Download

Click here to download this article as a .pdf document.

| Executive Summary

Global supply chains are under unprecedented pressure. From pandemics and geopolitical conflicts to climate-related events and cyber threats, disruptions have become more frequent, severe, and complex. In this volatile environment, many companies still rely on traditional, reactive approaches to resilience – treating it as a cost center or crisis response mechanism. This mindset is no longer sufficient.

This white paper calls for a fundamental shift: reframing supply chain resilience as a proactive strategic capability embedded across the value chain. It explores the rising urgency for transformation, outlines the limitations of conventional models, and presents a compelling case for why resilience should be treated as a long-term enabler of competitive advantage – not just a defensive measure.

We examine the strategic value of resilience beyond risk mitigation, including its role in sustaining customer and investor trust, regulatory compliance, and operational agility. The paper outlines key points of integration across the supply chain, from sourcing and inventory to digital infrastructure and ecosystem collaboration.

To support implementation, we present a practical framework of strategic levers and provide perspective on balancing investment and value creation, ensuring that resilience initiatives deliver both protection and performance.

For business leaders, the message is clear: resilience is no longer optional. Companies that embed it as a core strategy today will be better positioned to withstand disruption, adapt quickly, and seize opportunities in an uncertain world. The time to act is now.

1 | Introduction: From Global Efficiency to Strategic Resilience

Redefining the Global Supply Chain Model

Efficiency once ruled supply chain strategy – but the origins of this model stretch further back than many realize. Long before global supply chains became synonymous with cost minimization and speed, the just-in-time (JIT) philosophy emerged from postwar Japan as a response to scarcity and resource constraints. What began as a lean manufacturing innovation evolved into a defining global doctrine – one that shaped decades of supply chain design across industries and geographies. The just-in-time (JIT) manufacturing model was pioneered by Toyota as a way to optimize limited resources and reduce waste. By the 1980s and 1990s, this philosophy had been exported globally and became the gold standard in supply chain management. Its promise – minimal inventory, low overhead, and rapid response – fit perfectly with the hyper-globalized world that emerged after China’s WTO accession in 2001.

By the 2000s, multinational corporations had embraced JIT at scale, outsourcing aggressively to Asia and centralizing operations in China, attracted by low labor costs, favorable trade conditions, and reliable infrastructure. This model enabled rapid growth and profitability during an era defined by geopolitical stability and synchronized global trade.

But the very traits that made the system efficient also made it fragile. When the COVID-19 pandemic disrupted production in Hubei, halted shipping lanes, and paralyzed ports, companies across sectors – from automotive to pharmaceuticals – experienced cascading shortages and delays. The Suez Canal blockage, Red Sea disruptions, and semiconductor crunch only further exposed the risks of over-optimization.

These successive crises served as a wake-up call, prompting a fundamental rethinking of what supply chains must deliver – not just efficiency, but endurance. Today, strategic priorities are shifting. Companies are no longer judged solely on cost per unit or delivery speed, but on their ability to absorb shocks, comply with evolving regulations, and ensure continuity amid geopolitical and environmental volatility. Resilience is no longer a luxury – it has become a core driver of long-term competitiveness.

Global institutions are increasingly calling for a systemic rethink of supply chain design. The Organisation for Economic Co-operation and Development (OECD), an intergovernmental organization for international trade and development on global trade and economic policy, has emphasized that supply chain resilience is critical for broader economic resilience, citing rising exposure to climate events, policy fragmentation, and geopolitical risk similarly urges economies to transition away from over-concentrated export models and embrace regionally embedded, diversified production networks. These interventions reflect a growing international consensus: the traditional efficiency-first model is no longer fit for purpose.

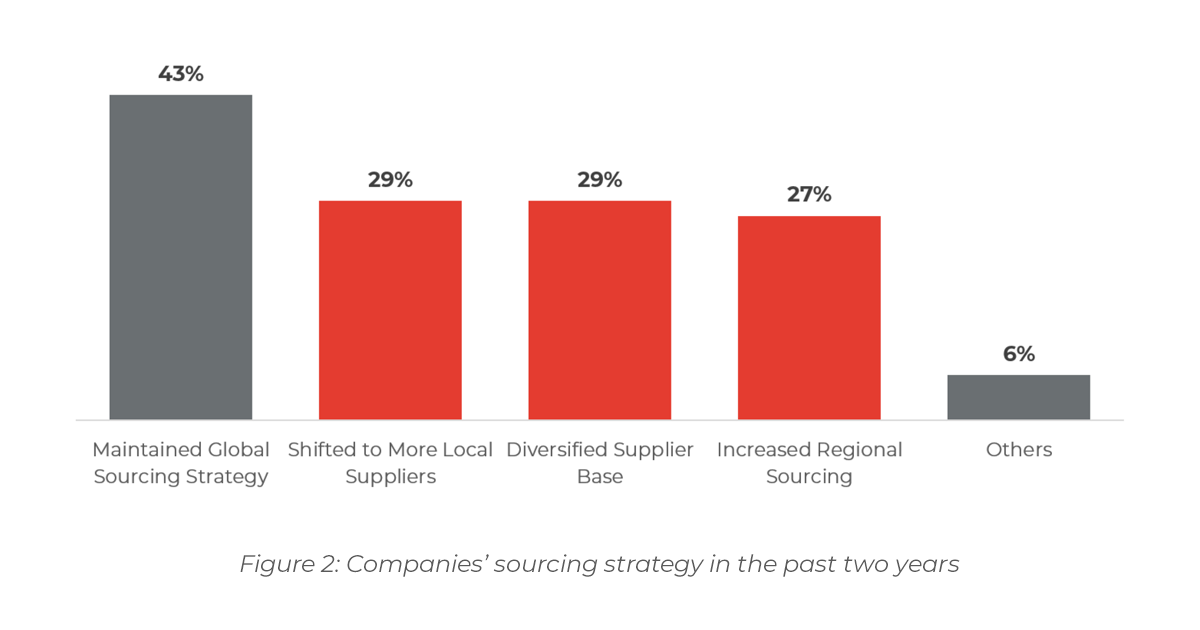

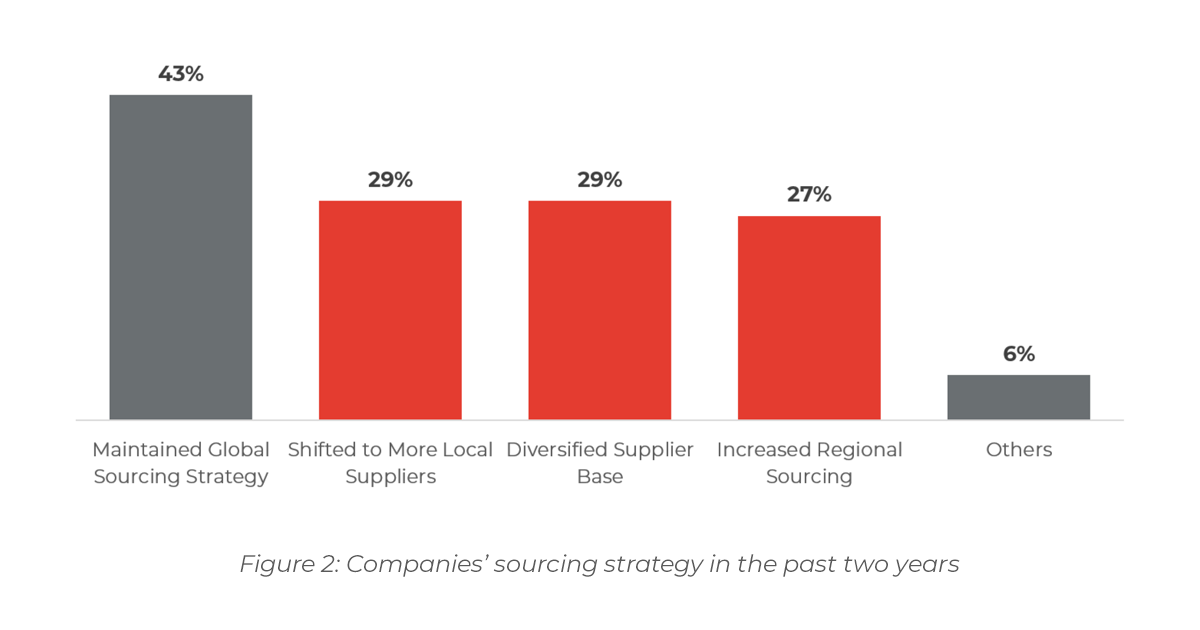

Some companies are already responding. In Alarar Capital Group’s 2024 Sourcing Survey – based on direct interviews with over 100 executive leaders, procurement directors, and supply chain heads across Europe and Asia – 29% of firms reported expanding regional sourcing, 29% diversified their supplier base, and another 27% shifted toward more localized procurement. These shifts point to a growing preference for hybrid operating models that balance risk mitigation, agility, and geographic flexibility without sacrificing performance.

The Age of De-Globalization and Policy Fragmentation

The backdrop to this strategic pivot is a fundamental transformation in global trade dynamics. While global trade volumes remain relatively stable, the foundational architecture of globalization is beginning to fracture. Policymakers across major economies are increasingly prioritizing economic security over liberalization – evident in the U.S. CHIPS Act and IRA, China’s Dual Circulation Strategy, and the EU’s CBAM and Foreign Subsidies Regulation. This shift, often referred to as ‘selective de-globalization’, marks a move away from universal trade norms toward regionally fragmented, politically motivated industrial policies.

