Introduction

The malting industry stands at a pivotal moment. As an essential link between agriculture and beverage manufacturing, maltsters have spent over a century expanding organically, scaling from family-owned operations to industrial powerhouses. Today, with rising demand from craft brewing, whiskey distillation, and premium food sectors, coupled with mounting pressure for capacity, innovation, and efficiency, the industry is undergoing an accelerating wave of global consolidation.

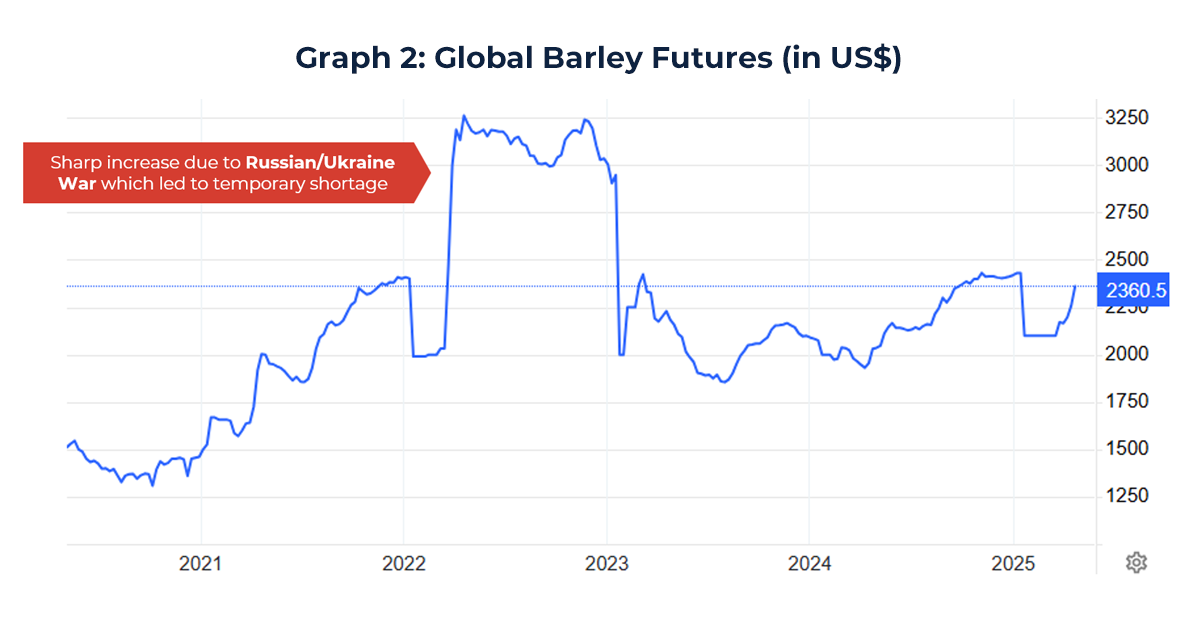

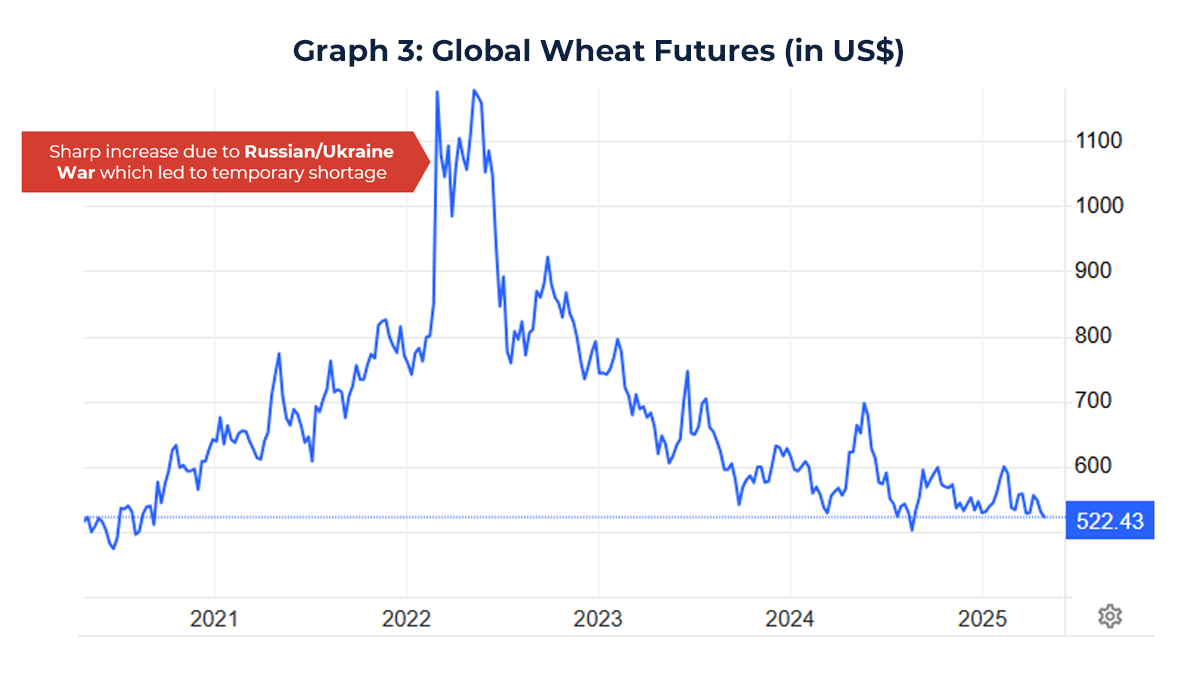

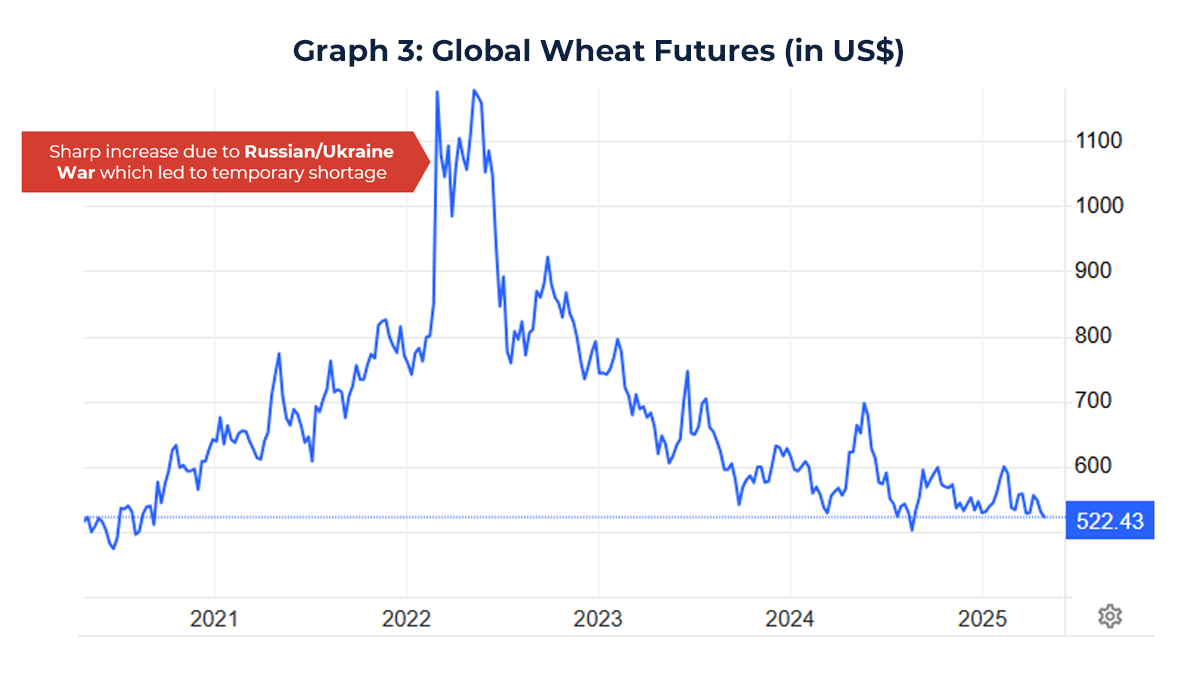

The malting industry is easily impacted by both upstream and downstream disturbances. From the supply side, the Ukraine war has put pressure on global wheat/barley supply and caused significant uncertainties (the practical impossibility of exporting out of Ukraine, a major producer/exporter of barley/wheat, leading to surge in prices) for the maltsters. From the demand side, COVID had radically decreased the demand of alcoholic beverages for three years. Under these strenuous conditions, strategic M&A has become the primary lever for growth, value creation, and risk mitigation.

Against this backdrop, Alarar Capital Group has identified two key transactions, and is uniquely positioned to support maltsters, agricultural groups, and investors in navigating this dynamic environment. With deep expertise in niche industries, a proven track record in cross-border M&A, and a global investor network, we are excited to bring the strategic insight and executional excellence needed to unlock new opportunities in the malting sector.

I. What is Malt & Who are the Maltsters?

Malt

Malt is a grain product that is used in beverages and foods as a basis for fermentation and to add flavour and nutrients. As such, the malt industry is specialized in the sourcing and production of malt which serves as a crucial ingredient for a range of food and beverage products.

