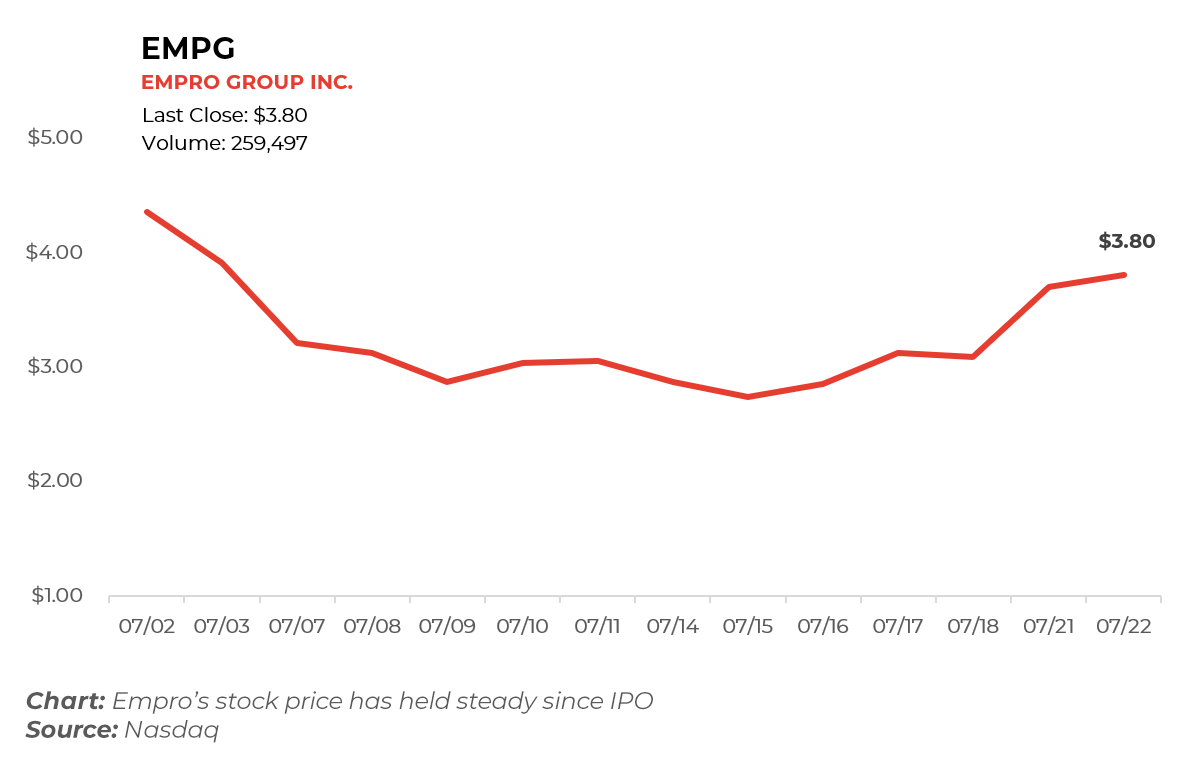

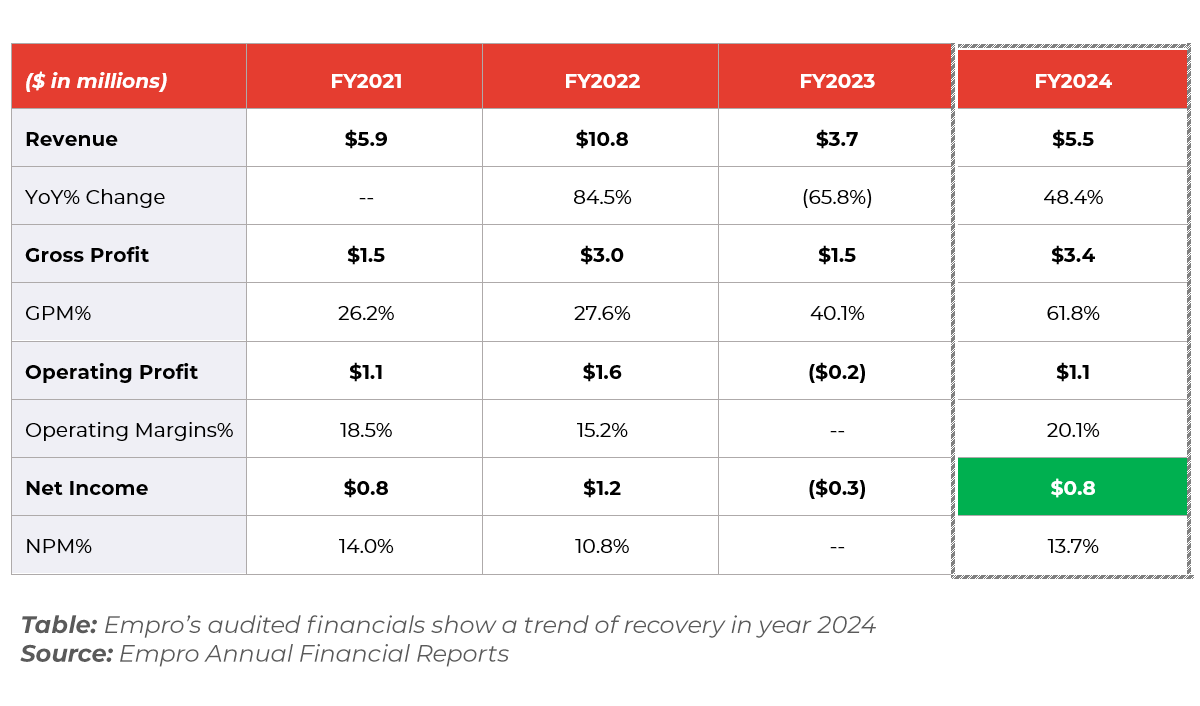

On July 3, 2025, Empro Group Inc. (Nasdaq: EMPG) (“Empro” or the “Company”) became the first Malaysian beauty brand to be listed on Nasdaq, closing its initial public offering (IPO), raising $5.5 million at $4.00 per share, upsized from $5.0 million due to strong investor interest. The market valuation at IPO implies a P/E multiple of approximately 36x and a P/S multiple of 5x, highlighting the enhanced valuation multiples offered to small cap Asian companies on U.S. senior exchanges. This case serves as a guiding example for a successful micro-cap IPO.

While Empro’s IPO ultimately stands as a success story, the journey was far from straightforward. As a Malaysian business that had never relied on external equity funding, the process presented unique challenges. Nonetheless, the decision to go public in the United States and tap into its deep capital pool was a bold and resolute choice by Empro. The Company is a pioneer in Malaysia’s beauty sector and the management team wanted to leverage an IPO to bring Empro to the world.

Engaging a lead advisor and partner with a deep understanding of the end-to-end process, established relationships with credible and experienced service providers, and strong financial and market expertise was therefore a critical first step in their journey. Bringing ARC onboard to quarterback the transaction marked the official start of Empro’s journey to gain public status in the United States.

Understanding the US IPO Process

The IPO process can be broken down into two main parts: (1) completing the regulatory approval process through the submission of the offering document (Form F-1 for foreign companies) and (2) the go to market process and investor roadshow.

The first part can be lengthy. Empro’s F-1 was comprised of a 200-page offering document, requiring contributions from all parties involved in the transaction. This document included PCAOB audited financial statements for the past two years, a detailed management discussion around performance variations over the reporting periods, risk factors, intended use of proceeds, among other detailed information on the Company. Legal advisors drafted disclosures related to regulatory compliance and the Company’s articles of association, while Alarar Capital Group, Empro’s exclusive financial advisor, assisted the Company in articulating its industry prospects, business model, and financial tailwinds.

ARC advised on many facets of the transaction, guiding Empro from initial conversations to pricing its IPO, ensuring that hurdles along the way were navigated diligently. Strong coordination and advisory from all parties, as well as a committed management team with a strong corporate vision, were the catalysts that led to Empro’s successful public listing on Nasdaq.

