In April 2025, the U.S. administration announced tariffs on all imported goods, including semiconductor chips, sending ripples through the global technology industry. These trade measures, aimed at bolstering domestic manufacturing, have reshaped the global semiconductor landscape, prompting companies to seek stable and cost-effective manufacturing hubs. At the heart of this process lies the Outsourced Semiconductor Assembly and Test (OSAT) industry, and right now, Southeast Asia (SEA) is emerging as its new frontier. With its strategic location, competitive labor costs, and robust government support, SEA is becoming a cornerstone of the semiconductor supply chain, offering resilience amid global trade uncertainties.

The global OSAT market is projected to grow from USD 47.1 billion in 2025 to USD 71.21 billion by 2030, with a CAGR of 8.62%. This growth is driven by demand for advanced packaging and testing services, fueled by innovations in artificial intelligence, 5G technology, and the Internet of Things. As geopolitical tensions reshape supply chains, SEA offers a compelling combination of advantages that make it a focal point for OSAT operations.

The Chip’s Journey: From Design to Device

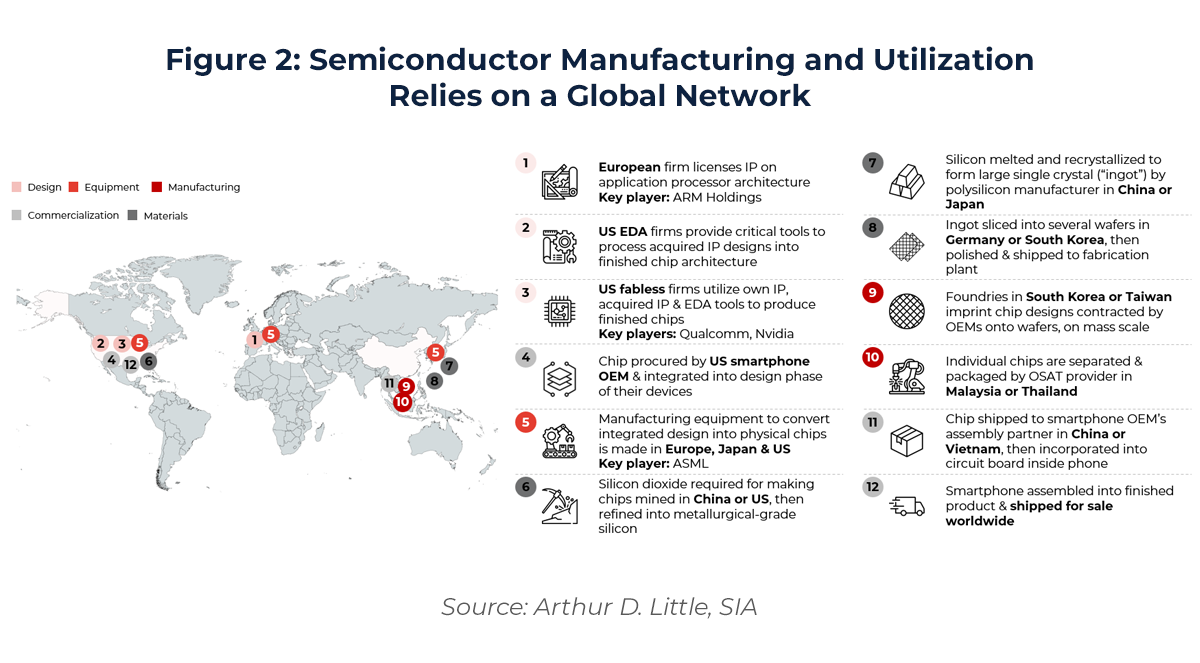

Imagine a single semiconductor chip, destined to power a smartphone or an electric vehicle. Its journey begins in the design labs of Silicon Valley or Cambridge, where companies like Qualcomm or ARM craft intricate blueprints for its functionality. These designs are then sent to foundries in Taiwan or South Korea, such as TSMC or Samsung, where silicon wafers are transformed into functional chips through cutting-edge fabrication techniques.