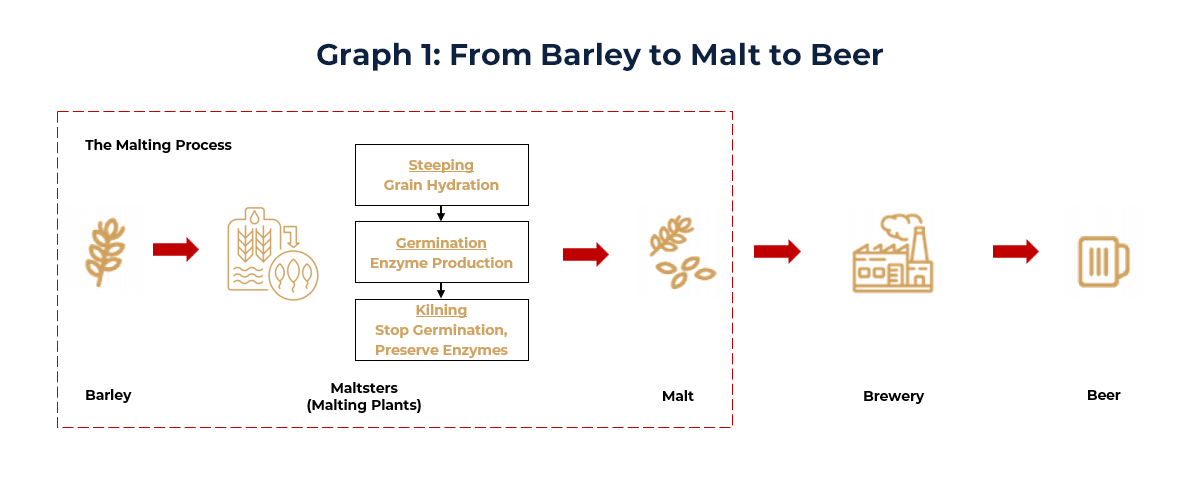

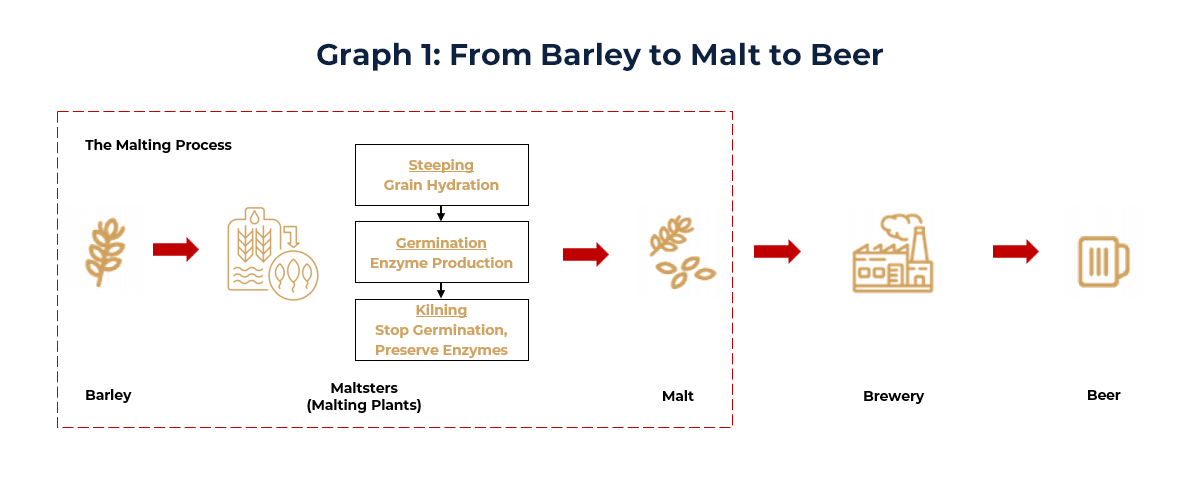

For a malt producer (Maltster) the typical production process is as follows:

- Raw Material Sourcing:

Barley Procurement: Malt processing companies source high-quality barley from farmers. The choice of barley variety can affect the flavour and quality of the final product.

- Malting Process:

The process of steeping, germination, and kilning to convert barley to malt.

- Quality Control:

Testing: Throughout the malting process, samples are regularly tested for moisture content, enzyme activity, and other quality metrics to ensure consistency and quality.

- Processing and Packaging:

Grading: The malt is sorted based on quality and intended use (e.g., for brewing vs. distilling).

Packaging: Malt is packaged in bags or bulk containers for distribution to breweries and distilleries.

The most prominent application of malt is for the brewing of beer and the distillation of whiskey, whereby the flavour of these beverages is predominantly the result of the malt from which it was made. Malt extracts are also used for flavour, enzyme activity, and starch content in such food products as flour, malt vinegar, breakfast cereals, baby foods, confections, and baked goods.