Key Reflections Drawn from the Empro Experience

A Two-Year Journey Highlighting the Crucial Role of Fundamentals

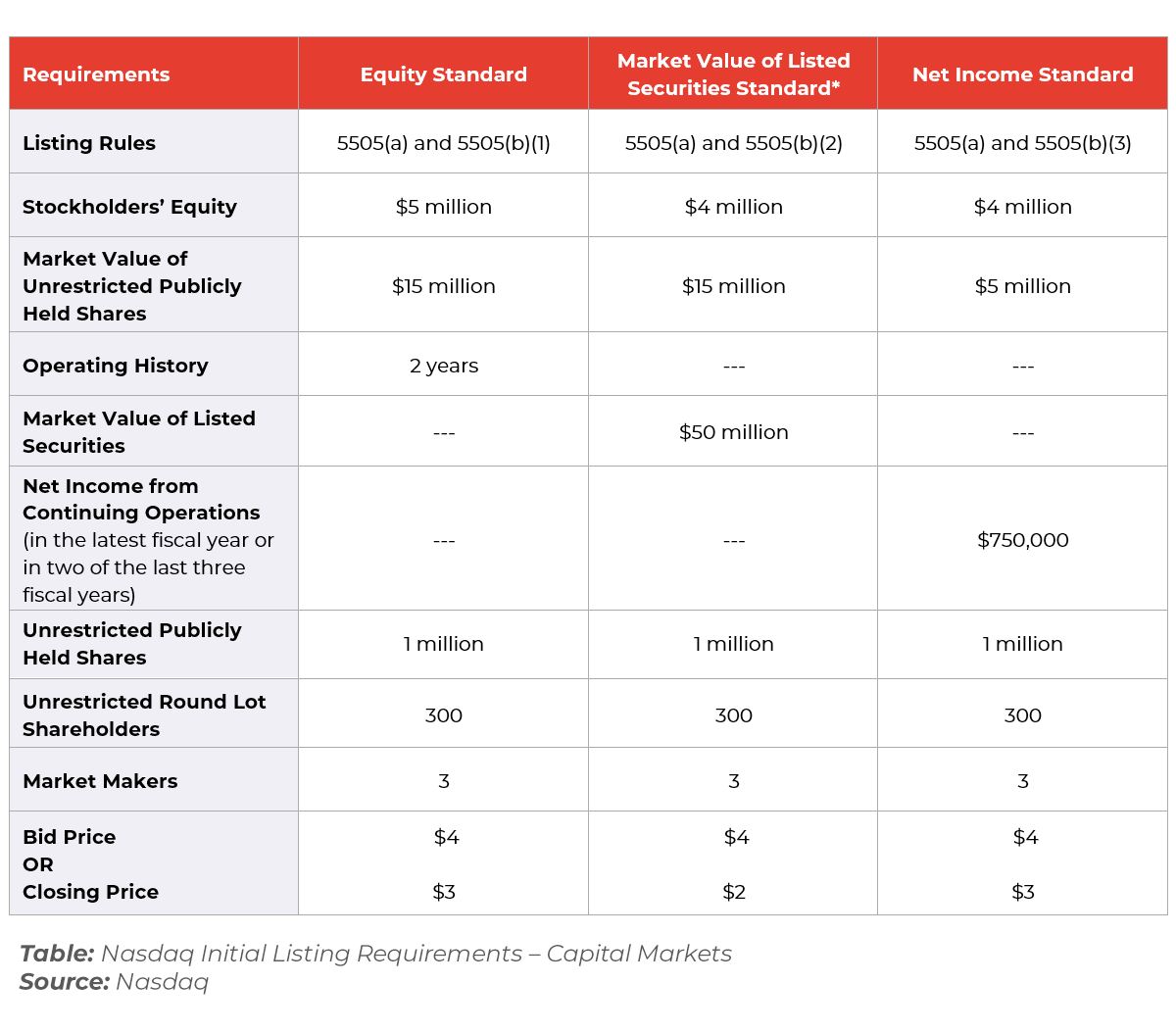

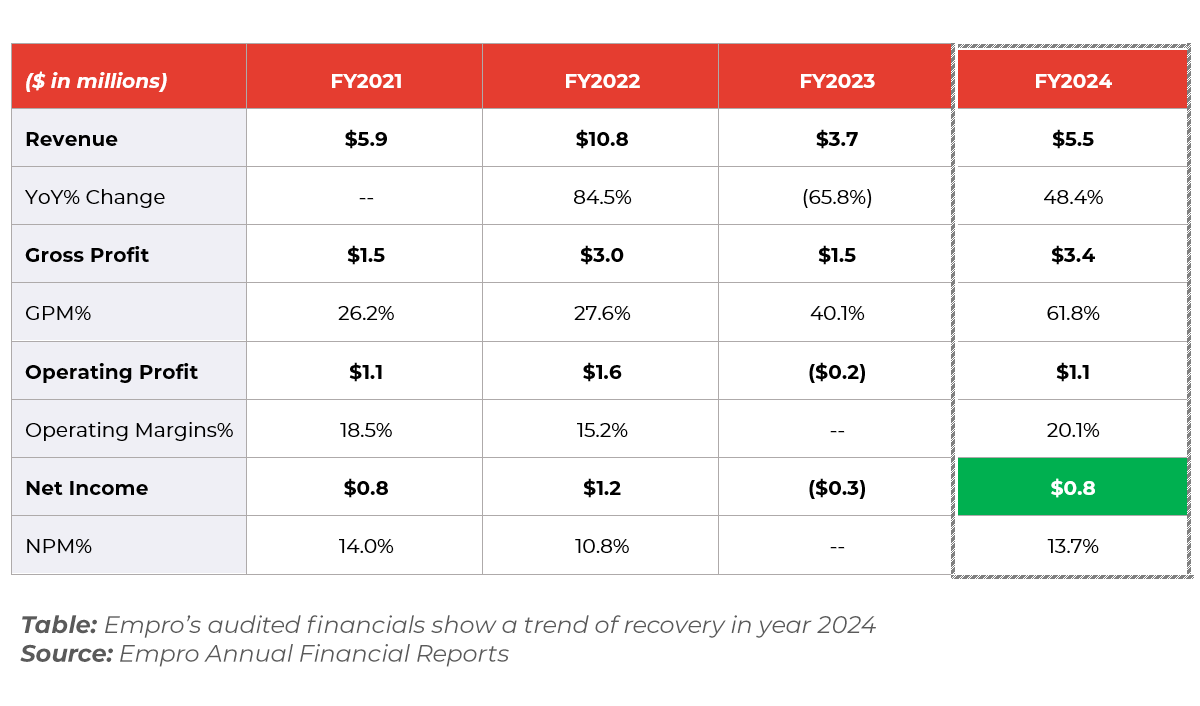

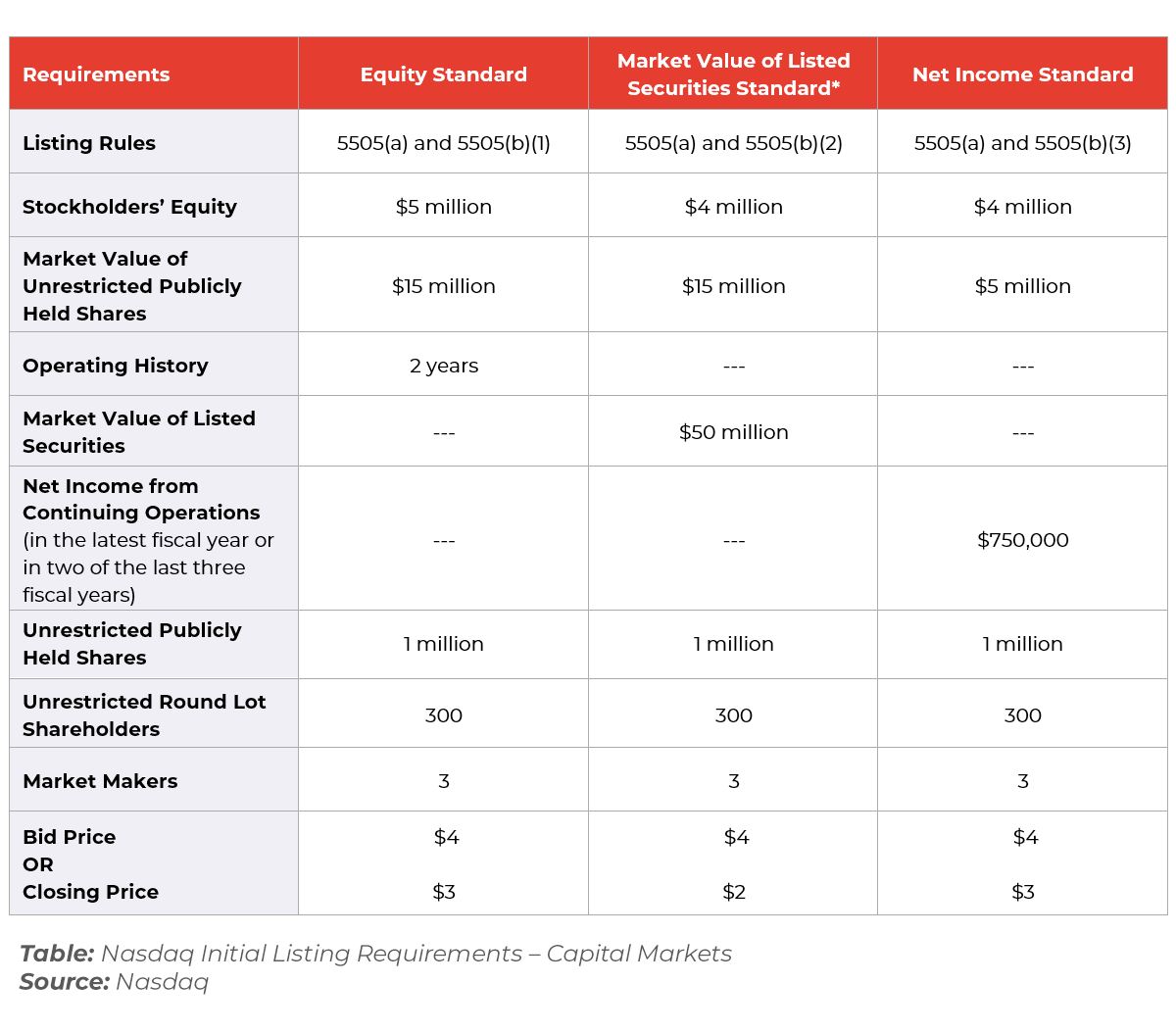

Empro’s path to Nasdaq began two years ago, propelled by its pandemic-era success in medical-grade face masks. Record FY2021–2022 revenues not only established its brand in Malaysia and Europe but also secured eligibility for Nasdaq’s Net Income Standard—a critical advantage allowing the Company to raise less than $15 million in its IPO. Without this qualification, Empro would have faced far stricter requirements (Equity or Market Value Standards), forcing a larger, more dilutive capital raise.

Regulatory delays pushed the timeline into 2025, expiring the 2021 financials just as Empro transitioned away from pandemic-driven sales. A net loss in 2023 threatened its ability to meet the Net Income Standard, but proactive diversification into SpaceLift™ skincare restored profitability in FY2024—locking in eligibility for the preferred listing path.

By preserving the Net Income Standard, Empro gains three key advantages:

- Minimized dilution – Raising less upfront protects shareholder value and avoids over-issuing equity in a still-evolving market.

- Strategic flexibility – A smaller initial raise allows the Company to pursue follow-on offerings at higher valuations as its skincare line scales.

- Lower execution risk – With reduced capital requirements, the IPO is less dependent on volatile market conditions, ensuring a smoother path to listing.

