As domestic competition intensifies and core markets become increasingly saturated, many Chinese listed companies are proactively turning outward to unlock their next phase of growth. At Alarar Capital Group, we’ve seen a surge in demand from Chinese LISTCOs seeking strategic guidance for overseas expansion to strengthen competitiveness. The most common motivations include:

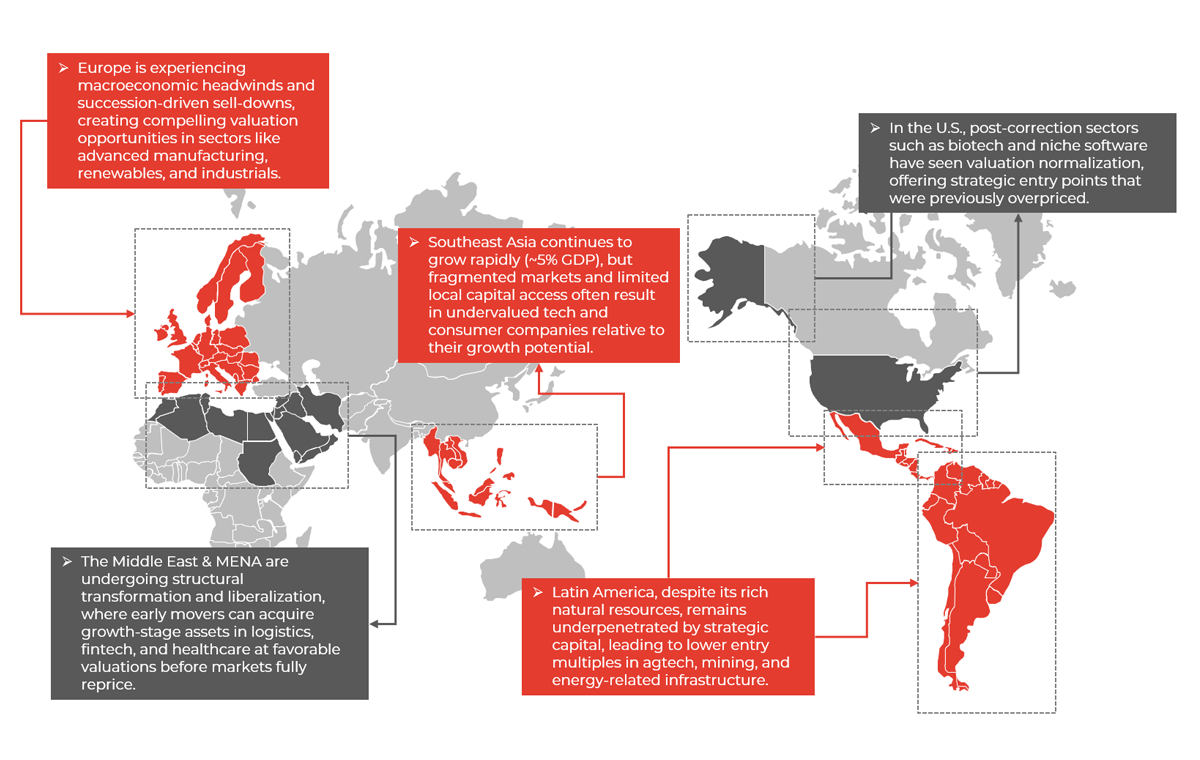

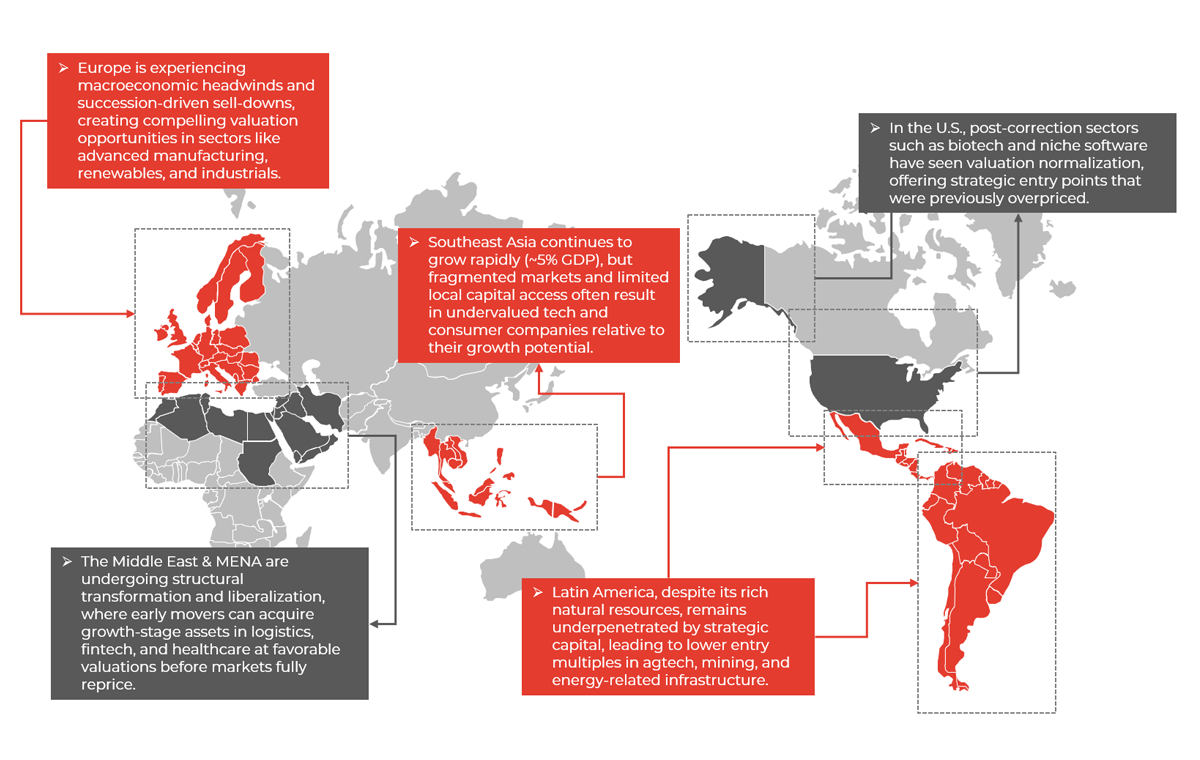

Simultaneously, global M&A markets are offering a rare alignment of timing and opportunity, making this an optimal moment for outbound acquisitions.

Beyond valuation, geopolitical risks and supply chain diversification are reinforcing the urgency for outbound M&A. Heightened tariffs and rising global uncertainty are pushing Chinese firms to diversify manufacturing and commercial footprints.

However, executing a successful cross-border acquisition takes more than capital—it requires navigating foreign markets, regulations, negotiation norms, and cultural nuances. This is where an experienced advisor makes a critical difference.

