Download

Click here to download this article as a .pdf document.

| Executive Summary

Indonesia’s TKDN (Tingkat Komponen Dalam Negeri – Local Content Level) requirements have evolved from regulatory guidelines into strategic imperatives that determine market access in Southeast Asia’s largest economy. As Indonesia emerges as the primary China+1 manufacturing hub, TKDN compliance represents a critical entry point into the region’s economic transformation, extending far beyond simple local content obligations.

Non-compliance carries escalating costs: companies risk exclusion from public tenders, face delays or rejections in market entry, and forfeit access to key fiscal benefits such as tax exemptions, import duty relief, and expedited licensing. With stricter enforcement through digital verification systems and escalating penalties, non-compliance costs are increasing exponentially while early movers are capturing strategic advantages – reducing competitive intensity and gaining higher margin in select segments.

Crucially, Indonesia’s strategic position as ASEAN’s economic anchor makes TKDN compliance regionally significant. With parallel localization policies gaining traction across ASEAN – supported by frameworks like RCEP and bilateral FTAs – investments in Indonesian localization can unlock region-wide scalability. Companies that integrate TKDN into broader ASEAN strategies benefit from supply chain synergies, cross-border partnerships, and faster access to emerging growth corridors.

The window for advantageous positioning is closing rapidly. To compete effectively, companies must immediately take action: assess supply chain exposure, build partnerships with local firms, and engage with evolving policymakers. As Southeast Asia transforms into the world’s fourth-largest economy by 2030, early localization investment will compound into sustainable competitive advantages. Acting now is not only about compliance. It is about seizing a strategic gateway into one of the world’s most dynamic regions – a springboard for the broader regional growth wave that will define the next decade of international business.

1 | Introduction: Acting on TKDN isn’t just compliance – it is a strategic entry point into ASEAN