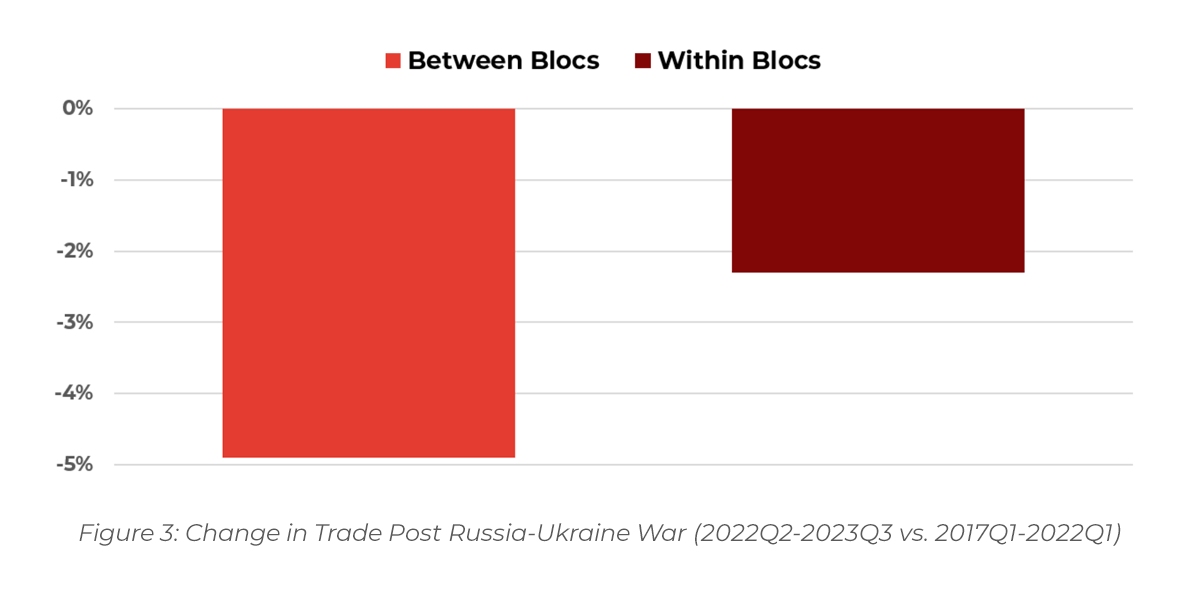

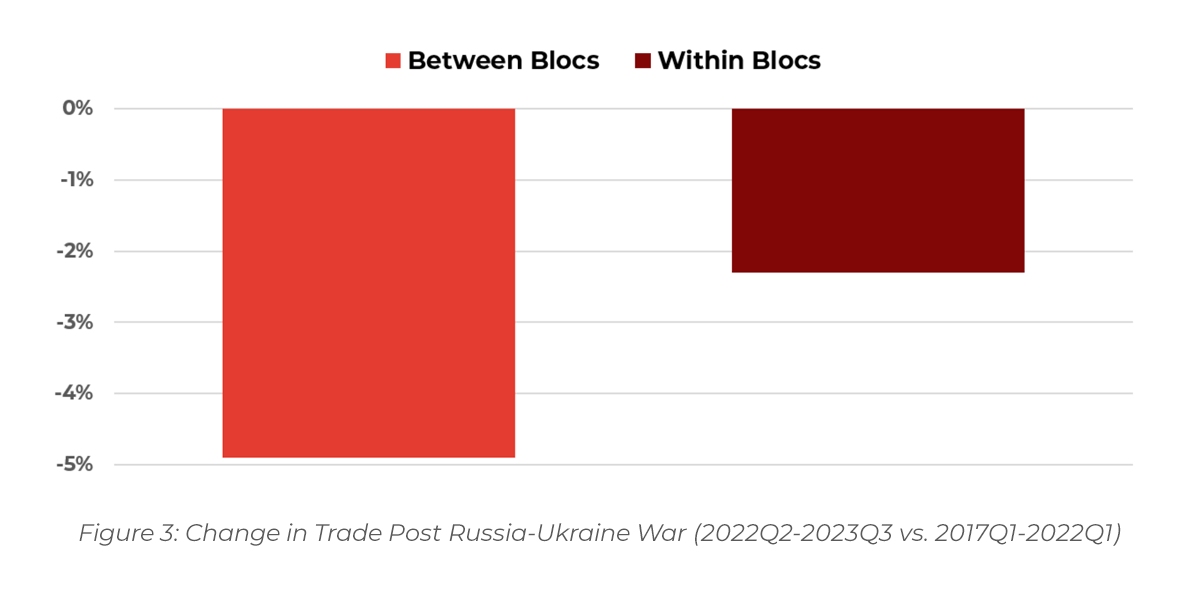

This shift is now clearly measurable. According to the IMF, trade between countries aligned with the United States and those aligned with China grew nearly 5 percentage points more slowly between Q2 2022 and Q3 2023 compared to the five years prior. This indicates that global trade is increasingly concentrating within geopolitical blocs rather than between them – a sign of accelerating fragmentation. Russia’s invasion of Ukraine acted as a geopolitical accelerant in an already shifting trade landscape. The IMF notes that this divergence, first visible after the onset of U.S.–China trade tensions in 2018, has now become structurally embedded.

The deepening fragmentation of global trade is increasingly driven by major economies embedding industrial policy into their trade strategies. In the United States, measures like the CHIPS and Science Act and the Inflation Reduction Act are actively redirecting investment flows and reshaping supply chain decisions across high-tech and green sectors. The 2025 introduction of a 10% universal import tariff, alongside new “reciprocal” tariffs targeting over 100 countries, further signals Washington’s shift toward protectionist and security-oriented trade.

The deepening fragmentation of global trade is increasingly driven by major economies embedding industrial policy into their trade strategies. In the United States, measures like the CHIPS and Science Act and the Inflation Reduction Act are actively redirecting investment flows and reshaping supply chain decisions across high-tech and green sectors. The 2025 introduction of a 10% universal import tariff, alongside new “reciprocal” tariffs targeting over 100 countries, further signals Washington’s shift toward protectionist and security-oriented trade.

In parallel, China is reinforcing its commitment to domestic self-sufficiency. Through programs such as Made in China 2025 and the Dual Circulation Strategy, Beijing is expanding local manufacturing ecosystems while tightening export controls on critical materials like rare earths, gallium, and graphite. These developments reflect a long-term strategy to secure supply chains against external pressure and to build leverage over essential global inputs.

The European Union, while publicly committed to open markets and rules-based trade, is quietly recalibrating its economic defense mechanisms. Tools such as the Carbon Border Adjustment Mechanism (CBAM), the Foreign Subsidies Regulation, and mandatory supply chain due diligence laws signal a more assertive stance on sustainability, transparency, and fair competition. In parallel, Brussels has intensified scrutiny on Chinese imports, particularly in sectors where state-backed pricing advantages, threaten European industry.

Yet the EU’s position remains strategically complex. Unlike the U.S., which has adopted a more overt decoupling stance, Europe faces a dual imperative: safeguarding its industrial base while preserving economic interdependence with China, a major trade partner and critical supplier. The bloc must now navigate between aligning more closely with U.S. security-driven policies or pursuing a more independent path that balances values-based trade with economic pragmatism.

This ambivalence is reflected in the EU’s uneven policy execution and internal divisions on how to manage China’s rise. For European businesses, this translates into growing uncertainty, not only about external risks but also about the future direction of the EU’s own industrial and trade strategy.

Rather than converging around a shared trade framework, global powers are now entrenching conflicting industrial strategies forcing multinational companies into a fragmented regulatory maze. What was once a coordinated environment is fracturing into a patchwork of export bans, local content rules, subsidy regimes, and compliance mandates that differ radically between the U.S., EU, and China.

For global companies, this is no longer a complexity to monitor – it’s a structural risk to solve. Executives must redesign operating models to function across conflicting jurisdictions. That means establishing parallel compliance systems, ring-fencing region-specific supply chains, and localizing critical activities where needed. Sitting still is not an option: the cost of regulatory missteps, trade restrictions, or market access loss is now too high.

