Executive Summary

China’s mergers and acquisitions (M&A) market is entering an exciting new phase, driven by landmark regulatory reforms aimed at fostering strategic, value-driven transactions. With major policies such as the State Council’s new “National Nine” Guidelines, the CSRC’s transformative “M&A Six” Measures, the proactive “2025 Action Plan,” and an expanded “2022 Catalogue,” China is reshaping its capital markets to prioritize meaningful consolidation, technological innovation, and international openness.

Historically dominated by policy-driven public markets, China’s M&A landscape is shifting dramatically with streamlined deal processes, flexible payment structures, and a decisive pivot away from speculative backdoor listings towards purposeful industrial and technological consolidations. The recent rebound in deal-making activity underscores investor confidence, particularly in sectors aligned with national priorities—tech innovation, advanced manufacturing, and strategic industrial integration.

For global investors, China is actively lowering barriers and clearly signaling sectors of encouragement, creating unprecedented opportunities to participate through cross-border deals. Meanwhile, domestic companies find a more accessible pathway for strategic restructuring and partnership.

In this transformative period, Alarar Capital Group’s deep China expertise, extensive international network, and proven transactional track record uniquely position us to help navigate and capitalize on these strategic opportunities. As China’s M&A market evolves rapidly, ARC stands ready to guide clients through every step, from strategy and due diligence to execution and integration, ensuring success in this exciting new era of Chinese deal-making.

I. China M&A Landscape: Setting the Stage

China’s M&A activity primarily revolves around publicly listed companies, specifically those under the regulatory oversight of the CSRC. Unlike the U.S. market—where private equity and venture capital are robust engines of deal-making—China’s private markets are significantly shaped by dynamics in the public markets, making regulatory policies especially influential.

M&A in China: Types, Objectives, and Methods

In China, M&A broadly encompasses mergers (兼并) and acquisitions (收购). Mergers are further subdivided into absorption mergers (吸收合并), where one company fully absorbs another, and new establishment mergers (新设合并), where entities combine into a newly established entity. Acquisitions primarily refer to equity purchases (股权收购). Another commonly used term, restructuring (重组), refers to the recombination of resources within a business, generally classified into expansion-oriented, contraction-oriented, or other strategic forms.

From an acquirer’s perspective, M&A deals primarily aim to enhance operational efficiency through industrial consolidation, to facilitate asset listings, or to optimize market capitalization management (市值管理).

Valuation methods for M&A in China typically employ the income approach (收益法), market approach (市场法), and asset-based approach (资产基础法), alongside necessary qualitative adjustments—particularly for “new economy” enterprises characterized by rapid growth and technological innovation.

Regulatory Review and Decision-Making Process

Internally, Chinese public companies typically navigate a structured decision-making process for M&A that includes initial consultations, advisor appointments, due diligence, trading suspensions (if necessary), board resolutions, and shareholder meetings. Externally, regulatory review by the CSRC involves formal acceptance, inquiries, committee reviews by the M&A restructuring panel, registration approval, and potential additional scrutiny from other governmental bodies.

China’s regulatory approach toward capital market M&A has evolved considerably over two decades, identifiable through five distinct phases:

- System Formation (2000-2013): foundational rules and market structures established.

- Enhanced Support (2014-2015): policy push to facilitate increased deal activity.

- Issue Response (2016-2017): tightening controls to address emerging speculative practices.

- Marginal Relaxation (2018-2023): gradual easing to reinvigorate transactions amid economic slowdowns.

- Policy Reinvigoration (2024-Present): aggressive new policies introduced to stimulate strategic and industrially coherent M&A.

Over these years, China’s capital market experienced cycles of “launch—boom—correction—relaunch,” now entering a new phase characterized by strategic consolidation and value-driven growth.

Remarkably, the success rate of completed M&A deals in China’s public market remains exceptionally high—often exceeding 70%. Between 2010 and 2024, transactions in the A-share market consistently maintained completion rates above 80%, with a notably high 92.5% success rate from 2024 onward.

