Recent Chinese IPO Activity in the U.S.

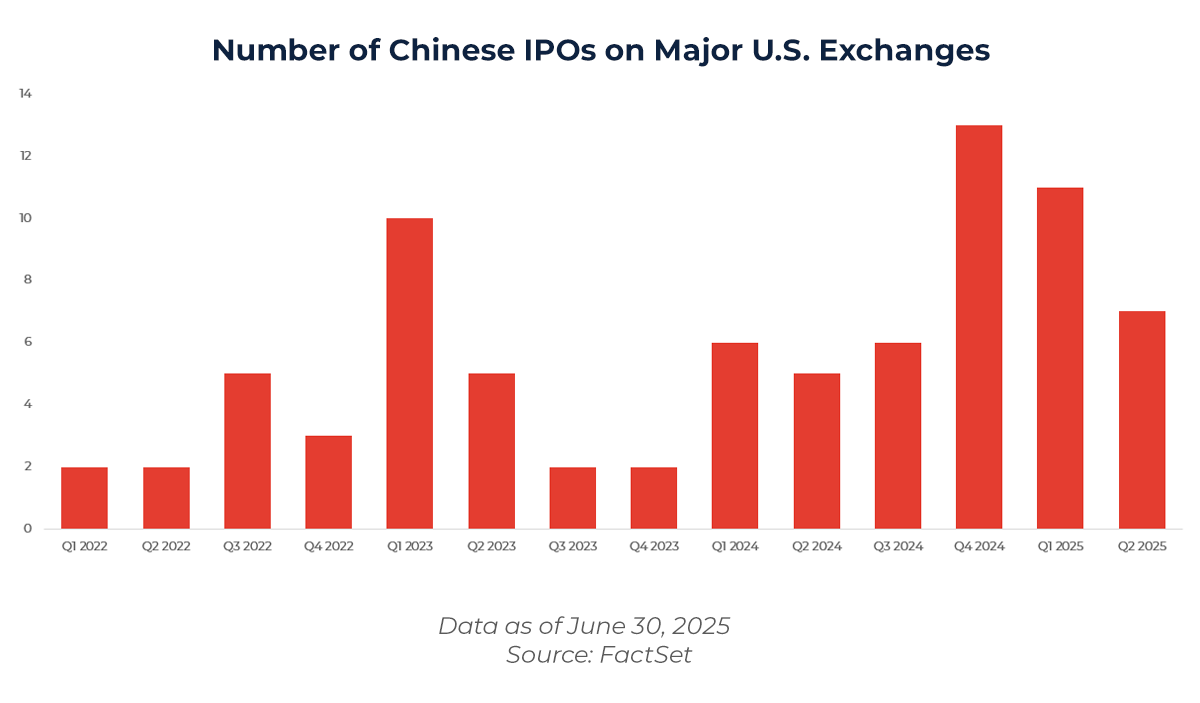

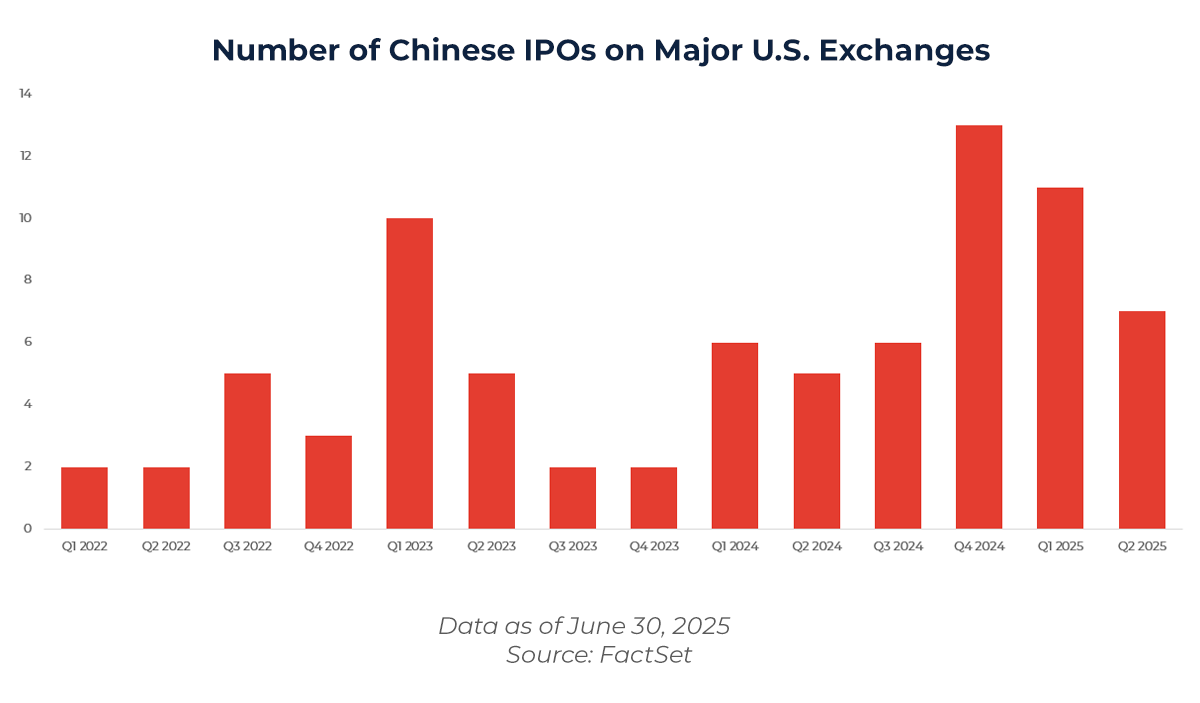

The trend of Chinese companies listing on major U.S. exchanges has been steadily increasing, reflecting a strong resurgence in investor appetite and market interest following the peak in 2021. After a slow start in 2022, the number of IPOs surged significantly in 2023, particularly in the first quarter, signaling renewed confidence in cross-border listings. This upward momentum continued into 2024, with a notable peak in the fourth quarter, highlighting the growing attractiveness of U.S. capital markets for Chinese firms. Despite fluctuations in activity, the overall trend indicates robust and sustained interest from Chinese companies seeking global visibility, funding, and valuation benchmarks offered by U.S. exchanges.

The increased return to the U.S. markets, led by early-stage and founder-driven businesses, highlights the continued relevance of American exchanges for Chinese issuers. It underscores the opportunity for Chinese companies of all sizes to access U.S. capital markets. The U.S. continues to offer unmatched liquidity and depth, making it particularly attractive for high-growth companies that may not yet be profitable. U.S. exchanges consistently attract a greater share of these companies compared to other major listing venues, highlighting their appeal for innovation-driven issuers seeking long-term capital support.

Liquidity and Growth Capital: The U.S. Advantage

Despite evolving regulatory frameworks affecting foreign issuers, the U.S. capital markets remain the deepest and most liquid in the world. For Chinese firms, particularly those in sectors such as advanced manufacturing, clean energy, software, and biotech, access to growth capital and valuation benchmarks remains a critical draw. The U.S. is also uniquely receptive to high-growth, pre-profit businesses. The flexibility of senior U.S. exchanges, such as Nasdaq and the NYSE, makes U.S. listings the ideal path for innovation-stage firms. The structural appeal goes beyond capital. Listing in the U.S. offers Chinese firms global investor visibility, dollar-based fundraising, and, in many cases, a first step toward international expansion. For issuers with scalable platforms and international ambitions, U.S. markets remain the benchmark.

The Continued Role of VIE Structures

Variable Interest Entities (VIEs) remain a dominant feature of U.S.-listed Chinese firms. A significant portion of the listed Chinese companies utilize VIE arrangements. Under this structure, firm ownership resides with Chinese nationals, but economic claims are held through contractual agreements with offshore entities. This arrangement enables listing in sectors otherwise off-limits to foreign investment.

