Foreign companies pursuing a public listing are increasingly choosing U.S. exchanges over their domestic exchange. In the first quarter of 2025, 58% of all U.S. IPOs were launched by foreign issuers[1], and this momentum has continued through the first half of 2025. Foreign companies’ participation has significantly accelerated the U.S. IPO markets, with total proceeds raised reaching $25.4B year-to-date as of June 11th, representing a 39.2% increase year-over-year compared to the same time period in 2024 and a 166.1% jump compared to 2023[2].

The NYSE now hosts more than 530 international companies from 48 countries[3], the largest such cohort on any global exchange, while Nasdaq remains the premier venue for technology, consumer, and high-growth issuers globally. In H1 2025, many high-profile foreign issuers have chosen to list in the U.S., highlighting this continued trend among companies exploring a public listing:

- May 2025 – eToro (Israel): The social trading and brokerage platform secured $620M in its Nasdaq IPO. As of June 17th, 2025, the stock is trading at $61.50, an 18% increase from its IPO price, demonstrating that fintech issuers continue to attract strong investor interest despite a challenging macroeconomic environment[4].

- April 2025 – Chagee (China): The premium milk-tea chain raised $411M in its Nasdaq IPO. Its shares surged 21% on the first day of trading, reflecting global investor appetite for high-growth Asian consumer brands[5].

This trend is evident among small- and mid-cap issuers as well, as U.S. exchanges have seen strong new issuance activity for foreign companies exploring a smaller IPO:

- June 2025 – Pitanium (Hong Kong): The beauty and personal care products retailer raised $7M at an $80M valuation in its Nasdaq debut. Its shares have gained more than 50% since its IPO less than three weeks ago.

- May 2025 – Fast Track Group (Singapore): The events management and talent agency raised approximately $15M in its Nasdaq IPO. With an estimated market cap of $85M at IPO, the deal marked one of Southeast Asia’s first entertainment companies to list in the U.S.[6]

- April 2025 – Phoenix Asia Holdings Limited (Hong Kong): The substructure contractor raised $6.4M and its shares opened at $7.00, up 75% from the $4.00 IPO price[7]. The deal valued the company at approximately $86M, reinforcing the strong momentum of U.S. listings among small-cap Asian issuers

Looking ahead, this trend is expected to continue as the pipeline of companies exploring an IPO is seeing strong participation from international companies:

- Knorex (Singapore): A programmatic advertising firm recently filed to raise approximately $12M through an NYSE American IPO.

- Center Holdings (Japan): The mobile connectivity provider filed in June for a Nasdaq IPO, aiming to raise between $15M to $23M.

- Klarna (Sweden): The buy-now-pay-later pioneer filed in March for a NYSE listing, targeting a valuation exceeding $15B[8].

Together, these listings reflect the continued appeal of U.S. exchanges for issuers seeking broader capital access, valuation uplift, and enhanced investor visibility.

What is Driving this Trend?