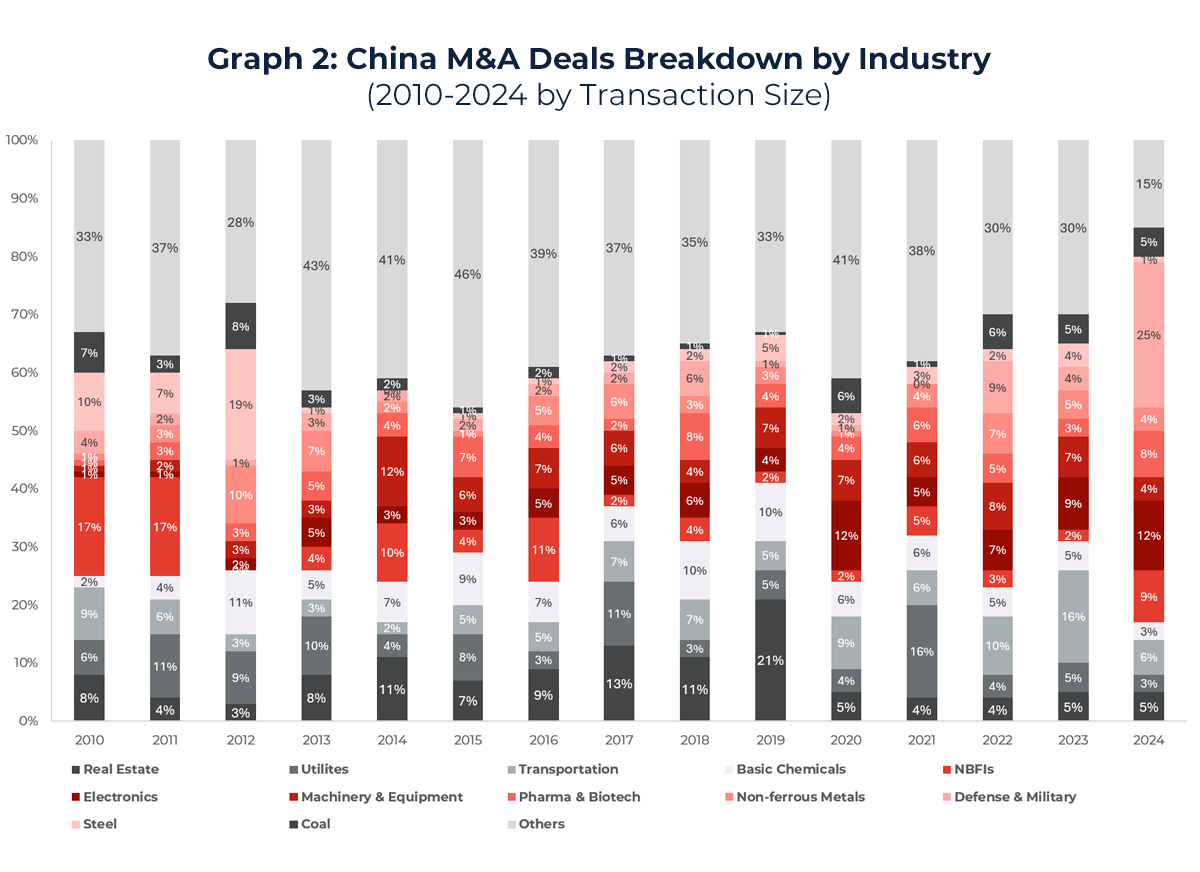

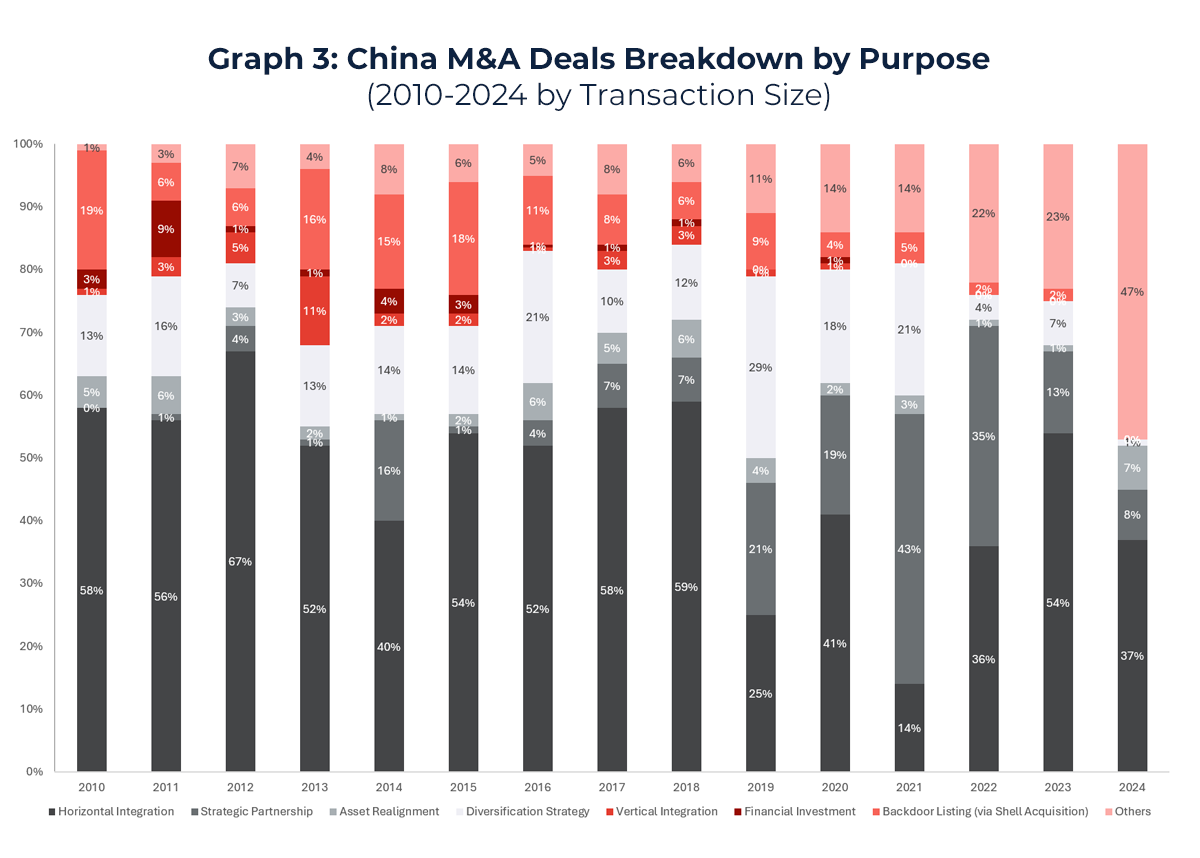

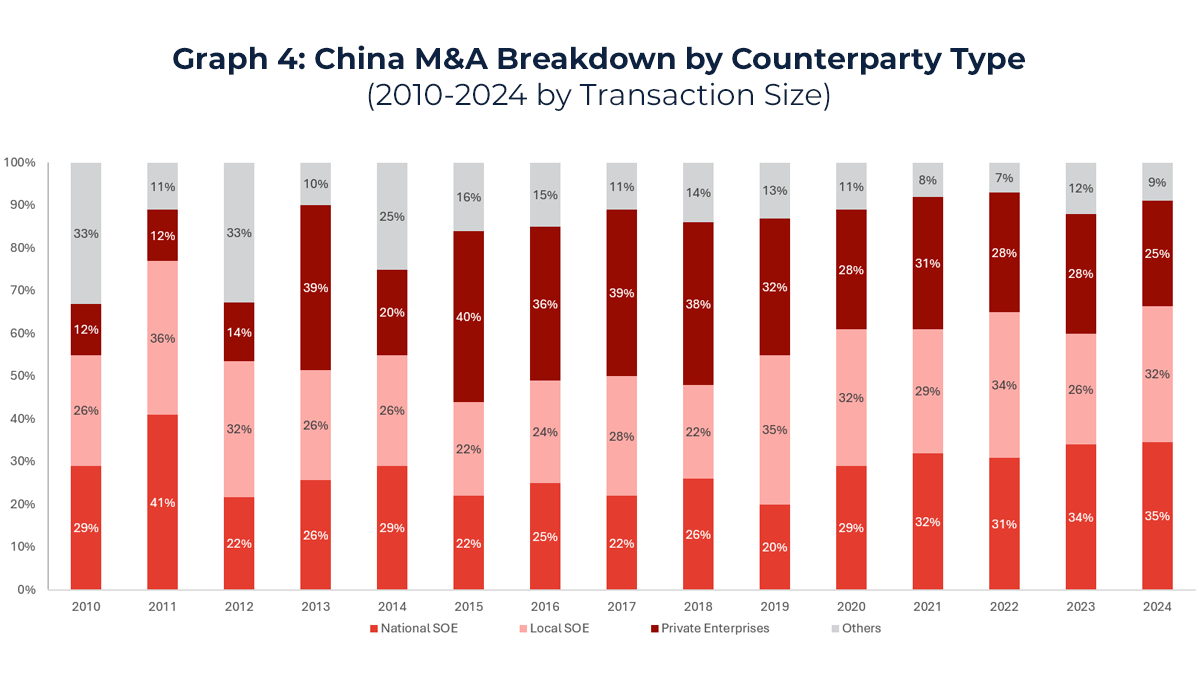

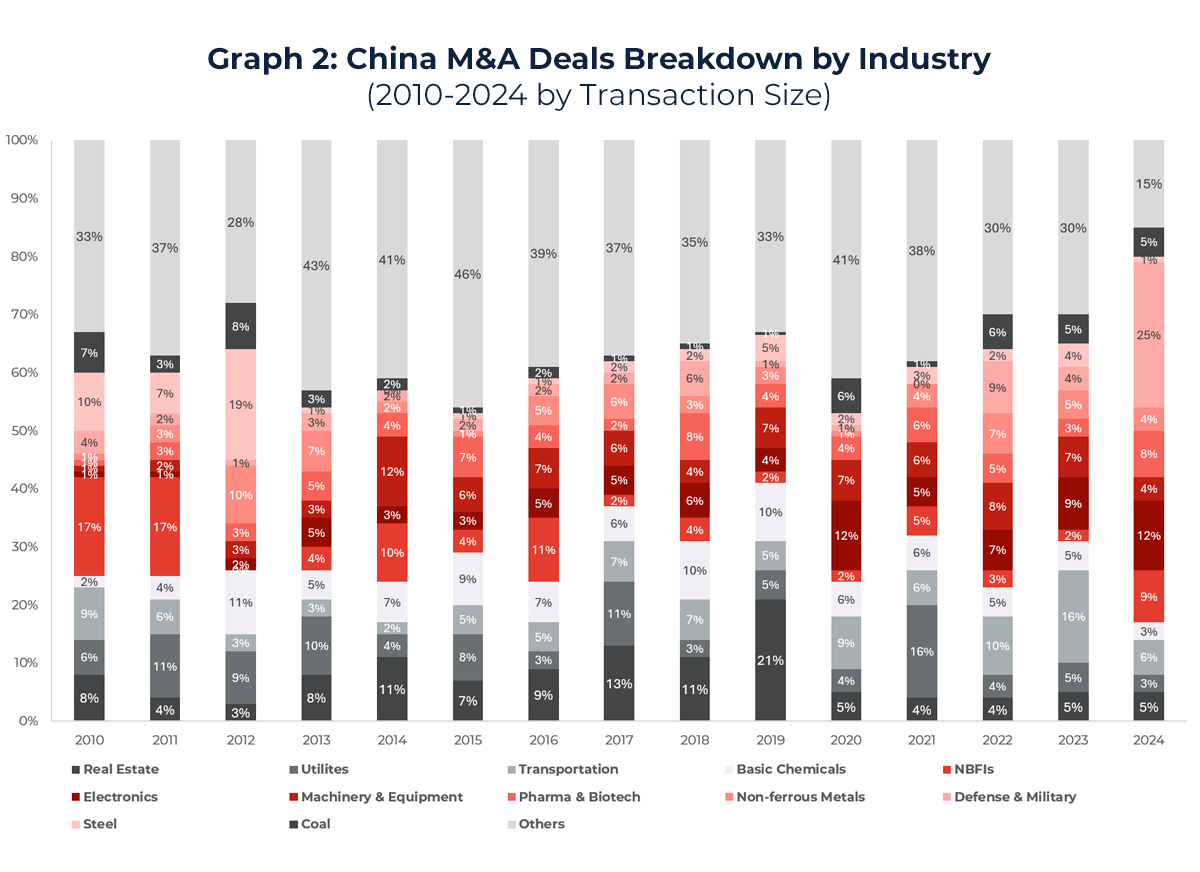

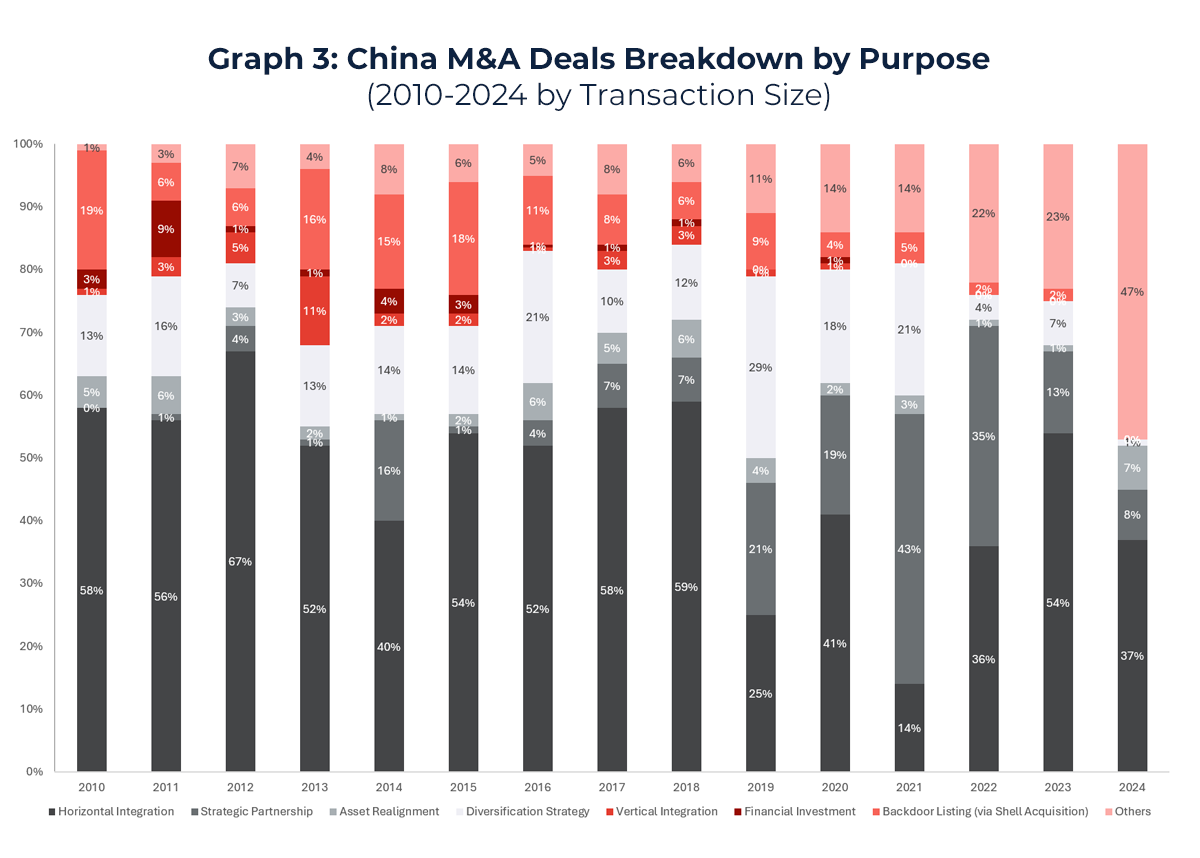

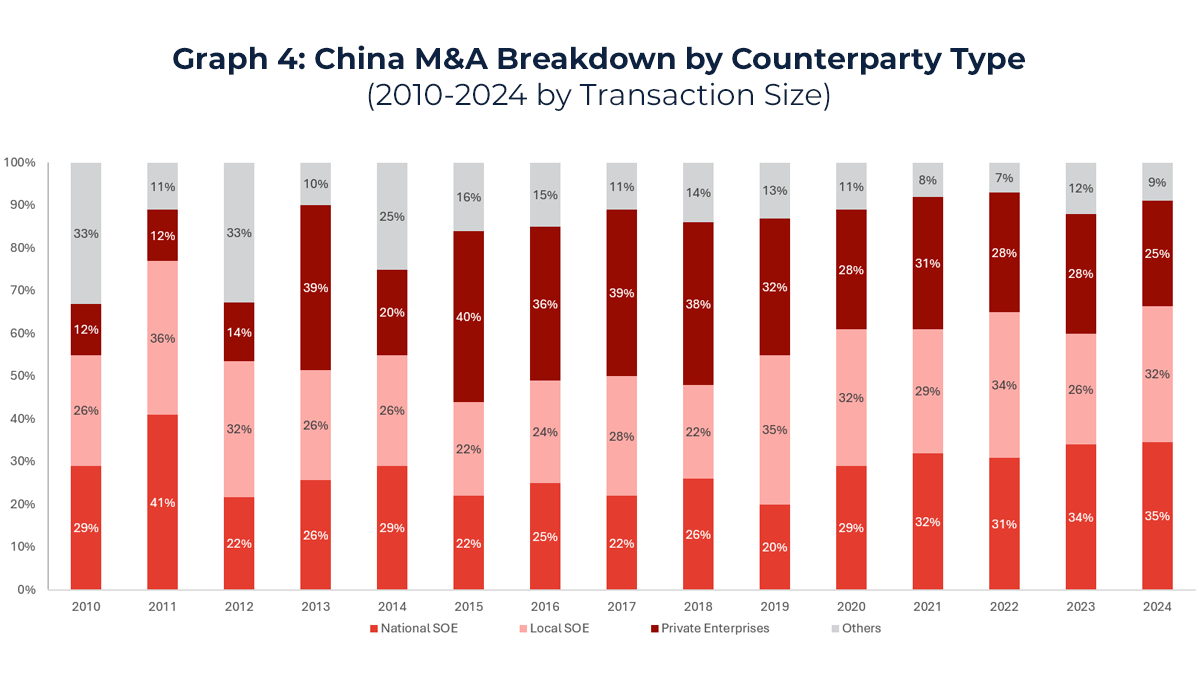

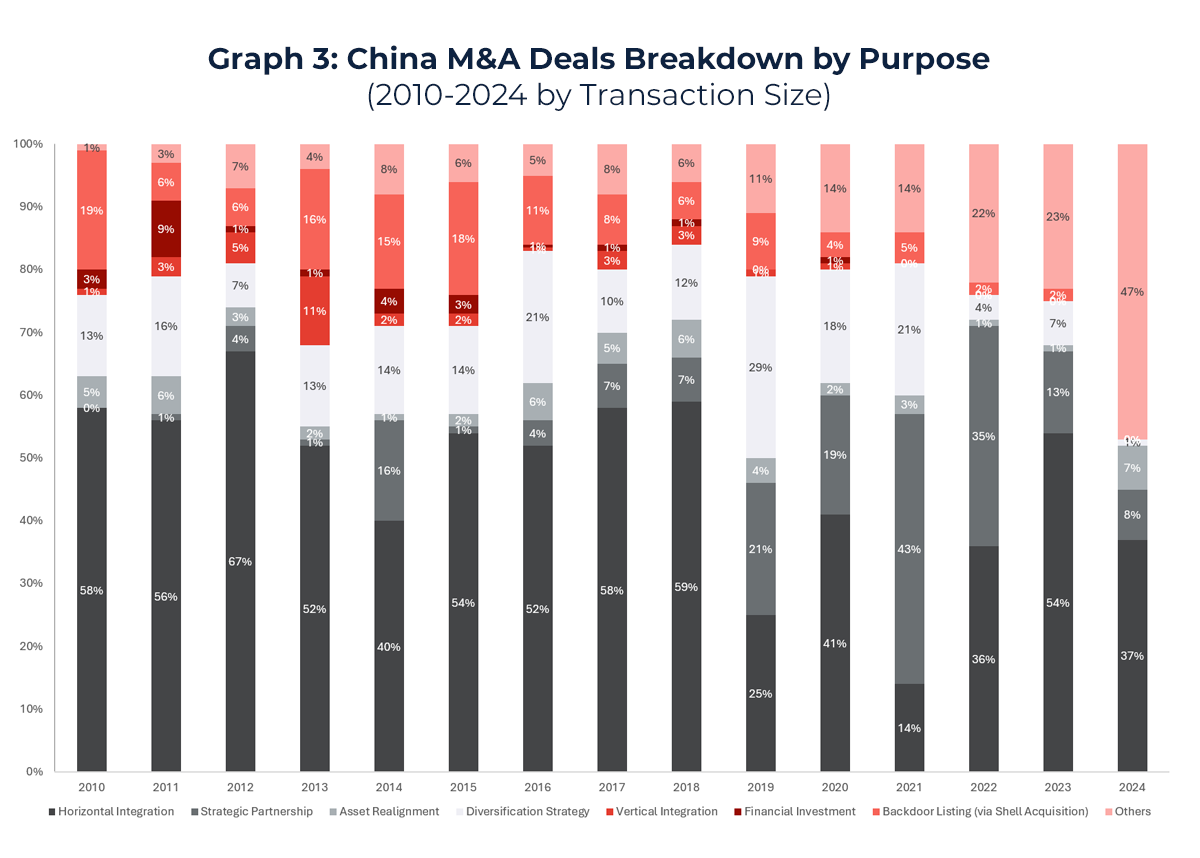

Historically, sectors like real estate, utilities, and transportation have dominated by transaction value. Agreement-based acquisitions (协议收购) remain predominant, though absorption mergers saw a significant uptick in 2024. Recent trends also highlight a decline in backdoor listings (借壳上市), with strategic cooperation and horizontal integrations increasing. Deals financed with cash have steadily risen, overtaking equity-financed acquisitions, reflecting investor preference for clearer valuation and lower risk profiles. Typically, companies involved in M&A transactions exhibit larger market capitalizations, faster revenue and net profit growth, higher price-to-book ratios, relatively lower ROEs, and higher quick ratios compared to their peers.

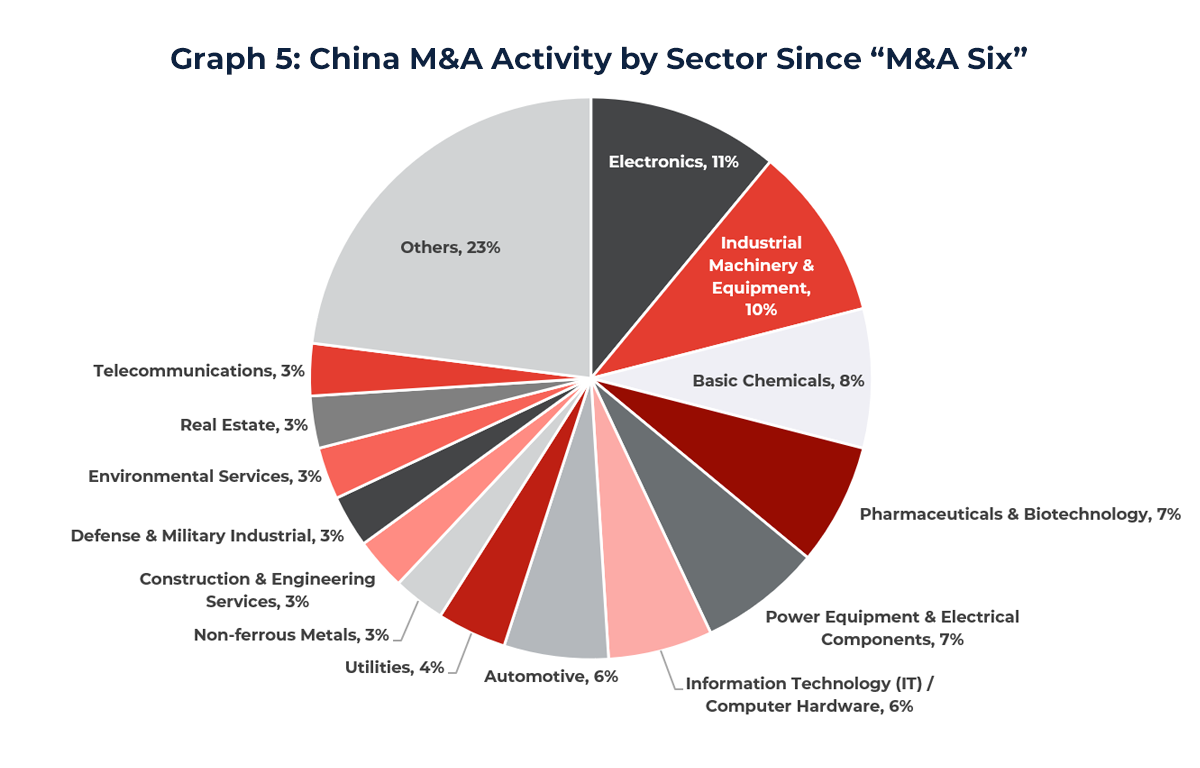

From 2010 to date, real estate, utilities, and transportation consistently recorded the highest average shares of transaction value (7.9%, 6.9%, and 6.6%, respectively). Basic chemicals and non-banking financial institutions also feature prominently, exhibiting clear cyclical trends. Within the technology manufacturing sector, electronics, machinery, and pharmaceuticals led with average shares of 6.4%, 6.2%, and 5.2%, respectively.

Historical Issues: Shell Companies and IPO Reform

A longstanding issue in China’s public market is the absence of a robust exit mechanism for listed companies. Historically, obtaining a listed status (上市资格) itself—particularly under the previous approval-based IPO system (核准制)—inherently bestowed substantial intrinsic value. The regulatory philosophy then was that companies needed to “earn” their listing right through stringent vetting. Consequently, even underperforming Special Treatment (ST) companies retained significant value as shell entities, since acquiring them allowed indirect access to public markets without enduring an arduous IPO review.

