1. Introduction: From Boxes to Billions

The logistics industry has never been more visible—or more vital. Events like the pandemic, geopolitical tensions, and chokepoint disruptions (e.g., the Red Sea and Panama Canal) have exposed the fragility of global trade. As a result, supply chain resilience has become a boardroom priority, and consolidation is emerging as the fastest route to scale, agility, and stability.

More than just the movement of goods, logistics is the circulatory system of global commerce. It connects factories to consumers through freight forwarding, warehousing, customs brokerage, and last-mile delivery. Today, logistics is powered not just by trucks and ships, but by automation, AI, and real-time data. From smart routing to warehouse robotics, logistics has evolved into a tech-driven engine of competitive advantage.

Against this backdrop, Alarar Capital Group highlights several major ongoing transactions and emerging trends shaping the future of logistics. Drawing on our deep expertise in industries, a robust cross-border M&A track record, and a global investor network, we are well-positioned to deliver strategic insights and executional excellence. As consolidation unfolds, we see significant opportunity to unlock value across the logistics ecosystem—particularly in high-growth, fragmented markets.

A Brief History of Modern Logistics

While logistics has roots in ancient trade and military campaigns, its transformation into a modern business discipline began in the mid-20th century with the advent of containerization and the rise of global manufacturing.

- Ancient Roots and Military Origins: Logistics indeed has origins in ancient trade routes and military campaigns where the movement and supply of goods and troops were critical.

- Mid-20th Century Transformation: The introduction of containerization in the 1950s revolutionized global trade by drastically reducing shipping costs and transit times, enabling the rise of global manufacturing and complex supply chains.

- 1980s and 1990s – Supply Chain Management Emerges: During this period, companies began formalizing supply chain management as a discipline to improve coordination, reduce costs, and enhance responsiveness across procurement, production, and distribution.

- 2000s – Lean Logistics and Just-in-Time: Lean principles and JIT inventory models became widespread, focusing on minimizing waste and inventory while improving efficiency and responsiveness.

- 2010s and 2020s – Digitalization and E-commerce: The explosive growth of e-commerce and omnichannel retail transformed logistics priorities, emphasizing speed, flexibility, and customer experience. Digital platforms, real-time tracking, automation, and data analytics became key enablers.

- COVID-19 Impact: The pandemic exposed vulnerabilities in global supply chains, accelerating investments in technology, diversification, resilience, and sustainability. It brought logistics to the forefront of global economic discussions.

- Post COVID: The pandemic accelerated the shift of global supply chains from China to Southeast Asia, driven by rising costs, geopolitical tensions, and disruption risks. SEA countries offer competitive labor, favorable trade terms, and strategic locations. Decoupling from China in critical sectors is gaining traction, though full separation remains complex. To manage fragmented, diversified supply chains, companies are embracing digital transformation—leveraging AI, IoT, blockchain, and analytics to boost resilience and offset added complexity and costs.