But the chip’s journey doesn’t end there. To become a reliable component, it must be packaged and rigorously tested—a process known as Assembly, Testing, and Packaging (ATP), or OSAT. This final stage ensures the chip is protected and performs flawlessly in devices ranging from laptops to medical equipment.

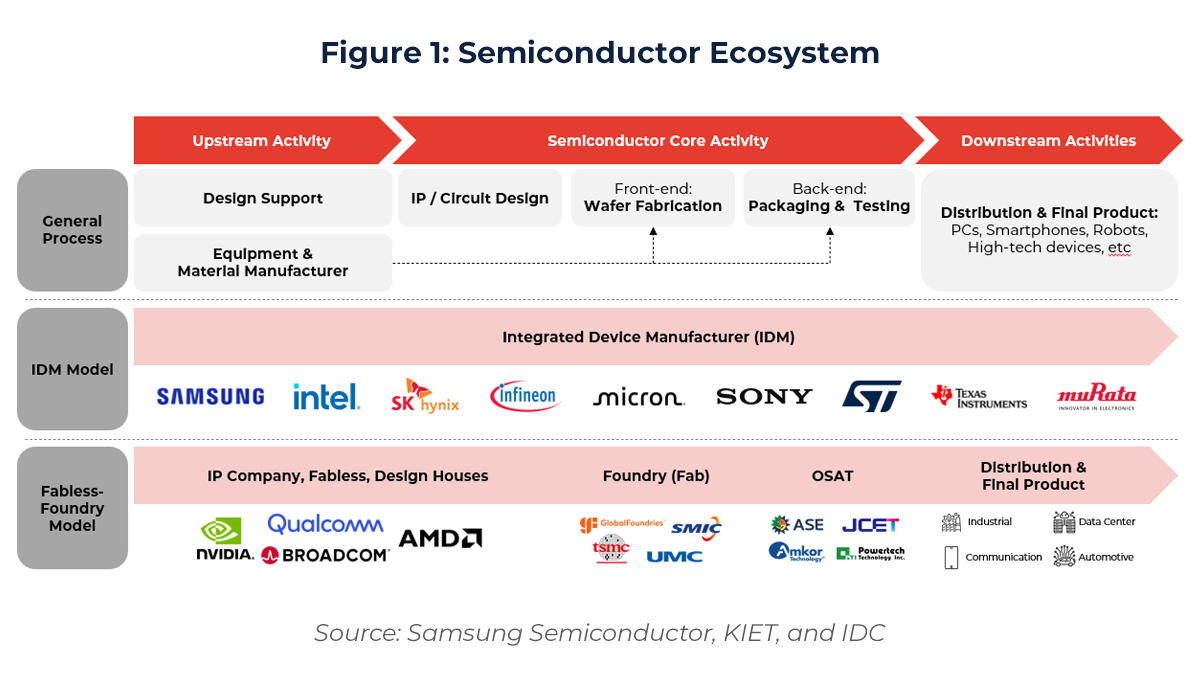

As depicted in Figure 1, the semiconductor ecosystem is segmented into three primary areas:

- Upstream Process:

This segment includes firms that provide design support (e.g., ARM) along with the materials and equipment essential for chip production.

- Core Processes:

- IP and Circuit Design: Involves developing chip functionality and layout.

- Front-End Wafer Fabrication: Transforms silicon wafers into preliminary chips through advanced manufacturing techniques.

- Back-End Packaging and Testing: Encapsulates chips into protective packages and rigorously tests them to ensure quality and performance.

- Downstream Process:

Chips manufactured in the earlier stages are integrated into a variety of products—such as PCs, smartphones, and industrial devices—that serve sectors including automotive, communications, and consumer electronics.

The semiconductor industry operates through a complex value chain involving design, fabrication, assembly, testing, and distribution. Key players include:

- Integrated Device Manufacturers (IDMs):

Companies like Samsung, Intel, and Micron manage the entire semiconductor lifecycle—from design to manufacturing and packaging—having full operational control.

