Executive Insight

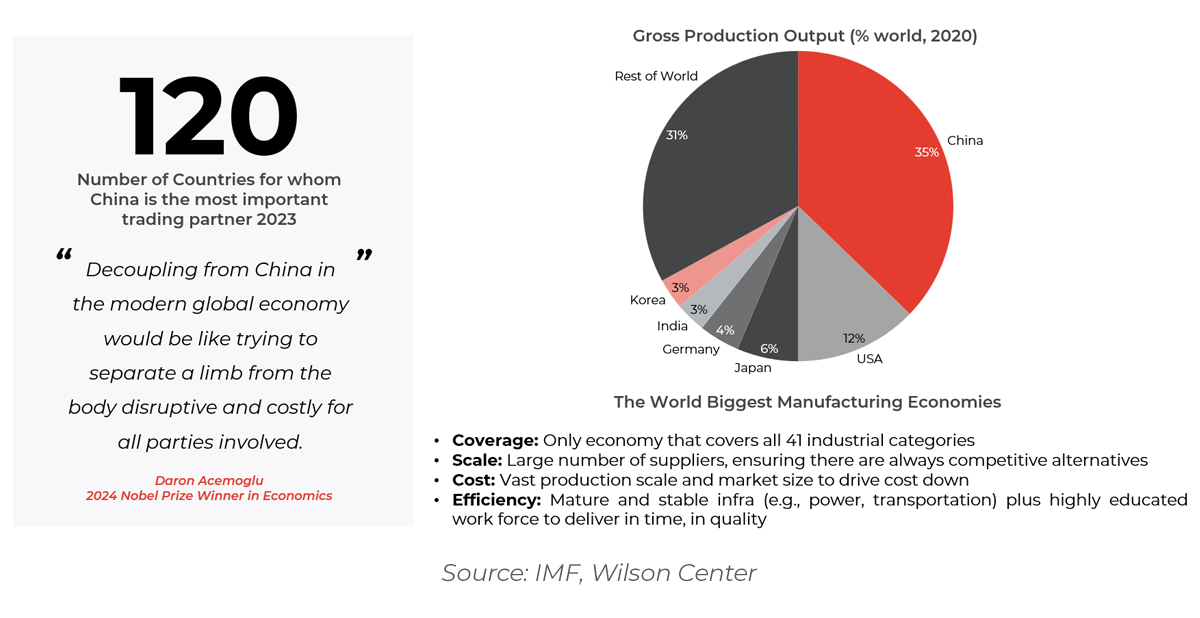

While calls for decoupling have grown louder in recent years, the structural interdependence between China and the global economy remains undeniable. China continues to lead global trade in volume, sustain vast industrial capacity, and advance rapidly in innovation. For most international businesses, a full exit from China is neither practical nor desirable. The strategic challenge is not detachment, but disciplined integration.