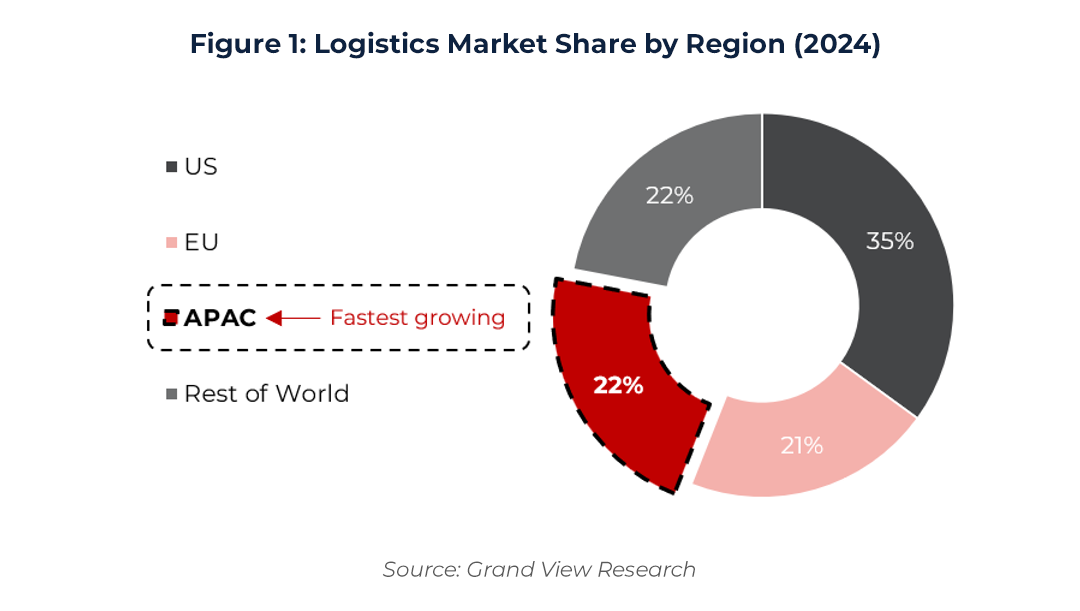

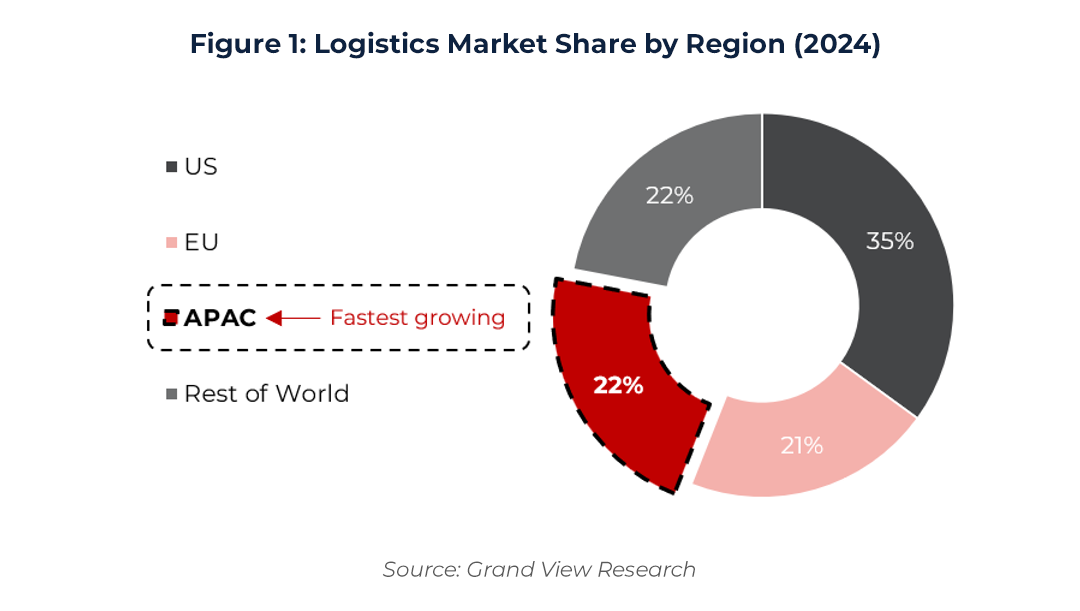

Market Size and Growth Projections: The global logistics industry valued around US$10 trillion in 2024, with projections to more than double to approximately US$23 trillion by 2034, aligns with industry forecasts reflecting expanding trade volumes, technological adoption, and evolving supply chain complexity.

2. Industry Trends – A Dynamic Sector with Significant Consolidation

The logistics sector is undergoing a seismic transformation. Once a behind-the-scenes enabler of commerce, logistics has emerged as a critical lever for global competitiveness and resilience. In this environment, mergers and acquisitions have become the key tool for companies. Strategic and financial investors alike are racing to consolidate the industry, focusing on last-mile delivery and logistics management technology, attempting to unlock high-margin and scalable opportunities with global growth potential.

Key Trends Impacting Logistics and Supply Chain

- Geopolitical Shocks and Trade Disruptions: Global supply chains in 2025 are marked by complexity, trade wars, shifting political climates, and escalating tariffs. These dynamics are forcing companies to rethink procurement and logistics strategies, making consolidation a tool to mitigate disruption and adapt swiftly to geopolitical risks.

- Shifts in Ocean Carrier Strategies: The formation of new ocean carrier alliances—now controlling over 60% of the global container market—is set to reshape global freight flows. For instance, Gemini Cooperation’s plan to cut port calls between Asia and North Europe in half will reduce transit times but may bypass smaller ports entirely, impacting inland logistics. Similarly, the Ocean and Premier Alliances are reducing capacity across the trans-Atlantic, while Peru’s new Port of Chancay aims to cut over 10 days from LATAM–Asia routes by bypassing U.S. ports. These developments may influence global rate structures and capacity allocation across multiple trade lanes.

