Executive Summary

As global corporations accelerate efforts to reduce their dependency on China amid geopolitical tensions, rising costs, and ongoing supply chain disruptions, India and Vietnam have emerged as the primary beneficiaries of this strategic pivot in Asia. Positioned as viable alternatives, both countries have seen a surge in investment and manufacturing activity as part of broader China risk-reduction strategies.

However, this rapid rise has pushed their industrial ecosystems closer to operational saturation. Despite their growing capabilities, India and Vietnam are now running at or near full capacity, creating significant barriers for companies that delay engagement. High occupancy rates in industrial parks, tight labor markets, and limited availability of certified suppliers are converging into a critical capacity crunch.

The window for securing high-quality, reliable suppliers in these markets is rapidly closing. Acting decisively—through early supplier partnerships, capacity lock-ins, and co-investment—is no longer a competitive advantage; it is a strategic necessity to ensure resilience and continuity in global supply chains.

Vietnam and India: Growth Outpacing Capacity

India: Expanding rapidly, but hitting operational ceilings

India has made remarkable progress in building a manufacturing ecosystem, supported by initiatives like “Make in India” and PLI (Production-Linked Incentives). With over 64,800 certified facilities (ISO 9001 and IATF 16949), India is second only to China in terms of supplier certification levels. Companies such as Apple, Foxconn, and Tata Electronics are expanding operations, aiming to shift significant production volumes into India.

However, this surge in demand is rapidly straining India’s manufacturing infrastructure:

- Foxconn is investing $1.5 billion in a new iPhone assembly facility near Chennai, India, underscoring Apple’s ambition to shift a major portion of its global production out of China. This rapid scale-up places significant pressure on the local supplier ecosystem to meet aggressive timelines and global quality standards.

- Regulatory red tape and infrastructure bottlenecks—including unreliable logistics and inconsistent energy supply—hinder quick scaling.

- A shortage of skilled labor in advanced manufacturing areas is emerging as a key obstacle, requiring long-term talent development investments.

Vietnam: Attractive, but tightly constrained

Vietnam’s strategic proximity to China, trade agreements like the CPTPP and EVFTA, and competitive labor costs have driven strong FDI growth. In the first two months of 2024, FDI surged 38.6% YoY, totaling over $4.29 billion—much of it directed toward electronics, textiles, and light industrials.

But this success has come with consequences:

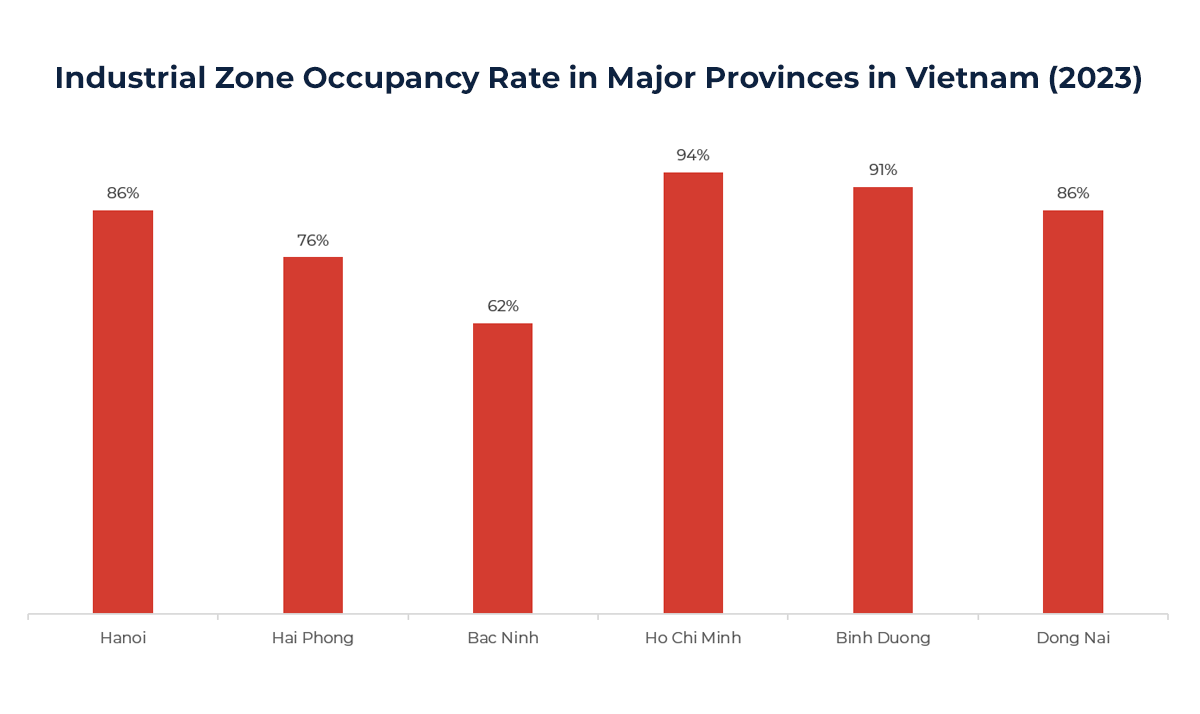

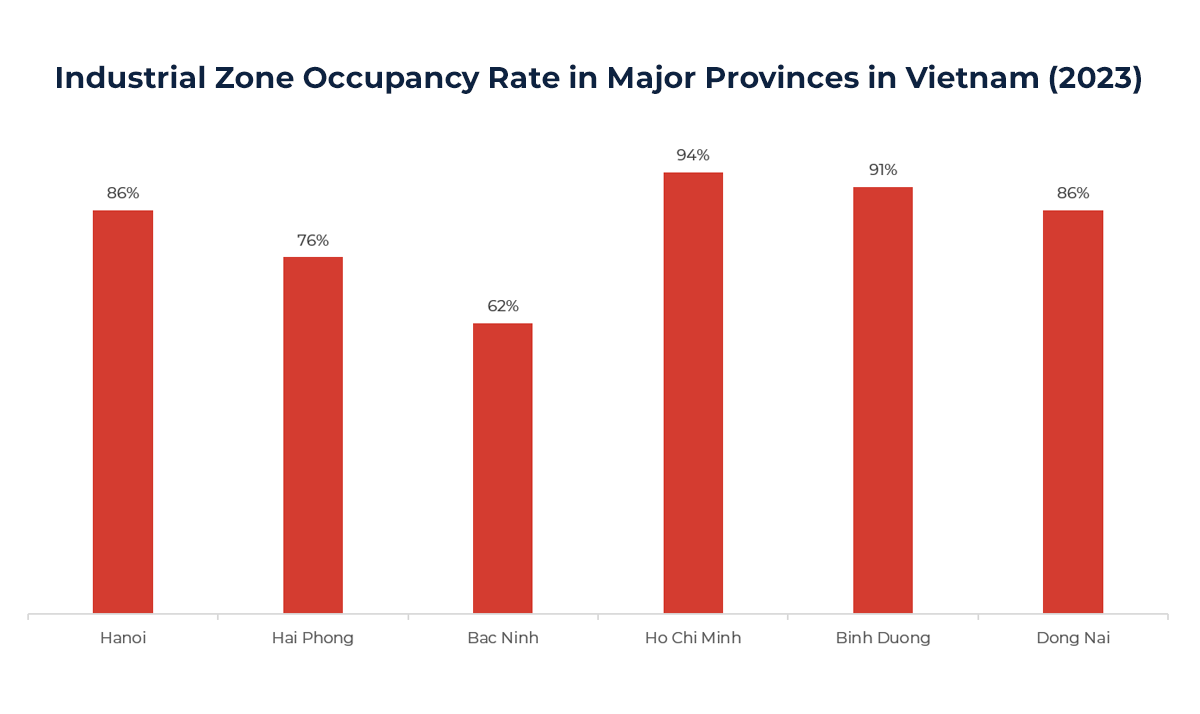

- Industrial parks and logistics hubs are at full capacity, with high occupancy rates making it harder for new entrants to find space. As of early 2025, occupancy rates in key northern industrial zones exceed 83%, while the southern region records an even higher rate of nearly 90%.

- Labor turnover and skills mismatch in high-tech sectors are undermining productivity.

- Vietnam is still highly dependent on imported raw materials, particularly from China, making its manufacturing vulnerable to upstream disruptions.

- The country’s certified supply base remains limited, further challenging companies with strict quality compliance needs.

The Result: A Hyper-Competitive Supplier Market

The sudden influx of investment and sourcing volume is turning top-tier suppliers in these regions into scarce commodities. Rather than merely searching for suppliers, companies are now competing for access:

- Supplier onboarding queues are lengthening, not because of lack of interest, but because qualified vendors are operating at full stretch and prioritizing existing clients.

- Cost inflation is rising, not from raw material volatility, but due to capacity premiums—the higher prices charged by suppliers who know they’re in high demand.

- Supplier relationships are becoming strategic assets. Those without early engagement or long-term agreements find themselves relegated to second-tier or underprepared vendors.

- Production ramp-up delays are increasingly common, with tooling, compliance audits, and trial runs bottlenecked by overbooked engineering and QA teams.

Strategic Recommendations

To avoid being caught in the capacity crunch, companies must act decisively:

- Move early and secure capacity: Identify and lock in partnerships with key suppliers now—before saturation becomes critical.

- Co-Invest in supplier development: Provide technical, compliance, and infrastructure support to elevate suppliers and ensure they can meet global standards.

- Use digital supply chain tools: Employ advanced analytics and monitoring platforms to track supplier performance and flag bottlenecks early.

Conclusion: Act Now or Be Left Behind

India and Vietnam offer real opportunities for supply chain diversification—but their capacity is not limitless. The window to secure capable suppliers in these markets is narrowing fast. As the demand curve rises sharply and infrastructure struggles to keep pace, companies that hesitate risk being squeezed out or forced into suboptimal sourcing relationships.

Diversification must be a strategic priority today—not a reaction tomorrow. The companies that invest now in partnerships, capacity, and ecosystem development will be the ones best positioned to lead in a multipolar manufacturing world.

Author:

Chulisa Nguyen

Associate