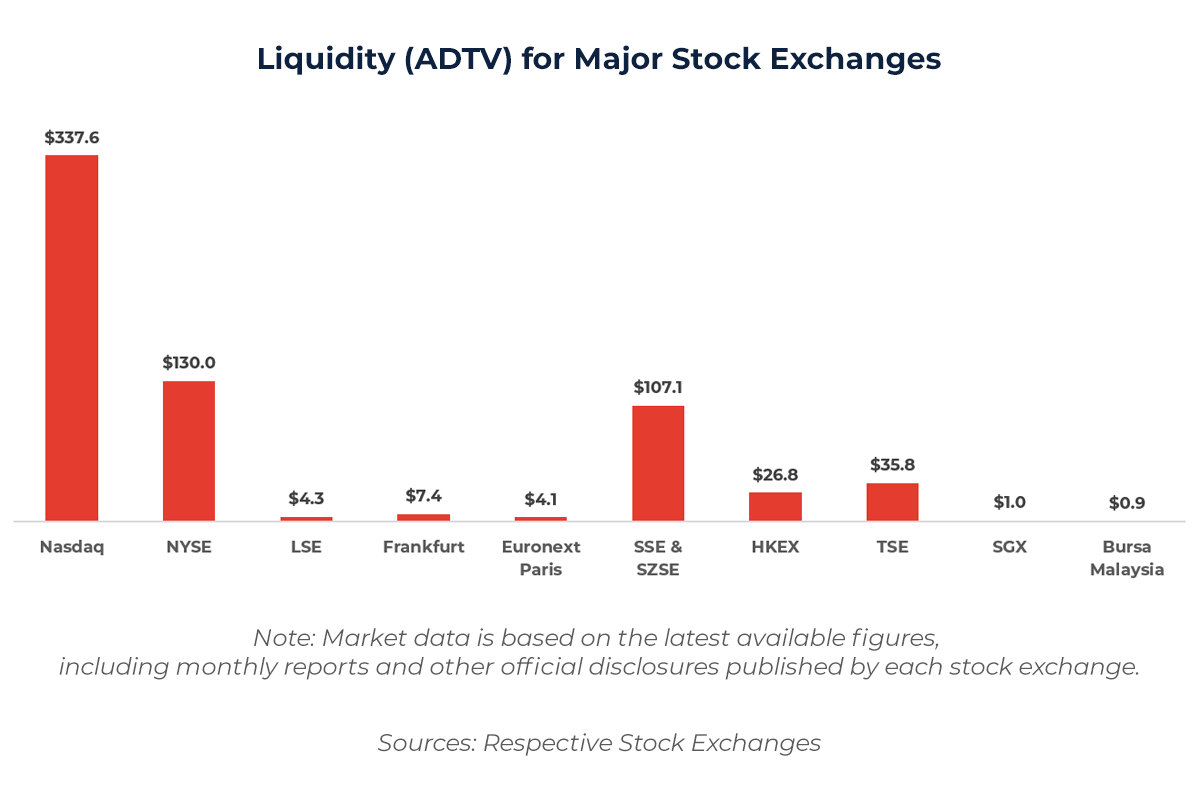

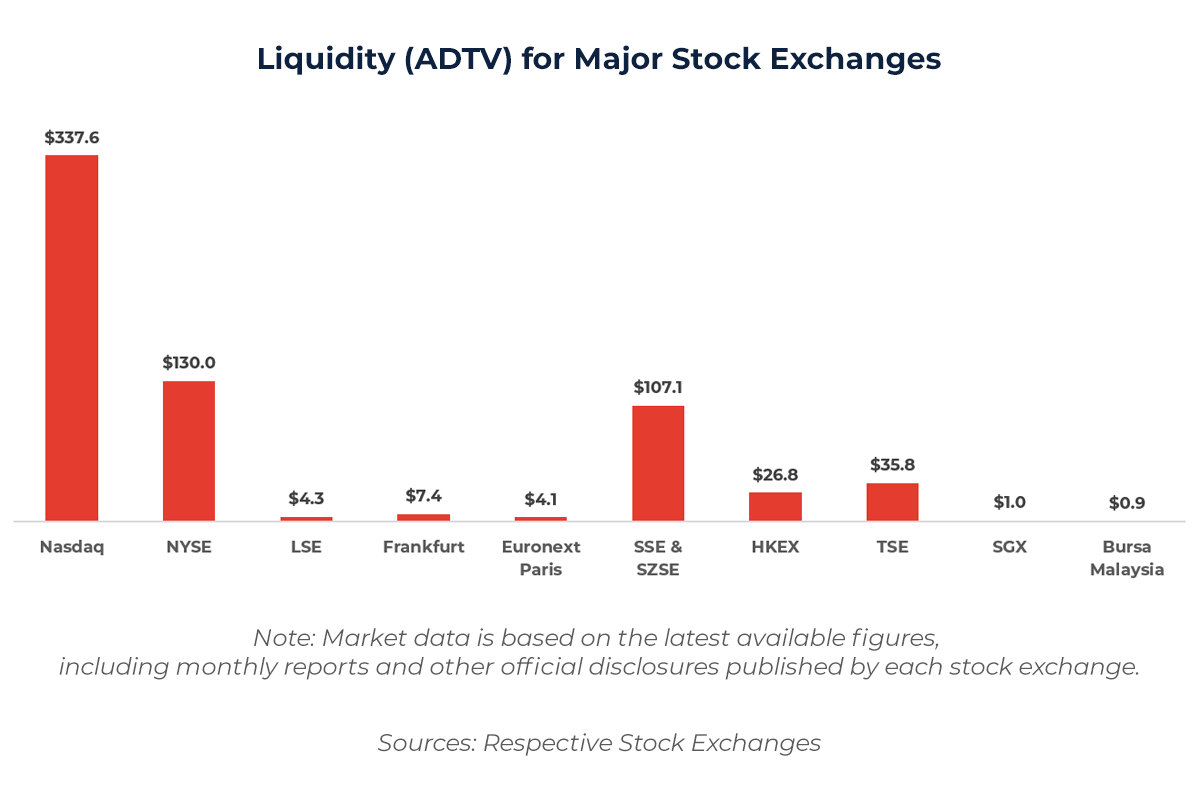

Ample Liquidity

Q1 2025 data shows that average daily equity turnover on U.S. exchanges rose to 15.7B shares, up 33.4% year-over-year[9]. This level of trading volume significantly outpaces non-U.S. exchanges and continues to grow steadily year-over-year. Additionally, the dollar value of turnover data further highlights the strength and liquidity seen on U.S. exchanges, as 2024 saw an average daily trading value of over $600B in U.S. equities, with the highest single-day volume exceeding $1.4T[10].

