As the global pharmaceutical landscape undergoes profound restructuring, China’s innovative drug industry has reached its “DeepSeek Moment.” Once seen primarily as imitators, Chinese biopharmaceutical companies are now emerging as core players on the global stage, driven by original innovation and globalization capabilities.

Since 2025, the pace of international expansion has accelerated significantly. In the first half of the year alone, over 50 major cross-border deals totaling nearly US$50 billion were recorded, with several homegrown drugs receiving FDA approvals or entering key clinical trials in the US and Europe. Chinese companies are evolving from global participants to value exporters and are increasingly viewed as premium asset pools by multinational pharma companies.

Behind this wave of breakthroughs lies a transformation in China’s innovative pharmaceutical ecosystem—spanning technology, product, and business models. What we’re witnessing is not just a new round of globalization, but a fundamental reconfiguration of value and redefinition of China’s role in the global pharmaceutical hierarchy.

I. Diversifying Globalization Pathways: License-Out Emerges as the Dominant Model

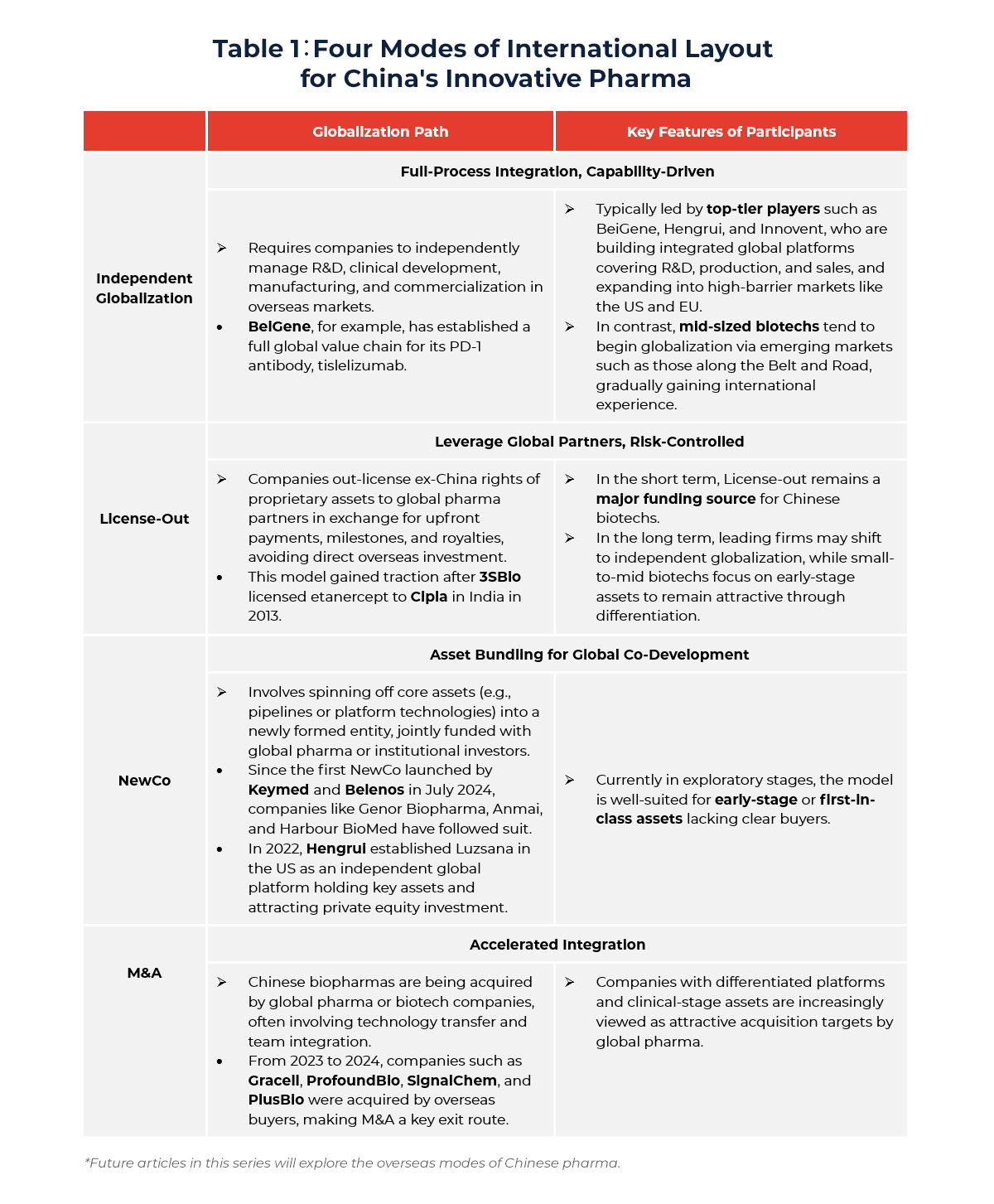

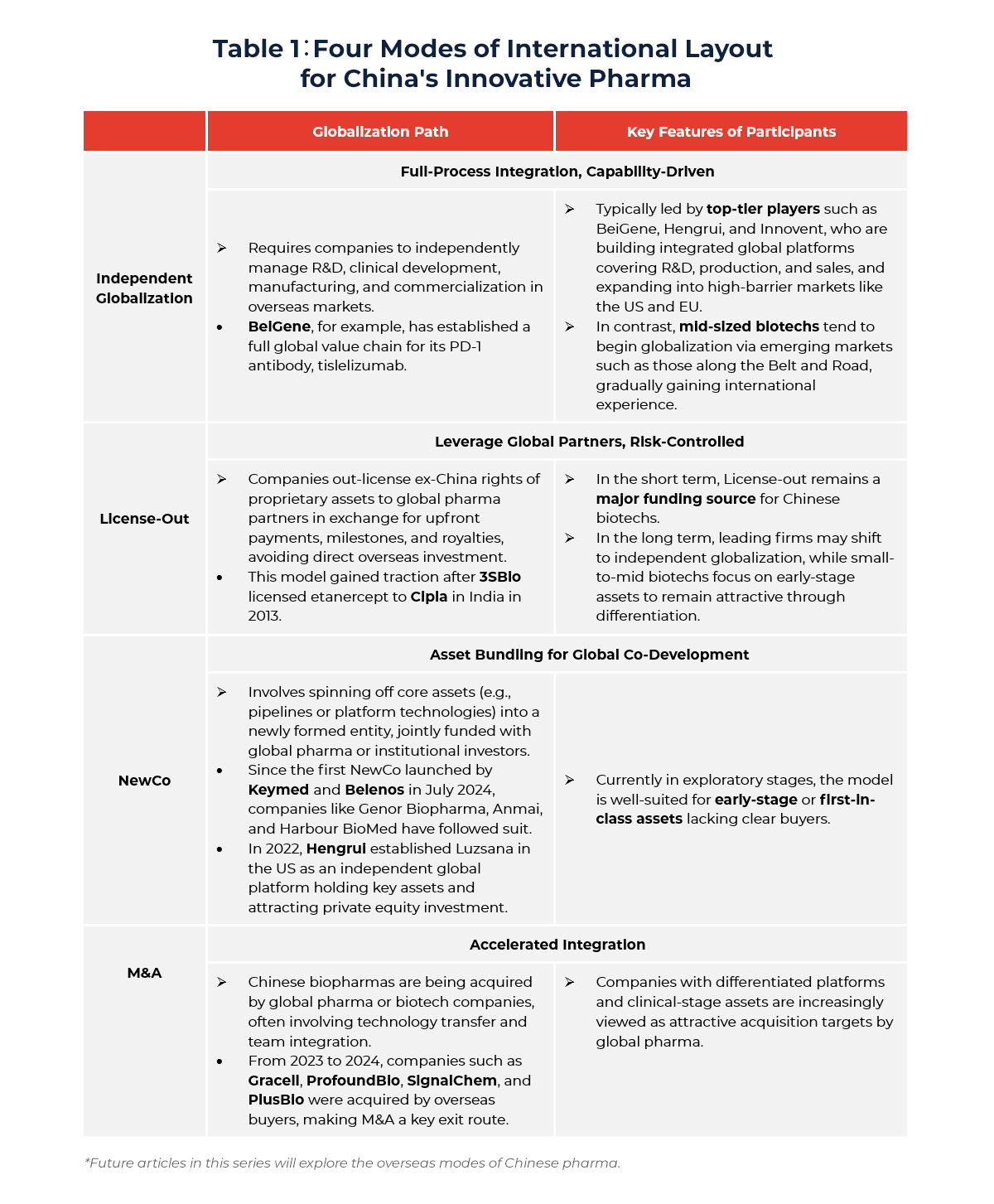

Chinese innovative drug companies are currently pursuing four main globalization strategies: Independent Globalization, License-Out, NewCo (Joint Venture) Formation, and Cross-Border M&A (See Table 1 for details).

Among these, independent globalization—where companies drive overseas R&D, regulatory filings, and commercialization themselves—is a hallmark of truly global innovative pharma players. However, it comes with high entry barriers, requiring deep expertise in global clinical, regulatory, and market access. Only a few companies, such as BeiGene and Innovent Bio, have made meaningful progress in this direction, backed by robust global infrastructures.

The NewCo model is gaining popularity, especially for early-stage assets. In this approach, companies spin out core pipelines or platforms into new entities co-funded by global investors or pharma partners. Cross-border M&A is also a critical path, allowing Chinese biopharma firms to integrate into multinational ecosystems while monetizing assets and exporting technology.

However, license-out has become the most practical and mainstream approach. It enables Chinese companies to leverage the R&D and commercial networks of global partners, accelerating global product launches while generating early-stage cash inflows. Typically, companies out-license regional rights while retaining domestic market control. A notable example is RemeGen’s 2021 deal with Seagen for a HER2-targeting ADC, which successfully entered global clinical trials and generated significant upfront and milestone payments—demonstrating the commercial potential of Chinese innovative drugs on the global stage.