This created market inefficiency: valuable companies struggled to enter the public markets while weak firms, once listed, found it difficult to exit. This lack of dynamism compromised overall market quality and transparency.

China’s recent shift toward a registration-based IPO system (注册制) represents a pivotal step aligning the Chinese capital market closer to international standards. Unlike the previous approval-based system (核准制), which involved regulator-led vetting to determine company eligibility for public listing, the registration-based system prioritizes comprehensive information disclosure, entrusting the market and investors with valuation and risk assessment. By emphasizing transparency and market-driven evaluation over regulatory gatekeeping, the registration system significantly reduces the intrinsic value of shell companies, encourages natural market exits, and enables efficient capital allocation toward high-quality enterprises.

II. Regulatory Policy Tailwinds: The New “National Nine” Guidelines and “M&A Six” Measures

In 2024, Chinese authorities have rolled out significant reforms to invigorate the M&A market and steer it toward higher-quality growth. Two cornerstone policies stand out amongst a basket of policy consortium.

State Council’s New “National Nine” Guidelines

In April 2024, China’s State Council the new “National Nine” guidelines (新“国九条”). This top-level directive calls for making M&A a primary tool for corporate development while clamping down on abuses. It “encourage[s] listed companies to focus on their main business and comprehensively use M&A and restructuring… to improve development quality”. It