Recent Events Highlight Real Urgency

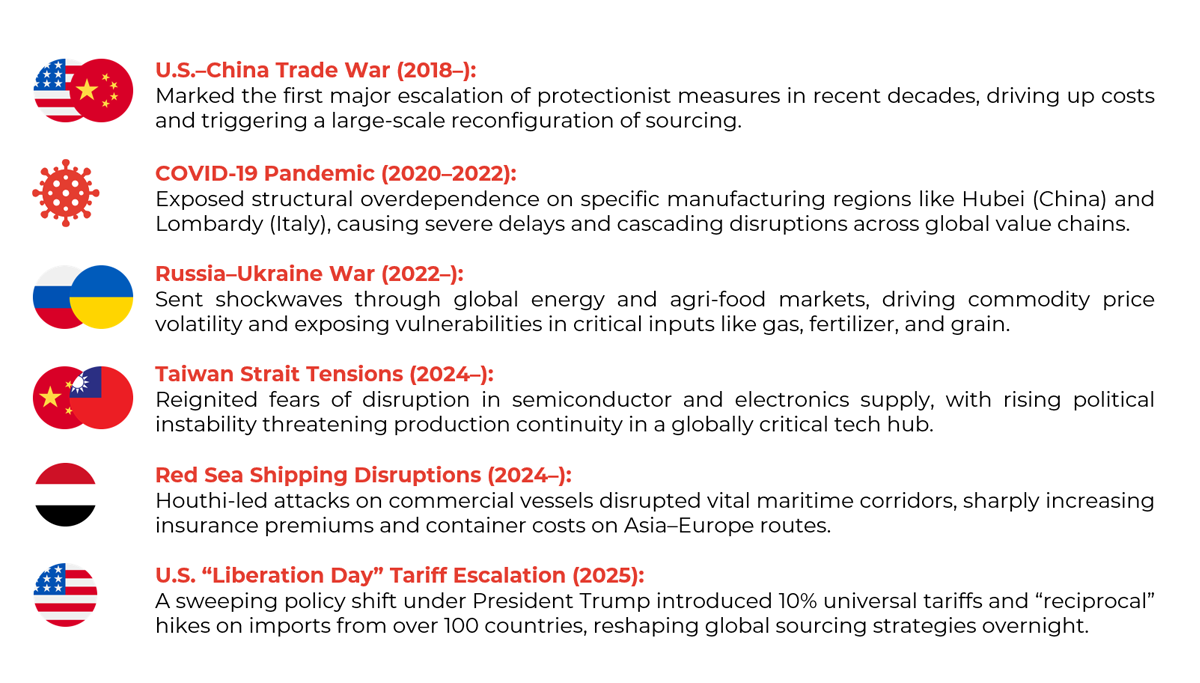

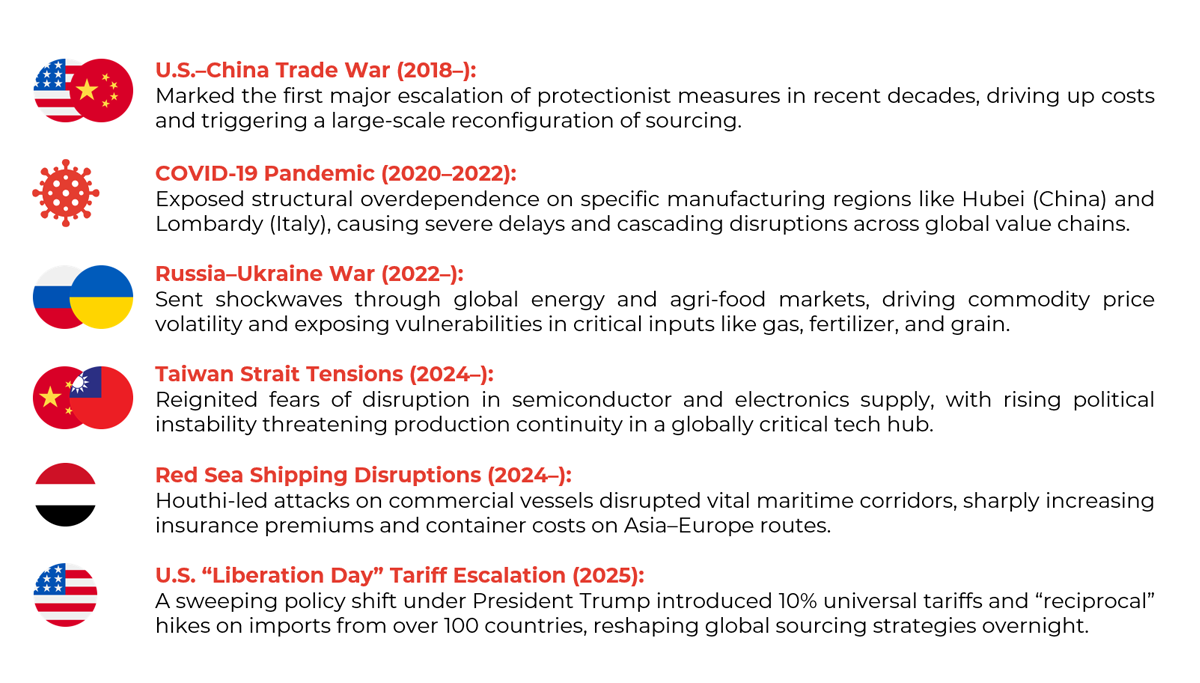

The urgency for change is not theoretical. A series of major disruptions in the last five years has exposed the structural weaknesses of hyper-optimized, single-point-of-failure supply chains:

These events have forced a reevaluation of the old supply chain paradigm. They have shifted risk from a low-probability contingency to a daily operational concern. Supply chain executives are now expected to anticipate disruption, not just react to it – and to architect operations accordingly.

Businesses are compelled to reassess foundational decisions regarding production locations, partnerships, and investment strategies. This necessitates a shift in key performance indicators (KPIs) beyond traditional metrics like cost-per-unit and lead times to include factors such as continuity, flexibility, and regulatory resilience. Developing supply chains that are not only efficient but also robust enough to withstand fragmentation and protectionist policies is imperative.

As companies navigate these complexities, the focus shifts to understanding the multifaceted pressures impacting supply chains and identifying strategies to mitigate associated risks.

2 | A Disrupted Landscape: Supply Chains Under Pressure

Supply chains are no longer disrupted by isolated events – they are now shaped by overlapping geopolitical, regulatory, and logistical forces that compound risk at every level. The notion of a stable, rules-based trade system has eroded, and companies now operate in a world where a single shipment may trigger three separate audits, and a supplier’s supplier – several tiers removed – can bring operations to a halt.

This section examines the operational consequences of this new environment: how divergent trade regimes, persistent geopolitical tensions, opaque supplier networks, and commodity volatility are transforming supply chain resilience from a functional concern into a strategic imperative. The shift is not just about managing disruption – it’s about redesigning how companies plan, source, and operate under structural uncertainty.

Trade Policy Fragmentation

The erosion of global trade harmonization is no longer just a geopolitical concern—it has become a daily operational reality for multinational businesses. What began as divergent national policies has cascaded into a fragmented regulatory environment that touches every layer of global operations.

U.S. authorities are expanding economic controls from semiconductor restrictions to outbound investment screening. China is reinforcing domestic self-sufficiency by limiting access to critical inputs and tightening outbound data flows. Meanwhile, the EU’s regulatory agenda is transforming supply chain obligations, with instruments like CBAM, CSRD, and the Foreign Subsidies Regulation directly impacting procurement, reporting, and compliance functions.

The practical result is a world where a single product crossing three regions may face three separate sets of carbon accounting rules, subsidy disclosures, or sourcing audits. This regulatory patchwork increases operational complexity, slows decision cycles, and raises the cost of compliance – particularly for firms with deep supplier networks or multi-market footprints.

In this environment, regulatory fluency is no longer the domain of legal departments alone. Supply chain, procurement, ESG, and finance leaders must now coordinate to ensure cross-functional readiness amid shifting compliance baselines.

Geopolitical Instability

The widening geopolitical fault lines are influencing sourcing and procurement decisions. Russia’s war in Ukraine continues to strain agri-food and metals exports; tensions in the Taiwan Strait bring constant risk to semiconductor supply lines; and the Red Sea shipping crisis has sharply increased logistics costs for goods transiting from Asia to Europe.

These crises are interlinked: political instability in one region can trigger knock-on effects across seemingly unrelated sectors and geographies. The globalized nature of tiered supply chains means that even localized tensions can generate global repercussions – often without warning.

