In today’s China, logistics is no longer just a support function. For consumer brands navigating a landscape of high-growth demand, digital-first retail, and cross-border complexity, logistics is central to strategy.

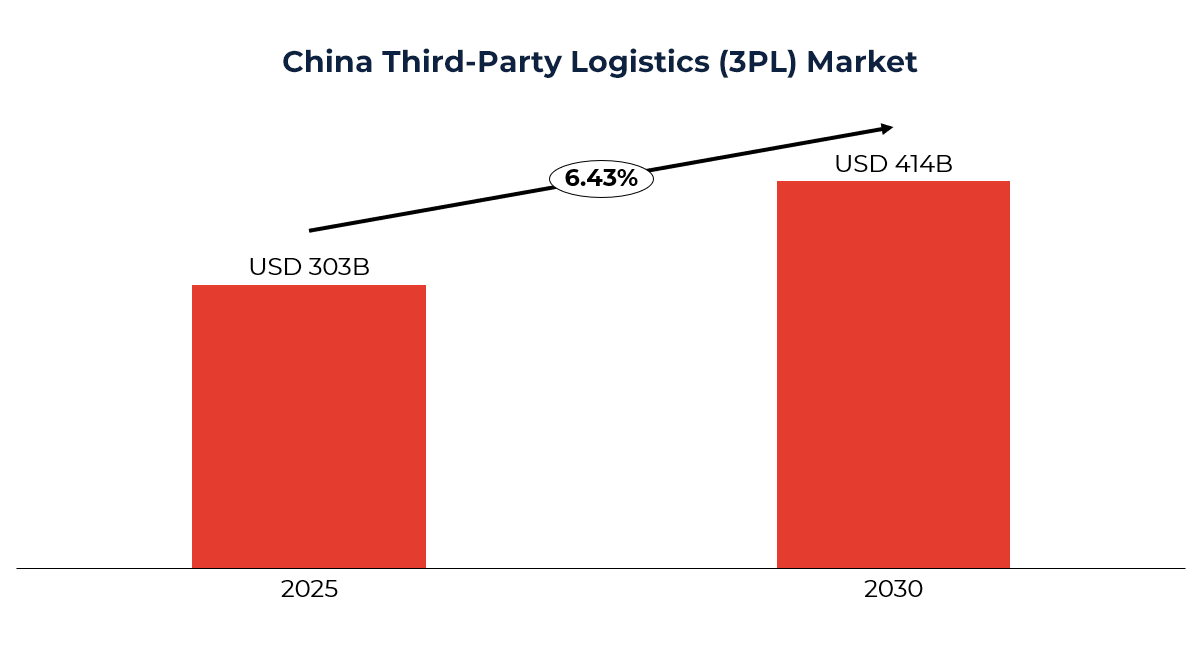

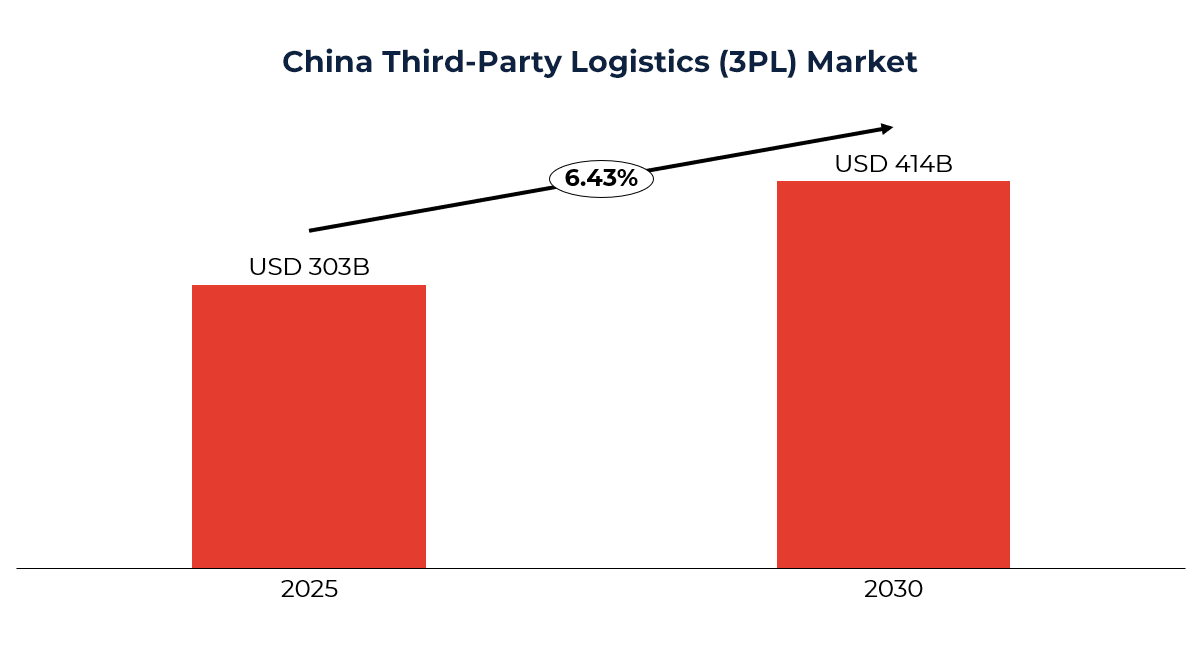

China’s third-party logistics (3PL) market is projected to reach over 414 billion (USD) by 2030, driven by the rise of e-commerce, supply chain diversification, and ongoing infrastructure modernization. But behind the impressive scale lies a growing tension: many existing 3PL setups are struggling to meet the pace, flexibility, and integration demands of modern consumer business models.

From beauty and wellness to apparel and home goods, brands are being asked to do more with less time, less room for error, and often, with logistics systems built for a different era.

1. One Inventory, All Channels: The Case for Unified Fulfillment

China’s consumer landscape is distinctly omnichannel. Customers move fluidly between e-commerce platforms, social commerce, and offline retail stores. Yet many supply chains still operate with channel-specific logistics: one setup for wholesale orders, another for online fulfillment.

This siloed approach leads to inefficiencies-duplicated inventory, inconsistent customer experiences, and missed opportunities during surges in demand.

A unified fulfillment structure, where one inventory pool supports all sales channels, allows for better resource allocation, greater speed, and tighter inventory control. It also enables brands to respond more effectively to promotional spikes or geographic shifts in demand-something that’s become increasingly critical in recent years.