also urges leading companies to consolidate industry peers (especially in their supply chains) and promises “multi-pronged measures to enliven the M&A market”. At the same time, the policy strengthens oversight – regulators will “strictly control the quality of injected assets, intensify scrutiny of backdoor listings, and crack down on illicit ‘shell’ preservation behaviors”. In short, the State Council set the tone that M&A should serve genuine industrial strategy rather than speculative moves.

CSRC’s “M&A Six” Measures

Building on that, the CSRC released the “M&A Six” measures in September 2024. Implemented in early 2025, these measures make M&A deals easier to execute and more value-driven:

- Boosting strategic M&A: Companies are encouraged to pursue acquisitions that support technology innovation and industrial upgrading. For example, high-quality listed firms are explicitly supported to engage in cross-industry M&A when it aligns with a bona fide business logic (e.g. seeking a “second growth curve”). At the same time, regulators are more tolerant of certain post-deal outcomes – allowing some temporary financial metrics fluctuation or related-party transactions, so long as the M&A serves long-term competitiveness.

- Flexible deal structuring: The rules broaden acceptable valuation and payment methods. Parties can use diverse valuation approaches (income, market, asset-based) to set prices and even negotiate performance-based arrangements at their own discretion. Crucially, companies can now combine payment tools – stock, cash, or even targeted convertible bonds – and even pay in installments. A new mechanism allows phased payment of share consideration over up to 48 months, reducing acquirers’ immediate funding pressure and one-time valuation risk. This particularly helps high-growth, less-profitable tech firms participate in M&A without betting everything on upfront pricing.