II. License-Out Deals Heat Up: Dual Engine for Capital and Globalization

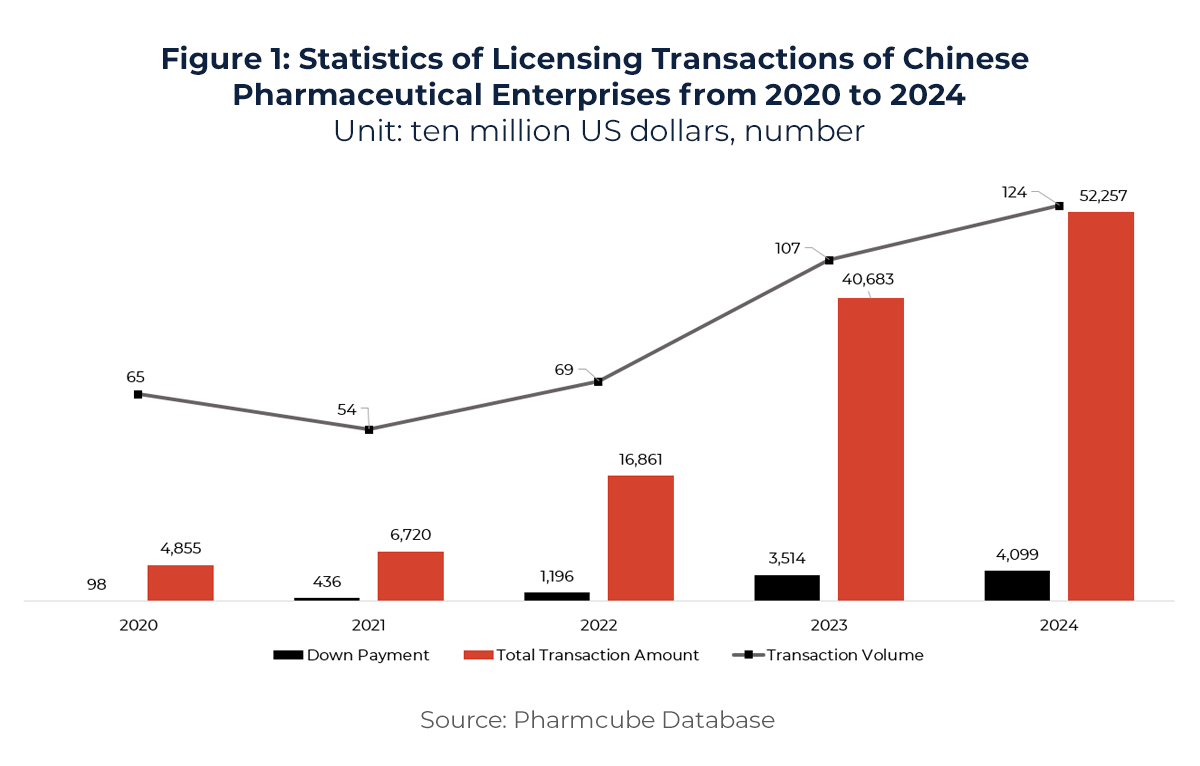

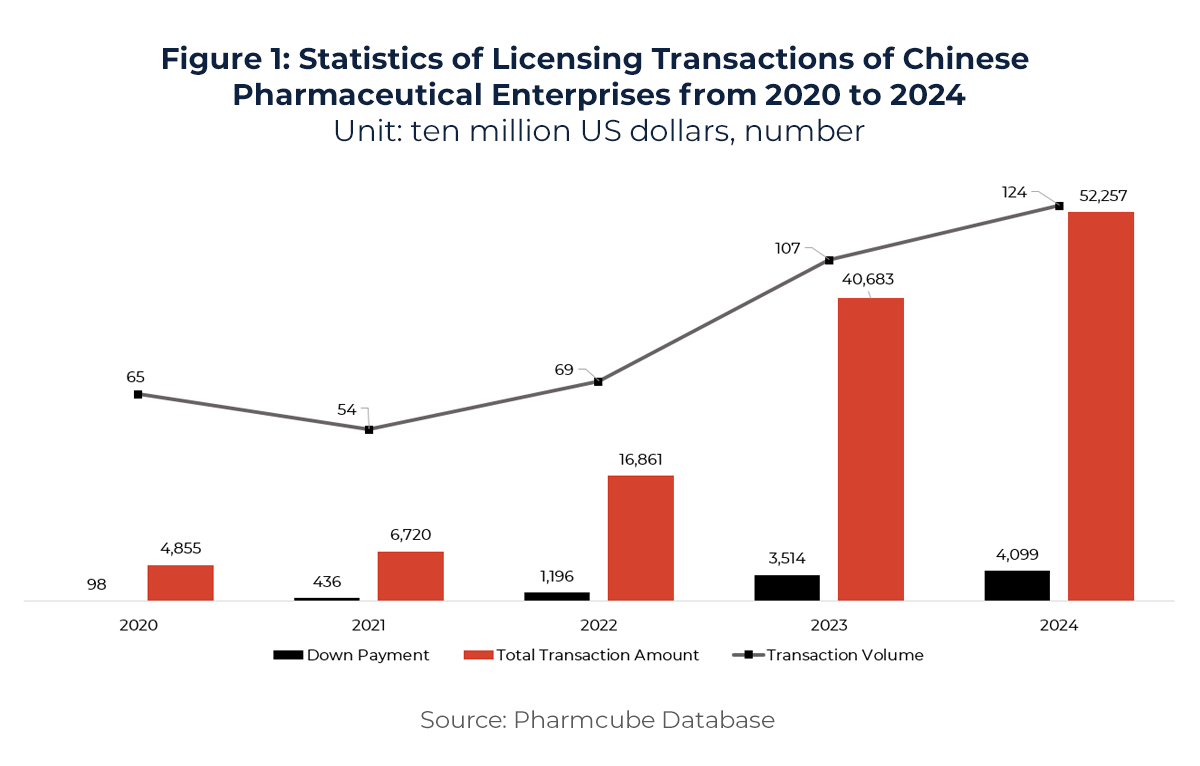

In 2024, China’s innovative drug License-out transactions reached record highs in both volume and value—with 94 deals totaling US$51.9 billion, a 26% year-on-year increase. Upfront payments alone reached US$4.1 billion, up 16% from the previous year, signaling growing global recognition of China’s innovation pipelines. A pivotal moment came in October 2024, when upfront payments from License-out deals (~US$3.1 billion) surpassed primary market financing (~US$2.71 billion) for the first time, marking License-out as a mainstream funding path.

The momentum continued into 2025. In Q1, deal count rose 34% year-on-year, while total deal value surged 222%—far outpacing deal volume. This indicates significant improvement in the quality of Chinese out-licensed assets. Eleven deals exceeded US$1 billion in value, with six ranking among the global Top 10, reflecting China’s rising bargaining power in global biopharma transactions.

Among the 24 License-out deals exceeding US$1 billion in H1 2025:

- 42% (10 deals) involved antibody-based drugs (including monoclonal, bispecific, trispecific, fusion proteins, and nanobodies),

- 33% (8 deals) involved ADCs (antibody-drug conjugates),

- 17% (4 deals) were small molecule drugs.

China’s innovative drug development is increasingly focused on high-potential categories. Antibodies are favored for their precision and mechanism diversity, showing strong efficacy in oncology and autoimmune diseases. ADCs, which combine antibodies with cytotoxic agents, offer both targeting accuracy and potent cell-killing effects, making them particularly attractive to global pharma players.

III. Evolving Deal Structures: Multi-Regional, Multi-Layered Development

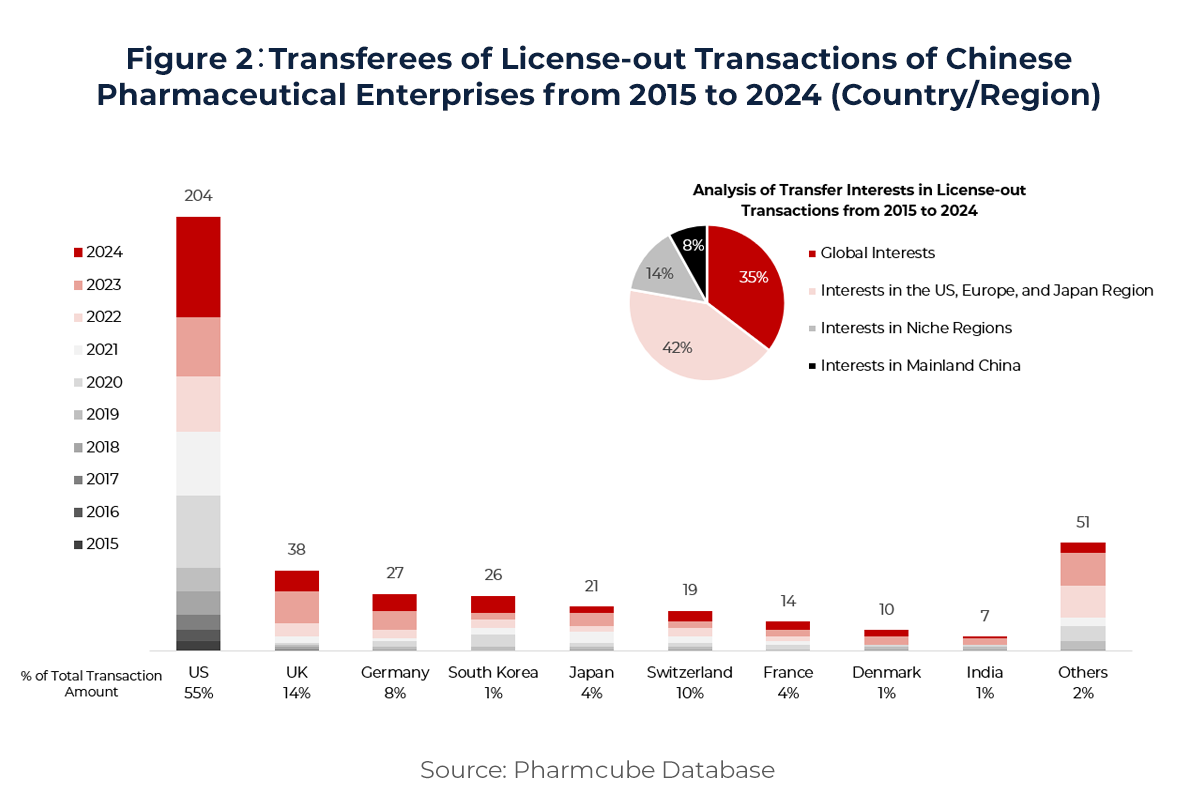

Over the past decade, License-out transactions by Chinese innovative pharma companies have steadily intensified, with international partnerships exhibiting both concentration and diversification.