- Fabless and Foundry Model:

- Fabless Companies: Such as NVIDIA and Qualcomm, focus on the design aspect and outsource manufacturing.

- Foundries: Companies like TSMC and GlobalFoundries specialize in chip fabrication.

- OSAT (Outsourced Semiconductor Assembly and Test): Firms like Amkor and JCET perform the critical packaging and testing stages after fabrication, readying chips for integration into finished products.

SEA plays a significant role in the backend OSAT processes, complementing design hubs in the U.S. and Europe and fabrication centers in East Asia.

The Rise of OSAT: Why Outsourcing Makes Sense

OSAT providers, such as Amkor and ASE, specialize in the backend stages of semiconductor production. After foundries produce raw chips, OSAT companies cut wafers into individual chips, encase them in protective packages, and test them to ensure quality and performance. This process, often called ATP, is critical to delivering reliable components for consumer electronics, automotive systems, and industrial applications.

Why outsource something as critical as assembly and testing? The answer lies in efficiency and specialization. OSAT allows semiconductor companies to focus on their core strengths—design and fabrication—while leaving the complex, capital-intensive backend processes to experts. This model offers several advantages:

- Cost Efficiency: Building and maintaining in-house assembly and testing facilities is expensive. Outsourcing can significantly reduce costs.

- Scalability: OSAT providers can quickly adjust capacity based on demand, offering flexibility that in-house operations often lack.

- Specialization: These providers are at the cutting edge of packaging and testing technologies, ensuring chips meet the latest standards.

- Risk Mitigation: By diversifying their supply chains, companies can better navigate geopolitical uncertainties or natural disasters.

Figure 2 illustrates globalization of the smartphone processor supply chain. The journey involves multiple countries across different continents, each specializing in a specific stage of the process. For example:

- Design and IP licensing happen in Europe and the US.

- Manufacturing equipment is made in Europe, Japan, and the US.

- Materials like silicon are sourced and processed in China, the US, Japan, and Germany.

- Chip fabrication and assembly are concentrated in Asia, particularly South Korea, Taiwan, Malaysia, and China.