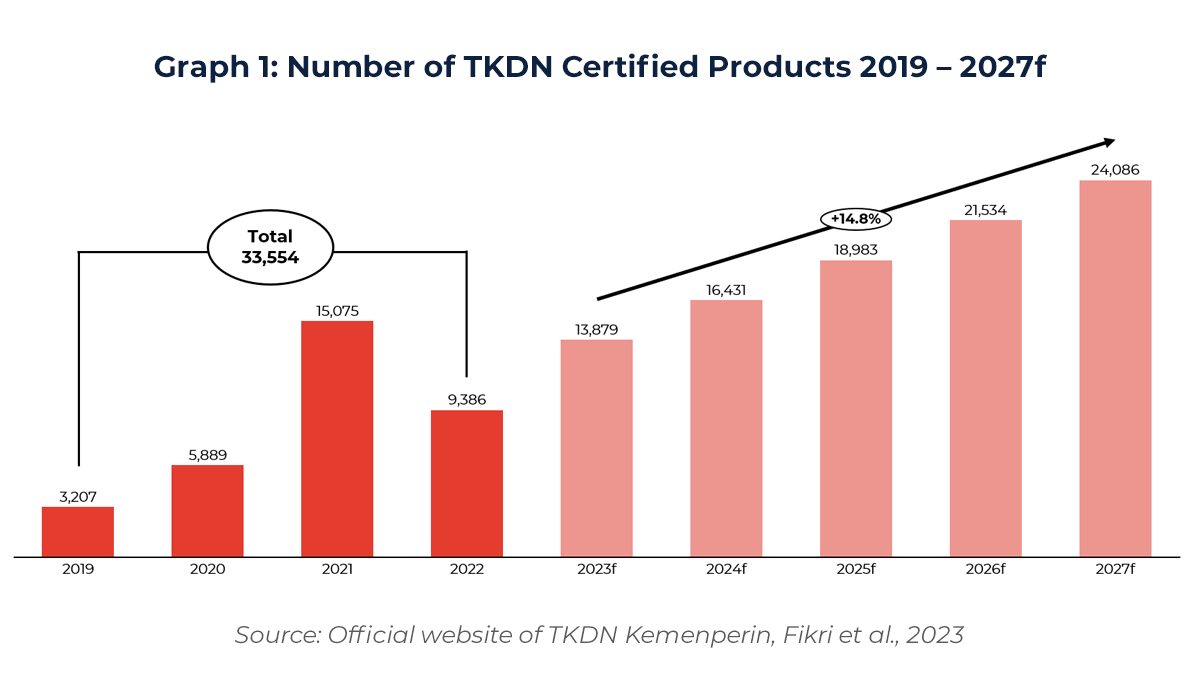

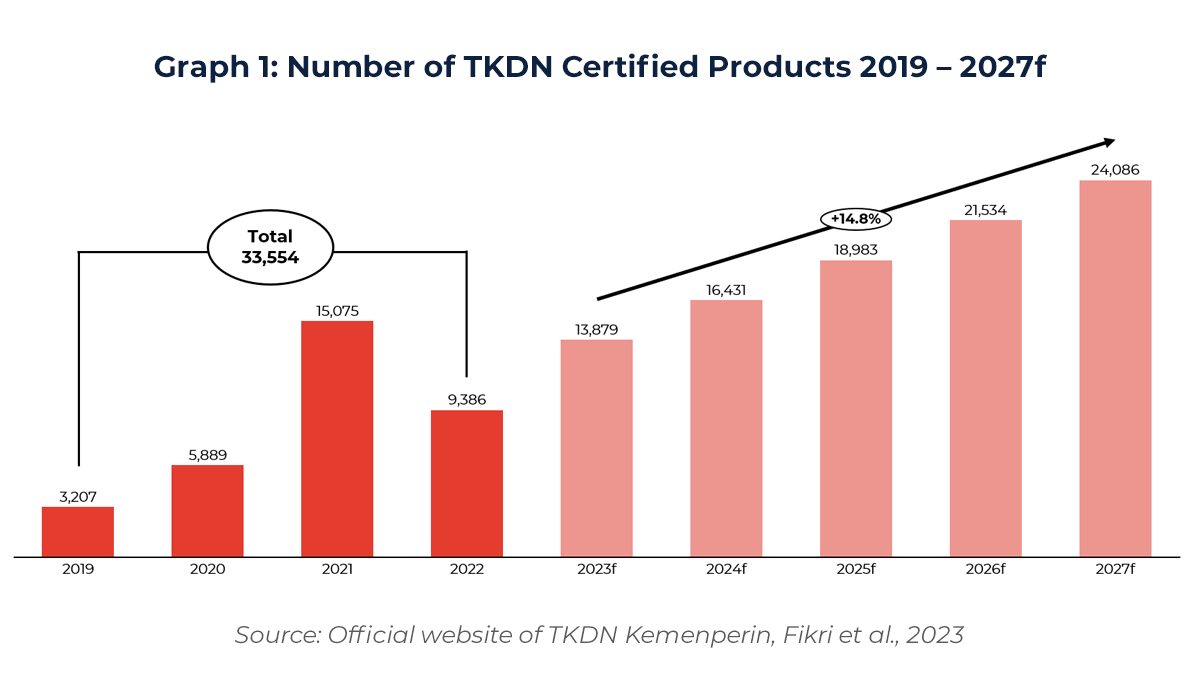

Indonesia’s TKDN regulations represent far more than conventional local content requirements – they constitute a fundamental recalibration of how multinational corporations access and operate within Southeast Asia’s largest economy. Initially introduced in 2009 but significantly strengthened under President Jokowi’s administration, these regulations have evolved from aspirational guidelines to rigorously enforced market access prerequisites backed by substantial penalties, procurement restrictions, and operational limitations for non-compliant entities. From 2019 to 2022, more than 33,000 products received TKDN certification, and the number is expected to grow significantly in the next 5 years with a CAGR of 14.8%.

