To capture how supply-chain leaders are navigating today’s unpredictable trade and geopolitical climate, Alarar Capital Group launched the weekly Flash Survey in 2025. This initiative delivers real-time, practitioner-level insights into how companies are responding to tariff volatility, shifting trade blocs, shippinglane disruptions, and tightening sanctions. Each short pulse engages a focused group of supplychain decisionmakers—directors, managers, and senior executives steering procurement, logistics, and operations for European SMEs—and includes seasoned consultants whose project portfolios span multinationals.

Findings from these weekly polls not only reflect emerging sentiment but also reveal the concrete actions businesses are taking—rerouting production, diversifying supplier bases, reshoring critical inputs. These results directly feed into the Alarar Capital Group’s Annual Sourcing Survey, our annual study tracking sourcing dynamics since 2013. The upcoming 2025 edition, to be released in June, will map how firms are responding to mounting supply-chain shocks, digitalization, and global uncertainty.

As part of this ongoing effort, we conducted a LinkedIn poll in April 2025 to better understand how businesses are currently adapting their sourcing strategies. Below, we summarize the key takeaways from the latest Flash Survey.

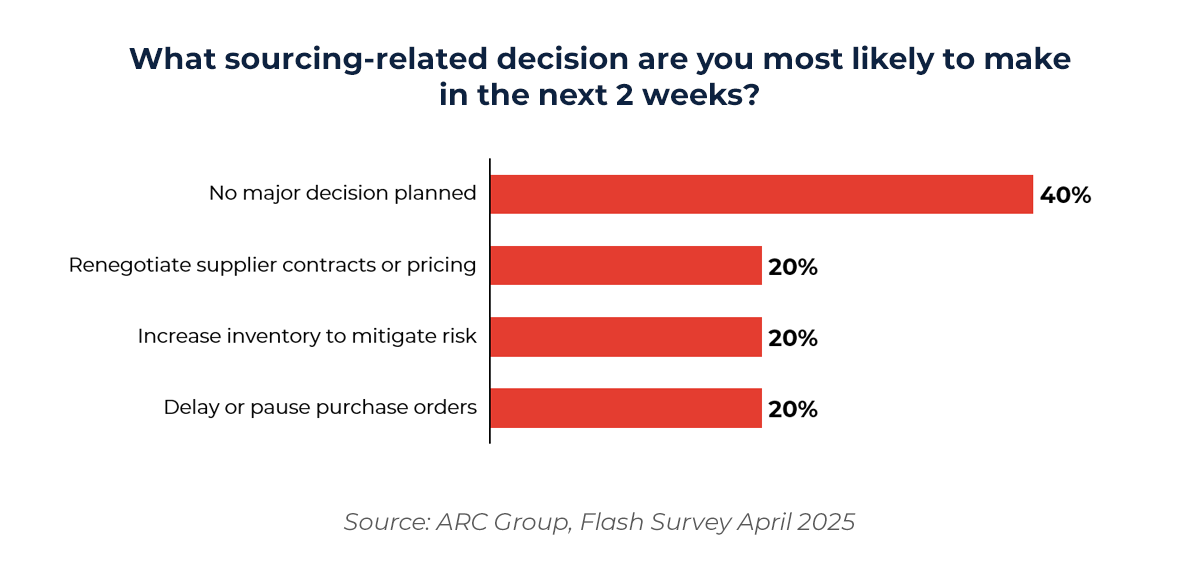

Cautious Optimism: A plurality (40%) of respondents do not foresee any major sourcing decision, signaling temporary stability or a wait-and-see approach amid uncertainties.

Risk Response Mode: 60% are considering or actively planning sourcing changes — including price renegotiation, inventory buildup, or pausing orders — reflecting reactive strategies to ongoing trade and geopolitical challenges.

Diverse Reactions: The equal split among the three action-oriented choices points to a fragmented market sentiment, where companies are reacting differently depending on their exposure, sector, or supplier risk.

40 % have no major decision planned

- The largest share is opting for the status quo, signalling either limited tariff exposure or decision paralysis in the face of uncertainty.

- Inaction risks missed savings and leaves companies vulnerable if conditions worsen.

20 % will renegotiate contracts/pricing

- A fast, low-cost lever to pass through duties or secure offsets (rebates, longer terms).

- Suggests solid supplier relationships and confidence in bargaining power.

20 % intend to increase inventory

- A classic buffer against supply shocks; ties up working capital but buys continuity if lead-times stretch.

- Works best alongside demand-planning upgrades to avoid over-stock.

20 % plan to delay or pause purchase orders

- A liquidity-preservation move that reduces exposure to suddenly overpriced inputs.

- Heightens risk of stock-outs and strained supplier goodwill if carried too long.