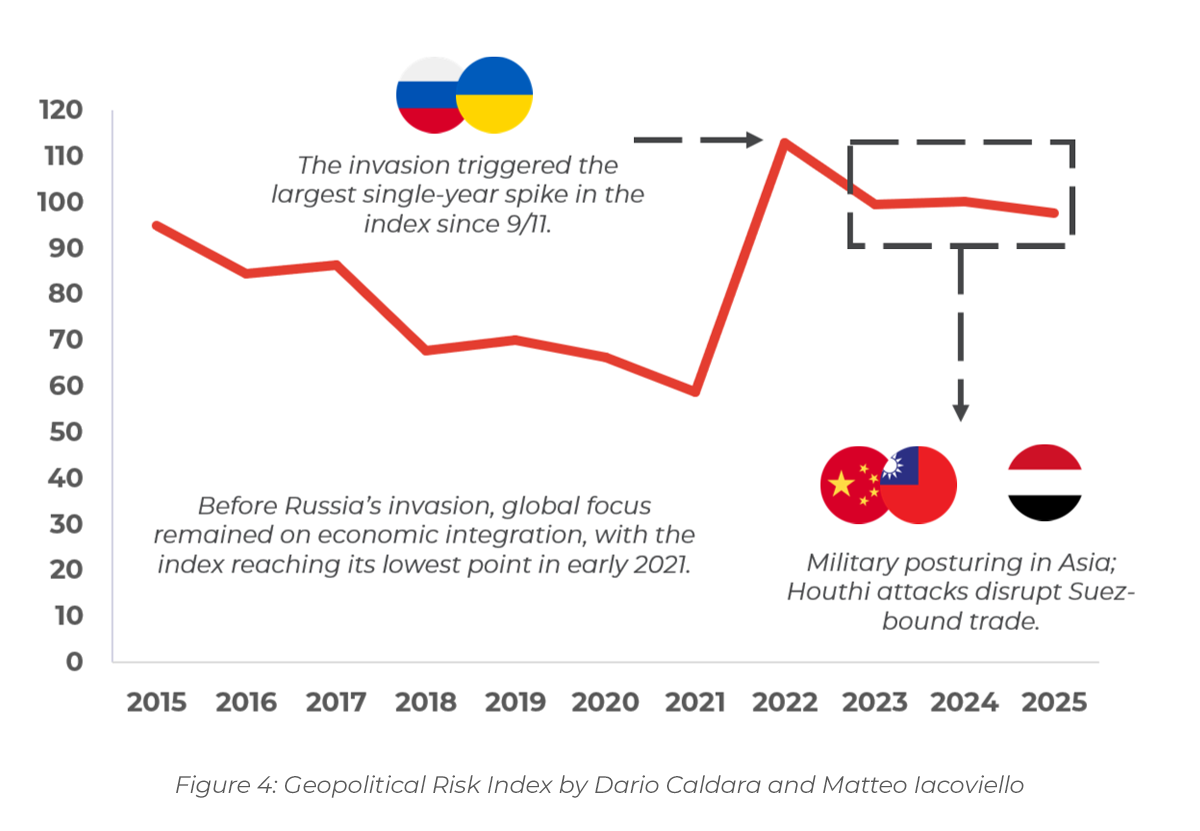

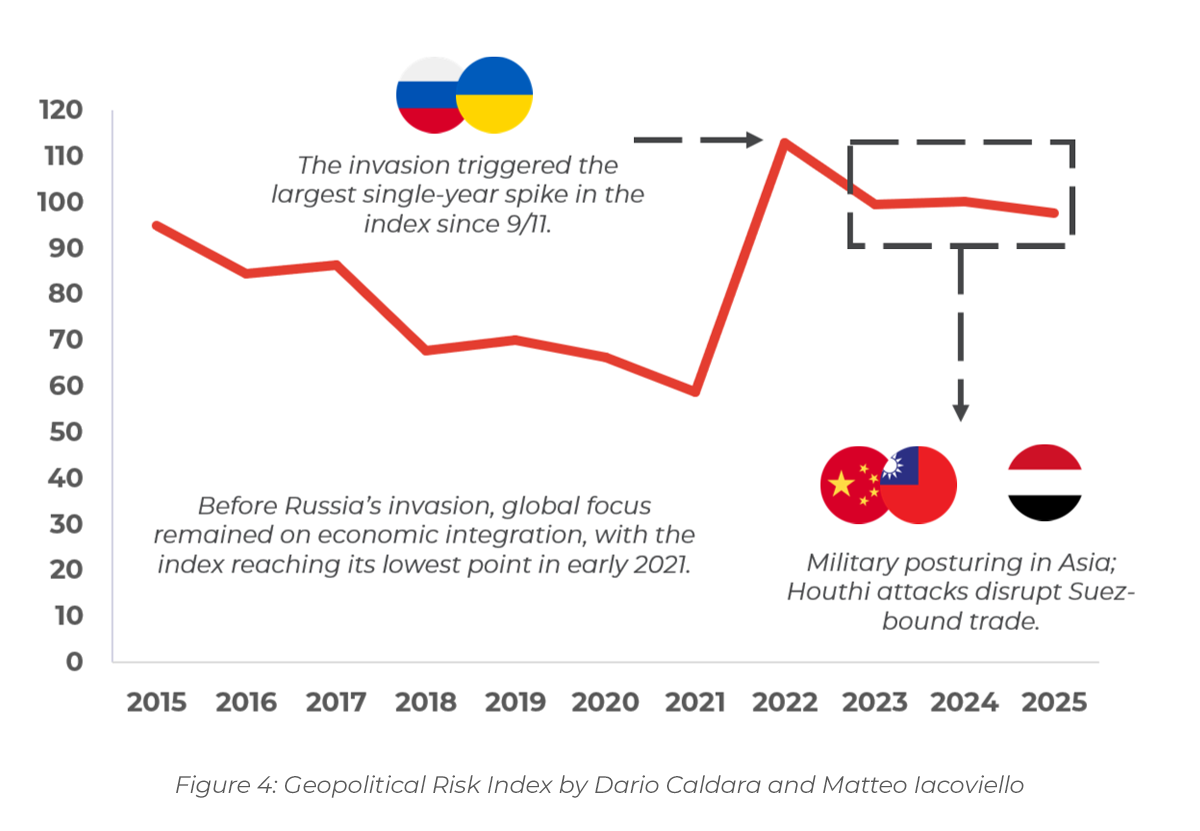

The Geopolitical Risk Index (GPR) – a measure developed to quantify geopolitical threats based on media coverage of military tensions, political crises, and acts of war – illustrates the sharp and sustained elevation in global risk perception since early 2022. The index spiked dramatically following Russia’s full-scale invasion of Ukraine, marking its largest single-year increase since 9/11.

Prior to this event, the GPR had trended downward, reaching a multi-decade low in early 2021, reflecting a period of relative stability and global economic integration. However, since the Ukraine conflict, the index has remained structurally elevated. This new plateau reflects persistent conflict, escalating tensions in the Taiwan Strait, and attacks on Red Sea shipping lanes – each compounding the perception of systemic geopolitical volatility.

For businesses, this sustained elevation signals a new normal: geopolitical disruption is no longer episodic but a permanent strategic variable, one that must be actively embedded into scenario planning, supplier strategies, and board-level risk frameworks.

Exposure to Third-Country Disruptions

While many multinational enterprises have made notable progress in diversifying their Tier 1 suppliers, few possess comprehensive visibility beyond their immediate vendor layer. This lack of transparency into Tier 2 and Tier 3 networks poses a critical risk. Disruptions in geographically distant or seemingly minor nodes, whether in flood-prone industrial zones of Southeast Asia or politically volatile provinces in South Asia, can trigger cascading failures across the entire supply chain.

As an example, the 2022 floods in Pakistan caused widespread agricultural disruption, resulting in delayed or canceled cotton deliveries. Several European apparel brands found themselves grappling with upstream shortages that their Tier 1 partners could neither anticipate nor resolve. These companies were not directly sourcing from the affected regions but relied unknowingly on raw materials and subcomponents produced there, demonstrating how indirect exposure can cripple production schedules, customer commitments, and reputational integrity.

This phenomenon, known as “tail dependency,” has emerged as one of the most significant blind spots in modern supply chain architecture. Unlike primary suppliers, these deeper-tier partners are rarely mapped, monitored, or stress-tested, making them highly vulnerable points of failure.

In today’s environment of climate volatility, political fragmentation, and localized unrest, ignoring these dependencies is no longer a tenable strategy. Leading organizations are increasingly investing in end-to-end supplier visibility tools, multi-tier digital mapping, and advanced scenario modeling capabilities. These tools not only identify hidden risks but also enable proactive mitigation planning, helping companies reroute, dual-source, or buffer inventory before disruption occurs.

Volatile Input Costs and Logistics Disruptions

The post-pandemic era has ushered in a period of sustained volatility across both input costs and global logistics – transforming what were once predictable variables into daily operational risks. Maritime disruptions such as the ongoing Red Sea crisis have triggered container rate surges exceeding 300% on certain routes, particularly those connecting Asia to Europe. While freight costs have partially stabilized in some corridors, the underlying fragility of global logistics remains acute.

Simultaneously, raw material markets have become increasingly turbulent. Inputs critical to energy transition and high-tech manufacturing such as lithium, copper, and rare earths continue to experience pronounced price swings, driven by geopolitical tensions, supply concentration, and growing demand from clean energy sectors. Energy markets, too, remain exposed to shocks from climate-related events and political conflict, as evidenced by the ripple effects of the Russia–Ukraine war on oil and gas availability across Europe.

In this environment, supply predictability has become a premium differentiator. Companies capable of ensuring stable input flows, reliable delivery schedules, and cost containment now command a competitive edge.

The implications are clear: the cumulative weight of geopolitical risk, regulatory divergence, and logistical fragility has elevated resilience from a secondary consideration to a board-level imperative. The core question for global businesses is no longer whether to act, but how to rewire their operational models to meet this new reality.

3 | Resilience as a Core Strategic Objective

The Need for a New Approach

Resilience has traditionally been viewed as a defensive measure or insurance policy against disruption. However, with the increasing frequency and magnitude of disruptions which has become the norm, this paradigm must shift. Companies now cannot afford to view resilience as a secondary concern in their strategic landscape. Instead, it should be treated as a core dimension alongside cost, quality, speed, and thoroughly incorporated into businesses’ strategic planning.