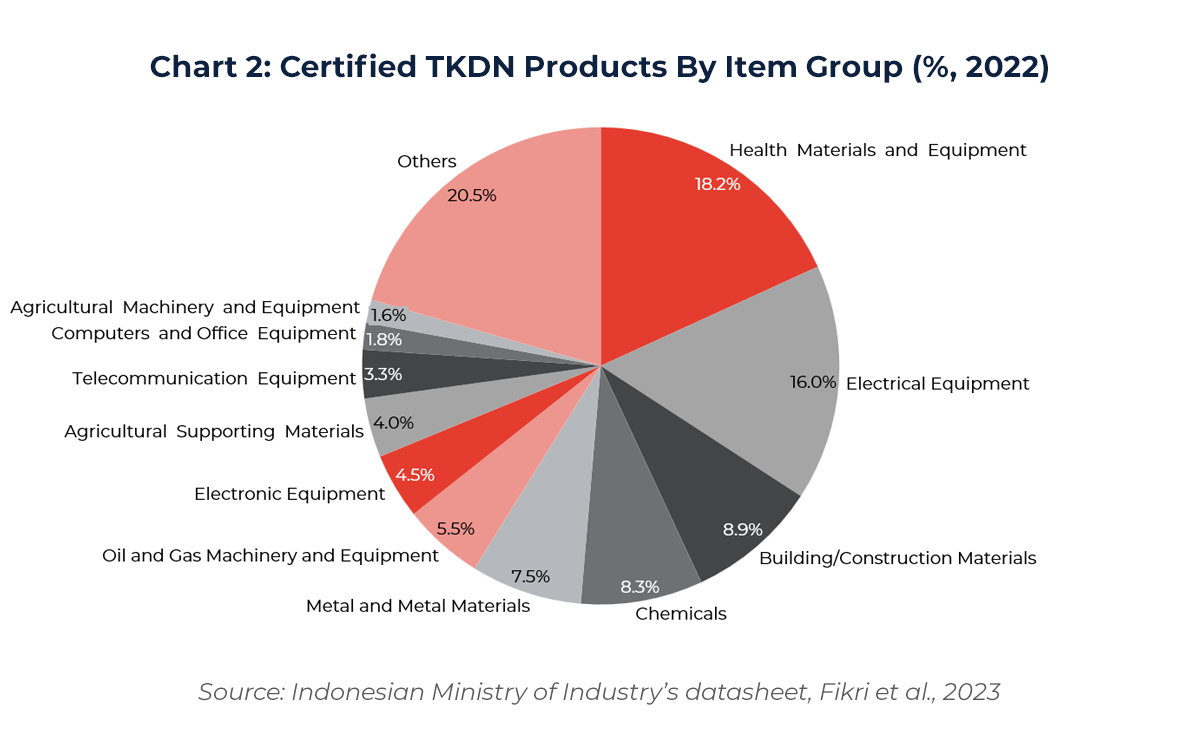

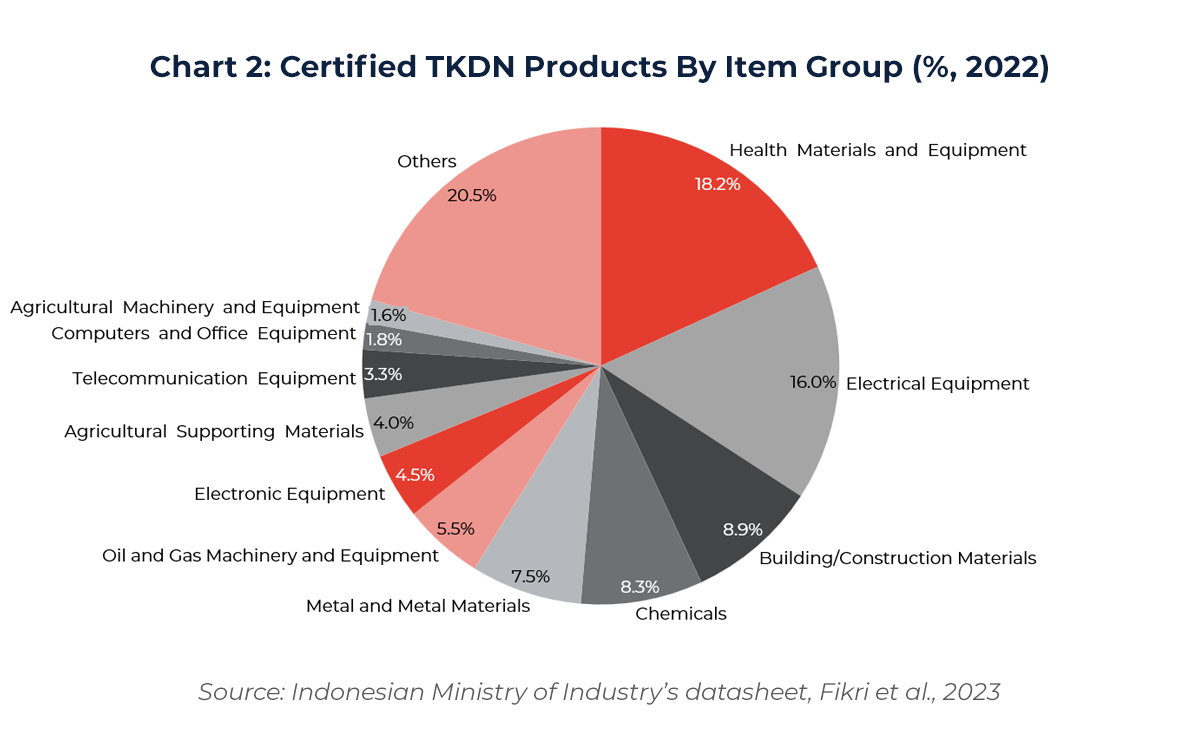

TKDN mandates that products across strategic sectors such as medical devices, electrical equipment, electronics, telecommunications, renewable energy, and automotive contain specified percentages of locally sourced components, materials, or services, with thresholds ranging from 25% to 70% depending on the industry. In 2022, the Health Materials and Equipment category leads with 18.18% of all TKDN-certified goods, underscoring the government’s strategic push to localize healthcare supply chains. Electrical Equipment (16%) and Building/Construction Materials (8.9%) represent a substantial portion of TKDN-certified goods, reflecting Indonesia’s emphasis on infrastructure and manufacturing.

The enforcement mechanism has transformed dramatically over recent years, with Indonesian ministries developing sophisticated verification systems, conducting regular audit protocols, and imposing increasingly severe consequences for non-compliance. Companies failing to meet TKDN requirements face exclusion from government procurement opportunities worth billions of dollars annually, restricted access to distribution channels, and potential suspension of operating licenses. More critically, enforcement has expanded beyond direct government contracts to encompass state-owned enterprises and their extensive supply chains, effectively creating mandatory compliance for any organization seeking meaningful market participation in Indonesia’s $1.3 trillion economy.

The strategic imperative for addressing TKDN has intensified due to converging pressures that make delay increasingly costly and potentially prohibitive. Foreign firms operating in Indonesia face mounting scrutiny from regulators who view TKDN compliance as a tangible demonstration of commitment to Indonesia’s economic development objectives. This scrutiny has translated into more frequent audits, stricter interpretation of compliance criteria, and reduced tolerance for partial or phased implementation strategies that previously provided companies with extended adjustment periods. The Indonesian government’s Industrial Masterplan 4.0 explicitly prioritizes local value creation, positioning TKDN as a cornerstone policy that will only expand in scope and stringency.

Policy momentum continues accelerating as Indonesia’s economic nationalism gains broader political support across party lines, making TKDN rollback politically untenable regardless of leadership changes. Recent policy developments include expanded sector coverage, increased local content thresholds, and more sophisticated calculation methodologies that close previous compliance loopholes.

Moreover, along with the emerging trends of MNCs seeking a new growth engine from new market expansion amid the instability and economic downturn in various key global economies (US, China, EU, India, etc.), Indonesia’s burgeoning domestic markets with access to one of the biggest regional economies as ASEAN, TKDN policy play a pivotal role in supporting Indonesia government to capitalize on its key market potentials and upgrading its position in the global value chain – a definitive catalyst for Indonesia’s transformation from a commodity-dependent economy to a sophisticated manufacturing powerhouse. This strategic positioning leverages Indonesia’s demographic dividend and resource endowments to capture higher-value manufacturing activities that were previously concentrated in more developed economies, fundamentally altering the country’s trajectory from a raw material exporter to integrated industrial ecosystem.

The convergence of regulatory enforcement, policy momentum, and market evolution creates a unique strategic inflection point where TKDN compliance becomes a gateway to broader ASEAN market leadership. Companies that strategically embrace Indonesian localization position themselves to capture disproportionate value from Southeast Asia’s emergence as the world’s next major manufacturing hub, while those that delay face progressively diminishing options and escalating entry barriers.

2 | What TKDN Really Means for Business

TKDN regulation is redefining the rules of engagement for companies operating in strategic sectors such as technology, energy, automotive, telecommunications, and healthcare. Initially introduced to support domestic industrial development, TKDN has evolved into a powerful policy instrument that shapes who gets to access the market, who qualifies for public procurement, and who benefits from state-backed incentives. In this environment, local content compliance is no longer a downstream legal concern; it is a strategic variable that can accelerate – or derail – commercial success.

Restricted Market Access: The First Barrier to Entry

One of the most immediate and consequential impacts of TKDN regulations is the potential restriction of market access for non-compliant products. In sectors such as consumer electronics, telecommunications, medical equipment, and solar energy, minimum TKDN thresholds are now enforced at the point of product registration and distribution licensing. Failure to meet these thresholds can result in outright exclusion from the Indonesian market, regardless of product quality, innovation, or brand recognition. This is particularly true in product categories with national strategic importance, where local content targets are closely tied to industrial policy.

A prominent example of this is Apple’s recent experience with the iPhone 16. In 2024, Apple encountered regulatory pushback due to its inability to meet the 35% TKDN requirement for 4G/5G smartphones. As a result, the company faced delays in securing distribution approval in Indonesia – despite high consumer demand and global brand equity. In an initial move to satisfy the regulation, Apple proposed a US$1 billion investment in a manufacturing facility on Batam Island focused on producing components for the AirTags. However, the Indonesian government viewed this as insufficient, arguing that AirTags were accessories and did not constitute a core component of the iPhone itself. To gain approval, Apple revised its approach by committing to a software R&D center and partnering with a local third-party assembler in Batam. This broader localization effort, along with fulfillment of past obligations and a pledge to increase investment, enabled Apple to secure TKDN certification and begin official sales of the iPhone 16.

Apple’s experience launching the iPhone 16 in Indonesia illustrates the increasing strategic weight of local content regulations in emerging markets. As Indonesia tightens enforcement of domestic component requirements across high-tech sectors, even global technology leaders are being forced to rethink their localization models to maintain market access. This provides a clear signal: market access in Indonesia increasingly hinges on demonstrated local contribution, and a nuanced, multi-faceted localization strategy is no longer optional – it is a prerequisite for sustainable commercial presence.

Disqualification from Public Procurement: The High Cost of Non-Eligibility

Government procurement represents a massive economic opportunity in Indonesia, with public spending accounting for a significant portion of GDP. TKDN requirements have transformed public tendering processes, making compliance a prerequisite for participation in lucrative government contracts. For companies engaged in sectors where public procurement plays a significant role – such as healthcare, education, infrastructure, and energy – non-compliance with TKDN thresholds represents a structural disadvantage. In Indonesia, public buyers ranging from ministries and state-owned enterprises (SOEs) to local governments are mandated to prioritize, and in many cases exclusively procure, TKDN-certified products. These requirements are embedded in national regulations such as Presidential Regulation No. 12/2021 and enforced through platforms like the LKPP e-Catalogue, which is the gateway to most government tenders.