This disciplined approach positions Empro to list efficiently today while retaining future funding options.

Selecting the Right Service Providers

Service providers must possess the appropriate certifications and practical experience, with pricing directly tied to their expertise, industry reputation, and the level of support they provide throughout the process. It is crucial to have a lead advisor with relationships across various service providers with different strengths, allowing for the selection of a well-balanced team that aligns with company specific requirements, meets the Company’s budget, and provides exceptional level of guidance.

Under ARC’s facilitation, Empro was able to engage a strong team of service providers shortly after the Company launched its IPO process. In a short period, the auditor began executing the required PCAOB audit and legal counsels began their due diligence to draft the F-1.

Starting Preparations Early

Crafting a compelling story around the Company’s existing business and expansion plans is a crucial step in the IPO process. In this particular case, Empro’s management had a strong vision for the Company’s future direction and growth strategy. ARC played a significant role in helping the Company articulate and execute on this strategy, often acting as an operational advisor in conjunction with its financial advisory function. Through multiple meetings with management, ARC helped fine-tune the messaging, ensuring it resonated with potential investors and aligned with public market expectations. Managing this early in the process allowed for continuous refinement throughout the process prior to the pricing of the IPO. This iterative approach ensured that we could address potential concerns, adjust to market dynamics, and make improvements based on real-time insights.

Another critical part of the transaction was determining and creating the corporate listing vehicle. A Malaysia-incorporated company seeking to directly solicit investments from US investors can face numerous challenges – all of which can be cured if properly identified and managed. Investors must navigate unfamiliar regulations related to corporate exercises, taxation on dividends and capital gains, as well as the protection of personal information. To help mitigate these concerns, ARC assisted the Company in reorganizing the Company’s corporate structure into a Cayman HoldCo structure, which would eventually be used as the listing vehicle. Investors generally feel more comfortable investing in a Cayman-based company rather than a foreign company, largely due to longstanding familiarity with the Cayman’ straightforward regulatory framework.

Additionally, legal due diligence often takes ample time. It is important for companies to maintain complete and accurate corporate records, and to communicate promptly with legal advisors if any rectifications are needed. This is especially critical for companies with operating entities across multiple jurisdictions.

Start Gauging Investor Interest Early, and Maintain Realistic Valuation Goals

With appropriate confidentiality arrangements in place, and the analytical support and financial expertise of the lead advisor, the Company should proactively approach potential investors to gauge interest and establish expectations around valuation early in the process. Setting these expectations early on helps ensure that both the Company and investors are aligned on pricing, which can significantly accelerate the closing process.

Critically for Empro, this message from ARC was embraced and implemented early on, so once all the hurdles from the regulatory process had been cleared, things moved swiftly. ARC, in collaboration with the Company and lead underwriter, R.F. Lafferty, initiated roadshow efforts early in the process and promptly arranged management meetings. As a result, the closing occurred within just one month of receiving clearance from the SEC.

Conclusion

Empro’s successful IPO journey highlights key lessons for foreign companies preparing for a Nasdaq listing, especially those in the micro-cap space. Through strategic planning and a focus on solidifying long-term fundamentals, Empro was able to successfully navigate the complexities of the IPO process, despite facing challenges along the way. The Company’s experience underscores the importance of assembling the right service providers, starting preparations early, and allocating resources to address regulatory queries efficiently. Empro’s pivot away from pandemic-driven healthcare revenue further demonstrates the significance of an agile management team in both ensuring continued regulatory compliance pre-IPO and shaping market perceptions post-IPO. Finally, it is critical for companies to engage with investors early to set the right expectation on pricing, ensuring early alignment between the new issuer and potential investors, facilitating a smoother offering process.

Author:

Nigel Wong

Director

Author:

Simon Kaung

Analyst

*Disclaimer*

This article does not purport to cover all aspects of an IPO process, and while points raised in the article should apply generally to micro-cap companies, companies in jurisdictions with specific regulatory regimes on overseas listings of domestic companies such as China will require more specific advice.