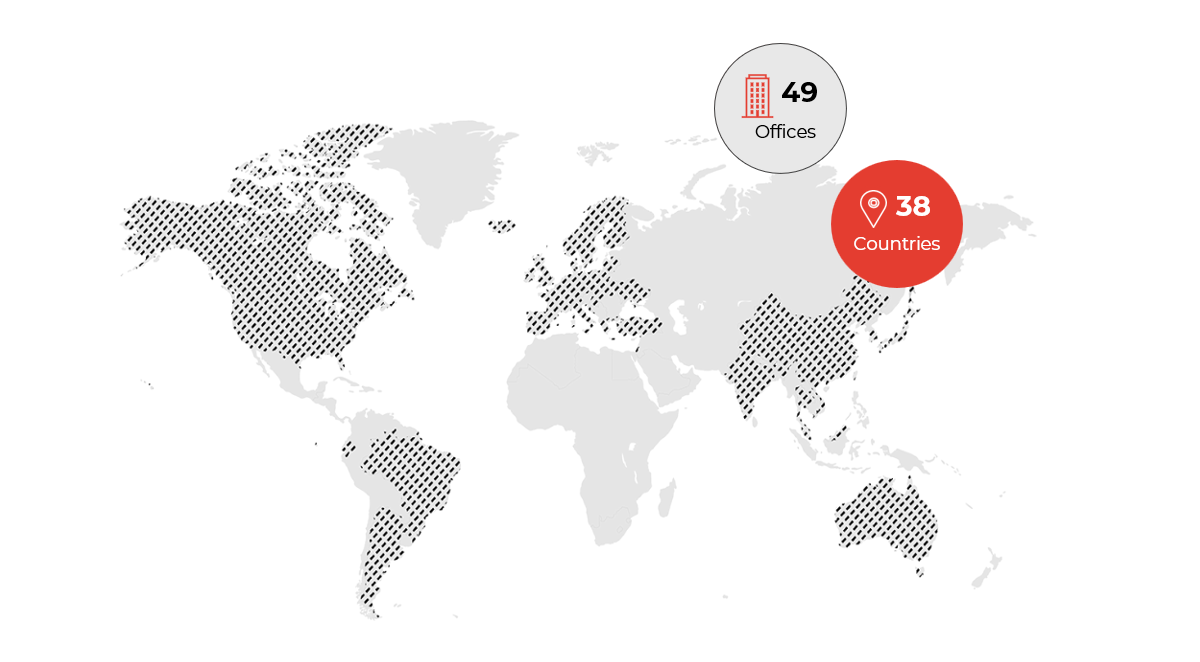

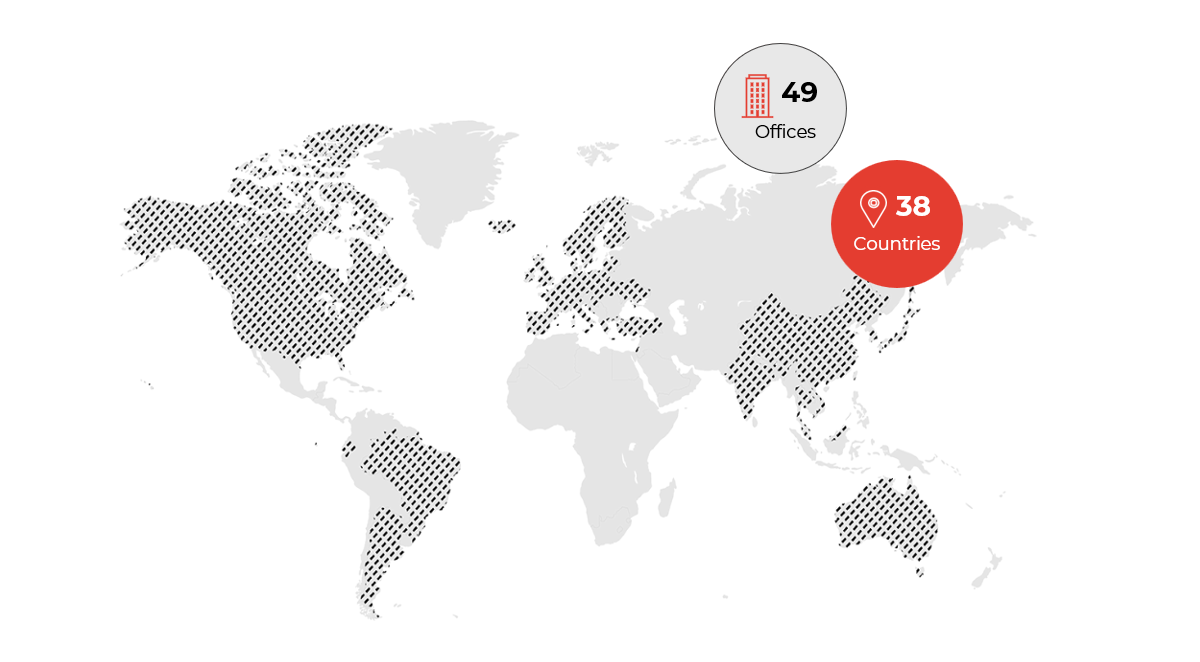

Alarar Capital Group provides end-to-end buy-side advisory tailored to Chinese acquirers, including global target sourcing, commercial due diligence, valuation advisory, deal structuring, and negotiation through to closing. With 11 offices across Asia, Europe, the Middle East, and the Americas, we offer both local access and global insight—connecting Chinese capital with the right opportunities worldwide.