- Ecommerce Boom and Freight Capacity Shifts: The rapid growth of ecommerce—particularly outbound from Asia—is transforming air freight dynamics. Aircraft previously serving trans-Atlantic routes are being redirected to the trans-Pacific to meet ecommerce demand, resulting in rate spikes and capacity shortages on lower-volume lanes. As ecommerce continues to surge, especially in B2C sectors, these imbalances are expected to persist, requiring logistics providers to adopt more agile and flexible capacity management strategies.

- Supply Chain Diversification – Enhancing Resilience Amid Disruption: With 78% of logistics leaders naming it a top-three priority, supply chain diversification is vital for managing risks from geopolitical, technological, and climate disruptions. Strategies like nearshoring, regionalization, and multi-sourcing strengthen resilience—especially in critical sectors like automotive and pharmaceuticals. While it adds complexity and cost, diversification is increasingly supported by AI, IoT, and advanced logistics technologies, making it a key pillar of modern supply chain strategy.

- Supply Chain Visibility – Driving Transparency and Real-Time Decision-Making: Supply chain visibility is now critical for navigating disruption and improving operational decision-making. Ranked as the top trend by 86% of logistics leaders, visibility offers end-to-end transparency—from raw material sourcing to last-mile delivery. Technologies such as IoT, GPS, and AI enable real-time tracking, predictive analytics, and inventory optimization.

APAC: Zone of Opportunity for Logistics

The APAC region, specifically Southeast Asia, is now the fastest-growing logistics market globally, driven by a rising middle class, fragmented regional supply chains, and strong government investment in infrastructure and digitalization.

As a result, overseas investors are targeting high-growth logistics platforms across Asia, aligning with rising demand for speed and cross-border capabilities. Key examples include Bain Capital’s acquisition of Trancom, and Hidden Hill Capital’s stake in COSCO Logistics Supply Chain.

At the same time, Chinese and Japanese holding companies are expanding their presence into Southeast Asia. SF Holding’s investment in Kerry Logistics’ Thailand arm reflects this momentum, underscoring a dynamic shift reshaping the Asian markets.

Fragmentation Breeds Opportunity in Asia

The Asian logistics market remain highly fragmented, presenting a compelling opportunity for consolidation. Legacy infrastructure and informal networks are prevalent in rural and Tier 2/3 markets. For instance, 85% of road freight operators control fewer than five trucks. Likewise, Indonesia’s logistics landscape is populated by over 15 domestic carriers, reflecting deep regional fragmentation.

For strategic and financial buyers, this patchwork presents a unique opportunity, offering clear pathways for buy-and-build roll-ups and geographic expansion.

There is also significant traction among financial investors within the logistics industry. Recurring revenue, sticky contracts, growth tailwinds, and the fragmentation make logistics an attractive space for financial investors.