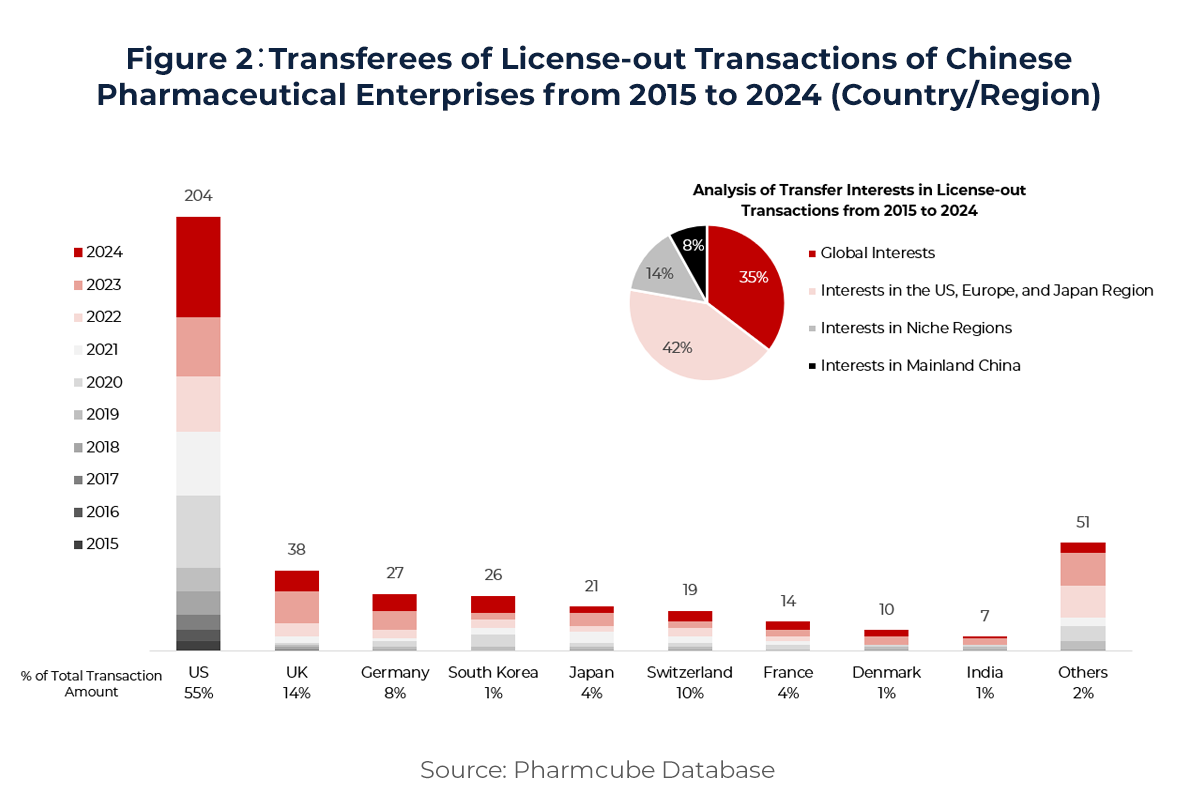

From the perspective of asset rights transferred (see Figure 2), deals are primarily focused on rights in the US, Europe, and Japan (42%) and global rights (35%). Transfers to non-traditional markets—such as the Middle East, Southeast Asia, South Korea, and India—account for 14%, while domestic (China-only) rights transfers represent 8%. Notably, some deals involve multinational companies acquiring local commercialization rights, or Chinese firms transferring China rights for in-licensed products. These trends indicate that licensing partnerships are becoming increasingly multi-regional and multilayered in structure.

In terms of counterparties (see Figure 2), US-based companies remain the dominant licensees, accounting for 204 deals—nearly 49% of total transactions—and contributing over half of the total deal value. This far exceeds the second-largest licensing partner, the UK, with 38 deals and 14% of total value. At the same time, Chinese companies are gradually expanding collaborations with mature markets in Europe and Asia. Engagement from the UK, Germany, South Korea, Japan, and Switzerland has risen significantly, underscoring the growing global appeal of China’s innovation pipelines.

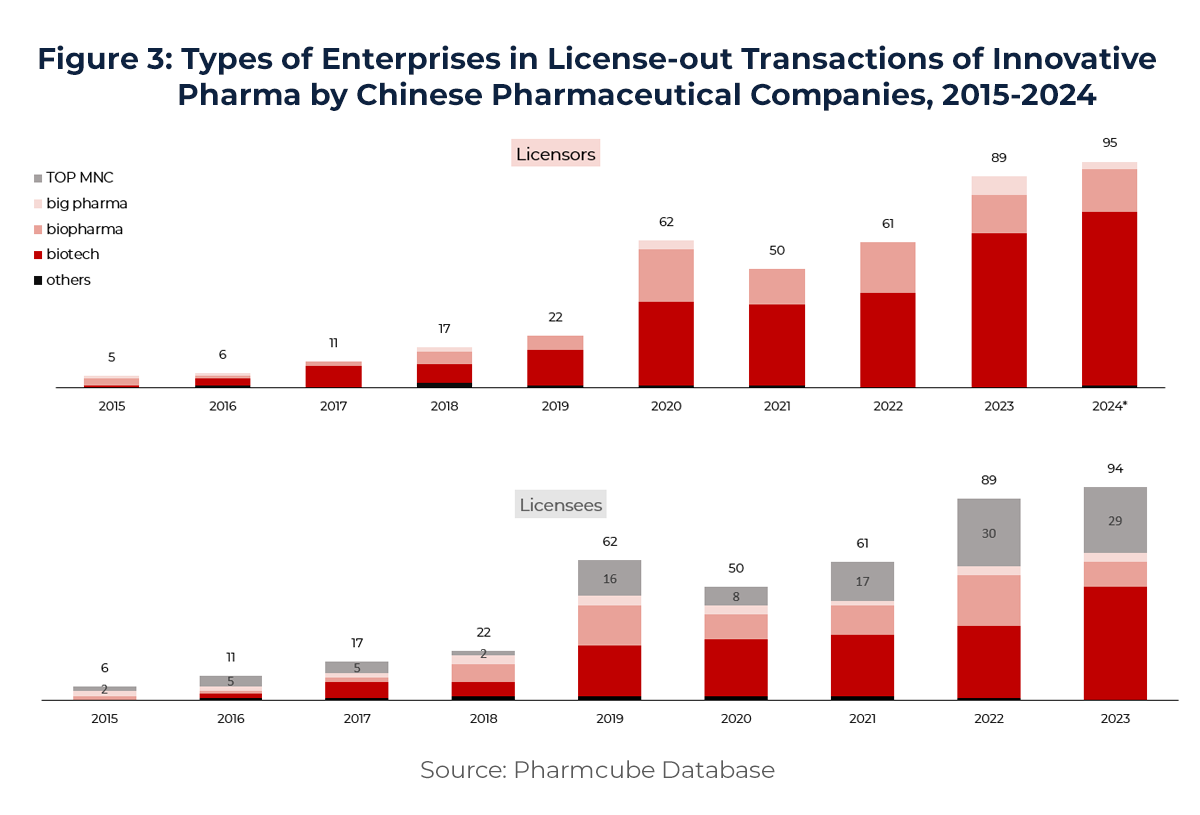

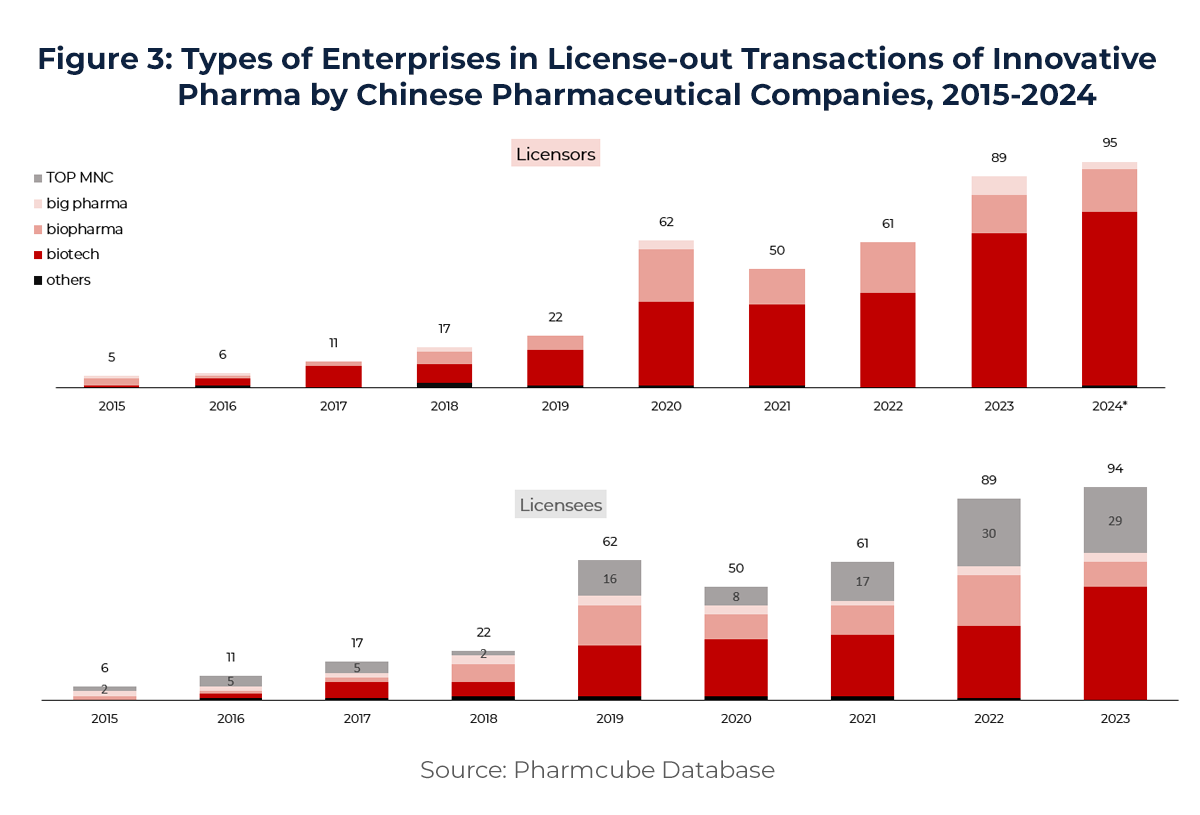

On the supply side (see Figure 3), early-stage biotech companies remain the primary licensors. Their cutting-edge innovation continues to draw attention from global pharma leaders. In 2024, top multinational pharma companies (MNCs) signed 29 licensing deals with Chinese firms, accounting for 31% of total transactions. China has now become the second-largest source of innovative collaboration for MNCs globally—highlighting its rising prominence in the international biopharma ecosystem and signaling a future of more frequent, deeper, and more complex licensing activity.