GE Healthcare, a global leader in medical imaging and diagnostics, faced mounting challenges in Indonesia due to the country’s increasingly strict enforcement of TKDN (Domestic Component Level) regulations. With many of its high-tech devices falling short of the required local content thresholds – especially in public procurement segments – GE risked being excluded from lucrative government tenders. In response, the company adjusted its market strategy by forming a joint venture with local partners and committing to localized production of select product lines. This strategic localization not only enabled GE to improve its TKDN score but also restored its eligibility for listing in the LKPP e-Catalogue, ensuring continued participation in Indonesia’s fast-growing healthcare infrastructure programs. GE’s experience highlights how even globally dominant firms must tailor their operations to comply with national content mandates in order to compete in state-driven markets.

Loss of Fiscal and Operational Incentives: A Strategic Trade-Off

Beyond procurement eligibility and market access, TKDN compliance is increasingly tied to the availability of government-backed incentives that directly affect the financial and operational viability of doing business in Indonesia as well as competitive positioning. Companies that meet local content thresholds can access a range of benefits, including import duty exemptions, corporate tax holidays, simplified customs clearance, and fast-track licensing through the Online Single Submission (OSS) system. These advantages not only reduce cost structures but also speed up product launches and regulatory approvals.

The electric vehicle (EV) sector offers a particularly salient example. Manufacturers such as BYD and Hyundai prioritized local assembly facilities in Indonesia to ensure compliance with TKDN requirements for EV components. This compliance enabled them to qualify for import tax relief, value-added tax (VAT) incentives, and eligibility to participate in public fleet contracts. In contrast, foreign OEMs attempting to enter the market through fully built-up (CBU) imports faced higher tax burdens and limited access to incentive programs, placing them at a competitive disadvantage.

Strategic Industries Most Affected by TKDN Enforcement

TKDN enforcement is concentrated in industries prioritized by the Indonesian government for local value creation, industrial resilience, and reduced import dependence. These sectors are subject to formal TKDN thresholds and are often tied to government procurement, fiscal incentives, and preferential policy treatment. Indonesia’s TKDN policy operates with a tiered enforcement structure that reflects varying degrees of regulatory urgency and strategic importance:

1. Strategic Industrial Priority Sectors (National Development Focus)

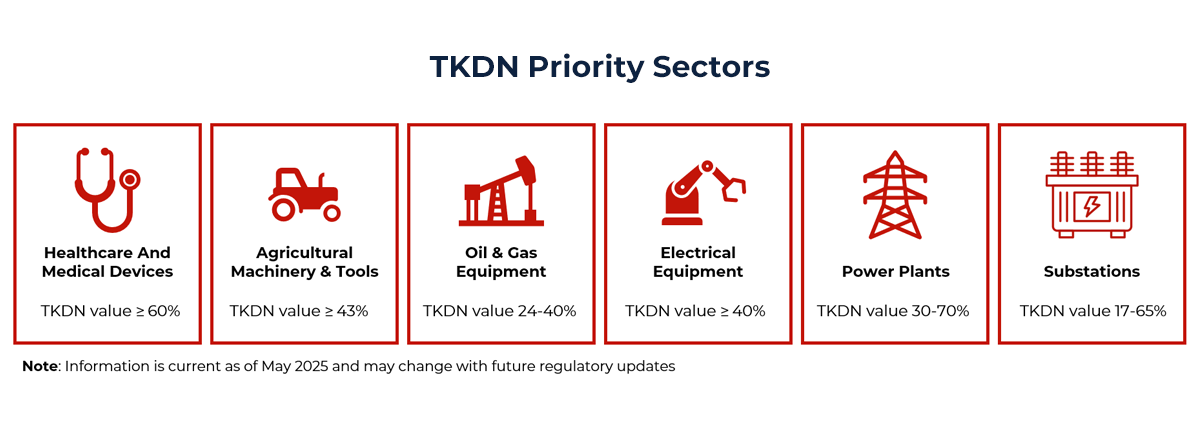

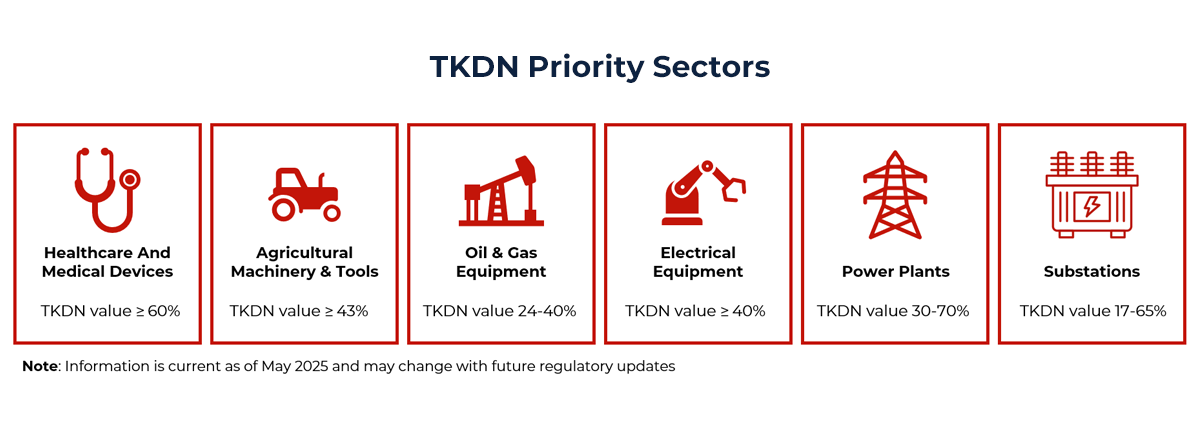

At the core of Indonesia’s localization strategy are the Strategic Industrial Priority Sectors – industries that have been formally designated as critical to national development and industrial self-reliance. These sectors include healthcare equipment, agricultural machinery, oil and gas components, electrical equipment, and power generation infrastructure. Each of these categories carries explicit TKDN thresholds, often exceeding 40% and in some cases reaching up to 70%.

Compliance is not optional for priority sectors. It is a prerequisite for participation in public procurement, infrastructure tenders, and SOE supply chains. Enforcement is codified through Presidential and Ministerial regulations, and access to government-led projects is effectively limited to TKDN-certified products. For companies operating in these sectors, localization is not a competitive differentiator – it is a baseline requirement for market access and long-term viability in Indonesia.