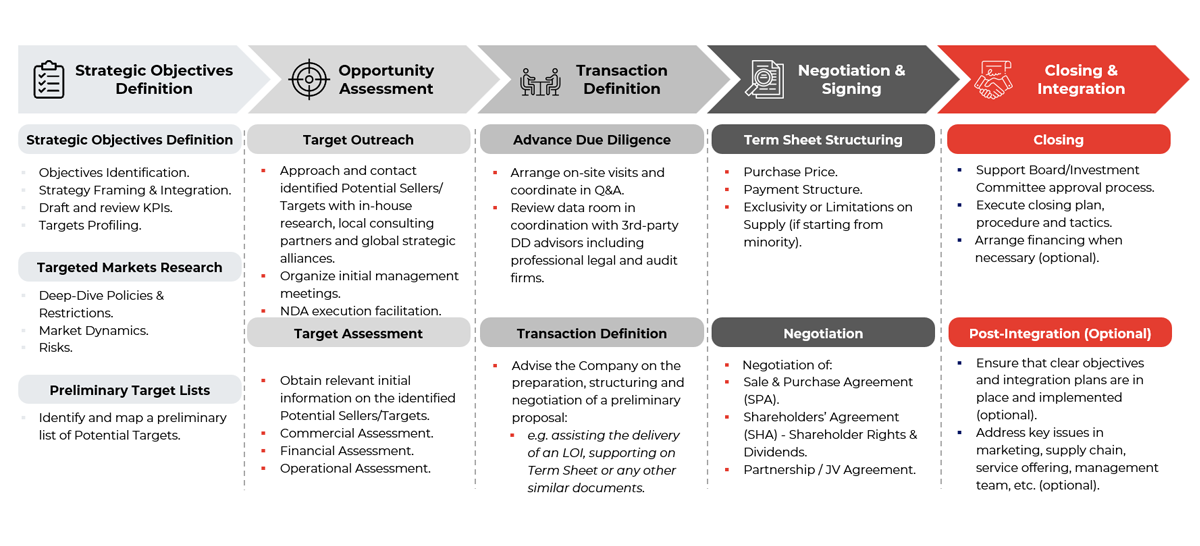

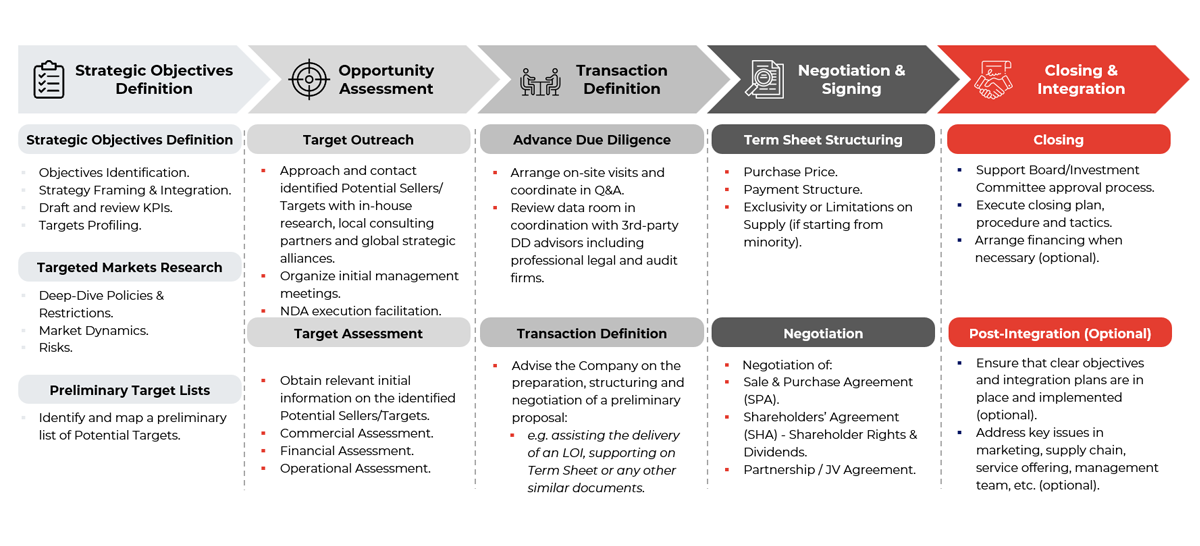

Our typical buy-side process includes:

Hiring a professional advisor significantly reduces execution risk, accelerates timelines, and ensures deal quality.

- We conduct rigorous target screening using proprietary databases and global deal intelligence.

- Our valuation modeling and deal structuring optimize terms—be it cash, equity, earn-outs, or hybrids.

- We guide clients through complex cross-border regulatory approvals, including CFIUS (US), various FDI frameworks (EU), and ODI (China), to ensure compliance and avoid costly delays.

For example, we recently advised a Fortune 500 German company on the successful divestment of its mainland China assets. Our ability to bridge execution gaps between Chinese acquirers and overseas sellers through hands-on, regionally embedded advisory was key to closing.

With outbound momentum building and quality overseas assets attracting increasing attention, now is the time to act in case you get left behind by your competitors. Alarar Capital Group is here to help you execute with confidence, clarity, and results.

Author:

Jerry Zhu

Vice President