Executive Insight

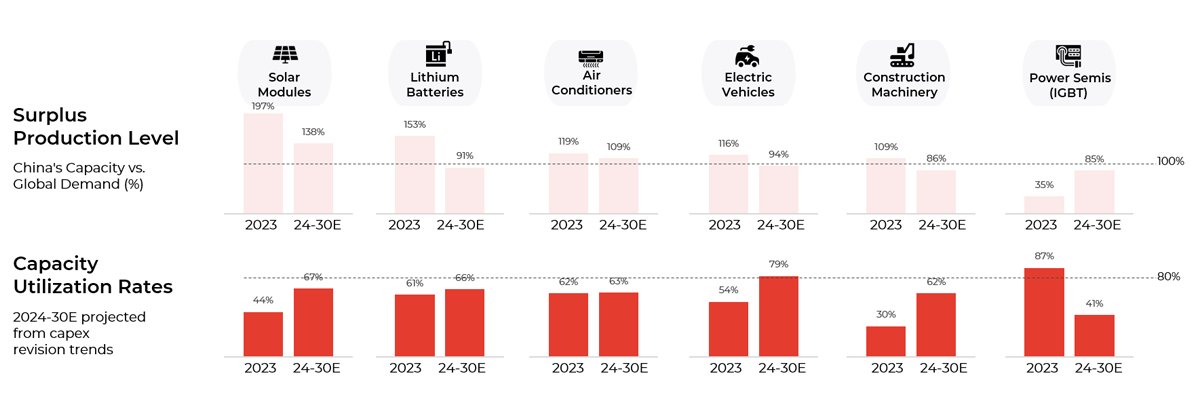

China’s industrial ecosystem, once a symbol of limitless scale and speed, now faces one of its most entrenched structural challenges: overcapacity. Sectors like electric vehicles, solar energy, semiconductors, and new materials are grappling with excessive supply built for yesterday’s demand. As margins shrink and supply chains destabilize, global businesses must reassess their exposure to China’s increasingly saturated industrial base.