3. Notable Ongoing Transactions in Global Logistics

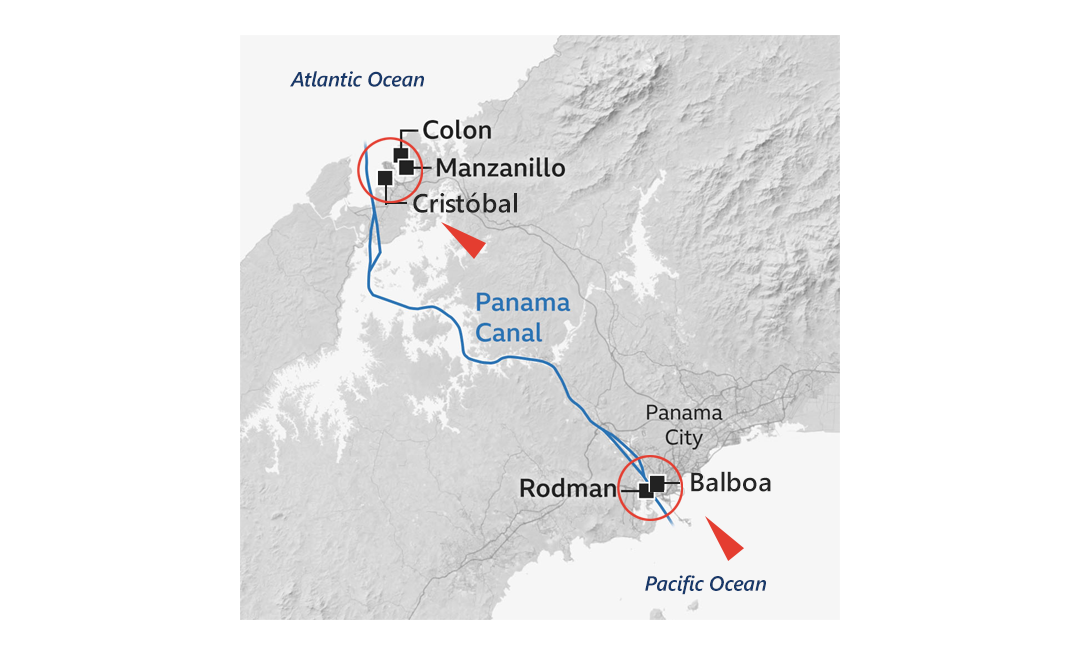

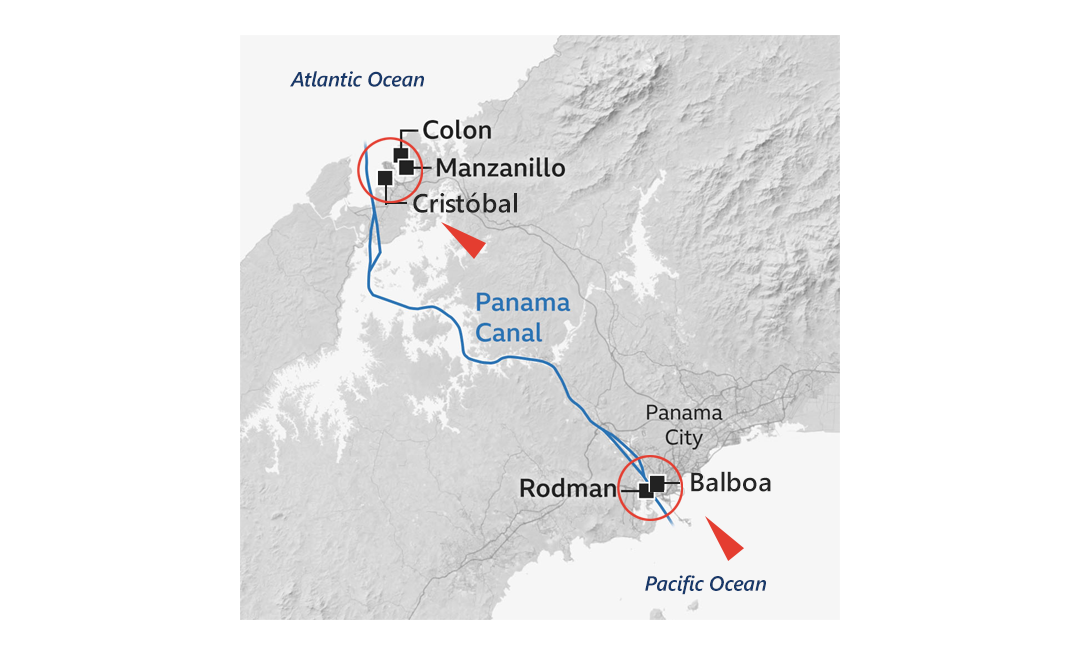

1. CK Hutchinson Potential Terminal Sales to Blackrock & MSC Consortium (Mar 2025)

In March 2025, a landmark transaction was announced in which a consortium led by BlackRock and Terminal Investment Limited (TiL)—a subsidiary of the Mediterranean Shipping Company (MSC)—agreed in principle to acquire an 80% stake in Hutchison Ports’ global terminal assets outside China and Hong Kong. The deal, valued at approximately US$22.8 billion, encompasses 43 ports with 199 berths across 23 countries, including the strategically critical ports of Balboa and Cristobal located on either side of the Panama Canal. These ports serve as vital maritime gateways connecting the Atlantic and Pacific Oceans, handling a substantial portion of global container trade.

Strategic Importance and Consortium Composition

The consortium is composed of BlackRock, Global Infrastructure Partners (GIP), and TiL, with MSC as the principal investor behind TiL. This acquisition is expected to catapult MSC to the forefront of the global terminal operator rankings, potentially making it the world’s largest container terminal operator by capacity, managing over 78 million TEUs annually once combined with its existing operations.

Regulatory and Geopolitical Challenges

Despite the commercial appeal, the transaction has encountered significant regulatory and geopolitical headwinds. In late March 2025, CK Hutchison announced a delay in signing the definitive agreement for the Panama Ports Company sale, initially expected by early April. This postponement was largely due to intensified scrutiny from Chinese authorities, which launched a thorough antitrust review citing concerns over market competition and national interests.