- Streamlined approval process: Perhaps most game-changing is the introduction of a simplified regulatory review for certain transactions. Deals meeting specific criteria can skip the lengthy vetting by SZSE and SSE committees and receive fast-track registration approval within 5 working days. Qualifying cases include mergers between two listed companies (stock-for-stock “absorption mergers”), as well as acquisitions by large, well-governed listed companies that do not constitute a “major asset reorganization”. This pilot “green channel” is a clear signal to the market – straightforward, accretive deals will get rubber-stamped quickly. Smaller deals by tech companies also enjoy an expedited “small fast track” review and even dedicated rules for using convertible bonds in M&A, making tech M&A more convenient.

- Investor protection and oversight: While easing procedural hurdles, regulators also reiterate that they will police “abusive” restructurings and fraud. The CSRC vows to “strictly punish fraudulent M&A, financial fraud, and insider trading, and crack down on various illegal ‘shell preservation’ acts”, to maintain market order. This balanced approach aims to weed out speculative deals while facilitating genuine mergers that enhance business value.

Collectively, these policy tailwinds have reset the M&A playbook in China. The emphasis is squarely on “industrial M&A” over “arbitrage M&A” – i.e. encouraging acquisitions that strengthen core operations, foster innovation, and enable corporate restructuring in line with national priorities. Unviable “shell” companies are no longer a safe haven as backdoor listing tricks are curtailed. Instead, well-run companies are rewarded for expansionary M&A: those with good disclosure records and solid governance get regulatory perks like faster approvals. The new rules also invite more private equity participation by addressing the perennial “exit” challenge – for instance, longer-term PE funds are now granted shorter lock-up periods on shares acquired via M&A (a creative “reverse link” incentive) to encourage patient capital.

Bottom line: China’s regulators have sent a clear message that 2025 is the start of a more M&A-friendly era. Quality deals – especially those that promote innovation, scale, and industrial synergy – are being actively promoted through policy, whereas purely speculative maneuvers face a tougher stance. These changes lay a strong foundation for a resurgence in deal activity, as we explore next.

III. A Rebounding M&A Market: Trends and Performance

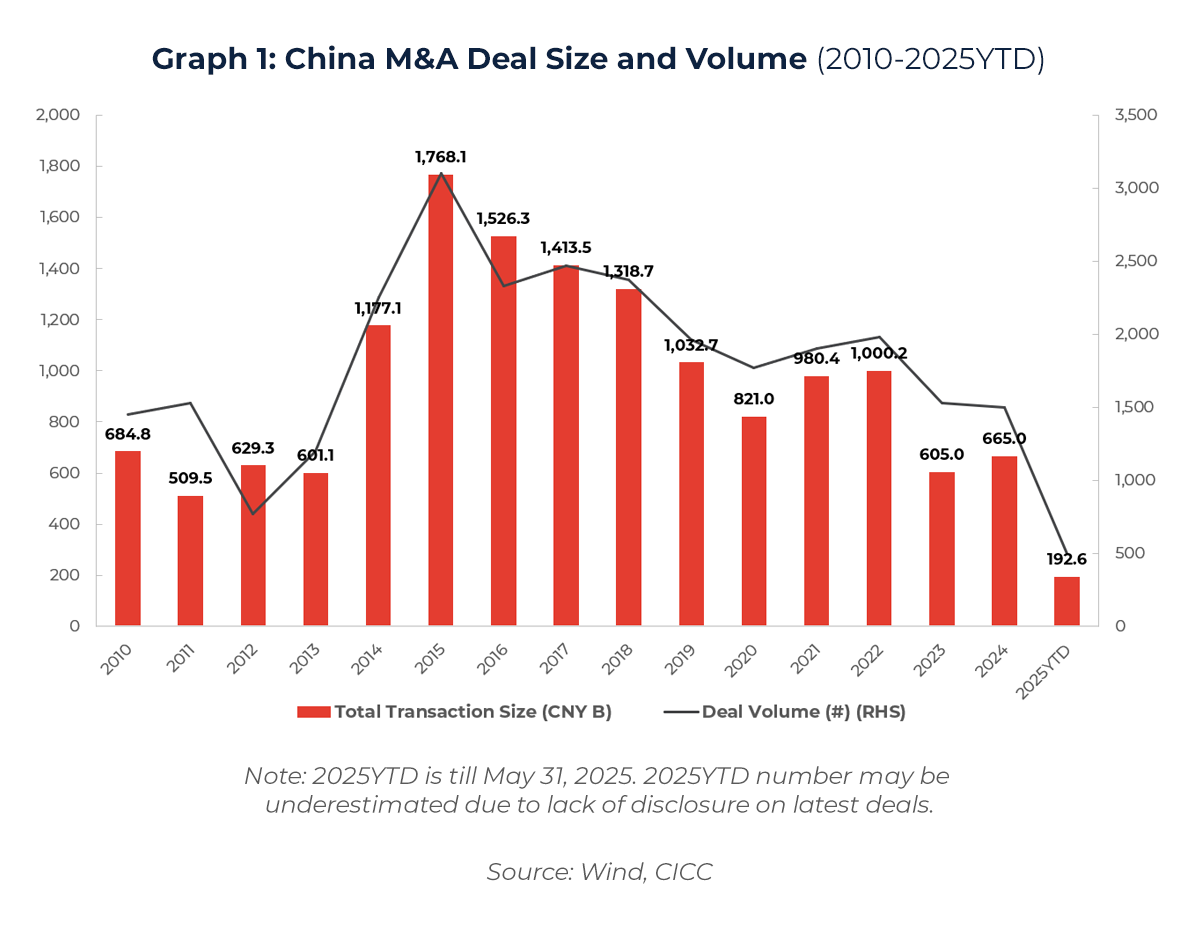

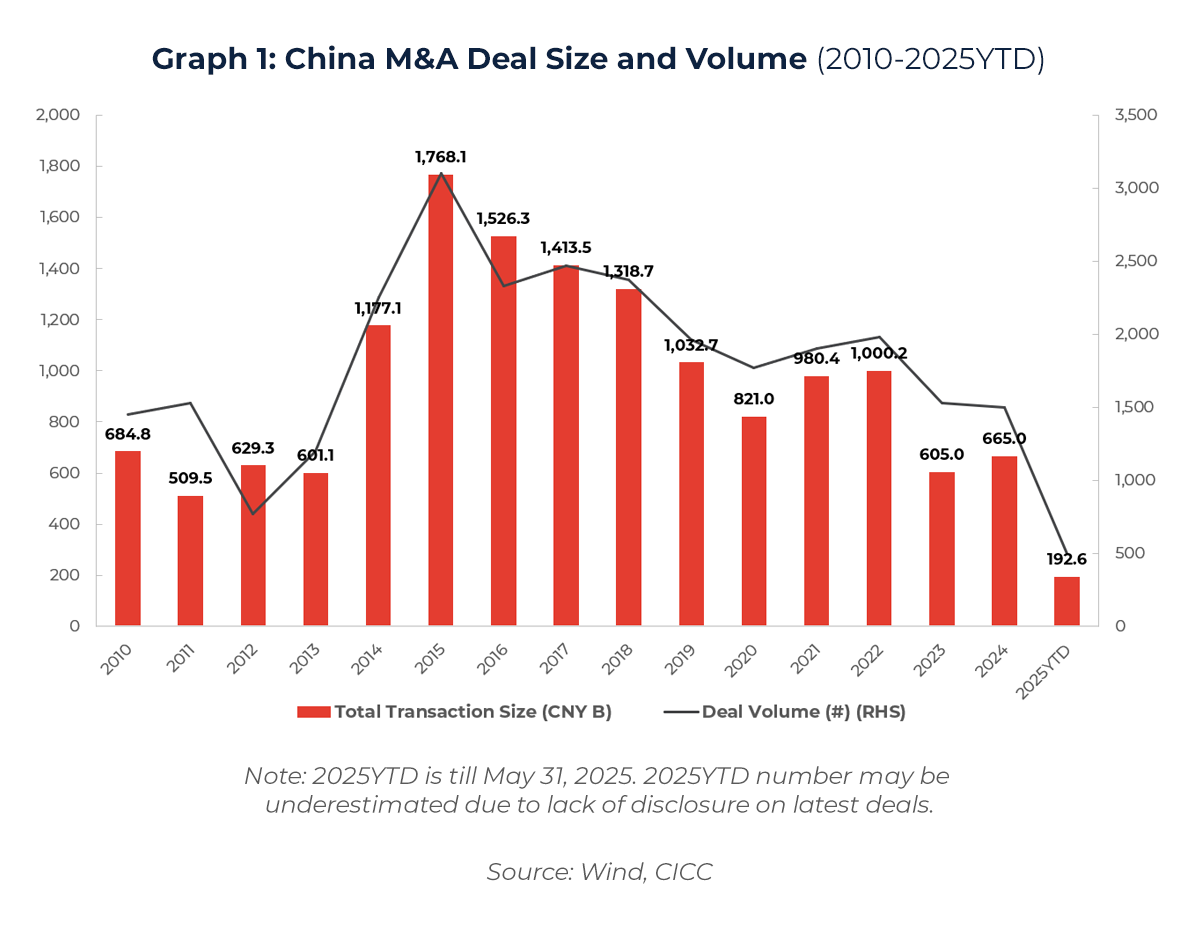

Signs of an M&A rebound are already materializing. In the wake of the “M&A Six” reforms and other policy boosts, transaction activity in China’s capital market has picked up momentum. From late 2024 through the first half of 2025, data shows an uptick in both the number and size of deals:

- Deal volume on the rise: In the eight months following the new CSRC measures (late September 2024 to late May 2025), A-share listed companies announced 1,076 M&A transactions, a 9.6% increase compared to the same period a year earlier. This marks a notable reversal from the stagnation seen in prior years. The total includes a broad range of deals – from small asset purchases to full acquisitions – indicating a broad-based revival in deal-making appetite. Notably, major asset restructurings (large transformative deals subject to special disclosure rules) more than doubled to 135 cases in that period, up 114.3% YoY. This surge suggests that the most significant, strategic transactions are back on the table after being dormant, precisely the kind of activity policymakers hoped to encourage.

- Accelerating post-policy: The growth in M&A activity clearly correlates with the timing of the new policies. In fact, deal announcements spiked immediately after the CSRC’s “M&A Six” were unveiled. For example, absorption mergers between listed companies – a type of deal given fast-track treatment under the new rules – saw 45 cases in the post-September window, up 125% from the prior year. This indicates companies are rapidly taking advantage of the simplified merger process. Market sentiment also reacted strongly: share prices of companies pursuing M&A have outperformed. Since the policy rollout, stocks of M&A-active firms delivered an average excess return of 12.9% in the first month after deal announcement, far above historical norms. Investors are effectively cheering the return of M&A as a growth catalyst.

- High success rates maintained: Importantly for both buyers and sellers, the vast majority of deals in China get completed once announced – a testament to the improving regulatory efficiency and deal execution environment. Over the past decade, over 90% of announced M&A deals have successfully closed, and in 2024 the success rate reached 92.5%, near record highs. In other words, if you strike a deal in China today, odds are it will go through, thanks to streamlined approvals and fewer policy hurdles. This reliability is a critical factor for global investors evaluating China’s deal risk.

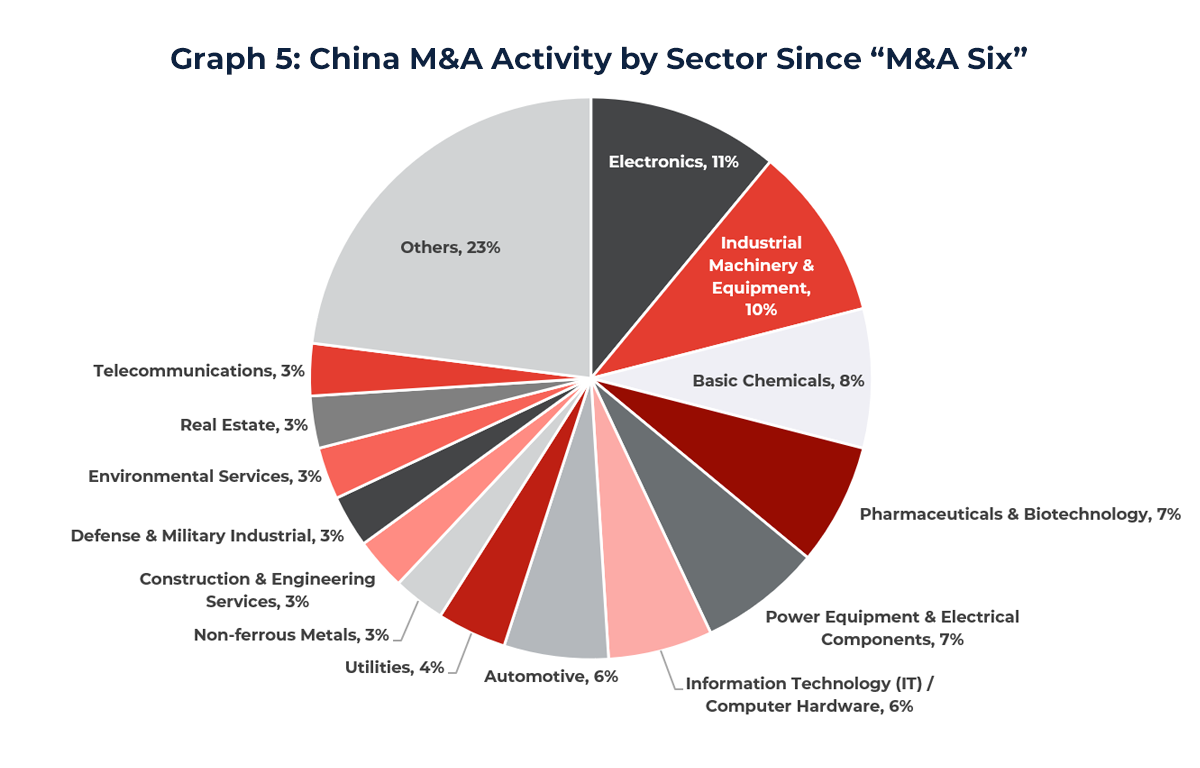

- Top sectors driving deals: The current M&A wave is concentrated in sectors aligned with China’s economic priorities. Technology and industrial upgrades dominate the scene. By number of deals, the electronics sector has led the pack in new M&A cases since late 2024, reflecting active consolidation in high-tech manufacturing. Other hot sectors include automotive, computer software/hardware, machinery, pharmaceuticals, and chemical materials – all industries targeted for growth and innovation. This aligns with policy signals (for example, support for “hard tech” companies to merge and acquire). Traditional industries like real estate and utilities, which historically saw many deals, have taken a backseat, while new economy and high-value manufacturing deals are surging. Geographically, many transactions also involve companies in emerging industrial clusters and innovation hubs, consistent with China’s regional development strategies.

- More strategic deal types: We are also seeing a shift in the nature of transactions. There are fewer opportunistic, unrelated diversifications and more strategic combinations. Horizontal mergers (between industry peers) and vertical integrations (along supply chains) make up a growing share of deals – exactly the types of transactions the new policies favor. Cross-sector acquisitions still occur but are increasingly story-driven (seeking technology, new markets, or a “second growth curve” for the acquirer) rather than speculative forays.

- Additionally, an interesting trend is the rise of “mergers of equals” and internal industry consolidations. With the simplified absorption merger process, healthy companies are more willing to merge with or absorb others in mutually beneficial deals (for example, two mid-sized competitors combining to achieve scale). All these developments point to a maturing M&A market focused on long-term value.

Together, these trends depict a revitalized M&A market heading into 2025. For global buyers, the message is that China’s deal pipeline is heating up, especially in tech and industrial sectors, with ample opportunities to invest or partner. For sellers (Chinese entrepreneurs or corporates), there is growing interest and liquidity for quality assets – strategic acquirers and investors are back in the hunt, armed with policy support and financing. However, capturing these opportunities requires aligning with the new strategic focus of M&A in China, as the next section discusses.

IV. Tech and Industrial Strategics Consolidation

One of the clearest shifts in China’s M&A landscape is a return to fundamentals-driven, strategic consolidation deals (基本面出发,产业资本为主导). Policymakers and market participants alike are steering M&A toward China’s broader strategic goals: technological self-reliance, industrial modernization, and scaled-up enterprises. This marks a departure from the mid-2010s era when financial engineering and “shell company” plays were prevalent. In effect, Chinese M&A has “脱虚向实” – moving from the unsubstantiated to the real economy.