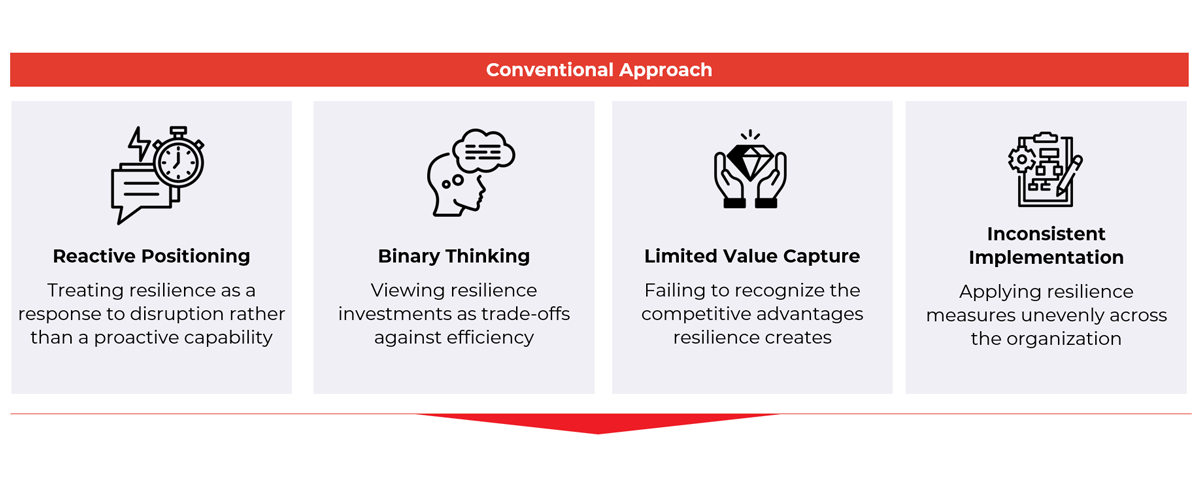

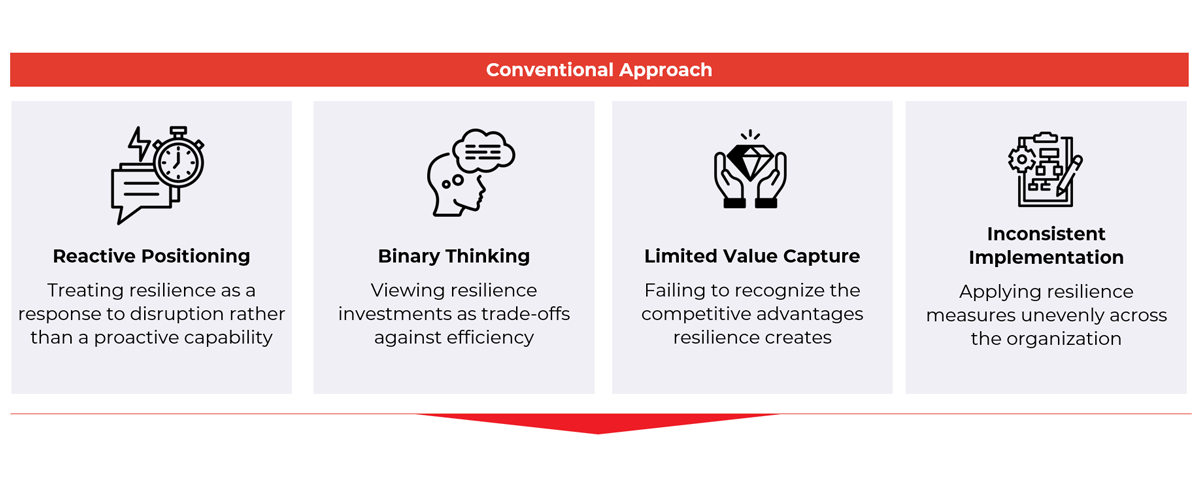

The conventional approach to resilience is fundamentally constrained by outdated assumptions and fragmented execution. Companies have been treating resilience as a reactive measure, mobilizing only in response to crises rather than embedding it as a proactive, forward-looking capability. This is fueled by the belief that investment in resilience inherently comes at the expense of operational efficiency. Additionally, the strategic value of resilience is often overlooked as firms view it merely as a cost burden rather than a source of long-term competitive advantage. Even among companies that emphasize resilience, those measures are frequently implemented inconsistently across functions and business units, resulting in uneven preparedness and weak systemic protection.

Numerous global companies have been caught off guard by disruptions as a result of adhering to conventional, reactive approaches to resilience. Since 2020, General Motors (GM), like many automakers, has suffered extended production halts due to the global semiconductor shortage despite mitigation efforts. Years of optimizing for lean, low-cost inventory had left them vulnerable, with minimal visibility into tier-2 and tier-3 suppliers. This cost GM billions in lost output and delayed launches of new models – highlighting the dangers of deprioritizing resilience in favor of efficiency and the urgency for strategic change.

Another example is Nike who faced challenges during the pandemic due to factory shutdowns in Vietnam – where nearly 50% of its products are manufactured. In April 2025, the company once again struggles after US imposing reciprocal tariffs of 46% on Vietnam, 54% on China, and 32% on Indonesia – where Nike also has manufacturing units. While the company had invested in some digital capabilities, its supply chain was still concentrated and overly reliant on these specific regions. The lack of proactive risk management could lead to increased costs, inventory shortages, and missed sales.

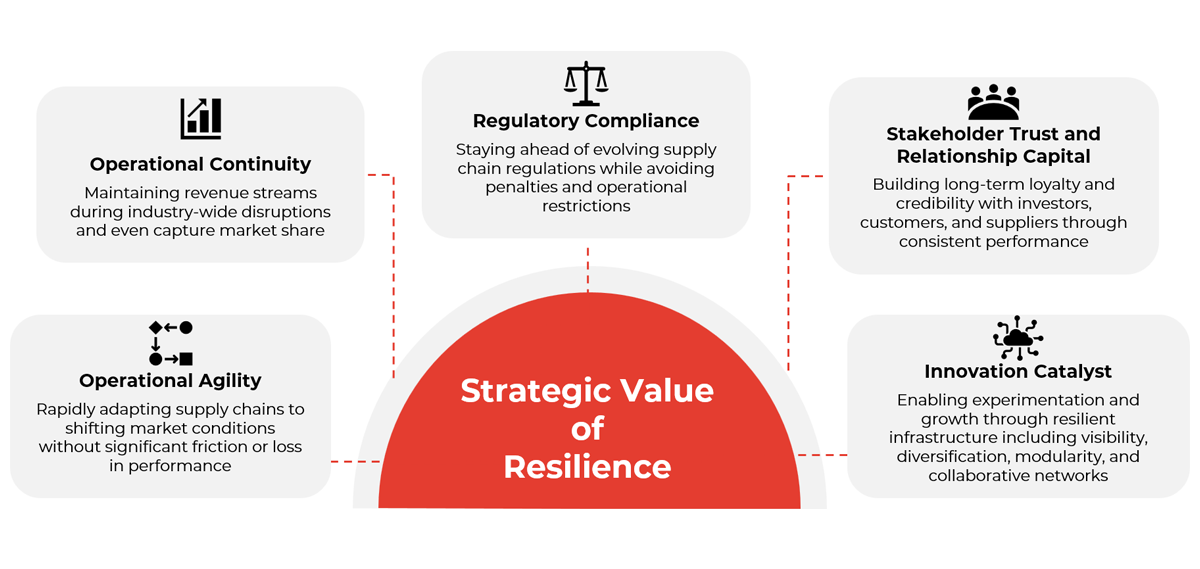

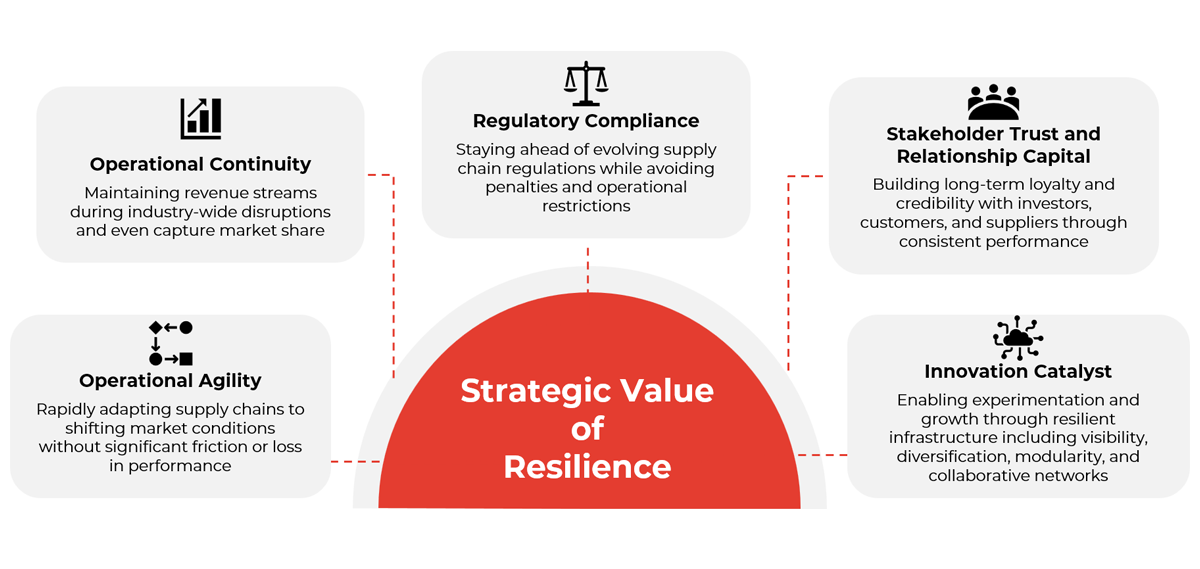

Strategic Value Beyond Risk Mitigation

The narrow perspective on resilience has left companies vulnerable to disruptions and unable to capitalize on resilience as a lever for growth, agility, market leadership, and long-term competitiveness. Resilience delivers strategic value that extends far beyond risk mitigation and directly supports critical boardroom priorities:

Operational Agility

Resilient supply chains possess the flexibility to quickly reconfigure and reallocate resources in response to changing market conditions. This agility enables organizations to capture emerging opportunities, introduce products faster, and respond to competitor moves more effectively.