The sale of the Panama Canal ports—Balboa and Cristobal—has drawn particular attention given their strategic significance in global trade and the ongoing geopolitical rivalry between the U.S. and China. The proposed sale has also drawn the attention of U.S. President Donald Trump, who has repeatedly expressed his desire to reduce Chinese influence around the Panama Canal and termed the deal a “reclaiming” of the waterway.

Deal Status and Outlook

While the regulatory review and political pressures have delayed the deal, the transaction has not been cancelled. The timeline and final outcome remain uncertain as negotiations continue and the consortium works to address antitrust and national security concerns. Industry experts anticipate that MSC may need to divest certain terminals in some jurisdictions to comply with competition laws, potentially reshaping the deal structure.

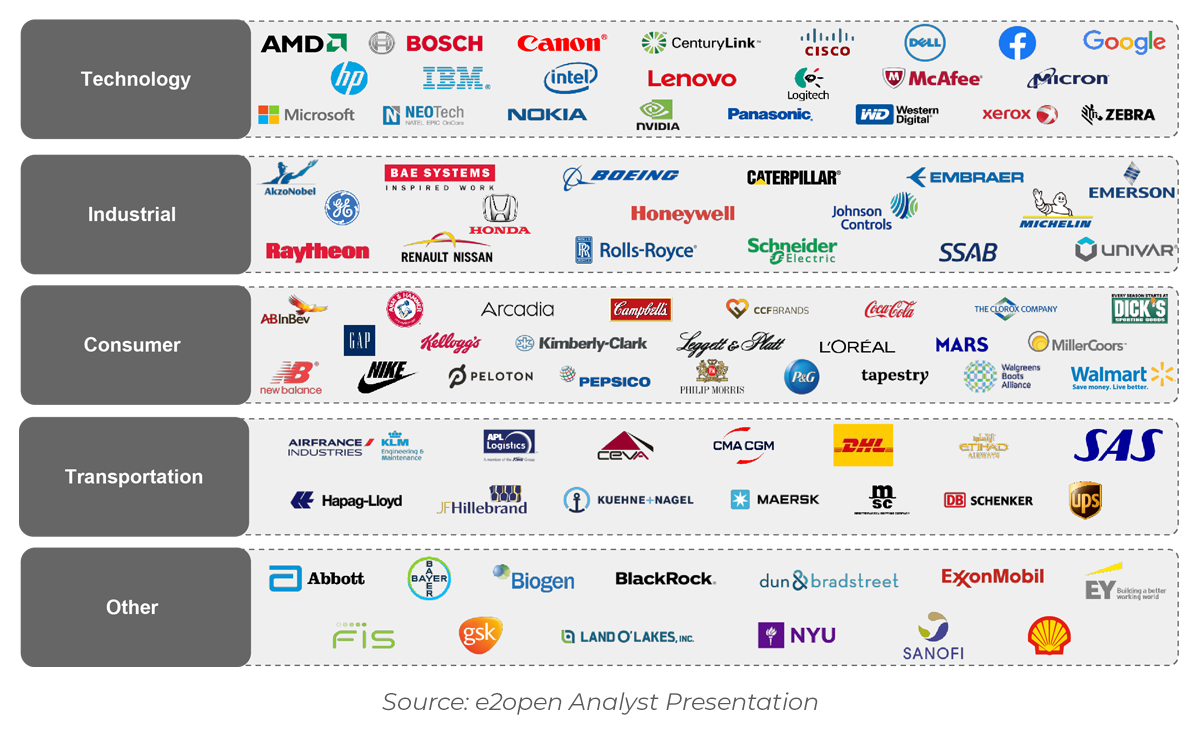

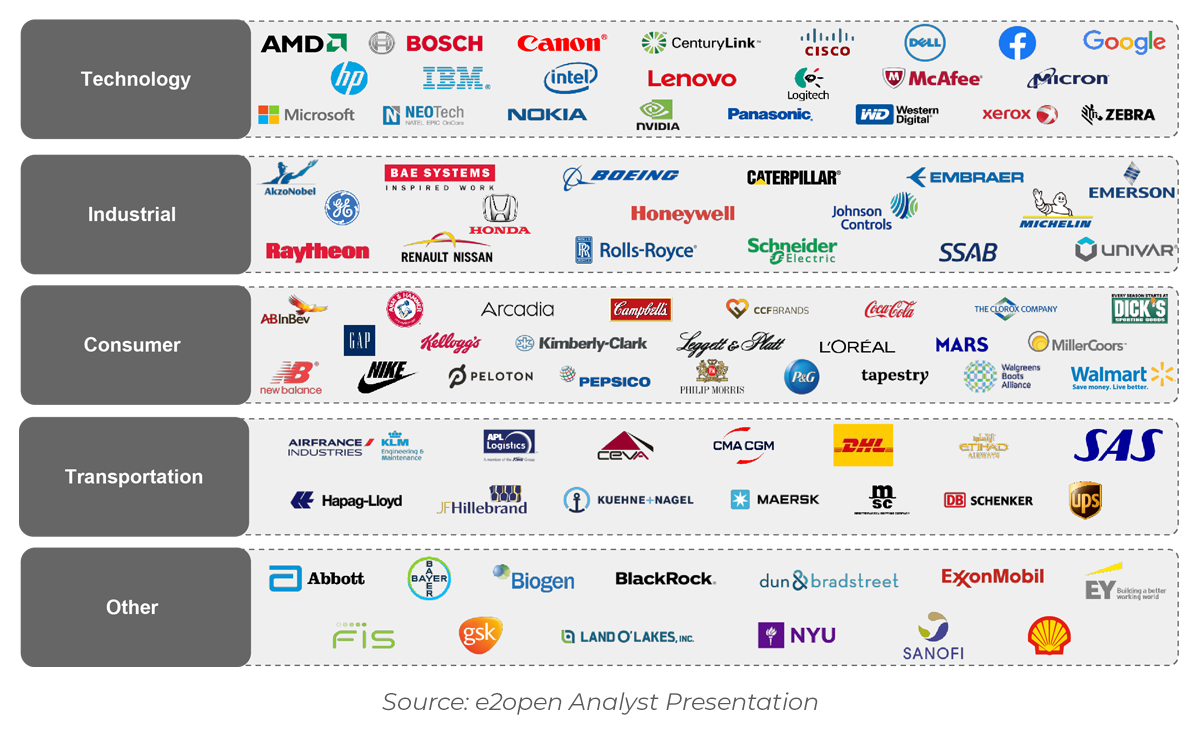

2. e2open Potential Sales to WiseTech Global

In May 2025, Australia’s WiseTech Global agreed to fully acquire US SaaS provider e2open for US$2.1 billion, a cash deal valuing e2open at US$3.30 per share, representing a 28% premium to the prior closing price ($2.57), representing a strong strategic rationale. Through this deal, WiseTech gain’s e2open’s 500,000+ connected enterprises across logistics, distribution, and retail.

Differentiating Aspects of Target

