Pop Mart has emerged as the new Moutai. The launch of LABUBU 3.0 caused an instant global frenzy among celebrities and KOLs. At Yongle’s 2025 Spring Auction, the world’s only mint-green first-generation LABUBU fetched a record-breaking RMB 1.08 million. Fueled by Labubu’s explosive popularity, Pop Mart reported dazzling results: with LABUBU as the core of its IP portfolio, first-quarter 2025 revenue surged approximately 170% year-on-year, including a ninefold increase in the Americas. Second-quarter revenue is projected to exceed Q1. Since late February 2024, Pop Mart’s share price has skyrocketed over 13 times, with its market capitalization briefly topping HKD 380 billion.

LABUBU has transformed from an oddly adorable collectible toy into a global fashion icon and social must-have, signaling not only a new wave of consumer resurgence but also a shift in consumption logic and market order. For consumer companies across the value chain, a key question is how to unlock China’s next wave of consumer demand and integrate China’s narratives and supply chain advantages into global markets. Following years of stagnation, global consumer companies are now trading at relatively low PE ratios, particularly in discretionary segments, making strategic M&A a preferred route to expand markets, upgrade capabilities, and capture emerging consumer opportunities.

Chinese Enterprises Accelerate Overseas Acquisitions and Brand Upgrades

In recent years, Chinese companies have stepped up overseas acquisitions—not just for outbound expansion, but to seek financially healthy targets that offer synergistic value. Ideal targets boast sound cash flows, customer/channel strength, and the ability to enhance product and brand portfolios—helping acquirers quickly enter new markets and build growth trajectories.

- In 2024, Kingdomway acquired Activ Nutritional, a leading U.S. calcium chew supplement brand. The deal filled a category gap, brought loyal customers and strong retail channels, and enhanced profitability through shared sourcing and manufacturing. It established a “China R&D + U.S. brand operations + global channel” closed-loop health ecosystem.

- That same year, JNBY partnered with contemporary art and design curator GDD to acquire a majority stake in British home design brand Established & Sons (E&S), leveraging E&S’s global influence and shared design DNA to expand its design-driven lifestyle ecosystem.

- In the new consumption space, Tencent continues doubling down on global entertainment assets. It is reportedly preparing a fresh bid for Korea’s gaming giant Nexon, and recently acquired 10% of SM Entertainment.

Global Brands Tap China’s Market and Supply Chain Strength

Despite geopolitical volatility, many global consumer giants remain highly focused on China’s market size and supply chain advantages:

- In 2025, Hsu Fu Chi became a wholly owned Nestlé subsidiary. Combined with Nestlé’s global brand resources, Hsu Fu Chi is now positioned for faster revenue growth.

- In 2024, Mondelēz International (Oreo’s parent company) acquired a controlling stake in Evirthfood, a domestic baked goods maker in China, filling gaps in frozen bakery and accessing over 200 premium Chinese channels (e.g., Sam’s Club, Freshippo, Naìsnow).

- In the same year, Asia Pacific Resources Group, under Golden Eagle, acquired Vinda International, a major Chinese tissue brand, entering the core battle of China’s paper products market. The group forecasts that the Chinese tissue market will double in the next decade.

Reshuffling Among Traditional Consumer Giants in China

Under mounting pressure from new consumption trends and challengers, traditional Chinese consumer leaders have struggled with outdated business models. Notably, Starbucks China and Häagen-Dazs China are rumored to be up for sale. The sector is undergoing a structural shake-up.

For buyers, this reshuffle presents an opportunity to acquire heritage brands with cultural value, loyal customer bases, and established networks at reasonable valuations. With post-acquisition supply chain optimization, channel penetration, and renewed storytelling, these legacy brands still have significant value-upside potential.

A prime case: after Carlyle exited its stake in “Golden Arches” (McDonald’s China) in 2023, McDonald’s Corporation increased its stake, while CITIC Capital remained the controlling shareholder and deepened localization efforts. The business has since entered a phase of accelerated expansion and earnings recovery.

As a new wave of consumption takes hold, market order is being redefined. For consumer companies and PE funds, strategic acquisitions offer a compelling path to rapidly enrich product lines, expand markets, and integrate value chains.