As an example, the American multinational conglomerate 3M demonstrated exceptional agility stemming from long-term resilience planning during COVID-19. Their global manufacturing footprint, designed with redundancy and flexibility as core principles, enabled them to rapidly scale N95 mask production by 1000% in key facilities while simultaneously reconfiguring other production lines. 3M’s resilience-centered approach to supplier relationships and inventory management allowed them to successfully navigate complex export restrictions and material shortages.

Operational Continuity

Resilient supply chains maintain revenue streams and customer service levels during disruptions, protecting financial performance, preventing market share erosion, and even capture market share when competitors cannot deliver.

For instance, Procter & Gamble maintained product availability during the pandemic through its investment in supply network visibility tools and regional manufacturing redundancy, allowing it to quickly shift production emphasis to in-demand products while maintaining service levels. This operational continuity resulted in a 4% organic sales growth during a period when many competitors experienced significant declines.

Regulatory Compliance

Emerging regulations increasingly mandate supply chain transparency, diversification, and contingency planning. Proactive resilience strategies ensure compliance while avoiding penalties and operational restrictions, as well as positions companies ahead of reactive competitors who struggle with last-minute adaptations.

This is exemplified by the case of Unilever who implemented its Responsible Sourcing Policy and monitoring systems well before the EU Corporate Sustainability Due Diligence Directive was proposed. While competitors later scrambled to meet these transparency requirements, Unilever’s mature systems including blockchain-based tracking and supplier development programs positioned them ahead of regulatory curves. This proactive approach helped them avoid the compliance costs and supply disruptions that affected competitors dealing with non-compliant suppliers.

Stakeholder Trust and Relationship Capital

Consistent performance during disruptions builds profound trust among customers, suppliers, and investors. This relationship capital translates into preferential treatment during resource constraints, customer loyalty, and favorable financing terms that deliver tangible competitive benefits. Supply chain failures can severely damage brand equity, erode customer and investor confidence.

For instance, during the height of the U.S.-China trade war, Microsoft faced rising uncertainty around its operations and market access in China. Instead of remaining passive, the company proactively communicated risk exposure and mitigation strategies to investors through earnings calls and SEC filings. Microsoft also diversified parts of its hardware supply chain (e.g., Surface production to Vietnam) while reassuring enterprise customers in China of its continued presence and compliance. Thanks to this transparent, forward-looking approach, Microsoft retained investor confidence, as its stock continued to perform strongly through the trade war.

Innovation Catalyst

The capabilities that enable resilience including visibility, diversification, modularity, and collaborative networks simultaneously foster innovation by exposing organizations to diverse knowledge sources and creating flexible platforms for experimentation. Schneider Electric stands out as a prime example of proactive resilience, having invested in digital supply chain infrastructure and scenario modeling well before the onset of COVID-19 and global component shortages. By implementing control towers, predictive analytics, and end-to-end visibility tools, the company was able to rapidly reroute shipments, anticipate demand fluctuations, and coordinate closely with suppliers in real time.

Embedding Resilience into Supply Chain Strategy

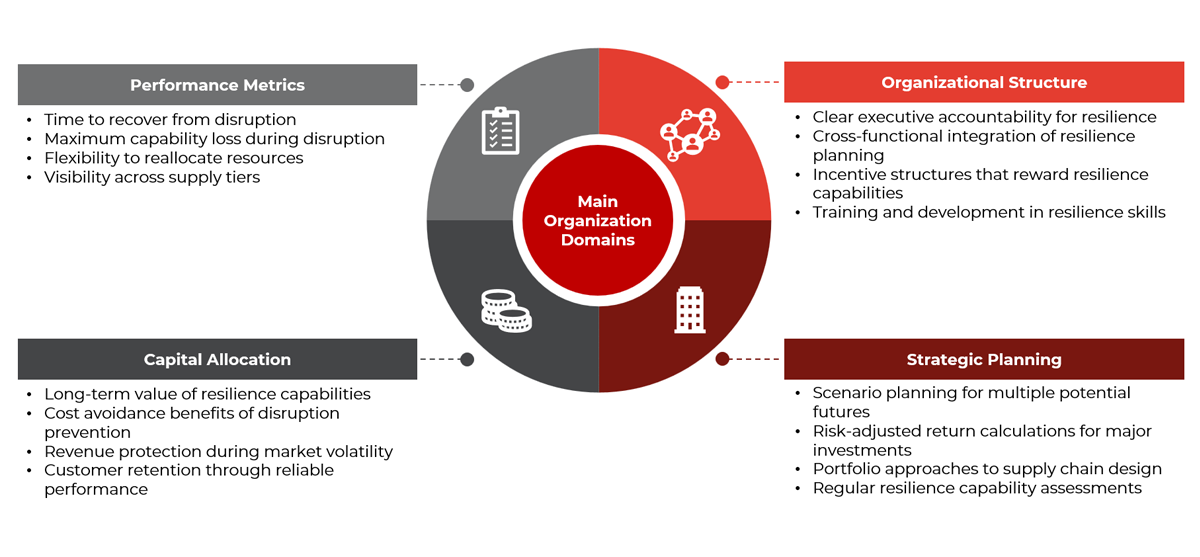

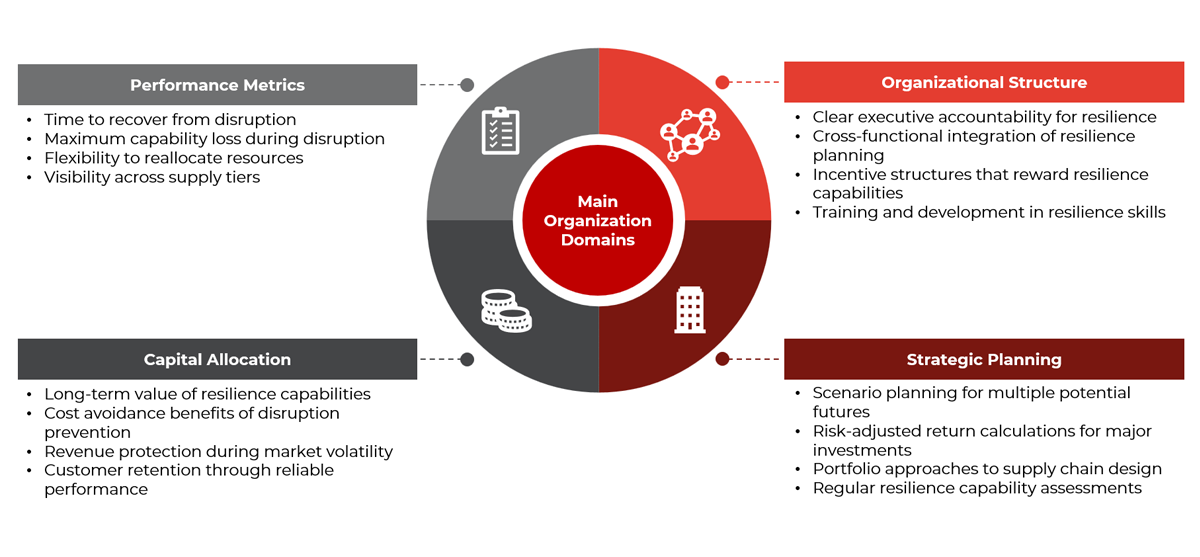

Elevating resilience to a core strategic dimension demands more than operational tweaks – it requires a structural redefinition of how organizations set priorities, allocate resources, and plan for the future. To make resilience a true strategic pillar, companies must integrate it across four critical domains: performance metrics, capital allocation, organizational structure, and strategic planning. This means moving beyond traditional KPIs like cost and lead time to track metrics such as recovery speed, operational flexibility, and tier-level visibility. Likewise, capital must be directed not just toward efficiency gains, but toward initiatives that reduce exposure, maintain customer trust, and protect revenue during volatility.

This shift also calls for organizational and planning reforms. Resilience needs clear executive ownership and cross-functional collaboration, supported by incentive systems that reward proactive risk management and adaptability. Strategic planning should evolve to include scenario modeling, risk-adjusted investment frameworks, and resilient supply network design – not just for crisis response, but as an embedded capability that shapes long-term competitiveness. Together, these changes elevate resilience from a reactive safeguard to a forward-looking, value-creating dimension of enterprise strategy.

Strategic Levers for Enhancing Supply Chain Resilience

To move beyond reactive responses and embed resilience as a competitive advantage, companies must deploy targeted strategic levers. These levers not only mitigate exposure to future disruptions but also enhance adaptability, operational continuity, and long-term agility. The following framework outlines key focus areas:

Strategic Network Design

Network design represents a foundational lever, involving strategic decisions about production locations, supplier footprints, and distribution networks that balance concentration efficiency with geographic diversification. Companies like Toyota have shifted from pure efficiency to “informed redundancy” following previous disruptions, strategically duplicating critical capabilities across regions. Supply chain diversification strategies to help organizations build resilience include selective diversification, dual sourcing or multi sourcing, nearshoring or regionalization.

Digital Transformation

Digital transformation serves as another powerful lever, with advanced analytics, AI-driven forecasting, and real-time visibility tools enabling companies to anticipate disruptions and rapidly reconfigure operations in response. Leaders like Procter & Gamble utilize digital twins of their supply networks to simulate responses to potential disruptions before they occur.

Relationship Management

Relationship management constitutes a third critical lever, as collaborative supplier development programs, strategic customer relationships, and ecosystem partnerships create resilience through preferential treatment during constraints and collaborative problem-solving during disruptions.