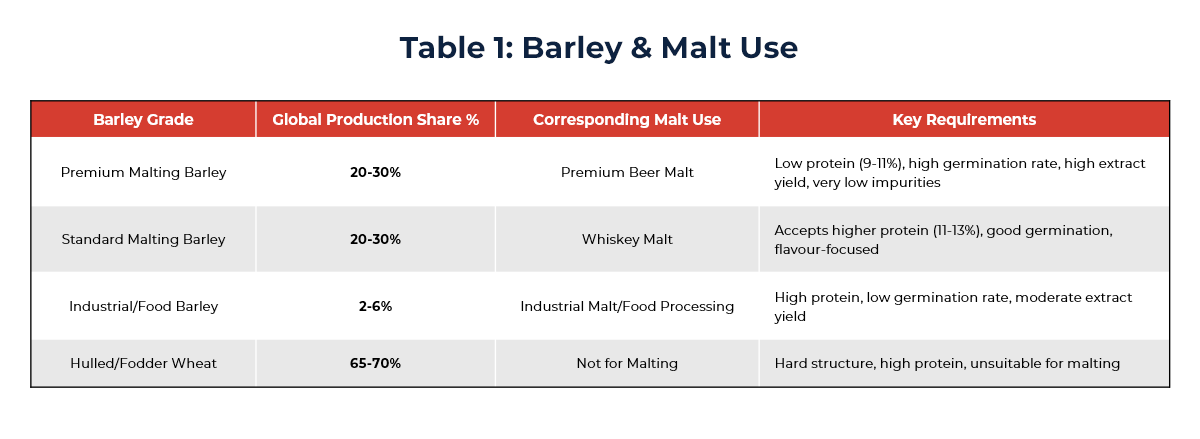

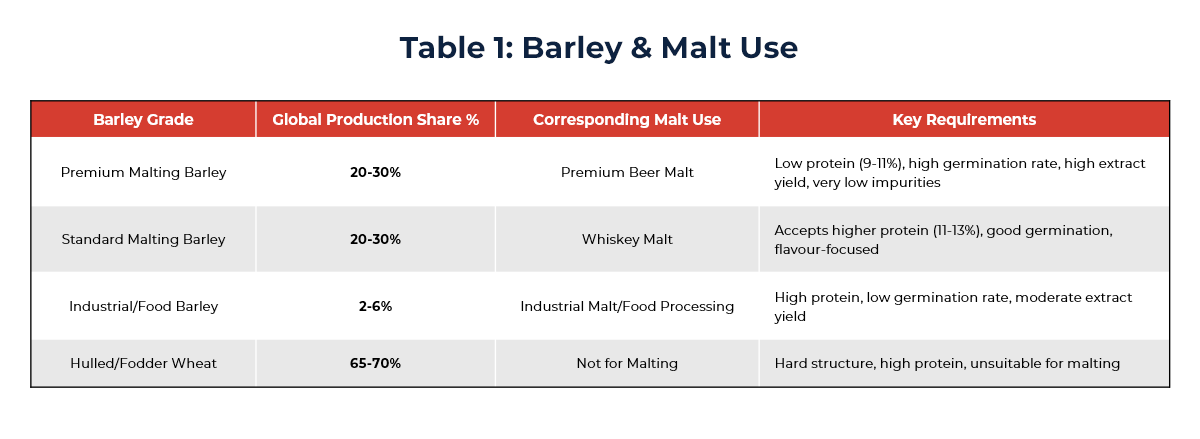

Malt producers primarily source their malt from Barley and the specific grade of barley is a key determinant of the malt it can produce. Table 1 provides and overview of the main types of barley, corresponding malt use, and downstream applications:

Maltster

A Maltster is a specialized processor that transforms raw barley into malt through a carefully controlled malting process. Unlike farmers who grow barley or brewers who produce beer, maltsters operate at the critical intermediate stage of the value chain, bridging agriculture and beverage manufacturing.

The maltster’s role extends beyond basic processing. It requires industrial-scale facilities, significant capital investment, and technical expertise across agriculture, biochemistry, and manufacturing operations. Key elements defining a maltster’s business include:

- Infrastructure/Capital-Intensive Operations

Malting is a highly capital-intensive activity. Modern malting plants must manage large-scale steeping tanks, germination vessels, kilns, and complex material handling systems. Facilities are often located strategically near barley-producing regions or major breweries to optimize logistics.

- Process Precision and Quality Assurance

The transformation from barley to malt demands tight control over moisture, temperature, airflow, and timing across each phase—steeping, germination, and kilning. Minor deviations can affect enzyme activity, sugar profiles, and ultimately, the quality of the malt. Maltsters employ advanced laboratory testing and process monitoring systems to maintain consistent output across batches.

- Product Customization and Technical Expertise

Maltsters do not simply produce one uniform product; they tailor different malt types (e.g., base malts, specialty malts, roasted malts; refer to Table 1) to meet the specific needs of brewers, distillers, and food manufacturers. This requires in-depth understanding of enzymatic profiles, flavour development, colour specifications, and functional performance during brewing or distilling.

II. Malting: A Consolidating Market

Market Overview

Malt ingredients market size was valued at US$22.4B in 2022 and is estimated to witness 5.2% CAGR from 2023 to 2032. Malt market size is expected to grow substantially between 2024 and 2032. With regards to the growth of the malt markets there are several determining factors:

- Rising Beer and Whiskey Consumption

There has been an overall rise in beer consumption in recent years, particularly in emerging markets which acts as the primary driver for increased demand for malt as a primary ingredient for beer. Similarly, consumption of whiskey has also risen with a growing number of whiskey distilleries and alignment with young adult drinking preferences.

- Craft Beer and Premiumization Trends

The growth of craft beer breweries is increasing demand for high quality malt and specialty malts which is driving production and innovation across the malting industry. Moreover, consumers are increasingly favouring premium products and beverages which further enhances demand for quality malt.