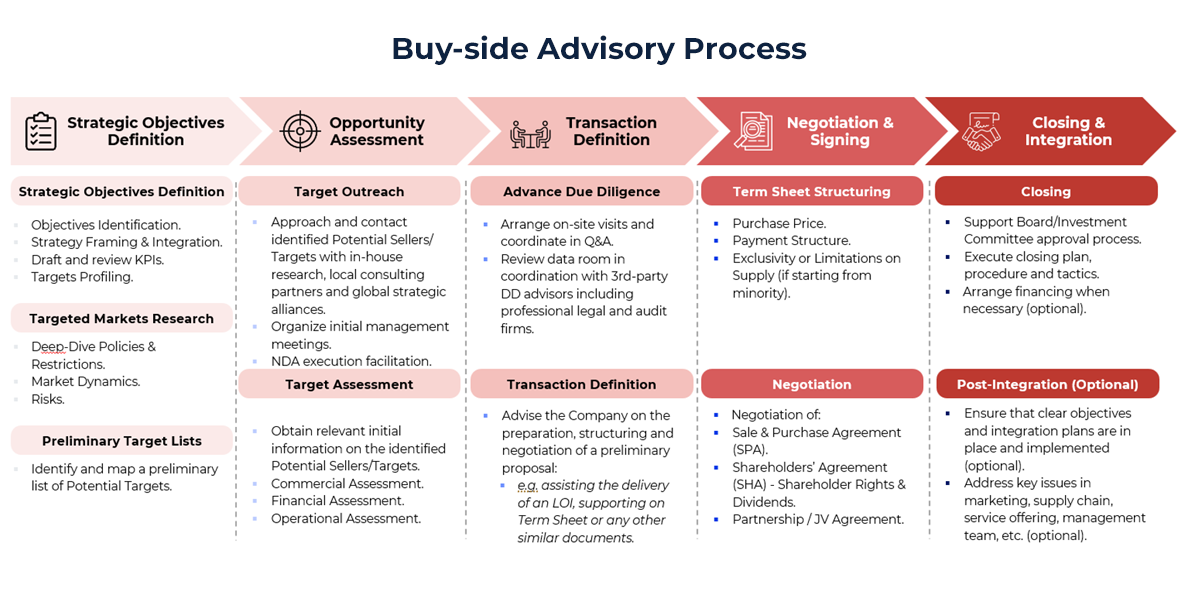

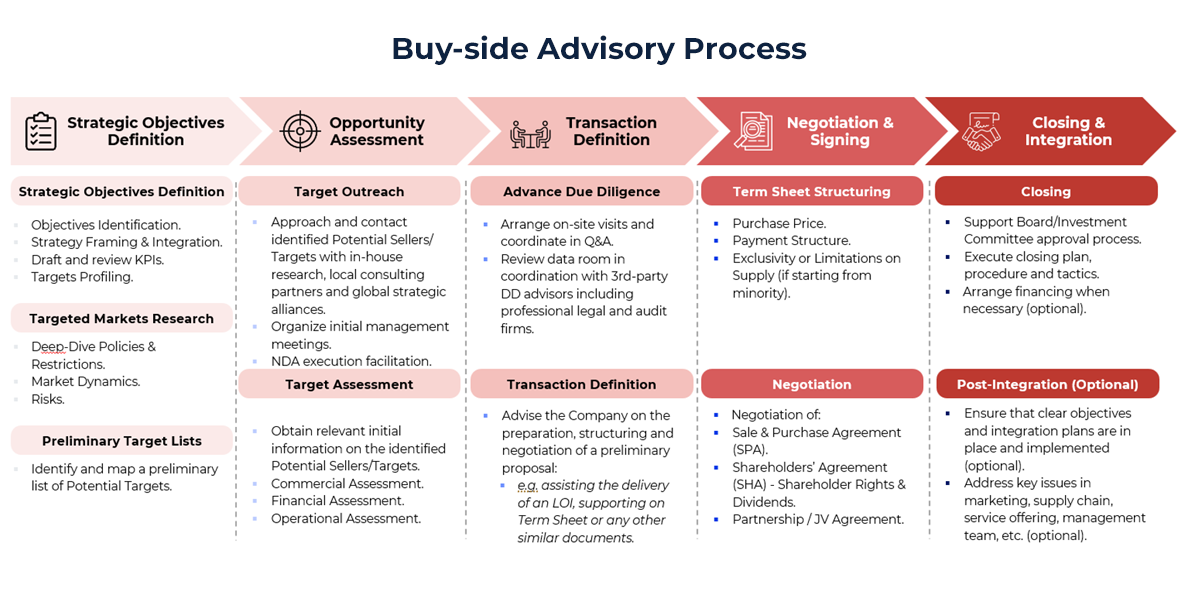

Alarar Capital Group, with 12 offices worldwide, provides end-to-end services—from strategic advisory and target screening to valuation, negotiation, and transaction execution—helping clients capture certainty in an uncertain world.

Author:

Joanne Guo

Associate