e2open’s platforms track and operate 18.5% of global export container bookings, covering over 5,600 direct customers, amongst them 250 blue-chip companies. Logistics tech companies tend to focus on either freight visibility or warehouse management. This deal bridges trade compliance with physical logistics execution, providing WiseTech a differentiated and compliance-first offering, very unusual in a market that treats these solutions separately. e2open’s software platform serves both shippers and carriers, allowing WiseTech to kill two birds with one stone, an outcome that would typically require multiple separate deals.

e2open’s End-To-End Client Base (As of 2021)

This customer base spans manufacturers, distributors, and brand owners—not just freight forwarders or 3PLs.

Deal Status and Outlook

WiseTech’s shares rose 4.7% post announcement, indicating investor approval of the strategic fit. WiseTech is financing the deal using a US$3 billion syndicated debt facility, with plans to reduce leverage below 2x EBIDTA within 3 years, signaling WiseTech is raising stakes to bet big on the long-term strategic fit.

Rationale for WiseTech

- End-To-End Supply Chain Control: Expanding from pure logistics execution into entire supply chain planning and orchestration, accessing higher pricing power.

- Geographic Diversification: e2open bring North American presence, as Wisetech is Australia based with a APAC heavy client profile.

- Accelerated Time-to-Market: Avoids the long lead time of developing complex enterprise-grade software in-house in a vertical WiseTech does not specialize in.