Since 2021, the U.S. Securities and Exchange Commission has tightened disclosure rules for companies using VIEs, particularly around governance and risk transparency. While these changes introduced new compliance requirements, they have also served to enhance the credibility of VIE-based issuers in the eyes of international investors. By clarifying ownership structures and risk factors, the regulatory enhancements have contributed to building greater investor confidence in Chinese listings.

In response, many companies have proactively strengthened internal governance, improved audit rigor, and expanded transparency measures. These reforms have not only addressed regulatory concerns but also positioned these firms as more robust, accountable, and attractive to long-term institutional capital. For many issuers, meeting these higher standards is a constructive step toward sustained market access and reputation building in global financial markets.

New Era for Chinese Listings

The recent growing trend of Chinese IPOs in the U.S. has been led by privately held and entrepreneur-led companies, bolstering a new era of cross-border capital engagement. This dynamic presents a compelling opportunity for smaller, innovative Chinese companies that may have previously struggled to access international markets. The U.S. exchanges, which offer vast investor diversity, are now providing a vital gateway for these firms to raise growth capital, gain international visibility, and establish long-term credibility. The surge in small-cap listings is not only a signal of continued market openness but also a reflection of growing global investor appetite for early-stage Chinese companies with differentiated business models. The recent uptick in market activity suggests that this momentum is gaining strength, offering a renewed window of opportunity for companies prepared to meet international standards and seize the advantages of a U.S. public listing.

Investor Perspective and Capital Market Positioning

From the investor standpoint, exposure to Chinese issuers remains substantial and continues to grow. Much of this renewed interest is being driven by institutional investors seeking exposure to China’s next wave of innovation. High-growth themes such as electric vehicles, clean energy storage, cross-border e-commerce, and artificial intelligence continue to attract capital, particularly as Chinese companies improve governance and transparency standards to meet heightened global investor expectations.

Moreover, a strong performance of U.S.-listed Chinese small-cap indices in recent months, bolstered by successful IPOs in the software-as-a-service and digital health sectors, has helped restore confidence in the long-term viability of the U.S. as a listing venue. Trading volumes have increased steadily, while price stabilization following IPOs has improved, signaling stronger aftermarket support.

Issuer Strategy and IPO Readiness

For Chinese companies aiming to expand globally, a U.S. IPO remains a strategic gateway to the world’s most liquid capital markets. While regulatory expectations have evolved, Chinese issuers that prioritize transparency, corporate governance, and audit readiness are well-positioned to thrive in the U.S. market. Key factors to consider include:

- Proactively addressing the legal clarity of VIE structures to enhance investor confidence.

- Preparing for audit compliance under the Holding Foreign Companies Accountable Act to ensure long-term listing stability.

- Differentiating through a U.S. listing, where valuations, analyst coverage, and institutional investor participation often exceed that of regional exchanges.

- Navigating China’s regulatory environment with an experienced financial advisor and expert counsel to support compliant overseas fundraising.

With over $1T in Chinese equity value already listed across major U.S. exchanges, the U.S. remains the preferred platform for ambitious issuers seeking global capital, brand elevation, and strategic expansion.

Conclusion

The presence of China-based companies on U.S. exchanges is entering a new phase, marked not by retreat but by realignment. While recent listings have shifted toward small and mid-cap IPOs, overall market value has rebounded, and investor interest in high-quality Chinese companies remains strong. As regulatory expectations around structures such as VIEs continue to evolve and state-owned enterprises reassess their listing strategies, private sector companies have a unique opportunity to gain visibility and leadership in the market.

Looking ahead, U.S. capital markets aim to strike a balance between national security, investor protection, and continued global access. For Chinese issuers, this environment presents an opportunity to succeed by focusing on strong corporate governance, transparent financial reporting, and early engagement with experienced advisors. A U.S. listing continues to offer access to deep capital pools, global investor exposure, and long-term strategic positioning. Companies that prepare effectively and lead with compliance are well positioned to build lasting value and investor confidence.