IV. Diversifying Product Categories: Early-Stage Assets Gain Global Attention

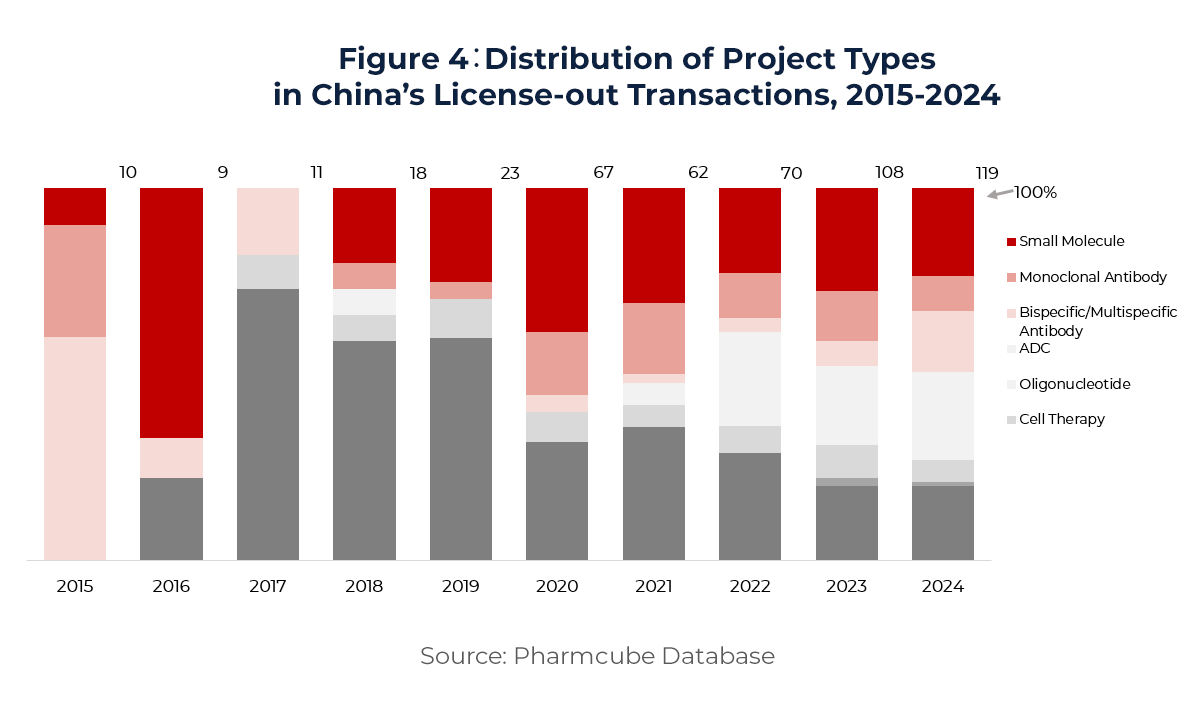

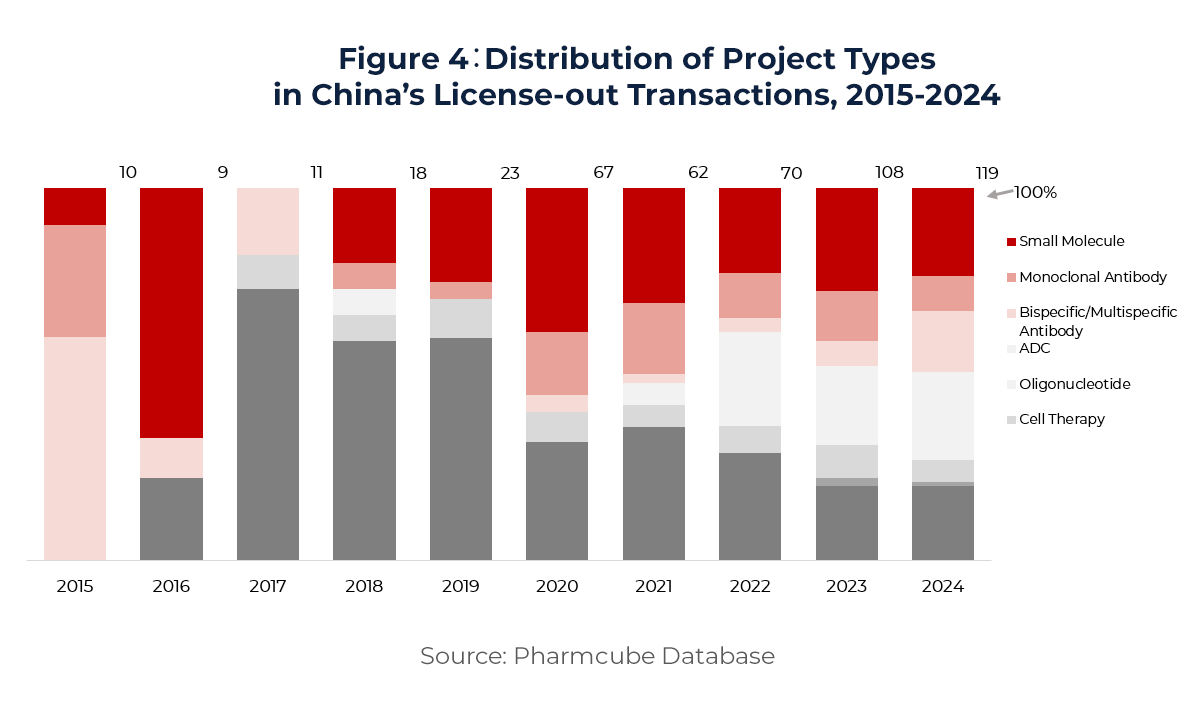

The scope of China’s License-out transactions has expanded significantly—from traditional small molecules to include monoclonal antibodies, cell and gene therapies, oligonucleotides, and vaccines. According to data (Figure 4), antibody-related deals accounted for 37% of transactions in 2024, with 20 involving antibody-drug conjugates (ADCs), totaling US$ 10.24 billion—nearly 20% of annual deal value. Oligonucleotide therapies also saw a breakthrough, with two major deals completed in 2024 worth over US$6 billion, reflecting growing global recognition of China’s technological advances in RNA therapeutics.

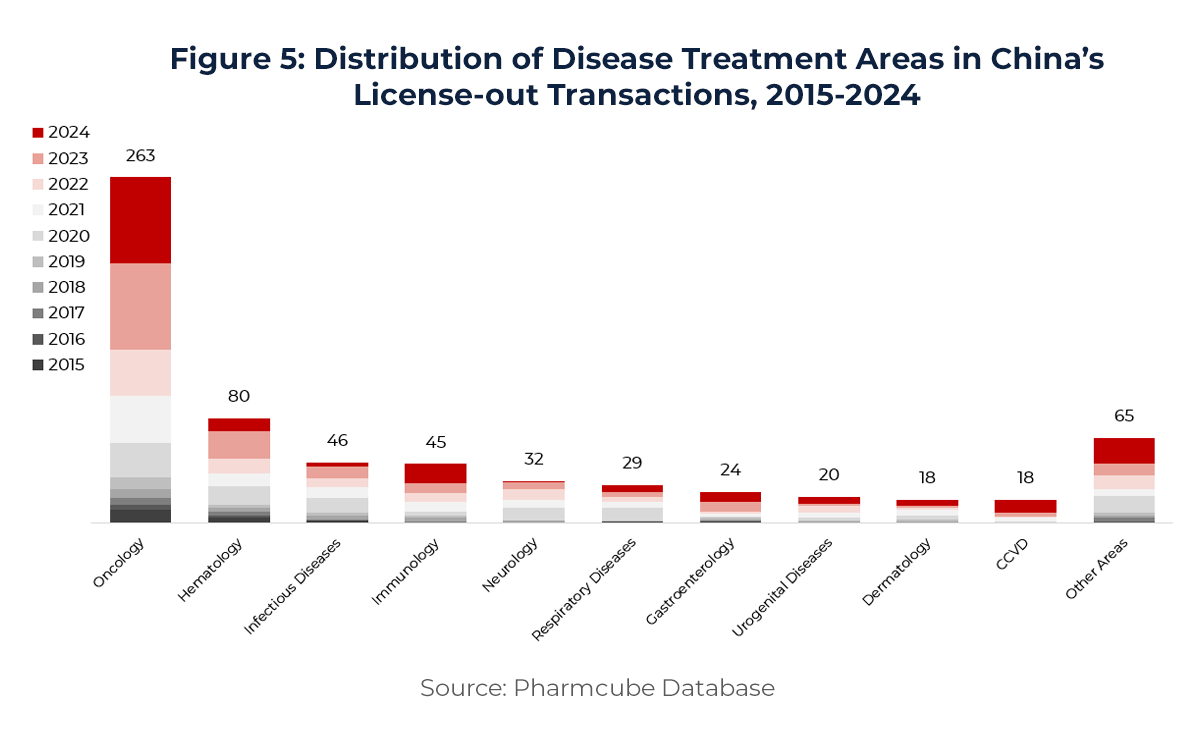

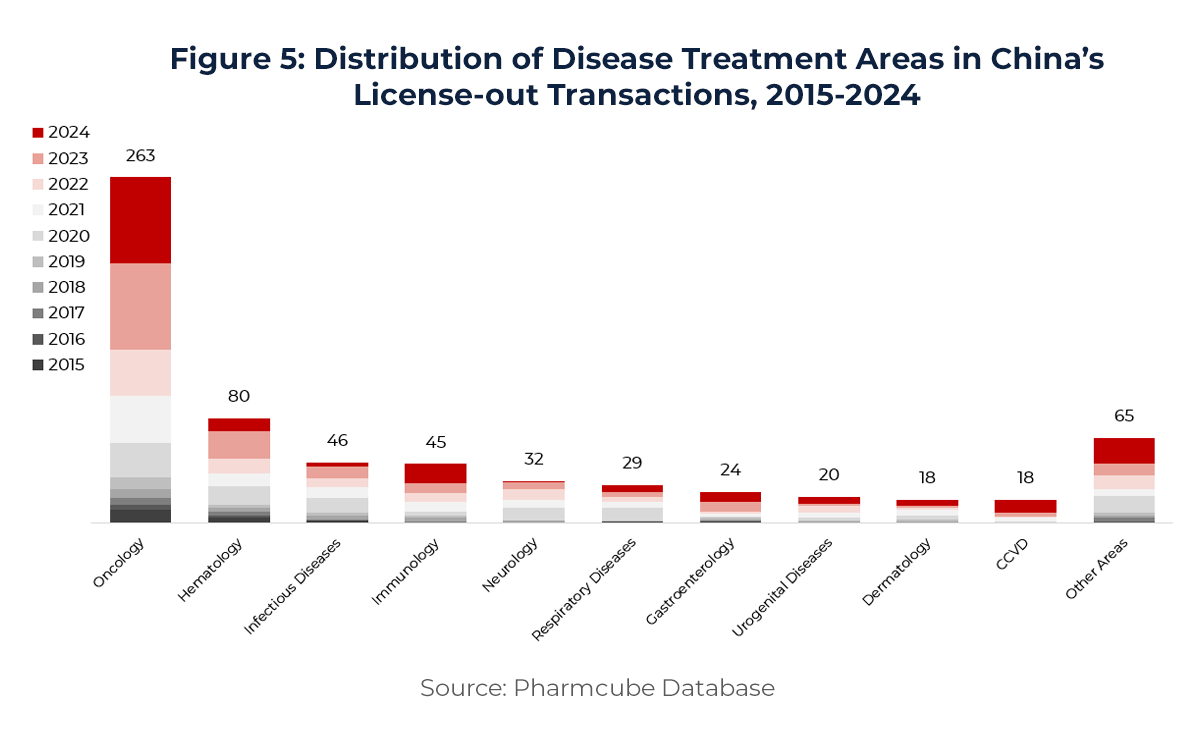

By therapeutic area (Figure 5), oncology remains the dominant field, representing 71% of all License-out activity. However, collaborations in immunology, cardiovascular, and metabolic diseases are steadily rising—demonstrating the expanding breadth and depth of Chinese innovation pipelines.