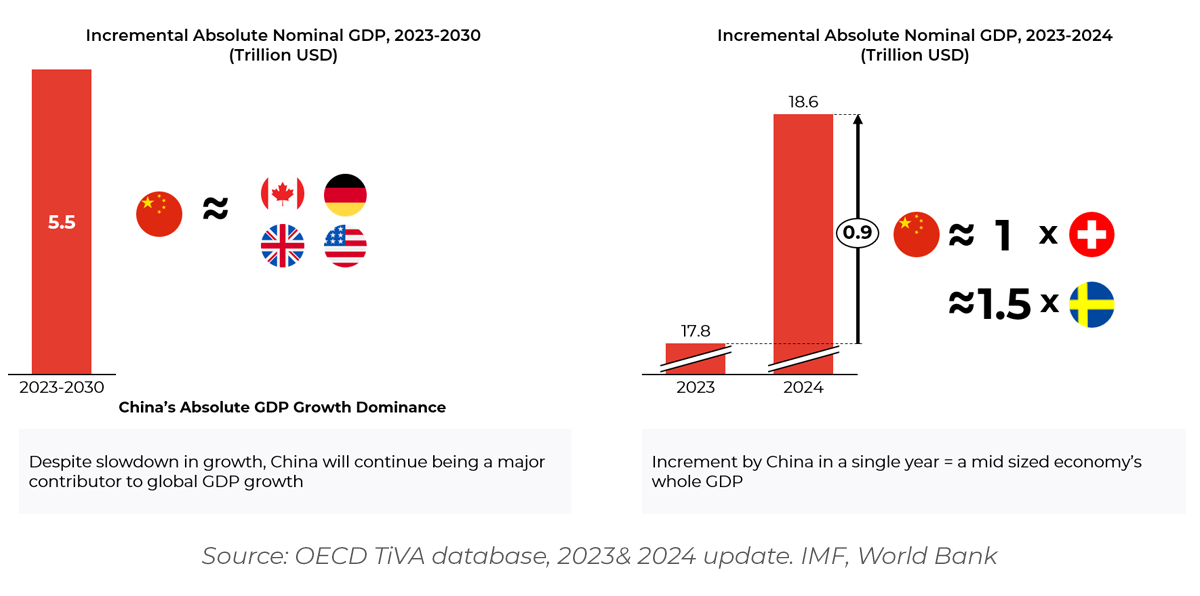

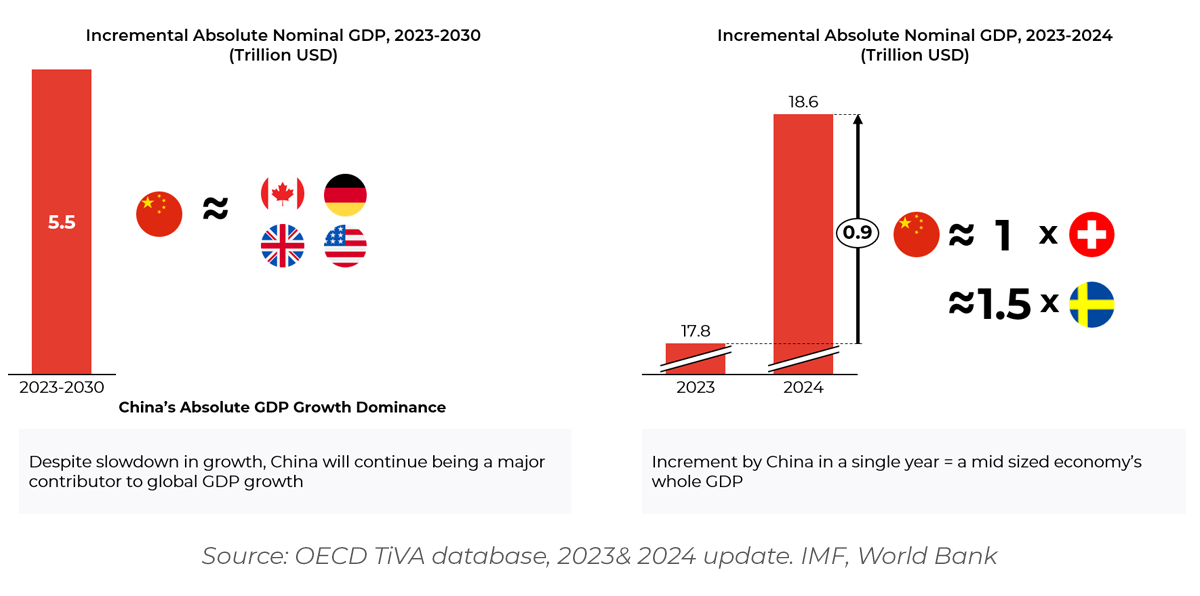

Economic Gravity Still Centers on China

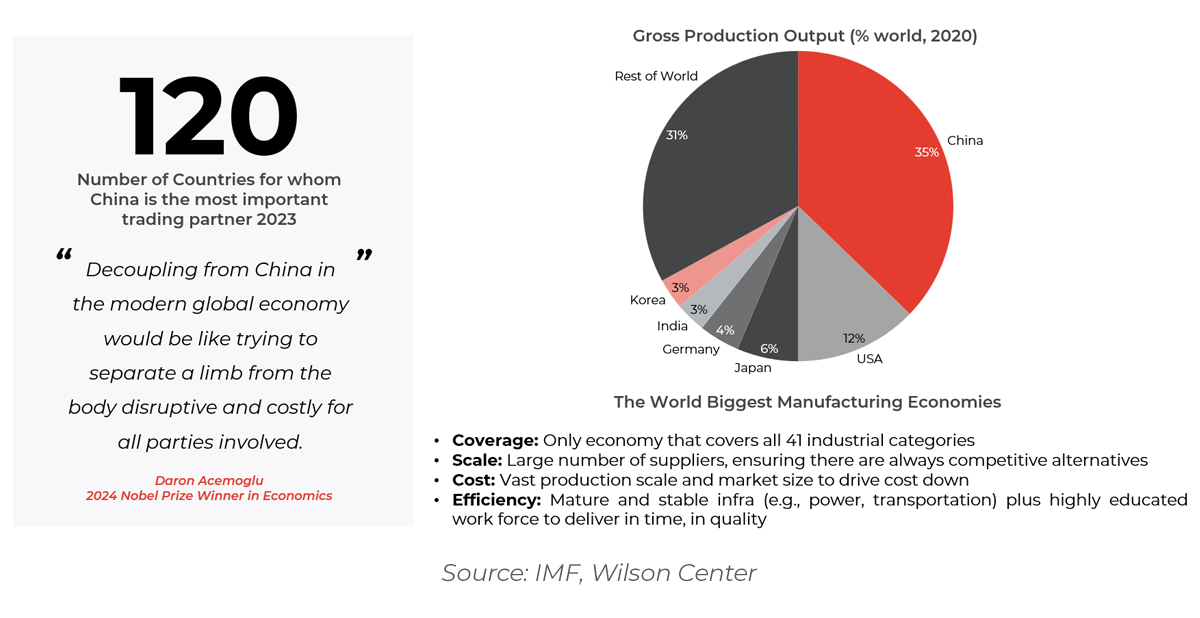

Despite a slowdown in GDP growth, China is expected to contribute more to absolute global GDP expansion than most other major economies combined through 2030. Its manufacturing ecosystem remains unmatched in scale, coverage, and efficiency:

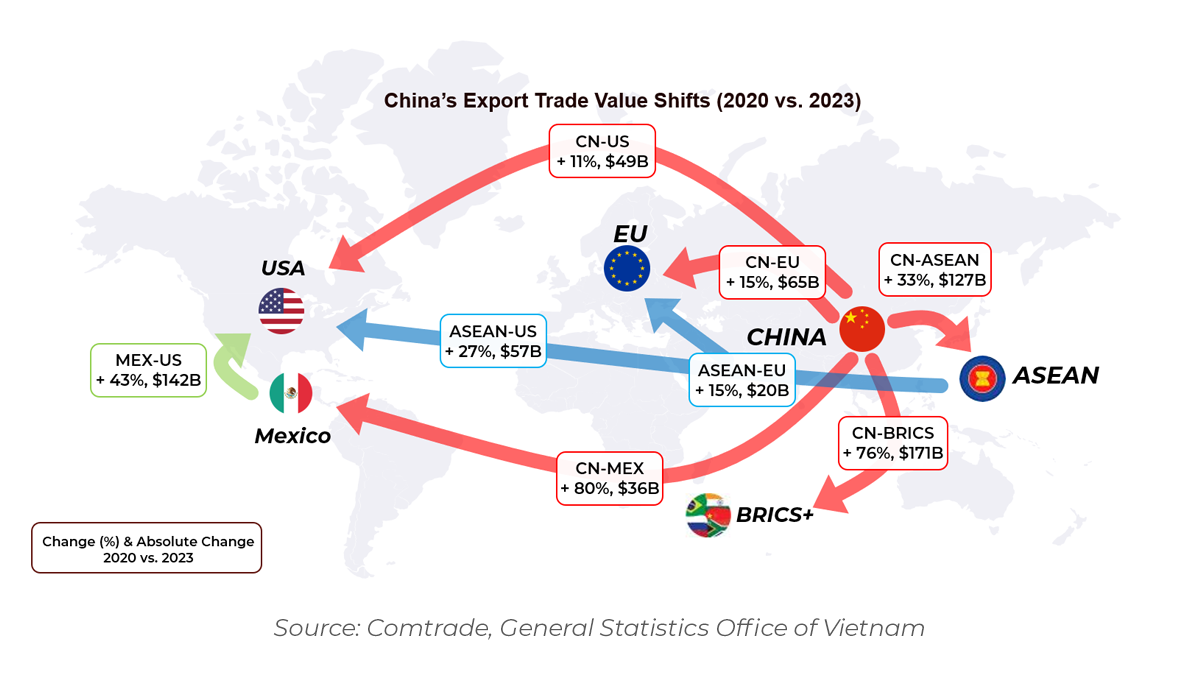

- Trade Superpower: China is the #1 trading partner for over 120 countries and consistently ranks at the top in global import and export volume.

- Manufacturing Depth: It is the only country operating across all 41 industrial categories, enabling seamless vertical integration at scale.

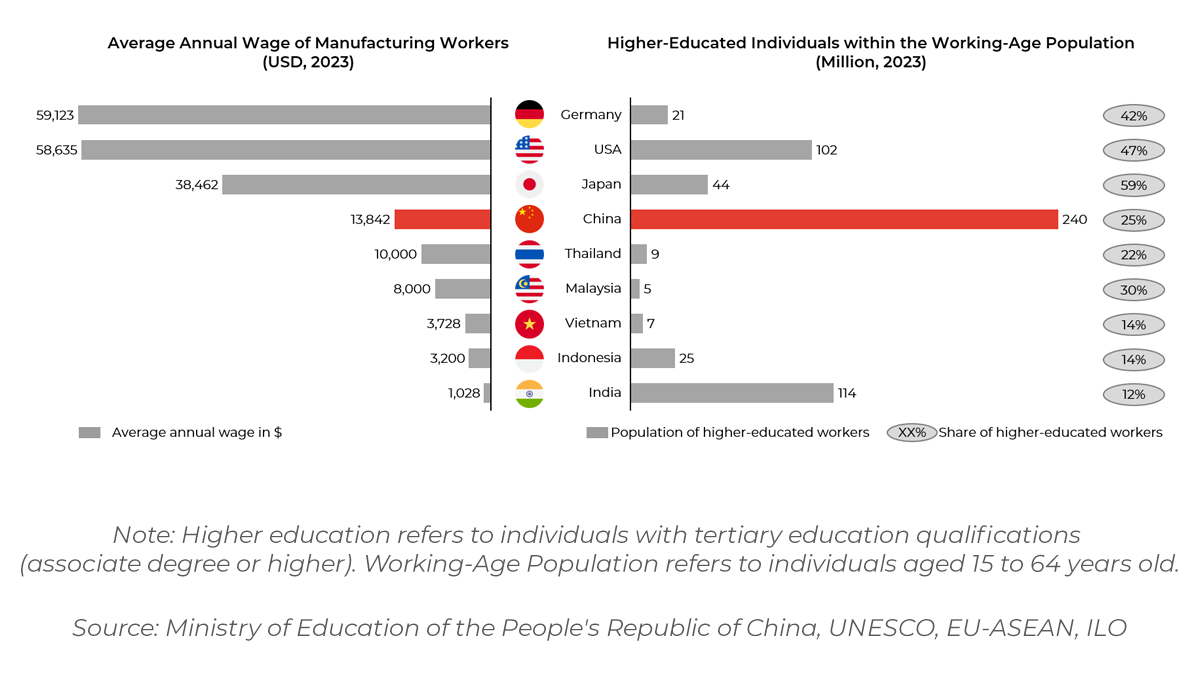

- Cost and Efficiency: A mature logistics infrastructure, competitive labor force, and concentrated supplier base continue to anchor China as the world’s primary production engine.

China’s economic footprint is not easily replicated, even in regions targeted for diversification.