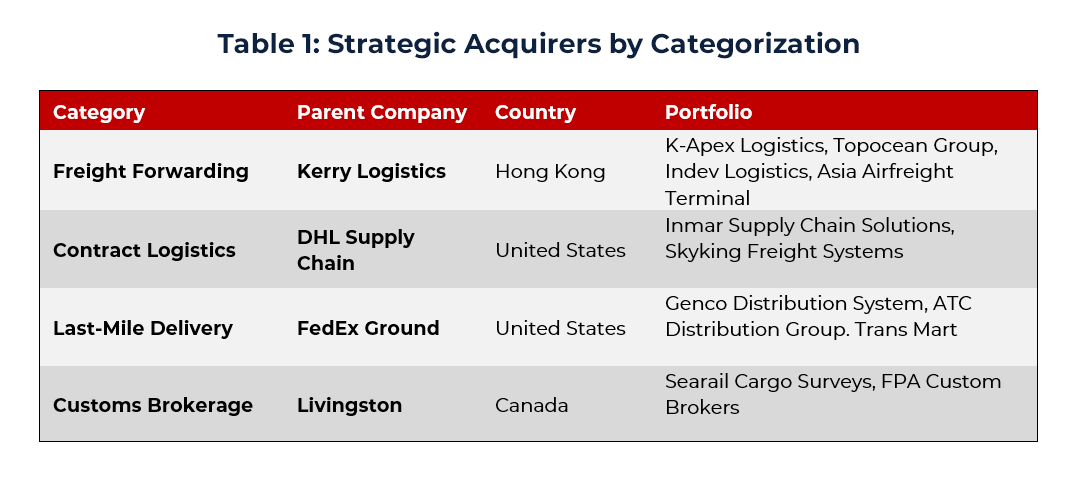

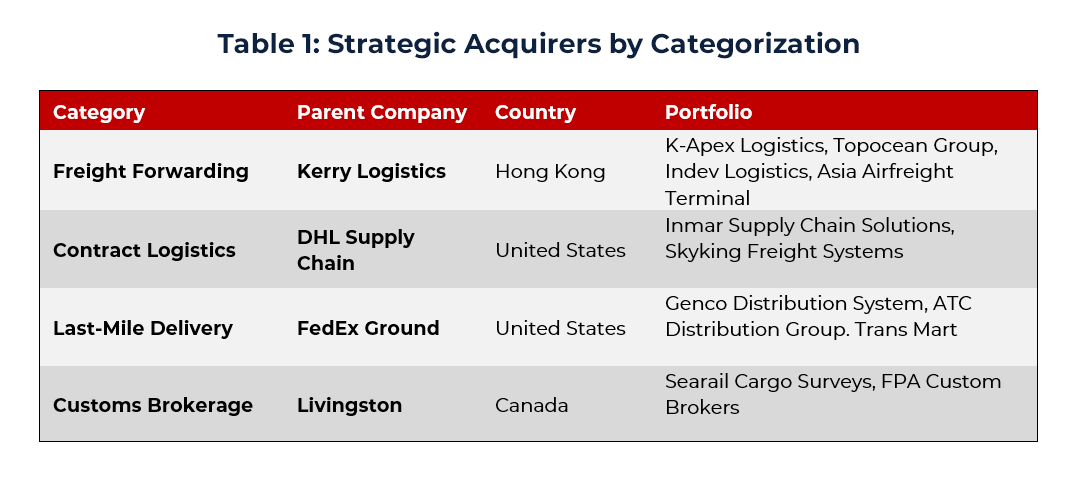

3. Notable Transaction Case Studies

Given the multiple drivers for M&A activity within the logistics industry, ARC observes an accelerating trend of global consolidation within the sector. Unlike sectors where brand identity can be preserved post-investment, logistics consolidation is primarily driven by full acquisitions. This is because achieving scale, efficiency, and network synergy often requires deep operational integration. We highlight three notable case studies to showcase the nature and rationale of consolidation across key logistics segments.

SF Holdings x Kerry Express – Cross-Border Parcel Bridge

Chinese leader in integrated logistics has acquired Kerry Express (Thailand) from Kerry Logistics Network, marking a strategic expansion in its international footprint, complementing its existing Chinese dominance.

Processing up to 3 million parcels a day in 2023 and covering 99% of Thai postal codes, Kerry Express has been a long dominant player in Thailand’s delivery scene, benefiting from its early-mover advantage. Despite dominating the domestic market, Kerry Express posted a net loss of US$80 million in 2023, largely due to intense pricing competition and declining margins in the growing yet crowded 3PL sector.

The acquisition was executed through SF’s Hong Kong-listed arm, SF International. SF Holding’s interest was twofold: to ride the wave of fast-growing ASEAN markets and to leverage Kerry’s established last-mile infrastructure to support its pan-Asian ambitions. Similarly, its competitor in the Chinese region, Alibaba’s logistic arm, Cainiao, has made strategic investments in Southeast Asia, including the launch of a “smart warehouse network” to support e-commerce growth.