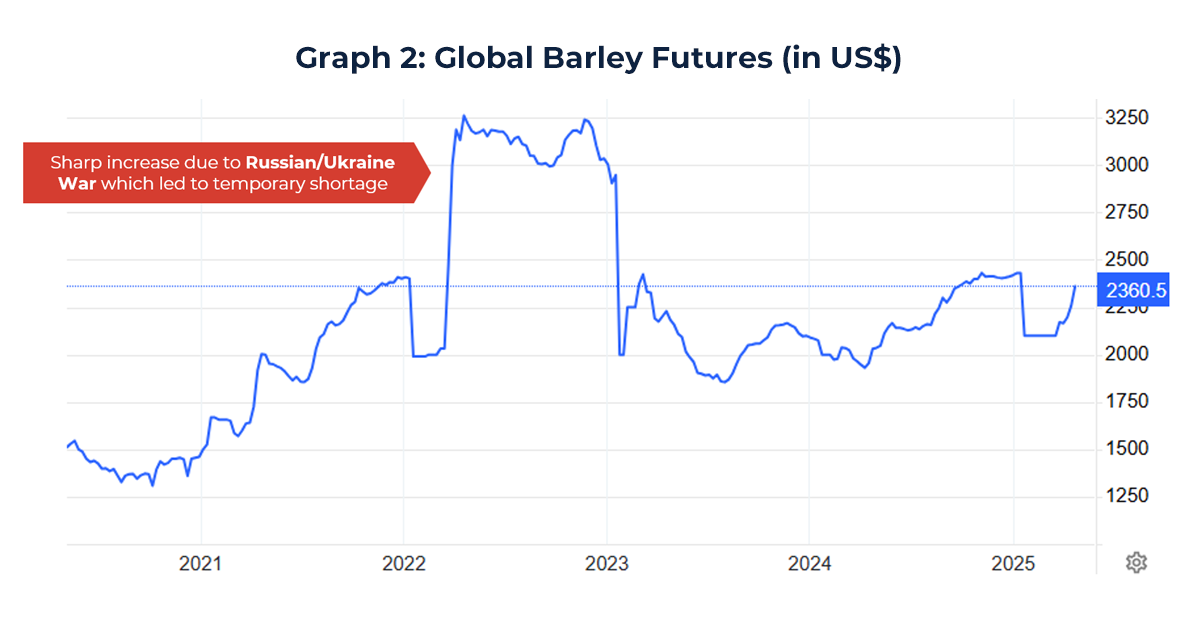

- Demand and Supply of Barley

The price, demand, and supply of barley directly influences the production costs faced by maltsters. Notably, during the initial onset of the Russian Ukraine war, there was significant uncertainty and supply shortage for barley, leading to an influx in prices. Barley prices have since then stabilised at a lower level providing a more stable environment for maltsters to grow.