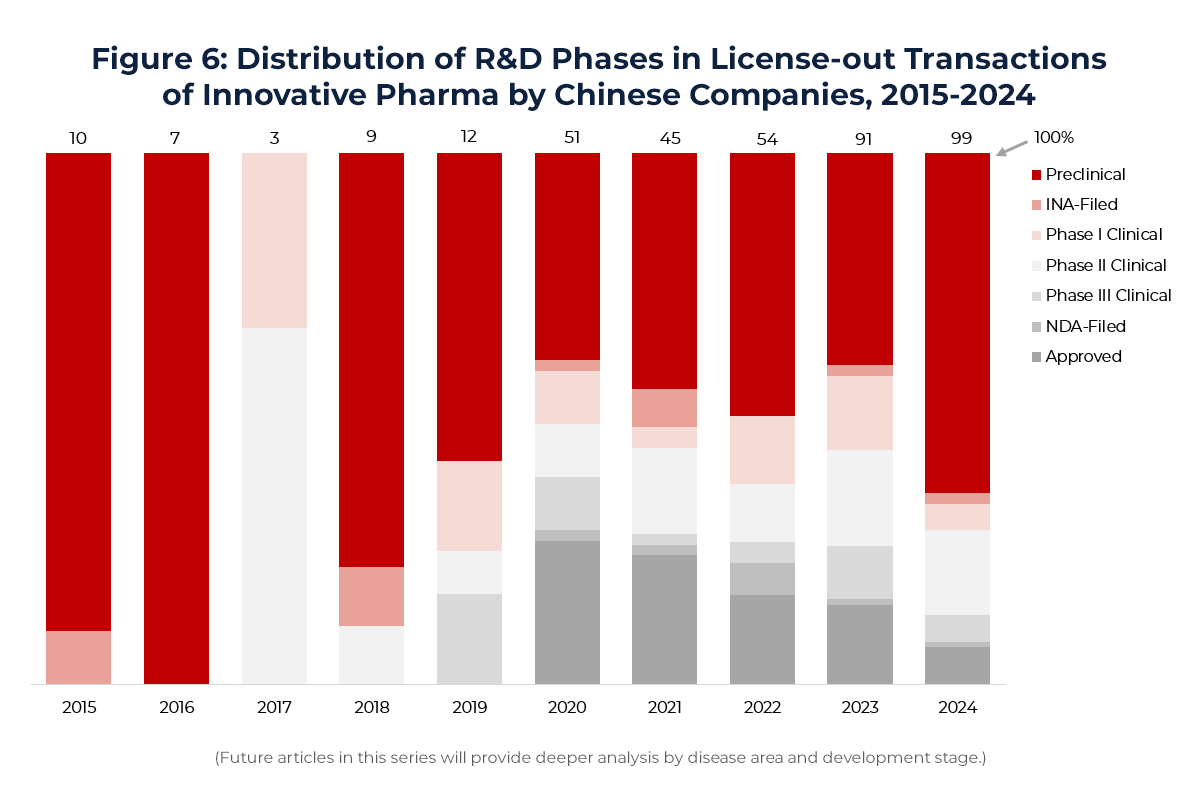

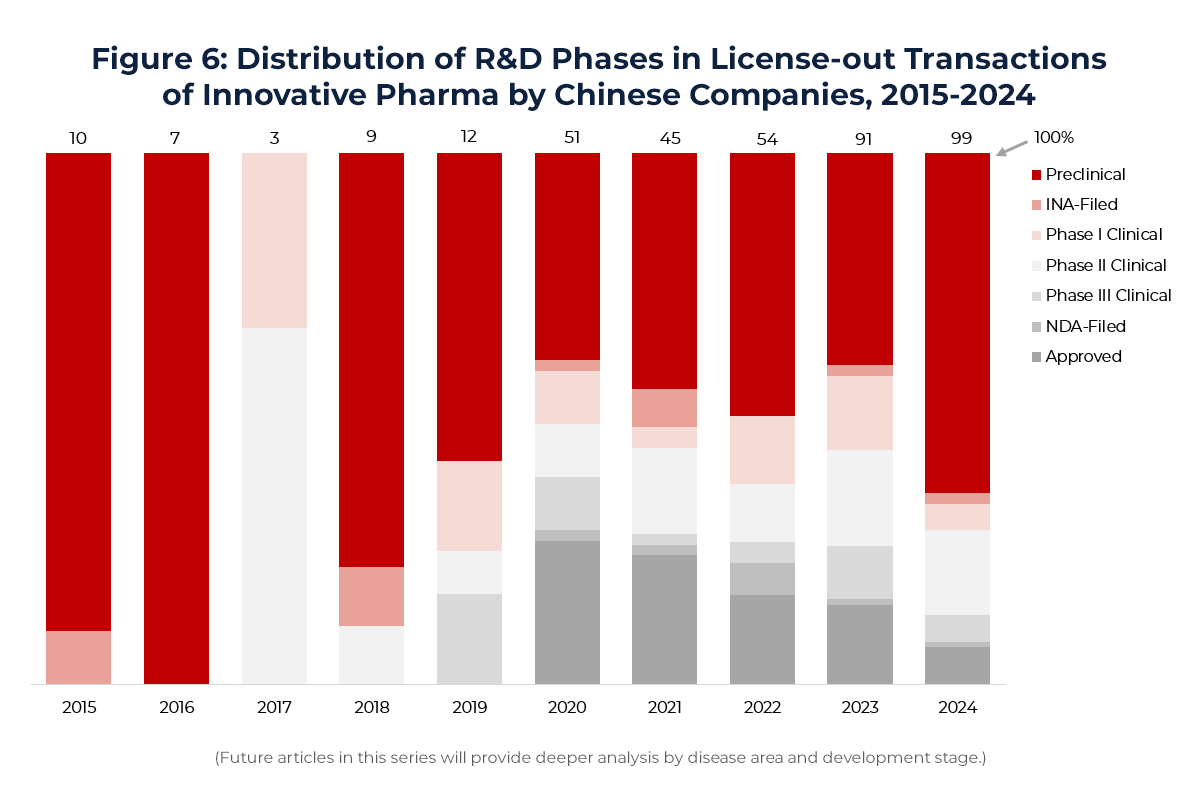

From an asset stage perspective, the focus of License-out deals is shifting earlier. Around 2020, most deals centered on registration and commercialization-stage assets (around 28%). By 2024, preclinical-stage transactions accounted for over 60% of total deals. As competition intensifies for late-stage assets and early programs gain global recognition, multinational pharma companies are increasingly prioritizing differentiated preclinical pipelines—highlighting China’s appeal in first-in-class innovation.

V. Driving Forces Behind the BD Wave: From Domestic Pressure to Global Ascendancy

The surge in business development (BD) activity around the globalization of China’s innovative drugs has been driven by multiple factors—particularly against the backdrop of a capital winter and major industry restructuring. This trend reflects not only sustained global recognition of China’s innovation capabilities—where multinational pharma companies increasingly seek to license Chinese innovations in frontier technologies, differentiated targets, and novel mechanisms—but also a strategic pivot by domestic biopharma companies to secure external funding and global partnerships amid tightened financing and a slower domestic market.

At a deeper level, this globalization wave is rooted in China’s growing structural advantages in pharmaceutical innovation. On one hand, Chinese companies have significantly improved their R&D efficiency, cost control, and technological iteration. On the other, increasing alignment with international clinical, regulatory, and compliance standards is laying a solid foundation for product globalization and overseas licensing.

Thus, the current BD boom is not merely a passive response to macro pressures, but a strategic breakthrough—driven by China’s ambition to become a key contributor to the global pharmaceutical value chain. Chinese innovative drug companies are quickly transitioning from regional competitors to globally integrated value creators.

(1) China’s Cost and Resource Advantages Power Forming a Global Innovation Asset Pool

Despite market cycles, China’s structural strengths in innovative drug development remain intact.

China benefits from world-class scientific and engineering infrastructure—including a vast network of research institutions, leading translational platforms, a large clinical trial population, a mature CRO/CDMO service ecosystem, and a highly cost-effective talent pool. Together, these form the foundation of China’s “fast pipeline + strong delivery” model.

Cost advantages are particularly significant. Chinese drug companies operate at a fraction of the cost of their Western counterparts. According to Huatai Securities, per-patient clinical trial costs in China are only 30–50% of those of multinational corporations (MNCs), and early-stage clinical development is 25–55% faster. This enables Chinese companies to complete proof-of-concept and early development with far lower investment, making them capable of exporting high-value assets to global markets. Many pipelines also adopt Global Multi-Center Trials (GMCT), with concurrent trials in China and abroad, enabling data-sharing and faster global registration.

Policy-wise, China is accelerating innovation-friendly regulatory reforms and fiscal incentives. Fast-track designations such as Priority Review and Conditional Approval shorten the development timeline and increase alignment with international markets.

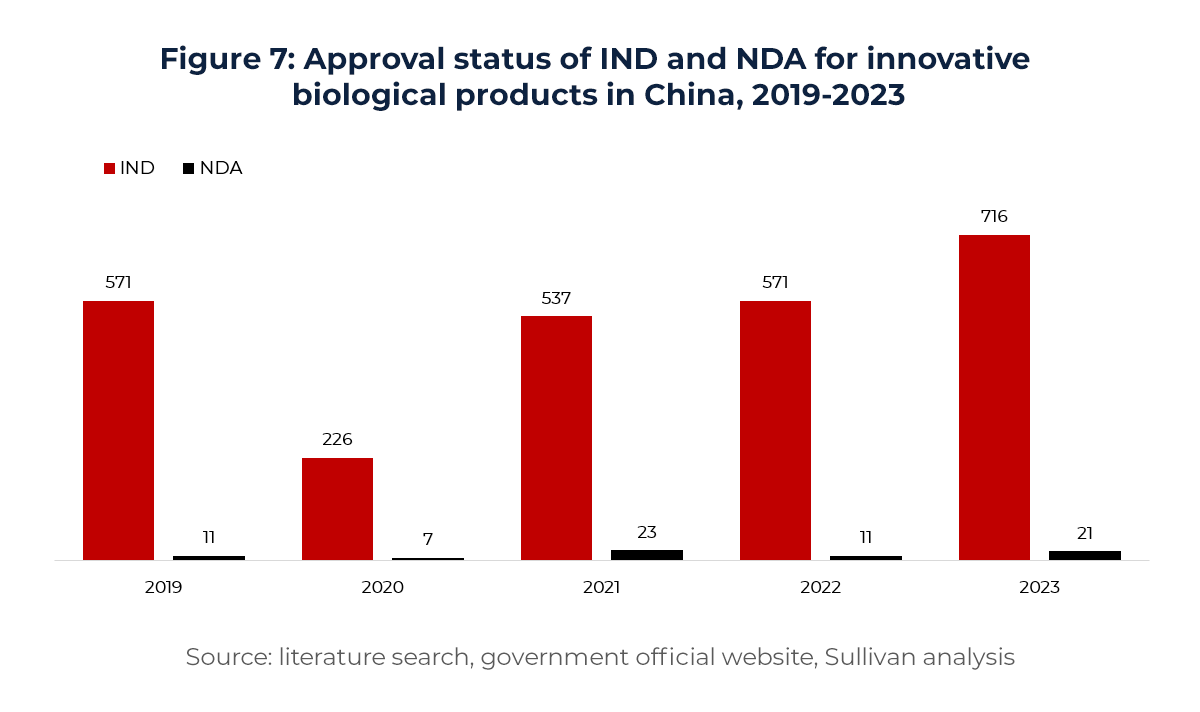

As more high-quality assets advance into clinical stages, China is shifting from a “pipeline-rich” to a “pipeline-strong” nation. The country now ranks second globally in pipeline count, with significant concentration in highly competitive areas such as oncology, immunology, and autoimmune diseases—building its status as a global innovation asset hub.