Operational Flexibility

Operational flexibility through modular product architectures, postponement strategies, and multi-skilled workforces enables rapid adaptation to changing conditions. Companies deploying all these levers simultaneously develop “resilience by design” rather than treating it as an expensive add-on, creating supply networks that deliver both efficiency under normal conditions and adaptability during disruptions.

Collectively, these structural shifts embed resilience into the core of organizational decision-making, repositioning it from a reactive cost burden to a proactive driver of competitive advantage. Far from being standalone tactics, these strategic levers are most effective when integrated and customized to the unique risk profile and operational context of the business. Together, they form a cohesive resilience blueprint – empowering organizations to absorb shocks, respond swiftly to change, and strengthen their position in an increasingly unpredictable world.

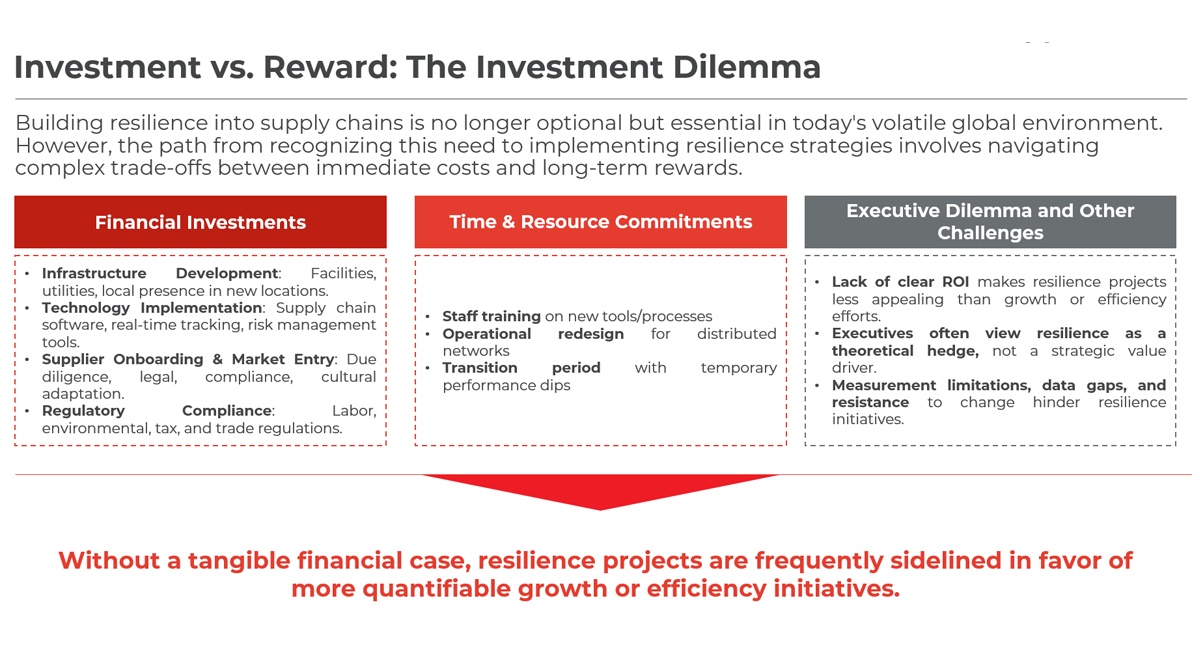

4 | Investment vs. Reward: Managing the Trade-Offs

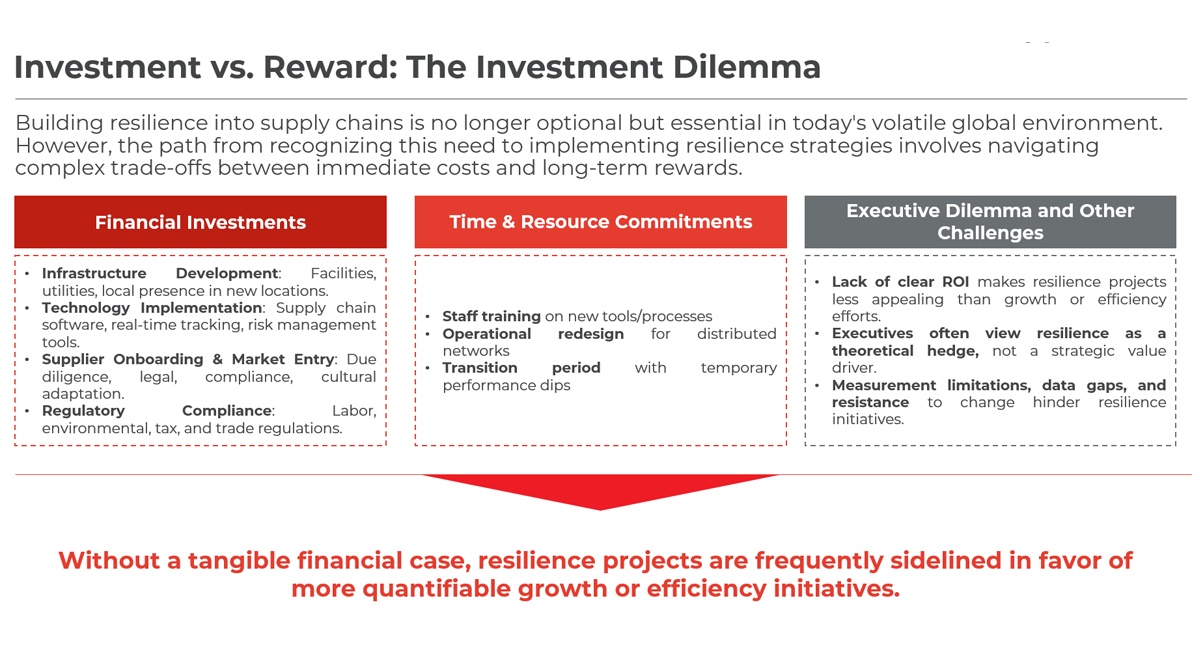

Building resilience into supply chains is no longer optional but essential in today’s volatile global environment. However, the path from recognizing this need to implementing resilience strategies involves navigating complex trade-offs between immediate costs and long-term rewards. This challenge is compounded by measurement limitations, data constraints, and organizational resistance to change.

Despite growing awareness of resilience importance, many firms still struggle to secure executive buy-in for significant investments. The primary obstacle is often the lack of a clear return on investment (ROI). Without a tangible financial case, resilience projects are frequently sidelined in favor of more quantifiable growth or efficiency initiatives. Executives tend to perceive resilience investments as theoretical – a hedge against unlikely scenarios rather than a source of competitive value.

This perception results in underfunded or fragmented efforts that fall short of meaningful impact. However, this framing overlooks the strategic imperative of resilience in an increasingly interconnected and unstable global marketplace.

The Investment Dilemma: Quantifying Resilience ROI

Building a resilient supply chain requires substantial initial investments across various dimensions. Financial investments include infrastructure development for establishing operations in new locations, which necessitates significant capital for facilities, utilities, and local resources. Technology implementation presents another major cost category, as integrating advanced supply chain management software and real-time tracking systems is essential for overseeing diversified operations.

Supplier onboarding and market entry introduce expenses related to due diligence, quality assessments, and establishing contractual agreements. Additionally, entering new markets incurs costs associated with understanding local regulations, cultural nuances, and consumer preferences. Operating in unfamiliar jurisdictions requires investments to ensure adherence to various local laws and standards, including environmental regulations, labor laws, and trade policies.

Beyond direct financial outlays, organizations must commit significant time and resources to their resilience transformation. Employees must be trained on new processes and technologies to effectively manage diversified operations. This includes understanding new supply chain software, adapting to different cultural business practices, and complying with varied regulatory requirements. Operational procedures need to be reevaluated and redesigned to accommodate new suppliers and markets.

The transition from a centralized supply base to a diversified network can span several years before achieving operational stability.

Kshore, a Chinese appliance maker with operations in India and Vietnam, faced growing pressure from global clients like Walmart to make its supply chain more resilient and sustainable after COVID-19. To respond, the company explored expanding into Mexico to reduce geopolitical risks and improve flexibility. However, shifting away from its centralized setup in China came with major challenges — including a long ramp-up period, the need to train new local suppliers, higher material and labor costs, and short-term drops in productivity and service levels.

Measurement Challenge

Making the case for resilience is further complicated by the absence of standardized metrics. Tools like Time to Recovery (TTR) and Time to Survive (TTS) provide limited insight, often failing to translate into clear investment actions. More sophisticated approaches – such as digital twins for stress-testing – are promising but not yet widely scalable due to cost, complexity, and human input dependency.

Moreover, reliable data, especially from beyond Tier 1 suppliers, is scarce or outdated. Some firms rely on expert estimation, but this introduces variability and potential bias. These limitations erode confidence in proposed investments and hinder efforts to forecast cash flow or project impact.

From a financial perspective, resilience poses a unique dilemma: successful investments often appear invisible. If an initiative works – say, through added safety stock or dual sourcing – then the disruption never manifests, making the benefit seem intangible. Yet when disruption strikes, the value becomes unmistakable.

Adding complexity is the fact that timing and duration of disruption are unpredictable, making it difficult to calculate net present value (NPV) or justify trade-offs between different investment profiles. This uncertainty often causes executives to default to inertia – hesitant to fund initiatives based on hypothetical crises, especially if no past disruption has created visible damage.