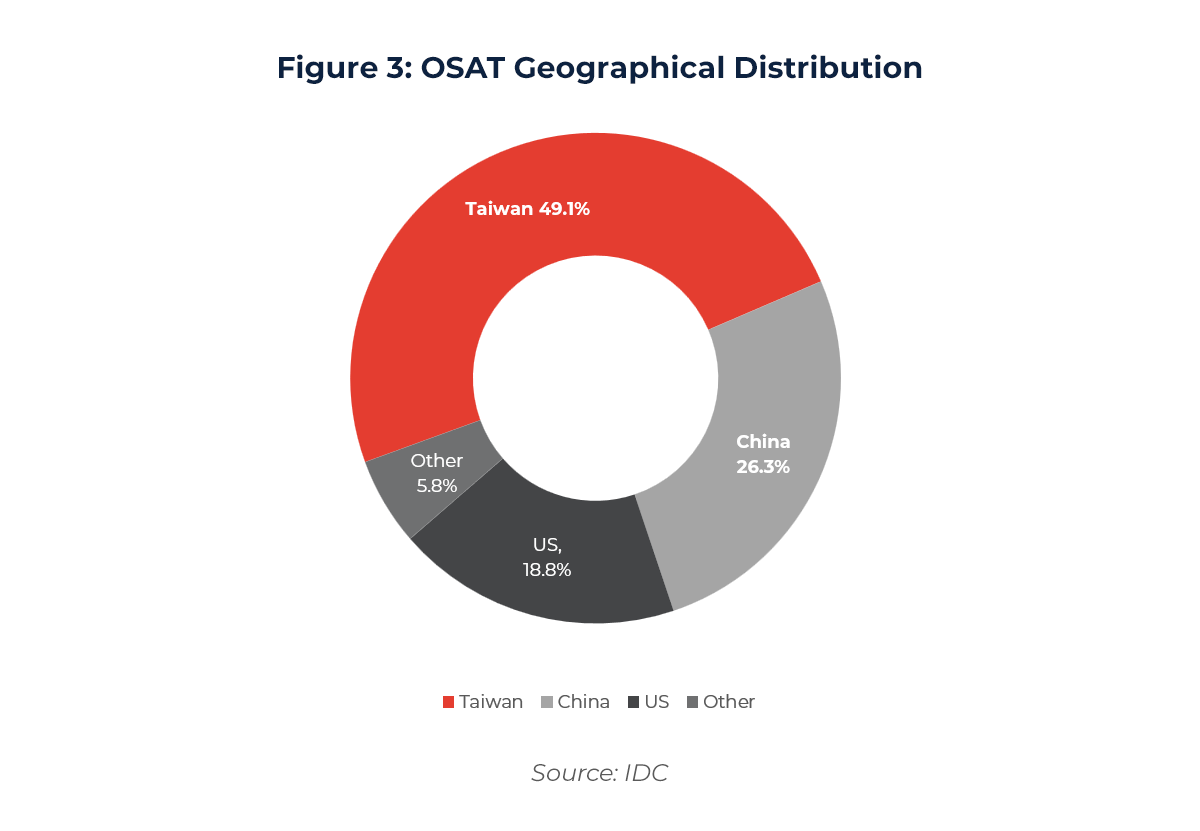

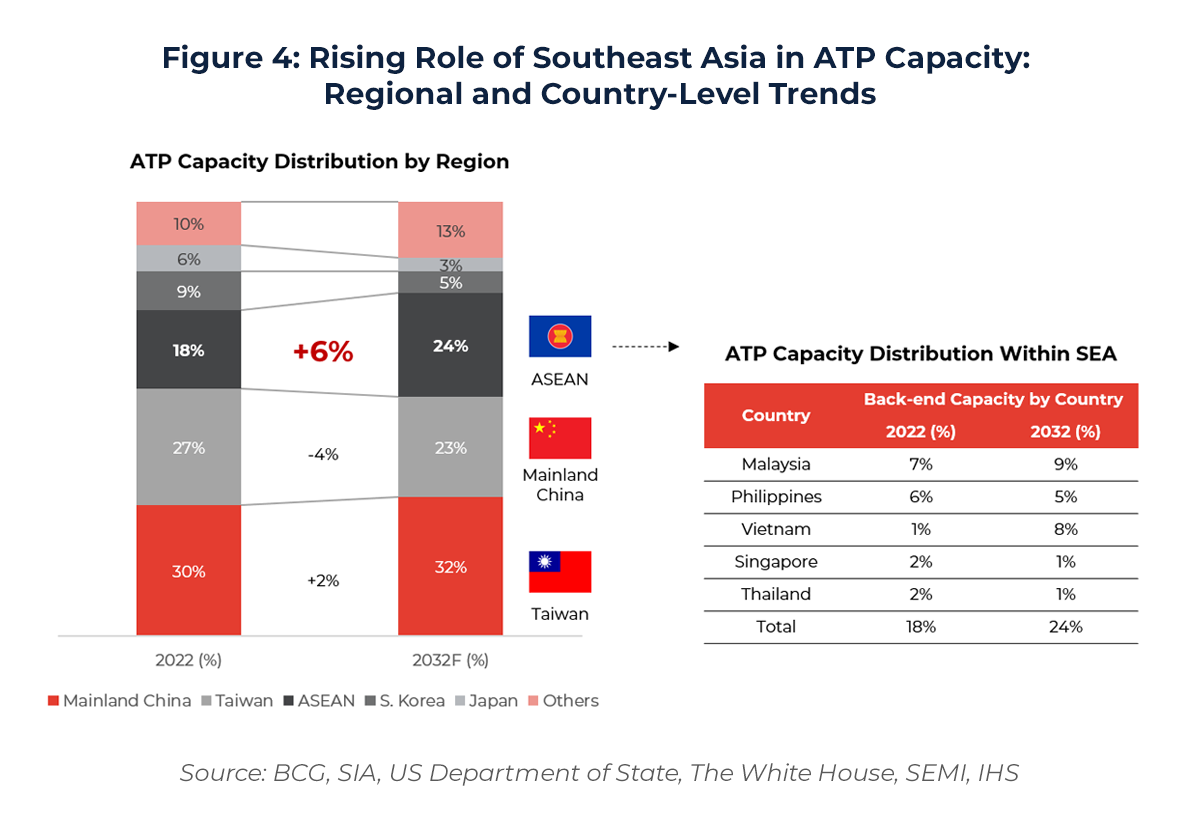

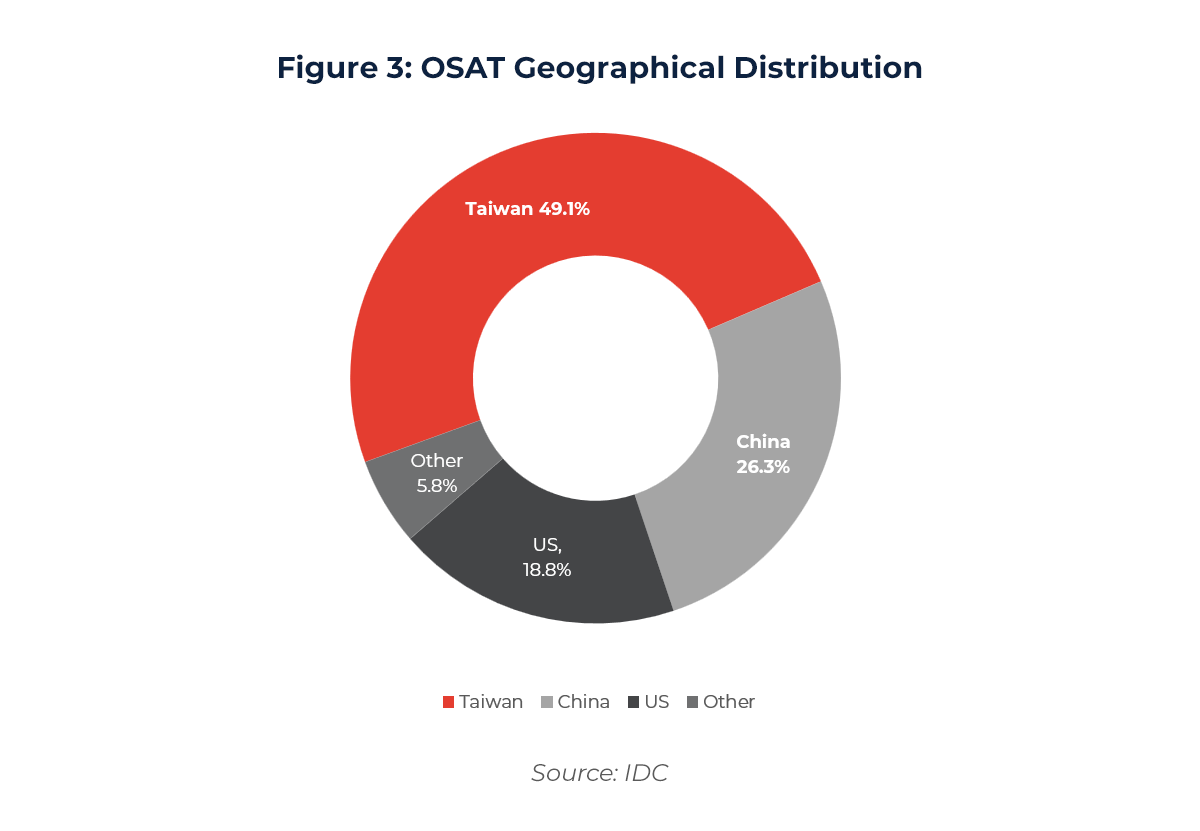

In 2023, Greater China (China and Taiwan) accounted for 75.4% of global OSAT operations, underscoring its dominance (IDC). However, SEA is rapidly gaining ground, driven by global trade shifts and regional advantages.

