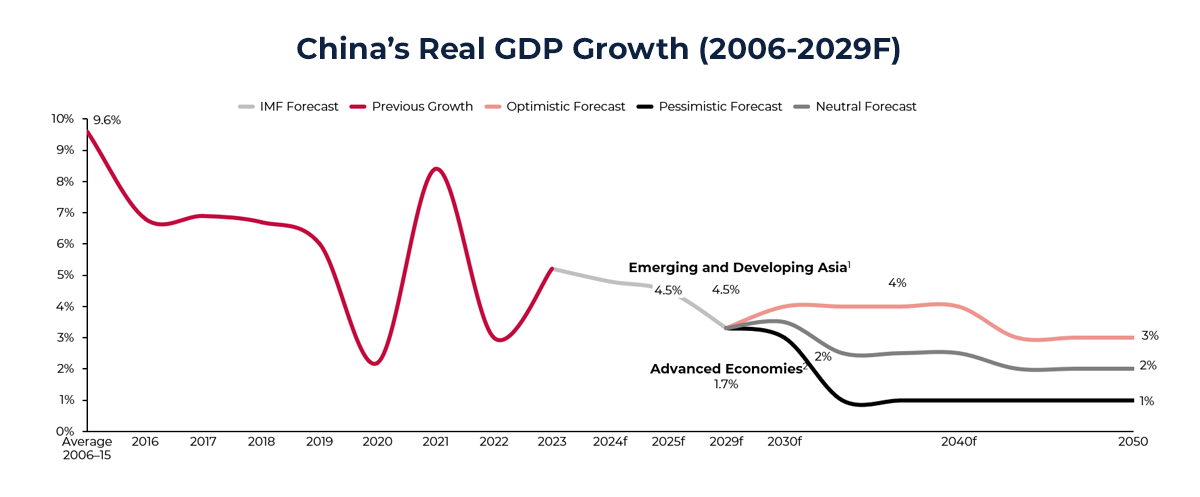

China’s post-industrial growth era is approaching its limits. Once powered by investment-led booms and labour abundance, the nation now faces a slow but steady transition into a structurally lower-growth economy. The coming decade will challenge assumptions built on two decades of rapid expansion and demand a sharper strategic focus from global businesses operating in China.

The New Normal Becomes Permanent

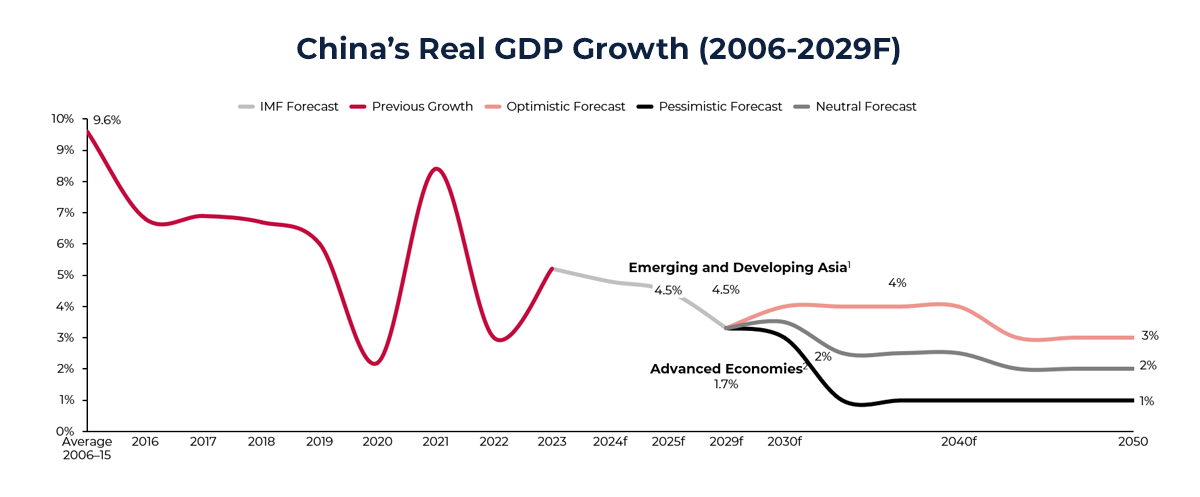

Growth projections suggest a deceleration to 2–3% GDP growth by 2030, lower than many neighbouring emerging economies. This is not a temporary adjustment, but the cementing of what President Xi Jinping once referred to as the “new normal”: slower, more stable, and structurally complex economic development.