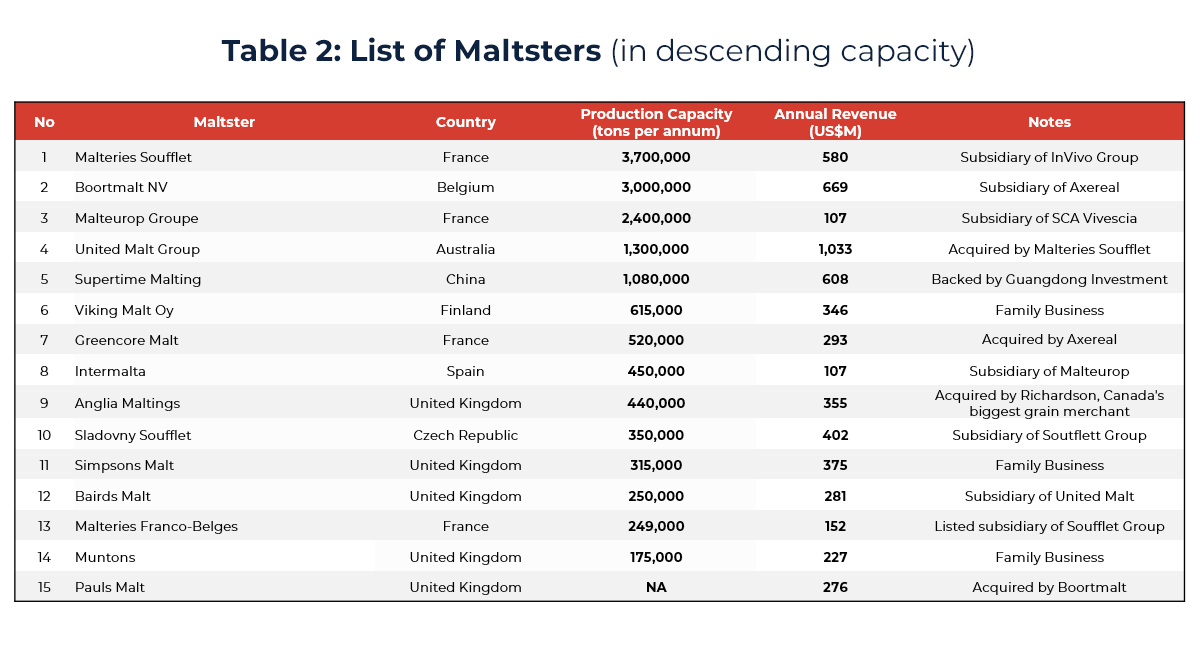

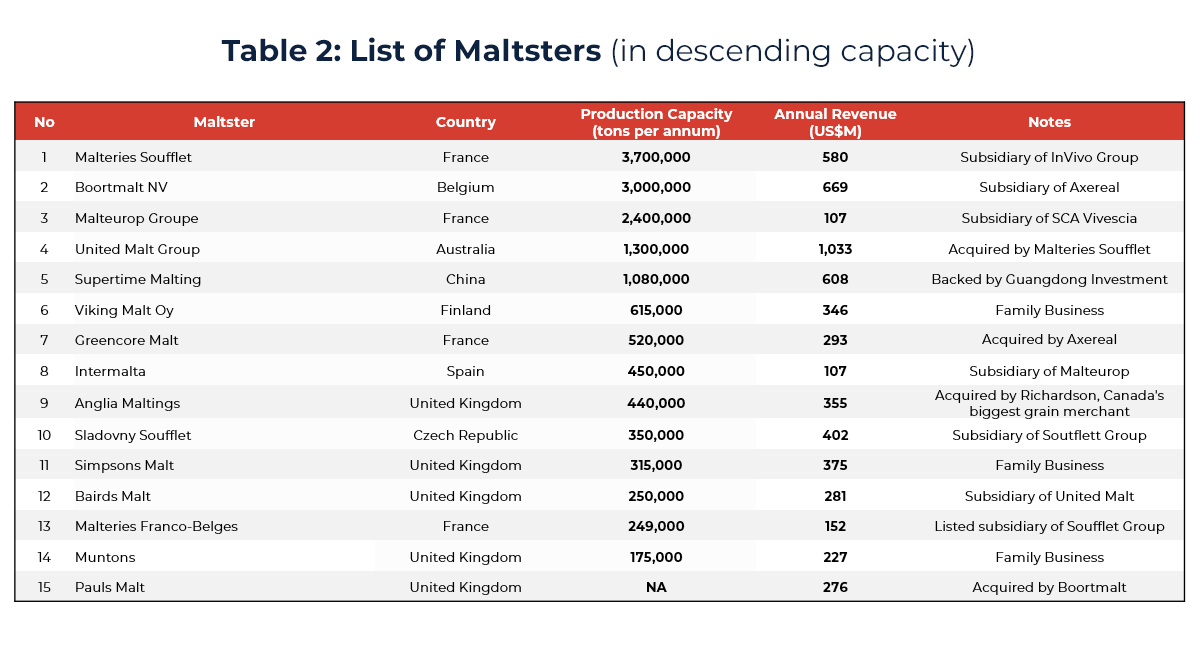

The malting industry is heavily dominated by large private European players such as Boortmalt and Malteries Soufflet who have asserted their position as market leaders through a series of acquisitions. Additionally, they are also subsidiaries of larger private agricultural conglomerates who provide them with the financing for acquisitions and expansion. The industry is also characterized by several smaller sized family malt businesses such as Viking Malt and Simpsons Malt.

Given the nature of the malt processing and production business, the malt industry is highly capital intensive with significant barriers of entry. This gives rise to several key drivers for the ongoing consolidation within the Malt Industry:

- Capacity Expansion

The need for capacity expansion is a significant driver within the malt production industry. By nature, malt production is capital intensive whereby significant investment in production facilities and technology is required to increase output and efficiency. As such, well-established maltsters often seek to acquire smaller malt producers to further optimise their operations, reduce costs, and achieve economies of scale that smaller producers may struggle to access.

- Broader Market Access

Consolidation facilitates wider market access for maltsters by combining distribution channels and client bases. Through consolidation, larger maltsters can benefit from existing relationships with downstream breweries and food manufacturers and more efficiently tap into new markets and regions.

- Added R&D Capabilities

Consolidation enables maltsters to pool resources for research and development which can significantly enhance innovative capabilities. Given the increasing preference for premium malt products, there is growing emphasis on new and high-quality malt varieties further expediting the need for consolidated R&D.

Industry Trend and Notable Transactions

Given the capital-intensive nature of the maltster business and the fact that most players have already undergone over a century of organic growth—from family-owned shops to industrial-scale operations—ARC observes an accelerating trend of global consolidation within the sector. To illustrate this dynamic, we highlight two landmark transactions.