As the semiconductor industry evolves, so does the importance of OSAT. Advanced packaging technologies—like 3D stacking and chiplets—are pushing the boundaries of what’s possible, enabling smaller, faster, and more efficient devices. OSAT providers are the unsung heroes behind these innovations, turning raw chips into the building blocks of tomorrow’s technology.

With the benefits of outsourcing clear, the question becomes: where should these critical operations be located? Enter Southeast Asia, a region that’s rapidly positioning itself as the new hub for OSAT.

Southeast Asia: The New OSAT Hub

Southeast Asia’s rise in the OSAT industry isn’t just a coincidence; it’s the result of a perfect storm of factors that make it an ideal location for backend semiconductor manufacturing.

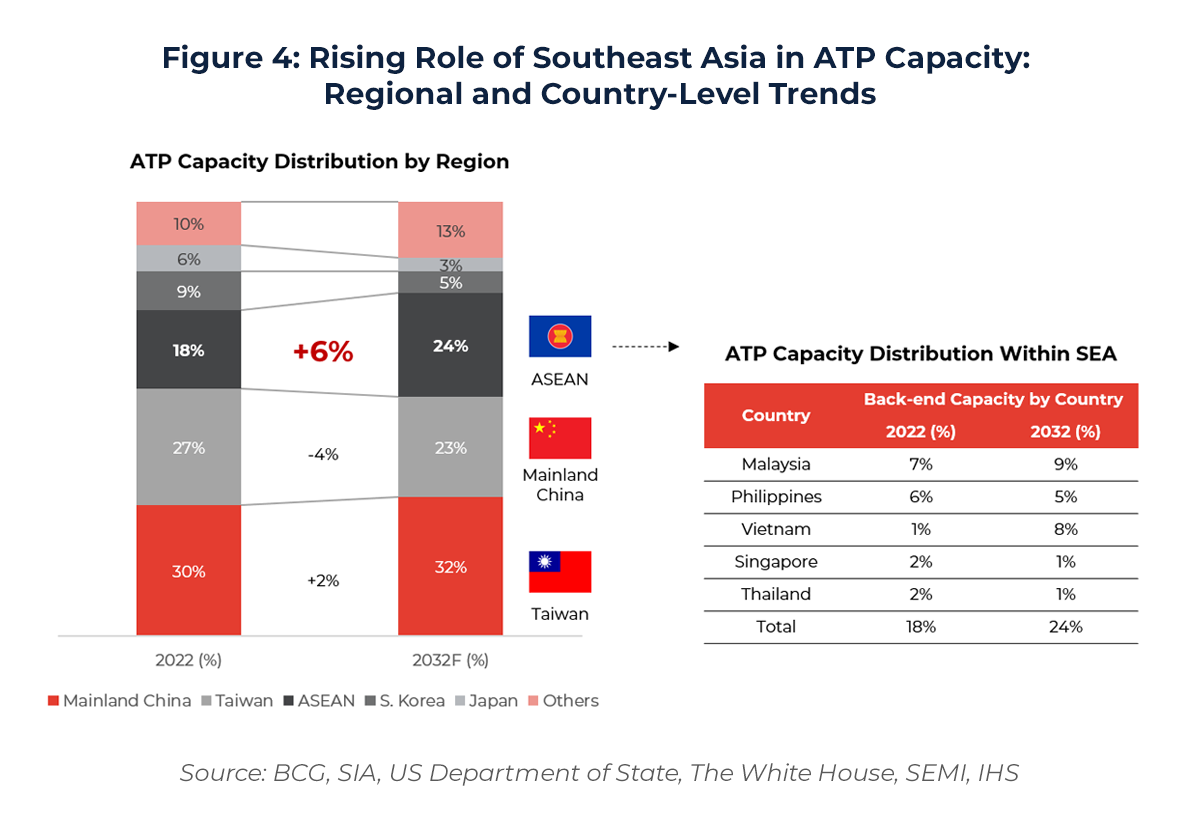

As U.S.-China trade tensions and new tariffs disrupt traditional supply chains, SEA has emerged as a beacon of stability and opportunity. The region’s “China + 1” strategy—diversifying manufacturing away from China—has attracted semiconductor giants seeking resilient operations. SEA’s neutral geopolitical stance, proximity to Asia-Pacific markets, and robust infrastructure make it an ideal hub for OSAT.