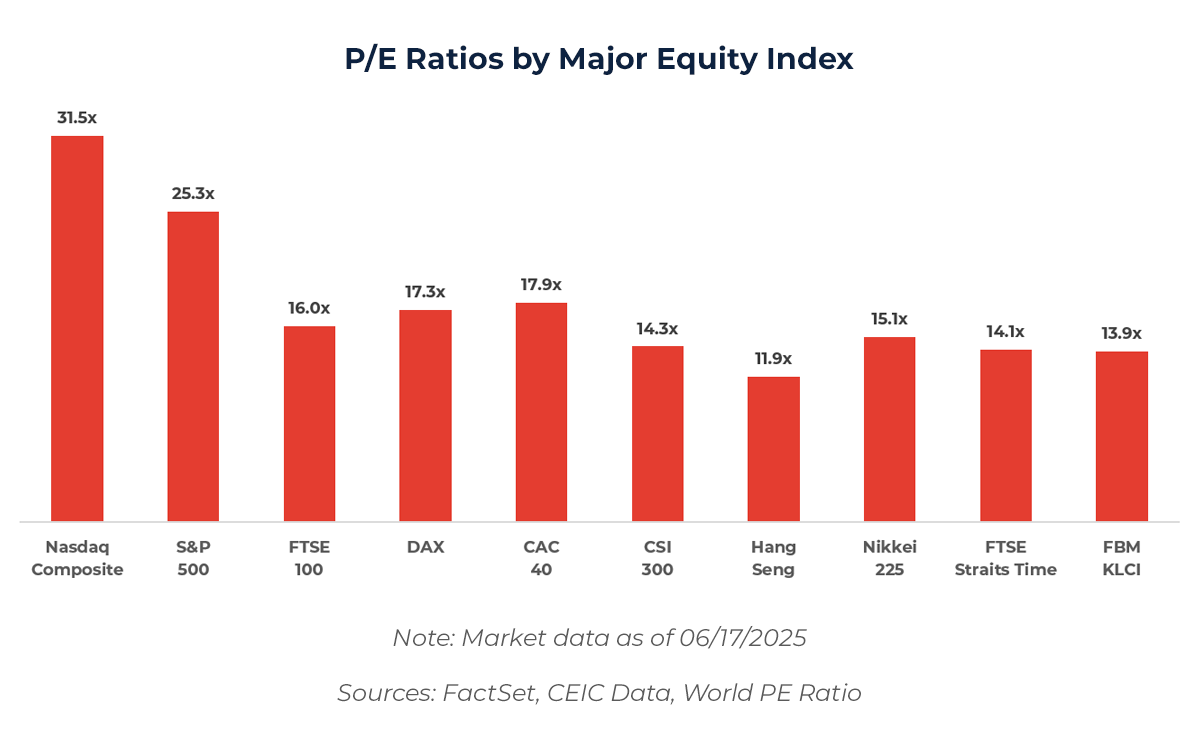

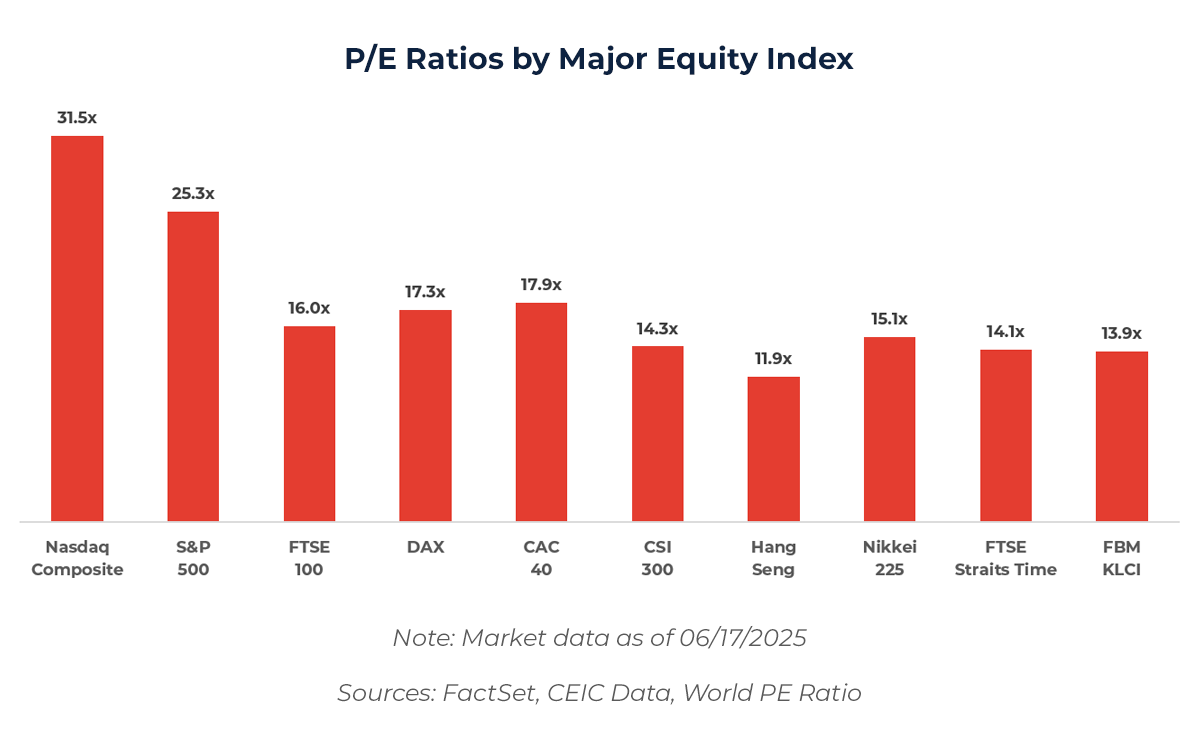

Premium Valuation Multiples

The chart above reflects the latest P/E ratios for major equity indices, providing clear evidence of the valuation premium offered to U.S. listed companies. The Nasdaq Composite (31.5x) and S&P 500 (25.3x) trade at significantly higher P/E ratios compared to major indices in Europe and Asia, making it the clear choice for growth-oriented issuers.

Enhanced Research Coverage and Investor Access

Listing on a major U.S. exchange connects a company with the world’s most influential network of sell-side analysts and institutional investors. Extensive research coverage improves price discovery, narrows information asymmetries, and attracts a broader institutional shareholder base, which in turn supports increased trading liquidity and higher valuation multiples. This dynamic is especially beneficial for small- and mid-cap issuers from emerging markets that may receive limited domestic analyst attention.

Additionally, U.S.-listed companies are able to gain access and visibility to the world’s deepest and most diversified pool of capital. U.S. institutions, such as pension funds, mutual funds, and ETFs, collectively represent the largest long-term capital base globally. These investors typically allocate a significant portion of their capital to U.S.-listed companies, attracted by the superior liquidity, transparency, and governance standards these exchanges offer. As a result, companies that list on U.S. exchanges gain direct access to institutional demand, benefiting from steady buying activity that broadens the shareholder base and reinforces trading liquidity.

Accessible U.S. Listing Standards