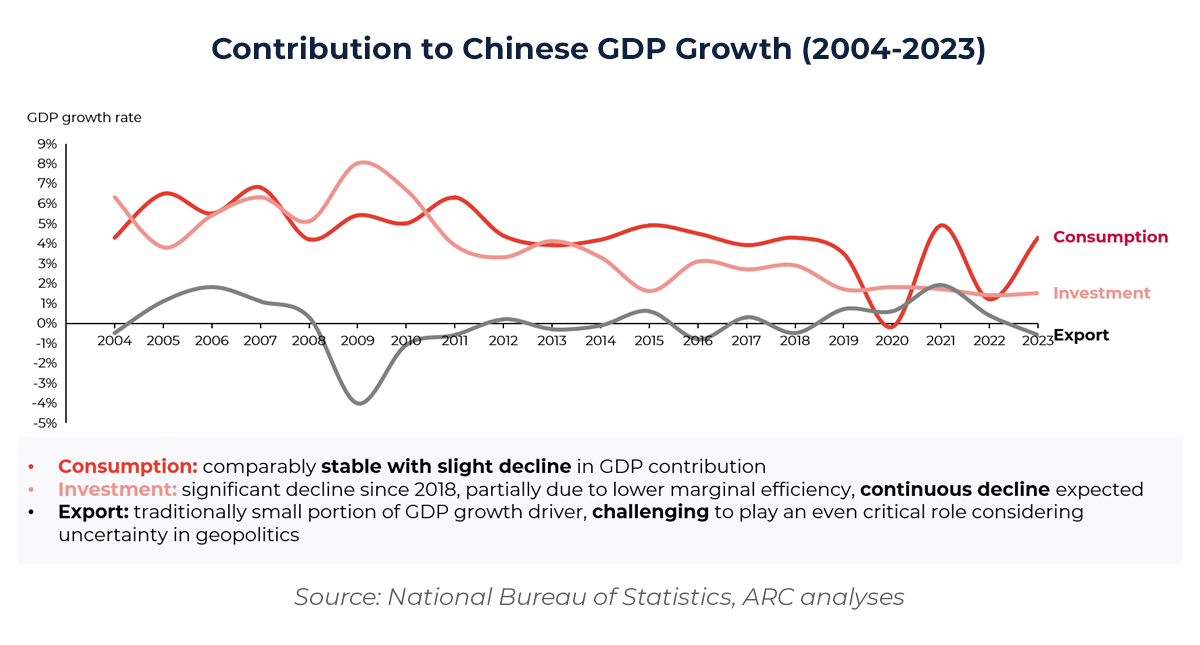

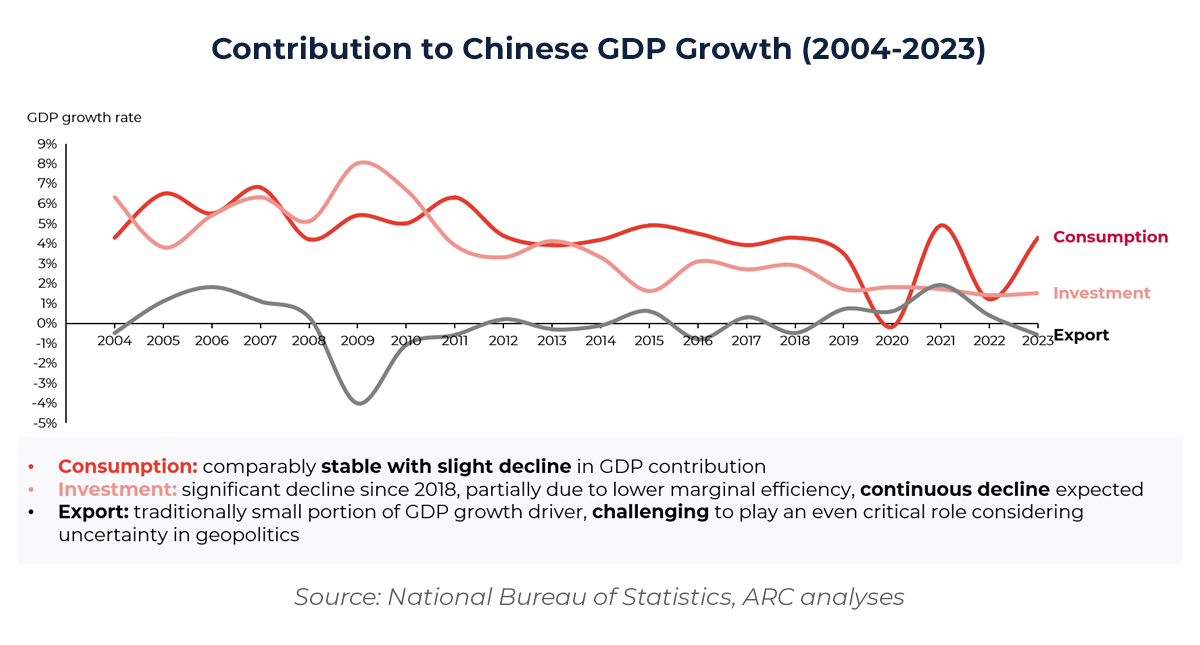

Three key pillars that once supported China’s ascent, investment, export, and consumption are all under pressure:

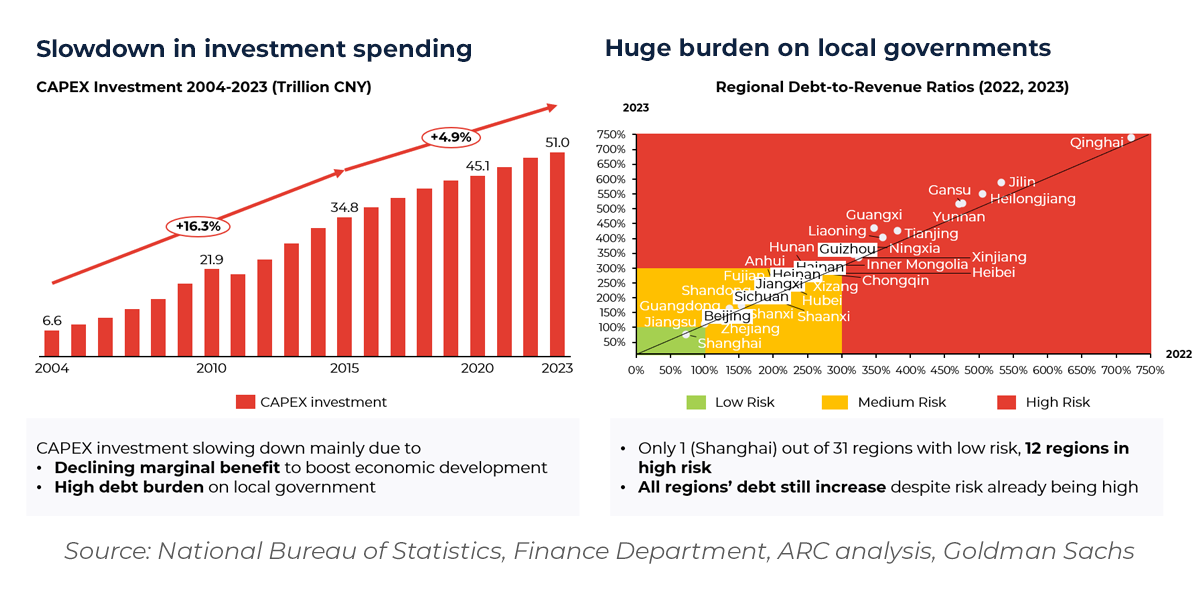

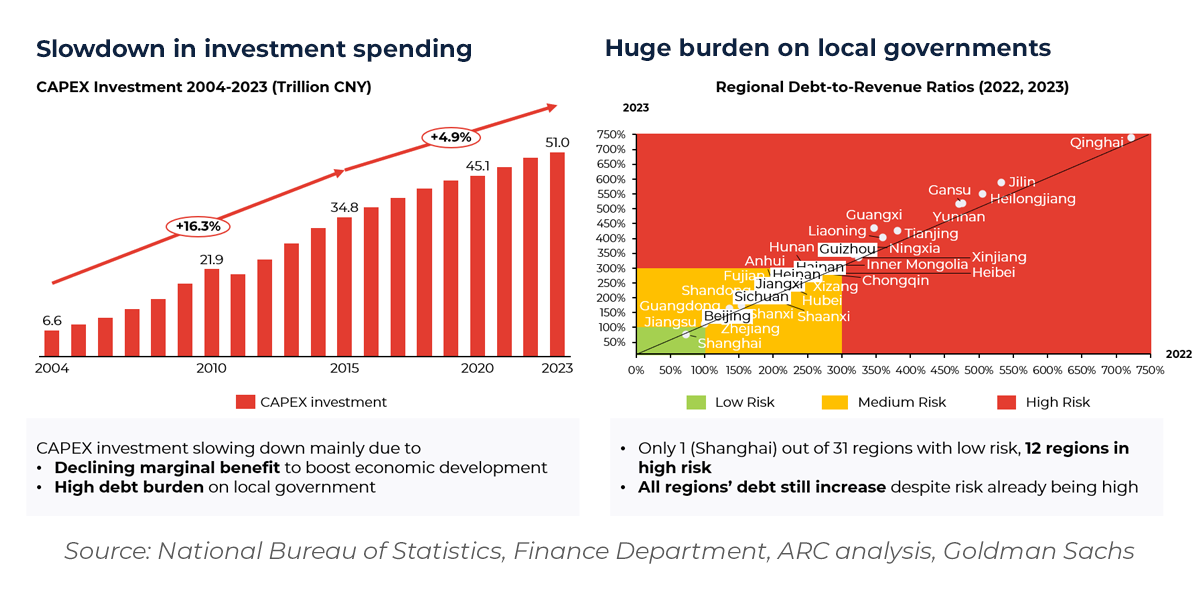

- Investment: Efficiency has eroded. Since 2018, diminishing marginal returns and fiscal constraints have made investment a less effective engine.