2. Regulatory and Market Access Priority Sectors

A second enforcement tier includes sectors where TKDN compliance is enforced primarily through regulatory barriers and market entry controls rather than industrial policy. These include high-demand, tech-driven industries such as smartphones, laptops, telecommunications equipment, and software solutions. In these sectors, TKDN certification, typically ranging from 25% to 40%, is essential for product registration, distribution licensing, and inclusion in public-sector purchasing platforms like the LKPP e-Catalogue.

While these sectors may not appear in national industrial roadmaps, the Ministry of Industry and sectoral regulators enforce TKDN compliance rigorously, especially where public funding or large-scale rollouts are involved. Companies in these industries must adopt agile localization strategies, including in-country assembly, software development, or partnering with local EMS providers, to ensure compliance and sustain commercial operations.

3. Emerging TKDN-Relevant Sectors

The third category comprises Emerging TKDN-Relevant Sectors – industries not yet subject to formal or standardized TKDN thresholds but where localization is increasingly incentivized or informally required. This group includes electric vehicles, pharmaceuticals, construction materials, aerospace systems, pharmaceutical and medical consumables, energy & power, and railway infrastructure, and more.

While not uniformly regulated, these sectors are experiencing growing pressure to localize as part of broader industrial policy objectives or SOE procurement preferences. Access to tax incentives, green energy programs, or strategic public-private partnerships often hinges on demonstrating local content, even when not legally mandated. Companies operating in these sectors face a window of opportunity: by investing early in local supply chains or joint ventures, they can build regulatory goodwill, position themselves ahead of future mandates, and gain preferential access in a policy environment trending toward stricter localization norms.

These sectors reflect Indonesia’s industrial priorities and are subject to active monitoring and enforcement by agencies such as the Ministry of Industry, Ministry of Health, SKK Migas, and PLN. Companies operating in these fields should treat TKDN compliance not just as a regulatory requirement, but as a strategic prerequisite for growth, eligibility, and competitiveness in the Indonesian market.

3 | Why Companies Can’t Wait

The urgency surrounding TKDN compliance has intensified dramatically as Indonesia’s regulatory landscape evolves and enforcement mechanisms strengthen. What began as gradual policy implementation has accelerated into a comprehensive industrial strategy that demands immediate strategic response from multinational corporations.

Recent Developments Show Stricter Enforcement and Evolving Expectations

Indonesia’s approach to TKDN enforcement has undergone a fundamental transformation over the past three years, shifting from advisory guidelines to mandatory compliance with severe penalties for non-adherence. This evolution reflects the government’s commitment to achieving industrial self-sufficiency and technological sovereignty.

1. Enhanced Regulatory Oversight

The establishment of specialized TKDN monitoring units within key ministries has created systematic enforcement mechanisms that were previously absent. The Ministry of Industry now conducts regular audits of TKDN compliance across manufacturing sectors, with real-time tracking systems that monitor local content percentages throughout production cycles. Companies can no longer rely on periodic compliance reporting; they face continuous scrutiny that demands consistent adherence to local content requirements.

The Ministry of Communication and Information Technology has implemented similar oversight for the ICT sector, requiring quarterly TKDN compliance reports and surprise facility inspections. These enhanced monitoring capabilities have caught several major technology companies off-guard, resulting in market access suspensions and substantial financial penalties.

2. Digital Verification Systems

Indonesia has invested heavily in digital verification infrastructure that makes TKDN compliance monitoring more precise and immediate. The new e-TKDN system tracks component sourcing, manufacturing processes, and value-addition activities in real-time, eliminating opportunities for compliance circumvention that may have existed under previous manual reporting systems.

This technological upgrade means companies must demonstrate compliance at granular levels, with detailed documentation of local supplier relationships, manufacturing processes, and value-addition activities. The days of superficial compliance or creative accounting to meet TKDN requirements have effectively ended.

3. Escalating Penalty Structures

Recent regulatory amendments have introduced graduated penalty systems that impose increasingly severe consequences for TKDN non-compliance. Initial violations now trigger immediate market access restrictions, while repeated violations can result in permanent exclusion from Indonesian markets and revocation of business licenses.

The pharmaceutical sector exemplifies this stricter enforcement approach. In 2023, several multinational pharmaceutical companies faced temporary import suspensions for failing to meet evolving TKDN requirements for critical medications. These suspensions not only disrupted revenue streams but also damaged relationships with local distributors and healthcare providers.

4. Sector-Specific Acceleration

Different industries face varying timelines for TKDN compliance, but enforcement acceleration is evident across all sectors. The automotive industry has seen TKDN requirements increase from 60% to 70% for certain vehicle categories, with further increases planned through 2025. Companies that assumed gradual implementation schedules now face compressed timelines that demand immediate strategic pivots.

The renewable energy sector faces particularly aggressive TKDN escalation as Indonesia pursues its net-zero emissions commitments. Solar panel manufacturers must achieve 40% local content by 2024, rising to 60% by 2026. Wind energy projects face similar acceleration, with local content requirements increasing annually until 2027.

Early Movers Can Build Stronger Local Ecosystems and Long-Term Advantage

Proactive TKDN compliance creates sustainable competitive advantages that extend far beyond regulatory adherence. Companies that invest early in local capabilities develop integrated value chains, supplier relationships, and market positions that become increasingly difficult for competitors to replicate.

1. Supplier Network Development

Early compliance requires extensive supplier development programs that create exclusive or preferential relationships with local manufacturers. These relationships often involve technology transfer, quality improvement initiatives, and long-term supply agreements that provide cost advantages and supply chain security.

Samsung’s early investment in Indonesian component suppliers exemplifies this advantage. The company identified and developed local suppliers for smartphone components years before TKDN enforcement intensified. When competitors faced compliance pressure, Samsung’s established supplier network provided cost advantages and supply chain flexibility that newer entrants could not match.

2. Technology Transfer Leadership

Companies that initiate technology transfer programs early often secure more favorable terms and better local partnerships than those forced into compliance by regulatory pressure. Early movers can choose optimal local partners, negotiate better intellectual property arrangements, and establish technology transfer programs that align with their global strategies.

Unilever’s long-term commitment to Indonesian manufacturing demonstrates this advantage. The company’s decades-long investment in local R&D capabilities and manufacturing technology has created a competitive moat that newer entrants find difficult to penetrate. Unilever’s local innovation capabilities now serve as a competitive advantage in product development and market responsiveness.