Listing on a U.S. exchange is relatively straightforward, supported by a clear regulatory framework and a well-established process for foreign issuers. Both Nasdaq and NYSE apply entry thresholds, such as minimum equity capital and public float, but these requirements are generally less stringent than those of comparable senior markets in Europe and Asia. This enables issuers to access the public markets at an earlier stage of their growth cycle, often prior to achieving profitability, providing these companies with access to necessary growth capital on a larger and faster scale than private markets. With early involvement of experienced advisors, U.S. legal counsel, and PCAOB-registered auditors, foreign issuers of all sizes can achieve a smooth and timely listing on a U.S. exchange.

Conclusion

For issuers with strong growth ambitions, U.S. capital markets continue to offer unmatched advantages. Recent transactions demonstrate that issuers across various sectors and geographies continue to rely on U.S. exchanges to raise strategic capital and provide a strong liquidity and investor base. Superior valuation multiples, extensive research coverage, and direct exposure to the world’s largest pool of institutional capital are among the key reasons many companies favor a U.S. listing over their domestic market. For any company aiming to efficiently secure capital, boost market confidence, and reach a broad investor base, a U.S. listing remains the proven and practical choice.

References:

[1] EY (2025): EY Global IPO Trends report Q1 2025

[2] Reuters (2025): US IPO market revival takes root as Chime soars in debut | Reuters

[3] NYSE (2025): International Listings | NYSE

[4] Reuters (2025): Israel’s eToro valued at $5.6 billion in bumper Nasdaq debut after tariff-driven delays | Reuters

[5] Reuters (2025): Chinese tea chain Chagee valued at $6.2 billion as shares pop in Nasdaq debut | Reuters

[6] AInvest (2025): Fast Track Group’s IPO: A Bold Play in Asia-Pacific’s Booming Entertainment Scene

[7] Investing (2025): Phoenix Asia starts trading at $7, IPO priced at $4 By Investing.com

[8] Reuters (2025): Klarna IPO filing spurs hope of British fintech listings | Reuters

[9] SIFMA (2025): SIFMA Research Quarterly – Equities 1Q25

[10] CBOE (2025): North American Equities Year in Review