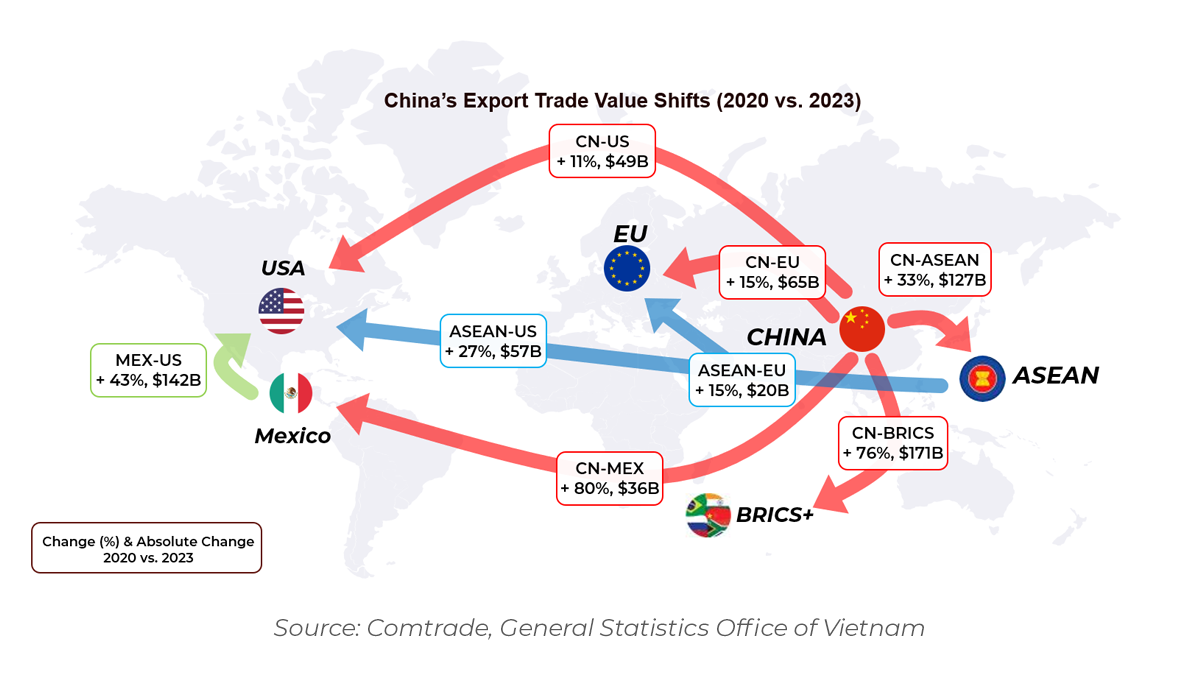

Geopolitics Pushes, But Economics Pulls

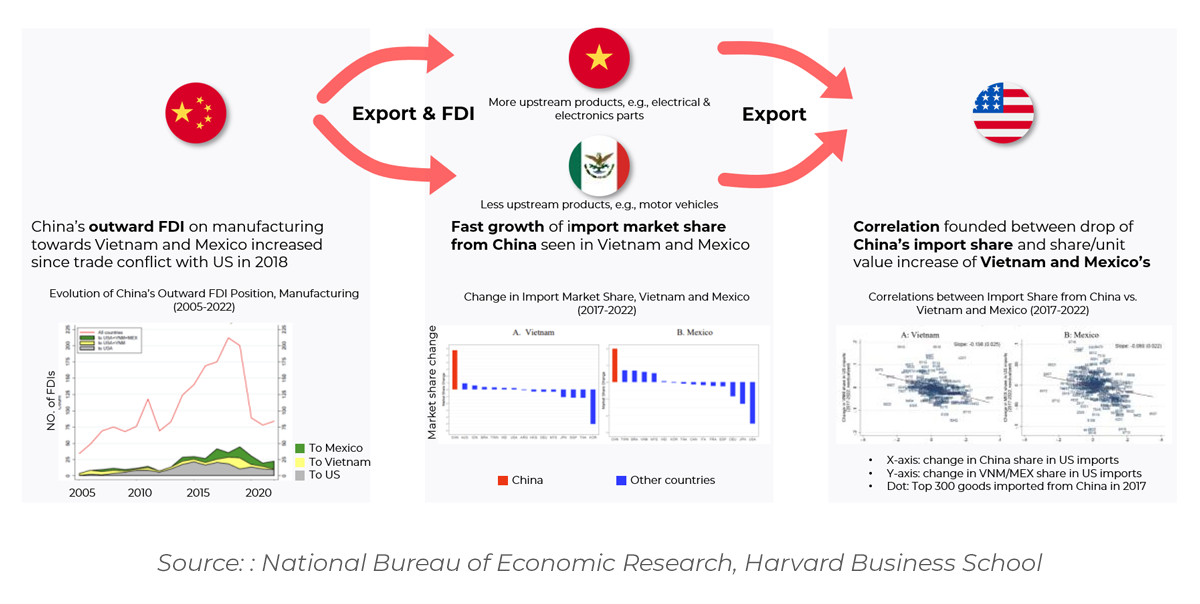

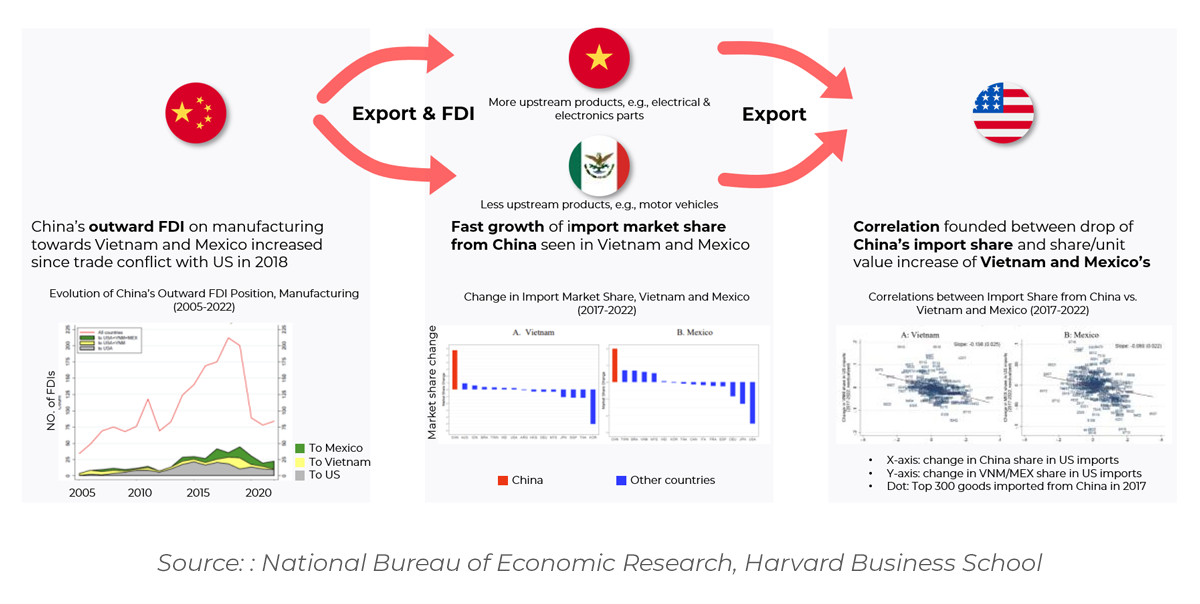

Trade restrictions and rising political tension have accelerated efforts toward reshoring, friendshoring, and China+1 strategies. Yet, several structural realities tether global companies to China:

- Cost Barriers to Relocation: High switching costs for equipment, supplier relationships, and regulatory compliance make relocation a multi-year, high-risk process.

- Market Importance: As the world’s second-largest importer, China remains a critical source of demand—not just supply.

- Technological Innovation: With nearly half of global patent filings and aggressive R&D investments, China is a co-driver, not merely a follower, of next-gen technology standards.