3. Talent Development Advantages

Proactive TKDN compliance requires substantial investment in local talent development, including technical training, management development, and research capabilities. Companies that begin these investments early develop human capital advantages that persist long after initial compliance achievements.

Early movers often become preferred employers for top local talent, creating virtuous cycles of capability development that strengthen their competitive positions. These companies also develop institutional knowledge about operating effectively within Indonesian regulatory and business environments that provides ongoing operational advantages.

4. Government Relationship Building

Companies that voluntarily exceed TKDN requirements often develop stronger relationships with Indonesian government agencies, creating advantages in policy influence, regulatory interpretation, and future compliance planning. These relationships can provide early warning about regulatory changes and opportunities to influence policy development.

Loss of Opportunity to Compliant Competitors: Reduced Competition and Margin Compression

The window for advantageous TKDN compliance is rapidly closing as compliant competitors consolidate market positions and non-compliant companies face increasing exclusion. This dynamic creates a winner-take-all environment where delayed compliance results in permanent competitive disadvantages.

1. Market Share Consolidation

TKDN-compliant companies are experiencing accelerated market share gains as non-compliant competitors face access restrictions. This consolidation is particularly pronounced in sectors with high TKDN requirements, where compliant companies can charge premium prices due to reduced competition.

In the telecommunications equipment sector, compliant suppliers have seen average margins increase by 15-20% as non-compliant competitors face procurement exclusions. This margin expansion reflects reduced competitive pressure rather than operational improvements, creating sustainable profitability advantages for early compliance achievers.

2. Procurement Preference Acceleration

Indonesian government agencies and state-owned enterprises increasingly prefer to work with suppliers who exceed minimum TKDN requirements, creating procurement advantages that extend beyond basic compliance. Companies that achieve 80-90% local content often receive preferential treatment over those meeting minimum 60-70% requirements.

This procurement preference creates positive feedback loops where compliant companies secure larger contracts, enabling further local investment and higher TKDN percentages. Non-compliant companies face increasingly difficult market entry as preferred suppliers strengthen their positions through expanded local capabilities.

3. Distribution Network Exclusivity

Local distributors and channel partners increasingly prefer working with TKDN-compliant suppliers due to reduced regulatory risk and government relationship advantages. These partnerships often include exclusivity arrangements that prevent non-compliant competitors from accessing established distribution networks.

4. Customer Loyalty Consolidation

Indonesian customers, particularly in B2B markets, are developing preferences for TKDN-compliant suppliers due to their own compliance requirements and government relationship management. These customer relationships often involve long-term contracts and integrated supply chain arrangements that create switching costs for future competitors.

5. Innovation Ecosystem Advantages

Compliant companies that invest in local R&D capabilities often gain preferential access to Indonesian universities, research institutions, and government innovation programs. These relationships provide ongoing advantages in talent recruitment, technology development, and market intelligence that non-compliant competitors cannot access.

The combination of stricter enforcement, early-mover advantages, and competitive consolidation creates an environment where TKDN compliance delay carries exponentially increasing costs. Companies that wait for regulatory pressure to force compliance decisions will find themselves competing for diminished opportunities at higher costs with reduced strategic flexibility.

4 | Indonesia: TKDN and the Rise of a China+1 Powerhouse

TKDN as a Catalyst for the China+1 Movement

Indonesia’s TKDN policy represents far more than standard protectionist legislation. It functions as a sophisticated industrial development mechanism that has inadvertently synchronized with the global China+1 movement. Companies confronting TKDN’s requirement of 30-70% local content across electronics, telecommunications, medical devices, and renewable energy sectors are discovering that compliance necessitates substantial operational restructuring. These same structural adjustments position them advantageously within the broader China+1 strategy that boardrooms worldwide are implementing in response to geopolitical volatility and supply chain vulnerabilities.

The dual imperatives of TKDN compliance and supply chain diversification have created a compelling business case for deeper Indonesian manufacturing investments. This convergence is particularly evident in electronics manufacturing, where investments by seven major ODMs and component suppliers have exceeded $850 million in 2020, directly attributable to this strategic alignment. Rather than viewing TKDN as merely a trade barrier, forward-thinking organizations leverage these requirements to accelerate their diversification strategies while securing preferential market access.

Unmatched Scale and Economic Momentum

Indonesia’s demographic profile is characterized by a substantial working-age population, emerging consumer class, and rapidly expanding digital infrastructure. With 270+ million citizens, Indonesia’s labor market delivers both scale and cost advantages, with manufacturing wages averaging 30-40% lower than China’s eastern seaboard. The country’s working-age population of 185 million presents a demographic dividend that will extend well into the 2040s, in stark contrast to China’s increasingly challenging demographic outlook.

Indonesia’s digital economy – valued at $70 billion in 2023 and projected to reach $146 billion by 2025 – has transformed consumer behavior and distribution channels. This digital transformation is particularly significant for manufacturing operations seeking to integrate into modern supply networks. Indonesia’s rising middle class now constitutes over 52 million households with discretionary purchasing power, creating domestic demand patterns that increasingly resemble those of developed markets, providing manufacturers access to sophisticated local consumers for product testing and adaptation.

Strategic Positioning in a Recalibrated Global Order

Indonesia’s strategic non-alignment policy has positioned it uniquely within the evolving geopolitical landscape. Indonesia maintains balanced relationships with major economic powers while avoiding the direct tensions that have compromised China’s manufacturing advantage. This neutrality provides assurance for multinational corporations concerned about potential tariffs, trade restrictions, or geopolitical complications affecting their manufacturing investments.

Indonesia’s abundant natural resource endowment – including nickel (22% of global reserves), tin, bauxite, and copper – provides built-in supply chain resilience for critical raw materials. This natural advantage takes on heightened significance as resource nationalism and supply chain sovereignty become central considerations in manufacturing location decisions. Companies establishing manufacturing operations in Indonesia gain proximity to these essential inputs, reducing vulnerability to the supply disruptions that have repeatedly affected China-centric supply chains.

Regional Integration as a Competitive Advantage

Indonesia’s participation in regional free trade agreements, including ASEAN Economic Community (AEC) and the Regional Comprehensive Economic Partnership (RCEP), positions it as an ideal base for companies seeking regional scale. By establishing TKDN-compliant operations in Indonesia, manufacturers gain preferential access to a trade bloc encompassing 30% of global GDP and 30% of the world’s population. The country’s strategic position as ASEAN’s largest economy provides unparalleled leverage within these trade architectures, allowing Indonesia-based manufacturers to optimize regional value chains while meeting demanding country-of-origin requirements.