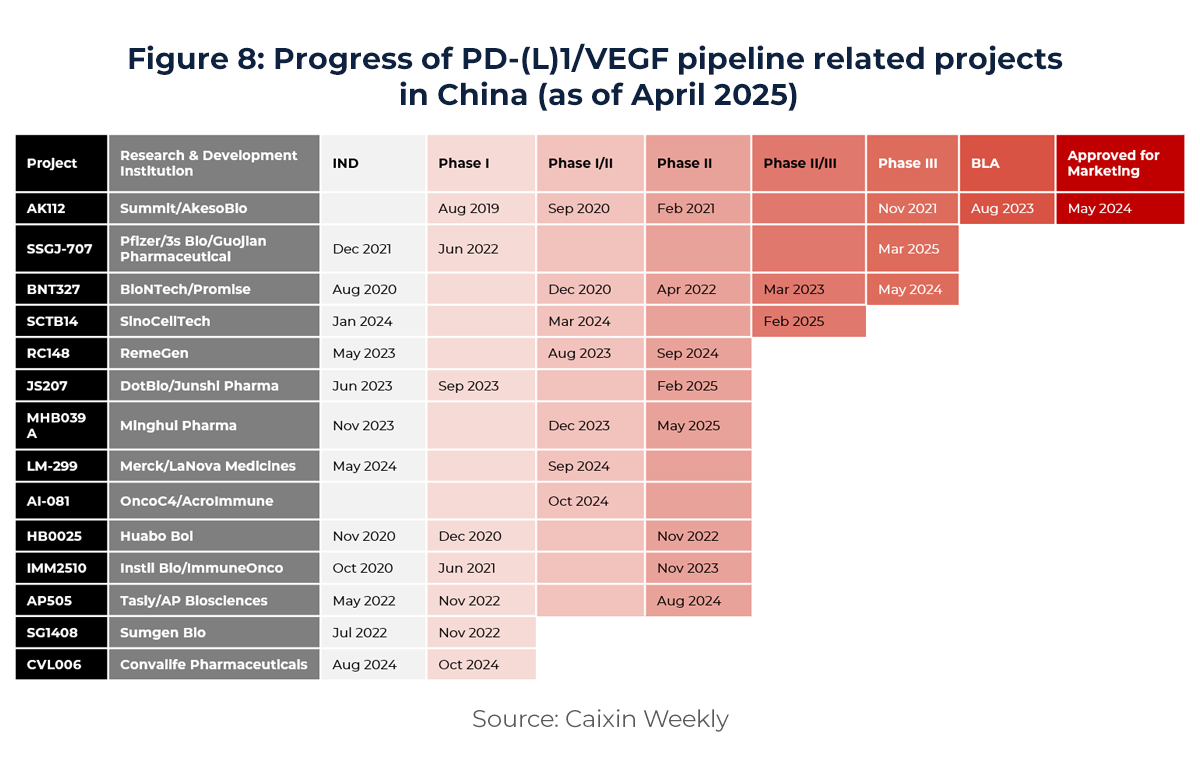

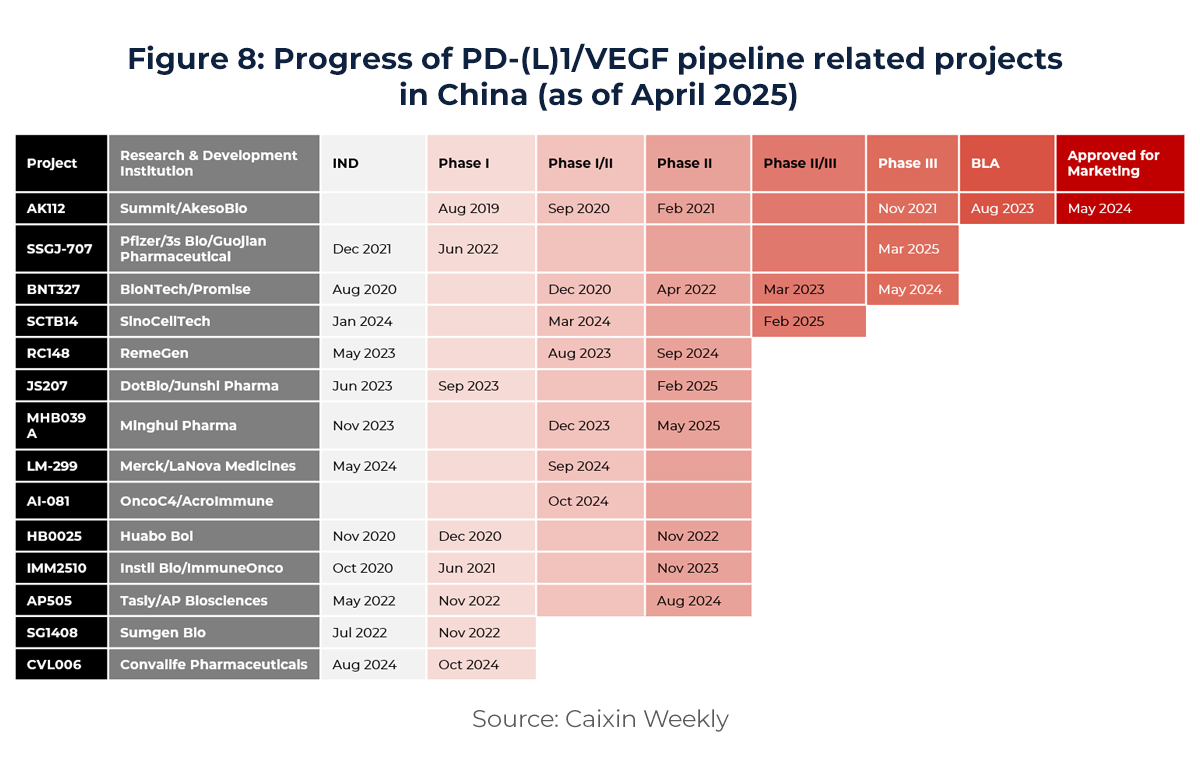

For instance, in oncology—the largest therapeutic area—China has become the global leader in active clinical-stage PD-(L)1/VEGF programs as of 2024. This reflects not only sustained investment in immuno-oncology but also China’s deep and fast-evolving expertise in novel targets.

(2) 2024: The Inflection Point of “First-in-Class” and Global Trust

(2) 2024: The Inflection Point of “First-in-Class” and Global Trust

The year 2024 marked a major turning point—from volume to quality—in China’s innovative drug globalization. Biopharma companies broke through long-standing trust barriers with original mechanisms, high-value assets, and compelling clinical data. Three landmark deals exemplify this shift:

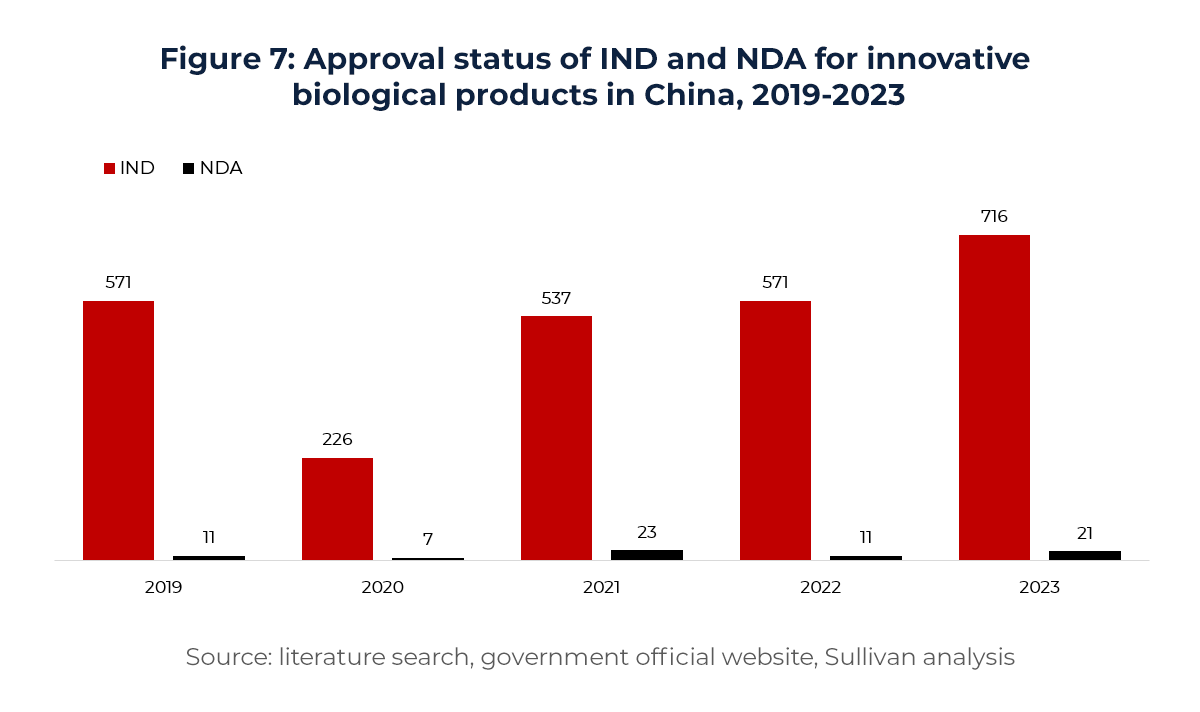

Historically, China’s innovative pipelines relied heavily on “me-too” and “fast-follow” strategies, leading to intense homogeneity and internal competition. However, as domestic R&D capabilities matured and the innovation ecosystem evolved, the number of clinical-stage biologics has grown significantly. From 2021 to 2024, first-in-class (FIC) clinical programs across various subfields steadily increased—especially in emerging modalities such as cell therapies, gene therapies, bispecific/multispecific antibodies, and ADCs—demonstrating clear progress in original innovation and mechanism differentiation.

Historically, China’s innovative pipelines relied heavily on “me-too” and “fast-follow” strategies, leading to intense homogeneity and internal competition. However, as domestic R&D capabilities matured and the innovation ecosystem evolved, the number of clinical-stage biologics has grown significantly. From 2021 to 2024, first-in-class (FIC) clinical programs across various subfields steadily increased—especially in emerging modalities such as cell therapies, gene therapies, bispecific/multispecific antibodies, and ADCs—demonstrating clear progress in original innovation and mechanism differentiation.

This progress reflects sustained improvements across China’s biopharma ecosystem: from technical know-how and translational efficiency to clinical execution and GxP compliance. The three aforementioned landmark transactions not only set new records for License-out deal value but also broke through longstanding “technical barriers” and “trust thresholds.” These deals send a strong signal across the global pharmaceutical value chain: Chinese biotech companies have matured into globally competitive innovators in first-in-class and best-in-class drug development, with commercialization potential that is now being realized on the international stage.

Global trust is never built overnight. It is the result of long-term technical validation and data-driven evidence. The year 2024 marked a key inflection point where this trust began translating into tangible deal value—a true leap forward in perception and reality.

(3) The Patent Cliff: China’s Innovation Assets as Critical Fill-Ins

The looming “patent cliff” has become one of the most pressing challenges for global pharmaceutical companies—particularly those whose revenue relies heavily on blockbuster drugs. As numerous patents for high-revenue drugs expire, the entry of generics and biosimilars rapidly erodes market share, often leading to steep declines in sales.