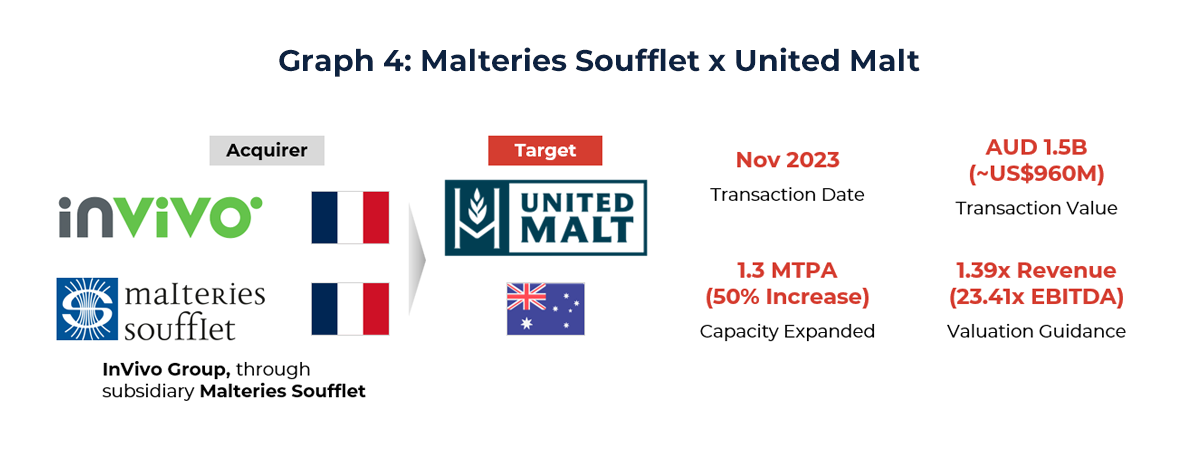

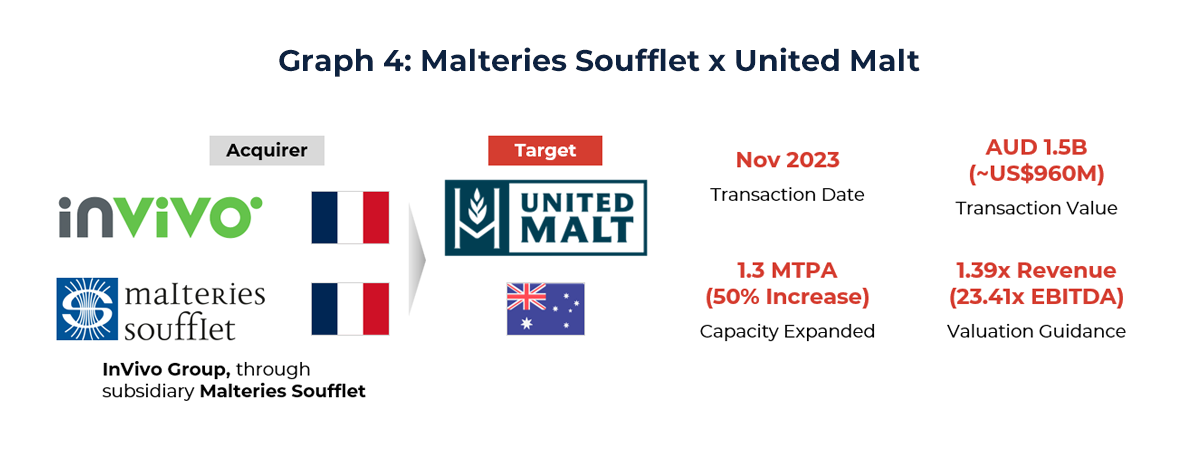

Case Study: Malteries Soufllet x United Malt

In November 2023, Malteries Soufflet, the second largest malt producer in the world and a subsidiary of European agricultural group InVivo Group, completed the acquisition of 100% of United Malt Group. United Malt Group was the world’s fourth largest maltster with a capacity of 1.3MTPA (million ton per annum), a distribution network of 21 warehouses and a wide range of distribution partnerships.

United Malt Group was acquired in a public-to-private buyout for a total of AUD1.5B (US$960M), equivalent to 1.39x Revenue or 23.41x EBITDA, aiming to further consolidate Malteries Soufflet’s position and make them the world’s largest malt producer.

Notably, a significant portion of the acquisition’s funding was provided by InVivo Group and their strategic partners. The acquisition also underscores InVivo’s commitment towards making malt one of its core businesses by strengthening Malteries Soufflet as an industry leader. The acquisition also marks an exit for GrainCorp, an Australian grain business who had acquired United Malt in 2009.

Key objectives/Rationale

- The creation of a larger global malt platform which combines the complementary assets of the two companies both in terms of business segments and geographic footprint.

- A 50% increase in total annual production capacity, boosting Malteries Soufflet’s capacity to 7 million tons of malt per year with 41 facilities across 20 countries, serving both craft and industrial brewers.

- Pave the way for further investment in research and development, improved operations, and new sustainable products, enabling Malteries Soufflet to achieve continued growth.