Indonesia’s rapidly developing seaport infrastructure – including the Patimban Deep Sea Port (capacity: 7.5 million TEU) and expanded facilities at Tanjung Priok – has enhanced its logistics capabilities to support this regional manufacturing hub status. The country’s commitment to reducing dwell times from 4.8 days to 3.1 days across major ports directly addresses previous logistics constraints that limited its manufacturing potential. These investments position Indonesia to function as both a production base and distribution hub for companies implementing regional manufacturing strategies.

By strategically embracing TKDN requirements while leveraging Indonesia’s distinctive combination of scale, resources, geopolitical positioning, and regional integration, companies can transform a regulatory compliance challenge into a cornerstone of their global manufacturing strategy – establishing Indonesia as the definitive China+1 destination in Southeast Asia.

5 | What Companies Should Do Now

The accelerating pace of TKDN enforcement and the narrowing window for competitive advantage demand immediate strategic action from multinational corporations operating in Indonesia. Companies can no longer afford to treat TKDN as a distant regulatory concern; it requires urgent integration into core business strategy and operational planning.

Assess Your Exposure to TKDN Across Supply Chain and Product Lines

1. Comprehensive Product Portfolio Analysis

Companies must conduct detailed TKDN exposure analysis for every product line, service offering, and business unit operating in Indonesia. This analysis should identify current local content percentages, regulatory requirements by sector, and compliance gaps that require immediate attention.

The assessment process should map each product’s value chain to identify components, materials, and processes that could potentially be localized. For complex products like automobiles or telecommunications equipment, this requires component-level analysis that traces sourcing origins, manufacturing locations, and value-addition activities throughout the supply chain.

Manufacturing companies should analyze their Bill of Materials (BOM) to identify localization opportunities that align with TKDN requirements. This analysis must consider not only direct material costs but also logistics, quality, and supply chain reliability implications of local sourcing transitions.

2. Supply Chain Vulnerability Mapping

Critical supplier dependency analysis reveals where TKDN compliance might disrupt existing supply relationships and operational efficiency. Companies should identify single-source suppliers, long-lead-time components, and specialized materials that currently rely on non-Indonesian sources.

This mapping exercise should prioritize supply chain elements based on TKDN impact, business criticality, and localization feasibility. High-impact, high-feasibility opportunities should receive immediate strategic attention, while complex technical components may require longer-term partnership and capability development strategies.

Companies should also assess their suppliers’ own TKDN compliance status, as regulatory requirements often cascade through supply chains. Tier-1 suppliers who themselves face TKDN requirements may need support in developing local sourcing capabilities that benefit the entire value chain.

3. Market Access Risk Quantification

Financial exposure assessment should quantify potential revenue losses from TKDN non-compliance across different scenarios and timeframes. This analysis must consider both immediate market access restrictions and longer-term competitive disadvantages that compound over time.

Companies should model revenue impact across product lines, customer segments, and geographic markets within Indonesia. Government procurement exposure requires particular attention, as public sector revenues often represent substantial portions of total Indonesian operations.

The assessment should also evaluate opportunity costs associated with delayed compliance, including premium pricing opportunities, market share gains, and strategic partnership access that early compliance might enable.

4. Regulatory Timeline Mapping

Each business unit and product line face different TKDN implementation timelines and requirement escalations. Companies must create detailed compliance calendars that identify critical dates, requirement increases, and enforcement milestones across all relevant regulatory frameworks.

This timeline mapping should extend beyond current regulations to anticipate likely future requirements based on government policy directions and industry development trends. Companies that prepare for anticipated requirements rather than responding to current mandates often achieve better compliance outcomes at lower costs.

The assessment should prioritize high-value products with significant Indonesian market potential against their current TKDN compliance gaps. Companies with mature TKDN strategies develop weighted scorecards that balance compliance investment costs against market access benefits, enabling strategic resource allocation. This granular analysis often reveals that 60-70% of TKDN compliance challenges concentrate on 20-30% of components or processes, creating clear targeting priorities.

Build or Deepen Partnerships with Local Firms to Meet Localization Targets

TKDN compliance through partnerships represents the most capital-efficient pathway for many organizations, particularly those without extensive manufacturing experience in Indonesia. Successful compliance typically requires close collaboration with Indonesian partners who provide local manufacturing capabilities, supplier networks, and market knowledge that foreign companies cannot develop independently within required timeframes.

1. Strategic Partnership Development

Identifying optimal local partners requires careful evaluation of technical capabilities, financial stability, cultural alignment, and strategic objectives. The most effective partnerships combine complementary strengths where international companies provide technology, capital, and global market access while local partners contribute manufacturing capabilities, supplier networks, and regulatory expertise.

Partnership structures should align incentives for long-term collaboration rather than short-term compliance achievement. Joint ventures, technology licensing agreements, and supplier development programs often create more sustainable value than simple procurement relationships.

Companies should evaluate potential partners based on their existing customer relationships, government connections, and industrial ecosystem participation. Partners with strong relationships in relevant industry clusters can accelerate compliance timelines and reduce development costs significantly.

2. Technology Transfer Planning

Effective TKDN partnerships often require structured technology transfer programs that build local capabilities while protecting intellectual property rights. These programs should balance compliance requirements with competitive advantage preservation through careful IP strategy and partnership structuring.

Technology transfer planning must consider both immediate compliance needs and long-term development objectives. Programs that focus only on meeting minimum TKDN requirements often fail to create sustainable competitive advantages or meaningful local value addition.

Companies should develop clear technology transfer roadmaps that specify capability development milestones, performance metrics, and intellectual property protections. These roadmaps help ensure that partnership investments create lasting value rather than short-term compliance achievements.

3. Supplier Ecosystem Development

Building robust local supplier networks requires systematic capability development programs that often extend beyond immediate TKDN compliance needs. Companies that invest in comprehensive supplier development create competitive advantages through cost reduction, quality improvement, and supply chain resilience.

Supplier development programs should identify high-potential SMEs (Small and Medium Enterprises) that can grow into strategic suppliers with appropriate support. These programs often include technical assistance, quality system development, financial support, and long-term purchase commitments that enable supplier investment in capabilities.

The most successful supplier development initiatives create supplier networks that serve multiple customers, reducing dependency risks while building industrial clusters that benefit entire sectors. Companies that lead supplier ecosystem development often become preferred customers and gain competitive advantages through preferential treatment and collaboration opportunities.