Why SEA Stands Out

Strategic Location: SEA’s central position enables seamless access to major manufacturing and consumer markets. Its proximity to China, Japan, and India enhances logistical efficiency, making it a prime location for semiconductor operations.

Cost Advantages: The region offers some of the most competitive labor costs globally. Countries such as Vietnam, Indonesia, and the Philippines allow multinational corporations to establish ATP (Assembly, Testing, Packaging) facilities that combine cost advantages with high quality. Moreover, SEA’s closeness to leading East Asian chip design hubs—China, Taiwan, South Korea, and Japan—as well as its access to global shipping routes further bolster its appeal.

Government Support: Countries across SEA are rolling out the red carpet for semiconductor investments. Vietnam offers generous tax incentives and land subsidies, while Malaysia has developed state-of-the-art industrial parks dedicated to the semiconductor industry. Singapore, meanwhile, has invested heavily in advanced manufacturing capabilities, positioning itself as a leader in next-generation packaging.

Skilled Workforce: The region is set to see a significant increase in skilled labor—from 37 million working-age individuals with postsecondary education in 2015 to a projected 65 million by 2030—positioning Southeast Asia as a prominent talent hub for both labor-intensive and technical roles in the semiconductor industry.

These advantages have transformed SEA into a magnet for OSAT investment, with Vietnam, Malaysia and Philippines at the forefront:

Vietnam: A New Semiconductor Powerhouse

- Vietnam plans to establish at least 300 design companies, three semiconductor chip manufacturing plants, and 20 packaging and testing facilities by 2050, with the goal of mastering semiconductor research and development., the country is positioning itself as a global talent hub by 2050.

- Foreign Investments Fueling Growth:

- Hana Micron (South Korea): Investing approximately $930 million until 2026 to expand packaging operations for legacy memory chips, responding to client demands for alternatives to China.

- Amkor Technology (U.S.): Constructing a $1.6 billion ATP facility in Bac Ninh, spanning 200,000 square meters, designed to be Amkor’s most advanced site for next-generation packaging

- Intel (U.S.): Operates Vietnam’s largest backend semiconductor facility, reinforcing the country’s role in its global network.

- Domestic Semiconductor Expansion:

- FPT Corporation: Developing a 1,000-square-meter semiconductor testing facility, set to begin operations in 2025 with a $30 million investment. It will start with 10 testing machines, with plans to triple capacity by 2026.

- Sovico Group: Seeking a foreign partner to co-invest in an ATP facility in Danang, reflecting growing local ambition.

- Viettel: Planning Vietnam’s first semiconductor foundry, aligning with the government’s goal of an operational fabrication plant by 2030.

Other regions including Malaysia is also leading the change.

Malaysia: Malaysia is targeting over $100 billion in semiconductor investments, with plans for Southeast Asia’s largest integrated circuit design park. Intel’s $7 billion investment in a Penang plant and ARM’s $250 million commitment for chip design underscore Malaysia’s ambitions (Reuters, ASEAN Briefing). Malaysia is also tightening regulations on chip exports due to U.S. pressure (Reuters).

Global Players Expand Through Acquisitions

Global semiconductor companies are not only investing in new facilities but also expanding their SEA presence through strategic acquisitions, capitalizing on the region’s growth potential. A notable example is ASE Technology Holding Co.’s acquisition of Infineon Technologies’ backend manufacturing facility in Cavite, Philippines, in February 2024.

- Transfer of Operations:

ASE assumed full control of the Cavite facility while retaining the existing workforce. This smooth handover ensured minimal disruption and set the stage for further facility development to address diverse customer needs.