Technology at the forefront: High-tech companies and innovators are now at the heart of M&A policy. China wants its tech sector to grow through consolidation and acquisition of key assets. The CSRC’s new measures explicitly “prioritize support for technology enterprises to utilize mergers and acquisitions”. We see this in practice with more deals in semiconductors, AI, biotech, and other high-tech fields. Notably, regulators have lifted constraints that previously hindered tech M&A – for example, allowing acquisitions of pre-profit or asset-light tech startups (with higher tolerance for lofty valuations) and permitting payment in forms like convertible debt to get deals done. A “green channel” for tech M&A was also introduced, accelerating approval for deals involving “hard technology” firms. All of this signals that if you are a global tech company or investor, combining forces with Chinese tech counterparts (through joint ventures, strategic investments or buyouts) is now more feasible and encouraged than ever.

Industrial consolidation and “M&A 3.0”: Outside of pure tech, China’s vast traditional industries are also entering a new consolidation cycle. After years of fragmented competition in sectors like manufacturing, energy, and consumer goods, leading players are now incentivized to merge and acquire to achieve scale and efficiency. The government is nudging leading listed companies to integrate their industry chain – essentially encouraging bigger firms to acquire smaller peers or suppliers to create more competitive national champions. This push has been termed the “M&A 3.0 era” by industry insiders, meaning a phase where industrial logic prevails. As one investment executive observed, “from 2020 to now we are in M&A 3.0 – we see industrial M&A officially starting, with industry forces truly driving a new wave of M&A”. In practical terms, this means more cases of, say, a manufacturing conglomerate buying a specialized component producer to strengthen its supply chain, or a state-owned enterprise merging with regional competitors to eliminate overlap and improve scale. Such deals are viewed favorably by regulators as they align with China’s economic upgrade plans.

State-owned enterprises (SOEs) and value-driven M&A: A notable component of this new focus is the role of SOEs. Central and local SOEs are being encouraged to use M&A as a tool for “市值管理” (market value management) and industry restructuring. The State Council’s guidance urges top SOEs to focus on core businesses and actively acquire or merge with listed subsidiaries in their value chain. The idea is that stronger SOEs can help consolidate industries and improve overall efficiency, while also unlocking value from undervalued assets. We anticipate more SOE-led acquisitions, particularly in industries like energy, utilities, and infrastructure, where state players can absorb smaller firms. For global sellers in those sectors, this could mean potential exit opportunities if an SOE is seeking technology, expertise, or assets that foreign firms are willing to sell. However, any such deals would be assessed for strategic fit – the era of random conglomerate diversification is over.

Private companies and the IPO alternative: Another emerging facet is the rise of M&A as an alternative path for private companies that might otherwise pursue IPOs. In recent years, China’s IPO process has become more selective (despite the registration-based reforms), and market conditions have not favored every aspiring public listing. Consequently, many pre-IPO companies are turning to M&A – either selling to or merging with an established listed company – as a way to achieve growth or liquidity. This trend enlarges the pool of potential acquisition targets for both domestic and foreign buyers. For instance, a global company looking to enter China could acquire a successful private Chinese firm that had been eyeing an IPO, creating a win-win: the Chinese founders get an exit, and the foreign buyer gets a foothold in the market. The policy environment strongly supports this—mergers are now an accepted outcome for private firms, not a second choice.

In summary, China’s M&A scene in 2025 is characterized by purposeful, strategic transactions. Whether it’s big tech acquisitions, traditional sector consolidation, SOEs optimizing their portfolios, or private firms aligning with larger groups, the common thread is industrial synergy and long-term value creation. Global buyers and sellers should align their strategies accordingly. If you bring genuine technology, industrial expertise, or scalable assets to the table, Chinese stakeholders (and regulators) are keen to welcome you. Conversely, Chinese companies with solid fundamentals and market positions may find eager international investors or partners, as long as the partnership drives tangible growth or innovation. The next section looks at the expanding avenues for such cross-border engagements.

V. Opening Up: Opportunities for Global Investors | The “2025 Action Plan”

China is not only reforming domestic M&A rules; it’s also opening its doors wider to foreign capital in M&A and direct investment. For global investors and multinational companies, these developments present new avenues to participate in China’s growth story through acquisitions, joint ventures, and strategic stakes. Key initiatives on this front include:

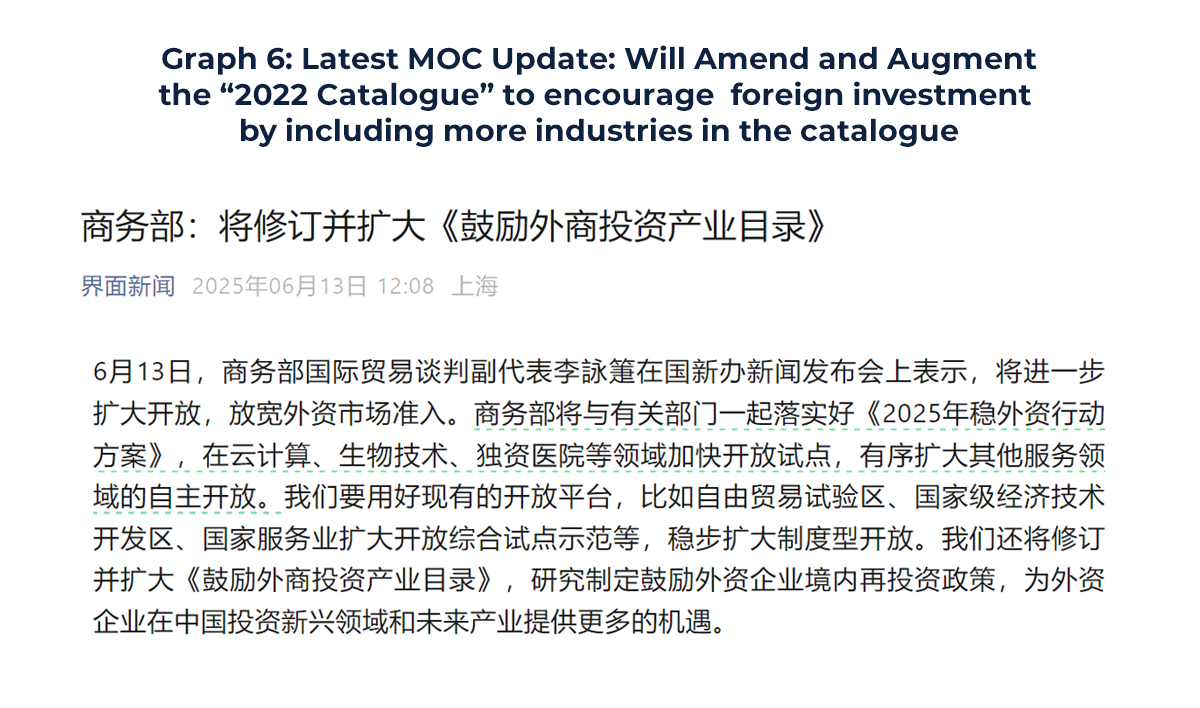

- Easier inbound M&A rules: The Chinese government has explicitly recognized the importance of foreign involvement in its capital markets. A joint 2025 Action Plan for Stabilizing Foreign Investment (by the MOC and NDRC) outlines measures to attract and retain overseas capital. Notably, authorities will “amend the Provisions on the Merger and Acquisition of Domestic Companies by Foreign Investors under the framework of the Foreign Investment Law, refining M&A rules and transaction procedures, better defining the scope of administration and lowering the threshold for cross-border share swaps”. In plain English, the often-cumbersome 2009 regulations governing foreign takeovers of Chinese companies are getting an update – expect clearer rules, simpler approval steps, and more flexibility (for example, allowing foreign buyers to use their stock as deal consideration more easily). This is a big deal for global buyers: it means acquisitions in China (whether of private companies or stakes in listed firms) should face fewer bureaucratic hurdles going forward.

- Equal treatment and expanded sectors: China is also reducing formal restrictions on foreign investment entry. Sectors not on the negative list (the list of prohibited or restricted industries for FDI) are now governed by the principle of national treatment, meaning foreign investors will be treated on par with domestic ones. Manufacturing, in particular, is wide open – all foreign equity caps in manufacturing have essentially been lifted, encouraging global manufacturers to invest or acquire local players. Beyond that, the government is expanding the “2022 Catalogue” (鼓励外商投资产业目录) to guide capital into priority areas. This catalogue, updated effective January 2023, contains 1,474 encouraged industries, from high-tech manufacturing and advanced materials to modern services and green industries, including region-specific opportunities in China’s central and western provinces. Foreign investors in these encouraged sectors enjoy incentives like tax breaks, easier land access, and streamlined permitting. Moreover, officials plan to further broaden the encouraged list to cover emerging fields. As the 2025 Action Plan states, “we will revise and expand the catalogue of industries where foreign investment is encouraged… promote high-quality development of manufacturing with foreign investment, steer foreign investment to the modern services sector, and support more flows into central, western and northeastern regions”. In short, if your acquisition target aligns with China’s industrial policy (think electric vehicles, renewable energy, advanced machinery, healthcare, logistics, etc.), you’ll not only find less resistance but may actually get policy support.