Despite these challenges, organizations can adopt more strategic measurement approaches. The long-term value of diversification strategies can be quantified through several key metrics:

- Return on Resilience Investment – comparing diversification costs against disruption-related losses avoided during crisis events

- Operational efficiency improvement

- Market share stability/gain during industry disruptions

- Customer retention during periods of market volatility

- Premium pricing potential for guaranteed supply

Balancing Critical Trade-Offs

Investing in supply chain diversification inevitably involves navigating complex trade-offs. Organizations must strike a careful balance between short-term costs and long-term strategic benefits, and between sufficient diversification and operational complexity.

At the core of every resilience initiative is a cost-benefit calculus. Diversification strategies often require significant capital outlays that must be evaluated against projected benefits: continuity of operations, reduced exposure to geopolitical shocks, faster recovery times, and enhanced stakeholder confidence. A comprehensive cost-benefit analysis at each phase of implementation helps organizations make informed decisions, justify spending to stakeholders, and prevent underinvestment or misallocation of resources.

Not all risks carry equal weight, and not all parts of the supply chain are equally vulnerable. Diversification efforts should be prioritized in areas that represent high-value or high-risk exposure – such as sole-source suppliers, critical production geographies, or logistics bottlenecks. Aligning these efforts with the company’s strategic priorities and core competencies ensures that resilience investments are both relevant and impactful.

While diversification improves resilience, excessive diversification can introduce diminishing returns. Managing too many suppliers, product variants, or operating regions can lead to fragmented oversight, inconsistent quality, and inflated overhead costs. Firms must avoid the trap of spreading themselves too thin – where the added complexity outweighs the benefits of risk reduction.

The goal is to diversify intelligently, not indiscriminately. This means maintaining a strong grip on core markets and capabilities while selectively expanding into complementary areas. Balanced diversification ensures the company can leverage economies of scale, protect brand integrity, and maintain consistent customer experiences – all while gaining the agility needed to navigate disruptions.

The Case of Strategic Payoff

Despite the hurdles, the rewards of investing in resilience are compelling. Take Toyota, which stockpiled semiconductors after the 2011 Tōhoku earthquake – an investment that appeared idle for nearly a decade.

Despite the challenges and trade-offs associated with building resilience, the long-term rewards can be substantial – as demonstrated by Toyota. Following the devastating 2011 Tōhoku earthquake, which led to a 78% drop in Toyota’s production output in April of that year and took six months to fully recover, the company undertook a comprehensive review of its supply chain. This review extended beyond immediate suppliers to include multiple tiers across the network, with the goal of identifying hidden vulnerabilities and reinforcing system-wide stability.

One of the most significant strategic shifts was Toyota’s decision to move away from its hallmark just-in-time (JIT) production model, at least for critical components like semiconductors. Recognizing the fragility of highly optimized, lean supply chains in the face of major disruptions, Toyota mandated that its suppliers maintained inventories of semiconductors sufficient to cover two to six months of production, depending on delivery timelines. This “just-in-case” approach represented a deliberate investment in supply continuity over short-term efficiency.

This forward-thinking strategy proved its value nearly a decade later during the COVID-19 pandemic, when a perfect storm of factory shutdowns, soaring demand for electronics, and geopolitical tensions triggered a global semiconductor shortage. While other major automakers such as Ford and Nissan were forced to halt production due to chip scarcity, Toyota maintained operational continuity. As a result, the company not only avoided production losses but also capitalized on competitors’ weaknesses.

Toyota’s resilience strategy paid off in a big way. In 2021, it became the top-selling automaker in the U.S. for the first time in 90 years – surpassing General Motors – a testament to how investments in resilience, while not immediately profitable, can protect business continuity and create a competitive edge during times of crisis.

By approaching supply chain resilience as a strategic imperative rather than a reactive necessity, companies can transform potential vulnerability into sustainable competitive advantage in an increasingly unpredictable global economy. These benefits should not be viewed in isolation, but as part of a broader, systemic advantage that enables firms to thrive amid volatility and disruption.

Phased Implementation Roadmap

To manage investments effectively while maximizing rewards, businesses can adopt a phased implementation approach:

Phase 1: Pilot

- Identify High-Risk Areas: Begin by identifying areas of the business most vulnerable to geopolitical risks, such as single-source suppliers or operations in volatile regions.

- Conduct Small-Scale Experiments: Implement small-scale pilots to test diversification strategies. This could involve partnering with new suppliers, expanding into a new market, or diversifying product offerings.

- Measure Initial Outcomes: Use key performance indicators (KPIs) such as cost savings, risk reduction, and operational stability to evaluate the success of pilot projects.

Phase 2: Scale

- Expand Successful Initiatives: Based on the outcomes of pilot projects, expand successful strategies across broader operations. This may involve investing in technology and infrastructure to support scaling efforts.

- Ensure Strategic Alignment: Ensure that scaled initiatives align with overall strategic goals and stakeholder expectations. This includes maintaining focus on core competencies while diversifying.

Phase 3: Optimize

- Continuous Monitoring: Continuously monitor performance metrics to identify areas for improvement. This involves tracking KPIs and adjusting strategies as needed.

- Adapt to Evolving Risks: Adapt diversification strategies based on evolving geopolitical risks and market dynamics. This requires ongoing analysis of global trends and their potential impacts on operations.

5 | Recommendations for Business Leaders

Organizations aiming to strengthen their resilience can employ several key approaches:

- Elevate Resilience to a Board-Level Priority

- Integrate resilience metrics into your balanced scorecard alongside growth and profitability measures

- Allocate specific budget for resilience-building initiatives rather than treating them as overhead

- Include resilience scenarios in your regular strategic reviews, not just in crisis management

- Design operations for flexibility, not just stability

- Invest in organizational agility – cross-functional teams, simplified decision processes, and flexible resource allocation

- Develop sensing capabilities to identify early warning signals of both threats and opportunities

- Create “strategic optionality” through flexible supply chains, modular technology architecture, and diversified talent pools

- Deploy Targeted Strategic Levers Across the Supply Chain

Apply a tailored combination of strategic levers such as:

- Selective Diversification to reduce geographic risk

- Multi-Sourcing to build input redundancy

- Hybrid Inventory Models to balance efficiency and shock absorption

- Regional Hubs and Nearshoring to improve speed and compliance

Each lever should be aligned with product category needs, market dynamics, and risk exposure – not implemented uniformly.

- Transform stress testing from compliance to innovation

- Use scenario planning to generate new business ideas, not just risk identification

- Create “shock simulations” as innovation workshops that leverage disruption for advantage

- Design regular exercises that test your organization’s ability to pivot to new opportunities, not just recover

- Build Agility through Digital Enablement

Leverage technology to enhance resilience without sacrificing other dimensions:

- Advanced analytics for early warning and response

- Digital twins for scenario modeling

- Automation to reduce dependency on labor availability

- Visibility platforms to identify and address vulnerabilities

- Build resilience-focused ecosystems

Extend resilience thinking beyond organizational boundaries:

- Collaborative planning with key suppliers and customers

- Industry consortium approaches to common challenges

- Public-private partnerships for critical infrastructure

- Knowledge sharing across supply networks

| Conclusion: Preparing for a Resilient Future

The disruptions of recent years have exposed the fragility of global supply chains and the limitations of reactive resilience strategies. As business environments grow increasingly volatile, the strategic value of resilience will only increase. Organizations that continue to treat resilience as merely a cost center will find themselves at a significant disadvantage compared to those that recognize it as a core strategic dimension. To stay competitive, resilence must be reframed as a foundational pillar of competitive strategy – deliberately embedded across functions, tailored to risk exposure, and supported by data-driven insights.

Importantly, building resilience does not mean sacrificing efficiency or over-preparing for unlikely scenarios. It is about creating adaptive, responsive, and robust supply networks that enable continuity during crises and agility in recovery. Companies that embrace this shift proactively will not only reduce their exposure to shocks but also unlock new value – through faster time-to-market, stronger stakeholder trust, and differentiated performance under pressure.

Ultimately, the most successful organizations will be those that seamlessly integrate resilience into their strategic identity – not as something they do in addition to their core business, but as an essential characteristic of how they create and deliver value in an uncertain world. This transformation demands bold leadership, targeted investment, and a readiness to challenge legacy assumptions. But the reward is clear: a supply chain that doesn’t just survive disruption but evolves, scales, and thrives because of it.

Download

Click here to download this article as a .pdf document.

Contributor:

Daniel Karlsson

Partner

Contributor:

Leo Jibrandt

Associate Partner

Contributor:

Kelly Nguyen

Associate

Contributor:

Glen Qoku

Analyst

Contributor:

Clyde Tran

Analyst

The deepening fragmentation of global trade is increasingly driven by major economies embedding industrial policy into their trade strategies. In the United States, measures like the CHIPS and Science Act and the Inflation Reduction Act are actively redirecting investment flows and reshaping supply chain decisions across high-tech and green sectors. The 2025 introduction of a 10% universal import tariff, alongside new “reciprocal” tariffs targeting over 100 countries, further signals Washington’s shift toward protectionist and security-oriented trade.

The deepening fragmentation of global trade is increasingly driven by major economies embedding industrial policy into their trade strategies. In the United States, measures like the CHIPS and Science Act and the Inflation Reduction Act are actively redirecting investment flows and reshaping supply chain decisions across high-tech and green sectors. The 2025 introduction of a 10% universal import tariff, alongside new “reciprocal” tariffs targeting over 100 countries, further signals Washington’s shift toward protectionist and security-oriented trade.