By the end of 2023, patents had expired for 69 drugs with annual global sales exceeding US$1 billion, significantly amplifying revenue volatility across the sector. Yet, new drug development is inherently risky, expensive, and time-consuming—often requiring over a decade to bring to market. Meanwhile, large pharma companies are increasingly scaling back internal early-stage R&D in favor of leaner cost structures and resource reallocation. According to IQVIA, the share of oncology trials sponsored by US$10 Billion+ revenue pharma companies dropped from 60% in 2015 to 28% in 2024. This shift signals a broader transition from internal discovery to external partnerships and late-stage acquisitions.

In this environment, high-potential external pipelines have become essential for bridging future revenue gaps. Chinese biotech companies—offering differentiated targets, strong clinical data, and partnership-friendly deal structures—are emerging as key targets for collaboration and acquisition by global pharma.

(4) A Strategic Alternative as Primary Market Financing Tightens

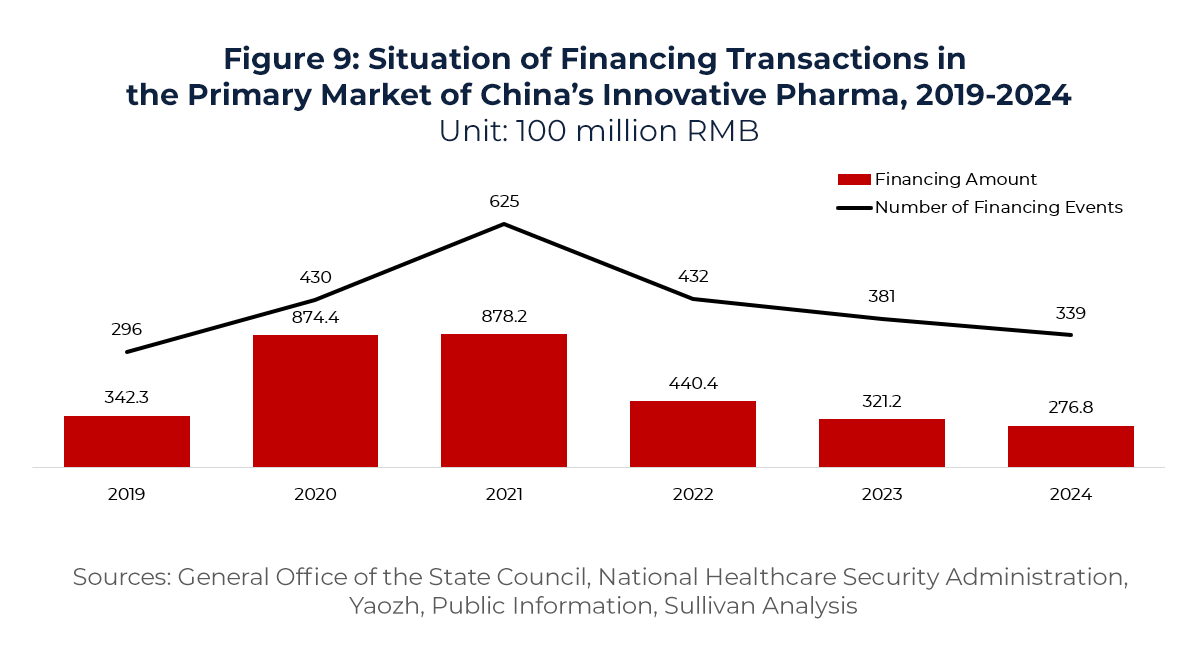

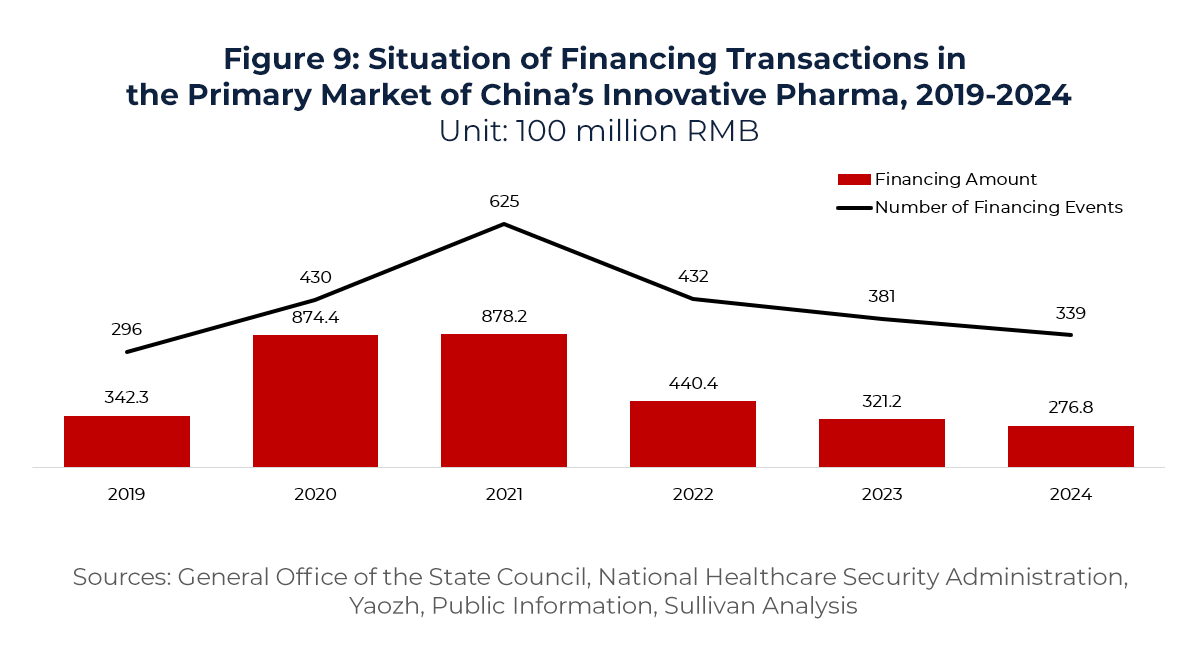

In recent years, access to primary market capital for Chinese biotech companies has tightened considerably. In 2021, the number and value of financing events peaked at 625 transactions totaling CNY 87.82 billion. Since 2022, however, both figures have declined for three consecutive years, reaching just 339 transactions and CNY 27.68 billion in 2024—a multiyear low.

Against this constrained funding backdrop, biopharma companies are increasingly caught between R&D capital shortfalls and rising operational pressures. To alleviate these constraints and ensure project continuity, many firms are now turning to License-out deals—or hybrid structures involving License-out plus NewCo formation—as alternative financing strategies. By accessing capital and commercialization opportunities in global markets, these companies aim to establish a sustainable innovation cycle through external resources.

(5) China’s Payment Ecosystem for Innovative Drugs: Room for Improvement

While domestic demand for innovative therapies in China continues to grow, the current payment ecosystem remains underdeveloped, posing a major bottleneck to the commercialization of high-value biologics.

On one hand, the public reimbursement system—dominated by basic medical insurance—faces mounting fiscal pressure. With fund reserves declining and cost-containment policies tightening, the system struggles to accommodate high-priced therapies. Between 2017 and 2024, a total of 66 innovative biologics (110 products) entered the national reimbursement drug list (NRDL) through negotiations or bidding, with an average price cut of 57.6%. While this “volume-for-price” approach has improved access, it has significantly squeezed margins, weakening companies’ capacity for continued R&D investment.

On the other hand, the commercial insurance market in China lacks broad coverage and high payout capabilities, falling far behind the US and European models. Commercial health insurance still accounts for a small portion of drug spending, failing to serve as a strong supplementary mechanism. As a result, the profitability of innovative drug companies in the domestic market is increasingly constrained, prompting them to accelerate expansion into markets with greater pricing power.

Compared to China, the US and EU offer superior market size, pricing flexibility, and reimbursement support. Together, they account for over half of the global biologics market. Their strong payment willingness and institutional support make them far more attractive environments for commercialization. For example, adalimumab is priced nearly 19 times higher in the US than in China, and bevacizumab is priced 4 times higher. Such pricing disparities across payment ecosystems are becoming a direct incentive for Chinese drugmakers to “go global.”

As payment reforms in China will take time to mature, more companies are opting to monetize their assets abroad first—via License-out deals—and reinvest overseas returns into long-term domestic R&D. This approach is quickly forming a critical financial feedback loop within the broader globalization trend.