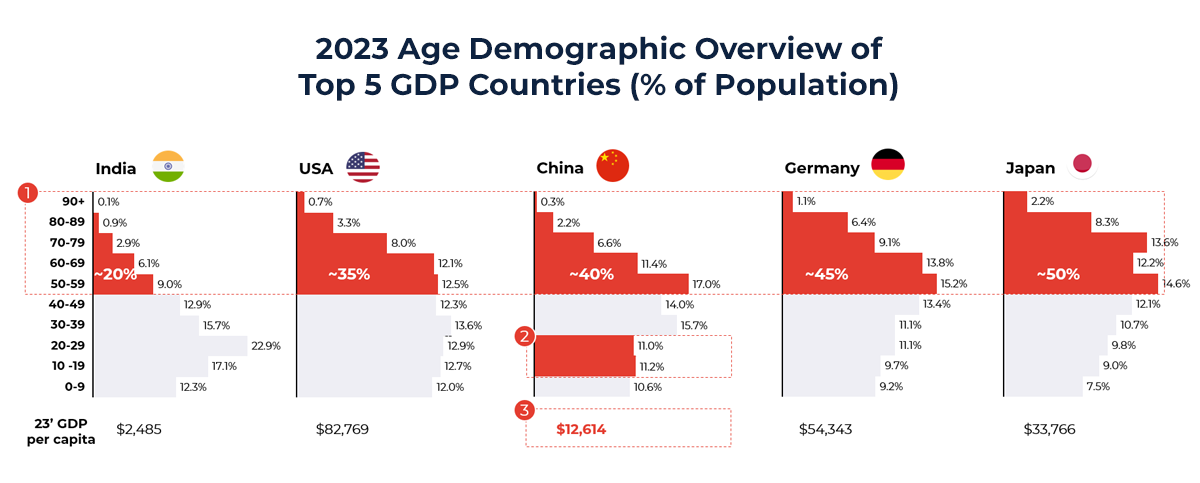

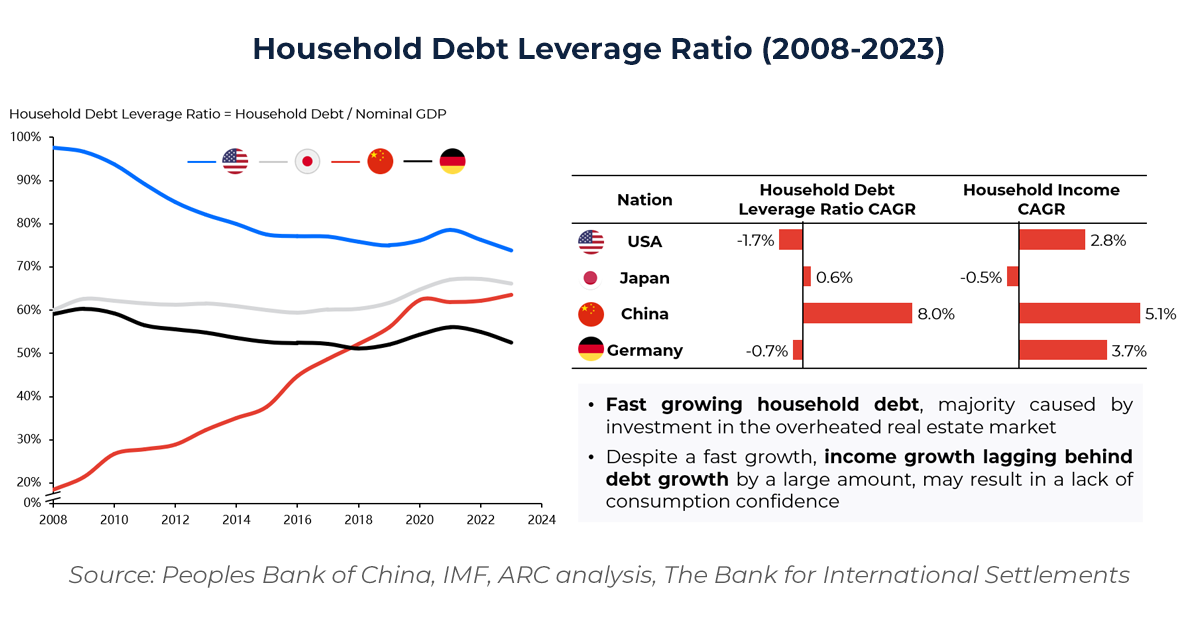

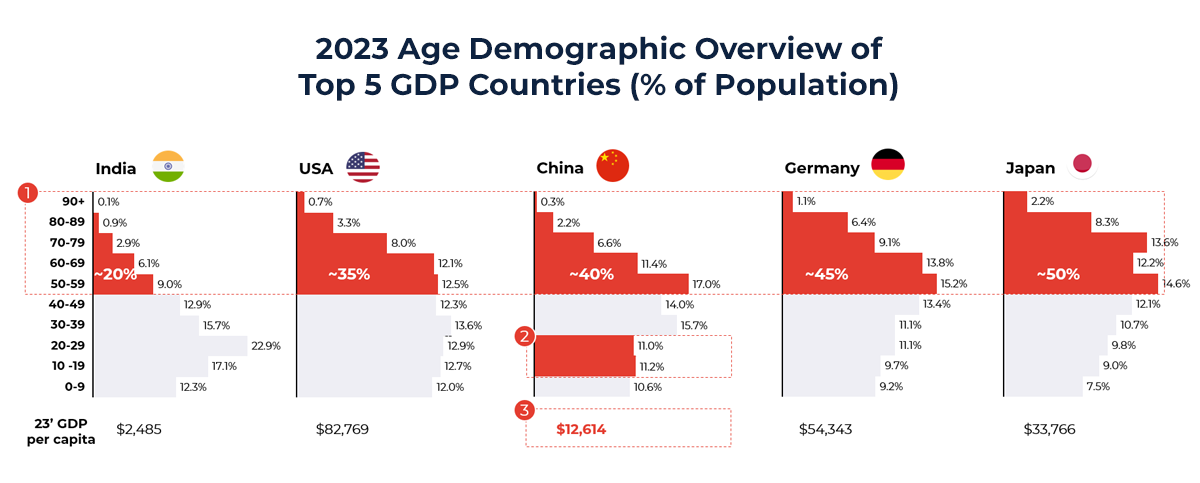

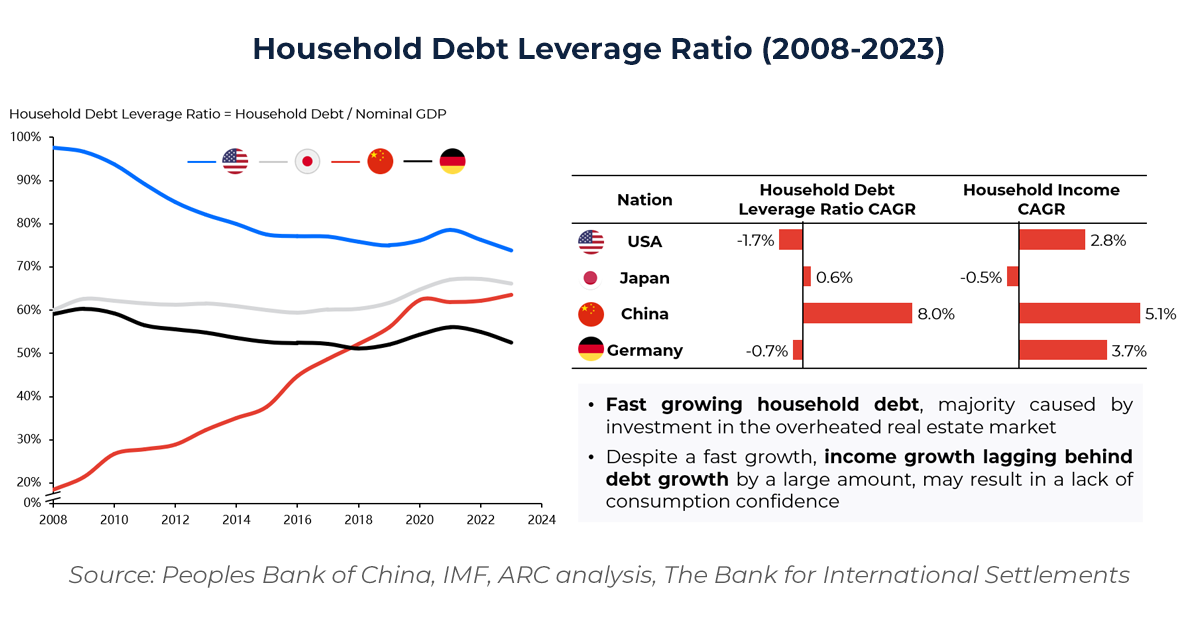

- Consumption: While stable, consumption has not accelerated meaningfully. Rising household debt, aging demographics, and modest income levels cap growth potential.

- Export: Geopolitical tensions, trade barriers, and changing global dynamics have diminished China’s role as the world’s factory.

Demographics and Debt: The Double Bind

By 2030, China will face one of the steepest demographic cliffs among major economies. A shrinking workforce and a growing dependent population will strain public services and reduce per capita productivity. At the same time, the household debt-to-GDP ratio continues to rise, fueled by speculative real estate and slow wage growth, further eroding consumer confidence.

