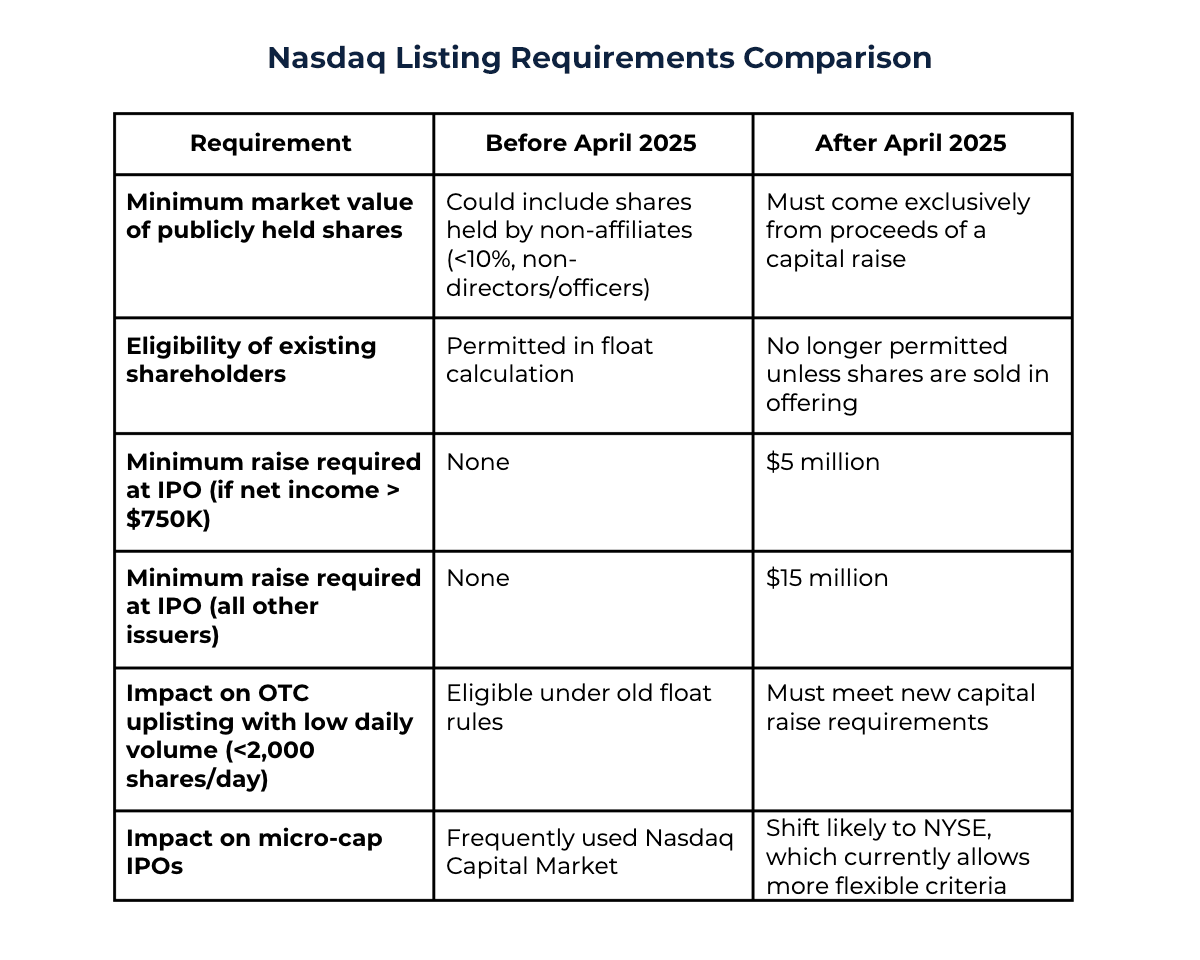

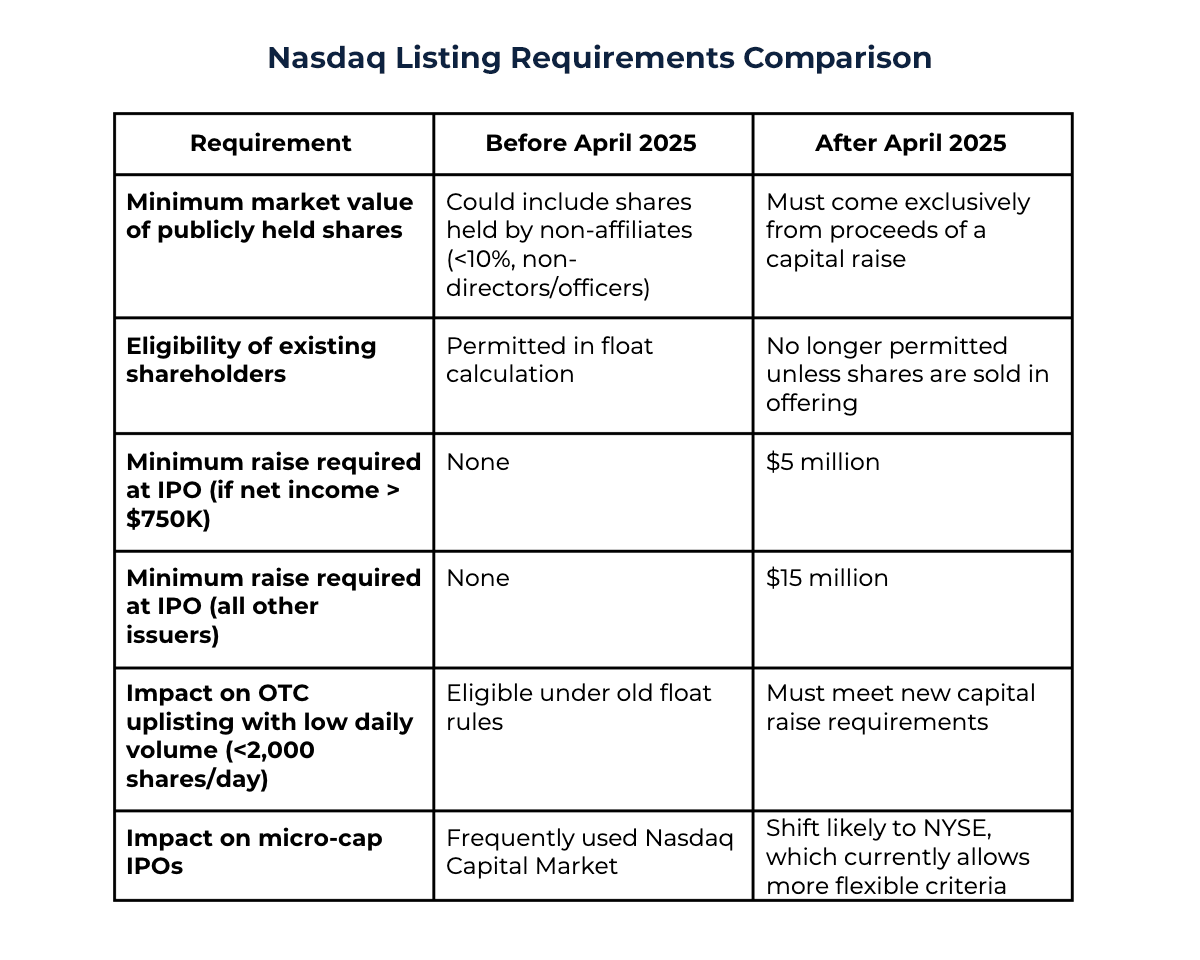

In a move aimed at improving post-listing stability, Nasdaq tightened its initial listing standards. The most impactful change: companies must now meet the minimum market value of publicly held shares using proceeds from a capital raise, not existing shareholders.

This rule disproportionately affects small and mid-cap companies, particularly those pursuing uplisting from OTC or planning smaller IPOs. Learn more about the SEC’s approved updates to Nasdaq listing requirements here.

The following table outlines how requirements have changed:

Why Nasdaq Changed the Rules and What It Means

Why Nasdaq Changed the Rules and What It Means

The intent behind these changes is to curb volatility. Nasdaq observed that companies relying on “free float” from passive, low-volume shareholders often suffered from poor liquidity and price instability post-listing.

By requiring capital to be raised as part of the listing process, Nasdaq aims to improve price support, attract institutional participation, and strengthen investor confidence in small and mid-cap IPOs.

But for issuers, the implications are significant:

- Higher cost of going public: More dilution, legal, and underwriting expenses.

