Amid tightening IPO approvals and prolonged exit timelines, private equity (PE) firms and majority shareholders are now reassessing the limitations of traditional listing pathways. From 2023 to date, over 120 companies in A-share and Hong Kong markets have either failed to pass listing hearings or voluntarily withdrawn applications, marking a five-year high. In the time of capital market uncertainties, achieving exits through M&A transactions is potentially an efficient and predictable strategic alternative for PE and controlling shareholders.

Unlike IPOs, which rely on secondary market performance and has volatility, M&A exits allow PE investors and founders to lock in transaction valuations upfront through cash or hybrid payment structures, enabling flexible divestment of old shares. For unlisted companies, selling to strategic buyers or buyout funds not only accelerates shareholder exits but also leverages the acquirer’s resources to drive technological integration, market expansion, and supply chain restructuring, thereby elevating corporate value. Controlling shareholders may retain minority stakes to align with new strategic partners/buyers and exit remaining shares at higher valuations after three to five years of collaborative growth.

Current global M&A trends present two key opportunities. First, persistent interest in quality targets in the country: both international and domestic capital remain keen on Chinese high-quality targets/assets, particularly in sectors like new energy, advanced manufacturing, and innovation-driven industries. Strategic M&A valuations in these areas sometimes beat secondary market multiples or match post-listing average multiples throughout lock-up period. Second, increasing domestic buyout PE fund momentum: encouraged by national M&A policies, Chinese buyout funds are accelerating deployments through “buyout + operational enhancement” models to unlock corporate transformation potential.

Controlling shareholders could prioritize two types of transactions. First, synergy-driven sell-side transactions: to partner with domestic or overseas strategic buyers to access technology, brands, and distribution channels. Second, fund-led collaboration/ restructuring: collaborate with buyout funds to establish management incentive mechanisms, complete restructurings and upgrades, and prepare for secondary exits (e.g., eventual sale to strategic buyers). Our recent experience shows M&A exits are particularly suited for profitable mid-sized enterprises across sectors such as new materials, consumer and retail, advanced manufacturing, new energy, and healthcare.