From Overdrive to Overhang

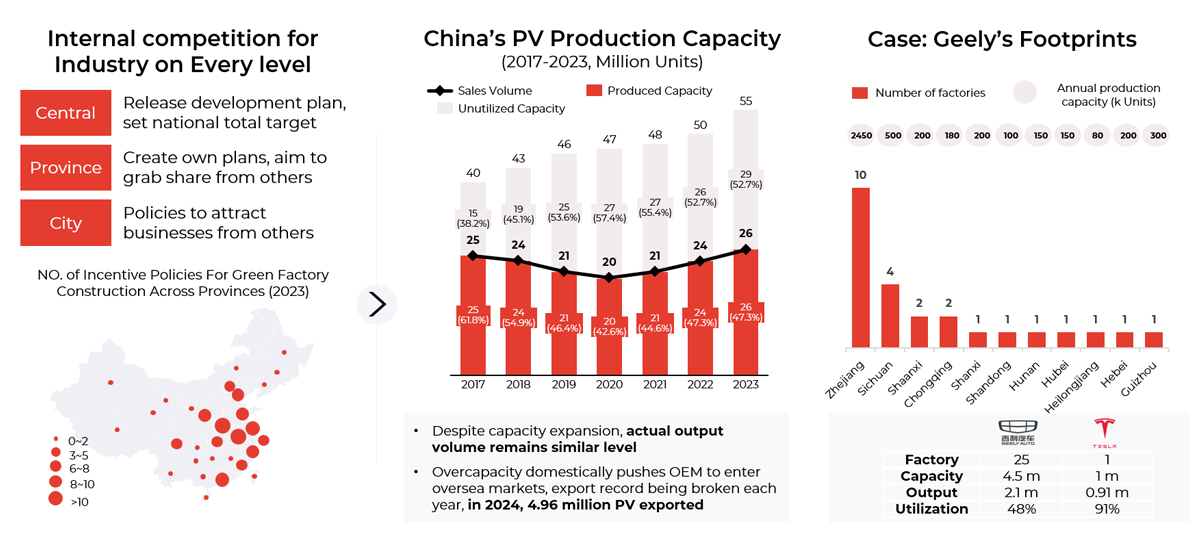

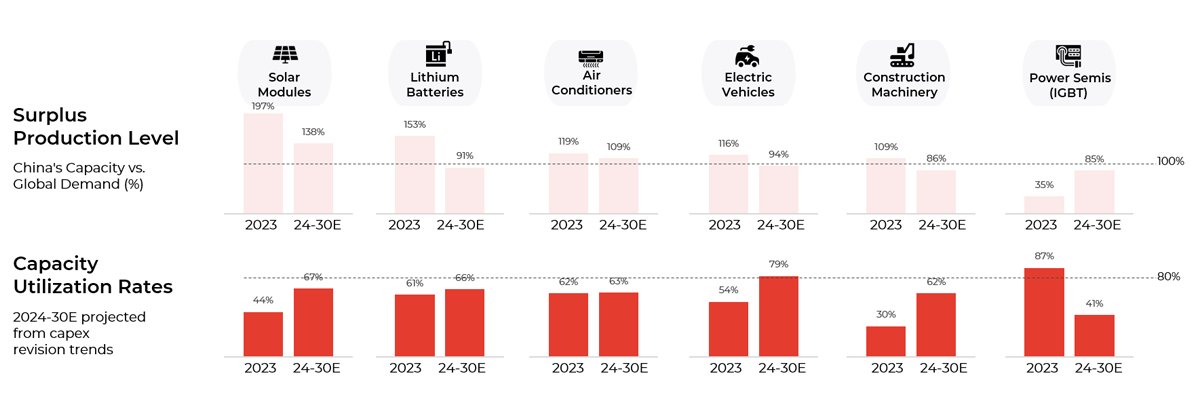

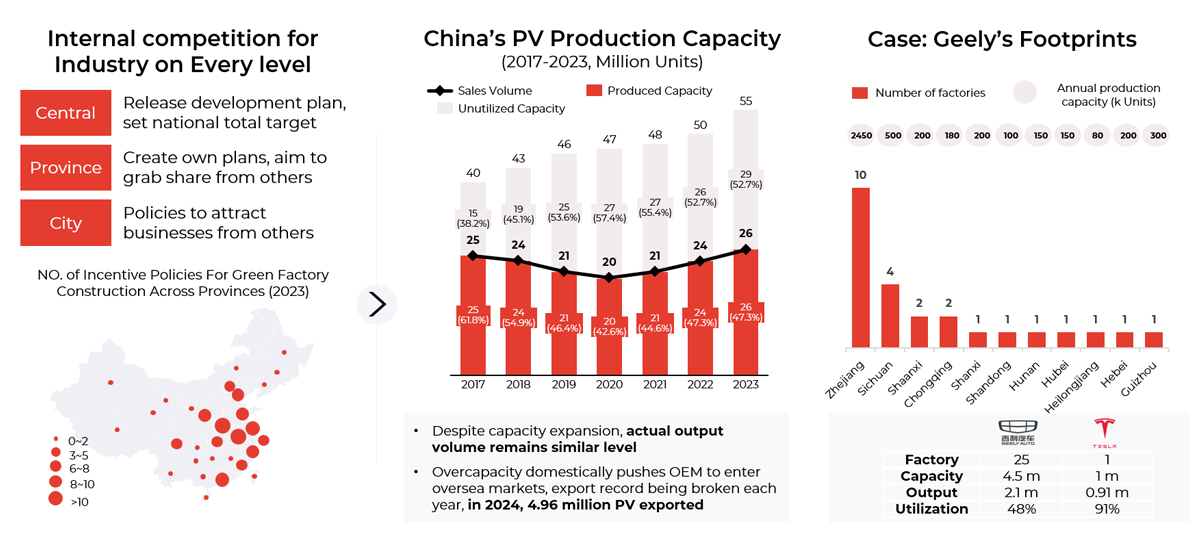

Fueled by ambitious national targets, overlapping regional incentives, and a supply chain architecture optimized for boom cycles, many Chinese industries now operate well below market equilibrium. Across key sectors, capacity utilization rates have fallen under 80%, a threshold often used to define overcapacity. This misalignment is the result of:

- Demand Plateaus: Domestic demand growth has stagnated or declined in many industries post-2020.

- Policy Duplication: Local governments continue to roll out incentive programs to compete for industrial share, leading to redundant investment.

- Export Pressure: To offload surplus production, Chinese firms have aggressively expanded into global markets, triggering price wars and margin erosion.