2. Scalability Is Becoming Non-Negotiable

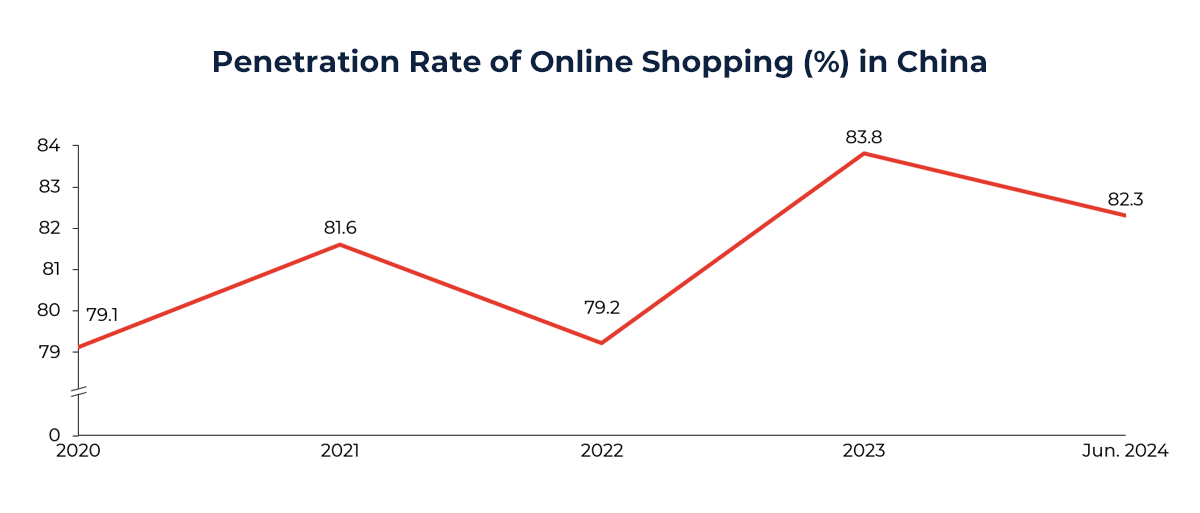

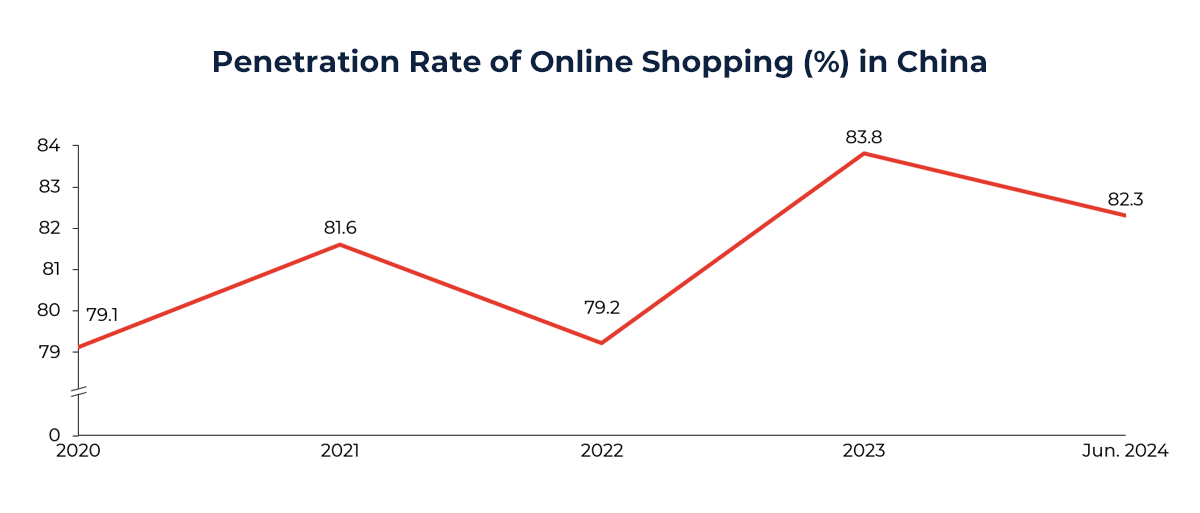

China’s online shopping penetration remains consistently high, peaking at 83.8% in 2023 and holding strong at 82.3% as of mid-2024. This sustained digital adoption underscores the importance of logistics models that can serve e-commerce demand seamlessly-alongside B2B and offline retail channels.

Whether it’s Singles’ Day, 618, or a viral campaign launched by a key opinion leader, consumer demand in China is anything but predictable. Logistics networks must be able to flex in response, not just by adding trucks or labor, but through modular capacity, pre-positioned inventory, and dynamic planning.

More brands are now planning fulfillment like they plan campaigns: in cycles, with volume forecasts, time-bound SLAs, and backup infrastructure. Warehousing and labor models that are rigid or purely reactive often result in bottlenecks, slower fulfillment, or stockouts at the worst possible moment.

The ability to scale up—or down—at the right time is quietly becoming one of the most important operational levers for performance in this market.

3. Cross-Border Efficiency Through Bonded and Regional Logistics

China’s Free Trade Zones and bonded warehouses offer powerful benefits, especially for companies managing cross-border shipments or APAC-wide distribution. By deferring import taxes, improving customs flexibility, and enabling faster re-export to surrounding countries, bonded setups have become a go-to solution for inventory staging and multi-market servicing.

This model offers brands the chance to:

- Position inventory closer to final demand

- Shorten fulfillment lead times to end customers

- Reduce total landed costs and avoid “U-turn” shipping loops

- Navigate policy or regulatory changes with greater flexibility

In a region where speed, compliance, and cost all matter, regionalized fulfillment and bonded strategies are increasingly seen not just as logistics tactics—but as business enablers.

4. Making Systems Talk: The Importance of Integration

China’s consumer logistics is fast, data-rich, and unforgiving to delays. Yet system fragmentation remains common. Brands rely on manual updates, disconnected OMS and WMS platforms, or receive delayed fulfillment data that hinders planning and communication with customers.