Meanwhile, the central government’s signal that “houses are for living in, not speculation” underlines the country’s commitment to taming the property sector, once a major growth lever, now a drag on economic performance.

Strategic Implications for Global Business

For international firms, China’s slower growth necessitates a shift from volume-driven models to margin- and efficiency-oriented approaches. Growth will be harder to come by, but not impossible, especially for firms that align with structural priorities like domestic consumption, green technologies, and productivity-enhancing innovation.

It is time for multinational enterprises to recalibrate by:

- Reevaluating the size and sustainability of the China business case

- Focus on profitable micro-segments rather than broad market capture

- Localize value chains to mitigate economic and political shocks

How Our Management Consulting Division Can Help

Our management consulting division specializes in guiding global companies through inflection points like these. As China transitions into a more constrained growth environment, we help clients respond with clarity, speed, and strategic depth.

We support organizations in:

- Assessing the Viability of Their China Business Model: We evaluate exposure to macroeconomic risks and identify the most resilient market segments.

- Redesigning Go-to-Market Strategies: We tailor commercial approaches to reflect shifts in consumption behavior, regulatory complexity, and digital adoption.

- Building Resilient Operating Structures: We help companies reduce dependency on unstable growth levers, strengthen local agility, and plan for long-term sustainability.

With decades of on-the-ground experience and a robust cross-border track record, our team equips clients to lead, not just adapt, in the face of China’s new economic normal.

Author:

Leo Jibrandt

Associate Partner