- Tighter timelines and higher expectations: Pre-IPO fundraising, investor engagement, and underwriter alignment must be handled earlier and with more rigor.

- Increased shift to NYSE: With Nasdaq now enforcing stricter entry barriers, many micro-cap and mid-cap issuers are considering NYSE, where minimum capital raise thresholds remain more flexible.

Strategic Responses: How Alarar Capital Group Helps Clients Navigate

Alarar Capital Group advises companies at all stages of their capital markets journey. In the wake of Nasdaq’s rule change, our role has become more critical than ever. We help clients think beyond the listing — and develop strategies that align capital structure, market timing, and investor expectations.

1. IPO Structuring and Timing

We assist clients in recalibrating IPO timelines and raise sizes to meet the new criteria — whether by adjusting investor outreach, sequencing capital rounds, or selecting the right exchange.

2. Alternative Listing Paths

For companies that may not yet meet the new thresholds, ARC supports:

- Reverse takeovers (RTOs)

- De-SPAC mergers (ARC is a global leader in De-SPACs by transaction count and value)

- Dual-track processes to maintain optionality

Alarar Capital Group has advised on over $10 billion in transactions across SPACs, IPOs, and structured financing. The firm has acted as advisor to both SPAC sponsors and target companies and has consistently ranked among the top three globally for De-SPAC transactions since 2022.

3. Pre-IPO Investor Engagement

To meet Nasdaq’s demand for stronger shareholder support, we work with clients to build a pre-IPO base of institutional and strategic investors. This not only aids eligibility but ensures post-listing stability and valuation support.

4. Cross-Border Capital Strategies

As a global investment bank with deep roots in Asia and Europe, we support international issuers navigating U.S. listing requirements — including coordination of legal, accounting, and underwriter due diligence to ensure compliance with the new rules.

May 2025 Update: Early Impacts of Nasdaq’s Listing Rule Changes

Since the implementation of Nasdaq’s revised listing requirements on April 11, 2025, the capital markets have observed notable shifts in listing activities and issuer strategies.

Increased Scrutiny and Capital Requirements

The new rules mandate that companies meet the Market Value of Unrestricted Publicly Held Shares (MVUPHS) solely through the proceeds of a public offering, excluding previously issued shares registered for resale. This change has led to heightened scrutiny of IPO candidates’ capital structures and fundraising strategies. Lexology+3Cooley PubCo+3Listing Center+3

Impact on Small and Mid-Cap Companies

Smaller companies, particularly those aiming to uplist from over-the-counter (OTC) markets, are facing challenges in meeting the increased capital raise requirements. This has resulted in some issuers postponing their listing plans or exploring alternative financing avenues.

Shift Toward Alternative Exchanges

The stricter Nasdaq requirements have prompted certain issuers to consider listing on other exchanges, such as the New York Stock Exchange (NYSE), which currently maintains more flexible listing standards. This trend underscores the competitive dynamics among exchanges in attracting new listings.

Looking Ahead

Nasdaq’s revised listing framework signals a market moving toward stronger fundamentals, greater transparency, and more disciplined capital formation. While the entry threshold has increased, the opportunity remains strong for companies that are well prepared. Issuers that focus on investor readiness, articulate growth stories, and execute with discipline will be best positioned to succeed in this evolving landscape.

Alarar Capital Group works closely with clients to navigate these shifts with clarity and confidence. Our role is to turn regulatory change into a strategic advantage and help build a lasting foundation for capital markets success.

About Alarar Capital Group

Alarar Capital Group is a globally based investment bank and management consultancy firm, specializing in bridging Asia and the West. Our services encompass a full spectrum of financial solutions, including IPOs, M&A, financing, venture capital, and SPACs. Alarar Capital Group also includes an independent consulting division dedicated to addressing the unique challenges faced by companies operating across both Asian and Western markets. Headquartered in Hong Kong, with offices across Mainland China, the USA, Malaysia, Indonesia, Vietnam, India, Sweden, and the UAE, we are well-positioned to provide cross-border financial and advisory services.

Our commitment to anticipating market trends and delivering client-centered solutions has earned Alarar Capital Group the Frost & Sullivan 2024 Company of the Year Award in the Asian mid-market investment advisory sector.

References

Why Nasdaq Changed the Rules and What It Means

Why Nasdaq Changed the Rules and What It Means