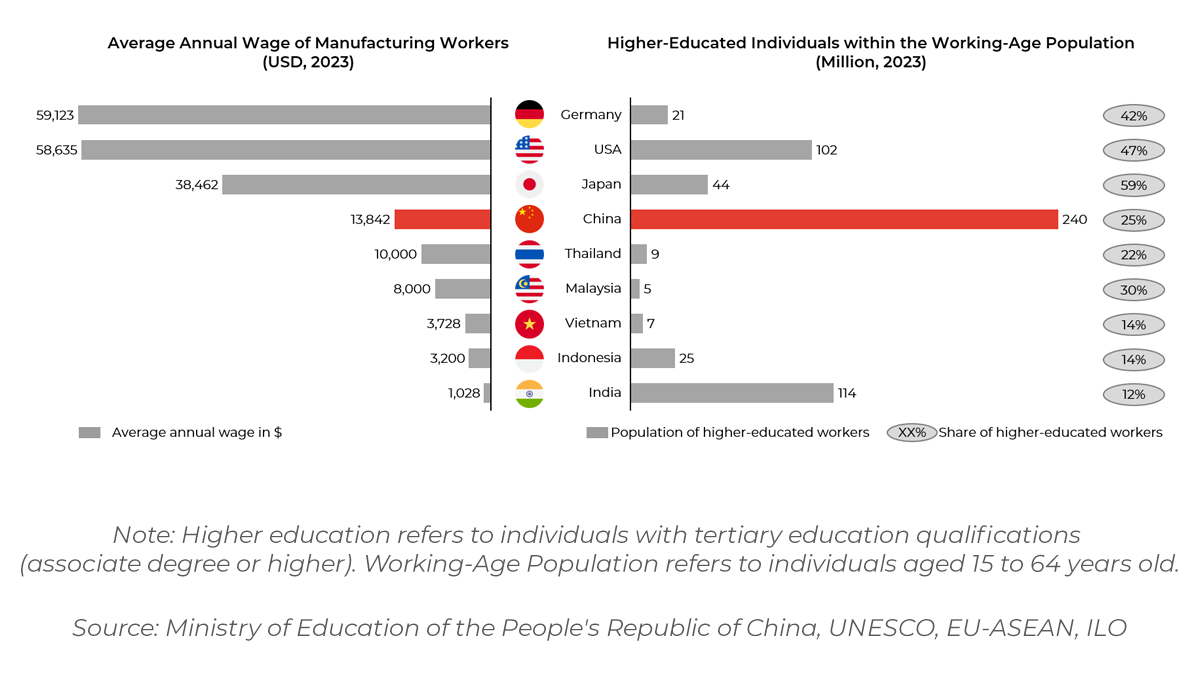

Even as companies diversify, China continues to shape global value chains, competitive dynamics, and innovation trajectories. Its value proposition is further reinforced by the unmatched return on talent investment: China combines the world’s largest pool of higher-educated individuals with comparatively low manufacturing wages. This rare combination of scale, skill, and cost-efficiency enables companies to pursue both innovation and productivity at a margin that few other countries can offer.

BRICS+ and Strategic Multipolarity

China’s deepening alignment with emerging markets, especially through BRICS+ has reinforced its position in a multipolar economic order:

- 45% of the world’s population and 35% of global GDP (PPP) is now aligned through BRICS+.

- China is actively promoting local currency trade, regional infrastructure, and alternatives to Western-dominated financial systems.

The implication is clear: China is not retreating from globalization—it is reshaping it.

Strategic Implications for Global Leaders

Rather than viewing China as a binary risk, executives must reframe their strategies to reflect its complex role:

- Design Dual-Track Models: Separate “China for China” and “China for the World” strategies to manage regulatory and geopolitical divergence.

- Stay Close to the Frontier: Invest in co-development, R&D hubs, and local partnerships to stay aligned with China’s tech trajectory.

- Plan for Regulatory Volatility: Build internal capabilities for agile compliance and long-range scenario planning.

The companies that thrive will be those who neither overcommit nor overcorrect, but instead calibrate their engagement with precision.

How Our Management Consulting Division Can Help

Our management consulting division helps companies craft pragmatic, data-driven strategies for long-term engagement with China without compromising resilience or compliance.

We support clients through:

- Strategic China Footprint Planning: We assess where China fits into your global value chain—commercially, operationally, and technologically.

- Dual Operating Model Design: We help you build distinct structures for “China in China” and “China for RoW,” enabling both integration and insulation.

- Geoeconomic Risk Analysis: We provide scenario modeling for trade, regulatory, and supply chain developments, helping clients stay ahead of shifts in global alignment.

Whether your goal is to maintain a competitive edge in China or to reposition for long-term strategic balance, our team brings the expertise and executional rigor needed to navigate complexity with confidence.

Author:

Leo Jibrandt

Associate Partner