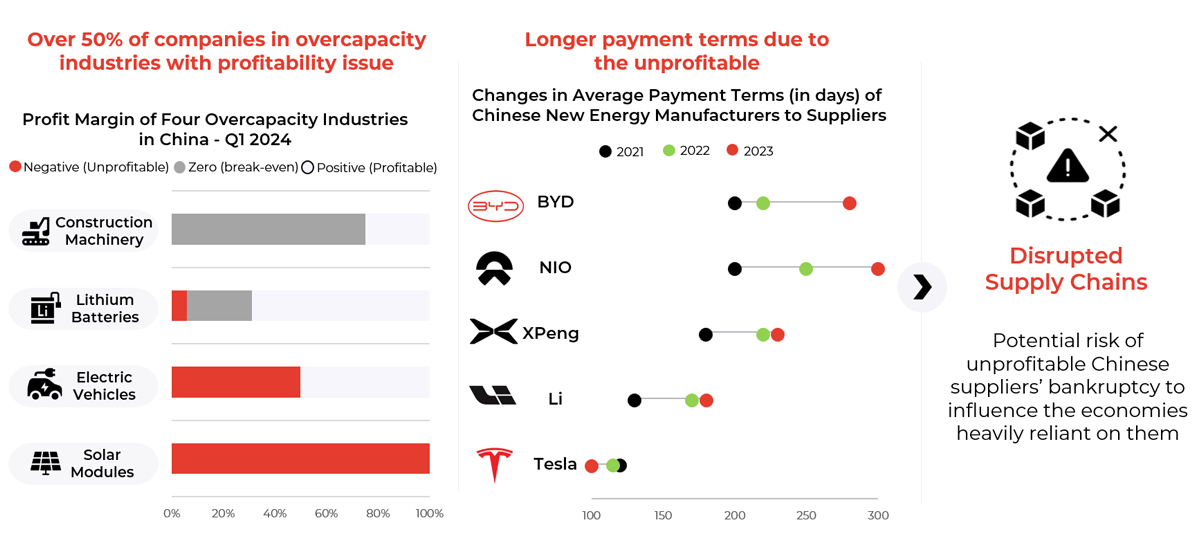

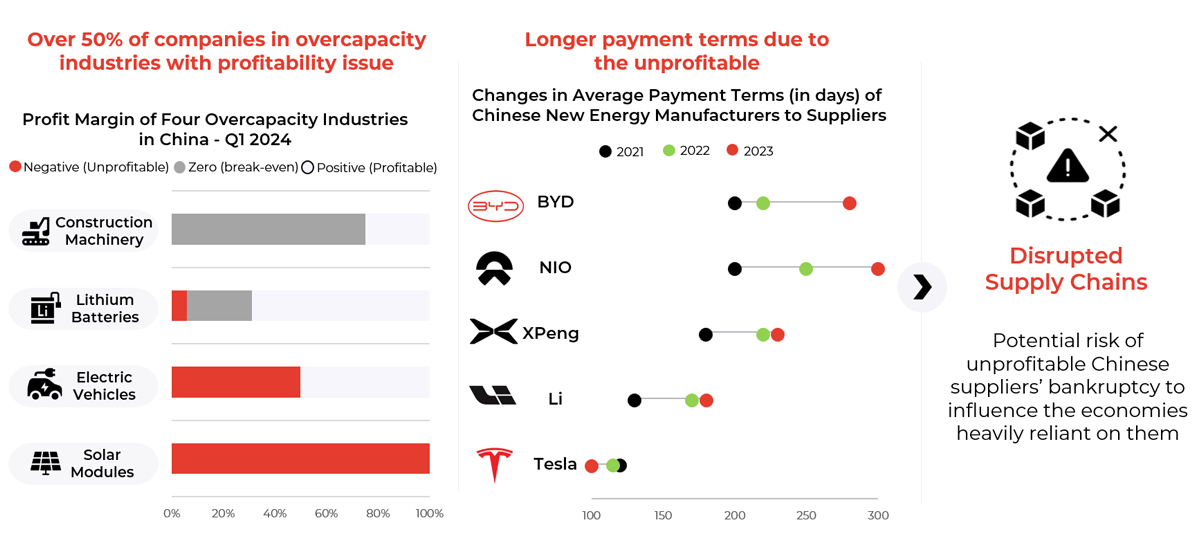

A growing number of overcapacity sectors in China, such as electric vehicles and solar modules, are experiencing a profitability squeeze, forcing manufacturers to extend payment terms to suppliers. This signals deepening financial strain across the value chain and sets the stage for broader supply chain volatility.

Supply Chain Volatility and Downstream Risks

Overcapacity is not just a domestic issue, it cascades globally. For multinational corporations relying on Chinese partners, the risks are multifaceted:

- Financial Instability: An increasing number of producers, especially in green tech and automotive, are operating at a loss, delaying payments and jeopardizing supplier relationships.

- Policy Intervention: Governments may impose anti-dumping measures, tariffs, or regulatory scrutiny on sectors associated with industrial excess, disrupting export flows.

- Operational Risk: Oversaturated sectors become less predictable, with frequent shutdowns, uneven quality control, and heightened reputational risks.

For global businesses, managing China-related supply chain exposure is no longer about cost alone, it’s about resilience, diversification, and foresight.

Strategic Implications for Global Players

Navigating this environment demands more than tactical sourcing changes. It requires a structural rethink of supply chain strategy:

- Evaluate supplier ecosystems for financial health and geopolitical exposure.

- Diversify sourcing beyond overbuilt sectors or regions, including through nearshoring or “China+1” strategies.

- Collaborate with fewer, stronger partners to reduce systemic risk and increase leverage in price and quality negotiations.

Firms that respond proactively will not only reduce risk but unlock strategic advantage in a period of global realignment.

How Our Management Consulting Division Can Help

Our management consulting division works with global firms to turn supply chain risk into opportunity. We help leaders identify exposure, restructure sourcing strategies, and build long-term resilience in the face of systemic overcapacity.

Our services include:

- Supply Chain Health Assessments: We map vulnerabilities across tiers, from raw materials to finished goods, and evaluate financial robustness and risk concentration.

- Diversification and China+1 Execution: We support end-to-end implementation—from identifying alternative suppliers in Southeast Asia and Mexico to integrating new logistics and compliance frameworks.

- Policy Monitoring and Strategic Foresight: We track evolving regional incentives, industrial policy trends, and trade restrictions to help clients stay ahead of disruption.

Whether your organization seeks to reinforce supply chain integrity, optimize cost structures, or reposition for long-term competitiveness, our consulting team delivers the insights and execution support needed to navigate this complex shift with confidence.

Author:

Leo Jibrandt

Associate Partner