- Long-Term Supply Agreements:

Infineon and ASE entered into multi-year agreements under which ASE will provide both established services and new product support, ensuring Infineon can meet its commitments to customers.

- Strategic Collaboration:

The partnership includes combining manufacturing volumes from Cavite, leveraging synergies to deliver high-quality services and fostering growth opportunities for both companies.

Operational Integration & Potential Benefits

ASE’s acquisition of the Cavite facility was managed with a focus on seamless operational integration. By preserving the existing workforce and infrastructure, ASE minimized transition costs and maintained operational continuity. This strategic expansion offers several key benefits:

- Enhanced Geographic Diversification and Supply Chain Resilience: With the addition of the Cavite site in the Philippines, ASE strengthened its presence in the Southeast Asia region. This expansion improves geographic diversification and bolstered its supply chain resilience. The strategic location helps mitigate risks from geopolitical tensions or natural disasters, ensuring continuity of operations and better positioning ASE to serve customers across the region.

- Expanded Capacity and Workforce: By acquiring the Cavite site, ASE gains additional production capacity to serve a growing customer base. Retaining the existing workforce ensures continuity of expertise and operations, minimizing onboarding costs and maximizing efficiency.

- Strengthened Strategic Partnerships: Long-term supply agreements with Infineon ensures a steady revenue stream for ASE while fostering collaboration on new product developments, consolidating ASE’s role as a trusted partner in the semiconductor supply chain.

- Broader Customer Base: The acquisition allows ASE to serve not only Infineon through long-term supply agreements but also other customers by leveraging the expanded infrastructure, creating opportunities for revenue growth and market diversification.

- Market Leadership and Growth Potential: The acquisition reinforces ASE’s leadership in backend semiconductor manufacturing and testing, allowing it to capture new growth opportunities in a rapidly evolving market.

This inorganic expansion reflects a broader trend of global players leveraging mergers and acquisitions to secure a foothold in SEA’s burgeoning OSAT market. By acquiring existing operations, companies like ASE gain immediate access to established infrastructure, skilled workforces, and client relationships, accelerating their ability to meet rising demand while navigating global trade complexities.

Looking Ahead: The Future of SEA OSAT

The OSAT industry in Southeast Asia is set to grow steadily, supported by ongoing tech innovation, government support and rising market demand.

Emerging technologies, such as 3D integrated circuits and System-in-Package designs, are increasing demand for sophisticated packaging. Artificial intelligence is revolutionizing the testing and packaging processes. AI-driven systems can identify defects with unprecedented precision, improving product quality and reducing costs. Advanced packaging technologies, such as 3D ICs and System-in-Package (SiP), are crucial for meeting the demands of modern electronics, which require more functionality in smaller sizes.

Yet, challenges remain. Sustainability is a pressing concern, as semiconductor manufacturing consumes significant energy and resources. Developing a skilled workforce to keep pace with technological advancements is critical, particularly as SEA scales its operations. Geopolitical complexities, including ongoing trade tensions and tariffs, require careful navigation to maintain stability.

Conclusion: A New Chapter in Semiconductor History

Southeast Asia’s rise in the OSAT industry is a story of strategic adaptation and economic opportunity. As U.S. tariffs and global trade dynamics reshape the semiconductor landscape, SEA stands as a resilient hub, offering stability, cost advantages, and innovation. For investors, companies, and policymakers, understanding these trends is essential to capitalizing on this transformative moment.

Alarar Capital Group provides expert guidance for navigating SEA’s OSAT market. With deep industry knowledge, a global investor network, and proven transaction expertise, Alarar Capital Group supports businesses in identifying opportunities, structuring deals, and forging strategic partnerships. As SEA continues to shape the future of semiconductors, Alarar Capital Group is a trusted partner for sustainable growth.

Author:

Valentin Ischer

Managing Director

Author:

Felix Chu

Vice President

Author:

Charlene Lui

Associate

Author:

David Choi

Analyst

References