Successful partnerships require meticulous due diligence beyond financial and operational assessment to include cultural alignment, governance expectations, and intellectual property protection protocols. Companies with mature TKDN strategies establish clear technology transfer boundaries that balance compliance requirements against core IP protection, often utilizing tiered partnership models where sensitive technologies remain protected while non-critical operations transfer to local partners.

4. Local Talent Development Integration

Partnership success depends heavily on developing local talent capabilities that support technology transfer, quality management, and continuous improvement. Companies should integrate human resource development into partnership strategies to ensure sustainable capability building.

Talent development programs should address both technical skills and management capabilities required for successful partnership operations. These programs often include exchange programs, technical training, leadership development, and university collaboration that builds long-term human capital advantages.

Stay Close to Policymakers – Rules Are Evolving, and Early Engagement Brings Flexibility

Indonesia’s TKDN regulatory framework continues evolving rapidly as policymakers balance industrial development objectives with practical implementation challenges. Companies that maintain close dialogue with regulatory authorities often gain advantages in compliance planning and strategic positioning.

1. Regulatory Intelligence Systems

Developing systematic regulatory monitoring capabilities enables companies to anticipate policy changes and prepare strategic responses before requirements become mandatory. This intelligence gathering should extend beyond formal regulatory announcements to include policy discussions, ministerial statements, and industry consultation processes.

Companies should establish relationships with key regulatory agencies including the Ministry of Industry, Ministry of Trade, and sector-specific regulators that oversee their operations. These relationships provide early warning about regulatory changes and opportunities to influence policy development through constructive engagement.

Industry association participation offers another avenue for regulatory intelligence and policy influence. Active participation in chambers of commerce, industry groups, and trade associations provides access to collective advocacy opportunities and shared regulatory insights.

2. Policy Engagement Strategy

Proactive engagement with policymakers allows companies to contribute technical expertise to regulatory development while advocating for practical implementation approaches. This engagement should focus on constructive collaboration rather than regulatory resistance, emphasizing shared objectives of industrial development and economic growth.

Companies should prepare detailed position papers and technical analyses that help policymakers understand implementation challenges and opportunities within specific sectors. This technical input often influences regulatory design in ways that benefit both compliance feasibility and policy effectiveness.

Collaborative engagement approaches that propose solutions rather than problems tend to receive more favorable reception from regulatory authorities. Companies that contribute to policy development through pilot programs, technical working groups, and capability development initiatives often gain influence in regulatory design processes.

3. Implementation Flexibility Negotiation

Early engagement with regulators often enables companies to negotiate implementation approaches that balance compliance requirements with operational realities. These negotiations might involve alternative compliance pathways, phase-in schedules, or pilot program participation that provides flexibility while demonstrating commitment to localization objectives.

Companies should prepare comprehensive compliance proposals that demonstrate understanding of policy objectives while proposing practical implementation approaches. These proposals should include specific timelines, investment commitments, and performance metrics that provide regulators with confidence in compliance achievement.

4. Continuous Compliance Optimization

TKDN regulatory frameworks will continue evolving as Indonesia’s industrial development priorities change and mature. Companies must develop adaptive compliance capabilities that can respond to regulatory changes while maintaining operational efficiency and competitive advantage.

This adaptive approach requires ongoing investment in regulatory monitoring, stakeholder engagement, and compliance system flexibility. Companies that treat TKDN compliance as a dynamic strategic capability rather than a static regulatory obligation often achieve better long-term outcomes and sustainable competitive advantages.

By implementing these strategic approaches to TKDN compliance, companies can transform what initially appears as a regulatory burden into a structural advantage that simultaneously satisfies Indonesian policy requirements while accelerating broader supply chain diversification objectives. The organizations that will extract maximum value from Indonesia’s emergence as a China+1 destination are those that view TKDN not merely as a compliance exercise but as a catalyst for strategic supply chain reconfiguration.

| Conclusion

Indonesia’s TKDN requirements are no longer a regulatory footnote—they are a strategic signal marking the global pivot toward supply chain regionalization and Southeast Asia’s ascent as a manufacturing powerhouse. More than a government mandate, TKDN reflects a structural shift in how global production systems are organized: closer to consumers, more resilient to shocks, and increasingly anchored in dynamic regional blocs. Companies that view TKDN purely through a compliance lens risk missing the broader strategic realignment underway across global value chains.

Forward-thinking organizations recognize that TKDN represents not merely government intervention but marketplace evolution – where proximity to consumers, production resilience, and regional integration create sustainable competitive advantages that transcend regulatory considerations. The strategic imperatives driving Indonesia’s localization push mirror global trends toward supply chain regionalization, making TKDN compliance a prescient investment in future manufacturing architectures rather than a transactional response to immediate market access requirements.

Companies that strategically embrace Indonesian localization position themselves advantageously within the broader ASEAN integration framework – securing preferential access to a market of 660+ million consumers with rapidly expanding purchasing power. These early movers develop capabilities, relationships, and operational models that can be systematically replicated across the region as similar localization requirements inevitably emerge in neighbouring countries. The transferable knowledge gained through Indonesian compliance – navigating complex regulatory environments, developing local supplier ecosystems, adapting global standards to regional contexts – creates organizational muscle memory that delivers accelerated market penetration throughout Southeast Asia. Organizations with established Indonesian manufacturing operations effectively create optionality capital – the flexibility to rapidly shift production volumes between facilities as regional trade dynamics evolve, providing resilience against both supply shocks and policy changes.

The risks of inaction are growing. As industrial land becomes scarce, top-tier partners sign exclusivity agreements, and skilled labor markets tighten, the window for favorable localization conditions narrows. Companies that delay risk higher entry costs, slower market activation, and diminished bargaining power in strategic sectors. More critically, they risk falling behind in a region expected to become the fourth-largest economy by 2030. TKDN is not an isolated challenge – it is a bellwether of the new industrial era in Southeast Asia. The question is no longer whether to engage with TKDN, but how quickly and comprehensively businesses can transform regulatory compliance into strategic differentiation.

Download

Click here to download this article as a .pdf document.

Author:

Kelly Nguyen

Associate

References

[1] https://www.reuters.com/article/economy/indonesia-reports-850-million-in-factory-investments-says-billions-committed-idUSKBN2411HW/

[2] https://www.sucofindo.co.id/en/articles/general/inspection-audit-services-en-21/tkdn-definition-benefits-and-the-calculations-types/

[3] https://www.cekindo.com/blog/what-is-tkdn-indonesia

[4] https://jakartaglobe.id/tech/apples-iphone-16-series-to-launch-in-indonesia-on-friday-after-regulatory-delay

[5] https://www.researchgate.net/publication/375718008