Strategic takeaway

- The split shows two camps: proactive risk-managers (renegotiate/inventory build) vs. defensive postponers (delay/no change).

- Firms that combine contract resets with selective buffering will be better positioned than those waiting for clarity that may never come.

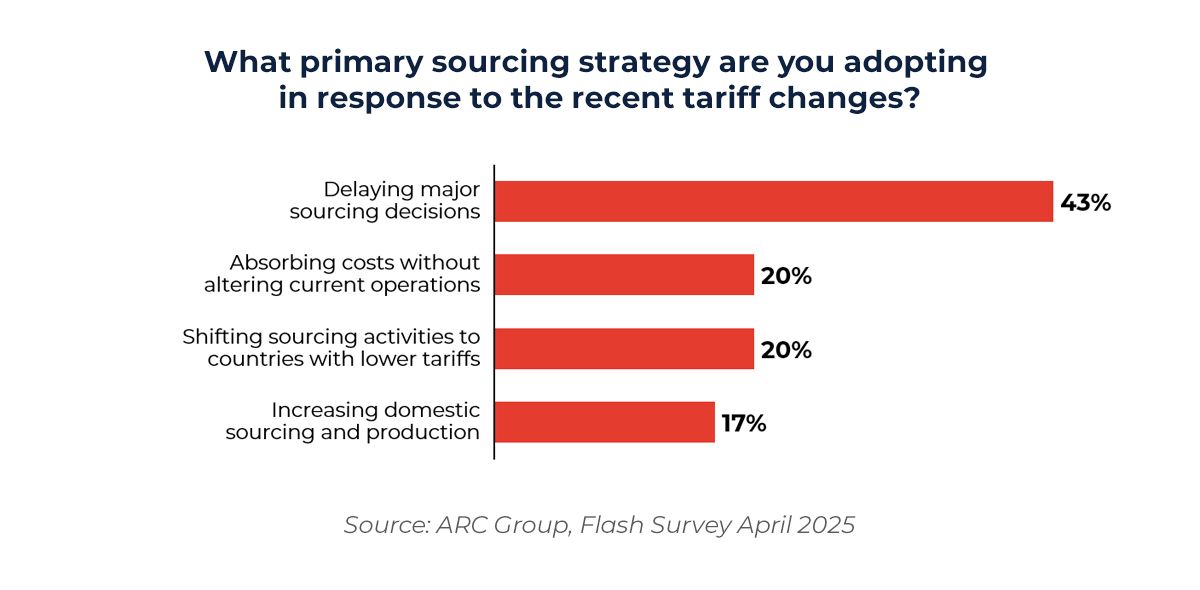

43% of respondents are choosing to delay major sourcing decisions, likely due to high uncertainty and the need for better visibility into future trade developments. Nearly half of the respondents are in “wait‑and‑see” mode, underscoring how tariff volatility is freezing investment decisions. This is consistent with cautious behavior seen in past trade disruptions, where companies prefer to wait for regulatory clarity before committing to structural changes, amid Trump’s uncertainty and potential retaliation from other countries.

Shifting sourcing to low-tariff countries or absorbing costs are both chosen by 20% of respondents. While shifting sourcing activities is the strategy with a bit more long-term and need resources and time to achieve, absorbing cost in short-term without any big changes in operations is the option with more possibility and align with “Delaying major decisions” amid recent uncertainties

Some businesses are adopting either reactive or resilient stances depending on their risk tolerance and operational flexibility. Meanwhile, domestic sourcing (17%) remains a niche solution, possibly constrained by cost or supply availability.

43 % are deferring major sourcing moves

- Reflects a classic “wait-and-see” posture when trade rules are in flux.

- Mirrors the caution shown during the 2018-19 U.S.–China tariff cycle: firms hold capex until regulatory fog clears.

20 % plan to shift sourcing to lower-tariff locations

- A proactive hedge that can deliver structural savings, but demands time, capital, and relationship re-building.

- Signals higher risk tolerance and longer planning horizons.

20 % will absorb the duties for now

- A short-term, least-disruptive tactic that preserves current operations but compresses margins.

- Philosophically aligned with the delay cohort—buying time while monitoring policy signals.

17 % favor expanded domestic sourcing

- Remains niche, likely constrained by local capacity gaps or higher unit costs.

- Attractive where government incentives or critical-supply mandates offset cost headwinds.

Strategic split emerging

- Companies are sorting into reactive cost-containment (delay/absorb) versus resilient diversification (shift/reshore).

- The speed of movement off the sidelines will shape competitive advantage as tariff volatility persists.

Stay tuned for our upcoming 2025 sourcing survey, where we will continue to track developments in sourcing strategies across global markets.