- Facilitating strategic stakes: Another opportunity is foreign strategic investment in Chinese listed companies. China has regulations that allow foreign investors to take significant equity stakes in listed A-share companies (under certain conditions), and the government is looking to invigorate this route. The Action Plan directs officials to “formulate and release guidelines for making strategic investment [in listed companies]… and encourage more high-quality long-term foreign investment in listed Chinese companies.” This means global institutional investors or industry players could more readily buy meaningful stakes in Chinese market leaders, potentially as a prelude to deeper cooperation or M&A. We anticipate clearer guidance on how foreign investors can, for example, surpass certain ownership thresholds or obtain regulatory approvals for strategic stakes. For global sellers (e.g. a multinational considering selling a Chinese division or seeking a Chinese strategic partner), this also signals that Chinese listed companies may be encouraged to invest outward or form alliances, as it’s a two-way street to boost their value.

- Enhanced transaction infrastructure: China is also improving the “soft infrastructure” around foreign investment. Free trade zones (FTZs) and development zones are being upgraded with more liberal policies to facilitate foreign-funded projects. Foreign-invested enterprises (FIEs) will find it easier to raise local financing, as rules now allow foreign investment holding companies to access domestic loans for their deals. There are also moves to ease cross-border capital flows and personnel movement (e.g. visa improvements for foreign professionals) to support investment activities. All these improvements aim to reduce the friction for cross-border M&A and integration – from due diligence and financing through to post-merger operation.

For global buyers, these opening-up measures mean China’s M&A landscape is becoming not only more accessible but also more welcoming. Unlike a decade ago, where foreign acquirers often faced uncertainty and lengthy approvals, today a well-structured deal in an encouraged sector can get the green light relatively smoothly. That said, investors should still be mindful of national security review mechanisms (especially for deals in sensitive sectors like defense, tech, or data-heavy businesses) which remain in place. China will balance openness with protecting strategic interests, as any country would. Nonetheless, the overall tone is proactive: China wants and needs foreign capital and expertise to meet its economic goals, and 2025 could see a rebound in inbound M&A accordingly.

For Chinese companies (“sellers” in potential deals), this means a larger pool of suitors and investors. Whether it’s seeking growth capital, selling a non-core business to a foreign firm, or entering a joint venture, the policy environment is supportive. Notably, mid-sized private companies in manufacturing or consumer sectors might find foreign buyers keener now, thanks to the catalogue incentives and market access reforms. Even startups and tech firms could see interest from global venture capital or tech giants as restrictions ease.

Outlook: The intersection of China’s domestic reform and international opening is creating perhaps the most favorable M&A climate in a decade. We expect 2025 to bring a higher volume of cross-border deals – both inbound investments into China and selective outbound acquisitions by Chinese companies abroad – driven by this policy momentum. Global buyers and sellers who understand the new rules of engagement stand to benefit greatly. However, navigating this evolving landscape requires local insight, financial savvy, and strategic foresight.

VI. How ARC Can Help

At Alarar Capital Group, we recognize that China’s M&A landscape in 2025 offers unprecedented opportunities – but also new complexities – for both international and domestic players. With deep experience in cross-border transactions and a strong on-the-ground presence in China, Alarar Capital Group is uniquely positioned to support clients in navigating this dynamic environment. Our expertise in mid-market M&A, combined with local market insight and global reach, allows us to bring strategic vision and execution excellence to every deal. Here’s how we can help buyers and sellers unlock value in China’s new M&A era:

- Deep China Market Insight – Our team has a nuanced understanding of China’s regulatory landscape, business culture, and industry-specific dynamics. From the latest CSRC rules to local due diligence practices, we stay abreast of every detail. This insight enables us to identify the right opportunities and tailored deal structures that align with policy incentives and our clients’ long-term objectives. We guide clients through regulatory approval processes, compliance requirements, and negotiation nuances that are unique to Chinese M&A, ensuring transactions progress smoothly and efficiently.

- Global Network and Cross-Border Expertise – With a presence in 12 countries across three continents, Alarar Capital Group is adept at facilitating cross-border transactions. Our global reach allows us to connect Chinese companies with international partners and investors – and vice versa – to create win-win deals. Whether it’s finding a foreign strategic buyer for a Chinese firm, or helping an overseas investor source the ideal target in China, we leverage our extensive network to bridge markets. We are experienced in managing cross-cultural deal negotiations, international valuation gaps, and integration planning, which are critical in cross-border M&A success.

- Proven Track Record in M&A – Alarar Capital Group has successfully executed over USD $1 billion in transaction volume over the last three years, specializing in cross-border M&A involving Asia. Our recent engagements span a range of industries – from technology and manufacturing to consumer goods – reflecting our versatility and deal-making acumen. We have advised on complex transactions that required meticulous structuring and regulatory navigation, including deals under China’s evolving foreign investment framework. This proven track record gives our clients confidence that we can deliver results even in challenging scenarios.

- Comprehensive Advisory Services – Beyond deal sourcing and execution, we provide end-to-end advisory support. This includes rigorous valuation analysis, thorough financial and legal due diligence coordination, deal financing solutions, and post-merger integration planning. We understand that a successful M&A does not end at signing; how the merger is realized afterward is equally important. Our advisory capabilities extend to structuring transactions to meet new regulatory requirements (such as using permissible payment instruments or adhering to foreign investment caps). Moreover, Alarar Capital Group is a leader in innovative deal structures – for instance, we have expertise in SPAC transactions and were ranked #1 globally in SPAC M&A league tables by deal value in 2022. We bring the same creativity and diligence to traditional M&A deals in China, ensuring our clients have all the tools and guidance needed for success.

Call to Action: As China’s M&A market enters this new phase of growth and openness, Alarar Capital Group stands ready to assist companies and investors in capitalizing on the opportunities while managing the risks. Our specialized knowledge, global network, and proven track record make us an ideal partner for those looking to explore strategic M&A opportunities in China’s dynamic market. Whether you are a global buyer seeking entry or expansion in China, or a Chinese business aiming to optimize and grow through M&A, we are here to provide objective, expert advice and hands-on deal execution.

Contact us today to learn how Alarar Capital Group can support your business objectives and help you navigate the exciting road ahead in China M&A 2025.

References:

[1] [“M&A Six” Articles] http://www.csrc.gov.cn/csrc/c100028/c7508366/content.shtml

[2] http://www.csrc.gov.cn/csrc/c101981/c7508364/content.shtml

[3] [“National Nine” Articles] https://www.gov.cn/zhengce/content/202404/content_6944877.htm

[4] http://www.csrc.gov.cn/csrc/c100028/c7474995/content.shtml

[5] https://www.sse.com.cn/lawandrules/sselawsrules/stocks/review/recombination/c/c_20240430_10753902.shtml

[6] https://www.szse.cn/lawrules/rule/allrules/bussiness/t20240430_607060.html

[7] http://www.csrc.gov.cn/csrc/c100028/c7487999/content.shtml

[8] http://www.csrc.gov.cn/csrc/c100028/c7508366/content.shtml

[9] https://www.sse.com.cn/lawandrules/publicadvice/c/c_20240924_10762326.shtml

[10] https://www.szse.cn/aboutus/trends/news/t20240924_609549.html

[11] https://mp.weixin.qq.com/s/osgu7Q-yJYij93oFw_rLUg

[12] https://mp.weixin.qq.com/s/cNSQHDWg32FUtc1lTf6XMA

[13] https://mp.weixin.qq.com/s/hRCBYq-veTaHIeoYNXYhFA

[14] [2025 Action Plan for Stabilizing Foreign Investment] https://wzs.mofcom.gov.cn/cms_files/filemanager/195082220/attach/20252/6551bb369c4d4a2fbfab85d853681e3e.pdf

[15] [Catalogue of Industries for Encouraging Foreign Investment (2022 version)] https://zt.www.jiyuan.gov.cn/zsyz/wstz_zsyz/syzy/P020230424617152040681.pdf