Visibility gaps aren’t just operational issues-they’re commercial risks. Without real-time integration between logistics partners and internal systems, it becomes difficult to ensure stock accuracy, track returns, or identify performance bottlenecks early.

Integrated systems create more efficiency. They create resilience and responsiveness—qualities increasingly necessary in a market that rewards speed and precision.

A Shift in Perspective

The conversation around logistics is evolving. It’s no longer just about warehouses and delivery fleets—it’s about building fulfillment ecosystems that support brand growth, adapt to customer behavior, and align with broader strategic goals.

For consumer brands operating in or entering China, now is the time to ask:

- Are our logistics designed to support both scale and flexibility?

- Do we have visibility and control across every channel we serve?

- Are our current 3PL arrangements keeping pace with how we sell and grow?

As expectations rise and market complexity deepens, the companies best positioned for success will be those who treat logistics not as a constraint—but as a capability.

Where Alarar Capital Group Can Support

Alarar Capital Group helps consumer brands develop modern logistics ecosystems that match the scale, speed, and channel complexity of China’s market. Our experience spans strategic design, hands-on implementation, and regional optimization across the following areas:

- Inventory Unification: Assessing current fragmentation and designing shared inventory systems to streamline fulfillment across B2B and B2C channels.

- Scalable Warehouse Strategy: Evaluating peak demand exposure and advising on modular, campaign-ready warehousing infrastructure.

- System Integration: Ensuring end-to-end digital alignment between your OMS, ERP, WMS, and e-commerce platforms for real-time visibility and control.

- Cross-Border Setup: Supporting bonded warehouse selection, customs optimization, and hub design for multi-market distribution across Asia.

For brands looking to modernize their logistics architecture in China—not just to fix today’s gaps, but to enable tomorrow’s growth—we offer the expertise and execution to make it happen.

Author:

Chulisa Nguyen

Associate