(6) Regulatory and Policy Advancements: Toward a “Go-Global Friendly” Ecosystem

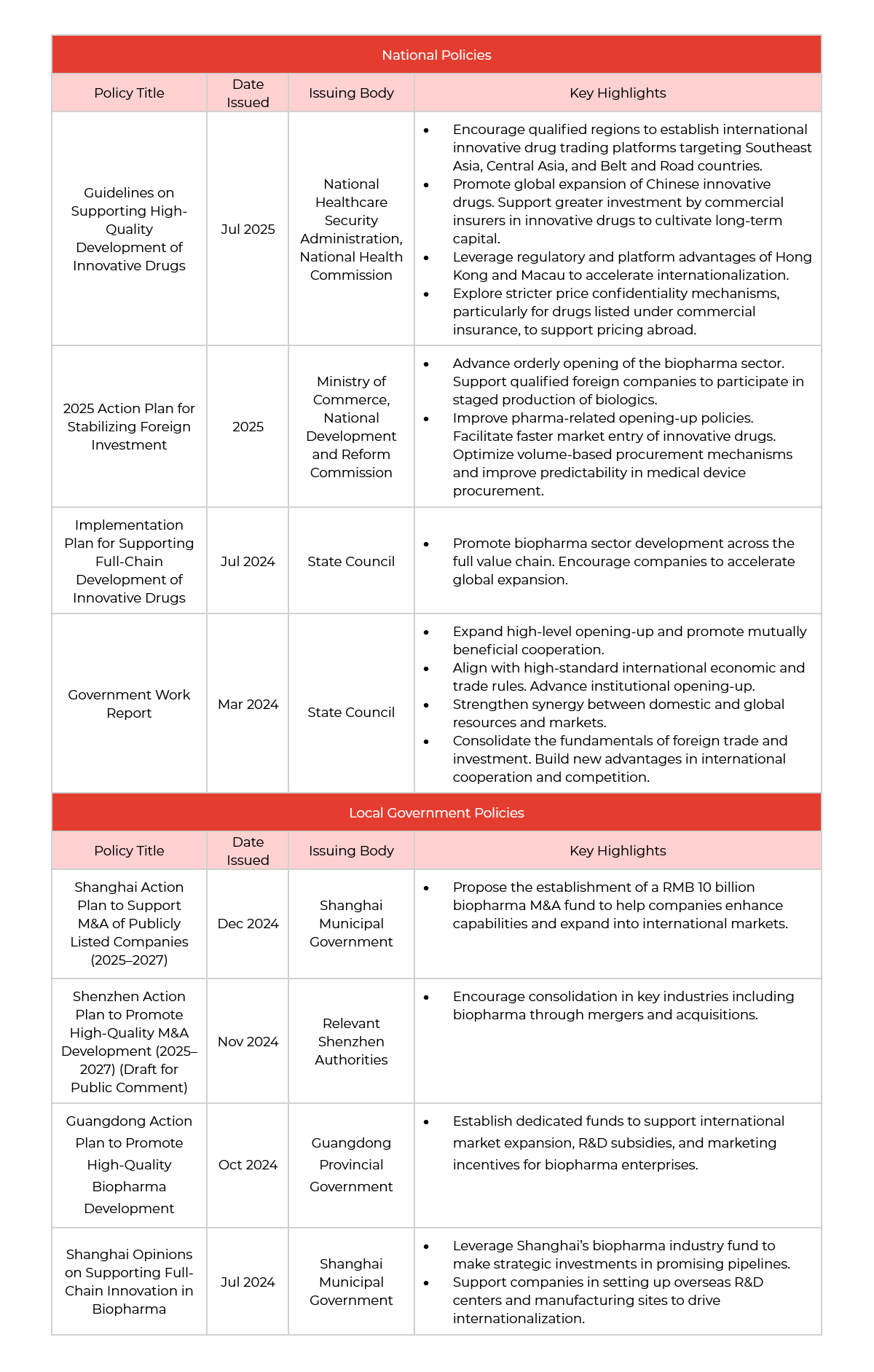

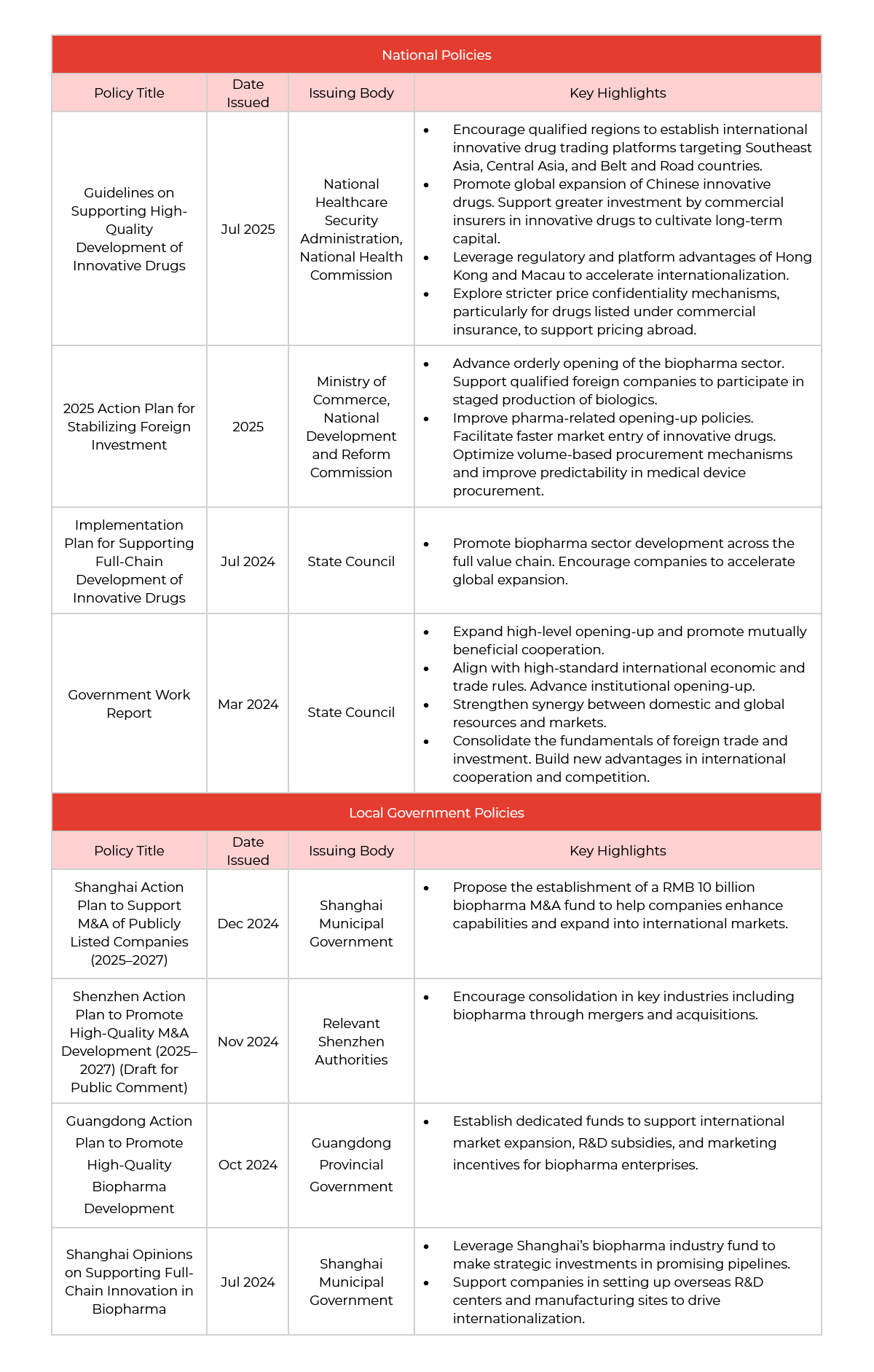

Amid intensifying global competition and accelerated industry transformation, the Chinese government is adopting a dual-track strategy—top-down policy design and bottom-up local execution—to systematically support the internationalization of its biopharma sector.

At the national level, multiple strategic documents have prioritized the globalization of innovative drugs as a key development objective. Local governments are also actively rolling out complementary policies. Together, these initiatives not only provide funding and resource support, but also aim to improve regulatory frameworks, compliance guidance, and global market access pathways. With institutional openness advancing, China’s biopharma industry is shifting from a model of isolated product exports to one of systematic capability expansion, evolving from exploratory outbound projects to long-term global strategy execution.

VI. Building Global Competitiveness Amid Complex Deal Environments

VI. Building Global Competitiveness Amid Complex Deal Environments

As Chinese innovative drug companies accelerate their global expansion, the volume of cross-border deals has risen rapidly—yet so have the associated risks. From a deal attrition perspective, many Chinese firms remain in the early stages of international BD experience. Data indicates that, to date, four independently globalized programs have failed outright, while another 36 transactions were either terminated or suspended due to factors such as disappointing clinical outcomes, regulatory changes, or buyer-side strategic shifts. Combined, the rate of failure or suspension exceeds 55%.

This underscores a critical need for Chinese biopharma companies to systematically assess the global competitiveness of their assets and to develop a nuanced understanding of target market regulatory environments, clinical evaluation standards, and commercial operating models.

Against this backdrop, two capabilities become core to effective BD: competitive landscape insight and deal timing optimization. On one hand, companies must conduct thorough pre-deal analyses to assess whether their assets meet global “entry thresholds” in areas such as target novelty, mechanism differentiation, and clinical data. On the other, they must identify buyer preferences, decision-making processes, and investment timing—ensuring responsiveness during key clinical milestones or regulatory windows to secure first-mover advantages.

Executing high-quality transactions depends on coordinated expertise across functions. In addition to internal BD and R&D teams, companies should engage external stakeholders with cross-border transaction experience—such as investment banks, legal advisors, clinical strategy experts, and intermediaries or institutional investors familiar with regulatory and market dynamics in both China and overseas.

Effective communication and alignment with potential buyers require a clear articulation of a company’s technical value proposition and a deep understanding of buyer-side evaluation criteria. Only through this dual clarity can companies enhance negotiation efficiency, strengthen their position, and build a self-reinforcing global partnership cycle.

That said, information asymmetry remains a critical barrier. While some multinational pharma companies have established China-based teams with basic local market knowledge, many still struggle to keep pace with China’s rapidly evolving healthcare landscape. Conversely, Chinese companies often lack sufficient understanding of foreign regulatory regimes and commercialization models—leading to strategic misjudgments. This makes it essential to front-load and systematize market research and outbound planning.

At a strategic level, companies must address the following critical questions:

- Buyer targeting: Should we build long-term alliances with large pharma, or work with more agile global biotechs?

- Go-global model: Should we pursue equity-based collaboration, out-licensing, or outright pipeline sales?

- Market selection and regulatory alignment: How do we evaluate differences in approval pathways, clinical standards, and reimbursement systems across countries to ensure compliance and access?

- Deal timing: Should we wait until key clinical readouts, or act early to secure first-in-deal positions?

- Pipeline valuation: How do we price assets scientifically to avoid undervaluation? Should we license platforms or retain core development rights?

- Manufacturing readiness: How can CDMO providers differentiate globally through process excellence and cost efficiency?

- ……

These are the fundamental issues that define a pharmaceutical company’s path to globalization. Future installments of the “China Pharma Going Global” Series Article will explore these strategic dimensions in depth to support more rational, actionable globalization planning.

VII. ARC’s Conclusion

At ARC, we remain firmly optimistic about the continued breakthroughs of Chinese pharma companies in both best-in-class and first-in-class innovation. As global confidence in China’s R&D capabilities continues to grow, we believe domestic innovators will play an increasingly central role on the international stage—not just as followers of global rules, but as creators of value and future standard-setters.

ARC has long tracked the globalization journey of Chinese life sciences companies. We offer full-spectrum support across transaction strategy, buyer matching, valuation modeling, compliance advisory, and cross-border deal execution. In addition to our M&A traditional services, we also provide tailored support for License-out and NewCo transactions.

Leveraging our global network and regulatory insights, we provide targeted support for companies at various stages of development—helping them identify opportunities, mitigate risks, and maximize value in complex international environments.

In this era of sweeping pharmaceutical globalization, ARC is proud to stand alongside China’s innovation forces—working together to shape a stronger global presence and voice for China’s biopharma industry.

References

- 2025 Bluebook on China Biologics Going Global

- Ten-Year Review and Outlook of China’s Innovative Pharmaceutical Industry from a Global Perspective, Institute for Drug Regulatory Science, Tsinghua University

- 2025 China Healthcare Industry White Paper – Pharmaceuticals & Biotechnology Chapter, by China Renaissance

- https://a.caixin.com/pOja8XJy

(2) 2024: The Inflection Point of “First-in-Class” and Global Trust

(2) 2024: The Inflection Point of “First-in-Class” and Global Trust Historically, China’s innovative pipelines relied heavily on “me-too” and “fast-follow” strategies, leading to intense homogeneity and internal competition. However, as domestic R&D capabilities matured and the innovation ecosystem evolved, the number of clinical-stage biologics has grown significantly. From 2021 to 2024, first-in-class (FIC) clinical programs across various subfields steadily increased—especially in emerging modalities such as cell therapies, gene therapies, bispecific/multispecific antibodies, and ADCs—demonstrating clear progress in original innovation and mechanism differentiation.

Historically, China’s innovative pipelines relied heavily on “me-too” and “fast-follow” strategies, leading to intense homogeneity and internal competition. However, as domestic R&D capabilities matured and the innovation ecosystem evolved, the number of clinical-stage biologics has grown significantly. From 2021 to 2024, first-in-class (FIC) clinical programs across various subfields steadily increased—especially in emerging modalities such as cell therapies, gene therapies, bispecific/multispecific antibodies, and ADCs—demonstrating clear progress in original innovation and mechanism differentiation.

VI. Building Global Competitiveness Amid Complex Deal Environments

VI. Building Global Competitiveness Amid Complex Deal Environments