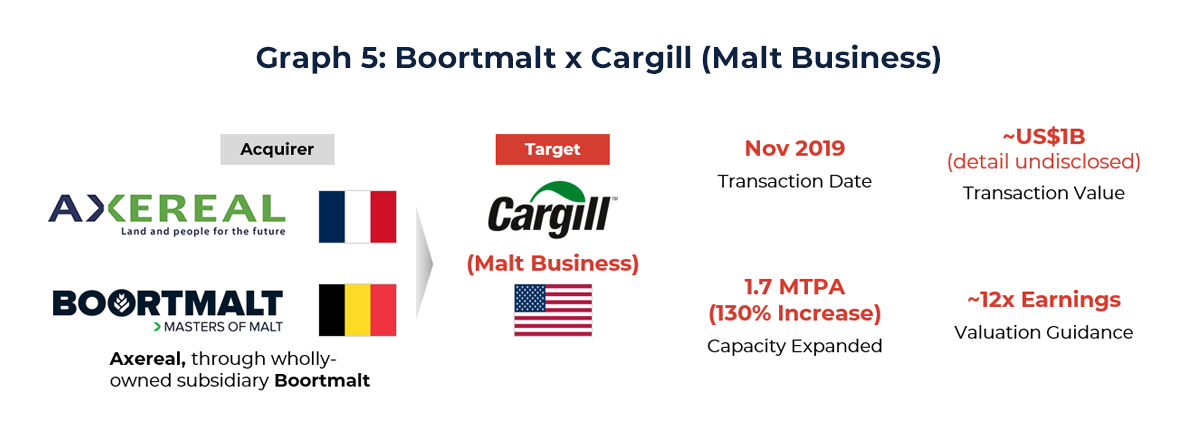

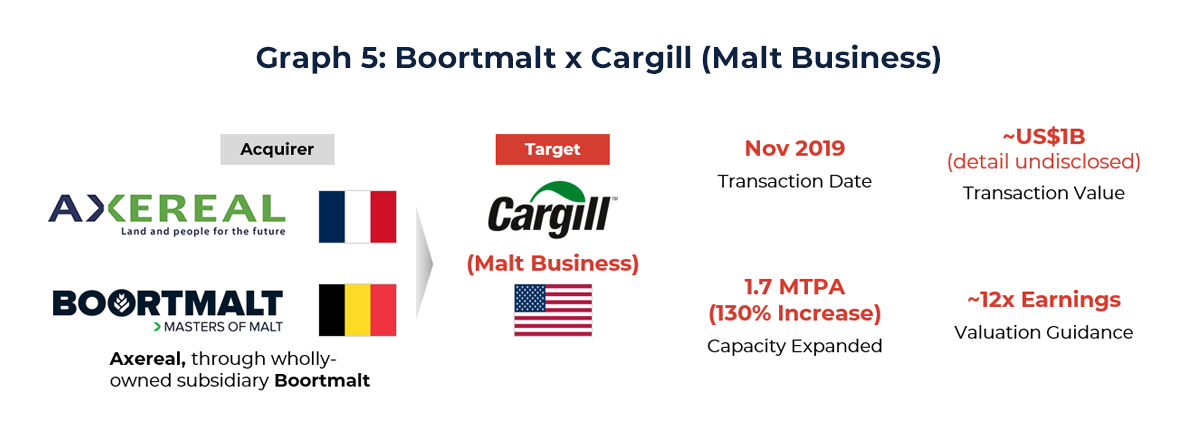

Case Study: Boortmalt x Cargill (Malt Business)

In November 2019, Axereal, France’s largest grain cooperative group, through its malting subsidiary Boortmalt, completed the acquisition of Cargill’s global malt business. This transformative transaction positioned Boortmalt as the world’s largest malt producer by capacity, at the time.

The acquisition included 16 malthouses across 9 countries, approximately 600 employees, and a total annual production capacity of 1.7 million tonnes. Following the transaction, Boortmalt’s global footprint expanded to 27 malting plants across five continents, with an aggregate production capacity of 3 million tonnes annually. The company’s headquarters, along with its R&D center and the world’s largest malthouse, remained in Antwerp, Belgium.

While the financial terms were not officially disclosed, industry estimates suggest the transaction was valued at approximately US$1B, representing earnings multiple of about 12x for the Cargill malt assets.

Strategically, this acquisition allowed Axereal and Boortmalt to integrate further downstream in the barley value chain, adding scale and diversification to their existing operations. It also supported Axereal’s broader strategic vision of enhancing value for its cooperative farmers, expanding into high-growth international markets, and positioning itself as a driver of agricultural and industrial innovation.

The transaction rationale centered on several key objectives:

- Global Leadership: Cement Boortmalt’s position as the largest malt producer worldwide by production capacity and geographic presence.

- Operational Synergies: Achieve efficiencies across production, logistics, and supply chain management on a global scale.

- Risk Diversification: Mitigate climate-related and supply risks through broader geographic dispersion and expanded barley sourcing capabilities.

- Innovation and Growth: Accelerate development of new barley varieties and specialty malts, strengthening Boortmalt’s technical leadership and product portfolio.

The transaction also underscored Axereal’s long-term commitment to competitive positioning in agricultural value-added sectors, while reinforcing its ties with the financial community. It marked a significant milestone in the evolution of both Boortmalt and Axereal, demonstrating the growing strategic importance of malting within the broader agri-food ecosystem.

III. How ARC Can Help

At Alarar Capital Group, we recognize the malting industry’s unique position at the intersection of agriculture, food processing, and beverage production. With over a century of organic growth, many maltsters have reached a plateau, making strategic consolidation a compelling path forward. Our expertise in mid-market M&A, particularly within niche sectors like malting, positions us to guide clients through this evolving landscape.

- Deep Industry Insight

Our team possesses a nuanced understanding of the malting sector’s complexities, from raw material sourcing to the intricacies of the malting process. This knowledge enables us to identify strategic opportunities and provide tailored advice that aligns with our clients’ long-term objectives.

- Global Network and Cross-Border Expertise

With a presence in 12 countries across three continents, Alarar Capital Group is adept at facilitating cross-border transactions. Our global reach allows us to connect malt industry players with international partners, investors, and markets, fostering growth and expansion opportunities.

- Proven Track Record in M&A

Alarar Capital Group has successfully executed over USD $1B in transaction volume over the last three years, specializing in cross-border M&A involving Asia. Our experience includes advising on complex transactions that require meticulous planning and execution, ensuring optimal outcomes for our clients.

- Strategic Advisory Services

Beyond transaction execution, we offer comprehensive advisory services, including valuation, due diligence, and post-merger integration support. ARC also specializes in SPAC/de-SPAC and ranked#1 globally in SPAC M&A league table in transactional value, market share, and number of transactions in 2022 and #2 in 2024.

Let’s Have A Chat.

As the malting industry continues to evolve, Alarar Capital Group stands ready to assist companies in navigating the complexities of consolidation and growth. Our specialized knowledge, global network, and proven track record make us the ideal partner for maltsters seeking to explore strategic opportunities. Contact us today to learn how we can support your business objectives.

References