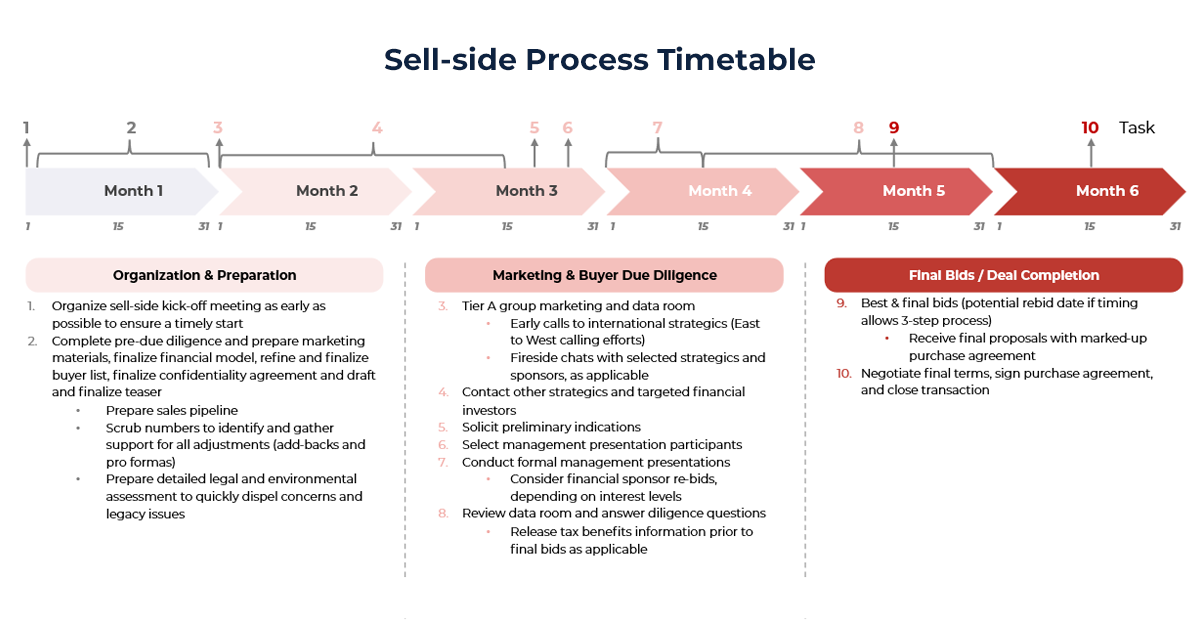

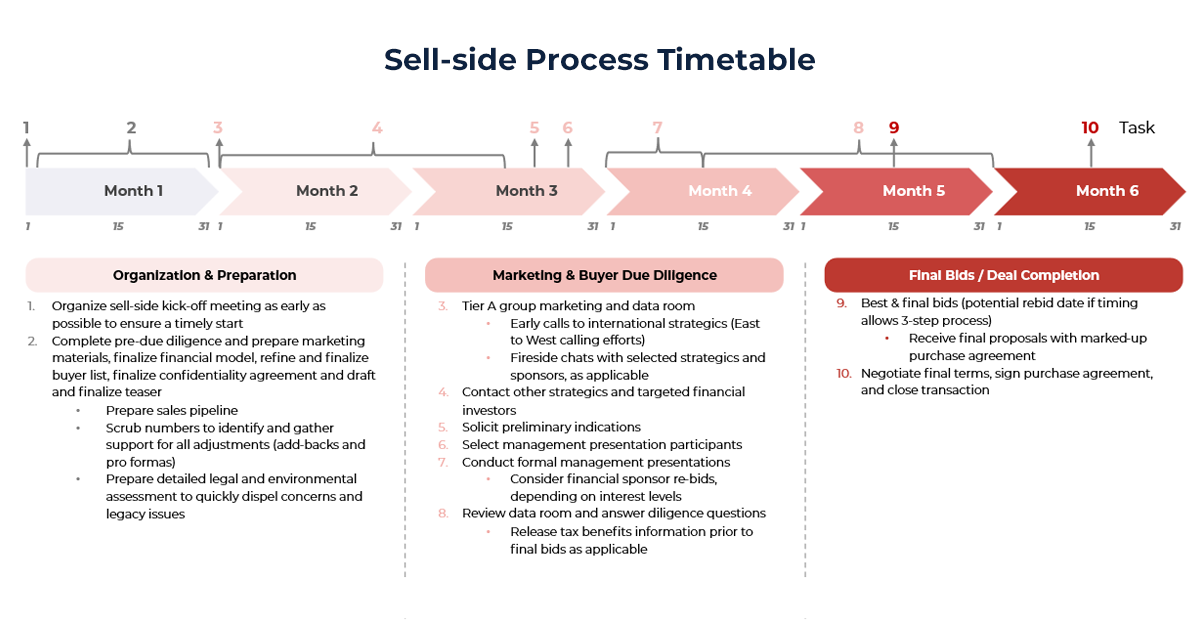

Companies also need to mitigate execution risks. Control-stake M&A deal involves complex deal structuring, tax planning, and regulatory compliance (e.g., antitrust, CFIUS and FDI reviews in the U.S. and EU respectively). Experienced financial advisors enhance transaction certainty by optimizing auction processes, refining merger agreements, and advising on shareholder terms. As capital exit pathways diversify, PE firms and corporate controllers could proactively engage with the M&A exit pathways.

With 13 global offices, Alarar Capital Group provides end-to-end services—from management consulting, sell-side bidding process management, and valuation modeling to deal negotiation and closing—helping clients secure returns amid uncertainty.

Author:

Jess Zhou

Director