Prior to SF Holding’s investment, Thai advertising and media firm VGI have also invested in Kerry Express, making it the exclusive delivery partner of the Bangkok Transit System.

Rationale for SF Holdings

- Regional Expansion: Deepen presence in the fastest growing e-commerce logistics market, using Thailand as a starting point to expedite acquisitions in other Southeast Asian countries.

- Cross-Border Synergy: Strengthen intra-Asia logistics capabilities and unlock economies of density.

- Strategic Buying Window: Acquired at discount amid sustained losses, positioned to unlock value through turnaround.

- Brand Strength & Scale: Leverage Kerry’s trusted consumer brand and local knowledge to build commercial volume in crowded Thai market.

Trancom x CBcloud – Freight at Speed of Software

Tokyo-listed logistics firm Trancom has acquired CBcloud, a Japanese logistics-tech startup, indicating the brand’s strategic approach in incorporating tech innovation in established traditional operations.

CBcloud operates a digital freight-matching platform that connects shippers with couriers, By relying on spot requests, CBcloud enables real-time load booking for Japan’s highly fragmented trucker market. With over 55,000 registered drivers and 1,000 contracts with common carriers, CBcloud boasts a 99.2% matching rate, optimizing capacity utilization and reducing empty drives. The tech-driven business model allows for high scalability, making it particularly attractive for large logistics players looking to digitalize.

Trancom’s strategy was clear – to improve on its current shipping matching . Trancom can reduce empty-miles and improve route transparency, The integration of Google Maps APIs is estimated to yield 80% parcel loading time savings for Tracom. Furthermore, this deal allows Trancom to outmaneuver traditional players in Japan still reliant on static routing and manual dispatch.

Rationale for

- Digital Differentiation: Gain a competitive edge through predictive technology, adapting fragmented nature of Japan’s trucking sector.

- SME Penetration: Tap into long-tail network of independent drivers and small fleet operators that CBcloud already aggregates, expanding market reach without capital-intensive investments.

- Futureproofing: Strengthen capabilities in urban logistics and time-sensitive delivery, areas of importance in the new era of e-commerce boom.

4. How Can ARC Help?

At Alarar Capital Group, we understand that logistics is no longer just about moving goods, but also moving intelligently. As the industry evolves—shaped by digitalization, platform ecosystems, and shifting global trade—logistics companies face critical decisions around integration and consolidation. Our deep expertise in mid-market M&A, particularly in logistics and transportation sectors, makes us a trusted partner in navigating this dynamic space.

1. Deep Industry Insight

Our team possesses a nuanced understanding of the logistics value chain, from freight forwarding and last-mile delivery to customs tech and warehousing automation. Our expertise enables us to identify strategic opportunities in emerging trends—such spot-requests and real-time tracking to align M&A with long-term growth objectives.

2. Global Reach and Cross-Border Expertise

With offices in 12 countries and a dedicated M&A team, ARC bridges cultural and operational divides. We connect brands with international partners, advise on market entry, and ensure deals succeed across markets including Europe, Asia, and the Americas.

3. Award-Winning & Globally Recognized

Alarar Capital Group is a multi-award-winning Investment Bank, including the 2024 Frost & Sullivan Company of the Year and M&A Worldwide Deal of the Year. These accolades reflect our ability to deliver superior outcomes in high-stakes transactions. This means working with an advisor who is trusted, respected, and proven at the highest level.

4. Comprehensive Strategic Advisory Platform

Today’s logistics players often require more than M&A advisory — they need an end-to-end growth partner. ARC offers a full spectrum of services including buy-side and sell-side M&A, capital raising, and market entry advisory. Our integrated platform enables clients to scale faster, access capital markets, and navigate strategic pivots with confidence.

5. Tailored Strategy for Platform & Infrastructure Operators

Every logistics business has a unique DNA. Whether you’re an asset-heavy operator, a tech-enabled platform, or a hybrid model, we tailor our deal strategy to fit your business model and growth trajectory. From platform roll-ups to infrastructure consolidation, we ensure your value proposition is front and center in every transaction.

5. Let’s Define the Future of Logistics

As customer expectations and digitalization reshape global trade, logistics is entering a transformative decade. Whether you’re a regional 3PL building scale, a tech-enabled forwarder expanding abroad, or a strategic investor seeking to consolidate fragmented verticals, Alarar Capital Group is your partner in unlocking that growth.

Let’s move what matters—because in logistics, every link counts, and every deal defines the next mile.

References: